Artificial intelligence is reshaping the economy, but the spotlight usually shines on the applications we see, from chatbots to autonomous driving. What often goes unnoticed is the infrastructure that powers these systems. The real backbone of AI is built by companies that supply the computing, storage, and energy needed to train and deploy advanced models at scale.

These firms are known as AI infrastructure stocks. They do not sell the applications themselves but provide the foundation that makes machine learning, natural language processing, and other AI workloads possible. Understanding this layer of the economy is crucial for investors who want to capture the most durable opportunities in the AI era.

At the heart of AI infrastructure are five essential components. Semiconductors are the brains of the system, from GPUs that train neural networks to accelerator chips designed for high performance computing and edge applications. Data centers are the physical facilities that house these chips, designed to handle the massive requirements of cloud data centers and AI model training. Cloud platforms such as Microsoft Azure, Amazon Web Services, and Google Cloud provide scalable access to these resources, enabling businesses worldwide to run AI workloads without building their own infrastructure.

The fourth layer is networking equipment, including high speed switches and interconnects that move enormous amounts of data seamlessly between servers in hyperscale clusters. Without this fabric, even the most advanced chips would be bottlenecked. Finally, power and cooling systems form the lifeline of AI infrastructure. GPU accelerated workloads consume extraordinary amounts of electricity and generate intense heat, making advanced power distribution and cooling technologies essential for reliability.

Together, these five elements create the ecosystem that allows artificial intelligence to grow. Every large language model, from Llama 4, ChatGPT to Google Gemini, depends on semiconductors, data centers, cloud providers, networking, and energy systems working in unison.

In the following sections, we will examine each of these pillars in detail, highlight the leading companies, and explore what makes them attractive to investors. By the end, you will see why the greatest long term opportunities in AI may lie not in the apps that grab headlines, but in the infrastructure that makes them possible.

What Are AI Infrastructure Stocks?

AI infrastructure stocks are companies that provide the critical foundation for artificial intelligence. Instead of selling AI applications, these firms deliver the components, systems, and services that allow AI to function reliably and at scale.

Here is what makes them essential:

- Semiconductors: The brains of AI, including GPUs, CPUs, and custom accelerator chips. These are required for training neural networks, powering high performance computing, and enabling edge computing.

- Data Centers: Facilities purpose built to host cloud data centers, hyperscale compute clusters, and AI model training infrastructure.

- Cloud Platforms: Providers such as Microsoft Azure, Amazon Web Services, and Google Cloud that deliver scalable computing resources for AI workloads.

- Networking Equipment: High speed switches and interconnects that move enormous amounts of data quickly and efficiently between servers in hyperscale data centers.

- Power and Cooling Systems: Data center equipment such as advanced cooling solutions and reliable power distribution, essential for GPU accelerated workloads that consume immense amounts of energy.

This ecosystem allows AI models to be built, trained, and deployed worldwide. Without the work of chipset manufacturers, data center operators, cloud providers, networking giants, and power specialists, applications ranging from chatbots to autonomous vehicles could not exist.

Top AI Infrastructure Stocks to Watch

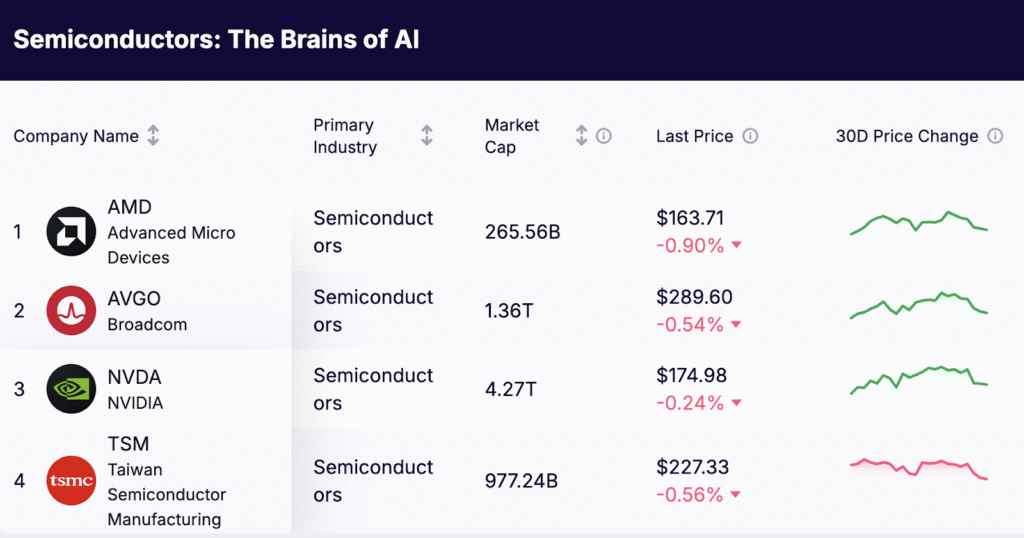

1. Semiconductors: The Brains of AI

The semiconductor industry is the engine of artificial intelligence, powering everything from large language models to autonomous vehicles and advanced drug discovery platforms. These companies design and manufacture the integrated circuits that make machine learning and natural language processing possible.

- NVIDIA (NVDA): The undisputed leader in GPU-accelerated infrastructure. Its CUDA platform has become the standard for AI model training and inference, making NVIDIA chips essential for hyperscale data centers, cloud providers, and AI research labs.

- Advanced Micro Devices (AMD): A fast-rising rival in accelerator chips and high-performance computing. AMD’s MI300 GPUs are increasingly used in AI workloads, offering competition to NVIDIA in both performance and cost efficiency.

- Broadcom (AVGO): While not always top of mind for AI, Broadcom supplies networking and custom silicon critical for hyperscale data centers, enabling efficient movement of data inside GPU clusters.

- Taiwan Semiconductor Manufacturing (TSM): The world’s most advanced foundry. TSM produces the integrated circuits for nearly every major AI player, from NVIDIA’s GPUs to Apple’s custom AI chips, making it the indispensable manufacturing hub of the semiconductor ecosystem.

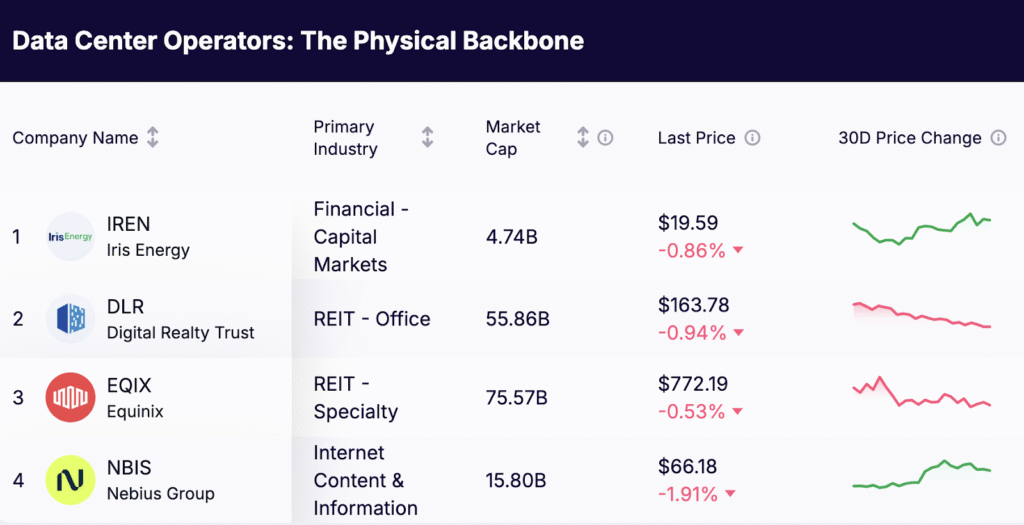

2. Data Center Operators: The Physical Backbone

Every AI workload requires massive physical infrastructure. Data centers serve as the warehouses of the digital economy, housing hyperscale compute clusters, cloud servers, and AI accelerator racks.

- Equinix (EQIX): The global leader in colocation and interconnection, providing secure, high-performance facilities where cloud providers and enterprises host AI infrastructure.

- Digital Realty (DLR): A dominant force in cloud data centers, expanding across regions to meet rising demand from hyperscalers and enterprises deploying AI workloads.

- Nebius Group (NBIS): A Nasdaq-listed company focused on AI-centric cloud and data infrastructure. Nebius has reported strong revenue growth in 2025 and is actively securing additional power capacity to expand its GPU hosting services.

- Iris Energy (IREN): Originally focused on cryptocurrency mining, Iris is now pivoting into AI cloud hosting by leveraging its existing power infrastructure and ordering NVIDIA Blackwell GPUs to build new AI compute capacity.

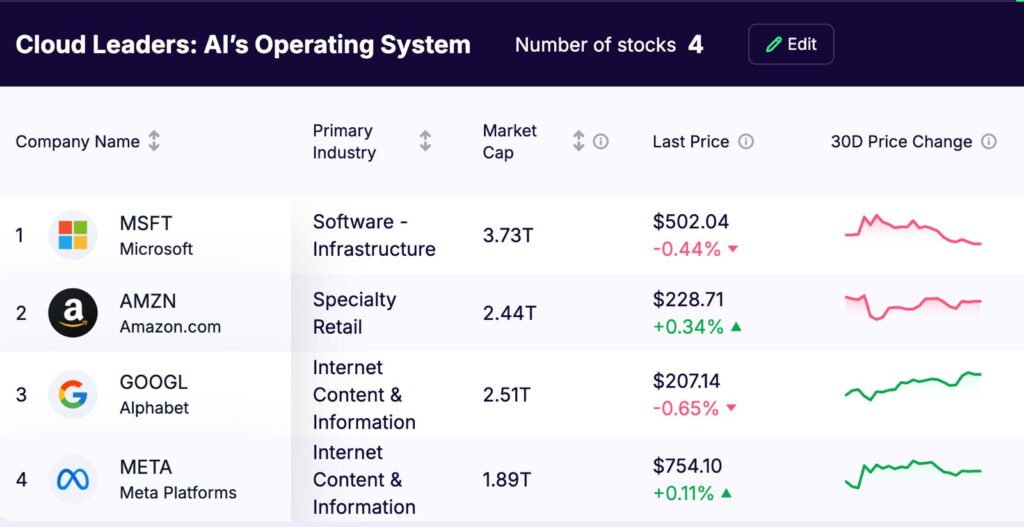

3. Cloud Leaders: AI’s Operating System

Cloud platforms are the operating system of artificial intelligence. They provide scalable compute resources for everything from AI model training to enterprise digital transformation. Without them, most AI adoption would stall.

- Microsoft Corp. (MSFT): Through Azure, Microsoft has positioned itself as a core cloud infrastructure provider for AI, partnering with OpenAI and integrating AI across its software suite.

- Amazon (AMZN): AWS remains the largest global cloud platform, with specialized chips like Inferentia and Trainium designed to lower AI compute costs and diversify beyond NVIDIA.

- Alphabet (GOOGL): Google Cloud combines leading AI research with infrastructure, powering workloads such as Google Search, generative AI models, and enterprise AI applications.

- Meta Platforms Inc. (META): While best known for social platforms, Meta is investing heavily in AI infrastructure to support its Meta AI ecosystem and large-scale models like Llama 4.

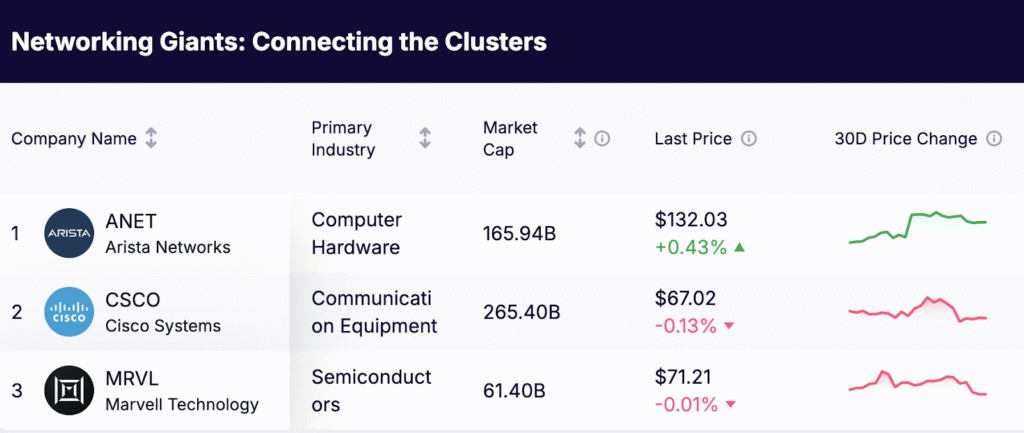

4. Networking Giants: Connecting the Clusters

The vast amounts of data required by AI models can only flow if networking infrastructure keeps pace. This segment ensures the low latency and high throughput needed inside hyperscale data centers.

- Arista Networks (ANET): A pure play on networking switches for hyperscale data centers, Arista has become a favorite for AI-driven expansion as it enables massive east-west traffic flows between servers.

- Cisco (CSCO): A global leader in enterprise and cloud networking, Cisco continues to evolve its product portfolio for AI workloads while benefiting from its broad market penetration.

- Marvell Technology (MRVL): Provides networking silicon and accelerators tailored for AI and cloud data centers, supporting both speed and energy efficiency in data movement.

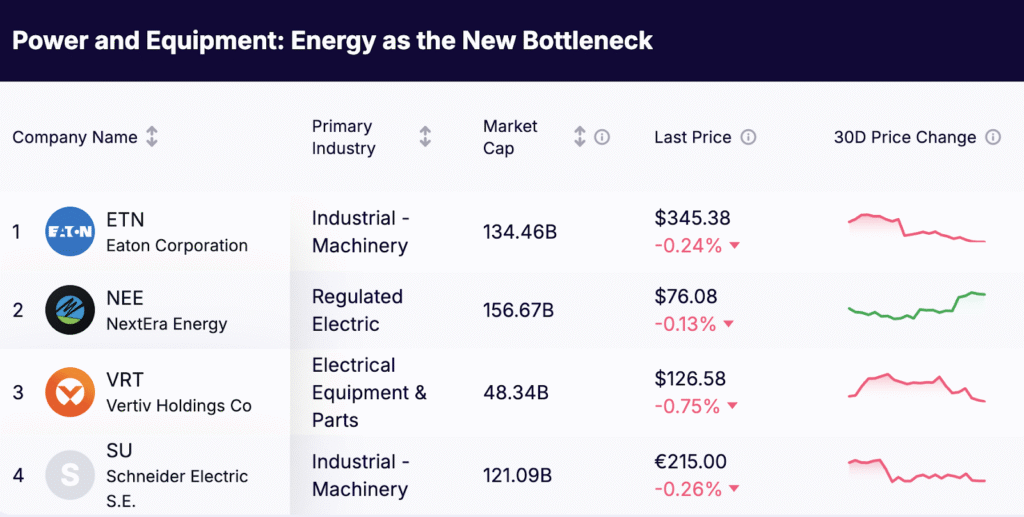

5. Power and Equipment: Energy as the New Bottleneck

The AI revolution is also an energy story. GPU-accelerated infrastructure consumes enormous amounts of power and generates heat that must be managed effectively. Companies in this segment provide the systems that keep data centers online, efficient, and sustainable.

- Eaton (ETN): Supplies power distribution and management solutions, ensuring reliability for hyperscale AI clusters.

- Schneider Electric (SBGSY): Specializes in industrial energy systems and efficiency technologies, helping reduce the cost and footprint of AI data centers.

- Vertiv (VRT): A key player in cooling and energy optimization, Vertiv benefits directly from the expansion of hyperscale AI clusters worldwide.

- NextEra Energy (NEE): While primarily a utility, NextEra is deeply tied to the energy transition, investing in renewable energy capacity that increasingly supports AI data centers’ massive power demand.

The Hidden Challenge of AI Infrastructure

At first glance, AI infrastructure looks like an unstoppable growth story. Demand for GPUs, hyperscale data centers, and cloud services has exploded, and every forecast points higher. Yet beneath the surface lies a more complicated reality. Technology leadership in infrastructure is far more fragile than it appears.

Semiconductors illustrate this perfectly. A company can dominate one generation of GPU or accelerator chips, only to lose share in the next if a rival introduces a more efficient design. The industry’s history is filled with giants that were once untouchable but are now footnotes. In AI, the upgrade cycle is measured in quarters, not years. For investors, this means today’s champions may face constant pressure from new architectures, custom chips designed by hyperscalers, or alternative computing models like quantum and neuromorphic designs.

Data centers face challenges of a different kind. Expanding capacity requires enormous amounts of power and land, both of which are becoming scarce. Northern Virginia, one of the world’s largest data center hubs, is already straining under grid limits. Ireland has capped new data center projects because electricity demand outpaced national capacity. These constraints highlight that the bottleneck in AI may not be chips, but power. Cooling technologies, grid resilience, and even nuclear energy producers are now part of the infrastructure conversation.

Financial dynamics add another layer of complexity. Revenue growth often outpaces profitability. Chipmakers face billion-dollar fabrication costs. Data center operators must deploy capital years in advance of returns. Cloud providers compete fiercely on pricing, and in many cases, reinvest heavily to secure share. The result is that investors see headline growth, but free cash flow can remain thin. To complicate matters further, hyperscale cloud providers such as Amazon and Google increasingly design their own AI accelerator chips, reducing their dependence on external suppliers and challenging the long-term pricing power of traditional semiconductor firms.

This is why leadership in AI infrastructure is not a guarantee of smooth returns. Companies must combine technological innovation with financial discipline, geographic diversification, and reliable energy sourcing. Those that fail in even one area risk falling behind, even in a market growing at double-digit rates.

Why AI Infrastructure Stocks Still Matter

Despite the hurdles, the stickiness of AI infrastructure is what makes it compelling for long-term investors. Once a hyperscale data center is constructed, it is rarely abandoned, and once a GPU platform becomes the industry standard, it is costly and risky to switch. These dynamics create durable competitive moats for market leaders like NVIDIA in semiconductors, Microsoft in cloud computing, and Equinix in data center interconnection.

For investors, the central insight is time horizon. AI infrastructure should be viewed as a multi-decade growth theme, not a short-term trade. Volatility is inevitable as companies navigate supply chain challenges, regulation, and technological shifts. However, those firms that scale efficiently, manage energy and land constraints, and maintain leadership in chip architectures or cloud platforms will define the backbone of the digital economy for decades.

Frequently Asked Questions

Q1: What makes AI infrastructure different from AI software?

A1: AI software includes applications such as chatbots, generative image tools, or self-driving systems. AI infrastructure refers to the underlying foundation (semiconductors, cloud data centers, networking, and power systems) that allow those applications to function.

Q2: Which stocks are the leaders today?

A2: NVIDIA leads GPUs, Microsoft dominates enterprise cloud, and Equinix defines global interconnection. These names form the spine of AI infrastructure.

Q3: Are valuations too high for AI infrastructure stocks?

A3: Some AI infrastructure stocks trade at premium valuations. In industries defined by high capital intensity, massive switching costs, and recurring demand, price alone cannot tell the full story. Valuation must be considered alongside durability and growth visibility.

Q4: What risks matter most for investors?

A4: The most pressing risks include supply chain bottlenecks in semiconductors, rapid shifts in chip architectures, escalating power demands for data centers, and the growing trend of cloud hyperscalers designing their own AI chips.

Q5: How long should investors hold these stocks?

A5: Patience is critical. A holding period of five to ten years allows investors to capture compounding, ride through capital-intensive cycles, and benefit from the structural demand for AI infrastructure.

Key Takeaways for Investors

- AI infrastructure stocks power the backbone of artificial intelligence.

- Leadership spans semiconductors, cloud platforms, data centers, networking, and power systems.

- Growth is real, but challenges include capital intensity, energy constraints, and rapid innovation cycles.

- The most resilient firms will be those that combine scale, efficiency, and adaptability.

- Investors who prioritize durability and scalability are best positioned to capture the long-term compounding opportunities of the AI era.