Mining stocks are entering a period where scale, asset quality, and capital discipline matter more than ever. Demand for metals is being shaped by long-term forces that move slowly but decisively: electrification, urbanization, energy transition, and infrastructure renewal. As 2026 begins, these trends are colliding with a precious metals rally that pushed gold, silver, and platinum to record levels in 2025, marking one of the strongest years for the metals complex in decades.

At the same time, supply growth remains constrained by long permitting cycles, declining ore grades, geopolitical friction, and rising capital costs. Recent market outlooks point to continued support from central bank gold accumulation, resilient investor demand for hard assets, and tightening industrial supply dynamics in silver and platinum markets, all of which keep attention focused on the mining companies that control high-quality reserves.

This combination has shifted the investment case for mining stocks. The opportunity is no longer about short-term price movements alone. It is increasingly about owning large, diversified producers with world-class assets, global operating footprints, and the ability to generate cash across multiple phases of the commodity cycle.

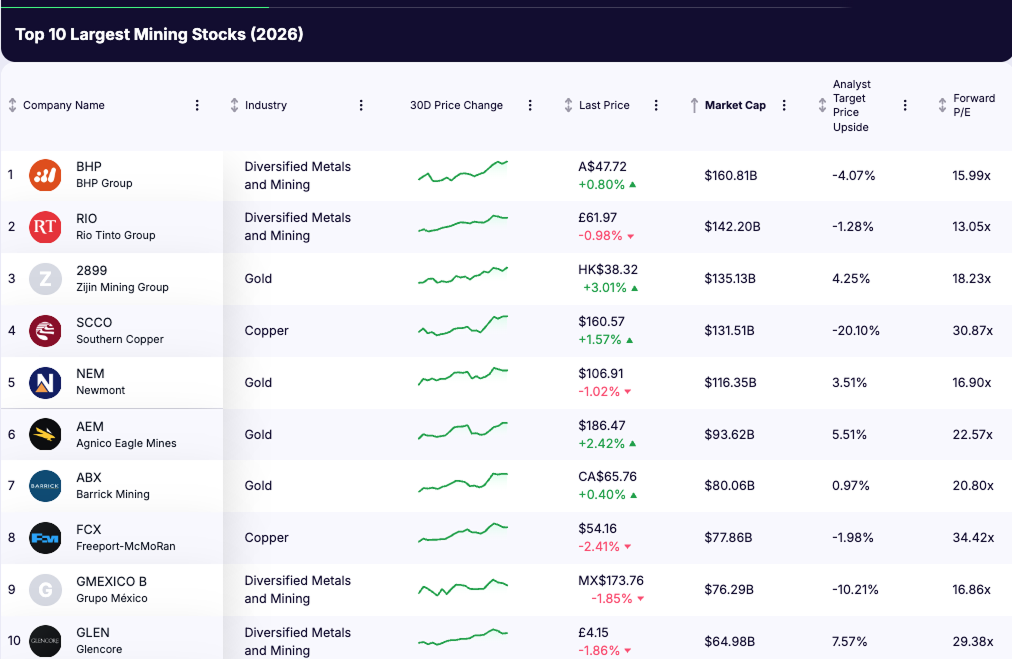

Against this backdrop, we take a closer look at the top 10 largest mining stocks heading into 2026, examining what they produce, where their scale comes from, and why they continue to play a central role in the global metals supply chain.

Key Takeaways

- Scale underpins resilience in mining. The largest miners benefit from diversified assets, global infrastructure, and the financial capacity to operate and invest through full commodity cycles.

- Copper, gold, silver, and platinum anchor structural demand. Copper demand is driven by electrification and infrastructure, gold continues to serve as a monetary and reserve asset, while silver and platinum benefit from a mix of industrial use, investment demand, and constrained supply growth.

- Capital discipline drives long-term value. Mining companies that focus on free cash flow, balance-sheet strength, and disciplined investment decisions are increasingly favored over those pursuing volume growth alone.

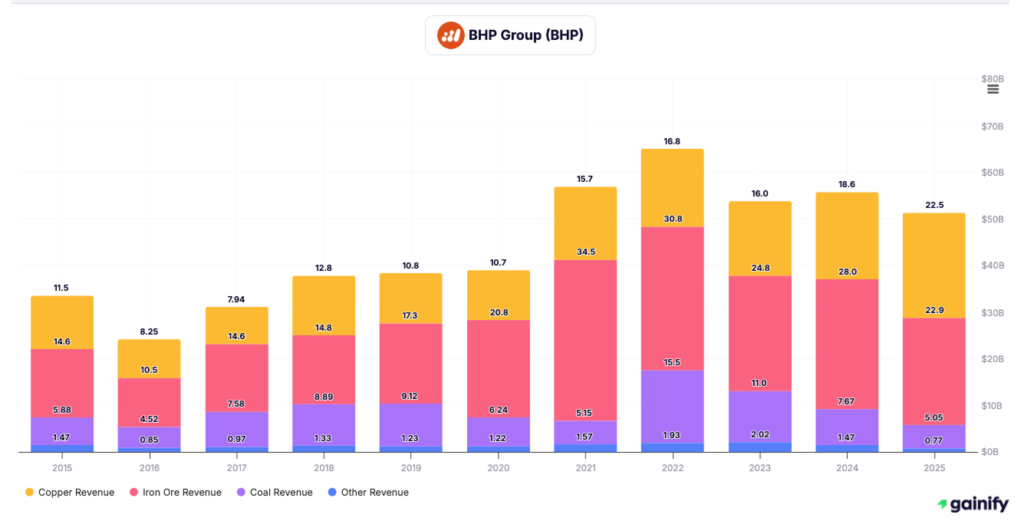

1. BHP Group (ASX: BHP)

Market Capitalization: $160.8 billion

Primary Exposure: Iron ore, copper

Secondary Exposure: Metallurgical coal, energy coal, nickel

Analyst Target Upside (2026): –4%

Why BHP Matters

BHP is the world’s largest mining company because it controls tier-one assets with long reserve lives and structurally low costs. The business is built to generate cash across commodity cycles and fund growth internally without balance-sheet strain.

What Drives Revenue

BHP’s earnings are concentrated in two core commodities (2025):

- Iron ore revenue: $22.9 billion

- Copper revenue: $22.5 billion

Coal contributes a smaller share at $5.0 billion and continues to decline in strategic importance.

Production (2025)

- Iron ore: 262.9 million tonnes

- Copper: 2.017 million tonnes

- Metallurgical coal: 18.01 million tonnes

- Energy coal: 15.04 million tonnes

Iron ore anchors cash generation, copper drives long-term structural growth, and coal contributes incremental cash flow without shaping the company’s strategic direction.

Capital Discipline

BHP prioritizes free cash flow, balance-sheet strength, and returns on invested capital over volume expansion, which reduces downside risk across cycles.

Investment Takeaway

BHP is a core diversified mining holding offering durable cash generation and long-term exposure to iron ore and copper. With shares trading near fair value, its appeal lies in resilience and discipline rather than upside optionality.

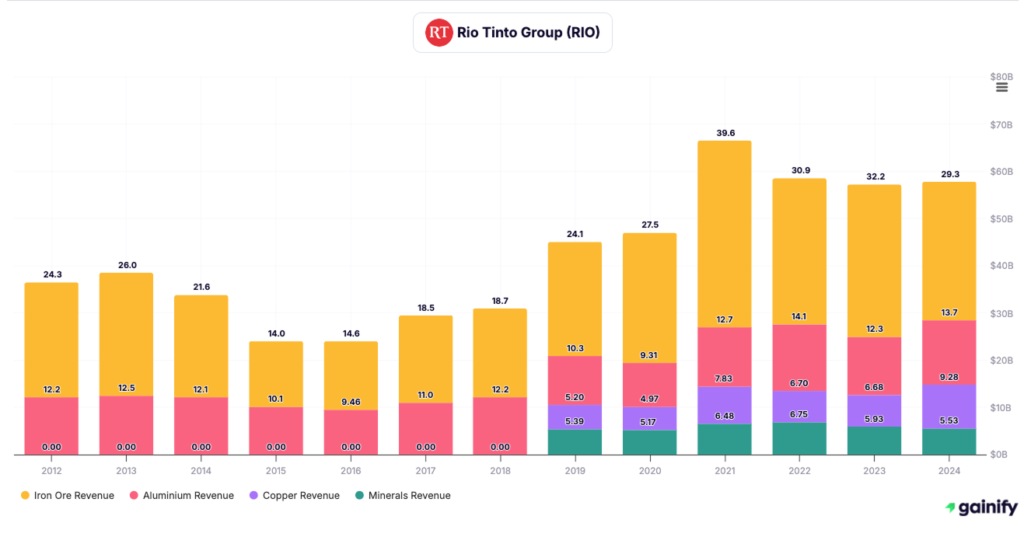

2. Rio Tinto (LSE: RIO)

Market Capitalization: $142.2 billion

Primary Exposure: Iron ore, copper

Secondary Exposure: Aluminium, lithium

Analyst Target Upside (2026): –1%

Why Rio Tinto Matters

Rio Tinto is one of the world’s most important mining companies due to its dominant iron ore position and expanding copper platform, supported by long-life assets and disciplined capital allocation. The business is structured to generate cash consistently rather than maximize short-term volume growth.

Production (9M 2025)

- Iron ore (Pilbara, shipments): 250.0 million tonnes

- Copper (consolidated): 663 thousand tonnes

- Bauxite: 46.6 million tonnes

- Alumina: 5.7 million tonnes

- Primary aluminium: 2.4 million tonnes

- Lithium (Rio Tinto share): 43 thousand tonnes LCE

Iron ore remains the primary source of cash generation. Copper is the fastest-growing contributor and increasingly central to the portfolio. Aluminium provides steady industrial exposure, while lithium remains a smaller but strategically important growth option.

Portfolio Logic

Iron ore anchors margins and cash flow through scale and cost leadership. Copper provides exposure to electrification, grid investment, and long-term supply tightness. Aluminium adds diversification tied to industrial demand, while lithium positions the company for future battery-related growth without dominating near-term earnings.

Capital Discipline

Rio Tinto emphasizes balance-sheet strength, controlled capital spending, and shareholder returns. Growth projects are sequenced deliberately, with a clear preference for tier-one assets and brownfield expansions over speculative development.

Investment Takeaway

Rio Tinto offers large-scale, cash-generative exposure to global metals demand with embedded optionality in copper and lithium. With the stock trading close to fair value, the investment case centers on durability, dividends, and disciplined participation in long-term resource demand rather than aggressive upside.

3. Zijin Mining Group (SEHK: 2899)

Market Capitalization: $135.1 billion

Primary Exposure: Gold, copper

Secondary Exposure: Silver, zinc, lithium

Analyst Target Upside (2026): +4%

Why Zijin Matters

Zijin Mining Group has emerged as one of the most important large-cap miners globally by combining rapid production growth with broad exposure to precious and industrial metals. The company has scaled faster than most peers through acquisitions, brownfield expansions, and aggressive project development, while maintaining cost competitiveness across its asset base.

Zijin’s importance lies in its role as a high-volume supplier of gold and copper, two metals central to monetary demand and electrification trends, with a growing footprint across Asia, Africa, Central Asia, and South America.

What Drives Revenue

Zijin’s earnings are primarily driven by precious and base metals:

- Gold: Core earnings and margin driver

- Copper: Fastest-growing contributor with structural demand support

Silver and zinc provide incremental revenue diversification, while lithium remains immaterial to current earnings but relevant to long-term strategy.

Production (9M 2025)

- Gold: 65 tonnes

- Copper: 829,903 tonnes

- Silver: 335 tonnes

- Zinc: 271,127 tonnes

Gold provides leverage to precious-metal pricing, copper supports long-term growth tied to electrification and infrastructure, while silver and zinc contribute supplemental cash flow without dominating strategy.

Capital Discipline

Zijin continues to prioritize production growth while maintaining balance-sheet flexibility. Operating cash flow in the first nine months of 2025 benefited from higher metal prices and rising volumes, allowing the company to fund expansion internally while keeping leverage at manageable levels. Capital allocation remains focused on copper capacity expansion, gold asset integration, and selective lithium development.

Investment Takeaway

Zijin Mining Group is best viewed as a growth-oriented large-cap miner offering strong exposure to gold and copper during a favorable metals cycle. Compared with more mature Western peers, Zijin carries higher execution and geopolitical risk, but also greater upside potential from continued production growth and rising metal prices.

4. Southern Copper (NYSE: SCCO)

Market Capitalization: $131.5 billion

Primary Exposure: Copper

Secondary Exposure: Silver, molybdenum, zinc

Analyst Target Upside (2026): –20%

Why Southern Copper Matters

Southern Copper is one of the purest large-scale copper producers globally, with operations concentrated in Peru and Mexico. Unlike diversified miners, the company’s results are overwhelmingly driven by copper prices and volumes, making it a direct vehicle for long-term copper demand tied to electrification, grid expansion, and infrastructure investment.

The company benefits from long-life reserves, vertically integrated operations, and ownership by Grupo México, which provides strategic stability and access to capital.

What Drives Revenue

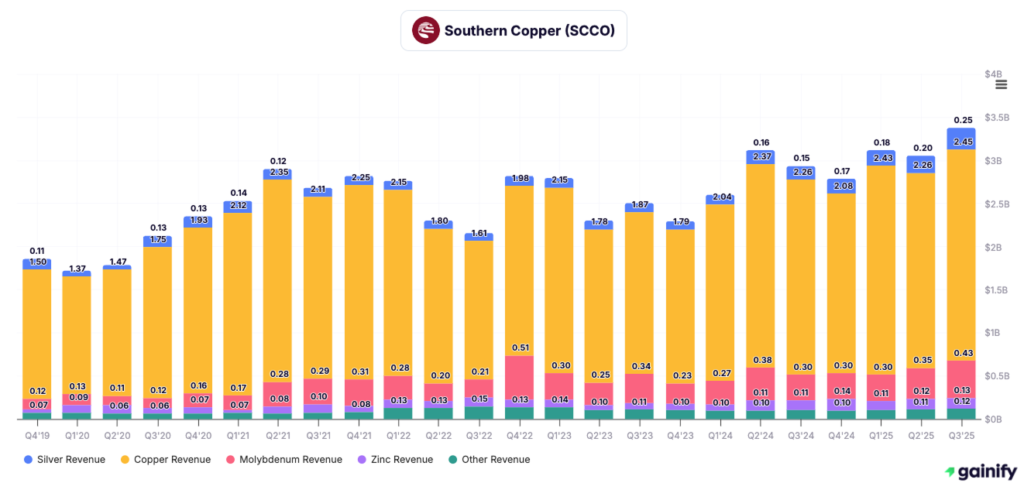

Southern Copper’s revenue base is highly concentrated, as shown by recent quarterly results:

- Copper revenue: $2.45 billion in Q3 2025

- Silver revenue: $250.2 million in Q3 2025

- Molybdenum revenue: $434.9 million in Q3 2025

- Zinc revenue: $126.5 million in Q3 2025

Copper consistently accounts for the majority of total revenue, while molybdenum and silver provide meaningful by-product credits that support margins. Zinc and other metals play a smaller, supplemental role.

Revenue Structure Insight

Copper anchors both revenue and earnings volatility. Silver and molybdenum meaningfully enhance cash flow during strong metals markets, helping offset cost pressures and sustaining margins across cycles. This by-product mix is a structural advantage relative to single-metal producers.

Capital Discipline

Southern Copper maintains a conservative balance sheet and prioritizes dividend payouts, supported by strong operating cash flow. Capital spending is focused on incremental capacity expansion and sustaining projects rather than aggressive growth, reflecting a measured approach to long-term development.

Investment Takeaway

Southern Copper offers highly concentrated exposure to copper prices with meaningful precious-metal by-product support. The stock tends to trade at a premium due to asset quality and dividend reliability, which limits upside but provides income and direct leverage to long-term copper demand. It is best suited for investors seeking copper exposure with cash-flow stability rather than valuation-driven upside.

5. Newmont (NYSE: NEM)

Market Capitalization: $116.4 billion

Primary Exposure: Gold

Secondary Exposure: Silver, copper, lead

Analyst Target Upside (2026): +4%

Why Newmont Matters

Newmont is the largest gold producer in the world, with a portfolio built around long-life, tier-one gold assets spread across North America, Australia, Africa, and South America. Scale, reserve quality, and geographic diversification make Newmont a central player in global gold supply.

Following the integration of Newcrest, Newmont’s asset base has expanded meaningfully, reinforcing its position as the industry’s benchmark for gold production and reserve depth.

What Drives Revenue

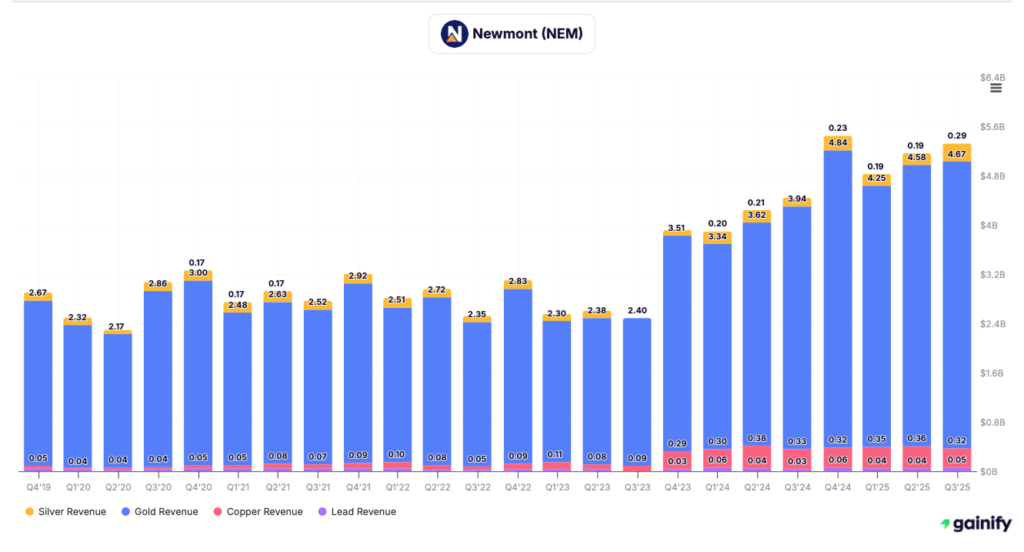

Newmont’s revenue is overwhelmingly driven by gold, with smaller but meaningful contributions from other metals:

- Gold revenue: $4.67 billion in Q3 2025

- Silver revenue: $290 million in Q3 2025

- Copper revenue: $50 million in Q3 2025

- Lead revenue: Immaterial

Gold consistently accounts for the vast majority of total revenue, while silver provides incremental upside during strong precious-metals markets. Copper and lead remain ancillary contributors.

Production (9M 2025)

- Gold produced: 4.17 million ounces

- Gold sold: 4.14 million ounces

- Other metals sold: 370 thousand gold-equivalent ounces

Gold production declined sequentially through 2025 due to mine sequencing and asset optimization, but remains industry-leading in absolute scale.

Portfolio Logic

Gold anchors both revenue and cash flow, offering direct exposure to precious-metals pricing and monetary demand. Silver enhances margins during periods of rising precious-metals prices. Copper and lead contribute marginal diversification without influencing overall strategy.

Newmont’s wide geographic footprint reduces single-asset and jurisdictional risk, supporting stable production across cycles.

Investment Takeaway

Newmont provides large-scale, diversified exposure to gold with limited operational concentration risk. With shares trading close to intrinsic value, the investment case centers on stability, scale, and leverage to gold prices rather than production growth. It is best suited for investors seeking core precious-metals exposure within a diversified mining portfolio.

6. Agnico Eagle Mines (NYSE: AEM)

Market Capitalization: $93.6 billion

Primary Exposure: Gold

Secondary Exposure: Silver, copper, zinc

Analyst Target Upside (2026): +5.51%

Why Agnico Eagle Matters

Agnico Eagle is one of the highest-quality gold miners globally, known for operational consistency, conservative execution, and a strong focus on politically stable jurisdictions. Its asset base is concentrated in Canada, Australia, Finland, and Mexico, which materially lowers geopolitical and permitting risk compared with many peers.

The company has built a reputation for steady production growth, disciplined capital allocation, and cost control rather than aggressive expansion.

What Drives Revenue

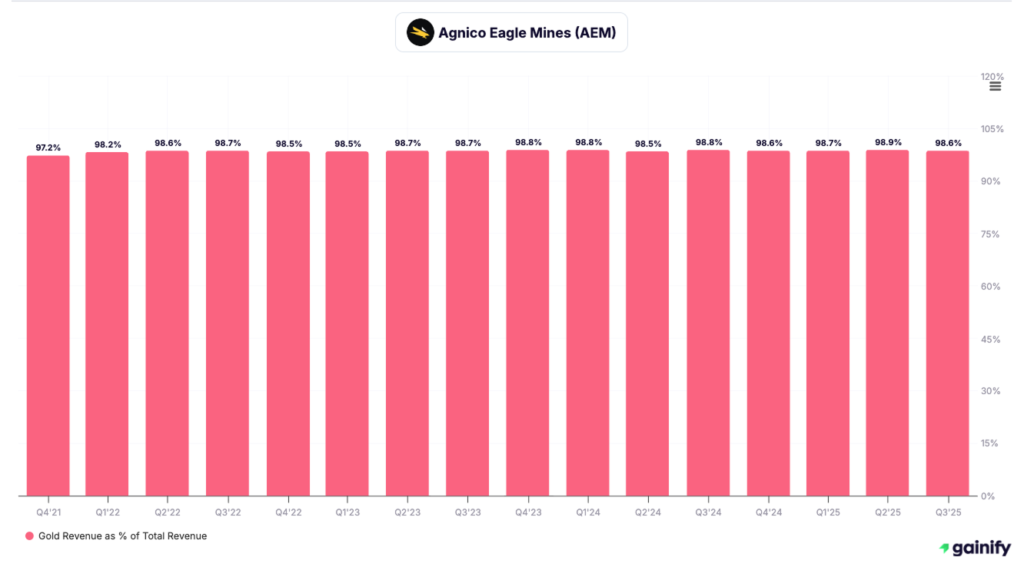

Agnico Eagle’s revenue is dominated by gold, with modest contributions from other metals:

- Gold revenue: $3.01 billion in Q3 2025

- Silver revenue: $28.1 million in Q3 2025

- Copper revenue: $13.5 million in Q3 2025

- Zinc revenue: $2.0 million in Q3 2025

Gold accounts for the overwhelming majority of total revenue, while silver and base metals provide small but helpful by-product credits.

Production (9M 2025)

- Payable gold: 2.61 million ounces

- Payable silver: 1.86 million ounces

- Payable zinc: 5.05 thousand tonnes

- Payable copper: 3.97 thousand tonnes

Gold production remained stable through 2025, reflecting consistent mine performance and disciplined sequencing across the portfolio.

Portfolio Logic

Gold anchors earnings and cash flow, offering direct exposure to precious-metals pricing and monetary demand. Silver adds incremental upside during strong precious-metals environments, while copper and zinc provide minor diversification without influencing overall strategy.

Agnico’s concentration in low-risk jurisdictions enhances earnings visibility and reduces operational volatility.

Capital Discipline

Agnico Eagle maintains a conservative balance sheet and prioritizes free cash flow, dividend sustainability, and high-return internal projects. Capital spending is focused on sustaining capital and selective expansions with clear return thresholds.

The company’s operating model emphasizes reliability and long-term value creation over volume-driven growth.

Investment Takeaway

Agnico Eagle Mines offers high-quality, low-risk exposure to gold with a track record of consistent execution and disciplined capital management. With shares trading near fair value, the investment case centers on stability, jurisdictional safety, and leverage to gold prices rather than aggressive production growth.

7. Barrick Mining (NYSE: B)

Market Capitalization: $80.06 billion

Primary Exposure: Gold

Secondary Exposure: Copper

Analyst Target Upside (2026): +0.97%

Why Barrick Matters

Barrick Mining is one of the world’s largest gold producers, with a portfolio built around long-life, low-cost gold assets and a growing copper platform. The company’s scale, reserve quality, and operating experience make it a core supplier in the global gold market.

Barrick’s strategy emphasizes asset quality, disciplined capital allocation, and partnership structures, particularly in complex jurisdictions, which helps manage operational and political risk.

What Drives Revenue

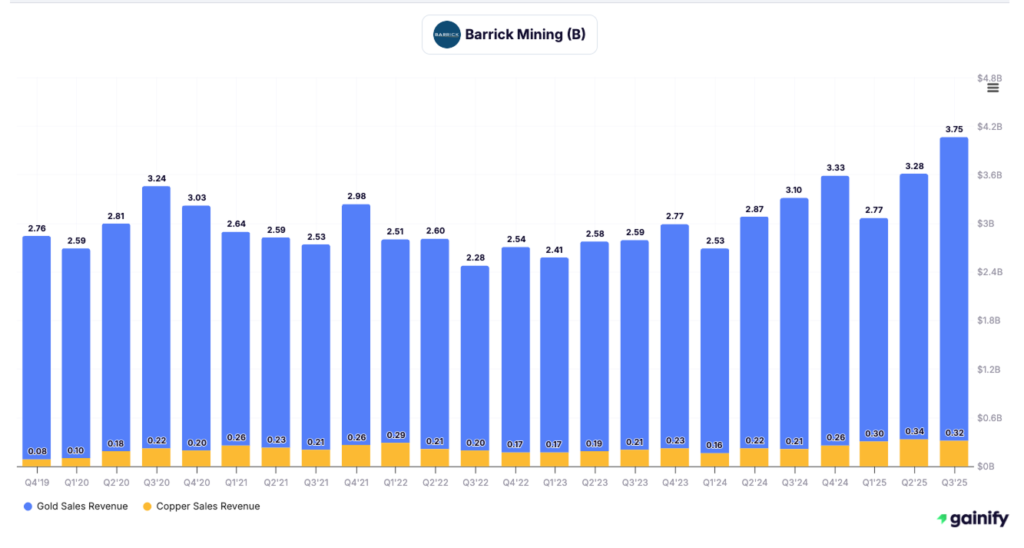

Barrick’s revenue is dominated by gold, with copper providing a growing secondary contribution:

- Gold revenue: $3.75 billion in Q3 2025

- Copper revenue: $320 million in Q3 2025

- Total revenue: $4.07 billion in Q3 2025

Gold consistently accounts for the majority of revenue, while copper adds diversification and long-term growth exposure tied to electrification and infrastructure demand.

Production (9M 2025)

- Gold produced: 2.38 million ounces

- Gold sold: 2.36 million ounces

- Copper produced: 159 thousand tonnes

- Copper sold: 148 thousand tonnes

Gold production remained stable across 2025, while copper volumes increased year over year, reflecting the importance of copper as a strategic growth metal within Barrick’s portfolio.

Portfolio Logic

Gold anchors cash flow and earnings, providing leverage to precious-metals pricing and monetary demand. Copper adds exposure to long-term structural demand while reducing reliance on a single commodity.

Barrick’s diversified asset base across the Americas, Africa, and the Middle East helps balance geological and jurisdictional risk.

Capital Discipline

Barrick maintains a conservative balance sheet and prioritizes free cash flow, shareholder returns, and high-return brownfield expansions. Capital spending is tightly controlled, with a focus on sustaining capital and selective growth projects.

The company’s approach favors long-term value creation over short-term volume expansion.

Investment Takeaway

Barrick Mining offers large-scale exposure to gold with meaningful copper optionality. With shares trading near fair value, the investment case centers on asset quality, disciplined execution, and leverage to higher gold prices rather than aggressive production growth. It fits well as a core holding for investors seeking stability within the precious-metals sector.

8. Freeport-McMoRan (NYSE: FCX)

Market Capitalization: $77.86 billion

Primary Exposure: Copper

Secondary Exposure: Gold, molybdenum

Analyst Target Upside (2026): –2%

Why Freeport-McMoRan Matters

Freeport-McMoRan is one of the most important copper producers globally, with a portfolio centered on large, long-life copper assets that sit at the core of global supply. The company’s scale and reserve quality make it a critical participant in electrification, infrastructure build-out, and energy-transition demand.

Its asset base spans North America, South America, and Indonesia, with Grasberg remaining one of the world’s most significant copper-gold deposits.

What Drives Revenue

Freeport’s revenue is dominated by copper, with gold and molybdenum providing meaningful by-product contributions:

- Indonesia mining revenue: $2.68 billion in Q3 2025

- South America mining revenue: $1.18 billion in Q3 2025

- Rod and refining revenue: $1.77 billion in Q3 2025

- Total revenue: $6.97 billion in Q3 2025

Copper pricing and volume are the primary drivers of earnings volatility, while gold and molybdenum help support margins across cycles.

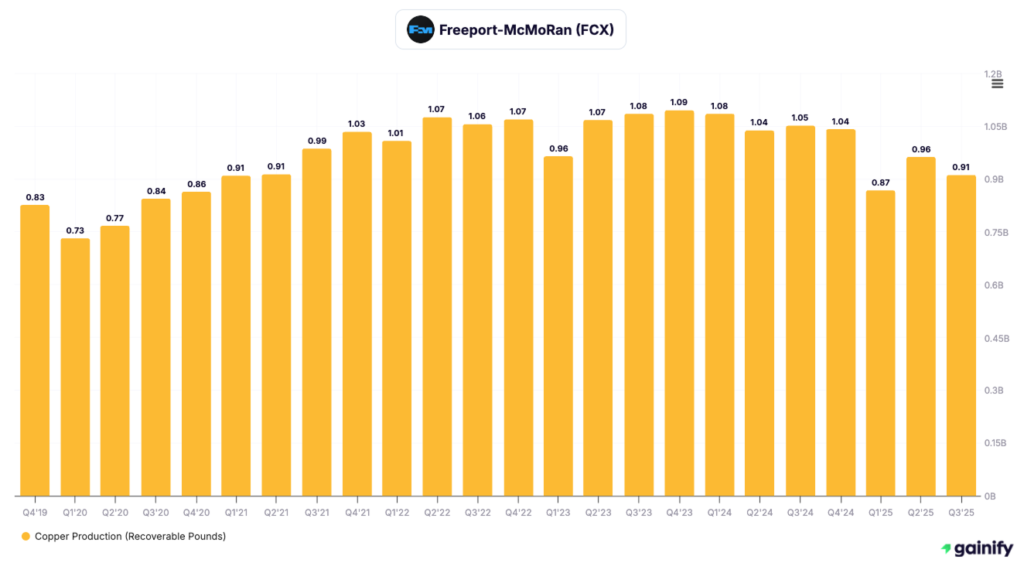

Production (9M 2025)

- Copper production: 2.59 billion recoverable pounds

- Copper sales: 2.82 billion recoverable pounds

- Gold production: 1.29 million recoverable ounces

- Gold sales: 1.87 million recoverable ounces

- Molybdenum production: 62 million recoverable pounds

Copper volumes declined modestly through 2025 due to mine sequencing, while gold output remained supported by Indonesian operations.

Portfolio Logic

Copper anchors revenue and long-term growth exposure, tied directly to electrification, grid investment, and infrastructure demand. Gold adds counter-cyclical support and margin stability, while molybdenum provides incremental cash flow without driving strategy. The geographic spread of assets helps balance operational risk, though results remain sensitive to conditions at a small number of large mines.

Capital Discipline

Freeport maintains a conservative balance sheet and prioritizes free cash flow, debt reduction, and shareholder returns. Capital spending is focused on sustaining capital and phased expansions rather than aggressive volume growth. The company’s capital allocation framework is designed to perform through copper price cycles rather than maximize peak-cycle output.

Investment Takeaway

Freeport-McMoRan offers direct, large-scale exposure to copper with meaningful gold and molybdenum by-product support. With the stock trading close to fair value, the investment case centers on long-term copper demand and disciplined execution rather than near-term upside leverage. It fits best as a core copper holding within a diversified mining portfolio.

9. Grupo México (BMV: GMEXICO B)

Market Capitalization: $76.29 billion

Primary Exposure: Copper

Secondary Exposure: Silver, zinc, molybdenum, transportation

Analyst Target Upside (2026): 10.21%

Why Grupo México Matters

Grupo México is one of the largest copper producers in the world and a unique player among miners due to its integrated business model. In addition to mining, the company owns a major rail and transportation network through Ferromex and other logistics assets, which provides operational leverage and diversification beyond metals pricing.

Its mining operations are concentrated primarily in Mexico and Peru, giving the company strong scale in copper with meaningful by-product exposure.

What Drives Revenue

Grupo México’s results are overwhelmingly driven by copper volumes and pricing, with by-products and transportation adding incremental contribution:

- Copper volumes sold: 252,498 tonnes in Q2 2025

- Silver volumes sold: 6.36 million ounces in Q2 2025

- Zinc volumes sold: 44,483 tonnes in Q2 2025

- Molybdenum volumes sold: 7,846 tonnes in Q2 2025

Transportation activity remains a steady contributor through rail volumes and freight services, helping stabilize results during periods of metals price volatility.

Portfolio Logic

Copper anchors revenue and long-term demand exposure, driven by electrification, infrastructure, and industrial growth. Silver and zinc add diversification and support margins. The transportation segment provides counter-cyclical stability and cash flow that differentiates Grupo México from pure-play miners.

Capital Discipline

Grupo México maintains a conservative financial profile and focuses capital spending on sustaining operations, selective mine expansions, and rail network efficiency. The integrated structure allows the company to reinvest internally while maintaining dividend capacity.

Investment Takeaway

Grupo México offers large-scale copper exposure with embedded logistics diversification. While upside is limited by valuation and geographic concentration, the company’s integrated model, asset scale, and transportation cash flows make it a durable long-term holding for investors seeking copper exposure with added stability.

10. Glencore (LSE: GLEN)

Market Capitalization: $64.98 billion

Primary Exposure: Copper

Secondary Exposure: Zinc, coal, nickel, cobalt, lead

Analyst Target Upside (2026): +7.6%

Why Glencore Matters

Glencore is one of the most diversified mining companies globally, combining large-scale metals production with a unique commodity marketing and trading operation. This integrated model allows Glencore to generate earnings not only from mining volumes, but also from logistics, trading margins, and supply-chain optimization.

The company plays a central role in global metals flows, particularly in copper, zinc, and battery-related materials.

What Drives Production

Glencore’s output spans a wide range of commodities, with copper at the core:

- Copper production: 239.6 thousand tonnes in Q3 2025

- Zinc production: 244.2 thousand tonnes in Q3 2025

- Coal production: 34.2 million tonnes in Q3 2025

- Nickel production: 15.8 thousand tonnes in Q3 2025

- Cobalt production: 9.6 thousand tonnes in Q3 2025

Copper is the primary earnings driver over the cycle, while zinc and coal provide material cash flow support. Nickel and cobalt add exposure to battery supply chains.

Portfolio Logic

Copper anchors long-term growth exposure tied to electrification, grids, and infrastructure. Zinc and coal provide cyclical cash flow, while nickel and cobalt position the company for battery-related demand. The trading and marketing segment smooths earnings volatility and differentiates Glencore from pure-play miners.

Capital Discipline

Glencore emphasizes balance-sheet strength, disciplined capital allocation, and shareholder returns. Capital spending is focused on sustaining assets and selective growth projects, while excess cash is returned through dividends and buybacks. The company continues to manage its coal portfolio with a focus on cash generation rather than expansion.

Investment Takeaway

Glencore offers broad-based exposure to industrial and energy-transition metals with an embedded trading advantage. With shares trading below intrinsic value, the investment case centers on diversification, cash-flow generation, and leverage to copper demand rather than reliance on any single commodity.

Industry Outlook for Mining in 2026 and Beyond

The mining sector is entering a phase where long-duration structural demand matters more than short-term commodity cycles. The drivers shaping metals demand are physical, capital-intensive, and slow to reverse. This favors large, diversified miners with high-quality assets, disciplined capital allocation, and the ability to operate through multiple economic regimes.

Electrification and grid expansion anchor copper demand

Copper demand is increasingly tied to electrification rather than traditional industrial cycles. Power grids, renewable energy, data centers, electric vehicles, and charging infrastructure all require large amounts of copper-intensive wiring and equipment. Global grid investment needs are rising as electricity demand grows faster than transmission capacity, creating sustained demand for copper over the next decade. Supply growth remains constrained by long permitting timelines and declining ore grades, reinforcing copper’s strategic importance.

Energy transition supports battery and industrial metals

The global energy transition is expanding demand for a broader set of metals, including nickel, cobalt, lithium, and zinc. These materials are essential for batteries, energy storage systems, electric motors, and industrial electrification. Unlike prior commodity booms driven by speculative investment, this demand is rooted in policy commitments, infrastructure build-out, and corporate decarbonization targets. Large miners with multi-metal exposure are better positioned to benefit from this trend than single-commodity producers.

Infrastructure renewal sustains iron ore and steel inputs

Despite the focus on energy transition metals, bulk commodities remain critical. Urbanization, infrastructure maintenance, and industrial rebuilding continue to support steel demand globally. Iron ore remains a foundational input for construction, transportation, and manufacturing, particularly in emerging markets. Demand growth may be moderate, but the absolute volume remains large, favoring low-cost producers with scale and logistics advantages.

Monetary uncertainty underpins gold, with silver and platinum gaining dual support

Gold continues to play a central role as a monetary and reserve asset. Central bank buying, geopolitical uncertainty, and elevated government debt levels support long-term demand. Silver and platinum add a dual-demand layer. Both benefit from precious-metals investment flows while also serving industrial roles. Silver is tied to electronics and solar installations, while platinum is used in emissions control, chemical processing, and emerging hydrogen applications. This combination supports structural relevance beyond pure price speculation.

Capital discipline and long lead times limit oversupply

Mining supply is structurally slow to respond to rising prices. New projects require years of permitting, development, and capital investment. At the same time, investors are increasingly rewarding miners that prioritize free cash flow, balance-sheet strength, and shareholder returns over aggressive volume growth. This discipline reduces the risk of rapid oversupply and supports more stable long-term pricing across many metals.

What this means for investors

Global mining demand is expected to grow steadily rather than explosively. In this environment, the companies best positioned to deliver consistent returns share common traits:

- Large-scale operations with diversified asset bases

- Long reserve lives and competitive cost structures

- Financial flexibility to invest during downturns and return capital during upcycles

As structural demand replaces speculative cycles, mining becomes less about timing commodity peaks and more about owning resilient producers that sit at the center of long-term metal demand.

Conclusion

The world’s largest mining companies sit at the foundation of the global economy. They provide the metals and materials required to build power grids, transport systems, data infrastructure, industrial capacity, and energy networks. Their role is structural and persistent, shaped by long-term demand rather than short-lived commodity cycles.

Looking toward 2026 and beyond, the most compelling mining opportunities are concentrated in companies that pair high-quality, long-life assets with geographic diversification and disciplined capital allocation. These businesses are designed to generate cash through a range of market conditions, reinvest selectively, and return capital without relying on aggressive expansion or favorable price timing.

Mining is not a short-term trade. It is an investment in physical systems that evolve slowly and scale globally. Companies with the balance sheets, operational depth, and strategic focus to operate across decades of development are best positioned to deliver durable returns as structural demand for metals continues to rise.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial or investment advice. All financial data is based on publicly available information at the time of writing and may change without notice. Investing in mining and commodity-related equities involves risk, including price volatility and potential loss of capital. Readers should conduct their own research and consider consulting a qualified financial professional before making any investment decisions.