Pipeline stocks head into 2026 in a far stronger position than most investors realize. While upstream energy remains exposed to commodity price swings, pipelines sit on the right side of the equation: rising volumes, long-term contracts, and infrastructure scarcity. These businesses are paid to move energy, not to predict its price, which makes their cash flows increasingly valuable in a market that now prioritizes durability over cyclicality.

The setup is straightforward. U.S. natural gas production remains high, LNG export capacity continues to expand, and electricity demand is accelerating due to data centers, electrification, and industrial reshoring. At the same time, permitting and regulatory constraints have made new long-haul pipeline construction difficult, if not impossible, in many regions. Existing networks are therefore becoming more strategic, not less.

The financial results are already reflecting this shift. Cash flows are stabilizing, leverage is coming down, and capital allocation is markedly more disciplined than in prior cycles. Dividend coverage has improved, balance sheets are healthier, and growth spending is increasingly focused on incremental expansions with clear returns rather than speculative builds.

For equity investors, this reframes the opportunity. The key drivers are no longer oil or gas prices, but contract quality, asset footprint, balance sheet strength, and capital discipline. The best pipeline stocks are those positioned to turn steady volumes into reliable cash flows, with selective growth layered on top.

With that context, the eight best pipeline stocks to watch in 2026 are not simply the highest-yielding names. They are owners of essential infrastructure that benefits from scarcity, scale, and improving fundamentals in a tightening energy transport market.

Key Highlights

- Scarcity, scale, leverage. North American pipeline infrastructure is becoming more valuable as energy demand grows and new project approvals remain limited, reinforcing the competitive advantage of incumbent operators with existing networks.

- Stability, yield, dispersion. Pipeline companies offer differentiated risk profiles, from conservative, contract-heavy operators like Enterprise Products Partners and Enbridge to higher-yield, more leveraged names such as Energy Transfer.

- Discipline, durability, cash. Balance sheets and capital allocation have improved meaningfully across the sector, shifting investor focus away from headline yield and toward sustainable, repeatable cash flow generation.

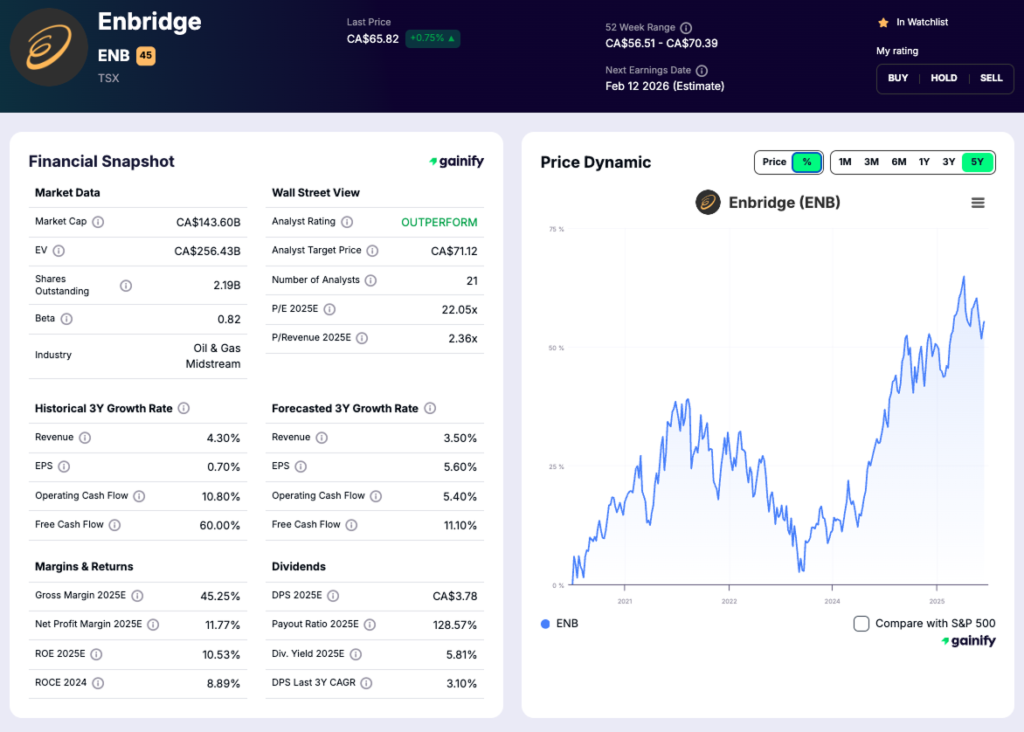

1. Enbridge (NYSE: ENB)

Market cap: $104.9B

Forward P/E: 22.2x

Forward dividend yield: 5.8%

Forward payout ratio: 128%

Net debt / EBITDA: 6.7x (last twelve months)

Business overview

Enbridge is one of the largest and most strategically important energy infrastructure owners in North America. Its asset base spans liquids pipelines, natural gas transmission, gas distribution, storage, and a smaller renewable power portfolio. The core of the company is its regulated and contracted pipeline network, including the Mainline system, which transports roughly 30% of North American crude oil, alongside major natural gas corridors serving utilities, LNG export facilities, and industrial demand centers.

The business model is built around long-duration assets with high utilization, regulated tariffs, and take-or-pay style contracts. This structure minimizes direct commodity price exposure and shifts earnings visibility toward volumes, rates, and system reliability rather than market conditions.

Investment thesis

Enbridge’s appeal heading into 2026 is driven by infrastructure scarcity and cash flow visibility. Management’s 2026 guidance calls for adjusted EBITDA of $20.2 to $20.8 billion, supported by secured capital projects, tariff escalations, recontracting activity, and system optimization. Distributable cash flow per share is guided at $5.70 to $6.10, supporting both dividend coverage and modest annual growth.

The dividend remains central to the equity story. While the forward payout ratio appears elevated on an earnings basis, management evaluates sustainability using distributable cash flow, where coverage remains supported by stable, contracted revenues. Capital allocation is increasingly disciplined, with growth spending focused on incremental expansions rather than large greenfield projects.

Structurally, Enbridge benefits from the increasing difficulty of permitting new pipelines. With limited new capacity entering the market, existing networks gain strategic value through higher utilization, pricing stability, and low-risk expansion opportunities.

Key risks

- Leverage sensitivity: Net debt to EBITDA remains elevated relative to some peers, increasing sensitivity to interest rates and capital market conditions.

- Regulatory exposure: A significant portion of assets operate under regulated frameworks in the United States and Canada, exposing returns to rate cases, permitting decisions, and political scrutiny.

- Capital intensity: Ongoing investment is required to maintain and expand assets, which can pressure free cash flow if execution or timing slips.

- Currency exposure: Cash flows generated in both Canadian and U.S. dollars introduce foreign exchange risk, partially mitigated through hedging.

Bottom line: Enbridge combines irreplaceable pipeline assets with strong cash flow visibility and a durable dividend. While leverage and regulatory risk warrant monitoring, infrastructure scarcity and disciplined capital allocation position the company as a core pipeline holding heading into 2026.

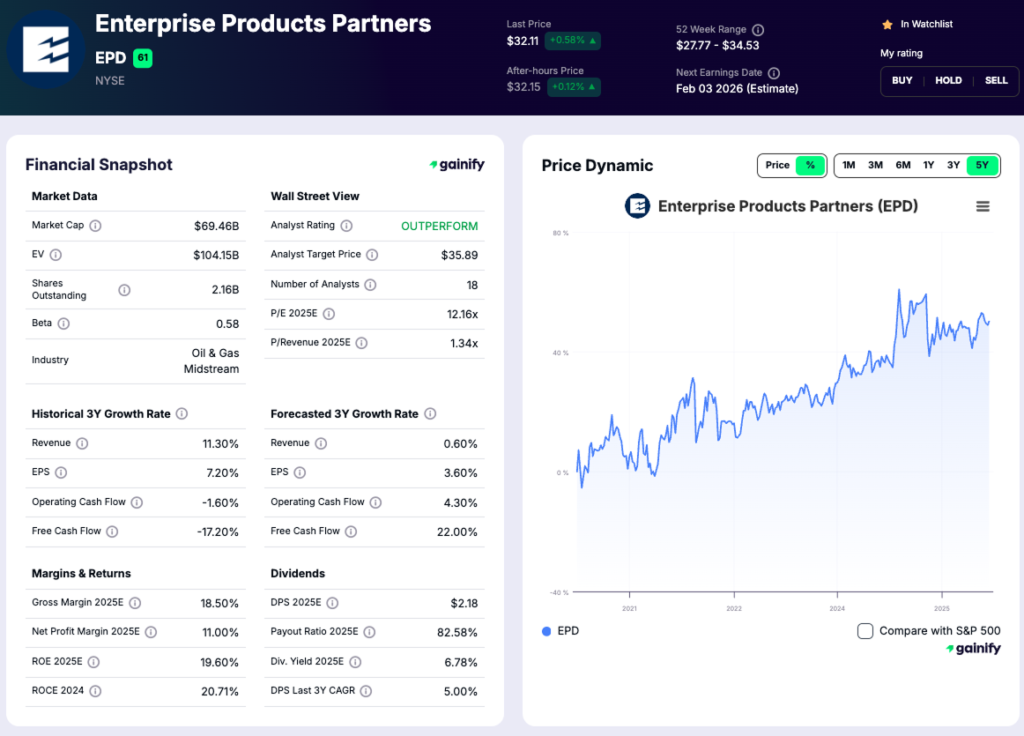

2. Enterprise Products Partners (NYSE: EPD)

Market cap: $69.5B

Forward P/E: 12.2x

Forward dividend yield: 6.8%

Forward payout ratio: 82%

Net debt / EBITDA: 3.3x

Business overview

Enterprise Products Partners is one of the most conservatively run midstream operators in North America. Its asset base includes more than 50,000 miles of pipelines, large-scale NGL fractionation and storage at Mont Belvieu, natural gas processing plants in key shale basins, and a leading U.S. export platform for NGLs, LPG, ethane, crude oil, and petrochemicals. The system is highly integrated, allowing Enterprise to capture volumes across multiple points in the value chain.

Roughly 90% of cash flow is generated from fee-based or fee-plus-margin contracts with long-term commitments and inflation escalators. The partnership has eliminated incentive distribution rights, self-funds most growth capital, and maintains one of the strongest balance sheets in the sector, supported by A-rated credit.

Investment thesis

Enterprise is best viewed as the defensive compounder among pipeline stocks. It has increased distributions for 27 consecutive years, including through commodity downturns and recessions, reflecting the durability of its model. Growth is focused on high-return NGL infrastructure tied to Permian volumes and U.S. export demand.

As of late 2025, the company had more than $5 billion of major projects under construction, largely backed by long-term contracts. These projects are expected to drive higher free cash flow in 2026, supporting unit buybacks, balance sheet strength, and steady distribution growth.

Leverage of 3.3x net debt to EBITDA sits at the low end of management’s target range, while distribution coverage remains strong. This allows Enterprise to return capital without increasing financial risk.

Key risks

- Yield tradeoff: A conservative balance sheet limits headline yield upside versus higher-risk peers.

- Growth pacing: Disciplined capital allocation can result in slower visible growth.

- Regulatory exposure: Expansion projects remain subject to permitting and regulatory timelines.

Bottom line: Enterprise Products Partners is a low-volatility pipeline owner built for durability, offering reliable income, strong balance sheet protection, and steady long-term compounding rather than aggressive yield chasing.

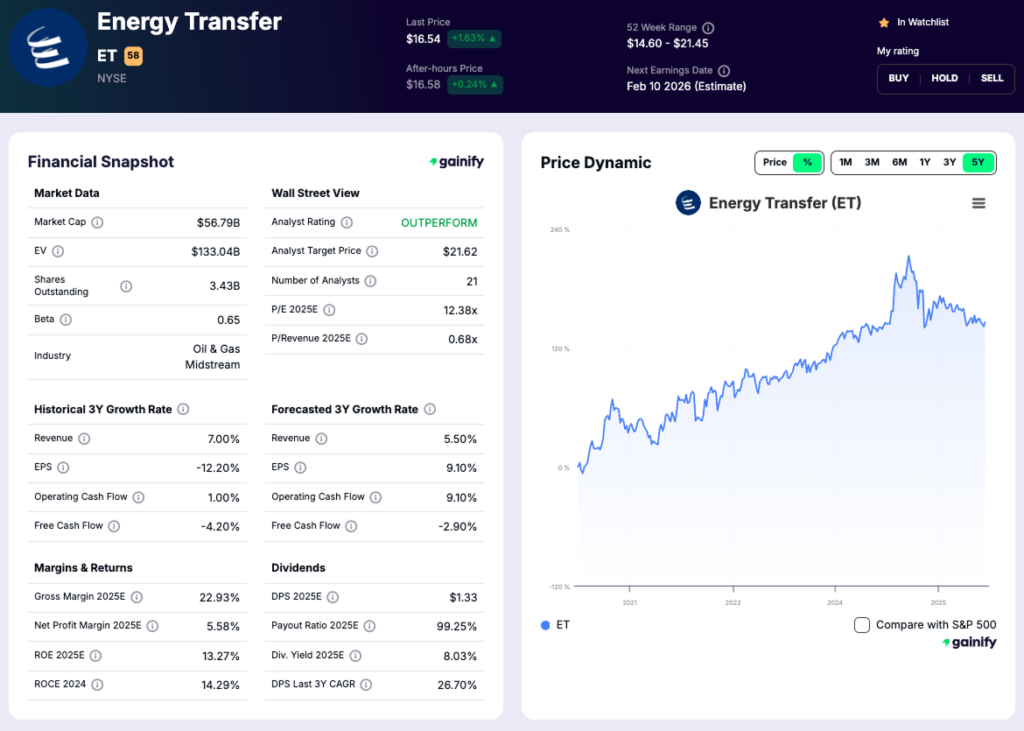

3. Energy Transfer (NYSE: ET)

Market cap: $56.8B

Forward P/E: 12.2x

Forward dividend yield: 8.2%

Forward payout ratio: 99%

Net debt / EBITDA: 4.2x

Business overview

Energy Transfer operates one of the largest and most diversified midstream platforms in North America, spanning natural gas, NGLs, crude oil, refined products, storage, and export infrastructure. Its system includes more than 140,000 miles of pipelines, major positions in Permian gas processing, Mont Belvieu fractionation, and leading U.S. crude and NGL export terminals such as Nederland and Marcus Hook. Roughly 90% of cash flow is generated from fee-based contracts, with minimal direct commodity exposure.

The company’s footprint is uniquely positioned to serve growing end markets, particularly LNG exports, data centers, power generation, and industrial demand. Long-term contracts with utilities, LNG developers, and large technology customers increasingly anchor volumes, improving visibility and reducing cyclicality

Investment thesis

Energy Transfer represents the high-cash-flow, higher-yield end of the pipeline spectrum. After years of balance sheet repair, leverage now sits in the lower half of management’s 4.0x–4.5x target range, marking the strongest financial position in the partnership’s history. Distribution coverage remains solid, supporting annual payout growth of 3% to 5%.

Growth is driven by a deep backlog of contracted projects tied to structural gas demand. These include Permian processing expansions, new interstate pipelines such as the Hugh Brinson and Desert Southwest projects, and significant NGL export and fractionation investments. Management expects these assets to translate into rising distributable cash flow through 2026 without materially increasing leverage.

At a forward P/E near 12x and an 8% yield, Energy Transfer offers one of the most attractive cash-on-cash profiles in large-cap midstream, with upside driven by execution rather than commodity prices.

Key risks

- Leverage sensitivity: Higher leverage than peers leaves less margin if volumes weaken or projects are delayed.

- Complexity: A vast, multi-segment asset base increases execution and operational risk.

- Regulatory exposure: Large-scale interstate projects face permitting and political risk that can affect timelines and returns.

Bottom line: Energy Transfer is a cash flow machine with improving discipline, offering elevated income and long-term growth tied to U.S. natural gas demand, for investors comfortable with a more complex and leveraged midstream model.

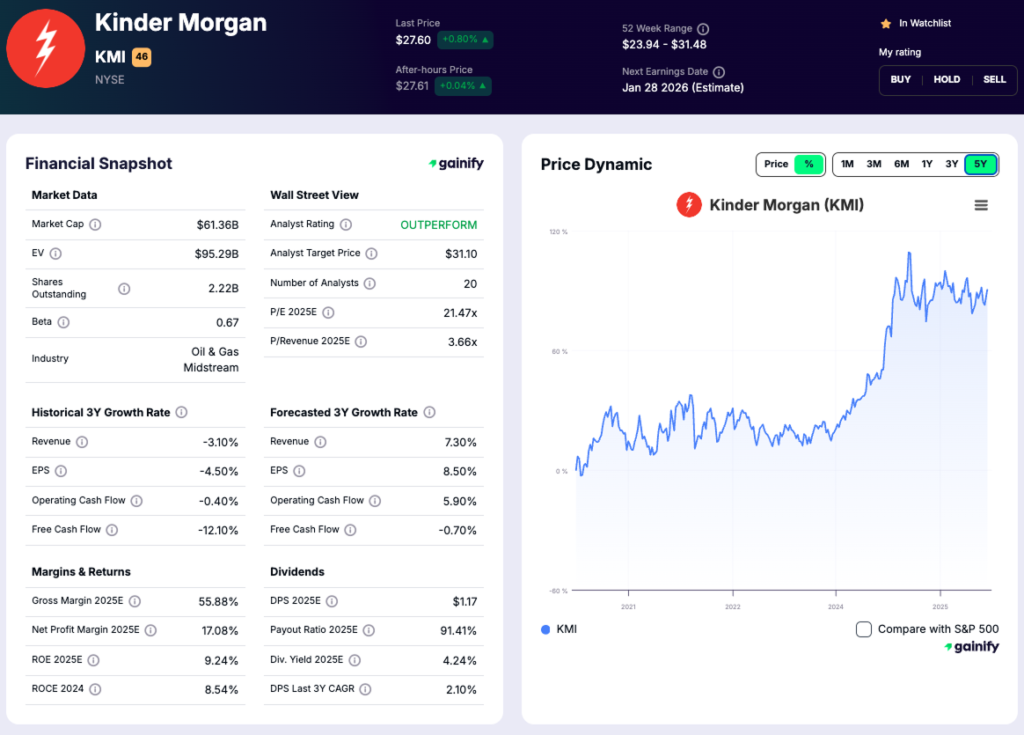

4. Kinder Morgan (NYSE: KMI)

Market cap: $61.4B

Forward P/E: 21.2x

Forward dividend yield: 4.3%

Forward payout ratio: 91%

Net debt / EBITDA: 3.8x

Business overview

Kinder Morgan operates the largest natural gas transmission network in the United States, moving about 40% of U.S. natural gas production through more than 58,000 miles of pipelines and extensive storage assets. The business is heavily weighted toward long-haul gas transportation, with smaller contributions from refined products pipelines, terminals, and CO₂ transportation.

Approximately 95% of earnings are generated from fee-based or take-or-pay contracts, resulting in highly predictable cash flows and minimal commodity price exposure. This positions Kinder Morgan as a direct beneficiary of rising gas demand from LNG exports, power generation, and industrial growth.

Investment thesis

Kinder Morgan’s value lies in scale, contract quality, and visibility. Management’s 2026 outlook calls for adjusted EBITDA of $8.7 billion and adjusted EPS of $1.37, driven primarily by natural gas expansions serving utilities and LNG facilities.

The company has a $9.3 billion backlog of committed projects, roughly 90% tied to natural gas, with average build multiples below 6x. These projects are largely contracted before construction and are expected to support steady cash flow growth without increasing leverage. Net debt to EBITDA is projected to remain at 3.8x, within the company’s target range.

Kinder Morgan has increased its dividend for nine consecutive years. While the yield is lower than higher-leverage peers, the tradeoff is greater cash flow stability and balance sheet strength.

Key risks

- Yield tradeoff: Lower income appeal relative to higher-yield peers

- Regulatory exposure: Interstate pipelines are subject to FERC oversight

- Execution risk: Returns depend on timely completion of gas expansions

Bottom line: Kinder Morgan offers durable exposure to long-term U.S. natural gas demand, favoring stability and steady growth over aggressive yield.

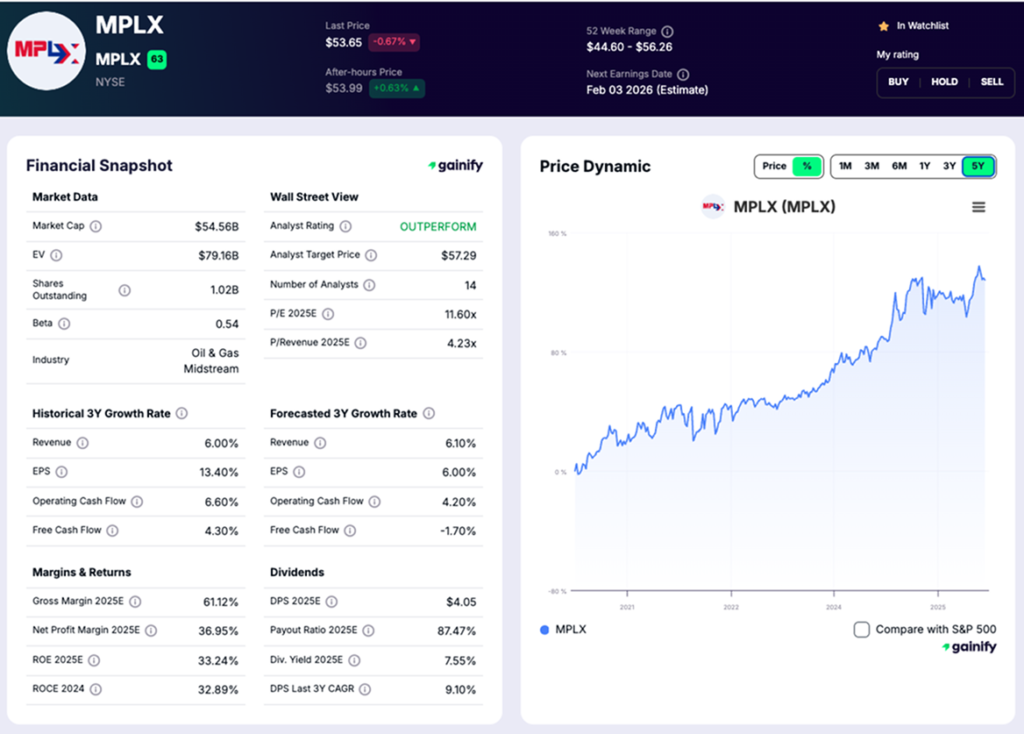

5. MPLX (NYSE: MPLX)

Market cap: $54.6B

Forward P/E: 11.7x

Forward dividend yield: 7.5%

Forward payout ratio: 88%

Net debt / EBITDA: 3.7x (last twelve months)

Business overview

MPLX operates a large, integrated midstream platform spanning crude oil logistics, natural gas gathering and processing, NGL fractionation, and long-haul transportation. Its asset base is concentrated in the Permian, Marcellus, Utica, and Gulf Coast, with deep integration into Marathon Petroleum’s refining system. More than 10% of U.S. natural gas production passes through MPLX-managed assets, highlighting the scale and relevance of its network.

The business is increasingly weighted toward natural gas and NGL value chains. More than 90% of current growth capital is directed toward gas processing, treating, fractionation, and export infrastructure, reflecting management’s focus on structurally growing demand rather than cyclical crude volumes.

Investment thesis

MPLX offers a compelling blend of income, growth, and balance sheet discipline. In the third quarter of 2025, adjusted EBITDA increased year over year to $1.77 billion, while distributable cash flow reached $1.47 billion, supporting distribution coverage of approximately 1.3x. Management raised the quarterly distribution by 12.5% for the second consecutive year, bringing the annualized payout to $4.31 per unit.

Growth visibility is supported by more than $5 billion of deployed capital across Permian and Marcellus gas infrastructure, including pipeline expansions, sour gas treating assets in the Delaware Basin, and Gulf Coast fractionation and export projects. These investments are largely fee-based, backed by long-term contracts, and targeted at attractive returns, positioning MPLX for steady cash flow growth through 2026.

Leverage remains controlled at 3.7x net debt to EBITDA, providing flexibility to fund growth, raise distributions, and opportunistically repurchase units without stressing the balance sheet.

Key risks

- Sponsor concentration: Commercial ties to Marathon Petroleum create customer concentration risk, though they also provide volume stability.

- Capital intensity: A large growth program requires disciplined execution to maintain free cash flow coverage.

- Volume sensitivity: While revenues are primarily fee-based, throughput depends on sustained upstream activity in core basins.

Bottom line: MPLX is a high-quality, income-oriented pipeline operator with improving growth visibility, strong distribution coverage, and a disciplined balance sheet, well positioned for durable cash flow generation into 2026.

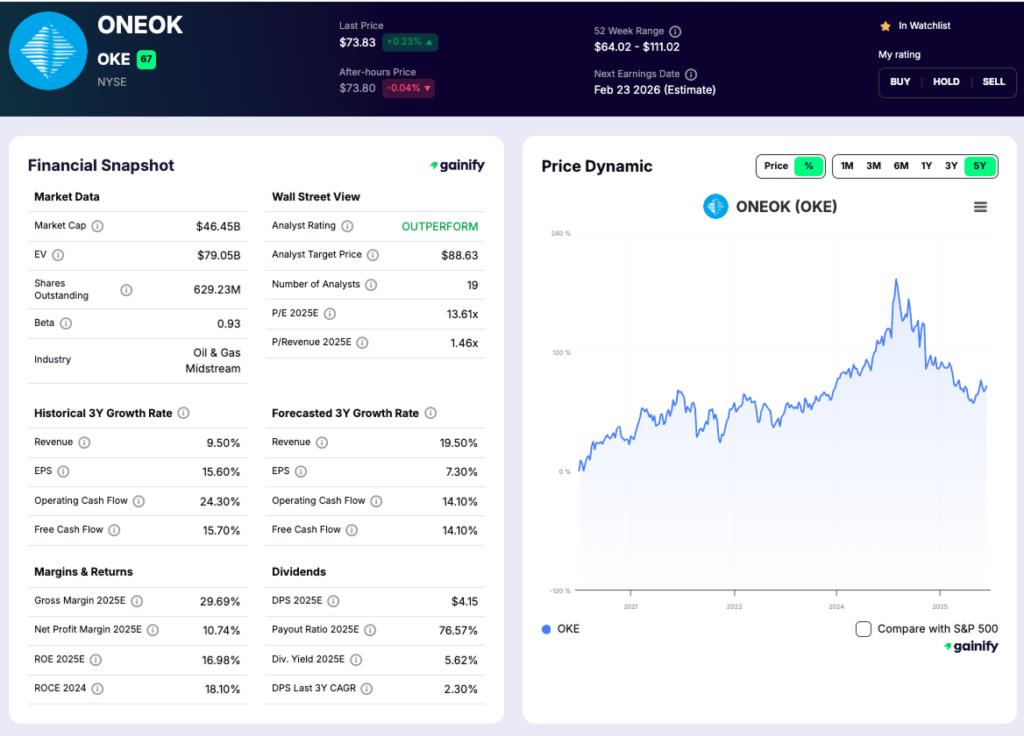

6. ONEOK (NYSE: OKE)

Market cap: $46.4B

Forward P/E: 13.4x

Forward dividend yield: 5.7%

Forward payout ratio: 77%

Net debt / EBITDA: 5.1x

Business overview

ONEOK operates a large, contiguous midstream network spanning natural gas liquids, natural gas gathering and processing, refined products, crude oil, and interstate natural gas pipelines. Its footprint covers approximately 60,000 miles of pipelines across the Permian, Bakken, Mid-Continent, and Gulf Coast regions, with deep connectivity to utilities, LNG facilities, petrochemical plants, refiners, and export terminals.

The company runs a diversified, fee-based model, with approximately 90% of earnings generated from fee-based contracts. NGLs represent the largest contributor to EBITDA, supported by more than 1.2 million barrels per day of fractionation capacity and direct connectivity from producing basins to Gulf Coast demand and export hubs.

Investment thesis

ONEOK’s investment case centers on scale, integration, and visible growth. Management guides to 2025 adjusted EBITDA of $8.0 to $8.45 billion, reflecting eleven consecutive years of EBITDA growth through multiple commodity cycles. The company targets dividend growth of 3% to 4% annually while maintaining a payout ratio at or below 85% of cash flow from operations.

Growth visibility is supported by a portfolio of high-return organic projects adjacent to existing assets. Key projects include the Medford fractionator rebuild, refined products pipeline expansions into the Denver market, new gas processing capacity in the Permian, and joint venture LPG export infrastructure at Texas City. These projects are largely fee-based, contracted, and designed to enhance utilization across ONEOK’s existing network rather than introduce greenfield risk.

Capital allocation remains balanced. ONEOK targets returning 75% to 85% of cash flow from operations to shareholders through dividends and share repurchases while maintaining investment-grade credit ratings and a long-term leverage target of 3.5x debt to EBITDA.

Key risks

- Leverage profile: Net debt to EBITDA remains higher than some peers, requiring continued execution to support balance sheet improvement.

- Integration risk: Recent acquisitions increase operational complexity and place greater emphasis on synergy realization.

- Volume sensitivity: While revenues are largely fee-based, throughput depends on sustained production in core basins.

Bottom line: ONEOK is a scaled, integrated midstream operator with strong NGL exposure, visible organic growth, and a clear capital return framework. Its contiguous asset base and fee-based earnings position it well for durable cash flow growth heading into 2026, with leverage reduction as the key variable to monitor.

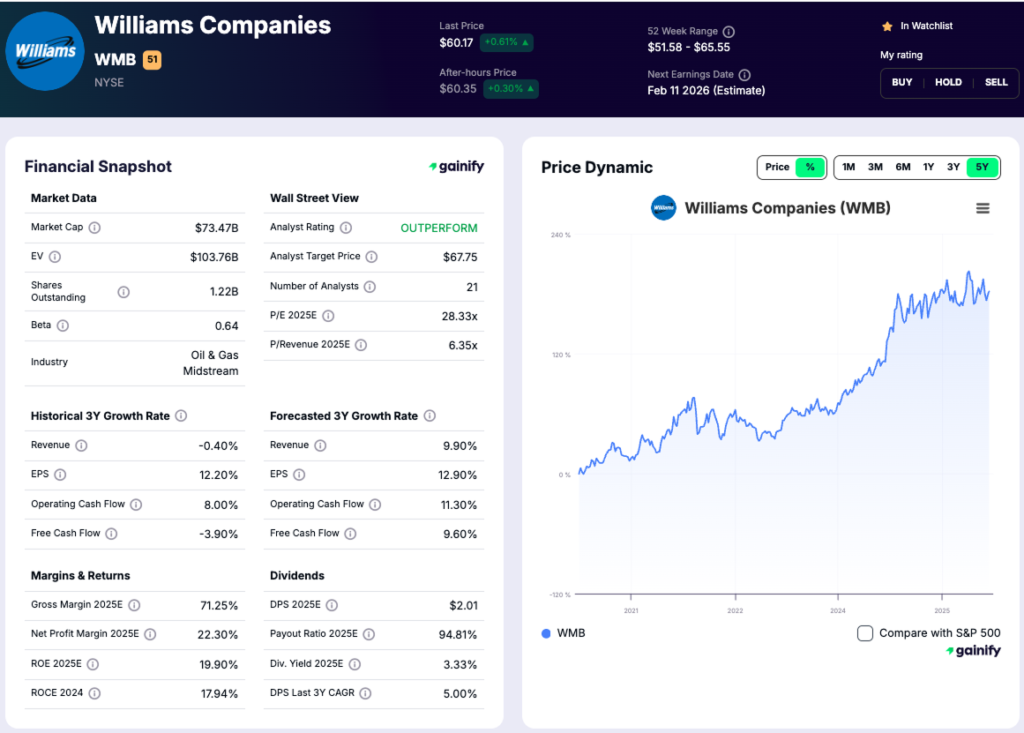

7. Williams Companies (NYSE: WMB)

Market cap: $73.5B

Forward P/E: 28.0x

Forward dividend yield: 3.4%

Forward payout ratio: 94%

Net debt / EBITDA: 3.7x

Business overview

Williams is the largest pure-play natural gas infrastructure company in the United States, anchored by its ownership of the Transco pipeline system. Transco is the dominant interstate natural gas artery serving the Eastern U.S., moving gas from the Gulf Coast through the Southeast and into the Mid-Atlantic and Northeast. In total, Williams operates more than 33,000 miles of pipelines and handles a substantial share of U.S. gas transmission, gathering, and processing volumes.

The business is overwhelmingly gas-focused, with transmission, power, and Gulf Coast operations accounting for nearly half of adjusted EBITDA. The remainder is generated from gas gathering and processing in core basins such as the Marcellus, Utica, and Haynesville. Cash flows are primarily fee-based, supported by long-term, take-or-pay contracts and regulated tariffs.

Investment thesis

Williams’ investment case is built around structural growth in U.S. natural gas demand rather than commodity price exposure. In the third quarter of 2025, adjusted EBITDA grew 13% year over year to $1.92 billion, driven by higher Transco rates, expansion projects placed into service, and increased volumes across multiple regions. Year-to-date adjusted EBITDA reached $5.72 billion, reinforcing the company’s consistent growth trajectory.

Looking ahead, Williams has one of the clearest growth backlogs in the sector. The company is advancing a large portfolio of fully contracted transmission expansions, storage projects, and power-related investments, including multiple Transco expansions, Haynesville gathering projects, and behind-the-meter power initiatives. Management expects these projects to drive mid-single-digit EBITDA and cash flow growth through 2026 while maintaining leverage discipline.

Balance sheet strength remains a key differentiator. Net debt to adjusted EBITDA stands at approximately 3.7x, supported by investment-grade credit ratings and a well-laddered debt maturity profile. Dividend coverage on an available funds from operations basis remains strong, supporting continued annual dividend growth in the mid-single-digit range.

Key risks

- Valuation: Shares trade at a premium multiple relative to most midstream peers, leaving less margin for execution missteps.

- Regulatory exposure: Interstate pipelines are subject to FERC oversight, which can affect allowed returns and project timelines.

- Concentration: A large portion of cash flow is tied to Transco, increasing sensitivity to operational or regulatory issues affecting that system.

Bottom line: Williams is the highest-quality natural gas infrastructure owner in the U.S. pipeline universe. Its scale, contracted growth backlog, and balance sheet discipline make it a long-duration compounder tied directly to LNG exports, power generation, and rising electricity demand heading into 2026.

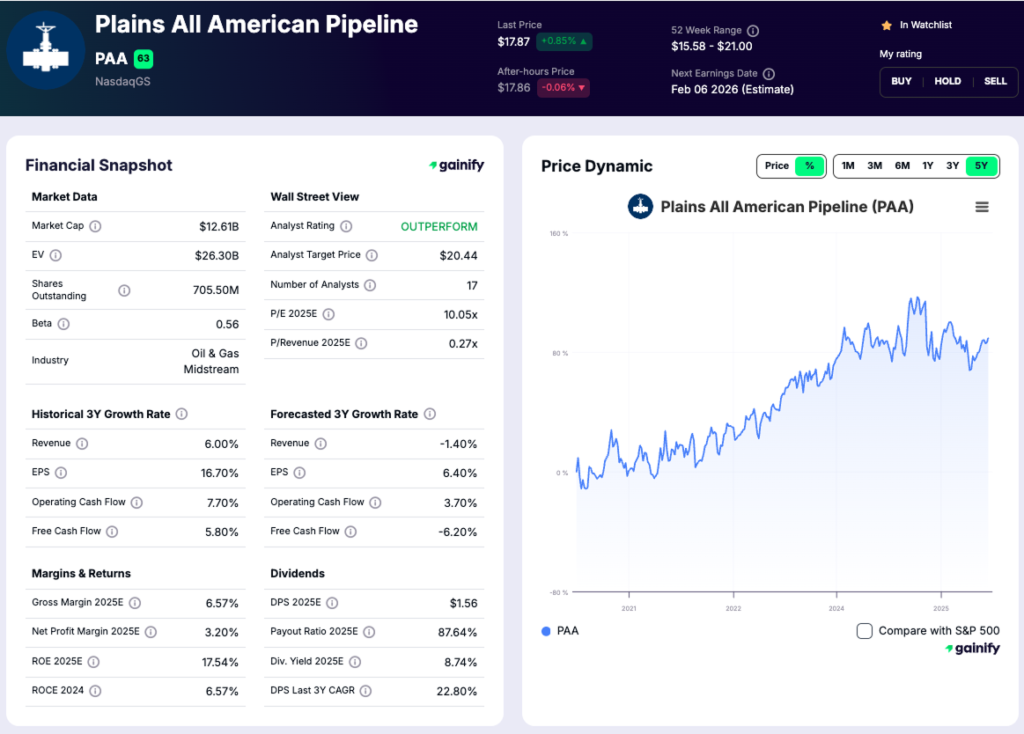

8. Plains All American Pipeline (NYSE: PAA)

Market cap: $12.6B

Forward P/E: 9.9x

Forward dividend yield: 8.9%

Net debt / EBITDA: 3.3x

Business overview

Plains All American is a crude oil–focused midstream operator with a dominant footprint in the Permian Basin and strong connectivity to Gulf Coast refining and export markets. Its assets span crude oil gathering, long-haul pipelines, terminals, and storage. In recent years, the company simplified its portfolio by exiting non-core NGL exposure, repositioning itself as a more focused crude transportation platform.

This shift has improved cash flow visibility and reduced commodity sensitivity. The business is now anchored by long-term, fee-based contracts tied primarily to Permian production and export demand rather than spot market activity.

Investment thesis

Plains enters 2026 with improving fundamentals that remain undervalued. In the third quarter of 2025, adjusted EBITDA attributable to PAA reached $669 million, prompting management to raise full-year guidance to $2.84–$2.89 billion following strong operating performance and contributions from recent acquisitions.

Balance sheet progress has been significant. Net debt to EBITDA declined to 3.3x as of 3Q25, down materially from prior years and within management’s long-term target range. Distribution coverage remains strong at approximately 1.75x, supporting a high yield while preserving flexibility for debt reduction and selective growth.

Plains benefits from rising Permian volumes, constrained long-haul capacity, and growing U.S. crude export demand. With new pipeline approvals difficult to secure, existing systems with established rights-of-way are becoming more valuable. The company’s focus on bolt-on acquisitions and operating leverage rather than greenfield risk supports durable cash flow growth.

At under 10x forward earnings, Plains offers a compelling mix of income, improving leverage, and embedded volume upside.

Key risks

Results remain sensitive to crude oil production levels in the Permian. Regulatory oversight can affect pipeline tariffs and operations. Continued capital discipline is essential to avoid overextension during favorable commodity cycles.

Pipeline Industry Outlook for 2026

The pipeline sector enters 2026 with one of the clearest fundamental setups in the energy complex. Demand visibility is improving while supply is structurally constrained. Natural gas flows are being pulled higher by power generation, LNG exports, data center buildouts, and industrial reshoring, while crude oil and NGL volumes remain durable across core basins. Pipelines sit directly in the middle of this system, monetizing throughput rather than price.

The revenue model matters. Long-term contracts, take-or-pay structures, and regulated tariffs convert physical volumes into predictable cash flows and dampen cycle risk. This has reduced earnings volatility across the sector and improved capital planning. As a result, operators are allocating capital with more discipline, prioritizing balance sheet repair, return of capital, and incremental expansions with clear economics rather than speculative growth.

On the supply side, constraints are becoming structural rather than cyclical. Permitting friction, regulatory uncertainty, legal challenges, and rising construction costs have sharply reduced the universe of viable new long-haul projects. In practice, this protects incumbents. Existing systems are seeing higher utilization, stronger recontracting terms, and expansion opportunities through compression, looping, and bolt-on capacity additions that carry lower risk and higher returns than greenfield builds.

This combination is reshaping how pipeline stocks trade. They increasingly resemble infrastructure assets with embedded growth rather than commodity-linked energy equities. Returns are being driven by contract quality, asset footprint, leverage discipline, and capital allocation rather than oil or gas price forecasts.

For investors, the implication is straightforward. The opportunity in 2026 is not in predicting energy prices, but in owning scarce infrastructure that benefits from rising volumes, constrained competition, and improving financial discipline. In a market that continues to reprice risk, pipelines offer a rare mix of stability, income, and incremental growth optionality.

Conclusion

Pipeline stocks enter 2026 with a combination of earnings visibility, infrastructure scarcity, and capital discipline that is increasingly rare in today’s energy market. Companies such as Enterprise Products Partners, Enbridge, Kinder Morgan, Williams Companies, ONEOK, MPLX, Energy Transfer, and Plains All American own assets that are essential to the functioning of the North American energy system and difficult to replicate. Their value is tied less to commodity prices and more to volumes, contracts, and network scale.

What differentiates outcomes from here is execution. Contract quality, balance sheet strength, and capital allocation will matter more than headline yields or short-term energy price moves. Conservative operators offer stability and income durability, while higher-yield names provide greater upside if financial discipline holds. In both cases, returns are driven by ownership of scarce infrastructure rather than by forecasting oil or gas prices.

For investors, the opportunity in 2026 lies in selectivity. Pipelines with defensible footprints, improving leverage profiles, and disciplined growth strategies are best positioned to convert steady energy flows into reliable long-term returns. In a market that increasingly rewards cash flow certainty over narrative growth, well-chosen pipeline stocks can function as long-duration infrastructure holdings rather than cyclical energy trades.

Disclaimer: This content is provided for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult a qualified financial advisor before making any investment decisions.