The US coal sector enters 2026 with fundamentals that look markedly stronger than the equities imply. After a cold winter, elevated natural gas prices and firm electric-power demand, US coal consumption is expected to rise 7 percent in 2025, outpacing production and driving utility inventories sharply lower. End-of-year stockpiles are now projected to fall to 106 million short tons, a 17 percent decline from 2024, with another draw expected in 2026 as production contracts more than demand.

Yet the equity market has ignored this tightening backdrop. The primary US coal ETF is flat year-to-date, significantly underperforming the S&P 500 despite improving domestic coal burn, rising export volumes, and multi-year lows in stockpiles across the Midwest and South. The disconnect between commodity fundamentals and equity pricing sits at the center of the 2026 setup.

Coal remains a supply-constrained industry with declining production capacity, limited capital investment, and an increasingly concentrated group of operators. As utilities move into 2026 with lower inventories and scheduled coal-plant retirements, the miners with the strongest cost positions, export leverage and free-cash-flow durability stand to benefit most.

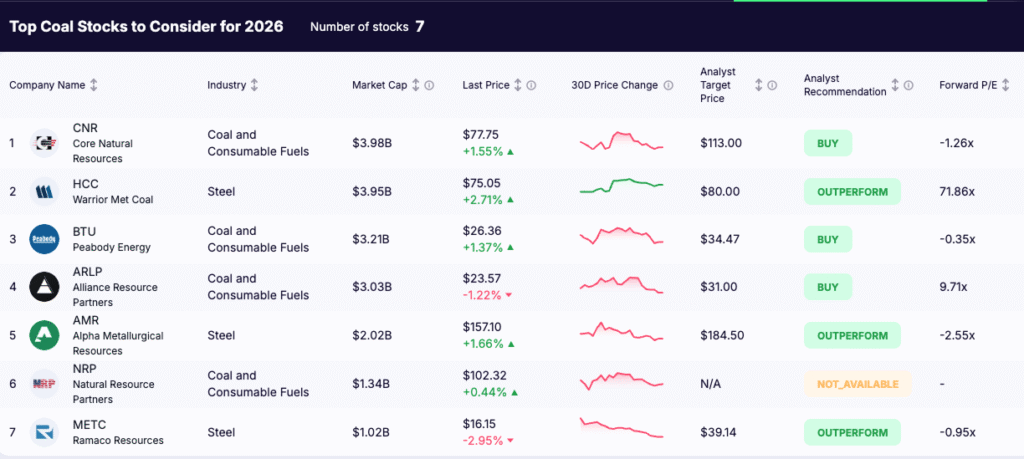

Below are the seven US coal stocks which might be best positioned to navigate this environment based on operational strength, forward earnings power and market exposure.

To find similar stocks, use the Gainify stock scanner and select ‘Coal and Consumable Fuels’ from the Industry filter.

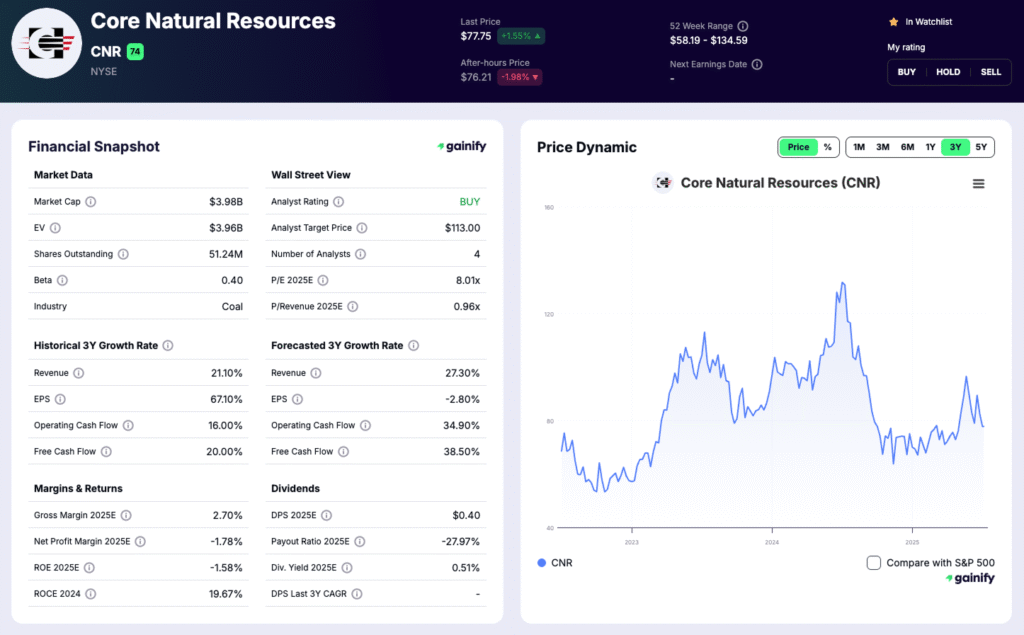

1. Core Natural Resources (CNR)

Overview

Core Natural Resources is the largest pure-play US coal producer following the 2025 merger of CONSOL Energy and Arch Resources. The combined platform spans high-CV thermal, met coal and PRB assets, supported by low-cost reserves, integrated logistics and strong free-cash-flow generation. Q3 2025 underscored the benefits of scale, with improving mine mix, firm contracting and a balance sheet positioned for 2026.

Recent Developments (Q3 2025)

CNR delivered a solid quarter despite the Leer South combustion event:

- Revenue reached 1.00 billion dollars, driven by strength across thermal, met and PRB volumes.

- Free cash flow totaled 38.9 million dollars, with operating cash flow of 87.9 million dollars.

- Capital returned to shareholders was 24.6 million dollars, bringing year-to-date returns to 218.3 million dollars. Liquidity increased to 995 million dollars.

- Operational progress included transitioning West Elk into the B-Seam and contracting 26 million tons, largely securing the 2026 high-CV thermal and PRB books.

Investment Thesis

CNR enters 2026 with unusually strong visibility. Contracted volumes derisk cash flow, the B-Seam transition lowers costs and Leer South’s return represents the key earnings catalyst. With significant authorization still available and a policy of returning ~75 percent of free cash flow, CNR screens as one of the highest FCF-yielding names in US coal. Its diversified footprint provides leverage to both domestic power markets and seaborne steel demand.

Key Risks

Leer South timing and execution remain the central near-term variable. Met-coal price volatility, PRB contract pass-through structures and operational disruptions could all influence margin stability.

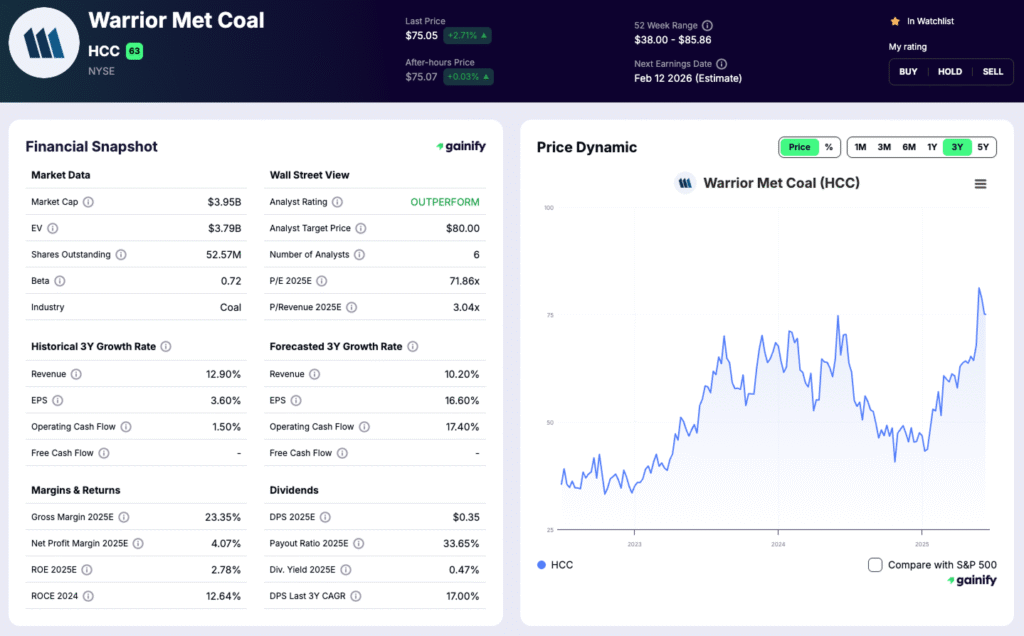

2. Warrior Met Coal (HCC)

Overview

Warrior Met Coal is a leading US producer of premium low-vol and high-vol A metallurgical coal with long-life underground reserves and a cost position near the bottom of the seaborne curve. The company is undergoing a major structural shift as Blue Creek ramps ahead of schedule, expanding high-margin volume and improving its competitive profile. With sizable export exposure and a disciplined balance sheet, Warrior remains one of the most operationally resilient met-coal platforms in the market.

Recent Developments (Q3 2025)

Q3 results showed strong volume growth, material cost improvement and ongoing execution at Blue Creek.

- Record sales of 2.4 million tons, up 27 percent year on year, including 378 thousand tons from Blue Creek.

- Cash cost of sales declined 18 percent to $100.73 per ton, reflecting efficiency gains and favorable early longwall mix.

- Blue Creek longwall started eight months early, on time and on budget, with full commissioning expected in early 2026.

Realized pricing softened to $135.87 per ton from $171.92 last year, pressuring net income to $36.6 million and free cash flow to negative $19.5 million. Liquidity remained strong at $525 million.

Investment Thesis

Warrior is transitioning into a larger, structurally lower-cost producer as Blue Creek ramps, pushing capacity toward 14 million tons and broadening premium product supply. The scale and cost benefits enhance margin durability while preserving upside to any recovery in global steelmaking coal. With strong logistics channels, premium-grade output and a conservative balance sheet, the company enters 2026 with improving long-term free cash flow leverage.

Key Risks

Met-coal price volatility remains the key earnings swing factor. Blue Creek ramp timing and efficiency are critical for 2026 profitability. Rail and port constraints, global steel demand variability and regulatory developments also represent ongoing exposures.

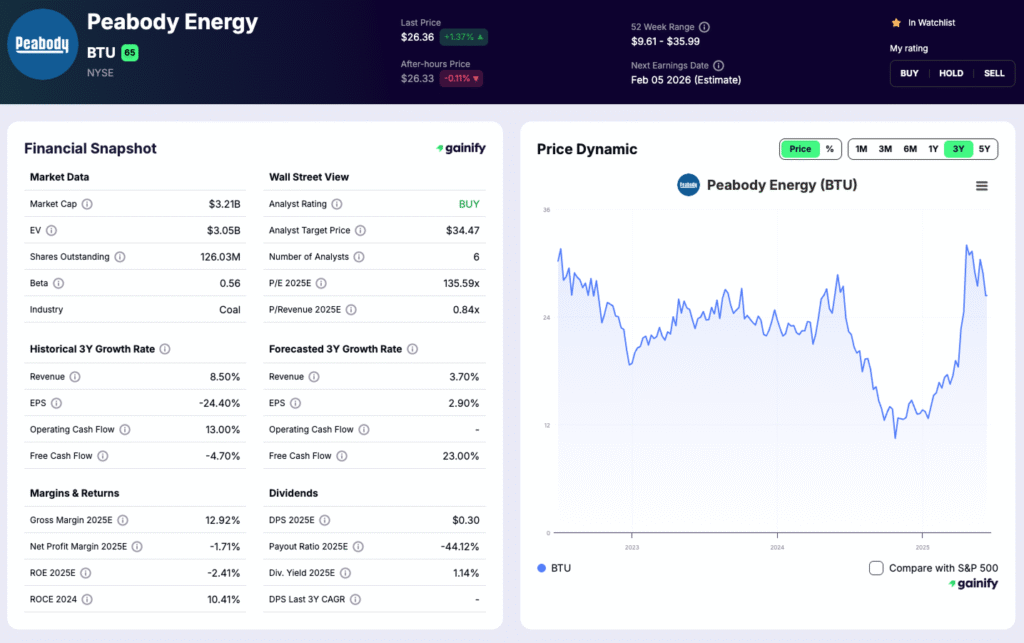

3. Peabody Energy (BTU)

Overview

Peabody remains the largest publicly traded US coal producer, with diversified exposure across seaborne thermal, seaborne metallurgical, Powder River Basin and domestic thermal markets. The company’s strategy is built on disciplined capital allocation, a low-leverage balance sheet and operational flexibility across multiple basins. Despite lower pricing and elevated charges in Q3, Peabody continues to benefit from strong liquidity and broad market optionality heading into 2026.

Recent Developments (Q3 2025)

Q3 reflected a mix of pricing pressure and one-time charges, while underlying liquidity stayed solid.

- Revenue of 1.01 billion dollars, slightly below the prior year as seaborne pricing weakened and US thermal shipments softened.

- Operating loss of 81 million dollars, driven primarily by 54 million dollars in charges tied to the terminated Anglo American transaction, along with restructuring and higher depreciation.

- Liquidity remained strong, supported by 603 million dollars in cash, 718 million dollars in restricted cash and an undrawn revolver providing more than 270 million dollars in additional availability.

Through the first nine months of 2025, Peabody generated 267 million dollars in operating cash flow, highlighting the resilience of its diversified platform.

Investment Thesis

Peabody offers one of the most balanced exposures to global coal fundamentals, with the ability to shift volume toward higher-margin seaborne markets as conditions tighten. The company’s near-zero net leverage and substantial cash reserves provide strategic flexibility and downside protection. As US utility inventories decline and international markets remain structurally tight, BTU’s free-cash-flow leverage improves meaningfully. The valuation continues to discount mid-cycle earnings power despite a robust asset base and strong liquidity.

Key Risks

Earnings remain highly sensitive to seaborne coal benchmarks, freight rates and foreign-exchange movements tied to the Australian dollar. Australian cost inflation is a continuing swing factor, and the failed Anglo transaction underscores execution risk around large M&A. Regulatory developments in both the US and Australia remain an ongoing consideration.

4. Alliance Resource Partners (ARLP)

Overview

ARLP is a leading diversified US thermal-coal producer with scale in the Illinois Basin and Appalachia, supported by a long-duration contract book and a conservative balance sheet. Low-cost operations, stable mine performance and growing minerals income continue to anchor its cash-flow profile. The partnership’s consistent execution keeps it among the sector’s most reliable operators heading into 2026.

Recent Developments (Q3 2025)

ARLP delivered another steady quarter with solid financial performance.

- Total revenue reached about $571 million, driven by $512 million of coal sales with stable production.

- Net income was roughly $95 million, helped by lower operating costs and improved segment margins.

- Year-to-date operating cash flow exceeded $500 million, supporting capex, debt reduction and distributions without stretching liquidity.

Investment Thesis

ARLP combines predictable contracted volumes with a disciplined cost structure and modest leverage. The partnership generates durable free cash flow, benefits from multi-year contract coverage and maintains flexibility through ample liquidity. Its minerals and non-coal assets provide incremental optionality, while thermal operations continue to deliver stable cash generation. For investors seeking yield with operational stability, ARLP remains a strong defensive name within the coal universe.

Key Risks

Thermal-coal demand beyond 2026 remains pressured by ongoing power-sector retirements. Transportation bottlenecks can disrupt shipments, while cost inflation and mine-specific challenges may affect margins. Regulatory and permitting risks are structural considerations for all US thermal producers.

5. Alpha Metallurgical Resources (AMR)

Overview

AMR is the leading US pure-play metallurgical coal producer, supplying premium met coal to global steelmakers. Its portfolio is concentrated in high-quality Central Appalachia mines with strong margins through the cycle. Despite met-price softness in 2025, the company retains a strong balance sheet, low leverage and consistent capital-return capacity.

Recent Developments (Q3 2025)

- Revenue for the first nine months declined to $1.6 billion from $2.3 billion as met benchmarks normalized.

- Net loss of $44 million, driven by weaker pricing and lower export realizations.

- Liquidity remained solid with over $400 million in cash and no ABL borrowings, supporting ongoing buybacks.

Investment Thesis

AMR maintains meaningful leverage to any recovery in global steel demand. Its premium CAPP met reserves, low-cost structure and strong export positioning create superior torque when pricing tightens. With minimal debt, disciplined capital spending and continued repurchases, the company remains one of the highest-quality met producers in the US. Rising global infrastructure and industrial activity offer embedded upside as markets rebalance.

Key Risks

AMR’s earnings remain tied to global met benchmarks, which are highly cyclical and exposed to steel-production volatility. Regulatory obligations, including black-lung collateral requirements, could increase cash outflows. Operational disruptions in Appalachia and shipping constraints can also add near-term variability.

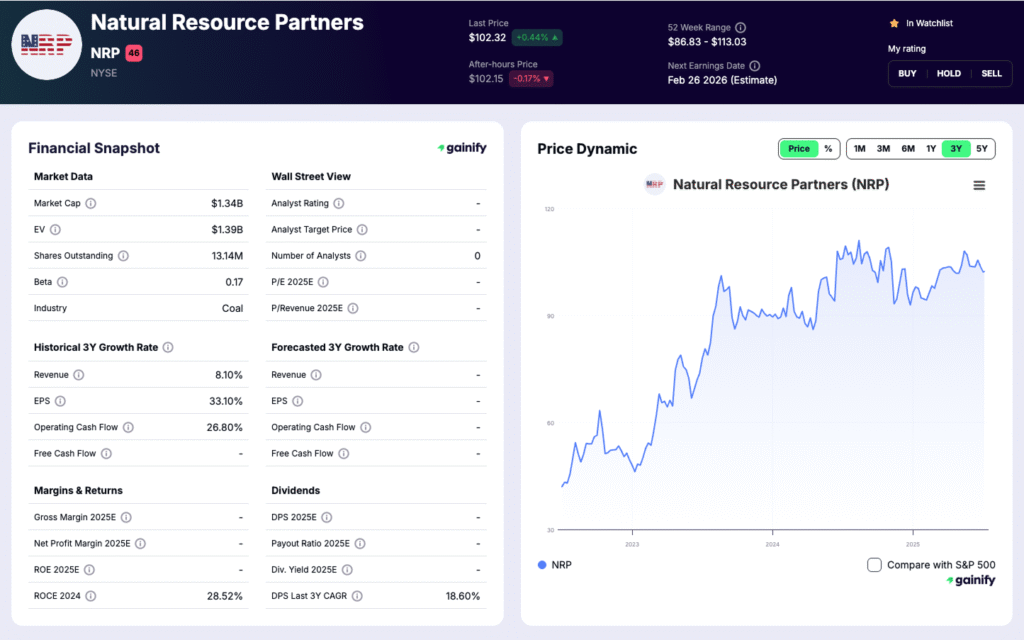

6. Natural Resource Partners (NRP)

Overview

Natural Resource Partners is a mineral-rights partnership with royalties in coal, aggregates and oil & gas, plus a 49 percent stake in low-cost soda-ash producer Sisecam Wyoming. Its royalty model generates high-margin cash flow with minimal operating exposure. Strong cash generation, low leverage and disciplined capital allocation make NRP one of the most stable cash-yield platforms in US natural resources.

Recent Developments (Q3 2025)

- Net income was $30.9M, down from $38.6M, mainly from weaker soda-ash equity earnings.

- Mineral-rights revenue was $49.6M, essentially unchanged, with coal royalties the core contributor.

- Long-term debt fell to $69M, down from $142M at year-end 2024, sharply improving leverage.

Investment Thesis

NRP’s royalty structure provides resilient, low-capex cash flow. Coal royalties remain steady under long-term leases, while soda ash offers cyclical upside without operational requirements. Rapid deleveraging expands flexibility for higher distributions and opportunistic buybacks. With predictable cash flow and limited operational risk, NRP stands out as a defensive, high-margin income vehicle.

Key Risks

Royalty revenue is tied to commodity prices across coal and soda ash. Customer concentration is elevated, with three counterparties accounting for over half of mineral-rights revenue in Q3. Regulatory pressure on coal-fired generation and soda-ash pricing volatility remain ongoing risks.

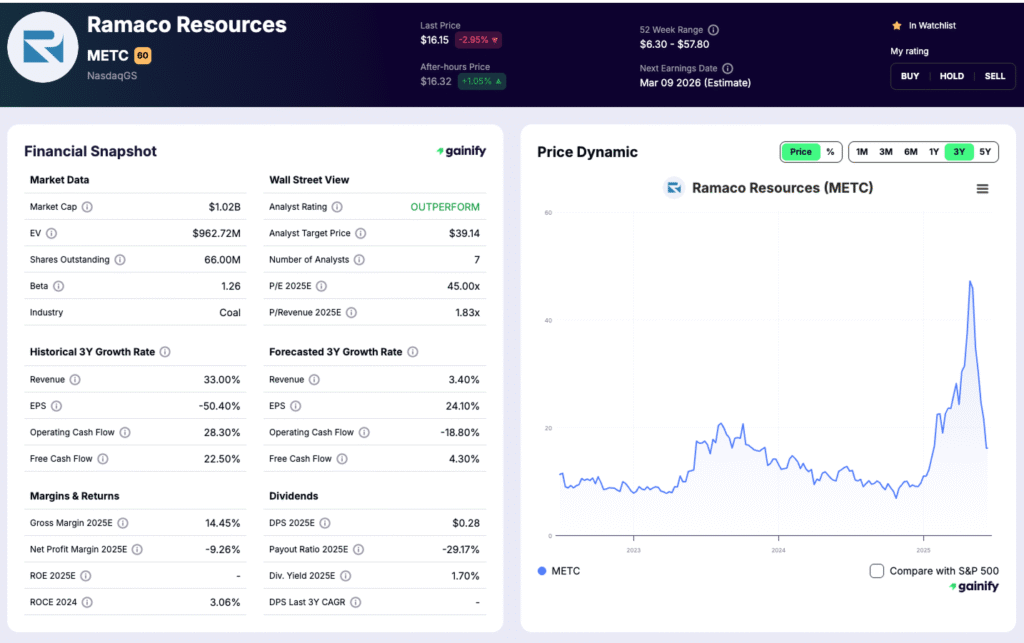

7. Ramaco Resources (METC)

Overview

Ramaco Resources is a pure-play metallurgical coal producer with a reserve base concentrated in the Central Appalachian region. The company differentiates itself through low-cost mining, a long reserve life and ongoing expansion projects that lift production visibility into 2026. Q3 2025 results reinforced the company’s position as a structurally low-cost operator with steady shipment execution across its Elk Creek, Berwind and Knox Creek complexes.

Recent Developments (Q3 2025)

Ramaco delivered another solid operational quarter despite met-coal price volatility.

- Revenue reached roughly $192 million, supported by higher realized pricing and consistent sales volumes.

- Costs remained competitive, with cash cost per ton improving across key mines as development spending tapered.

- Net income remained positive and cash flow supported ongoing capital programs tied to expansion at Berwind and the development of the Maben and Brook projects.

Investment Thesis

METC offers leverage to metallurgical coal pricing through an asset base with meaningful reserve depth and competitive cash costs. Expansion projects position the company for higher throughput in 2026, while contracted volumes provide baseline cash flow stability. With low-cost operations, long-lived assets and improving productivity, Ramaco provides one of the cleaner small-cap ways to gain exposure to US met coal fundamentals.

Key Risks

Exposure to spot met-coal price swings is the primary earnings driver. Development delays, geological variability and transport constraints could pressure cost performance. A sharper-than-expected downturn in steel demand would directly affect realized pricing and shipment cadence.

Final Take: Positioning Coal Stocks for 2026

The US coal sector enters 2026 from a stronger base than expected. Utility inventories have tightened, seaborne metallurgical markets remain constructive and production discipline persists even as 2026 retirements approach. Near-term fundamentals reflect a market that is tighter, more balanced and more resilient than the headline narrative suggests.

Across the sector, earnings power is increasingly defined by three factors:

- balance-sheet strength,

- contract coverage, and

- exposure to higher-quality met coal.

Producers such as CNR, HCC, BTU, ARLP, AMR, NRP and METC offer distinct ways to participate in this environment, from met-heavy torque to royalty-driven cash stability.

Structural headwinds remain, but the setup into 2026 leans constructive. Supply discipline, healthier stock levels and steady demand create a more favorable risk-adjusted profile. For investors willing to manage the inherent volatility, select coal equities continue to offer credible, idiosyncratic opportunities into the coming year.