Forex vs Stocks remains one of finance’s defining choices. Both command vast liquidity, yet they demand entirely different disciplines.

Forex offers constant access and continuous movement. It reacts to policy changes, data releases, and global sentiment. The same speed that attracts traders can also overwhelm them. Leverage amplifies both skill and error, and liquidity often disappears when it is needed most.

Stocks trade within set hours but can move with equal intensity. Earnings surprises, macro shocks, and investor sentiment can reshape valuations in a single session. Yet equities provide a framework built on businesses, data, and accountability that allows analysis and patience to work together over time.

Each market tests a different ability. One rewards reaction, the other conviction. Understanding which suits you best is how professionals build lasting performance.

Executive summary

- Forex, the global currency market, trades the value of one currency against another. It offers constant access, deep liquidity, and leverage that amplifies both opportunity and risk. Prices shift with macroeconomic forces such as interest rates, inflation, and global capital flows, rewarding speed, structure, and control.

- Stocks represent ownership in companies that generate earnings and long-term value. They provide transparency, dividends, and the compounding effect of sustainable growth. Performance depends on fundamentals, competition, and broader economic cycles.

- Professionals use both. Forex expresses short-term macro views with precision, while stocks remain the cornerstone of long-term wealth creation.

What Is Forex

The foreign exchange market, commonly known as forex, is the global system where currencies are traded. It is the largest financial market in the world, far exceeding the combined size of global equity and bond markets in daily turnover.

In 2025, worldwide forex trading volume is estimated at nearly 9.6 trillion US dollars per day, up from about 7.5 trillion in 2022, according to the latest surveys by major central banks and the Bank for International Settlements.

How the Market Operates

Forex is a decentralized over-the-counter network rather than a single exchange. It operates electronically through banks, brokers, hedge funds, corporations, and retail participants spread across major financial centers. The market runs twenty-four hours a day, five days a week, cycling through sessions in Asia, Europe, and North America. This continuous flow allows traders and institutions to react instantly to global economic and political developments.

At its core, forex is about relative value — the price of one currency compared to another.

Currencies trade in pairs, such as EUR/USD or USD/JPY. The first currency is called the base currency, and the second is the quote currency. The exchange rate shows how much of the quote currency is needed to buy one unit of the base. When traders believe one currency will strengthen relative to another, they buy that pair; when they expect it to weaken, they sell.

Scale and Dominant Pairs

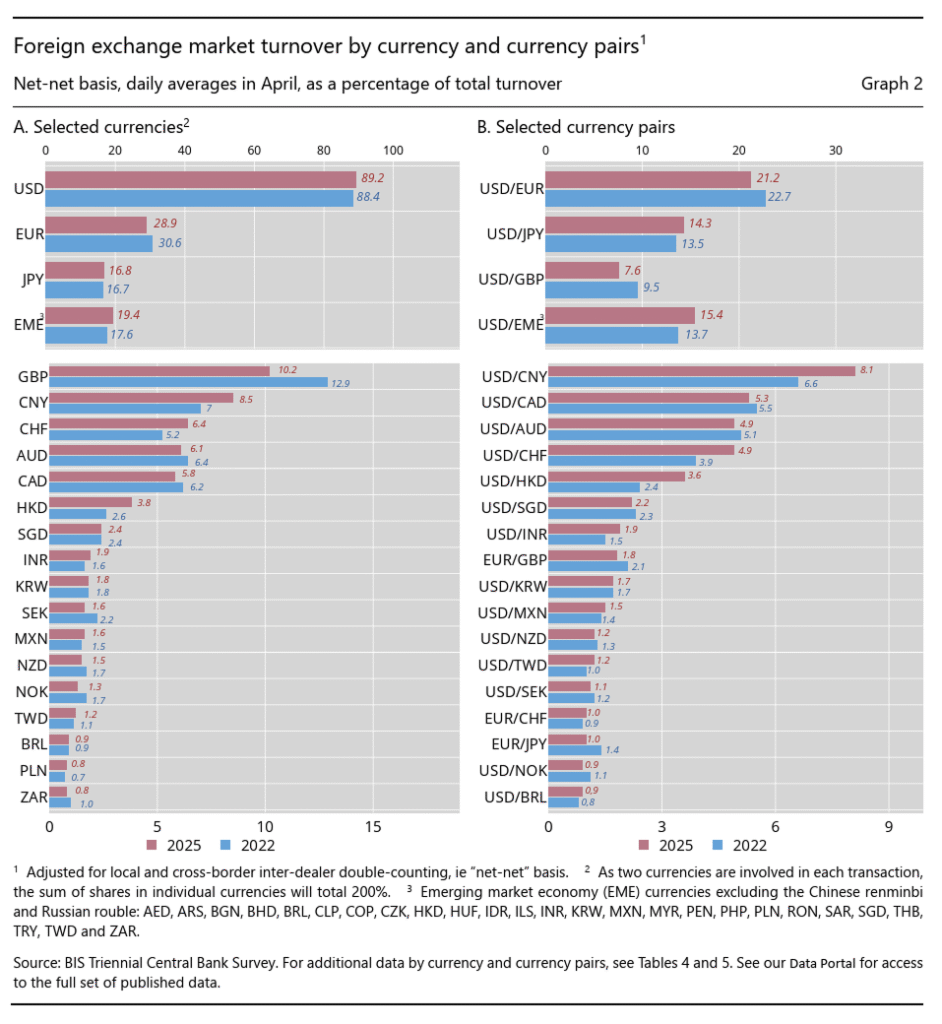

The US dollar remains the anchor of global finance and appears on one side of nearly nine out of every ten forex transactions. The euro, Japanese yen, British pound, Australian dollar, and Canadian dollar are the next most active currencies.

The five most traded pairs account for the majority of global turnover:

- EUR/USD (Euro vs US Dollar)

- USD/JPY (US Dollar vs Japanese Yen)

- GBP/USD (British Pound vs US Dollar)

- AUD/USD (Australian Dollar vs US Dollar)

- USD/CAD (US Dollar vs Canadian Dollar)

Together, these major pairs represent roughly three-quarters of all spot market volume.

Why Currencies Move

Exchange rates respond to broad economic and policy forces rather than corporate performance. The main drivers include:

- Differences in interest rates between countries

- Inflation and purchasing power trends

- Trade balances and current account flows

- Central bank policies and intervention

- Investor sentiment and global risk appetite

Because these factors are constantly changing, currency prices fluctuate almost continuously. Economic releases such as employment reports, inflation data, or interest rate decisions can move prices sharply within seconds.

Who Uses the Market

Participants come from every layer of the global economy.

- Central banks use forex to stabilize or influence their currencies.

- Corporations hedge exposure from imports, exports, and overseas operations.

- Investment funds and hedge funds express macroeconomic views or adjust portfolio risk.

- Retail traders participate for speculation or portfolio diversification.

What Are Stocks

Stocks represent ownership in a company. Each share is a fractional claim on that company’s assets, earnings, and future growth. Investors buy and sell these shares through regulated exchanges such as the New York Stock Exchange (NYSE), NASDAQ, and London Stock Exchange, which together facilitate trillions of dollars in trading every month.

How the Market Works

The stock market is a centralized and transparent system where prices are determined by supply and demand. When investors expect a company to grow its profits, they buy shares, raising the price. When outlooks weaken, they sell, causing prices to fall. Market participants include individual investors, mutual funds, pension funds, hedge funds, and institutions managing large pools of capital.

Trading occurs during defined market hours, though electronic platforms have expanded access through pre-market and after-hours sessions. Unlike forex, which reflects macroeconomic relationships between currencies, stocks focus on the fundamentals of individual businesses — their products, profitability, and competitive position.

Scale and Structure

As of 2025, global equity market capitalization exceeds US$110 trillion, led by exchanges in the United States, China, Japan, and Europe. The U.S. alone accounts for more than 40 percent of global market value. Thousands of companies are listed across major and regional exchanges, from global corporations to emerging innovators.

Stocks are grouped by market capitalization (large, mid, small cap), industry sector, and region. Investors use indices such as the S&P 500, FTSE 100, or Nikkei 225 to track performance across the broader market.

Why Stocks Move

Stock prices move in response to company performance and investor expectations. Key drivers include:

- Earnings growth and profitability

- Valuation multiples such as price-to-earnings ratios

- Interest rates and inflation, which influence the cost of capital

- Market sentiment and institutional flows

- Sector trends and technological change

Unlike currency markets, where macroeconomic policy dominates, stock performance reflects both micro-level factors and broad economic conditions.

Who Participates

Participants range from long-term investors building portfolios to professional traders seeking short-term opportunities.

- Institutions allocate capital to meet future liabilities or outperform benchmarks.

- Retail investors use stocks to grow wealth and save for goals.

- Companies issue shares to raise capital for expansion and innovation.

Forex vs Stocks: Side-by-Side Comparison

Dimension | Forex | Stocks |

Primary Instrument | Currency pairs representing relative value between economies | Shares representing ownership in companies |

Market Structure | Decentralized, over-the-counter network with interbank liquidity | Centralized exchanges with regulated order books and electronic auctions |

Trading Hours | 24 hours per weekday across global sessions (Asia–Europe–North America) | Defined exchange hours with limited premarket and after-hours trading |

Typical Liquidity | Extremely high in major pairs such as EUR/USD, USD/JPY, GBP/USD | High in large-cap equities, lower in mid- and small-cap stocks |

Drivers of Price | Interest rate differentials, inflation data, economic releases, central bank policy, and global capital flows | Corporate earnings, cash flow strength, competitive position, and sector or macroeconomic trends |

Leverage Availability | High leverage commonly available (30:1 to 100:1 depending on jurisdiction) | Moderate leverage (typically 2:1 for margin accounts) |

Cost Profile | Tight bid–ask spreads and overnight financing (swap) costs | Commissions, bid–ask spreads, exchange fees, and potential borrow costs for shorting |

Volatility Pattern | Continuous movement with sharp reactions to data releases and geopolitical events | Periodic volatility around earnings announcements, news, and macro shocks |

Information Transparency | Data from macroeconomic calendars, central banks, and interbank pricing feeds | Corporate filings, earnings reports, regulatory disclosures, and analyst research |

Ownership Claim | No ownership of an underlying asset; purely speculative or hedging exposure | Direct equity ownership with potential voting rights and dividends |

Income Potential | Interest rate differentials (carry trades) | Dividend income and share buybacks |

Strategy Fit | Macro trading, short-term speculation, hedging currency exposure | Long-term investing, fundamental analysis, and portfolio construction |

Tax and Reporting | Varies by jurisdiction; currency gains may receive different treatment | Capital gains and dividend taxation based on local regulations |

Capital Requirement | Lower initial capital due to leverage and micro-lot trading | Higher for active trading; minimums depend on broker and regulatory rules |

Primary Risks | Leverage exposure, high volatility, liquidity gaps, and policy shocks | Company-specific losses, earnings surprises, and market downturns |

How Professionals Navigate Forex and Stock Markets

Professionals in financial markets rely on process, structure, and discipline. They focus less on predicting outcomes and more on managing information, controlling exposure, and executing consistently.

While both forex and stock trading demand skill and preparation, the way professionals operate within each market reflects a different mindset and methodology.

Professional Approach to Forex

In the forex market, professionals focus on global macroeconomics and policy. They begin with a clear framework that connects growth, inflation, and interest rate trends across major economies. Each position expresses a view on how one currency may strengthen or weaken relative to another.

Trades are planned with precision. Risk per position is clearly defined, and position size is set according to volatility and liquidity conditions. Professionals use stop levels that protect capital and follow structured processes for entries and exits.

Macroeconomic releases such as employment data, inflation readings, and central bank statements are mapped in advance. These events shape short-term price behavior and often influence broader capital flows. Professional traders treat them as scheduled opportunities, not random surprises.

Holding costs and funding rates are part of the calculation. The interest rate differential between currencies can add to or reduce returns. Experienced traders track these mechanics closely and adjust their strategies based on time horizons, policy expectations, and market sentiment.

In practice, professional forex trading is less about speed and more about structure. Success depends on the ability to apply a consistent process to fast-moving data and to maintain discipline through all market conditions.

Professional Approach to Stocks

Professional investors in equities focus on understanding and valuing businesses. Each stock represents a claim on a company’s assets, earnings, and future potential. The task is to determine whether the market price accurately reflects that potential.

Professionals study financial statements, margins, and cash flows to assess the quality of earnings. They use valuation frameworks such as discounted cash flow analysis, relative multiples, and factor models that measure how a company compares to its peers. Portfolio exposure is diversified across sectors and market capitalizations to reduce concentration risk.

Holding periods align with investment objectives. Institutional investors may hold for quarters or years, while active funds adjust positions as market conditions evolve. Dividends, buybacks, and reinvestment decisions are managed as part of total return.

Professional equity management is built on process. Decisions are supported by research, performance is reviewed regularly, and portfolios are adjusted when fundamentals or assumptions change.

Risk and Cost Awareness

Both forex and stock professionals monitor cost and risk with equal attention. In forex, trading costs include spreads, slippage, and overnight financing. In equities, costs include commissions, exchange fees, and taxes on realized gains or dividends. Professionals track these factors because small inefficiencies compound over time.

Risk management forms the foundation of every approach. Position sizing, stop placement, and scenario testing are standard practices. Professionals plan for market events, test how portfolios would respond to shocks, and document results to improve future decisions. Consistency in process matters more than short-term outcomes.