It is one of the most common questions investors ask when markets are at all-time highs or when volatility shakes confidence: “Should I sell my stocks now?”

The truth is, there is no universal answer.

Markets are influenced by many factors such as economic growth, interest rates, corporate earnings, and global events. Short-term predictions are nearly impossible. What investors can do is evaluate valuations, consider their personal financial goals, and review their portfolio strategy in order to make thoughtful decisions rather than emotional ones.

Market Valuations: What the Numbers Tell Us

One of the most common ways to evaluate the stock market is through valuations. The price-to-earnings (P/E) ratio of the S&P 500 has ranged from below 15 in downturns to above 25 in bull markets. Elevated levels often suggest more modest forward returns, while lower levels may signal stronger long-term opportunities.

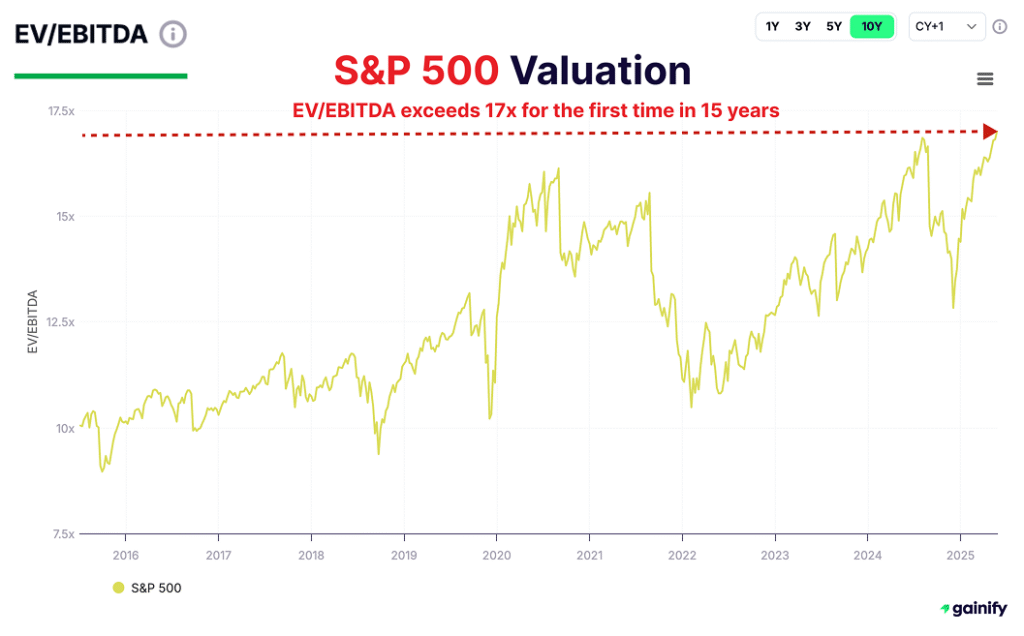

Another useful lens is the EV/EBITDA multiple. This measure adjusts for both debt and cash, giving a clearer view of company profitability than earnings alone.

Today, the S&P 500’s EV/EBITDA has climbed above 17x for the first time in 15 years.

Why does this matter? When EV/EBITDA stretches beyond its historical norm in the low teens, investors are paying a steep premium not just for earnings but for operating cash flow and enterprise value.

This does not guarantee a downturn. But it does raise the bar for future growth and makes it harder for companies to grow into such elevated multiples.

In short, both P/E and EV/EBITDA point to a richly priced market compared with history. Long-term investors may want to temper return expectations, while short-term investors should pay closer attention to risk management and balance.

Factors to Consider Before Selling

Before deciding whether to sell, step back and focus on the factors that matter most to your personal situation.

1. Your Investment Horizon

If you are investing for retirement or other long-term goals that are ten to twenty years away, short-term market moves should not drive your decision. History shows that long-term investors who stayed invested through both bull and bear markets captured significant gains despite downturns.

For example, those who sold during the 2008 financial crisis often missed the strong recovery that followed. A long horizon allows you to withstand volatility and benefit from compounding over time.

2. Your Risk Tolerance

Every investor has a different level of comfort with risk. If rising valuations or market swings make you uneasy, trimming positions can reduce exposure and improve peace of mind. On the other hand, if you are comfortable with volatility and believe in the long-term growth of companies, staying invested may be the better choice.

Understanding your own tolerance for risk is as important as analyzing the numbers.

3. Your Portfolio Allocation

Selling is not about predicting the exact top of the market. It is about ensuring your portfolio remains balanced. If certain stocks or sectors have grown too large compared with the rest of your holdings, rebalancing can help reduce concentration risk. Maintaining proper allocation keeps your portfolio aligned with your strategy and goals.

Alternatives to Selling Everything

Selling stocks does not have to be an all-or-nothing decision. Investors often benefit from more measured approaches such as:

- Rebalancing: Trim positions that have become overweight and reallocate to underrepresented areas.

- Diversifying: Add other asset classes such as bonds, gold, or real estate to spread risk.

- Gradual selling: Instead of exiting at once, reduce exposure step by step. This avoids the pressure of timing the market perfectly.

- Shifting within equities: Move from higher-growth or more volatile stocks to companies with stable dividends or defensive characteristics if your circumstances change.

These strategies provide flexibility and allow you to remain invested while adjusting risk levels.

Key Takeaway

Market valuations can offer useful perspective, but they should not be the sole driver of investment decisions. What matters more is how your portfolio supports your long-term goals, your tolerance for volatility, and your overall financial plan.

If you are a long-term investor, history suggests that remaining invested is usually the wiser approach. If you are approaching retirement or feel overexposed to equities, selective selling or rebalancing can help bring your portfolio back into alignment.

✅ Bottom line: Elevated valuations may warrant caution, but they are not a definitive signal to sell everything. Successful investing relies less on timing and more on discipline. Stay diversified, keep your goals in focus, and view selling as a strategic adjustment rather than a reaction to headlines.