Dividend stocks have long been considered one of the most reliable ways to build wealth. Unlike companies that focus only on capital gains, dividend payers return a portion of their earnings directly to shareholders in the form of regular income.

For many investors, this is more than just a cash flow advantage. Dividends can help reduce volatility during market downturns, provide predictable income for retirement planning, and create opportunities for reinvestment that compound over time.

Not all dividend stocks are created equal, however. Some offer high yields but cannot sustain them because they distribute too much of their profits. Others have solid businesses but fail to grow their dividends consistently.

The best dividend investments are those that strike a balance: they provide an attractive current yield, maintain a responsible payout ratio, and have the financial capacity to increase their dividends in the future.

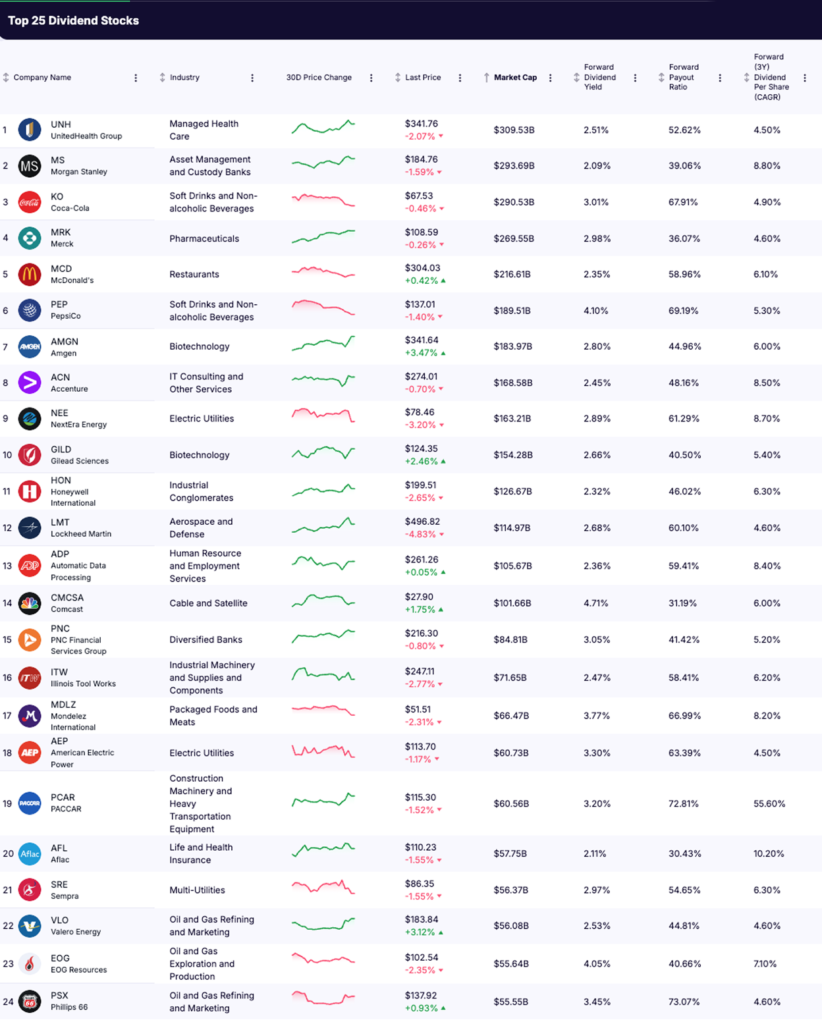

This list highlights the Top 25 Dividend Stocks for 2026, based on Wall Street estimates and strict fundamental criteria. These companies are not only leaders in their industries but also offer the right mix of income, sustainability, and long-term growth potential.

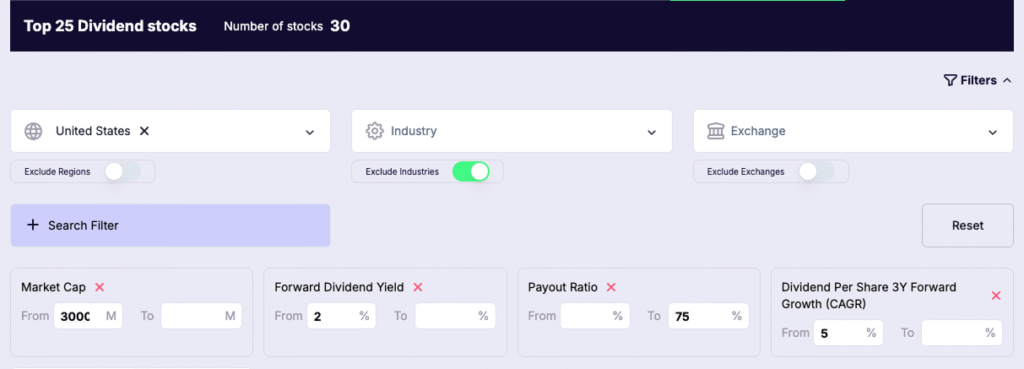

Selection Criteria

To make this list truly useful for long-term dividend investors, the screening process had to be both strict and realistic. The goal was to find stocks that not only provide attractive income today but also show a strong likelihood of sustaining and growing that income over time. Four key filters were applied:

- Market Capitalization of at least 50 billion dollars

Size matters when it comes to dividends. Larger companies tend to have stronger balance sheets, more diversified revenue sources, and easier access to capital. These traits make them far more resilient during recessions or industry downturns. A high market cap also reduces the likelihood of sudden dividend cuts that often occur in smaller, more volatile companies. - Forward Dividend Yield of at least 2.0 percent

This ensures the stock already offers an income stream that is meaningful compared to the S&P 500 average. While a double-digit yield might look tempting, such payouts are often unsustainable and a sign of stress. A 2.0 percent threshold provides a solid foundation while still leaving room for growth-oriented companies that pay steadily rising dividends. - Payout Ratio of 75 percent or lower

The payout ratio tells investors how much of a company’s net income is being distributed to shareholders. When the ratio is too high, it suggests management may be stretching to maintain dividends, leaving little room for reinvestment or balance sheet repair. By focusing on stocks with payout ratios under 75 percent, this list includes only those that combine generosity with discipline. Companies that retain part of their earnings are better positioned to fund growth initiatives, buy back shares, or withstand unexpected shocks. - Projected Dividend Per Share Growth of at least 5 percent (3-year forward CAGR)

Current yield is important, but dividend growth is the real driver of long-term income investing. A company that increases its dividend steadily gives investors a growing cash flow that keeps pace with inflation and boosts total returns. A forward growth rate of 5 percent or more suggests confidence in future earnings and a proven shareholder-friendly policy.

Taken together, these criteria filter out the common pitfalls of dividend investing. The companies that make the cut already yield attractively, do not overextend themselves with unsustainable payouts, and are expected to raise dividends consistently. In other words, these are stocks that can provide both stability and growth in an income-focused portfolio.

Top 25 Dividend Stocks Ranked by Yield

Using the filters above, Wall Street estimates were applied to create a ranked list of the 25 strongest dividend stocks for 2026. These companies cover a wide range of industries, from healthcare and technology to utilities and consumer goods, but all share the same three pillars: attractive income today, sustainable payout ratios, and room for future growth.

Rank | Company | Ticker | Industry | Market Cap | Forward Yield | Payout Ratio |

|---|---|---|---|---|---|---|

1 | Managed Health Care | $309.5B | 2.51% | 52.6% | ||

2 | Asset Management & Custody Banks | $293.7B | 2.09% | 39.1% | ||

3 | Soft Drinks & Non-alcoholic Beverages | $290.5B | 3.01% | 67.9% | ||

4 | Pharmaceuticals | $269.6B | 2.98% | 36.1% | ||

5 | McDonald’s | Restaurants | $216.6B | 2.35% | 59.0% | |

6 | Soft Drinks & Non-alcoholic Beverages | $189.5B | 4.10% | 69.2% | ||

7 | Biotechnology | $177.8B | 2.80% | 45.0% | ||

8 | IT Consulting & Services | $168.6B | 2.45% | 48.2% | ||

9 | Electric Utilities | $163.2B | 2.89% | 61.3% | ||

10 | Biotechnology | $150.6B | 2.66% | 40.5% | ||

11 | Industrial Conglomerates | $130.1B | 2.32% | 46.0% | ||

12 | Aerospace & Defense | $115.0B | 2.68% | 60.1% | ||

13 | Human Resource Services | $105.6B | 2.36% | 59.4% | ||

14 | Cable & Satellite | $101.7B | 4.71% | 31.2% | ||

15 | PNC Financial Services | PNC | Diversified Banks | $84.8B | 3.05% | 41.4% |

16 | Illinois Tool Works | ITW | Industrial Machinery & Components | $71.7B | 2.47% | 58.4% |

17 | Packaged Foods & Meats | $68.0B | 3.77% | 67.0% | ||

18 | American Electric Power | AEP | Electric Utilities | $60.7B | 3.30% | 63.4% |

19 | Paccar | PCAR | Heavy Transportation Equipment | $60.6B | 3.20% | 72.8% |

20 | Aflac | AFL | Life & Health Insurance | $57.8B | 2.11% | 30.4% |

21 | Sempra | SRE | Multi-Utilities | $56.4B | 2.97% | 54.7% |

22 | Valero Energy | VLO | Oil & Gas Refining & Marketing | $56.1B | 2.53% | 44.8% |

23 | EOG Resources | EOG | Oil & Gas Exploration & Production | $55.6B | 4.05% | 40.7% |

24 | Phillips 66 | PSX | Oil & Gas Refining & Marketing | $55.6B | 3.45% | 73.1% |

25 | Marathon Petroleum | MPC | Oil & Gas Refining & Marketing | $51.9B | 2.16% | 36.7% |

Key Takeaways

- Attractive Current Income: Every company on this list yields at least 2.0 percent, with several exceeding 3 percent. Comcast, CVS Health, and PACCAR stand out with yields at the top of the range.

- Sustainability Built In: None of the stocks exceed a 75 percent payout ratio, which gives them flexibility to continue paying even if earnings temporarily weaken. This avoids the common trap of “yield traps,” where high yields collapse due to cuts.

- Dividend Growth Ahead: Forward estimates show consistent growth in dividend per share, with most companies projected to raise dividends at a rate of 5 to 10 percent annually. A few, like PACCAR and AngloGold Ashanti, are forecasted to deliver far stronger growth.

- Diversification Across Sectors: The list is not concentrated in one industry. Utilities provide stability, healthcare and consumer goods offer defensive growth, while financials and industrials bring cyclical upside. This balance helps reduce risk while still keeping yields strong.