The biotech sector in 2025 is entering one of its strongest phases in years, supported by renewed capital flows, accelerating scientific progress, and a more constructive regulatory environment. After a difficult period between 2021 and 2023, the industry has regained momentum as innovation begins to translate into commercial strength. AI-driven discovery, next-generation gene editing, and precision-based therapies are shortening development timelines and expanding the range of viable treatments across oncology, neurology, autoimmune conditions, and metabolic disease.

Investor confidence has followed. Major biotech indices are outperforming broader equity benchmarks in 2025, supported by positive clinical results, an increase in FDA fast-track designations, and improving revenue growth across mid-cap and large-cap companies.

The iShares Biotechnology ETF (IBB) is up 26.1 percent over the past six months, ahead of the SPDR S&P 500 ETF (SPY) (as of Oct. 27, 2025). At the same time, deal activity is rising again. A notable example is Novo Nordisk’s takeover of Akero Therapeutics, which highlighted strong demand for late-stage metabolic and NASH assets and reinforced the long-term growth potential within the sector.

Against this backdrop, several companies stand out for their clinical depth, commercial execution, and upcoming catalysts. Below are 8 biotech stocks to consider right now, each well positioned for the next phase of innovation-driven growth.

Key Highlights

- The Comeback of Biotech in 2025: The biotech sector has performed exceedingly well in 2024-25 after a slowdown in 2021-23, with ETFs such as the IBB outperforming the broader market.

- Innovation Driving Growth: Advancements in areas such as precision medicine, RNA-targeted therapies, and CRISPR gene editing are changing the way cancers, neurological disorders, and rare diseases are treated.

- Performers to Watch Out For: Companies such as Axsome, Exelixis, Vertex, Regeneron, and BioMarin are leading the way with landmark therapies, promising clinical pipelines, and strengthened revenue growth.

- Emerging Trends in Sector-Specific Investment: The accelerated adoption of AI, widespread M&A activity, and expansion in gene and cell therapies reflect the transition of the biotech sector from innovation to achieving long-term market strength.

To find stocks like that, just use the Gainify stock screener and filter by “Biotechnology” under Industry.

8 Best Biotech Stocks in 2025

Before diving into individual companies, it is important to note that the biotech sector entering 2025 is defined by renewed capital flows, stronger clinical success rates, and improving commercial execution across mid-cap and large-cap leaders. Many of the companies on this list are benefiting from record FDA designations, expanding pipelines, and a rebound in investor risk appetite following several years of valuation compression. Against this backdrop, the following ten biotech stocks stand out for their combination of innovation, financial strength, and near-term catalysts that could define sector performance in the year ahead.

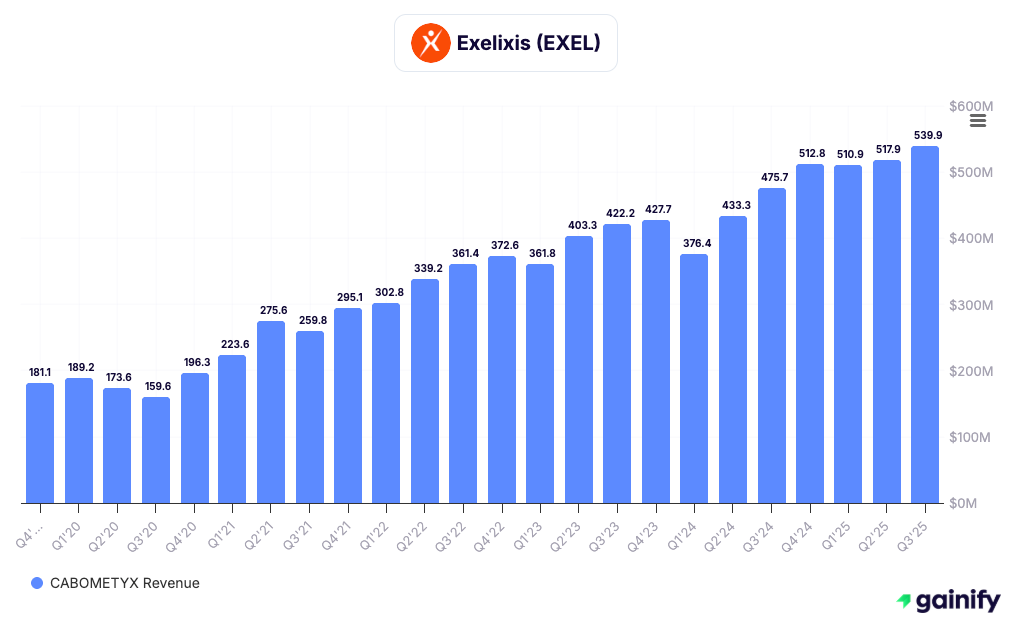

1. Exelixis (EXEL)

Market Cap: $11.25 Billion

EV (Enterprise Value): $9.86 Billion

Net Profit Margin 2025E: 30.66%

Exelixis (EXEL), headquartered in California, USA, develops small-molecule and antibody cancer therapies, which are also commercialized by the company. Its biggest success is the flagship product Cabometyx, used to treat hepatocellular carcinoma and renal cell carcinoma, relating to the liver and the kidney, respectively.

FDA Approvals and Trials: In July 2025, Exelixis announced that its partner Ipsen received approval from the European Commission for the use of Cabometyx to treat advanced neuroendocrine tumors in adults. It is also assessing the combination of Zanzalintinib, a drug targeting colorectal cancer, with Opdivo as part of its studies to treat non-clear cell renal cell carcinoma.

Revenue Growth: For investors focused on stocks registering significant growth, EXEL is a valuable option, with the estimated next 3 year Revenue CAGR of 11.50% recorded in 2024.

Investment Thesis: The company’s future growth is majorly dependent on the success of its under-trial drug Zanzalintinib, since there are significant investments tied to this program.

Key Risk: The upcoming patent expiry for Cabometyx around 2031 may lead to a significant drop in the company’s revenue unless it reduces its heavy financial reliance on this drug.

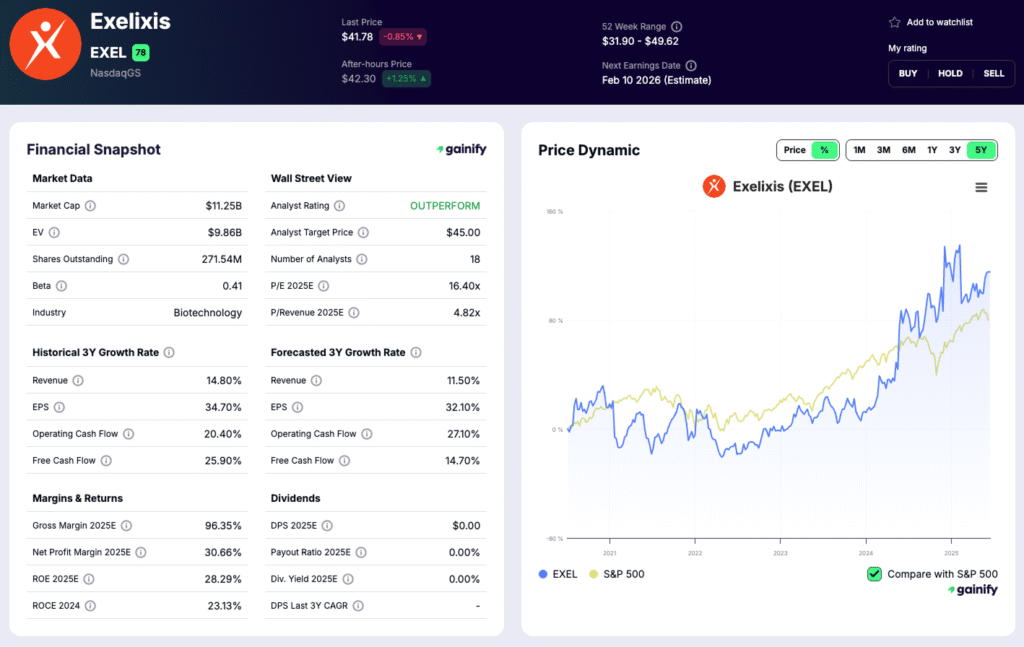

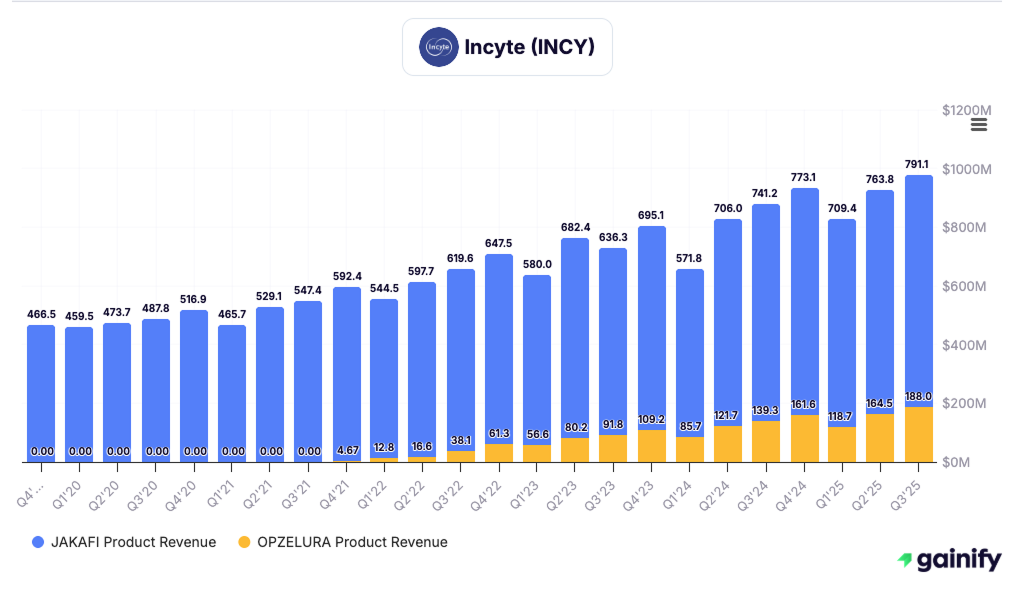

2. Axsome (AXSM)

Market Cap: $7.22 Billion

EV: $7.12 Billion

Net Profit Margin 2025E: -29.84%

Headquartered in New York, the biopharmaceutical company, Axsome Therapeutics, focuses on neurological and psychiatric conditions, such as those of the central nervous system (CNS), which have limited options for treatment. Currently, the company offers three products, namely Sunosi, Auvelity, and Symbravo.

Performance/Milestones: In May 2022, the company acquired Sunosi, a drug used to treat sleep disorders, from Jazz Pharmaceuticals. In the same year, around October, it launched Auvelity, a cure for depressive conditions.

FDA Approvals and Trials: Symbravo, developed by Axsome to treat migraines, got approved by the FDA in January 2025 and has significant potential for commercial success since existing medications aren’t as effective.

Furthermore, Axsome is likely to receive several other regulatory approvals for drugs such as AXS-12, which will be used to treat narcolepsy. The company is also evaluating Auvelity’s use in treating agitation associated with Alzheimer’s disease.

Revenue Growth: Altogether, the three-product line-up is driving significant growth in the company’s revenue, evident from its 42.53% year-over-year revenue growth in 2024. In fact, as per estimates by Nasdaq, Auvelity’s sales are likely to increase at a CAGR of 56.4% in the next three years.

Key Risk: Axsome primarily deals in CNS drugs, and the process of securing FDA approvals for these drugs can be complex and challenging. Thus, investors can’t fully rule out the chances of a delay in the approval of its pipeline candidates AXS-12 and AXS-05.

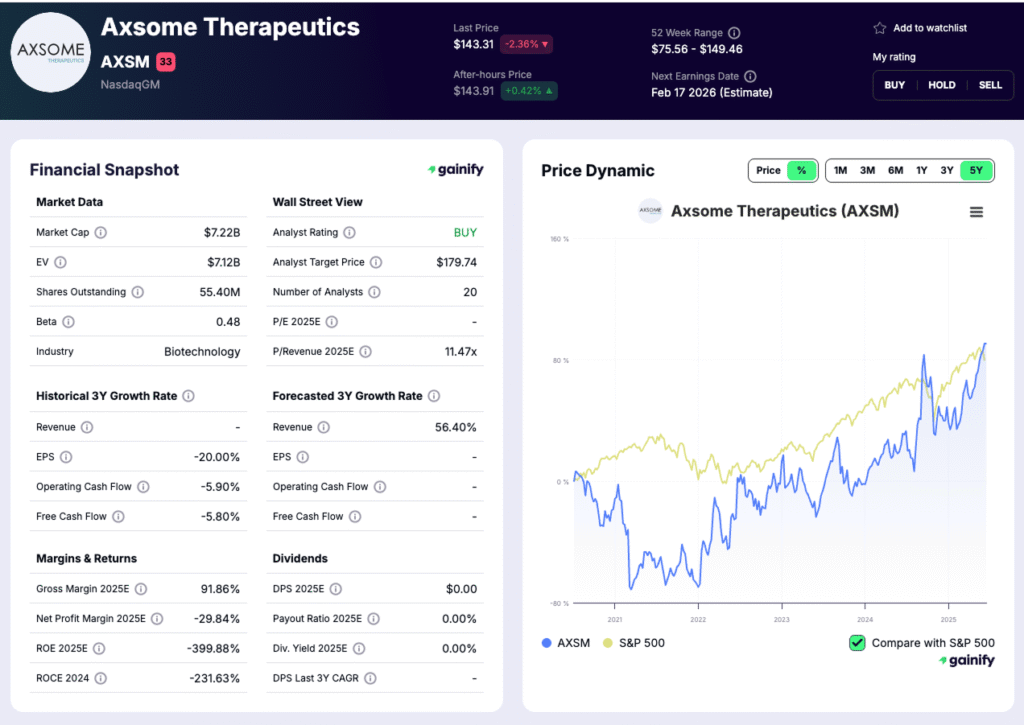

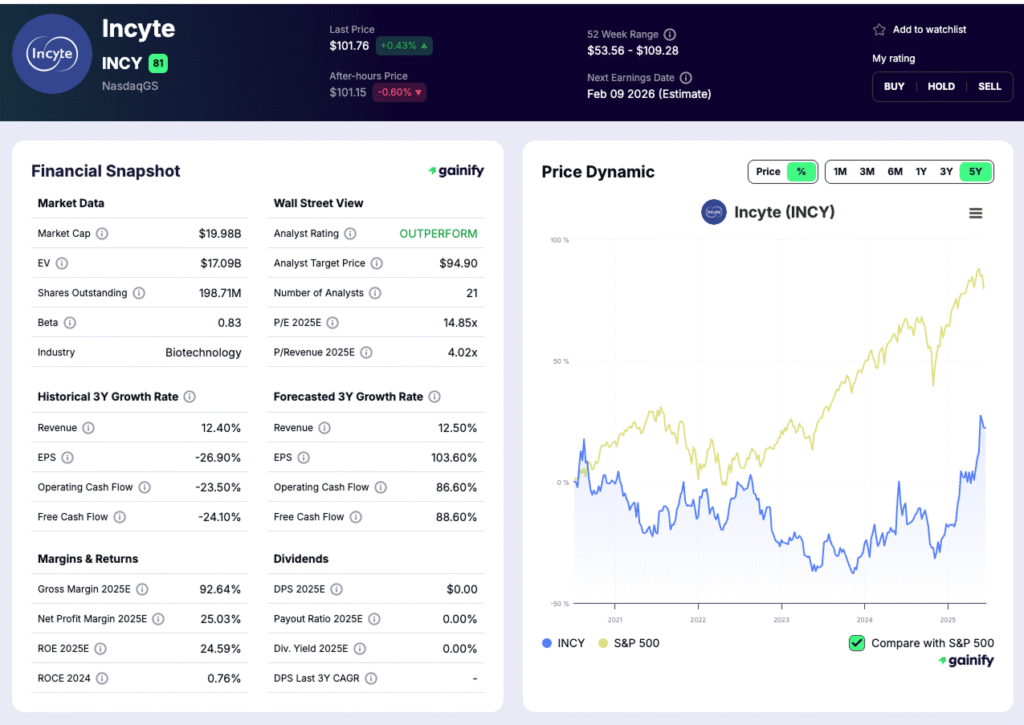

3. Incyte (INCY)

Market Cap: $19.98 Billion

EV: $17.09 Billion

Net Profit Margin 2025E: 25.03%

Incyte Corporation is based in Wilmington, Delaware. This global biopharmaceutical company discovers, develops, and sells small molecules in areas such as inflammation, autoimmunity, and oncology.

Performance/Milestones: Jakafi is the most successful performing drug developed by Incyte. It has also developed treatments for two rare types of blood cancer, namely Myelofibrosis (MV) and Polycythemia Vera (PV), and graft versus host disease (GVHD).

Other noteworthy products include Olumiant, an inhibitor for rheumatoid arthritis, and oncology drugs like Tabrecta and Inclusig, which are used to treat lung cancer and chronic myeloid leukemia, respectively.

FDA Approvals/Trials: The company also has several dermatological and oncological products in its pipeline with strong future potential. These include INCA033989, another treatment for Myelofibrosis, and Povrocitinib, a cure for skin conditions like vitiligo.

Revenue Growth/Stock Performance: Incyte has emerged as one of the frontrunners in the PV market by virtue of Jakafi, with an estimated revenue growth of 17% for 2025. The company’s stock has also shown impressive momentum, trading near its 52-week high of $87.99 and having fetched a significant 39.74% return in the last six months.

That said, with Jakafi’s patent set to expire in 2029, Incyte’s future growth will rely heavily on how well its upcoming products perform.

Key Risk: The company’s increasing dependence on its leading drug Jakafi signals the need for further diversification through its pipeline. It has reportedly faced setbacks, such as mixed results for its trials of Opzelura in treating prurigo nodularis.

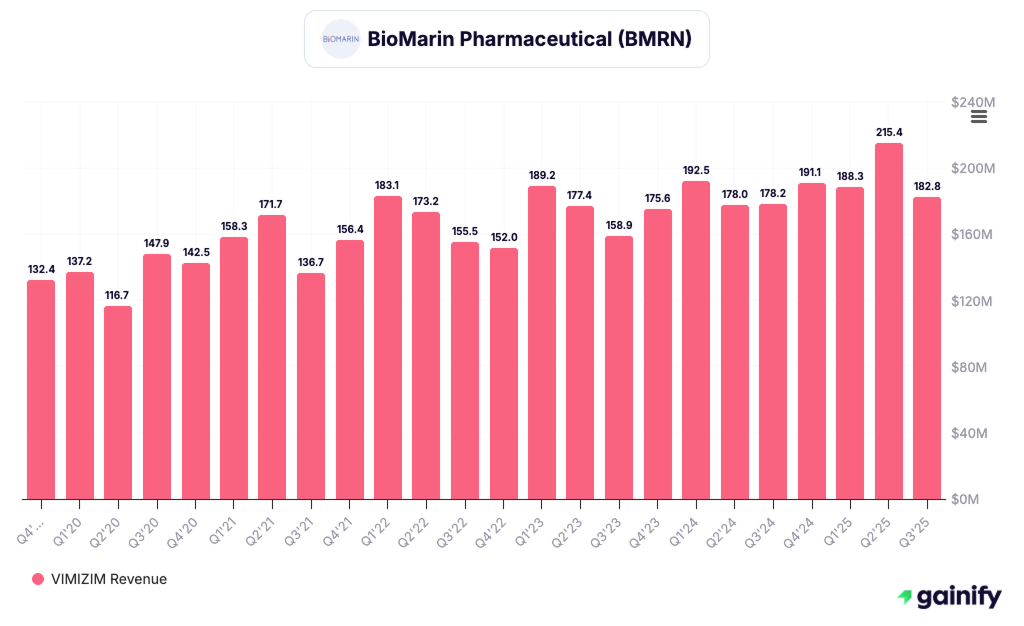

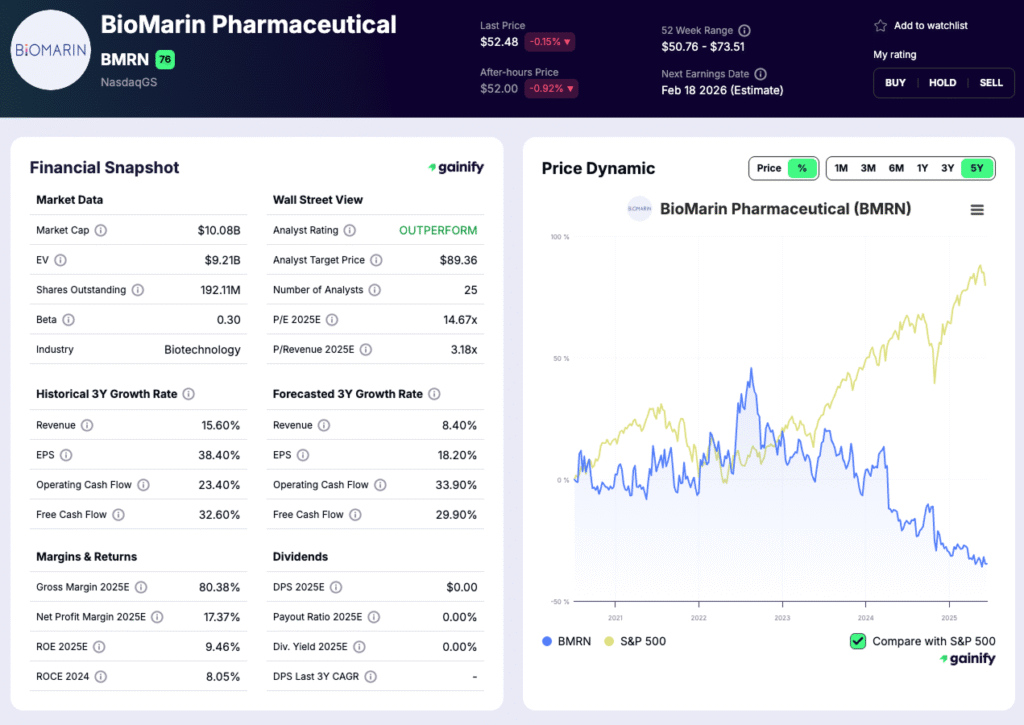

4. BioMarin Pharmaceutical (BMRN)

Market Cap: $10.08 Billion

EV: $9.21 Billion

Net Profit Margin 2025E: 17.37%

BioMarin Pharmaceutical, based in San Rafael, California, develops therapies for rare genetic disorders using enzyme replacement, small molecules, and gene therapy platforms. Its commercial portfolio includes treatments for conditions such as achondroplasia and phenylketonuria.

Performance and Recent Challenges: the company entered 2025 with strong expectations for Voxzogo and Roctavian, but the stock has materially underperformed through late 2025. The primary pressures include:

- Slower-than-expected Roctavian uptake due to payer reviews and durability questions.

- Physician caution around gene therapy adoption.

- Competitive concerns in hemophilia A from both established and emerging therapies.

Voxzogo remains the company’s strongest growth driver and continues to expand across age groups and geographies, but Roctavian’s rollout is tracking below earlier projections.

Regulatory and Pipeline Updates: Roctavian received full FDA approval in 2023 and is still ramping. BioMarin’s acquisition of Inozyme adds depth in metabolic and enzyme-based treatments. The pipeline includes additional rare-disease candidates in clinical development.

Key Risk: the central risk is commercial execution for Roctavian. Continued delays in payer adoption or stronger competition could limit long-term revenue. Voxzogo also faces emerging competitive pressure, including Ascendis Pharma’s TransCon CNP.

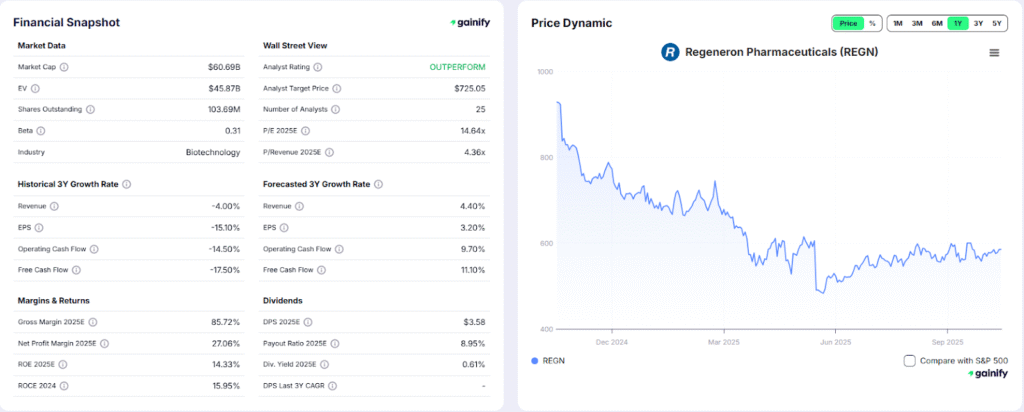

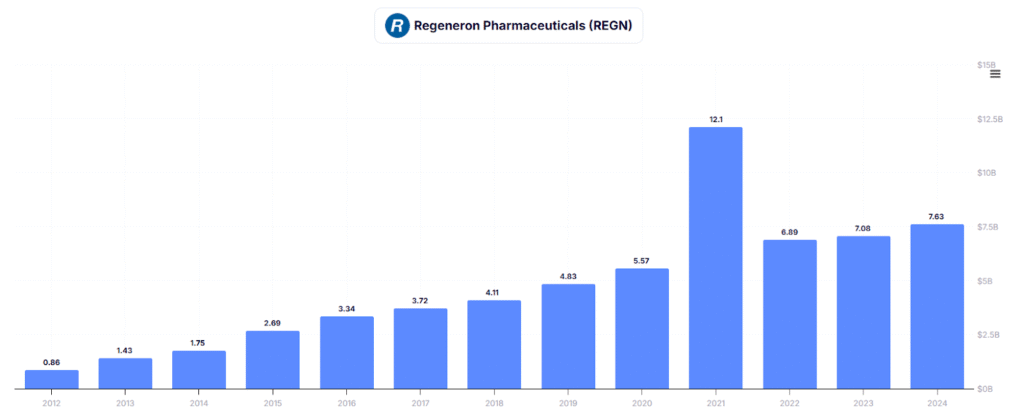

5. Regeneron (REGN)

Market Cap: $60.69 Billion

EV: $50.85B

Net Profit Margin 2025E: 31.32%

Based in Tarrytown, New York, Regeneron deals in the development and commercialization of solutions to treat rare cancers, cardiovascular conditions, eye diseases, and inflammation, among other conditions.

Performance: The company’s top-performing product, Eylea HD, created in collaboration with Bayer, has proved to be effective in treating age-related macular degeneration and diabetic macular edema.

FDA Approvals/Trials: In July 2025, the company received a fast-track approval for using Lynozyfic on adults with refractory or relapsed multiple myeloma. The company is also developing bispecific and monoclonal antibodies, including both collaborative and independently developed products. To this end, it utilizes its unique immunotherapy medication Libtayo, a PD-1 inhibitor, as a vital support.

Partnership: Regeneron has a thriving partnership with another pharma and life sciences company, Sanofi. Some of their significant products include oncology medications such as Zaltrap and Libtayo, and Paulent, a cholesterol-lowering drug.

Risk/Outlook: Such innovative efforts have made the company a promising name in the Biotech space. It’s also worth noting that Regeneron is collaborating with Intellia Therapeutics to apply advanced CRISPR/Cas9 technology for addressing genetic disorders. Data from 2024 reveals that the company experienced EPS and revenue growth of 4.18% and 8.27%, respectively.

Key Risk: Regeneron’s Eylea faces increasing competition from Roche’s Vabsyno and the influx of lower-cost biosimilar versions into the biotech market.

Regeneron (REGN)

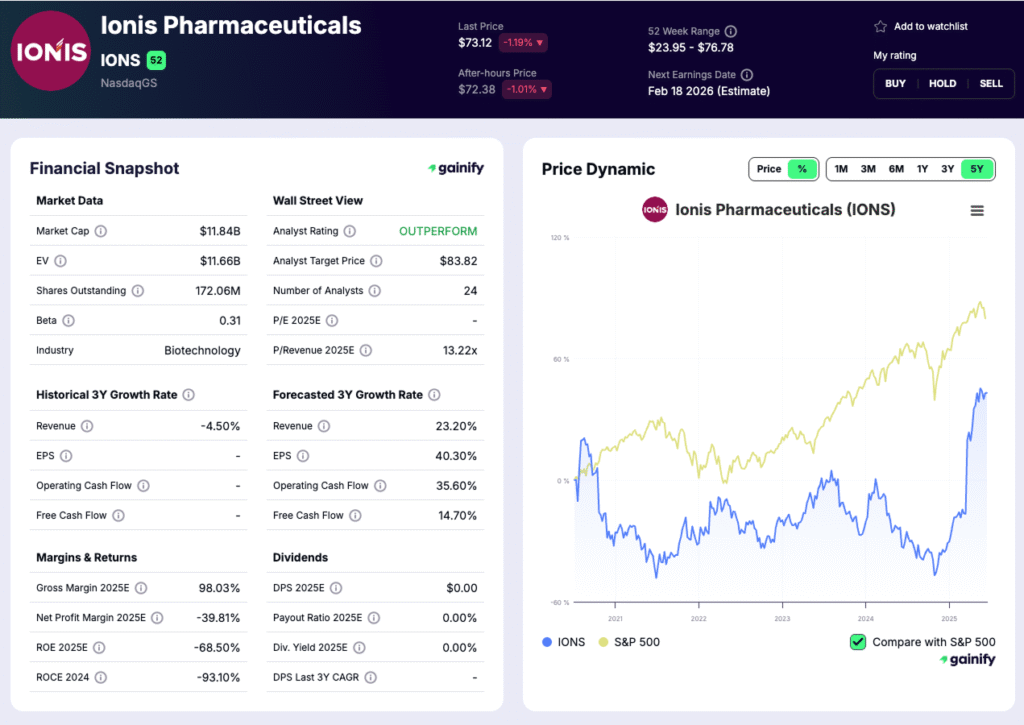

6. Ionis Pharmaceuticals (IONS)

Market Cap: $11.84 Billion

EV: $11.66 Billion

Net Profit Margin 2025E: -39.88%

Ionis Pharmaceuticals, based in Carlsbad, California, is the leading developer of antisense RNA-targeted therapies, with a portfolio spanning neurological, cardiovascular, and rare metabolic diseases. Its marketed products include Spinraza (with Biogen), Tegsedi, and Waylivra, which support a diversified commercial base.

One of Ionis’s most significant products is Spinraza, developed with Biogen, which treats spinal muscular atrophy. The company has also created Tegsedi, a treatment for ATTR amyloidosis, and Vaylivra, a drug for metabolic diseases like Familial chylomicronemia syndrome (FCS).

FDA Approvals/Trials: The company also has a strong pipeline of promising solutions that are in different stages of clinical trials. These include Donidalorsen, Zilganerse, and Olezarsen, which target rare genetic disorders such as Familial chylomicronemia syndrome (FCS) and atherosclerotic cardiovascular disease.

Risk/Outlook: The remarkable surge in stock prices has been brought about by two independent product launches in 2025, including Tryngolza, used for treating Familial Chlomicronemia Syndrome, and the US Launch of Dawnzera, which targets hereditary angioedema.

Key Risk: The success of its two major drug candidates in the pipeline, namely Donisalorsen and Olezarsen, is crucial for Ionis to register consistent growth in the near future.

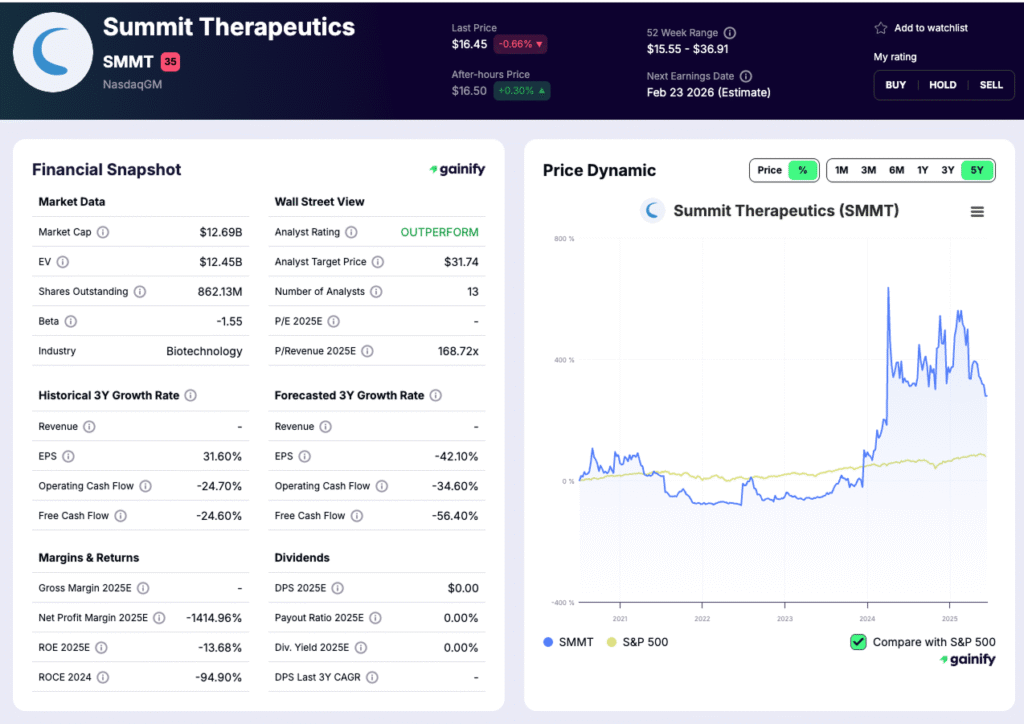

7. Summit Therapeutics (SMMT)

Market Cap: $12.69 Billion

EV: $12.45 Billion

Net Profit Margin 2025E: -1414.96%

Summit Therapeutics, which is based in Menlo Park, California, specializes in creating and commercializing novel antibiotics for highly infectious diseases. While the company doesn’t have any products on the market as of now, its innovative bispecific antibody, Ivonescimab, is in global Phase 3 clinical trials in its licensed territories in the US and UK.

Performance/Milestones: In May 2025, Summit also announced positive results from a late-stage study evaluating ivonescimab in combination with chemotherapy as a second-line treatment for non-small cell lung cancer.

Risk/Outlook: The pursuit of developing landmark therapies has heightened investor interest in this company. In fact, analysts predict a whopping revenue growth of 3262.03% in 2027.

This capital infusion, which was much needed for the company to continue its clinical endeavors, has significantly boosted its financial resources in the competitive industry landscape.

Key Trend: Summit is also actively funding its clinical development efforts. In October 2025, the company secured a landmark investment of $500 million from private investors, with most of the funding coming from its insiders and top executives.

Key Risk: The company’s primary risk for investors stems from its reliance on the successful development of the lead drug candidate, ivonescimab.

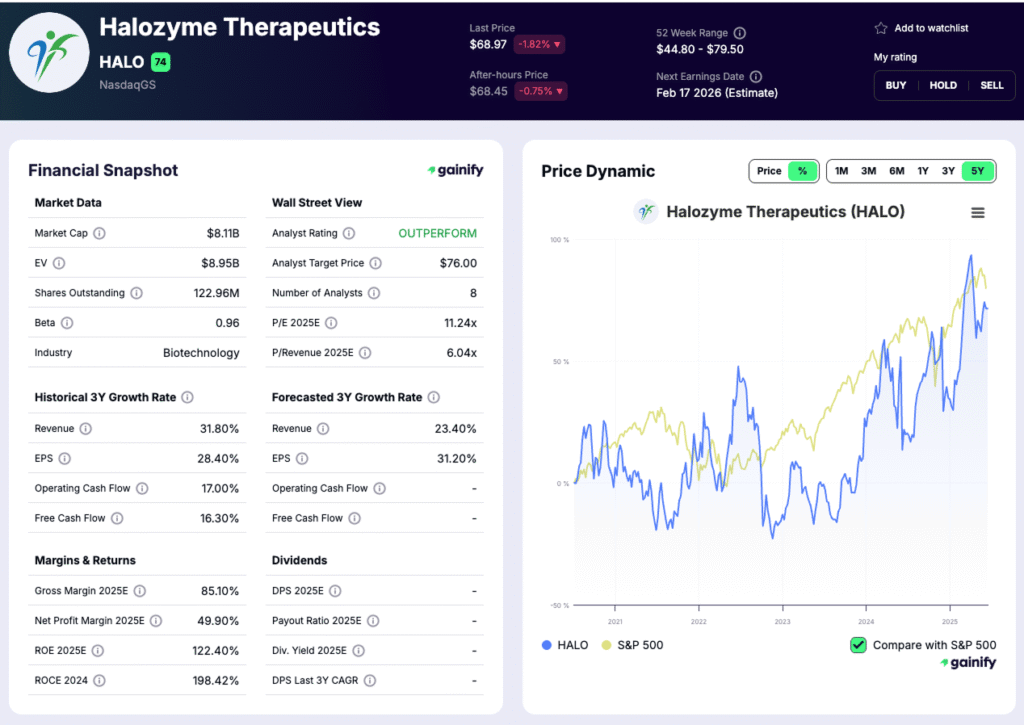

8. Halozyme (HALO)

Market Cap: $8.11 Billion

EV: $8.95 Billion

Net Profit Margin 2025E: 49.90%

Halozyme Therapeutics, headquartered in San Diego, is a biotechnology company focused on drug-delivery innovation rather than traditional drug discovery. Its core asset is ENHANZE®, a recombinant human hyaluronidase (rHuPH20) technology licensed to major pharmaceutical partners to convert intravenous biologics into more convenient subcutaneous formulations. ENHANZE continues to drive the company’s financial performance through milestone payments, royalties, and product sales tied to partner programs.

The main growth driver of Halozyme is its enzyme-based platform ENHANZE, which uses the rHuPH20 enzyme to ensure consistent high-volume drug delivery. Other notable products are Darzalex Faspro, a treatment for multiple myeloma, and similar breast cancer treatments such as Hylecta, Phego, and Herceptin.

FDA Pipeline and Collaborations: Halozyme’s partnered programs continue progressing through development, with multiple ENHANZE-enabled formulations in late-stage trials across oncology and immunology. While Halozyme is not developing proprietary oncology drugs, its technology is increasingly embedded across large pharma pipelines, broadening future royalty streams.

ENHANZE-enabled medicines such as Darzalex Faspro® (for multiple myeloma) and Phesgo® (for HER2-positive breast cancer) continue to deliver strong royalty revenue. In 2025, Halozyme raised its full-year outlook after reporting 22% year-over-year revenue growth in Q3 2025, supported by expanding partner adoption and rising commercial volumes.

Risk/Outlook: Speaking of the company’s stock market performance, it is estimated to record an EPS growth of 47.07% in 2025. It also showed a striking year-on-year revenue growth of 22.44% in 2024, which proves a strong standing in the biotechnology and pharma space.

Key Risk: Halozyme’s success hinges largely on its patents, which is why any legal or regulatory obstacles can create long-term uncertainty for investors.

Key Industry Trends

With continued evolution in the biotech field, several emerging trends are redefining the blend of investment, innovation, and patient outcomes. Here’s a quick look at the top trends that have got investors talking:

Personalized and Precision Medicine: For such innovations, biotech companies use unique biological data of patients, such as proteomics and genomics, to tailor prevention and treatment strategies. This trend has been fueled further by advancements in genetic profiling and biomarkers, with several industry experts identifying it as a leading opportunity.

Machine Learning and Artificial Intelligence: A majority of companies in the sector are utilizing the power of AI to transform drug development by accelerating timelines for R&D, identifying disease processes that drugs can act on, and enhancing the efficiency of trials. As such, they are channeling major capital into platforms driven by AI that cost less and boost success rates.

Mergers & Acquisitions: As we’ve seen for many of the companies listed in our guide, there has been a resurgence in M&A activity. These companies are looking to acquire de-risked, innovative assets from smaller biotechs to offset possible losses due to failed clinical trials or other significant challenges.

Cell and Gene Therapies (CGT): This trend continues to diversify beyond just blood cancers, showing potential in treating rare genetic diseases and solid tumors. Though there are complexities in manufacturing and higher upfront costs are involved in this area, investors are optimistic regarding the market growth and long-term potential.

Conclusion

To sum it up, Biotech is one of the most unpredictable yet exciting sectors to invest in, with bold scientific initiatives creating lucrative market opportunities.

Advancements in genetic editing, precision therapies, and AI drug delivery are turning research endeavors into real-world growth. Volatility is still a part of the game, which is why selective and patient investors could see strong returns for these maturing innovations.

That said, investors need to be mindful of certain key risks such as lengthy timelines for drug approval, regulatory hurdles, and an overdependence on successful trials. These challenges can impact the overall long-term performance of biotech companies, which can, in turn, affect investor confidence.

With investments going hand in hand with scientific discoveries, the companies leading the way are likely to shape a decade of progress in biotechnology and global healthcare.

Disclaimer: The information in this article is for educational purposes, and shouldn’t be considered as investment or financial advice. We encourage readers to conduct their own research through resources on Gainify or consult a financial advisor prior to making any investment decision.