Davis Selected Advisers, guided by portfolio manager Chris Davis, is one of the most enduring names in American asset management. The firm is known for its value investor heritage, disciplined investment strategy, and a commitment to long-term results over short-term speculation.

The latest 13F filing for Q2 2025 reveals a portfolio value of $18.70 billion, spread across 107 stock picks in a diversified equity portfolio. The average holding period remains at 31 quarters (nearly eight years), which is exceptionally long by modern standards, especially when compared to many hedge funds and active managers who turn over portfolios several times a year. The low turnover rate is not a sign of inaction, but of conviction: Davis buys with the intention to own for years.

Davis Advisors is no stranger to navigating cycles. Founded in 1969 by Shelby M.C. Davis, and now in its third generation of leadership, the firm manages strategies such as the Davis New York Venture Fund, Davis Financial Fund, Davis Select Worldwide ETF, Davis Select U.S. Equity ETF, Davis Select International ETF, and the Davis Large Cap Value SMA. These products invest in large cap stocks, mid-caps, and select global companies, often with significant insider ownership, which aligns management with shareholders.

The approach mirrors the principles of legendary investors Warren Buffett and Charlie Munger: focus on businesses you fully understand, buy their shares when the price offers good value, and hold them long enough for the company’s profits to grow. Over time, this allows earnings per share (EPS) growth, strong return on invested capital, and the power of compounding to steadily build wealth.

In this article, we will take a detailed look at Chris Davis’ Q2 2025 portfolio. You’ll see how his investment strategy works in practice, which companies make up his largest holdings, and the most significant changes he made this quarter. We will explain the top adds (increasing positions he already owned), new buys (brand-new positions), sold outs (completely exited holdings), and reductions (partial trims of existing positions). Along the way, we’ll discuss what each move reveals about his outlook and priorities. Finally, we’ll explore why the current portfolio fits the long-standing Davis Advisors playbook and highlight the key lessons individual investors can take from it.

Who Is Chris Davis

Chris Davis represents the third generation of one of America’s most respected investing families. He began his career at Davis Advisors in 1989, rising to become a portfolio manager in the mid-1990s, and now serves as chairman of the firm. His connection to investing is more than professional. It is personal and deeply rooted in family history. His grandfather, Shelby Cullom Davis, famously turned a modest investment into hundreds of millions of dollars by applying a disciplined, long-term focus to insurance stocks.

Today, Chris Davis oversees multiple strategies at Davis Advisors, including flagship products like the Davis New York Venture Fund, which has maintained the same core investment discipline since it launched in 1969. The firm’s culture values independent research, blends a quantitative approach with deep fundamental analysis, and ensures alignment between clients and managers through insider and employee ownership.

This philosophy has built a strong performance history over decades. It has also drawn attention from industry observers and authors such as Morgan Housel, who highlight Davis’ emphasis on patience, discipline, and the ability to make decisions without being swayed by short-term market emotions.

Investment Philosophy in Plain Language

Chris Davis focuses on owning businesses, not simply trading their stocks. This means looking well beyond the daily share price to understand how a company earns revenue, how it allocates that money, and how it plans to grow in the years ahead.

His team studies a range of key measures, including:

- P/E ratio and forward P/E to see how expensive or inexpensive a company’s earnings are compared to its share price.

- Price-to-book ratio (P/B), especially for asset-heavy businesses like banks and insurers, to compare market value with the value of assets on the balance sheet.

- Return on invested capital (ROIC) to judge how effectively management is using the company’s resources to create profits.

Davis Advisors also considers broader sector and industry trends along with economic factors like inflation and interest rates. For instance, financial services companies often see higher profits when interest rates rise, while consumer defensive companies such as Tyson Foods Inc can provide stability during periods of high inflation.

A defining feature of Davis’ strategy is maintaining a high active share, meaning the portfolio is built to look very different from benchmarks like the S&P 500 or the Russell 1000 Value Index. This is not an index-hugging strategy. Instead, it is a carefully selected, high-conviction collection of companies designed to perform well over a long-term bull market and remain resilient during downturns.

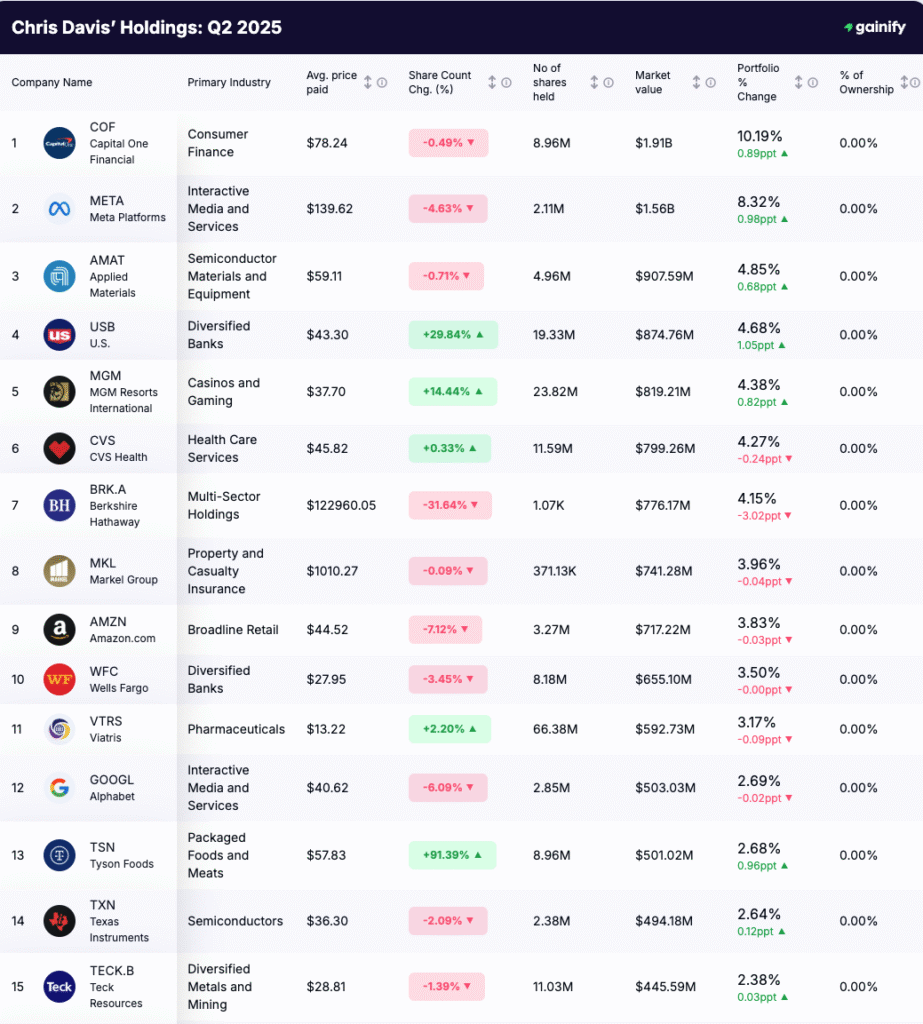

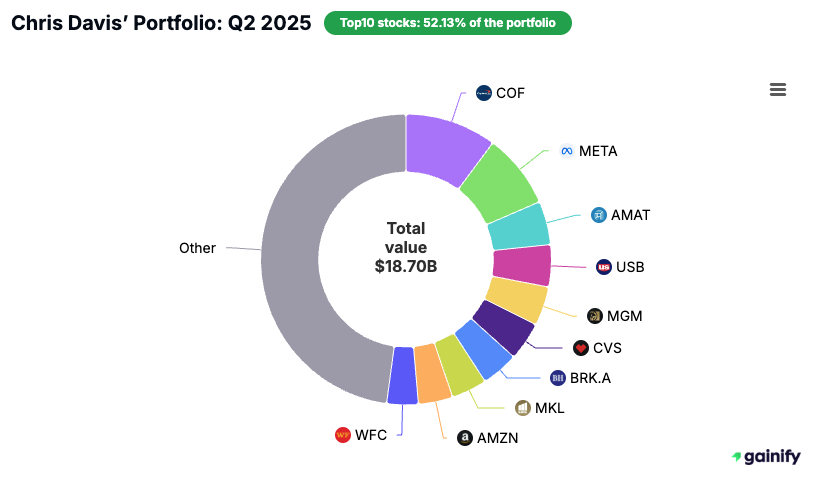

Portfolio Structure in Q2 2025

The Q2 2025 13F portfolio consists of 107 stocks, with the top ten holdings making up 52.13% of total assets. That concentration means the performance of these companies has an outsized influence on overall returns.

Top 10 Holdings – Q2 2025

Rank | Company Name | Ticker | Portfolio Weight | Value ($B) | Industry / Sector |

1 | Capital One Financial Corp | COF | 10.19% | 1.91 | Credit Cards & Banking |

2 | Meta Platforms Inc | META | 8.32% | 1.56 | Social Media & Virtual Reality |

3 | AMAT | 4.85% | 0.91 | Semiconductors & Equipment | |

4 | U.S. Bancorp | USB | 4.68% | 0.87 | Banking |

5 | MGM Resorts International | MGM | 4.38% | 0.82 | Leisure & Hospitality |

6 | CVS Health Corp | CVS | 4.27% | 0.80 | Health Care & Consumer Defensive |

7 | BRK.A | 4.15% | 0.78 | Multi-Sector Holdings | |

8 | Markel Group Inc | MKL | 3.96% | 0.74 | Insurance |

9 | Amazon.com Inc | AMZN | 3.83% | 0.72 | E-Commerce & Cloud Services |

10 | Wells Fargo & Co | WFC | 3.50% | 0.66 | Banking |

The top of Chris Davis’ portfolio leans heavily toward financial services, which provide steady earnings and reliable dividends when managed well. These holdings are balanced with technology and communication services companies that offer higher growth potential through innovation and global reach. A smaller share is in consumer defensive and health care names, which can provide stability during economic slowdowns, while consumer discretionary positions like MGM Resorts add exposure to cyclical recovery and spending trends. Together, this mix combines dependable cash flow with selective growth opportunities, aiming to perform well across different market conditions.

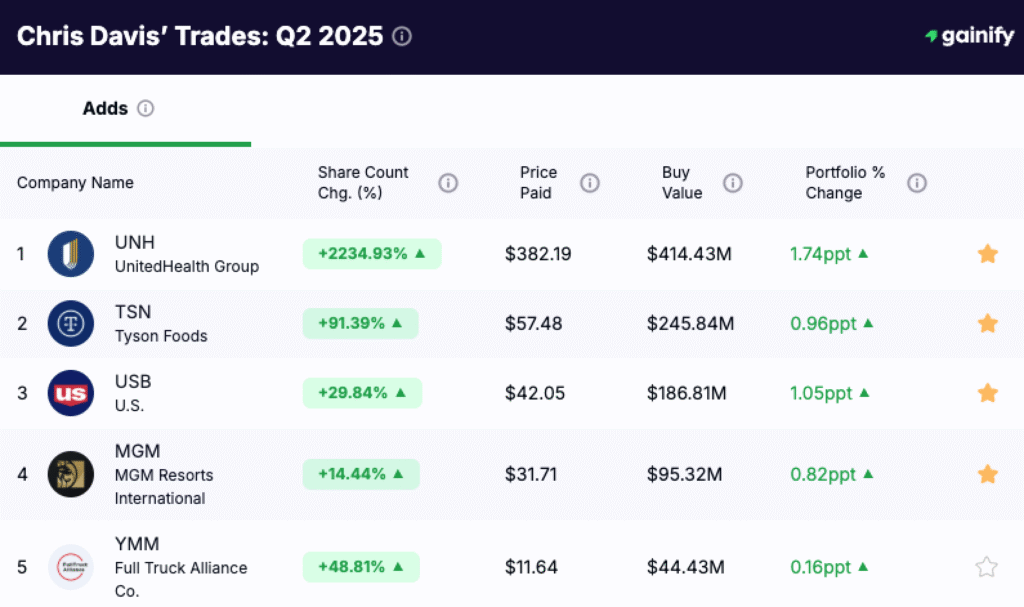

Top 5 Adds: Reinforcing Conviction

# | Company | Ticker | Change (%) | Shares Added | Current Shares | Current Value ($M) |

1 | UNH | +2234.9% | 2,202,217 | 2,301,942 | 1,158.45 | |

2 | Tyson Foods | TSN | +91.3% | 3,061,420 | 6,418,693 | 364.74 |

3 | U.S. Bancorp | USB | +29.8% | 6,058,783 | 26,352,057 | 874.76 |

4 | MGM Resorts International | MGM | +14.4% | 2,031,429 | 16,102,088 | 819.21 |

5 | Full Truck Alliance | YMM | +48.8% | 9,358,725 | 28,530,632 | 242.52 |

Top 5 New Buys: Fresh Opportunities

# | Company | Ticker | Shares Bought | Current Shares | Current Value ($M) |

1 | Coterra Energy | CTRA | 9,329,800 | 9,329,800 | 236.72 |

2 | Angi | ANGI | 3,756,819 | 3,756,819 | 17.08 |

3 | NVDA | 13,400 | 13,400 | 11.22 | |

4 | COPT Defense Properties | CDP | 197,000 | 197,000 | 3.99 |

5 | Realty Income | O | 41,700 | 41,700 | 2.76 |

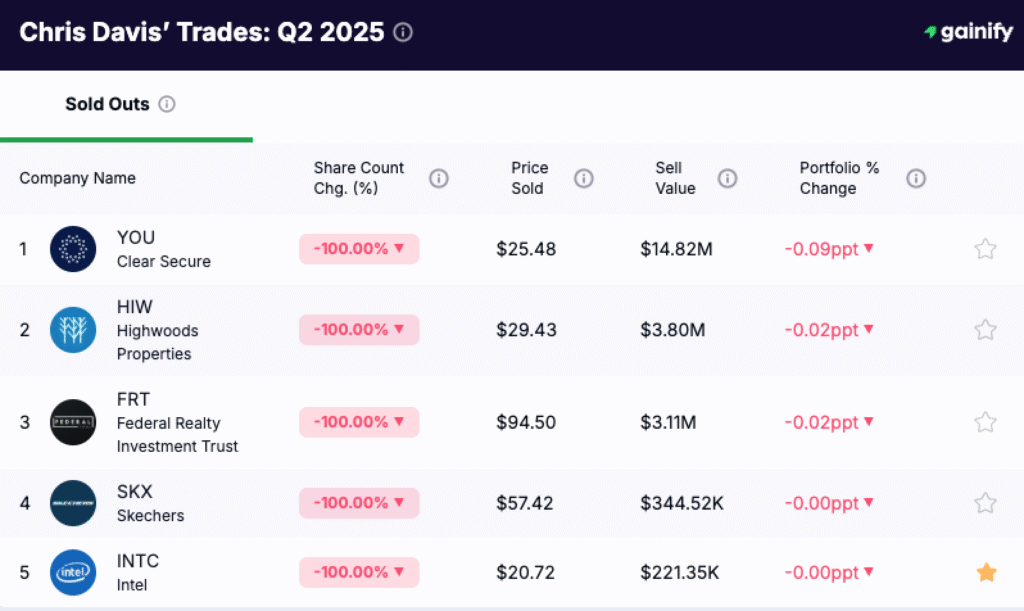

Top 5 Sold Outs: Strategic Exits

# | Company | Ticker | Shares Sold | Final Position | Final Value ($M) |

1 | Clear Secure Inc | YOU | 1,261,445 | 0 | 0 |

2 | Highwoods Properties Inc | HIW | 530,000 | 0 | 0 |

3 | Federal Realty Investment Trust | FRT | 246,000 | 0 | 0 |

4 | Skechers USA Inc | SKX | 300,000 | 0 | 0 |

5 | Intel Corp | INTC | 450,000 | 0 | 0 |

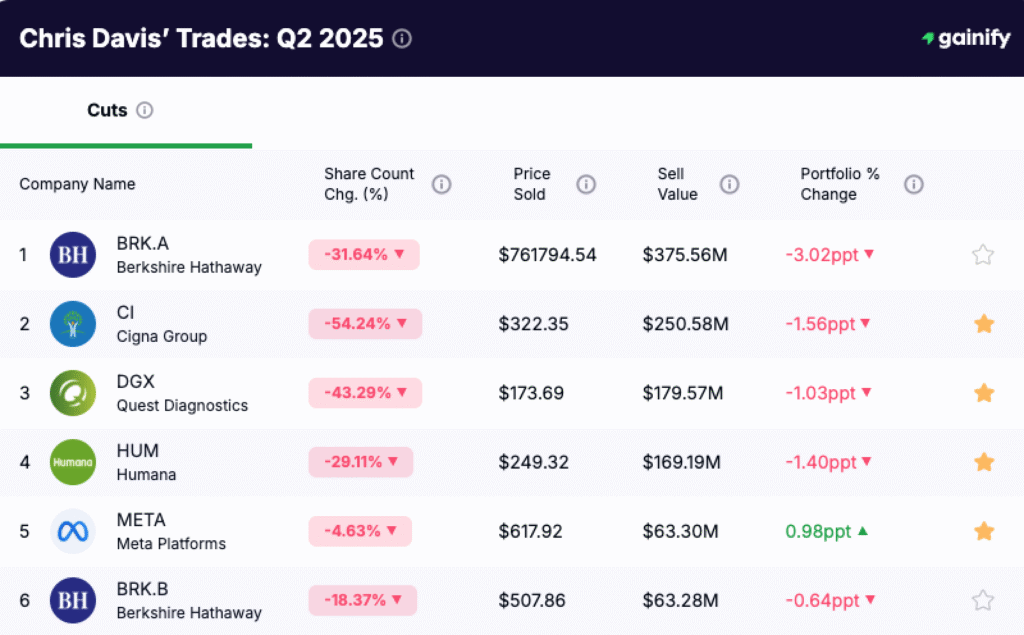

Top 5 Reductions: Managing Risk and Rebalancing

# | Company | Ticker | Change (%) | Shares Sold | Current Shares | Current Value ($M) |

1 | Berkshire Hathaway Inc | BRK.A | −31.64% | 350 | 757 | 776.17 |

2 | The Cigna Group | CI | −54.24% | 1,500,000 | 1,265,000 | 377.21 |

3 | Quest Diagnostics Inc | DGX | −43.29% | 2,100,000 | 2,753,000 | 321.85 |

4 | Humana Inc | HUM | −29.11% | 400,000 | 974,000 | 422.66 |

5 | Meta Platforms Inc | META | −4.63% | 228,000 | 4,548,000 | 1,558.29 |

What Stands Out in Q2 2025

Chris Davis’ long-horizon investment approach remains firmly in place. Many of the portfolio’s largest holdings have been held for years, a reflection of his belief in owning strong companies through both up and down markets.

This quarter’s most decisive action came in health care, where Davis made a massive addition to UnitedHealth Group Inc (UNH). The position surged by more than 2.2 million shares, bringing the total to over 2.3 million shares valued at roughly $1.16 billion. This is now one of the most influential holdings in the portfolio, and the scale of the purchase stands out even in a historically patient strategy.

While health care saw a major boost, financial services and other long-term holdings were adjusted more selectively. The most notable reduction was in Berkshire Hathaway, where both BRK.A and BRK.B shares were sold in significant quantities. The BRK.A stake dropped by more than 31%, while the BRK.B position saw an even larger reduction in share count. These sales freed up capital to reinforce other high-conviction ideas.

New buys blended two themes: companies that generate substantial shareholder returns through dividends, such as Coterra Energy Inc and Realty Income Corp, and structural growth leaders like NVIDIA Corp, a key player in AI and advanced computing.

On the exit side, several real estate investment trusts (REITs) were completely sold, including Highwoods Properties and Federal Realty Investment Trust, cutting back exposure to a sector still facing pressure from higher interest rates and shifting demand patterns.

Overall, Q2 activity sharpened the portfolio’s focus. It strengthened positions in high-quality, earnings-rich businesses, selectively introduced new opportunities, and trimmed holdings that no longer met the highest standards for long-term compounding.

Why It Fits The Davis Playbook

Since 1969, Davis Advisors has built portfolios that combine resilience during market stress with the flexibility to capture growth when opportunities arise. That same formula is visible in the Q2 2025 holdings. The largest positions are companies with the financial strength and competitive advantages to weather downturns. At the same time, a carefully selected group of smaller holdings gives the portfolio room to adapt as new opportunities emerge.

The current mix leans toward leading financial institutions, advantaged technology platforms, and stable health care cash generators. Each has been chosen through deep, independent research and a focus on fundamentals like return on invested capital, balance sheet strength, and the ability to compound earnings over many years.

This disciplined ownership history – holding top companies for the long term while making selective, well-researched changes – has been central to Davis’ track record for more than five decades. Q2 2025 reflects that tradition, pairing patience with the conviction to act when the right ideas present themselves.