In the bustling casino of the stock market, where blue-chip giants dominate headlines and fortunes are made (or lost) on established names, there exists a shadowy, often alluring, corner. This is the realm of penny stocks, whispered about with a mix of fascination and fear. They represent the ultimate underdog story, promising the dream of turning a tiny investment into a life-changing fortune. If one has ever imagined a small, unknown company suddenly hitting it big, skyrocketing a portfolio from humble beginnings, then understanding penny stocks is crucial to either embracing or avoiding this high-stakes game.

For many investors, the appeal is undeniable: the chance to buy hundreds, even thousands, of shares for pocket change. The very idea of a stock price at a few cents exploding to several dollars ignites the imagination, offering a tantalizing shortcut to wealth that established, higher-priced stocks rarely can. This powerful narrative of big wins and rapid capital appreciation draws many into their orbit, eager to discover the next hidden gem before the rest of the market catches on. Yet, beneath this glittering promise lies a landscape fraught with extreme volatility, limited information, and considerable risk.

At their core, penny stocks are shares of small scale companies that trade for a very low price, typically under $5 per share. They are often associated with emerging businesses, startups, or companies facing significant challenges, operating far from the regulated spotlights of major exchanges. Their low price per share does not necessarily indicate a cheap company; it often reflects the company’s small size, lack of profitability, or inherent operational risks. Understanding this fundamental truth is the first step in demystifying these often-misunderstood securities.

Understanding what defines penny stocks is essential for grasping how this segment of stock trading functions. These securities are a critical area where due diligence becomes paramount and risk management is tested to its absolute limits. This guide aims to clearly explain what defines these low-priced shares, delve into their inherent risks and rare rewards, and ultimately help individuals make an informed investment decision about whether to engage with this highly speculative corner of the capital markets.

What Are Penny Stocks? Defining the Underdogs

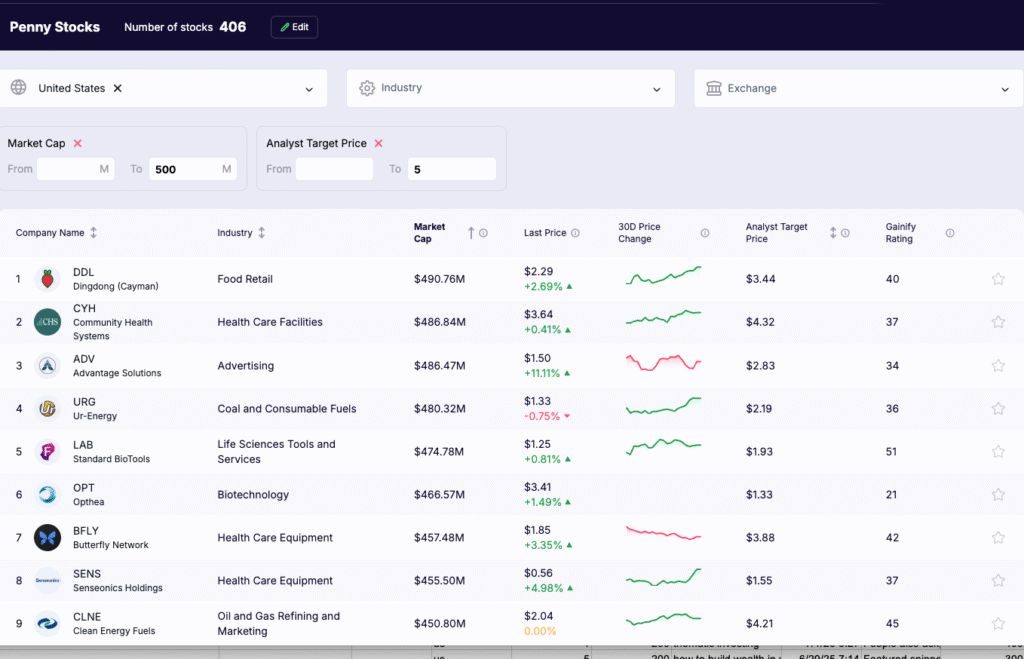

Penny stocks refer to the shares of small scale companies that trade at a very low price, typically defined as under $5 per share. These companies usually have a small market capitalisation, often falling below $300 million (though some definitions extend up to $500 million), indicating their relatively small size compared to established corporations like those in the S&P 500.

Key characteristics that define these low-priced securities include:

- Low Share Price: The most distinguishing feature is their nominal trading price, often ranging from a few cents to a few dollars.

- Small Market Capitalization: The companies issuing these shares are typically small, with limited operations, products, or revenue. Their total market capitalisation (share price multiplied by share outstanding) is usually modest.

- Limited Liquidity: Due to their small size and often niche appeal, trading volume for these stocks may be low. This means it can be difficult to buy or sell shares quickly without impacting the stock price. This low liquidity also leads to wider bid-ask spreads, where the difference between the buying and selling price is larger, adding to trading costs.

- Over-the-Counter (OTC) Trading: Many of these stocks do not meet the listing requirements of major exchanges like the New York Stock Exchange (NYSE) or the Nasdaq CompositeIndex. Instead, they trade on the over-the-counter market (Over-the-Counter stock), such as the OTC Bulletin Board (OTCBB) or the Pink Sheets (now operated by the OTC Markets Group), where regulatory oversight is generally less stringent than for exchange-listed stocks.

- Limited Information: Companies issuing Over-the-Counter stock often provide less public information or financial disclosure than larger, exchange-listed stocks. Their financial reports may be infrequent, unaudited, or difficult to obtain. Comprehensive media and analyst coverage is rare, making thorough fundamental analysis challenging.

- Emerging or Struggling Companies: They often represent start-ups, companies in early development stages, or businesses facing financial distress, with unproven business models or significant operational challenges. Examples of such companies that have attracted attention, often because of their connection to emerging technologies or resources, include Windtree Therapeutics, Inc. (biopharma), Denison Mines Corp. (uranium), Bit Origin Ltd. (blockchain), and Plug Power Inc. (hydrogen fuel cells). Note that the status and price of these examples can fluctuate.

Why Do Investors Consider These Low-Priced Shares? The Allure of High Returns

Despite their inherent risks, penny stocks continue to attract investors due to the promise of extraordinary returns. The allure stems from the mathematical possibility of significant capital appreciation from a small initial investment.

- Explosive Growth Potential: The primary draw is the potential for a small nominal increase in the share price to translate into a massive percentage gain on the investment. For example, a stock moving from $0.10 to $1.00 represents a 900% return. This possibility fuels dreams of big wins.

- Low Barrier to Entry: Their low per-share price allows investors with limited capital to purchase a substantial number of shares, feeling like they own a significant piece of a company. Unlike some exchange-listed stocks that might offer fractional share trading, the value proposition here is the low unit cost, even if fractions shares are not typically supported.

- Excitement and Speculation: The speculative nature of such securities appeals to some traders who thrive on high-risk, high-reward scenarios. They offer a sense of seeking out undervalued gems before anyone else.

- Perceived Asymmetry: The downside risk is often seen as limited to the invested amount, while the potential upside is theoretically unlimited. This asymmetry, though often misleading in practice, adds to the psychological appeal of betting small to win big.

The Real Risks: Why These Securities Are Dangerous

While the potential for high returns is tempting, investing in penny stocks comes with profound and often underestimated risks that can lead to rapid and complete loss of capital. A seasoned financial professional would highlight these dangers:

- Extreme Volatility: These securities are notoriously volatile. Their low share price and thin trading volume mean that even small buy or sell orders can cause dramatic price swings. This market volatility can lead to sudden, significant losses, especially for high volume trading.

- Lack of Liquidity: Due to low trading volumes, it can be very difficult to sell your shares when you want to, especially if stock prices are falling. This lack of liquidity means you might be “stuck” with your investment, unable to exit your position. Placing limit orders is crucial to avoid unfavorable prices, but even then, execution is not guaranteed.

- Limited Information and Transparency: As many of these stocks trade on over-the-counter market, they have fewer reporting requirements than exchange-listed stocks. This means less reliable financial reports, infrequent updates, and less information about company management, cash flow, or future prospects. Conducting proper due diligence is extremely challenging due to limited financial disclosure. Even a quarterly outlook may be missing or insufficient.

- High Risk of Scams and Fraud: This low-priced stock market segment has historically been a breeding ground for fraudulent schemes like pump-and-dump schemes. In these schemes, fraudsters artificially inflate a stock’s share price with misleading information (the “pump”) and then sell their own holdings once other investors buy in, causing the price to crash (the “dump”).

- No Guarantees of Future Performance: Many companies offering these securities are either unproven startups with no revenue or struggling businesses with a weak asset base or balance sheet. The vast majority fail, leading to total loss of the investment.

- Dilution: Companies reliant on these low-priced shares often need to raise capital frequently. They do this by issuing new shares, which dilutes the ownership percentage of existing shareholders and can depress the share price.

A Different Perspective: Scrutiny and Market Realities

While the narratives of big wins in these low-priced securities capture imaginations, a more grounded view recognizes the severe challenges. It is vital to understand that the perceived “cheapness” of a low share price is often deceptive. A $0.50 stock with 1 billion shares outstanding has a $500 million market capitalisation, which might not be “cheap” at all when compared to its meager revenue or non-existent profits, especially when considering its P/E ratio if earnings exist.

This perspective highlights that this stock market segment often thrives on investor speculation and a misunderstanding of fundamental financial metrics. The lack of stringent regulatory standards on over-the-counter market means investors have fewer regulatory protections compared to those on major exchanges. For instance, the Securities Investor Protection Corp. (SIPC) and the Federal Deposit Insurance Corp. (FDIC) generally do not cover losses from market speculation or fraud, and specifically not for securities held at firms not members or accounts not covered.

Moreover, identifying genuine hidden gems among thousands of speculative companies is incredibly difficult, even for professional fund managers with advanced analytical tools. The very market dynamics of low liquidity and susceptibility to manipulation mean that any real opportunity is quickly exploited by sophisticated players, leaving less informed individual investors vulnerable to significant losses. The stories of capital appreciation are often overshadowed by widespread losses across this low-priced stock market segment. According to Jacob Falkencrone, Global Head of Investment Strategy at Saxo Group, the allure often masks a lack of relative safety and the difficulty in discerning relative value and relative timing for such volatile instruments.

Understanding Penny Stocks: Key Concepts for Your Investment Decision

To navigate this segment of the market, understanding specific terms is vital:

- Over-the-Counter (OTC) Markets: Decentralized marketplaces where securities not listed on major exchanges like the NYSE or Nasdaq are traded. Common OTC platforms include the OTC Markets Group, which operates tiers such as Pink Sheets, OTCQB, and OTCQX.

- Market Capitalization: The total value of a company’s outstanding shares, calculated by multiplying the share price by the number of shares outstanding. Penny stock companies typically have micro-cap or nano-cap status, reflecting very small market capitalizations, often under $300 million.

- Liquidity: The ease with which a security can be bought or sold without significantly impacting its price. Penny stocks frequently suffer from low liquidity, which can make entering or exiting positions difficult and expensive.

- Pump-and-Dump Schemes: A common type of market manipulation where promoters artificially inflate a stock’s price through misleading statements, only to sell (dump) their shares at the peak, leaving other investors with losses as the price collapses.

- Due Diligence: The process of thoroughly researching and evaluating a company before making an investment decision. This is especially difficult with OTC stocks, as many have limited, unaudited, or outdated financial disclosures.

- Volatility: A measure of how much a stock’s price fluctuates. Penny stocks are known for their extreme volatility, with rapid and unpredictable price swings that can lead to both large gains and steep losses.

- Financial Reports: Key documents such as income statements, balance sheets, and cash flow statements help assess a company’s financial health. However, for penny stocks, these reports may be missing, unaudited, or intentionally vague.

- Technical Analysis: A method of evaluating securities by examining historical price and volume data. While some investors apply technical tools like moving averages or candlestick patterns to penny stocks, these indicators are often unreliable due to thin volume and irregular trading behavior.

- Trading Platform: Software provided by brokers (e.g., TD Direct Investing, Fidelity, Interactive Brokers) that enables users to place trades, access data, and manage portfolios. Platforms often include customizable features like table views, real-time quotes, and the ability to maximize screen space for better user experience.

Frequently Asked Questions About Penny Stocks

Q: What defines a penny stock?

A: A penny stock is generally defined as a share of a small company that trades for under $5.00 per share. They typically have a low market capitalisation and often trade on an over-the-counter market rather than major exchanges like the S&P 500.

Q: Are penny stocks regulated?

A: Yes, these low-priced shares are regulated by the Securities and Exchange Commission (SEC), especially if they are publicly traded. However, the regulatory oversight on OTC markets is generally less stringent compared to major exchanges, and there are fewer disclosure requirements for the companies themselves. Investors should be aware of these differences in regulatory standards and regulatory protections.

Q: Can these low-priced shares make you rich?

A: While it’s theoretically possible to achieve big wins with penny stocks due to their potential for large percentage gains, such outcomes are extremely rare. The vast majority of these investments result in significant losses or total loss of capital due to their inherent risks, including market volatility, fraud risks from pump-and-dump schemes, and business failures.

Q: What is a “pump-and-dump” scheme?

A: A pump-and-dump scheme is a fraudulent tactic where individuals artificially inflate the share price of a low-priced stock through misleading promotions or false information (the “pump”). Once unsuspecting investors buy in and drive the price up, the fraudsters sell their own shares at a profit (the “dump”), causing the stock price to collapse and leaving other investors with heavy losses. Be wary of lists or newsletters like a “Hot Penny Stocks list” that might promote such schemes.

Q: How can I research these low-priced shares?

A: Researching penny stocks is challenging due to limited reliable information. Investors should look for any available financial reports, press releases, and SEC filings (if the company makes them) to understand the company management, business model, and financial fundamentals. Be extremely cautious of unsolicited advice or aggressive promotions, and recognize the difficulty in assessing intrinsic worth or predicting bullish reversal through technical analysis indicators.

Q: Are there ETFs or mutual funds for penny stocks?

A: It is highly uncommon for traditional mutual funds or exchange-traded funds (ETFs) to focus exclusively on these low-priced shares due to their illiquidity, volatility, and inherent risks. Such funds would likely face significant investment risk and fund diversification challenges. Any fund that claims to specialize in this area should be scrutinized very carefully. Diversified index funds, like those tracking the S&P 500, offer a much different and generally safer investment strategy.

Weighing Risk and Reward in the Underdog World

Understanding what penny stocks are reveals a fascinating but exceedingly high-risk segment of the stock market. Their allure stems from the dream of massive capital appreciation from a small initial investment, appealing to the desire for big wins. However, this potential is dwarfed by profound dangers including extreme market volatility, a severe lack of liquidity, limited transparency in financial fundamentals, and a high susceptibility to pump-and-dump schemes.

Key Takeaways:

- Penny stocks are low-priced shares of small companies, often trading on less regulated over-the-counter (OTC) markets.

- Their appeal lies in explosive growth potential, but this is offset by extreme market volatility and limited liquidity.

- Investing in them carries significant fraud risks, including pump-and-dump schemes, due to limited financial disclosure and media coverage.

- These stocks are generally highly speculative and unsuitable for most investors, particularly for building long-term portfolios.

- Thorough due diligence is essential but challenging due to scarce reliable information.

Ultimately, for the vast majority of investors, the risks associated with penny stocks far outweigh their tantalizing, but rare, rewards. While the stories of big wins grab headlines, prudent financial management suggests focusing on more transparent and regulated segments of the capital markets where fundamental analysis and sound investment approaches can be more effectively applied, such as diversified index funds.