Dividend investing remains one of the most reliable strategies for generating consistent income. While growth stocks often dominate headlines, dividend-paying companies continue to attract investors who value steady cash flow and long-term stability over short-term market swings.

However, NOT ALL HIGH DIVIDEND YIELDS ARE CREATED EQUAL.

A stock offering a 10% yield might seem appealing at first glance, but such figures can sometimes signal declining share prices or unsustainable payout policies.

The most successful dividend investments strike a balance between attractive yield, earnings growth, disciplined payout ratios, and strong free cash flow generation.

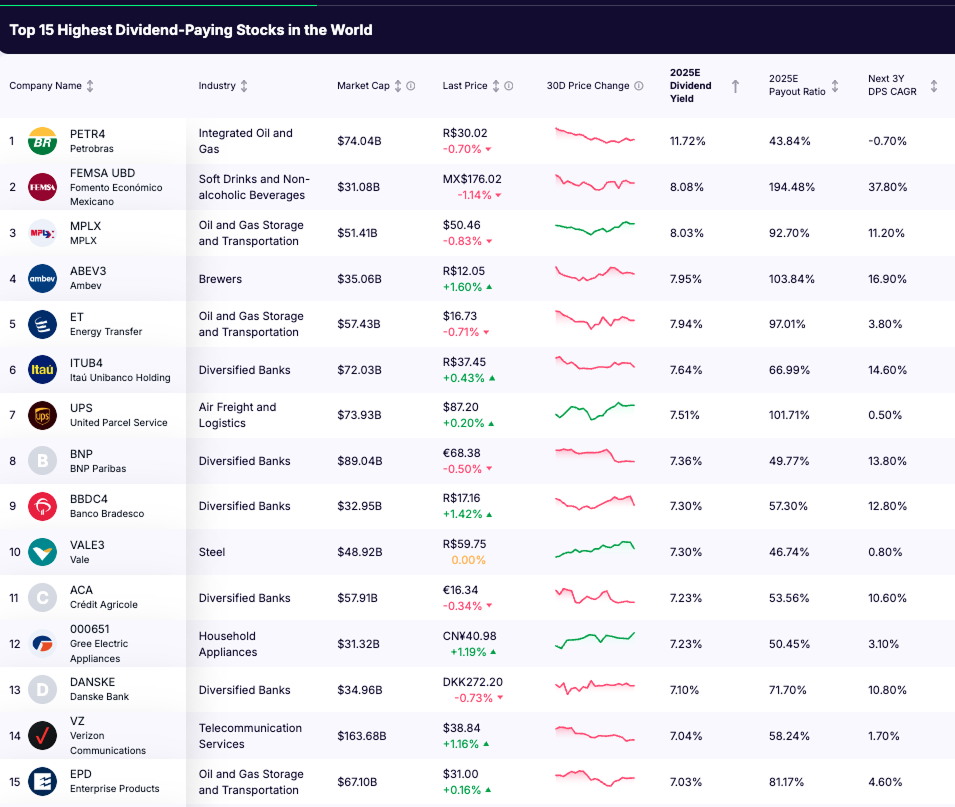

In this report, we explore the 15 highest dividend-paying stocks in the world as of 2025 and examine why dividend sustainability and free cash flow coverage are just as critical as the yield itself.

How the Highest Dividend-Paying Stocks Were Measured

The ranking of the highest dividend-paying stocks in the world is based on expected 2025e DIVIDEND YIELD, not the total nominal amount of dividends paid.

Dividend yield provides a consistent and comparable way to evaluate income potential across markets, currencies, and company sizes. It measures the annual dividend per share relative to the stock price, showing how much income an investor earns for every dollar invested.

Focusing on nominal dividends alone can be misleading. Large corporations may distribute billions in total dividends simply because of their size, but that figure says little about the return to each shareholder. A smaller company with a higher yield can offer far greater income potential per unit of investment.

Using dividend yield ensures a level playing field. It captures both payout size and valuation, allowing for a more accurate picture of true income efficiency.

All companies included in this list have a market capitalization above $30 billion and a forward dividend yield of at least 7 percent, based on the most recent consensus forecasts for 2025.

Top 15 Dividend Stocks by Forward Yield (2025E)

Rank | Company | Industry | 2025E Dividend Yield | 2025E Payout Ratio | Next 3Y Dividend CAGR | |

1 | Integrated Oil & Gas | $74.0B | 11.72% | 43.8% | -0.7% | |

2 | FEMSA (FEMSA UBD) | Beverages & Retail | $31.1B | 8.08% | 194.5% | 37.8% |

3 | MPLX LP (MPLX) | Oil & Gas Storage & Transport | $51.4B | 8.03% | 92.7% | 11.2% |

4 | Brewers | $35.1B | 7.95% | 103.8% | 16.9% | |

5 | Energy Infrastructure | $57.4B | 7.94% | 97.0% | 3.8% | |

6 | Itaú Unibanco (ITUB4) | $72.0B | 7.64% | 66.9% | 14.6% | |

7 | Logistics | $73.9B | 7.51% | 101.7% | 0.5% | |

8 | Banking | $89.0B | 7.36% | 49.8% | 13.8% | |

9 | Banking | $32.9B | 7.30% | 57.3% | 12.8% | |

10 | Metals & Mining | $48.9B | 7.30% | 46.7% | 0.8% | |

11 | Banking | $57.9B | 7.23% | 53.6% | 10.6% | |

12 | Household Appliances | $31.3B | 7.23% | 50.5% | 3.1% | |

13 | Banking | $34.9B | 7.10% | 71.7% | 10.8% | |

14 | Telecommunications | $163.7B | 7.04% | 58.2% | 1.7% | |

15 | Oil & Gas Infrastructure | $67.1B | 7.03% | 81.2% | 4.6% |

What the Top 15 Highest Dividend-Paying Stocks in the World Reveal

The 2025 list of the highest dividend-paying stocks in the world highlights a powerful theme: income leadership continues to be dominated by a handful of capital-intensive sectors. Every company on the list offers a forward dividend yield above 7%, and most belong to industries known for strong cash generation and mature business models.

While the geographic mix spans Brazil, the United States, Europe, and China, the sector concentration is clear. Financials and energy companies lead the way, supported by consistent cash flows and established market positions.

1. Energy and Infrastructure Powerhouses

- Companies: Petrobras (Brazil), MPLX LP (U.S.), Energy Transfer (U.S.), Enterprise Products Partners (U.S.), and Vale (Brazil).

- Average Yield: Around 8.5%–11%.

- Key Traits: These businesses benefit from long-term contracts, commodity exposure, and strong free cash flow generation. However, they are also cyclical, with earnings tied to oil and gas prices.

- Notable Leader: Petrobras remains the world’s top-yielding large-cap stock with a forward yield of 11.7%, supported by robust cash generation but constrained by government policy risk.

2. Banking and Financial Giants

- Companies: Itaú Unibanco, Banco Bradesco, BNP Paribas, Crédit Agricole, and Danske Bank.

- Average Yield: Around 7%–7.6%.

- Key Traits: These banks represent the most stable segment of high-yield payers. With moderate payout ratios and diversified income streams, they can sustain strong dividend levels without compromising capital.

- Notable Performer: BNP Paribas combines a 7.3% yield with a payout ratio below 50%, reflecting both prudence and dividend consistency.

3. Consumer and Industrial Leaders

- Companies: FEMSA, Ambev, UPS, and Gree Electric.

- Average Yield: Around 7.5%–8%.

- Key Traits: These firms offer more defensive cash flows derived from global consumption and logistics. However, high payout ratios for some, such as FEMSA and Ambev, raise sustainability questions.

- Notable Performer: UPS stands out for its scale and reliable global logistics network, maintaining consistent dividends even during earnings slowdowns.

4. Telecommunications and Utilities

- Company: Verizon Communications.

- Yield: 7.0%.

- Key Traits: A classic income stock, Verizon provides predictable cash flow and stability. Its yield remains appealing for conservative investors, though growth prospects are limited compared with other sectors.

High Dividend Yield: Opportunity or Warning Sign?

Dividend yield is one of the most visible metrics for income investors. It measures how much a company pays in dividends relative to its share price, and at first glance, a higher yield seems to imply stronger returns. Yet, in practice, a high dividend yield can signal both opportunity and risk. Understanding which one you are seeing depends on the broader financial context.

A rising yield can come from two different forces. It can result from genuine improvement in shareholder distributions, driven by growing profits and cash flow. But more often, it is the outcome of a declining stock price, which automatically pushes the yield higher even if the underlying dividend remains unchanged. The second case usually reflects falling investor confidence, weaker earnings prospects, or rising balance sheet pressure.

A dividend yield above 7 or 8 percent should prompt deeper investigation. While such levels may seem appealing in a world of moderate inflation and modest bond returns, they often point to structural or temporary stress within the company or its sector.

Several underlying causes tend to inflate yields artificially:

- Falling share prices: When markets anticipate slower earnings or regulatory pressure, stock prices fall, pushing yields higher. This often happens in cyclical sectors like energy, telecom, or logistics.

- Unsustainable payout levels: Companies that pay out most or all of their earnings leave little room for reinvestment or downturn protection. A payout ratio above 100 percent often means dividends are being funded from cash reserves or new debt.

- Sector cyclicality: In industries tied to commodity prices or capital spending cycles, profits can fluctuate widely. Yields appear high during peaks but often fall sharply when conditions reverse.

Case studies illustrate the point clearly.

- Petrobras currently offers the world’s highest large-cap dividend yield at about 11.7 percent, but its distributions are tightly linked to oil prices and Brazilian government decisions. The company’s balance sheet is robust, yet its payout policy remains unpredictable due to political influence and commodity volatility.

- FEMSA, with an 8.1 percent yield, has demonstrated strong growth and aggressive shareholder returns. However, its payout ratio exceeds 190 percent, suggesting that the company is distributing more than it earns. Without faster profit recovery, this yield level is unlikely to be sustainable over the long term.

- UPS, at roughly 7.5 percent, represents a different scenario. The company is financially solid, but its high yield reflects investor caution following slower global trade volumes and margin compression.

These examples show that context defines meaning. A high yield from a stable, cash-generative company may indicate undervaluation. The same yield from a firm with declining profits or policy exposure may signal an impending cut.

Ultimately, the difference between a yield opportunity and a yield trap lies in the source of the payout. Investors must look beyond the percentage to assess earnings quality, payout policy, and free cash flow coverage. Sustainable dividend investing is not about chasing the highest number; it is about identifying companies that can fund their dividends comfortably through cycles.

Beyond Yield: The Metrics That Actually Matter

High dividend yields attract attention, but sustainable income investing requires deeper analysis. Three key metrics help investors identify companies capable of maintaining and growing dividends over time: payout ratio, dividend growth, and free cash flow coverage.

Payout Ratio

The payout ratio measures how much of a company’s net earnings are distributed to shareholders as dividends. It is the most direct indicator of dividend sustainability.

A payout ratio below 70% is generally considered healthy, leaving room for reinvestment and a margin of safety during earnings downturns. Ratios above 100% indicate that the company is paying out more than it earns, often relying on debt or cash reserves to maintain the dividend.

For example, Petrobras and BNP Paribas maintain moderate payout ratios of 44% and 50%, which suggests disciplined capital management. In contrast, FEMSA (194%) and Ambev (104%) distribute more than they generate, signaling potential pressure if profitability does not improve.

Companies with consistent payout policies tend to preserve flexibility, allowing them to continue rewarding shareholders even in weaker economic cycles without compromising long-term growth.

Next 3 Year Dividend Growth (CAGR)

Dividend yield determines current income, but dividend growth shapes future income potential. The three-year Dividend Compound Annual Growth Rate (CAGR) measures how quickly a company has raised its dividend, providing insight into management’s confidence and earnings resilience.

Strong growers include FEMSA (+37.8%), Ambev (+16.9%), Itaú Unibanco (+14.6%), and BNP Paribas (+13.8%). Slower or stagnant payers such as Petrobras (-0.7%) and Vale (+0.8%) highlight the difference between short-term yield and long-term compounding.

Companies that deliver moderate but consistent dividend increases often outperform high-yield peers over time. Steady growth compounds returns and provides natural protection against inflation, strengthening the real value of income.

Free Cash Flow (FCF) Coverage

Earnings alone do not guarantee dividend stability. Free cash flow represents the true liquidity available to fund shareholder distributions. The FCF coverage ratio shows how comfortably a company’s cash generation supports its dividend payments.

FCF Coverage = Free Cash Flow / Total Dividends Paid

A ratio above 1.5x indicates that the company produces at least 50% more cash than it pays out, providing a solid buffer. Ratios below 1.0x suggest that dividends may rely on borrowing or balance sheet drawdowns.

How to Evaluate a Dividend Stock (The 4-Part Framework)

A high yield might catch your attention, but a truly great dividend stock checks four key boxes:

STEP 1: Attractive but Sustainable Yield (4–7%)

The “sweet spot” range. Higher than bonds or cash, but not dangerously high.

STEP 2: Manageable Payout Ratio (<70%)

Ensures dividends don’t depend on debt or one-time gains.

STEP 3: Consistent Dividend Growth

Regular increases show management’s confidence and long-term earnings visibility.

STEP 4: Strong Free Cash Flow Coverage (>1.5x)

Cash is king. Companies that generate excess cash flow can fund dividends and still reinvest in the business.

Final Takeaway: High Yield Is the Hook, Not the Whole Story

The 2025 list of the world’s highest dividend-paying stocks highlights a diverse mix of industries, from energy and banking to telecoms and logistics. Yet the headline numbers only tell part of the story.

A double-digit yield can look attractive at first glance, but it often reflects temporary profit spikes or falling share prices rather than long-term strength. Sustainable dividends come from steady cash generation, disciplined payout ratios, and consistent reinvestment in the business.

Over time, companies offering stable 6–8 percent yields with strong free cash flow coverage tend to outperform those paying 10–12 percent that later face cuts during downturns.

In dividend investing, quality and consistency matter more than size. The most successful investors focus not on how big the yield is, but on how long it can last.