Every trading day, markets generate a flood of price moves, financial reports, analyst opinions, and sentiment shifts. While some stocks rise and fall based on hype or short-term news, long-term investors know the real value lies beneath the surface. To find underpriced stocks, you need more than instinct. You need a structured process backed by reliable financial analysis and consistent data.

This is where a well-built stock screener tool becomes essential. It acts as a focused filter to cut through noise and identify companies trading below their intrinsic worth. If you’re a portfolio manager, private investor, or financial advisor, using a reliable method to screen for undervalued stocks can help you make more organized and informed investment decisions.

In this guide, you’ll learn how to build a powerful and repeatable screening system using Gainify. With access to real-time data, advanced filters, and customizable logic, Gainify helps you identify companies with strong fundamentals that may be mispriced by the market due to macroeconomic events, market sentiment, or overlooked financial strength.

Why Use Gainify to Find Underpriced Stocks?

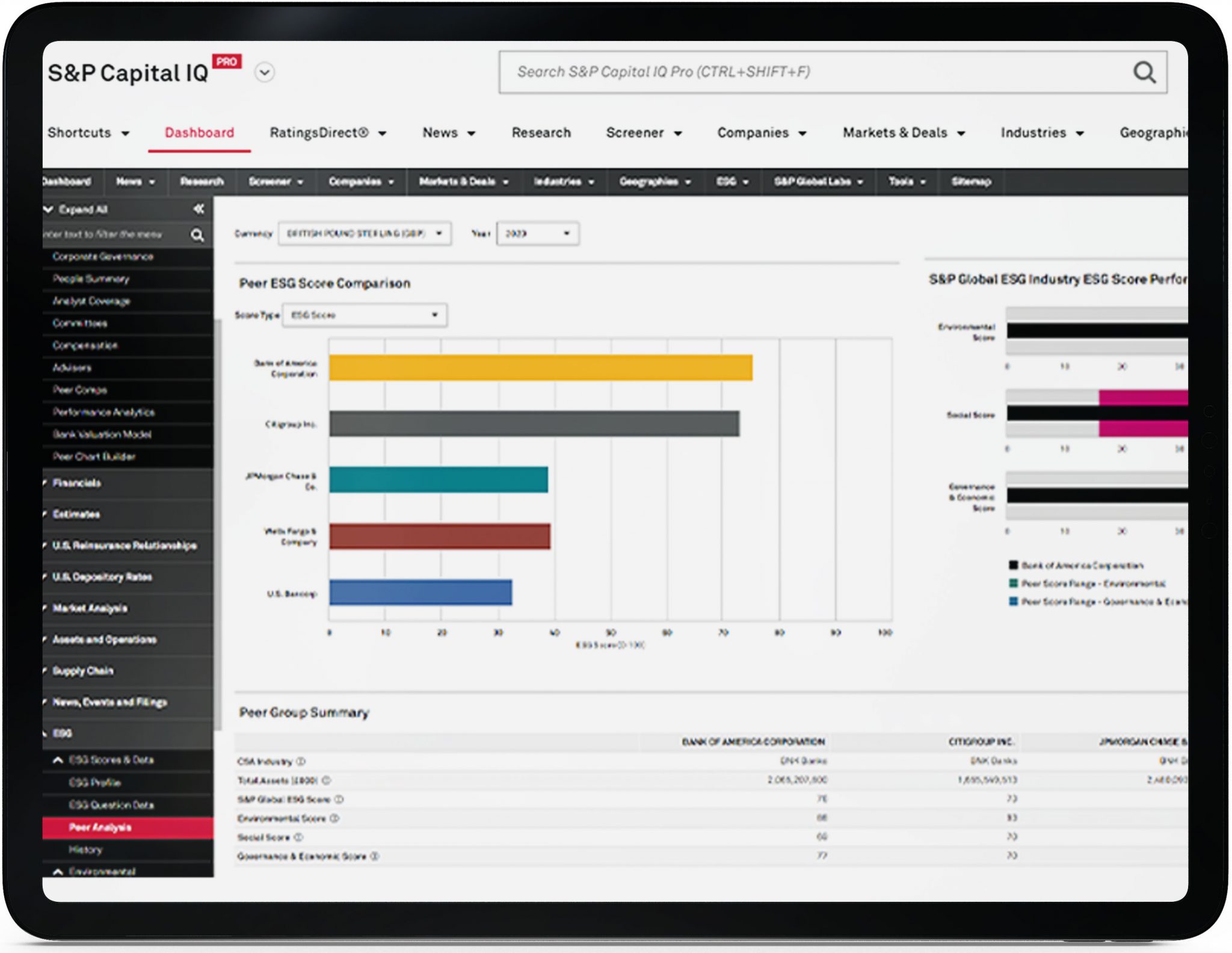

Gainify is built to help investors make decisions based on data, not noise. It offers over 500 filters sourced from S&P Global, covering everything from balance sheets, cash flow, and income statements to sentiment indicators, analyst expectations, and insider buying activity.

What sets Gainify apart is its ability to combine historical comparisons with forward-looking estimates. You can screen using valuation and growth metrics such as:

- P/E ratio, Trailing price-to-earnings (P/E) ratio, and Forward P/E ratio

- EV/EBITDA and Enterprise Value

- Free cash flow yield

- PEG ratio (Price/Earnings to Growth)

- Price-to-book ratio (P/B) and Price-to-sales (P/S) ratio

- Earnings yield

- Dividend yield

- Growth metrics: Revenue growth, Gross Profit growth and Operating Profit growth

- Liquidity and Solvency ratios such as Current ratio, and Debt-equity ratio (D/E)

- Earnings Per Share (EPS) trends: Estimated EPS growth and forecast EPS

This level of detail is especially useful for identifying stocks with high-quality fundamentals but depressed share prices due to temporary factors like geopolitical risks, market volatility, or negative press.

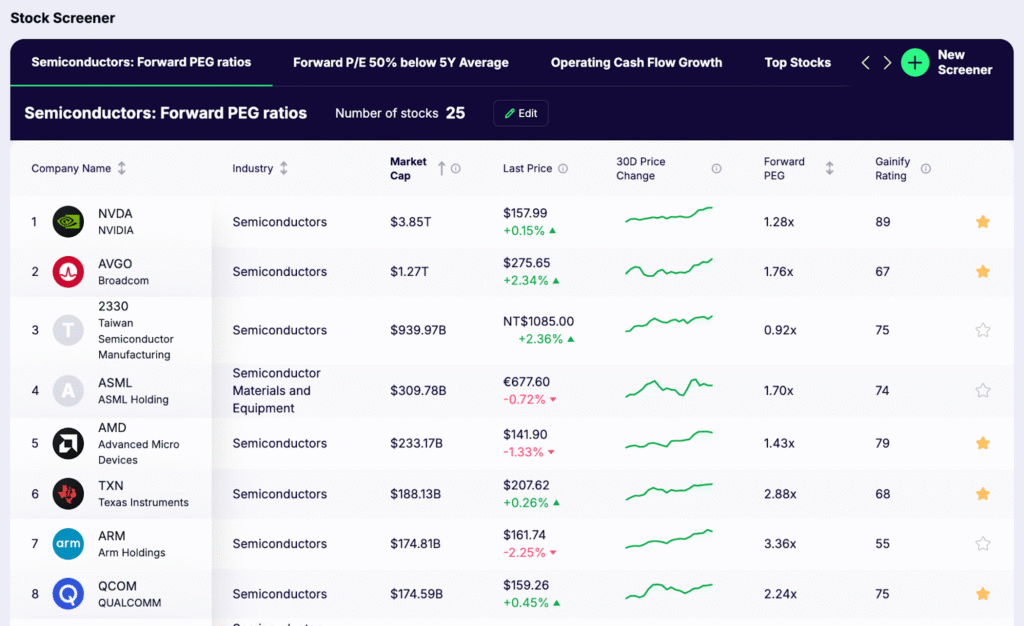

The platform is built for users who want a flexible, user-friendly platform that delivers meaningful insights in a larger table view. You can easily compare metrics, sort by valuation or performance, and adjust your filters based on your investment thesis or real-time market conditions.

How to Build a Screener to Find Underpriced Stocks

Here’s a step-by-step process to create a focused stock screener that identifies undervalued opportunities using Gainify.

Step 1 – Set a Clear Objective

Decide what kind of undervaluation you want to target. Your goal defines how you build the rest of your screener.

Common strategies include:

- Deep Value: Stocks trading far below historical valuation ranges based on PE ratio or book value

- GARP (Growth at a Reasonable Price): High-growth companies with strong EPS and low PEG ratios

- Turnaround: Companies recovering from a downturn, perhaps impacted by market corrections or initial public offering (IPO) mispricing

- Compounders: Quality companies with steady dividend yield, stable margins, and rising ROE, temporarily underpriced

Step 2 – Define the Investment Universe

To make your results relevant, narrow down where you want to search:

- Region and Exchange:

Examples: United Kingdom / LSE, United States / NASDAQ, Germany / Xetra - Market Capitalization:

Micro-cap (< $500M), Mid-cap ($500M – $5B), Large-cap (> $5B) - Sector or Theme (optional):

Focus on industries like semiconductors, insurers or aerospace & defence.

Tip: For thematic screens, narrowing your focus early helps manage risk and improve relevance.

Step 3 – Apply Fundamental Filters

This step defines how you interpret “underpriced” Instead of static thresholds, compare each metric to the company’s historical norms.

Valuation in Context

Use Gainify’s tools to compare forward valuation metrics over 3-, 5-, and 10-year periods:

- P/E ratio

- EV/EBITDA

- Price-to-Book (P/B)

- PEG ratio

- P/S ratio

Rule of thumb: Stocks trading one standard deviation or more below their 5-year valuation average often signal temporary mispricing.

Growth and Profitability

Look for undervalued stocks that still show signs of improving performance.

- 5-Year EPS growth above sector median

- Forecast EPS increasing over the next 12–24 months

- ROE > 12% and rising

- Free cash flow yield trending higher

- Stable or rising dividend yield

- Healthy current ratio and low debt-equity ratio

Tip: Gainify helps compare these metrics in context, which is especially useful when evaluating performance through volatile cycles or following volatile market conditions.

Step 4 – Add Sentiment and Market Validation

These filters help confirm whether other investors or analysts are starting to notice the opportunity.

- Analyst Price Target Upside: 10% or more

- Strong Buy Ratings: From at least three independent sources

- Insider Buying: Recent executive or board-level purchases

- Institutional Inflows: Increasing ownership by mutual funds or asset managers

These sentiment indicators strengthen your conviction and help prioritize companies aligned with positive investor sentiment.

Step 5 – Save, Review, and Monitor Your Screener

Once your screener is complete:

- Save it for repeated use across industries or market cycles

- Review the top 10–20 results manually to confirm quality

- Update quarterly to reflect changing conditions like interest rate movements or macroeconomic shifts

Treat your screener as an evolving process. This is how top analysts and value investors like Warren Buffett maintain long-term edge.

How to Judge If a Stock Is Truly Underpriced

Valuation ratios like a P/E of 10 or Price-to-Book under 1 might appear attractive, but they don’t always signal value. A stock may be underpriced, or it may be cheap for structural reasons.

Before acting, ask:

- Does the business still create meaningful value for customers?

- Is its growth supported by strong operations or just accounting tricks?

- Does the company have a sustainable edge over competitors?

- Is it exposed to long-term risks like geopolitical instability, regulatory shifts, or poor capital allocation?

This deeper layer of analysis helps distinguish undervaluation from long-term decline. As professionals advise, a financial screen is only the first step. The business case must support the data.

Final Thoughts

To consistently find underpriced stocks, you need structure, discipline, and the right tools. Gainify allows you to combine valuation filters, profitability signals, and sentiment metrics into a single, flexible framework. You also get access to high-quality data, real-time updates, and a clean visual dashboard.

By starting with a clear goal and refining your filters based on business quality and market trends, you can uncover stocks with strong upside potential and resilience through market corrections or broader volatility.

Quick Recap: Screener Setup to Find Underpriced Stocks

- Step 1: Define your objective

- Step 2: Set your region, market cap, and sector

- Step 3: Apply valuation, growth, and efficiency filters

- Step 4: Add analyst and sentiment validation

- Step 5: Save, monitor, and adjust your screener regularly

A disciplined approach gives you an edge in spotting value early, especially when others are distracted by headlines or reacting emotionally to market volatility and news cycles.