Gold’s shine has never been brighter.

In 2025, prices surged to record highs near $4,533 per ounce, finishing the year up more than 65% and standing over 70% above 2023 levels.

The rally is being powered by a combination of central bank buying, geopolitical tensions, and growing expectations of global rate cuts. With currencies weakening and inflation gradually growing, investors are turning back to hard assets as a way to preserve value.

Gold mining companies are among the biggest winners of the year. With prices near all-time highs, miners are reporting record cash flows, raising dividends, and restarting expansion projects that were once on hold. Years of cost control and balance sheet repair have left the industry in a much stronger position to benefit from this cycle.

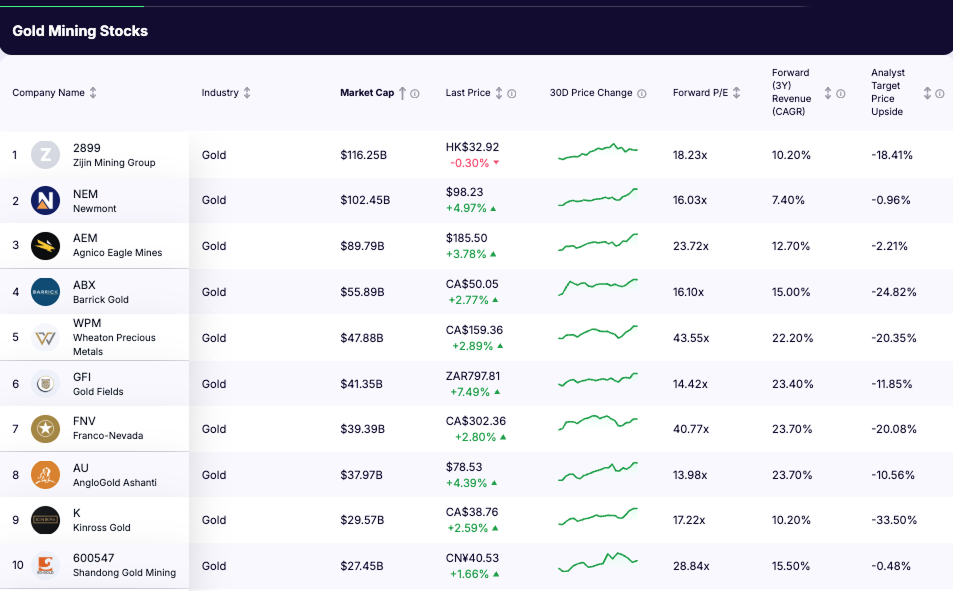

Here are the 10 largest gold mining stocks in the world, ranked by market capitalization, and how each is positioning for what could be the most profitable phase for the industry in decades.

Highlights

- Gold trades above $4,400 as global demand surges.

- Miners report record margins with all-in sustaining costs (AISC) near $1,200.

- Debt reduction, dividends, and buybacks accelerate.

- M&A and exploration activity reach multi-year highs.

- Diversified producers in stable regions outperform peers.

- Gold stocks offer strong leverage to metal prices.

How Gold Mining Stocks Work

When you invest in a gold mining stock, you are not just betting on the price of gold. You are investing in the business of finding, extracting, and selling it.

A miner’s revenue depends on how much gold it produces and the market price it sells at. Profitability is driven by operating efficiency, cost discipline, and the stability of the countries where the mines operate.

Gold stocks usually move faster than gold itself. A 10% increase in gold prices can translate into a 30% jump in earnings for efficient, low-cost producers. The same leverage works in reverse when prices fall, which is why gold miners tend to be more volatile than the metal they produce.

Top 10 Gold Mining Stocks in 2026

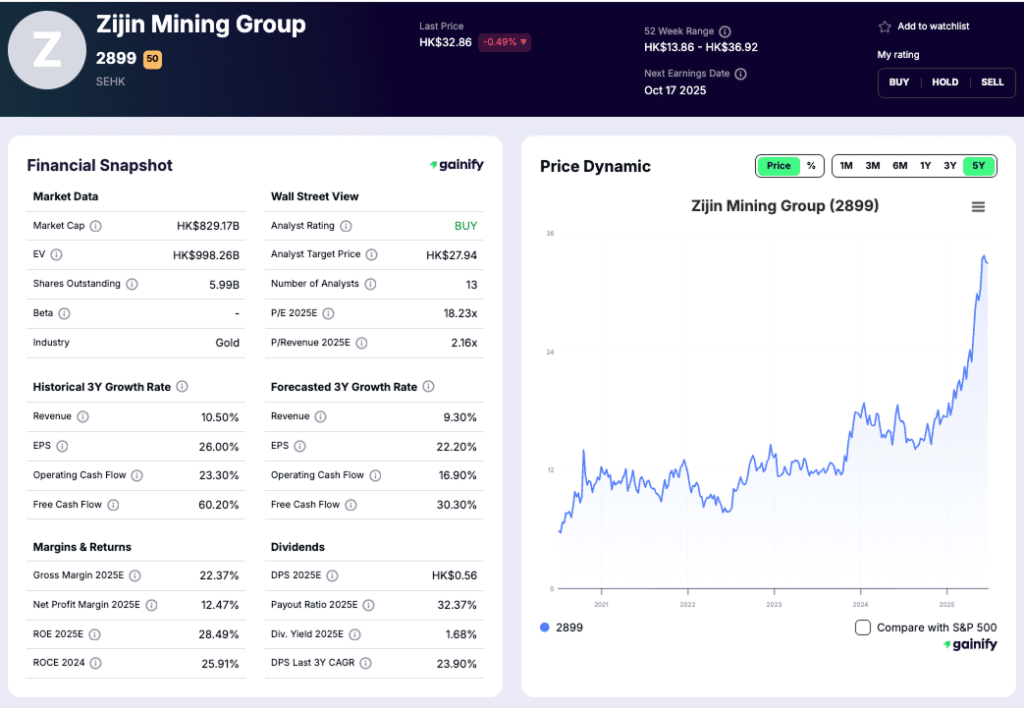

1. Zijin Mining Group (2899.HK) – Market Cap: $116B

What they do:

Zijin Mining is China’s largest integrated mining company with assets across gold, copper, and lithium. The firm operates major projects in China, Central Asia, and Africa.

Why it matters:

Zijin is one of the few gold producers successfully balancing growth with diversification. As gold prices surged, the company leveraged its scale and vertical integration to maintain cost efficiency, keeping margins among the best in the region.

What to watch:

- Expansion at Kamoa-Kakula (DRC) and Tibet’s Julong copper-gold mine.

- Ongoing efforts to reduce emissions and adopt renewable power at operations.

- Potential overseas acquisitions to boost reserve life.

Key risk:

Heavy reliance on politically complex regions and Chinese government oversight could increase long-term uncertainty.

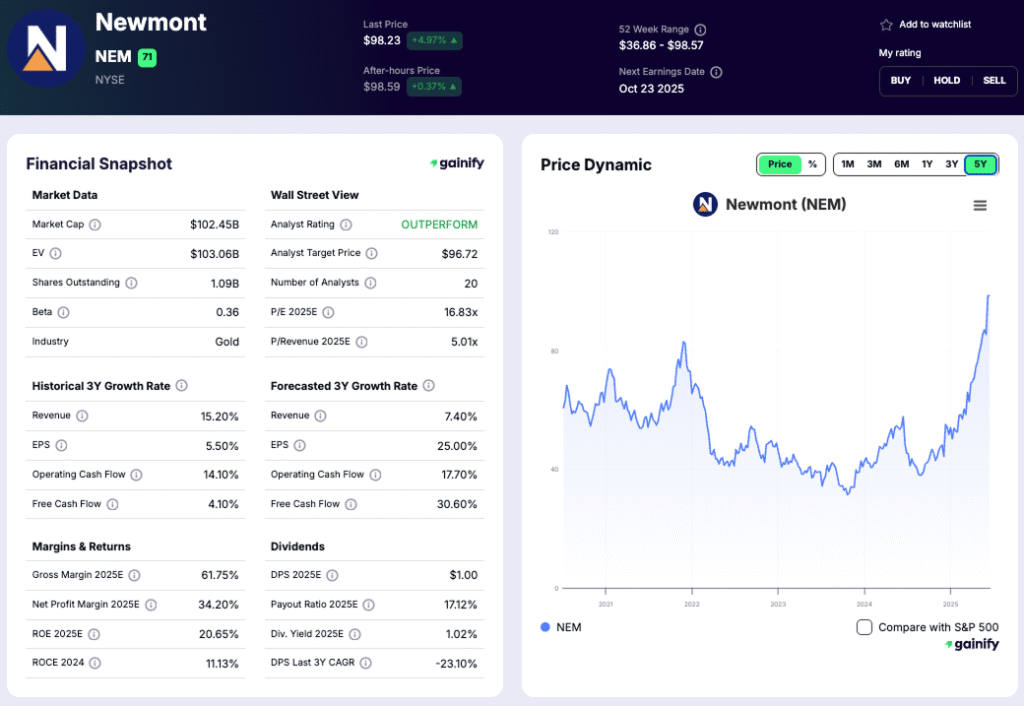

2. Newmont Corporation (NEM) – Market Cap: $102B

What they do:

Newmont is the world’s largest gold producer, with mines across North and South America, Africa, and Australia.

Why it matters:

The 2025 gold rally has sharply boosted profits, strengthening Newmont’s balance sheet and supporting higher dividends. The Newcrest acquisition nearly doubled its copper output, creating a more diversified growth platform.

What to watch:

- Synergy realization from Newcrest integration in Australia and Papua New Guinea.

- Progress on Tanami Expansion 2 and Ahafo North projects.

- Capital returns as free cash flow remains strong.

Key risk:

Persistent inflation in labor, materials, and equipment could pressure margins on large projects.

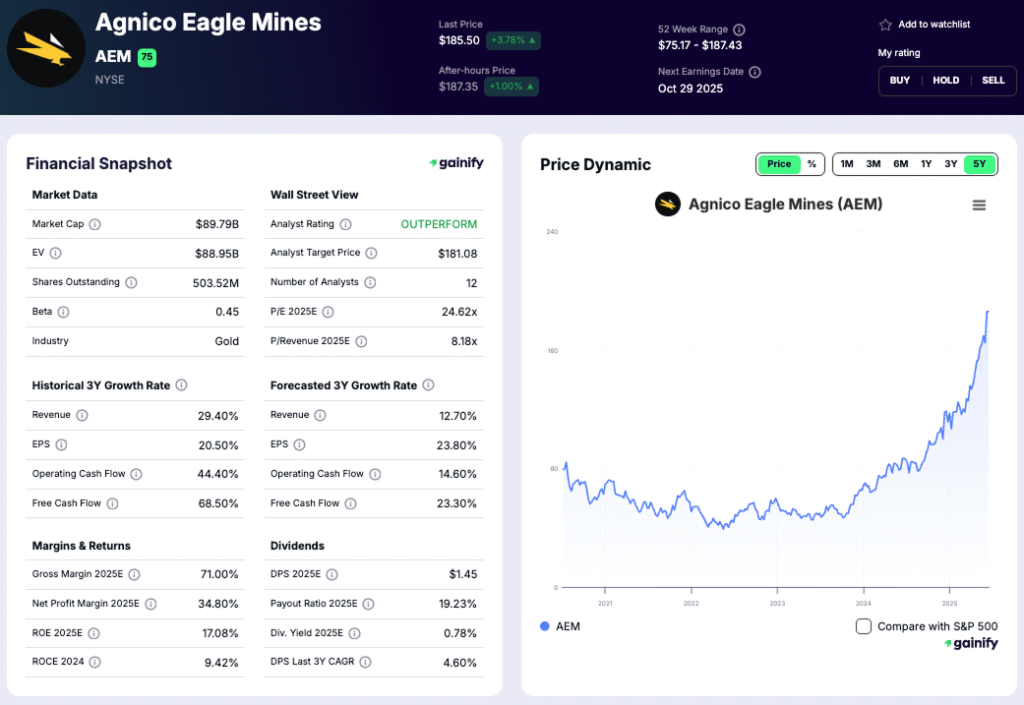

3. Agnico Eagle Mines (AEM) – Market Cap: $90B

Agnico Eagle is a leading Canadian gold producer with operations in Canada, Finland, Australia, and Mexico. The company is recognized for its reliable production, high-grade assets, and focus on operating in politically stable regions.

Why it matters:

In 2026, Agnico maintains one of the lowest cost structures among major producers, with all-in sustaining costs below $1,300 per ounce. Strong production from Detour Lake and Fosterville, combined with disciplined spending, has driven record free cash flow. The company continues to strengthen its balance sheet while raising dividends and repurchasing shares, positioning itself as one of the sector’s most efficient operators.

What to watch:

- Exploration success in Nunavut and Finland to extend mine life.

- Ongoing production ramp-up at Detour Lake and Hope Bay.

- Expansion of renewable energy capacity at remote sites to cut costs and emissions.

Key risk:

Heavy reliance on Canadian labor markets could sustain upward wage pressure, while energy and logistics costs may add volatility to operating margins.

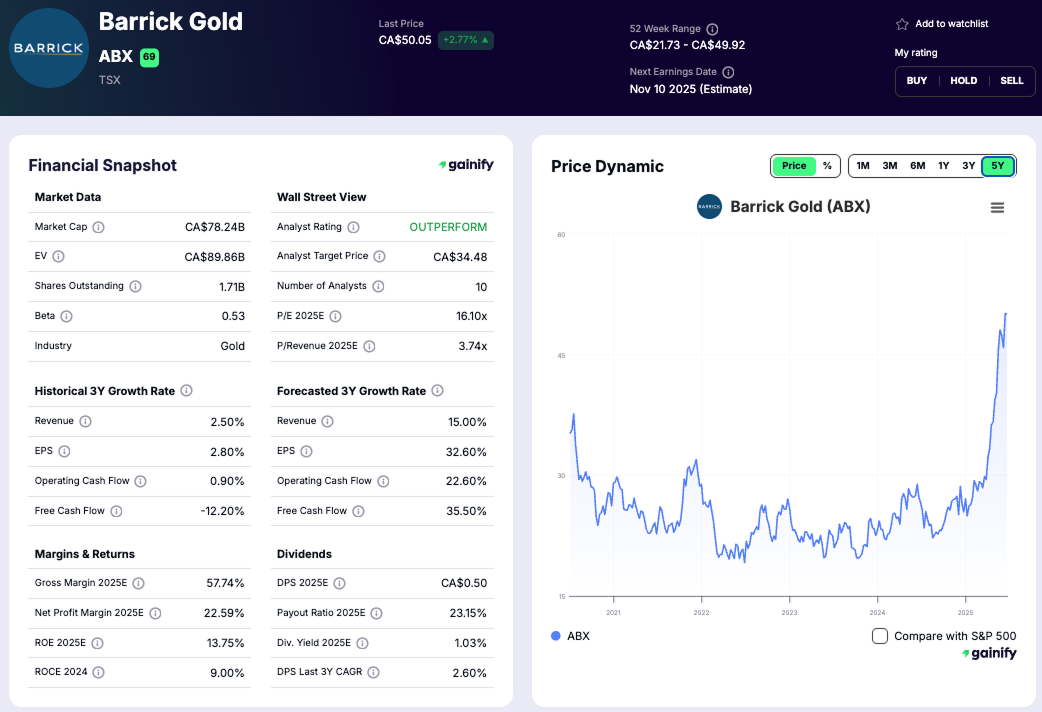

4. Barrick Gold (ABX.TO) – Market Cap: $56B

What they do:

Barrick is a global miner with major gold and copper operations across North America, Africa, and the Middle East.

Why it matters:

Exposure to both gold and copper makes Barrick one of most balanced plays. Strong metal prices have driven record free cash flow, enabling debt reduction, higher dividends, and ongoing reinvestment.

What to watch:

- Expansion progress at Lumwana and Jabal Sayid copper projects.

- Efficiency gains at Nevada Gold Mines joint venture.

- Execution of the company’s 2050 net-zero target.

Key risk:

Operational and political challenges in Africa and the Middle East may delay key projects.

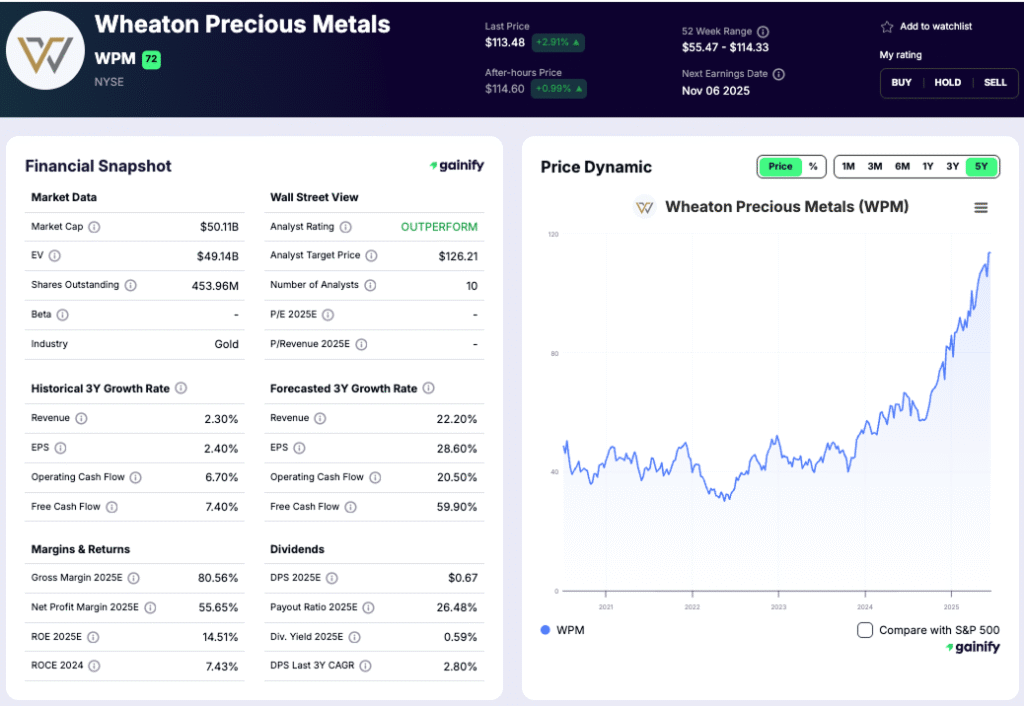

5. Wheaton Precious Metals (WPM) – Market Cap: $48B

What they do:

Wheaton Precious Metals is a streaming and royalty company that provides upfront capital to mining firms in exchange for a right to a portion of future precious-metal production, without operating any mines.

Why it matters:

With gold surging and its operating costs locked in, Wheaton converts rising metal prices directly into profit. Its capital-light structure and diversified portfolio across 22 operating mines and 24 development projects give the company predictable earnings and strong cash flow.

What to watch:

- Moving into new streaming deals for battery metals like nickel and cobalt.

- Adjustments to its dividend policy given record earnings.

- Adding new royalty or streaming contracts to expand exposure and longevity.

Key risk:

Revenue depends entirely on partner mines performing as expected. Operational issues or delays at those mines can reduce the stream volumes and hurt cash flow unexpectedly.

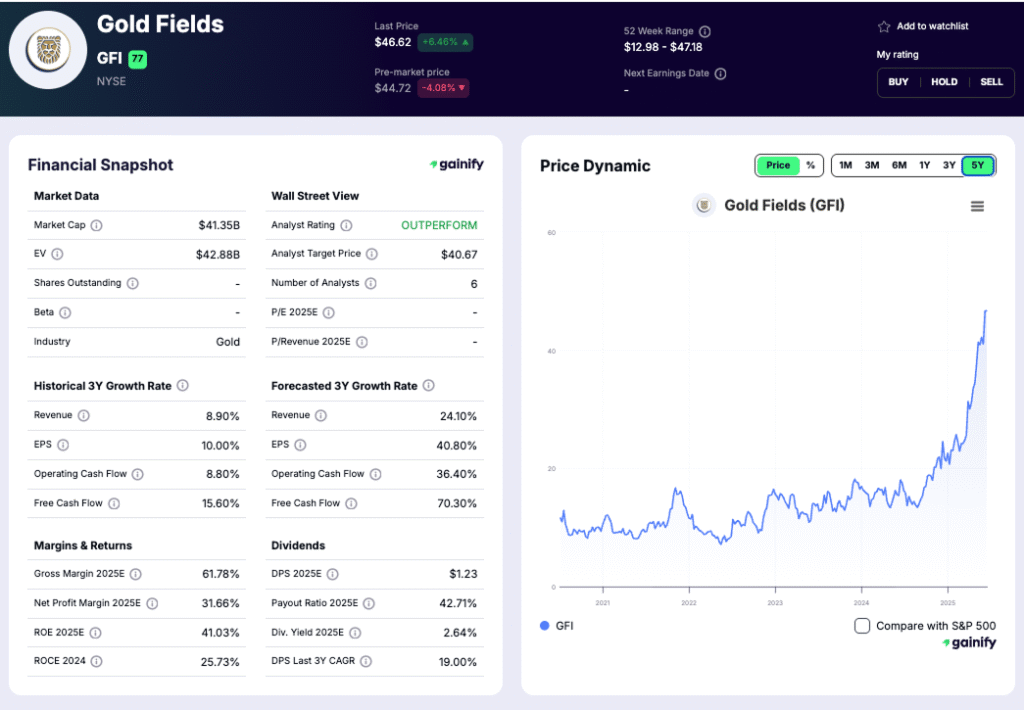

6. Gold Fields (GFI.JO) – Market Cap: $41B

What they do:

Gold Fields is a global gold producer with major operations in Australia, Ghana, South Africa, and Chile. The company focuses on large, efficient open-pit mines and remains one of the world’s lowest-cost producers.

Why it matters:

The successful start-up of the Salares Norte mine in Chile has lifted group production to record levels. Gold Fields’ focus on renewable power, automation, and digital systems is improving reliability and keeping costs competitive despite inflation.

What to watch:

- Continued production ramp-up and cost optimization at Salares Norte.

- Progress on ESG goals targeting a 50% cut in carbon emissions by 2030.

- Dividend growth tracking expanding free cash flow and higher gold prices.

Key risk:

Exposure to volatile African and South American currencies and shifting regulatory frameworks could pressure margins and project returns.

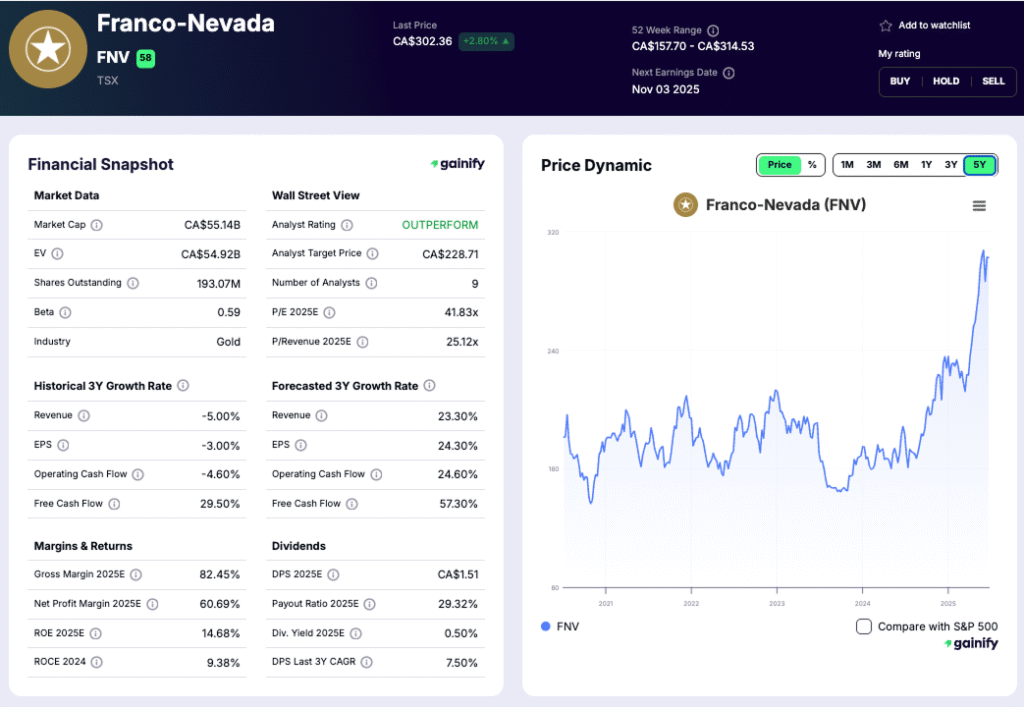

7. Franco-Nevada (FNV.TO) – Market Cap: $39B

What they do:

Franco-Nevada is a leading precious metals royalty and streaming company with interests across gold, silver, platinum, and energy assets. It earns income from a diversified portfolio of over 400 projects without owning or operating mines.

Why it matters:

Franco-Nevada’s business model provides steady cash flow and high margins with minimal operating risk. The company continues to generate strong returns from gold’s record prices and is rebuilding revenue streams following disruptions at its key Cobre Panamá asset.

What to watch:

- Recovery of royalty income from Cobre Panamá and performance of its top revenue contributors.

- Expansion into energy-linked royalties to diversify cash flow.

- Ongoing commitment to dividend growth and balance sheet strength.

Key risk:

High revenue concentration in a few large assets increases vulnerability to production shutdowns or geopolitical developments affecting partners.

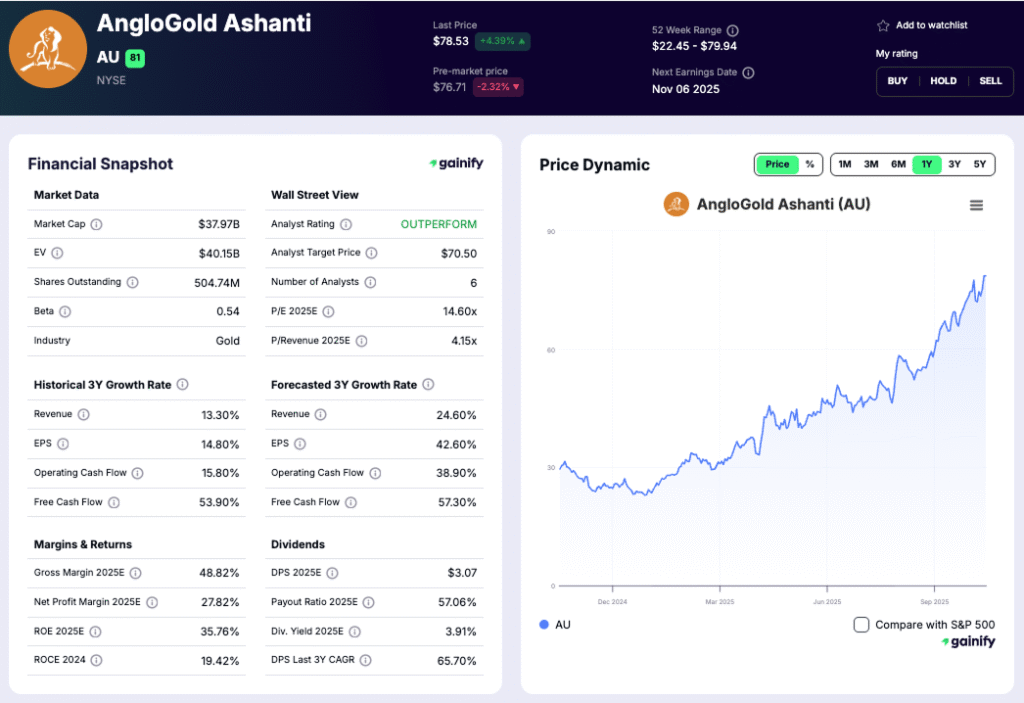

8. AngloGold Ashanti (AU) – Market Cap: $38B

What they do:

AngloGold Ashanti is a global gold producer with operations in Africa, Australia, and the Americas. The company recently completed its corporate redomicile to the United States and continues to streamline its portfolio for efficiency and growth.

Why it matters:

The move to a U.S. listing has improved governance and investor access. In 2025, stronger production from Australia and Tanzania, combined with cost discipline, has boosted margins. Ongoing investment in digitalization and automation is enhancing operational reliability.

What to watch:

- Production growth from Australian and African operations.

- Execution of efficiency programs and mine automation.

- Continued progress on cost reduction and balance sheet improvement.

Key risk:

Significant exposure to higher-risk jurisdictions in Africa and Latin America could create operational and political uncertainty that impacts output or costs.

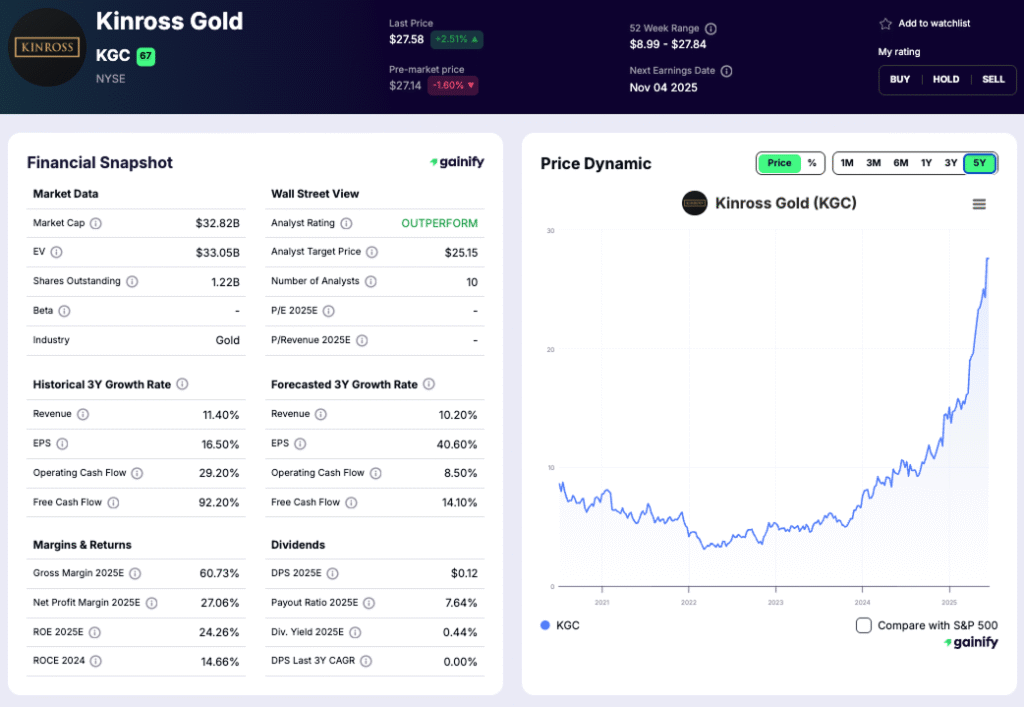

9. Kinross Gold (K.TO) – Market Cap: $29B

What they do:

Kinross Gold is a mid-tier Canadian gold producer with mines in the Americas and West Africa. Following its 2022 exit from Russia, the company has focused on lower-risk jurisdictions and improving operational efficiency.

Why it matters:

In 2026, Kinross continues to deliver strong free cash flow and steady production. High-grade output from Tasiast (Mauritania) and La Coipa (Chile) has supported earnings growth, while cost discipline and portfolio simplification have strengthened margins and shareholder returns.

What to watch:

- Performance at Tasiast and La Coipa, key drivers of 2025 production.

- Exploration results and new project development in Nevada.

- Further balance sheet strengthening and share repurchase activity.

Key risk:

Dependence on operations in Mauritania and Chile exposes Kinross to political and regulatory uncertainty, as well as potential logistics disruptions.

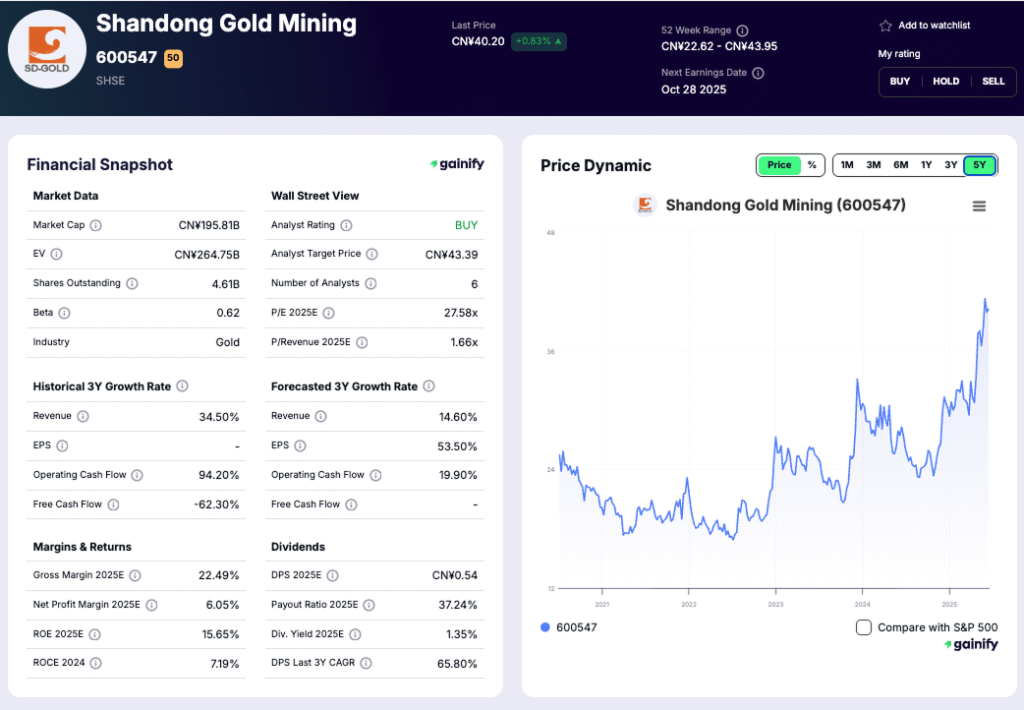

10. Shandong Gold Mining (600547.SS) – Market Cap: $27B

What they do:

Shandong Gold is one of China’s largest gold producers, operating multiple mines in Shandong province and expanding internationally through joint ventures and acquisitions. The company plays a key role in supporting China’s strategic resource security.

Why it matters:

Record gold prices in 2025 have driven strong revenue and profit growth. Backed by state ownership and access to low-cost financing, Shandong is investing heavily in automation, exploration, and overseas expansion to secure long-term production.

What to watch:

- New project development and global partnerships to grow reserves.

- Continued modernization and automation of domestic mines.

- Efforts to improve ESG reporting and transparency for international investors.

Key risk:

High state influence can limit flexibility in strategic decisions, while lower disclosure standards may affect investor confidence and comparability with global peers.

Key Market Trends (Jan 2026)

Trend | Direction | Insight |

Gold Price | ⬆⬆ | Gold trades near record highs above $4,400/oz, supported by central bank accumulation, de-dollarization trends, and strong retail demand across Asia. |

Production Costs (AISC) | ⬆ | All-in sustaining costs average $1,250–$1,400/oz, rising due to energy, labor, and royalty pressures but offset by productivity gains and automation. |

Free Cash Flow & Dividends | ⬆⬆ | Record margins are fueling double-digit dividend growth and aggressive share buybacks among top-tier producers. |

M&A & Reserve Expansion | ⬆ | Consolidation accelerates as miners seek scale, lower costs, and new resources to replace aging assets. Junior explorers remain key takeover targets. |

ESG & Decarbonization | ⬆ | Carbon reduction and renewable power integration are now core investment drivers, with major producers targeting net-zero by 2050. |

Geopolitical Diversification | ⬆ | Firms are pivoting toward stable jurisdictions (Canada, Australia, U.S.) to reduce exposure to high-risk regions in Africa and Latin America. |

Technology & Automation | ⬆ | Increased use of AI, digital twins, and autonomous fleets is improving safety, lowering costs, and extending mine life across leading operations. |

⚠️ Key Risks

- Falling gold prices can quickly compress margins and valuations.

- Rising energy and labor costs continue to pressure profitability.

- Regulatory and environmental hurdles may delay new projects.

- Currency fluctuations (especially in emerging markets) can affect costs and returns.

- Dilution risk for smaller miners raising capital during downturns.

Takeaway

Gold’s record-breaking run in 2025 reignited global interest in miners, and that momentum has carried into 2026. With prices elevated and balance sheets significantly stronger, the sector stands in its best shape in more than a decade.

With prices soaring and balance sheets stronger than ever, the sector is in its best shape in over a decade.

Large-cap producers like Newmont, Agnico Eagle, and Barrick offer stability, cash flow, and dividends.

Streaming firms like Wheaton and Franco-Nevada provide exposure with lower risk.

And for those chasing growth, Gold Fields and Kinross may deliver the biggest leverage to gold’s momentum.

If gold holds above $4,000, this could mark the start of a new “golden era” for miners – one built on discipline, technology, and record profitability.