Steel remains one of the most important materials in the global economy. It supports every major sector from construction and transportation to clean energy and defense. While the industry has long been cyclical, it is now entering a new era defined by innovation, decarbonization, and strategic relevance.

A combination of global infrastructure investment, reindustrialization in the U.S., and rapid progress in low-carbon technologies is reshaping the steel market. Producers are moving beyond volume and focusing on efficiency, sustainability, and high-performance materials.

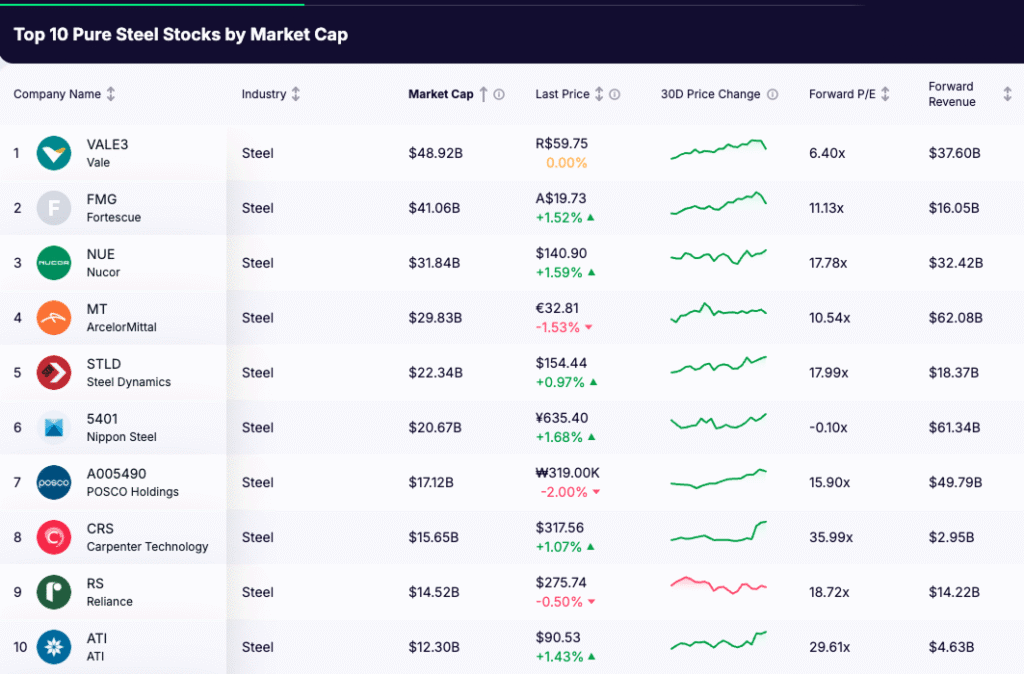

Below are the top 10 steel stocks by market capitalization as of October 2025, with key data, valuations, and strategic outlooks for investors.

Highlights

- Steel prices are up about 15 percent in 2025, reflecting a strong recovery driven by infrastructure spending, steady demand, and disciplined global supply.

- The industry is transforming from cyclical to strategic, with companies focusing on low-carbon production, recycling, and advanced materials instead of pure volume growth.

- U.S. producers such as Nucor and Steel Dynamics are key beneficiaries of the reindustrialization trend and record government infrastructure investment.

- Global leaders like Fortescue, POSCO, and ArcelorMittal are investing heavily in green hydrogen and decarbonized steelmaking, signaling the next phase of industry evolution.

- Investors are viewing steel as a long-term diversification play, offering exposure to both industrial strength and clean-energy innovation in a more stable pricing environment heading into 2026.

Top 10 Steel Stocks by Market Cap (October 2025)

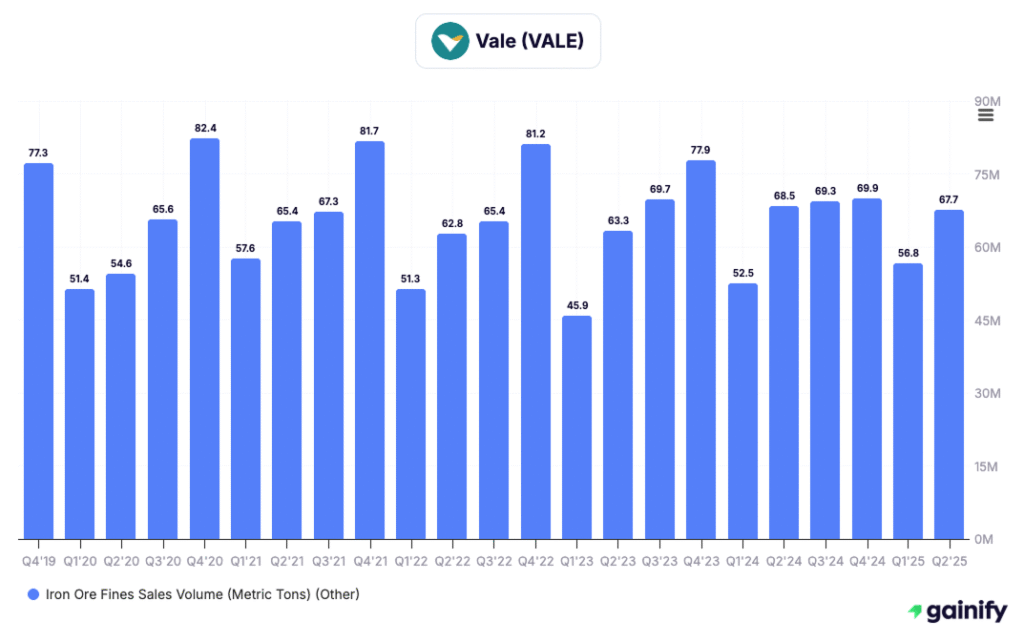

1. Vale (VALE3)

Market Cap: $48.92 billion

Valuation: 6.4x forward P/E

Analyst Target Price: +11% average upside

What It Does: Vale (VALE3) remains Brazil’s industrial powerhouse and one of the world’s largest suppliers of iron ore and steel products. While mining still accounts for most revenue, Vale’s integrated steel and pellet operations are expanding as it seeks to capture more downstream value. The company’s logistics infrastructure, including rail and port networks, gives it strong cost advantages in global exports.

Key Investment Theme: Vale offers dual exposure to raw materials and finished steel, a combination that positions it well for the global infrastructure boom. Its disciplined capital allocation and strong free cash flow support dividends and buybacks. Vale also continues investing in low-carbon steelmaking through renewable energy and biochar-based iron production.

Key Risks: Commodity price volatility, environmental liabilities, and policy uncertainty in Brazil remain headline risks. Currency swings against the U.S. dollar also affect profitability.

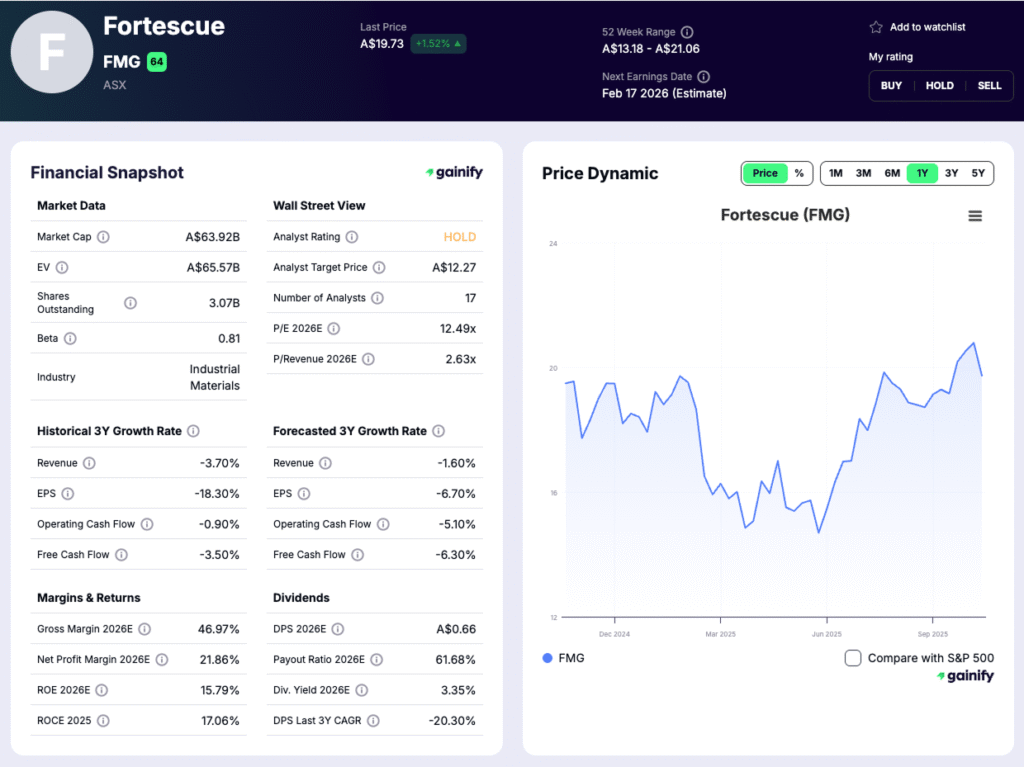

2. Fortescue (FMG)

Market Cap: $41.06 billion

Valuation: 11.1x forward P/E

Analyst Target Price: –3% downside

What It Does: Fortescue Metals Group, based in Australia, has evolved from a pure iron ore exporter to a pioneer in green hydrogen and decarbonized steel. Through Fortescue Future Industries, it is developing large-scale renewable projects aimed at replacing fossil fuels in steelmaking.

Key Investment Theme: Fortescue’s transformation positions it as a potential leader in carbon-free steel production. The company’s long-term strategy aligns with the global shift toward sustainable materials, and its early move into hydrogen and ammonia gives it a strong first-mover advantage in green industrials.

Key Risks: Execution risk remains high given the scale of investment in hydrogen infrastructure. Returns depend on technology maturity, policy incentives, and long-term demand from steel consumers willing to pay a green premium.

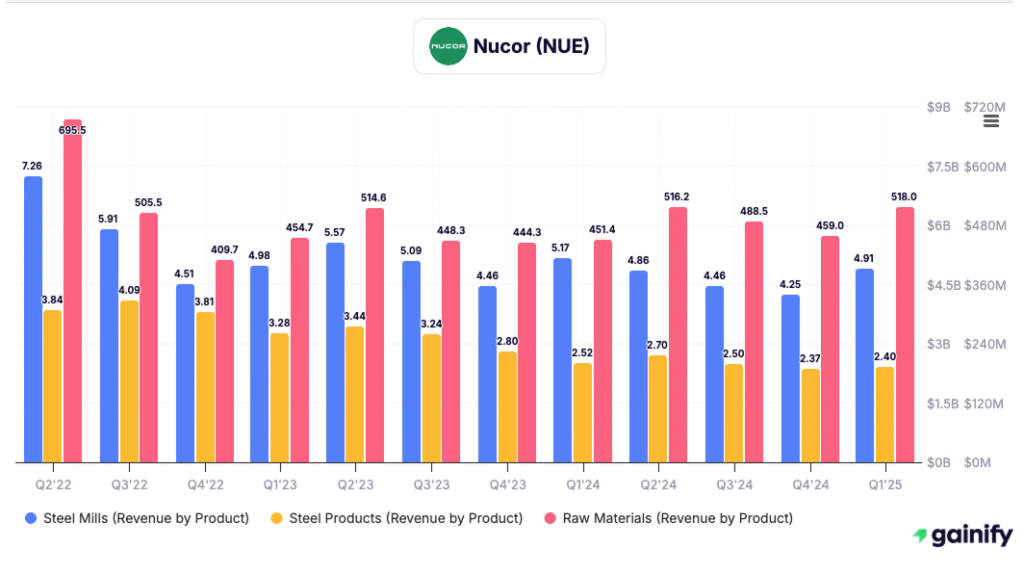

3. Nucor (NUE)

Market Cap: $31.84 billion

Valuation: 17.8x forward P/E

Analyst Target Price: +8% upside

What It Does: Nucor is the largest U.S. steel producer and the leading recycler of scrap metal. It operates a network of electric arc furnaces that are among the most efficient in the world, producing steel for construction, automotive, and manufacturing industries.

Key Investment Theme: Nucor is a core beneficiary of the U.S. infrastructure and reindustrialization trend. Its recycling-based model keeps emissions low and margins strong, and management’s focus on capital discipline has created one of the most consistent earnings profiles in the sector.

Key Risks: A slowdown in nonresidential construction or industrial spending could temporarily reduce demand. Energy prices and raw material costs are key margin variables.

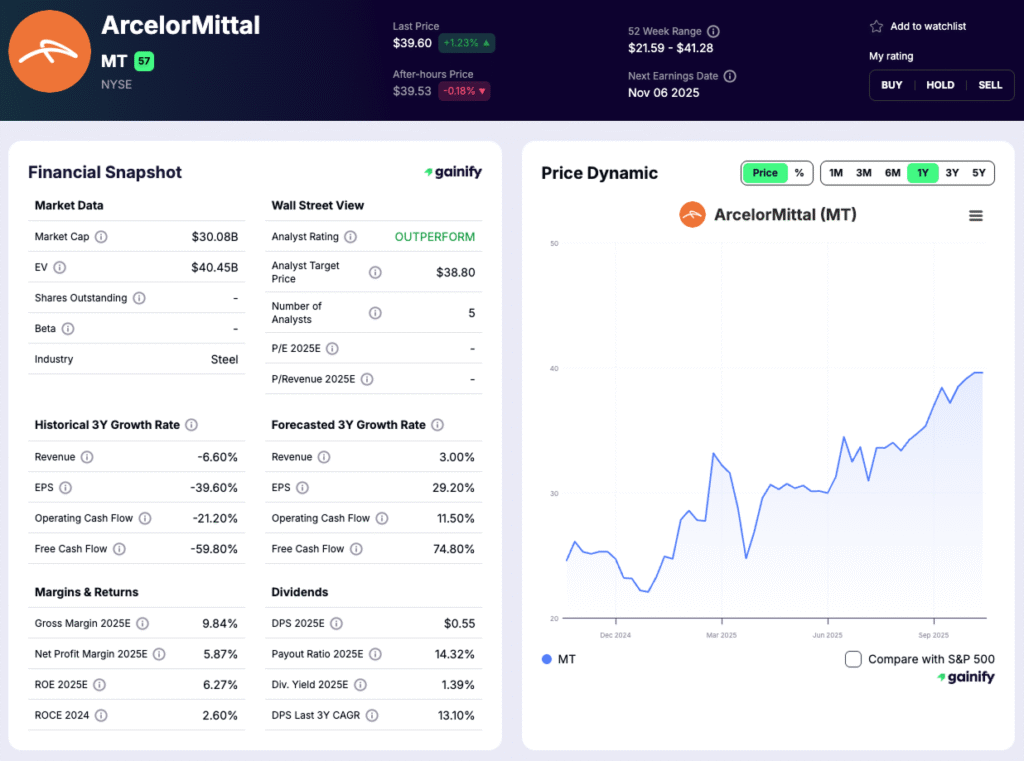

4. ArcelorMittal (MT)

Market Cap: $29.83 billion

Valuation: 10.5x forward P/E

Analyst Target Price: +9% upside

What It Does: ArcelorMittal is one of the world’s most diversified steel producers, with operations in more than 60 countries. The company’s portfolio spans automotive, energy, construction, and infrastructure steel, alongside mining operations that support self-sufficiency in raw materials.

Key Investment Theme: ArcelorMittal is leveraging its global scale to lead in low-emissions steelmaking, investing heavily in hydrogen-based technologies and carbon capture. Its exposure to multiple end-markets offers resilience across cycles, while the company continues to return capital to shareholders through buybacks.

Key Risks: High energy costs in Europe, exposure to economic slowdowns, and sensitivity to global trade policies could affect near-term profitability.

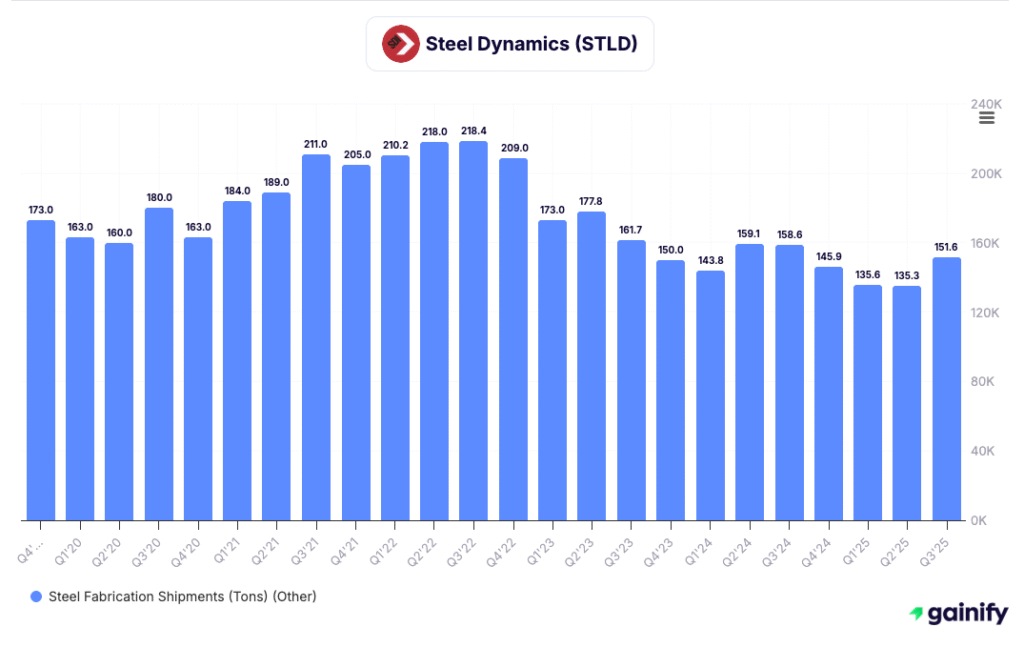

5. Steel Dynamics (STLD)

Market Cap: $22.34 billion

Valuation: 17.9x forward P/E

Analyst Target Price: +7% upside

What It Does: Steel Dynamics operates modern electric arc furnaces across the U.S., producing flat-rolled, bar, and structural steel. The company integrates scrap recycling and downstream manufacturing, making it one of the most vertically efficient producers in North America.

Key Investment Theme: Steel Dynamics continues to benefit from record U.S. infrastructure spending and reshoring of manufacturing. Its operational efficiency and low-carbon production process give it an advantage over legacy blast-furnace competitors. Its recent aluminum expansion also diversifies revenue streams.

Key Risks: Dependent on domestic demand cycles and construction activity. Raw material inflation and power costs may also reduce margin stability.

6. Nippon Steel (5401)

Market Cap: $20.67 billion

Valuation: ~10x forward P/E

Analyst Target Price: +6% upside

What It Does: Nippon Steel is Japan’s largest steelmaker and one of the world’s technological leaders in automotive and high-strength steel. It serves major carmakers, shipbuilders, and machinery manufacturers with innovative lightweight and durable steel grades.

Key Investment Theme: As global automakers transition to electric vehicles, Nippon Steel’s advanced product mix gives it strong pricing power. The company is investing in hydrogen-based steelmaking to achieve net-zero targets by 2050, positioning itself at the forefront of sustainable metallurgy.

Key Risks: Slower domestic demand and rising energy costs in Japan could limit near-term margins. Currency fluctuations may also impact export competitiveness.

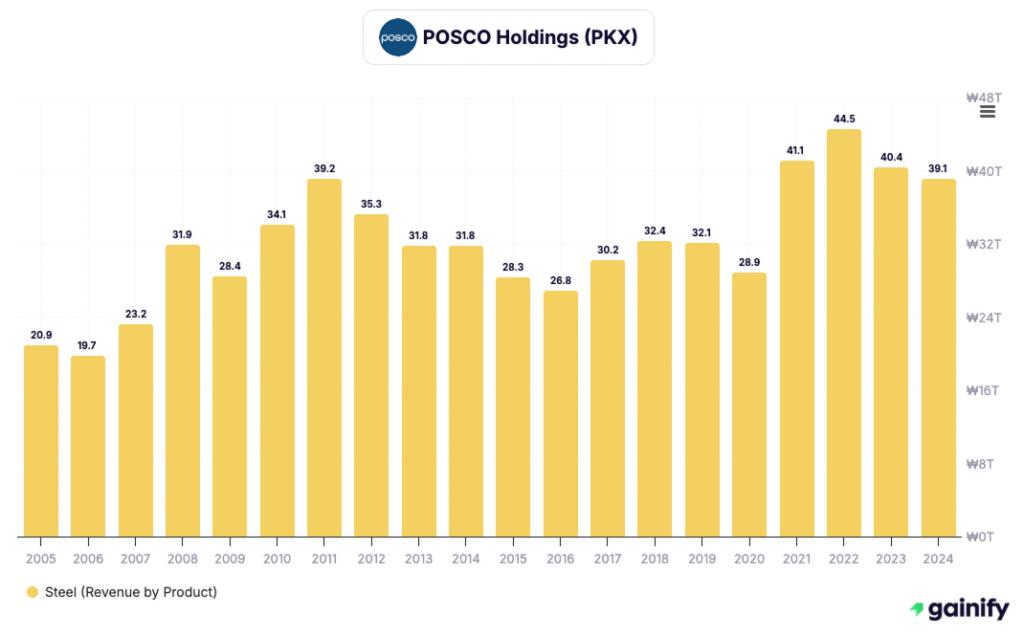

7. POSCO Holdings (A005490)

Market Cap: $17.12 billion

Valuation: 15.9x forward P/E

Analyst Target Price: +10% upside

What It Does: POSCO Holdings, headquartered in South Korea, is a global steelmaker with operations in steel, energy, and advanced materials. It has expanded into lithium refining, battery materials, and green hydrogen, aligning with the clean energy transition.

Key Investment Theme: POSCO’s integration of steel with the electric vehicle supply chain makes it one of Asia’s most forward-looking industrial groups. Its leadership in sustainable materials and partnerships with global automakers enhance long-term growth visibility.

Key Risks: Execution risk in diversification projects, high capital expenditure, and exposure to global trade fluctuations could weigh on earnings.

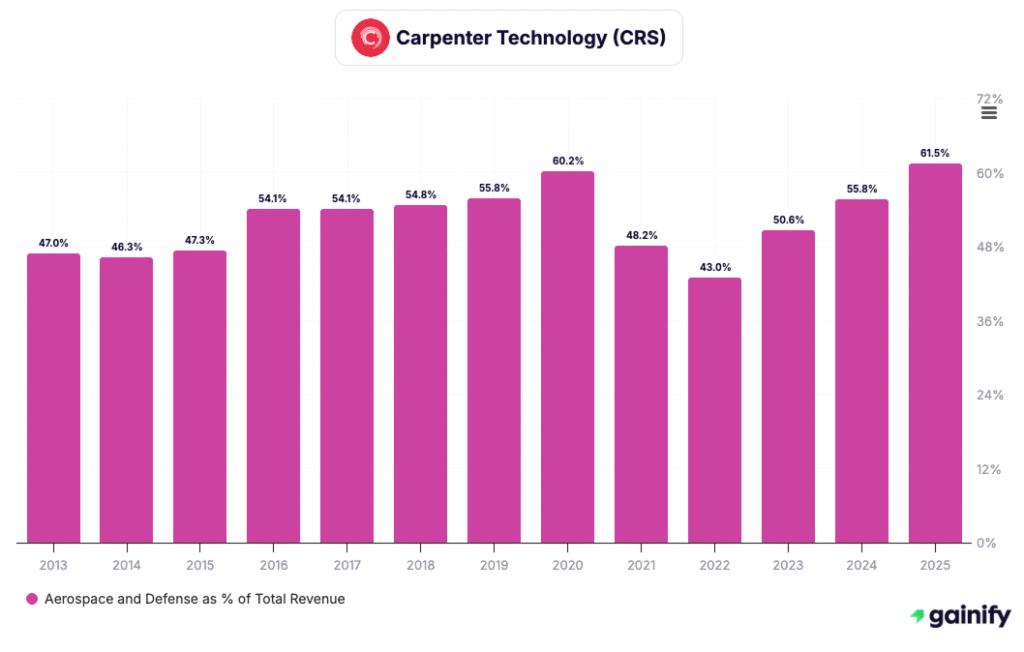

8. Carpenter Technology (CRS)

Market Cap: $15.65 billion

Valuation: 36.0x forward P/E

Analyst Target Price: +14% upside

What It Does: Carpenter Technology focuses on premium specialty alloys and advanced materials used in aerospace, defense, and energy sectors. Its metallurgical expertise and proprietary processes make it a key supplier for jet engines, turbines, and precision components.

Key Investment Theme: The ongoing recovery in commercial aerospace and higher global defense spending are strong tailwinds. Carpenter’s high-performance products have limited competition, allowing for superior pricing power and margin expansion.

Key Risks: Its premium valuation leaves little margin for error. Delays in aerospace production or defense procurement could affect revenue momentum.

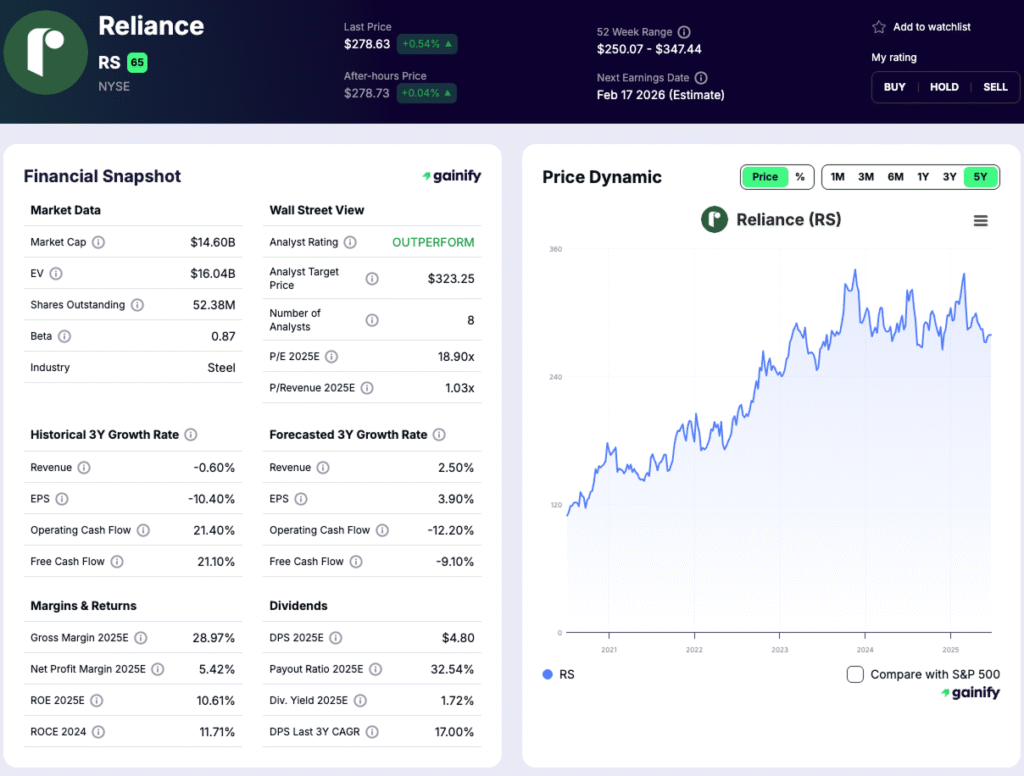

9. Reliance Steel & Aluminum (RS)

Market Cap: $14.52 billion

Valuation: 18.7x forward P/E

Analyst Target Price: +5% upside

What It Does: Reliance Steel & Aluminum is North America’s largest metals service center operator, processing and distributing steel, aluminum, and specialty alloys to industrial clients. It acts as a critical link between producers and end users.

Key Investment Theme: Reliance benefits from its diversification across industries and its ability to maintain profitability in any part of the cycle. Its strong balance sheet and disciplined acquisitions have created consistent shareholder value for more than two decades.

Key Risks: A slowdown in manufacturing or customer destocking can reduce near-term shipments and margins.

10. ATI Inc. (ATI)

Market Cap: $12.30 billion

Valuation: 29.6x forward P/E

Analyst Target Price: +9% upside

What It Does: ATI produces titanium, nickel, and specialty alloys used in aerospace, defense, and energy applications. Its products support critical components for next-generation aircraft, gas turbines, and nuclear systems.

Key Investment Theme: ATI’s exposure to the aerospace upcycle and clean energy transition provides strong multi-year demand visibility. Its move into high-margin engineered materials further strengthens profitability and resilience.

Key Risks: The stock’s valuation reflects high expectations. Delays in aerospace deliveries or defense spending adjustments could temper earnings growth.

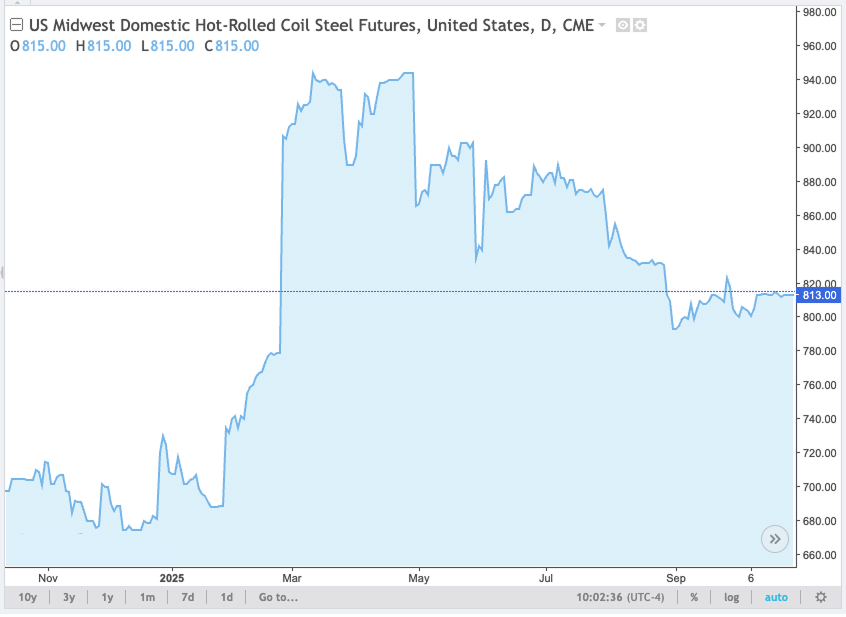

Steel Prices in 2025: A Steady Climb Driven by Demand and Supply Discipline

By October 2025, steel prices have gained about 15 percent year to date, reflecting a measured but meaningful recovery across global markets. The rebound follows a volatile 2024 when steelmakers struggled with uneven demand and margin pressure across construction and manufacturing.

In the United States, hot rolled coil steel futures are trading near 815 dollars per short ton, up from around 700 dollars earlier in the year. Prices briefly touched 950 dollars in April before easing as inventories improved and imports increased. Even after the correction, the trend for 2025 remains positive, supported by solid industrial activity and careful production management.

This year’s strength has come from steady infrastructure spending and disciplined supply behavior among major global producers. Mills in China, Japan, and South Korea have trimmed capacity to meet environmental goals, while North American producers have focused on profitability and margin stability. Public infrastructure investment and growing demand from renewable energy and manufacturing projects have added further support.

Analysts see the market as stable rather than overheated. Prices are expected to hold within the 800 to 850 dollar range through year end, as capacity utilization stays near 75 percent and global inventories remain balanced.

In summary, steel prices in 2025 show a market that has matured from recovery into resilience. The focus has shifted from chasing peaks to maintaining sustainable pricing and stronger fundamentals built on disciplined production and stable demand heading into 2026.

Types of Steelmakers

The top 10 companies in this list represent every major segment of the global steel industry. Each group operates with a distinct production model, cost structure, and growth driver. Understanding these differences helps investors see how diverse the sector truly is.

Category | Representative Companies | Production Method | Key Strengths | Typical Risks |

Integrated Steel Producers | ArcelorMittal, Nippon Steel, POSCO | Use blast furnaces that convert iron ore and coal into molten steel | Large scale, vertical integration, product variety | High capital costs and energy intensity |

Electric Arc Furnace (EAF) or Mini-Mill Producers | Nucor, Steel Dynamics | Melt recycled scrap in electric furnaces to make new steel | Low emissions, flexible production, high margins | Sensitive to scrap availability and energy prices |

Mining-Integrated Steel Suppliers | Vale, Fortescue | Combine iron ore mining with steel or pellet production | Cost control, raw material security, export exposure | Commodity price volatility, environmental regulation |

Specialty and Advanced Material Producers | Carpenter Technology, ATI Inc. | Produce high-performance alloys and engineered metals | Exposure to aerospace, defense, and energy markets | High valuation, cyclical demand from niche sectors |

Metal Service and Distribution Companies | Reliance Steel & Aluminum | Process, cut, and distribute metal products to end users | Stable cash flow, diversification across industries | Lower growth potential, margin pressure in downturns |

How They Differ

- Integrated producers drive global supply and dominate heavy industries like automotive and construction.

- EAF producers lead the sustainability transition with lower emissions and agile production models.

- Mining-integrated players like Vale and Fortescue provide a strategic hedge on both raw materials and finished steel demand.

- Specialty producers such as Carpenter Technology and ATI focus on innovation, producing alloys critical to aerospace and defense.

- Distributors like Reliance Steel & Aluminum deliver consistency, acting as the steady link between mills and manufacturers.

Together, these categories illustrate why steel is no longer a single-theme commodity sector. It is a mix of industrial resilience, clean-energy transformation, and advanced-material innovation – each with unique investment appeal.

The Future of Steel: From Commodity to Catalyst

As of late 2025, steel is transforming from a cyclical commodity into a structural growth story. Decarbonization is accelerating, infrastructure spending is expanding, and innovation is reshaping production.

Companies such as Fortescue and POSCO are redefining what it means to be a steelmaker through clean hydrogen and advanced materials. Nucor and Steel Dynamics are leading the U.S. in sustainable recycling-based production, while Carpenter Technology and ATI are positioned at the high end of aerospace and defense supply chains.

For investors, steel is now an essential component of global diversification. It connects the tangible world of industrial production with the emerging era of sustainable innovation. The sector’s evolution signals that the materials of the future will not only be stronger and lighter, but also cleaner and smarter – built to power the next generation of global growth.