Every time the market wobbles, investors rush toward “defensive stocks” as if they’re a built-in safety switch. But most people can’t explain what actually makes a stock defensive. Is it dividends? Is it brand recognition? Is it just a feeling?

Professionals look at something far more concrete: how a company behaves under stress. Do earnings collapse in a slowdown? Does cash flow remain steady? Does pricing power hold? Does the stock historically draw down less than the index?

This article strips the term down to its fundamentals, walks through what truly defines a defensive stock and gives you a clear, repeatable framework to identify them yourself.

Key Takeaways

1. Defensive stocks are defined by measurable stability. They show low earnings volatility, durable cash flow and a documented history of holding up better during market stress.

2. The core advantage of defensives is demand that doesn’t disappear. They sell essential products or services, which supports pricing power, margin consistency and steady fundamentals across cycles.

3. You can identify defensives with a simple, data-driven screen. Metrics like beta, downside capture, free-cash-flow stability and balance-sheet strength make them straightforward to evaluate and compare.

What Is a Defensive Stock? A Clear Definition Based on Measurable Traits

A defensive stock is a company whose revenues, profits and cash flows remain stable even when economic growth slows, and whose share price historically falls less than the market during downturns.

Rather than guessing, hedge funds evaluate defensiveness using four measurable dimensions: earnings stability, cash-flow consistency, price behavior and demand resilience.

Let’s walk through each one in detail.

1. Stable Earnings: Businesses That Don’t Suffer Wild Profit Swings

Defensive companies maintain steady earnings because their products remain essential in every economic environment. When demand doesn’t fluctuate, profits don’t either.

Examples of real businesses with stable earnings:

- Johnson & Johnson (JNJ) benefits from non-discretionary healthcare demand. Patients continue treatments and medications regardless of economic slowdowns, keeping earnings predictable.

- Procter & Gamble (PG) sells everyday essentials – detergent, diapers, cleaning supplies. Households buy these items in all conditions, which supports stable margins and consistent profit growth.

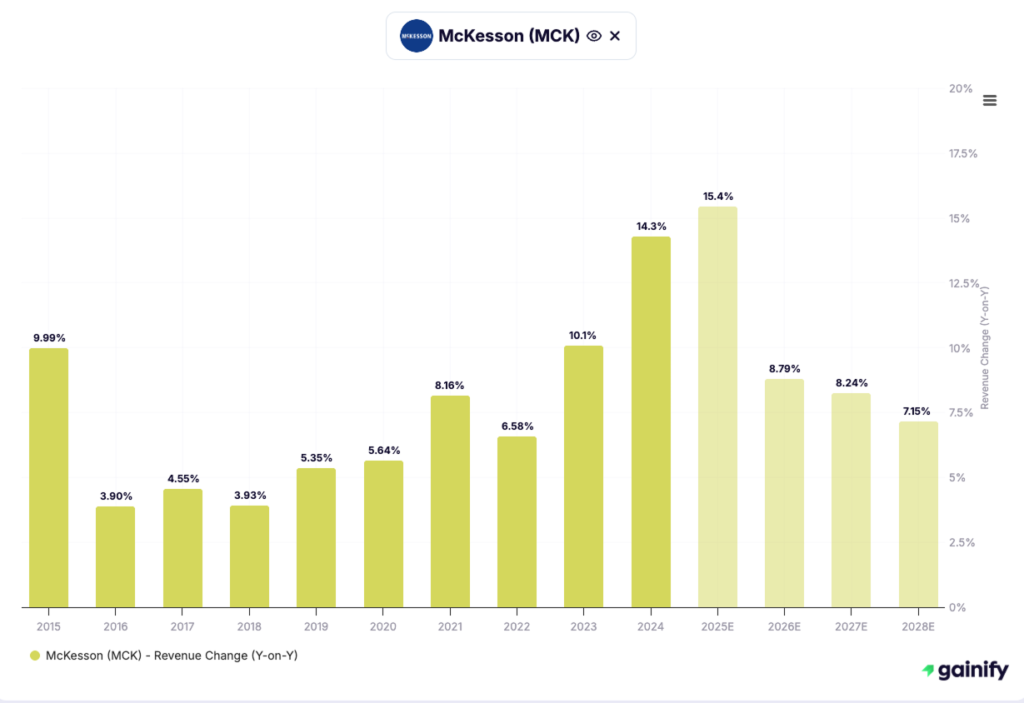

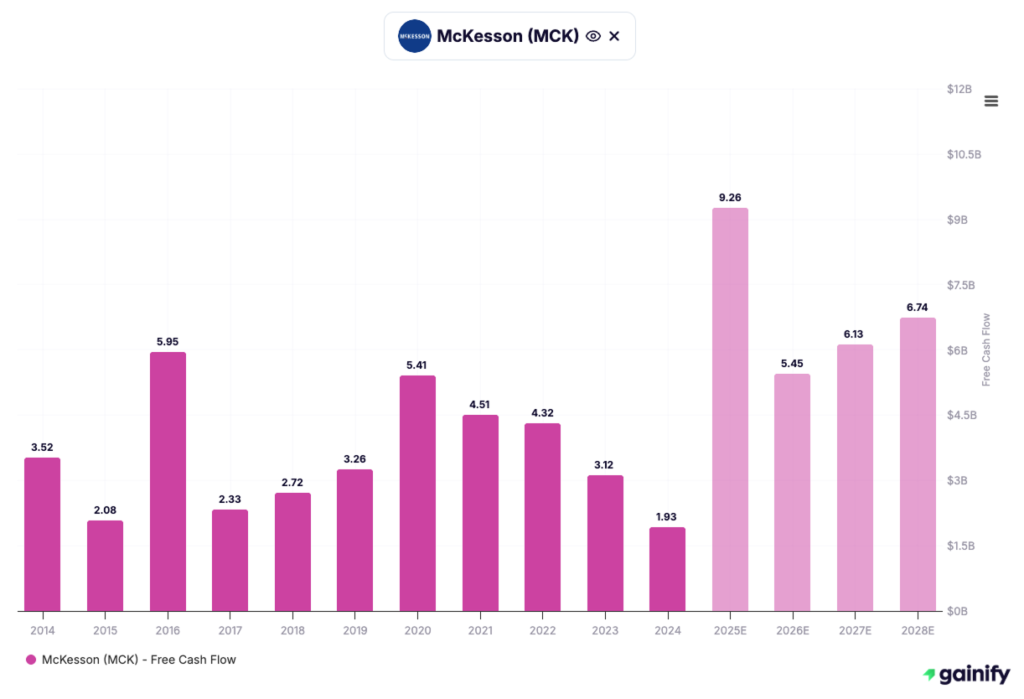

- McKesson (MCK) distributes prescription drugs nationwide. Healthcare volumes rarely fluctuate with GDP, giving MCK one of the smoothest earnings profiles in the market.

This is the opposite of cyclical businesses like airlines or apparel retailers, where profits can swing dramatically with consumer sentiment and economic cycles.

How Analysts Measure Stable Earnings

Professionals quantify earnings stability with several core indicators:

- Revenue growth stability

Consistent year-to-year growth with minimal slowdown during recessions. Strong defensives show steady top-line trends even in weak macro environments. - Gross margin development

Stable or improving margins signal pricing power, cost discipline and a business model resilient to input-cost volatility. - Percentage of positive EPS years

Defensive companies remain profitable almost every year—often above 90% over a decade, indicating predictable demand and effective operations. - Guidance revisions

Limited downward revisions and tight guidance ranges reflect reliability in forecasting and stable end-market conditions. - Cash conversion (FCF / net income)

High, consistent conversion rates show that earnings translate into real cash, not accounting-driven figures. Strong defensives typically maintain 80–100%+ conversion.

2. Lower Price Volatility: Stocks That Don’t Collapse When the Market Does

A second defining feature of defensive stocks is lower share-price volatility. These companies tend to fall far less than the broader market during corrections because their fundamentals are stable and investors view them as safe places to allocate capital when uncertainty rises.

To see this dynamic, compare two well-known businesses:

- Bristol Myers Squibb (BMY), a large-cap pharmaceutical company, also tends to experience smaller price declines during broad market sell-offs. Demand for its therapies remains stable across economic cycles because patients continue treatment regardless of market conditions. This durability in prescription volumes and recurring revenue helps anchor BMY’s valuation and reduces downside volatility.

- Nvidia (NVDA), on the other hand, operates in a cyclical industry where revenue and earnings are more sensitive to economic conditions and investment cycles. Its stock has historically moved sharply in both directions because expectations reset quickly when industry sentiment shifts.

This contrast highlights why defensive stocks behave differently: less economic sensitivity → fewer estimate cuts → lower volatility → smaller drawdowns.

How Analysts Measure Lower Price Volatility

Professionals rely on several key metrics to quantify a stock’s historical downside behavior:

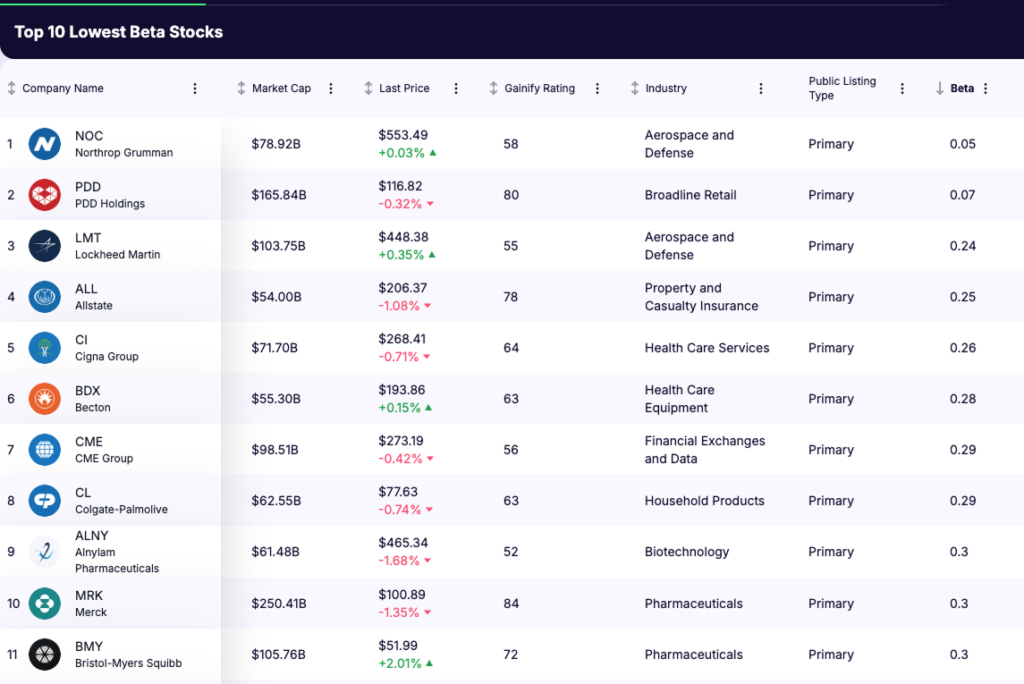

- Beta (typically < 0.6)

Measures the stock’s sensitivity to market movements. A beta below 0.6 indicates the stock moves significantly less than the index, especially in downturns. - Downside capture ratio

Shows how much a stock declines when the market is falling. A downside capture ratio of 60–70% or less is characteristic of defensive stocks, meaning they participate in only a fraction of the market’s drawdown. - Maximum drawdown (10+ year period)

Assesses the worst peak-to-trough decline over a long horizon. Lower max drawdowns signal resilience across multiple market cycles, not just a single event.

These measures provide a clear statistical view of how a stock behaves under pressure. If the market drops 20% and the stock falls only 6–10%, that is classic defensive behavior, preserving capital when it matters most.

3. Products or Services People Can’t Avoid Buying

A major reason defensive companies remain resilient is that they sell products or services people continue to purchase regardless of economic conditions. When demand is non-discretionary, revenue doesn’t swing with consumer sentiment, and earnings stay predictable.

These businesses operate in categories where spending is effectively mandatory, which creates a stable baseline of demand even in recessions.

Examples across essential sectors:

Essentials for Daily Living

- Colgate-Palmolive (CL) manufactures oral-care products used every single day. Toothpaste and toothbrush demand barely moves during downturns, giving the company a highly stable revenue stream.

- Kimberly-Clark (KMB) produces diapers, tissues and hygiene products. These remain unavoidable household purchases, providing consistent volume regardless of macro trends.

Utilities

- Duke Energy (DUK) supplies electricity to millions of households and businesses. Utility payments remain one of the last expenses consumers cut; usage patterns barely shift in recessions. This makes utility revenue among the most predictable in the public markets.

Telecom

- Verizon (VZ) delivers mobile and broadband services that are now essential infrastructure. Consumers routinely postpone travel, entertainment and big-ticket purchases long before they consider disconnecting internet or phone service.

Healthcare Essentials

- Abbott Laboratories (ABT) produces diagnostics, medical devices and nutritional products tied to ongoing patient needs. Healthcare demand is non-cyclical, supporting steady revenue through expansions and recessions alike.

Military Defense Industry

- Lockheed Martin (LMT) is a prime example. National defense spending is not discretionary and rarely declines during recessions. Countries commit to multi-year procurement programs for aircraft, missile systems, satellites and cyber defense that continue regardless of economic volatility.

Why Defensive Stocks Matter for Everyday Investors

Defensive stocks aren’t meant to outperform in roaring bull markets. Their value becomes obvious when conditions turn uncertain. They strengthen a portfolio in three important ways:

1. They limit losses during market downturns

Defensive stocks typically fall far less than the broader market during corrections. Smaller drawdowns shorten the time needed to recover—an advantage that compounds meaningfully over long horizons.

2. They reduce portfolio volatility

Allocating even 20–30% of a portfolio to defensive names can smooth overall returns. When high-growth or cyclical stocks swing sharply, defensives provide stability that keeps portfolio risk aligned with long-term objectives.

3. They preserve capital for future opportunities

Because defensives hold up better in downturns, they give investors dry powder. Professionals often rely on them to maintain liquidity and redeploy capital into cyclicals or growth names once the market resets.

Defensive stocks aren’t the portfolio’s engine. They’re the shock absorbers that keep you in the game when markets get turbulent.

A More Detailed Example of a True Defensive Stock

Case Study: McKesson (MKC)

- Distributes essential pharmaceuticals and medical supplies used every day

- Revenue growth remains stable across recessions.

- Has produced positive free cash flow for 20+ consecutive years.

- Pricing power: consumers don’t switch brands to save 20 cents.

- Low volatility and smaller drawdowns relative to the S&P 500.

This type of company isn’t dramatic. It doesn’t depend on hardware cycles, ad spending or discretionary purchases. It just steadily compounds. That’s the essence of a defensive stock.

A Practical Defensive Stock Screener (Fully Explained)

Below is a professional-grade framework simplified for everyday investors. You can apply this on most stock research platforms.

1. Fundamental Stability

- Earnings volatility: bottom 30% of the market

- Revenue volatility: bottom 30% of the market

- Free-cash-flow (FCF) volatility: bottom 30% of the market

- FCF yield: ≥ 3%

2. Risk & Price Behavior

- Beta: < 0.6

- Downside capture ratio: < 70

- 10-year max drawdown: better than sector median

3. Balance Sheet Strength

- Net debt / EBITDA: < 2.5x

- Interest coverage: > 6x

- Consistent dividend history (optional but typical for defensives)

4. Industry Filters

- Consumer staples

- Healthcare essentials

- Utilities

- Telecom

- Select insurance (primarily property & casualty)

Conclusion

A stock that satisfies most of these criteria is highly likely to be defensive in nature.

Final Thoughts

Defensive stocks are not slow-growth relics. They are structurally resilient businesses with steady earnings, reliable cash flow, and customer demand that holds up even in recessions. Professionals use them to manage risk, smooth returns, and anchor portfolios through all phases of the market cycle.

For everyday investors, understanding defensive stocks offers something equally valuable: the ability to stay invested, reduce volatility, and maintain discipline during periods of macro uncertainty.

If you’d like, I can also create:

✓ A downloadable watchlist of 15 high-quality defensive stocks

✓ A side-by-side comparison of defensives vs. cyclicals

✓ A step-by-step guide to building a defensive portfolio for 2026