Artificial intelligence (AI) is rapidly transforming the healthcare sector. From diagnosing complex diseases to powering robotic-assisted surgeries and streamlining administrative burdens, AI is playing a crucial role in solving long-standing inefficiencies and improving patient outcomes. This surge in AI-powered healthcare solutions is creating compelling investment opportunities across the broader market, particularly among public healthcare companies and disruptive technology stocks leveraging intelligent machines, deep learning algorithms, and precision analytics.

In this guide, we explore the top medical AI stocks poised for dynamic growth. Each company has been evaluated based on its technological leadership, relevance to AI innovation in healthcare delivery, and strategic positioning in digital healthcare. We also outline the investment thesis and expert views to help investors align their investment objective with this transformative space.

Why Invest in Medical AI Stocks?

Investing in medical AI stocks means tapping into the next wave of innovation in the healthcare landscape. Here’s why this segment is gaining traction:

- Solving healthcare system inefficiencies

AI-powered solutions are helping healthcare providers address physician shortages, automate repetitive administrative tasks, and enhance clinical decision-making. These technologies reduce healthcare costs while expanding access to care across patient populations. - Accelerating diagnostics and drug development

AI is transforming the entire drug discovery process from identifying drug candidates and modeling potential toxicities to optimizing trial design and outcomes. It also powers faster, more accurate medical diagnostics in areas such as breast cancer screening, medical imaging, and heart disease detection. - Capturing rapid growth potential

Adoption of AI-powered healthcare solutions is accelerating across use cases such as mental health, remote care, medical diagnostics, and personalized recommendations. - Driving institutional and governmental adoption

Academic institutions, government agencies, and health systems are deploying AI at scale. For example, in Bayesian Health’s concierge services or AI-supported population health platforms. This institutional demand reinforces the long-term viability of AI-driven healthcare investments. - Offering diversified access for investors

Exposure ranges from large-cap technology stocks and pharmaceutical giants to pure-play biotech companies and medical device innovators. For passive investors, options like the Global X Telemedicine & Digital Health ETF (EDOC) or iShares Healthcare Innovation ETF (HEAL) provide diversified coverage of the healthcare AI landscape.

However, medical AI carries elevated risks. These include substantial risk due to high R&D costs, and the dependency on FDA-approved AI algorithms and successful clinical validation. Investors should consult financial advice and consider their financial situation, growth potential, and investment objective before allocating capital.

Top Medical AI Stocks (Ranked by Market Cap)

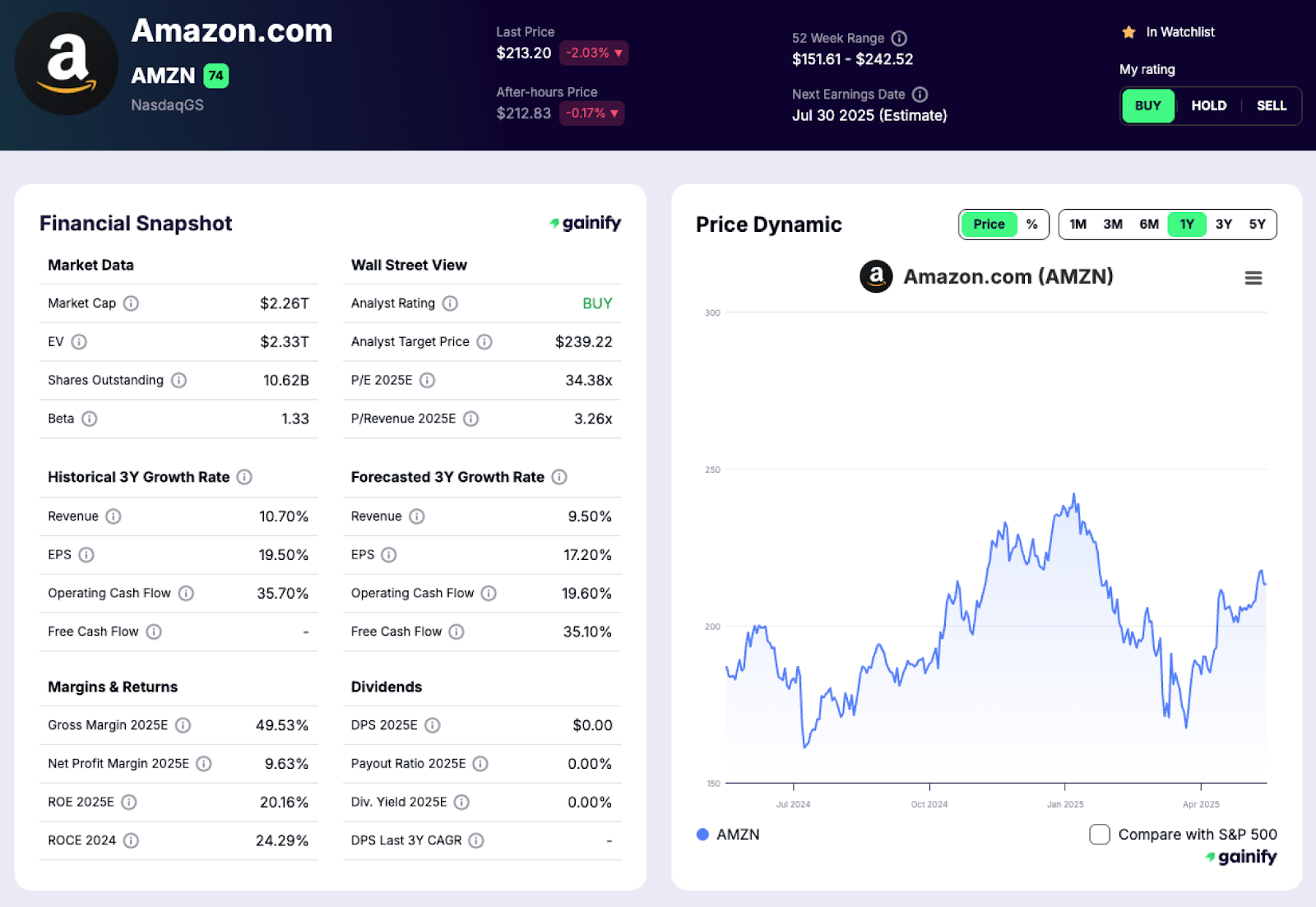

1. Amazon (AMZN – Amazon Health)

Market Cap: Over $2.6 trillion

Why: AMZN is integrating AI into medication tracking, remote diagnostics, and patient experience within its healthcare ambitions.

Expert View: A disruptor in digital healthcare with vast access to healthcare data and advanced AI-driven logistics.

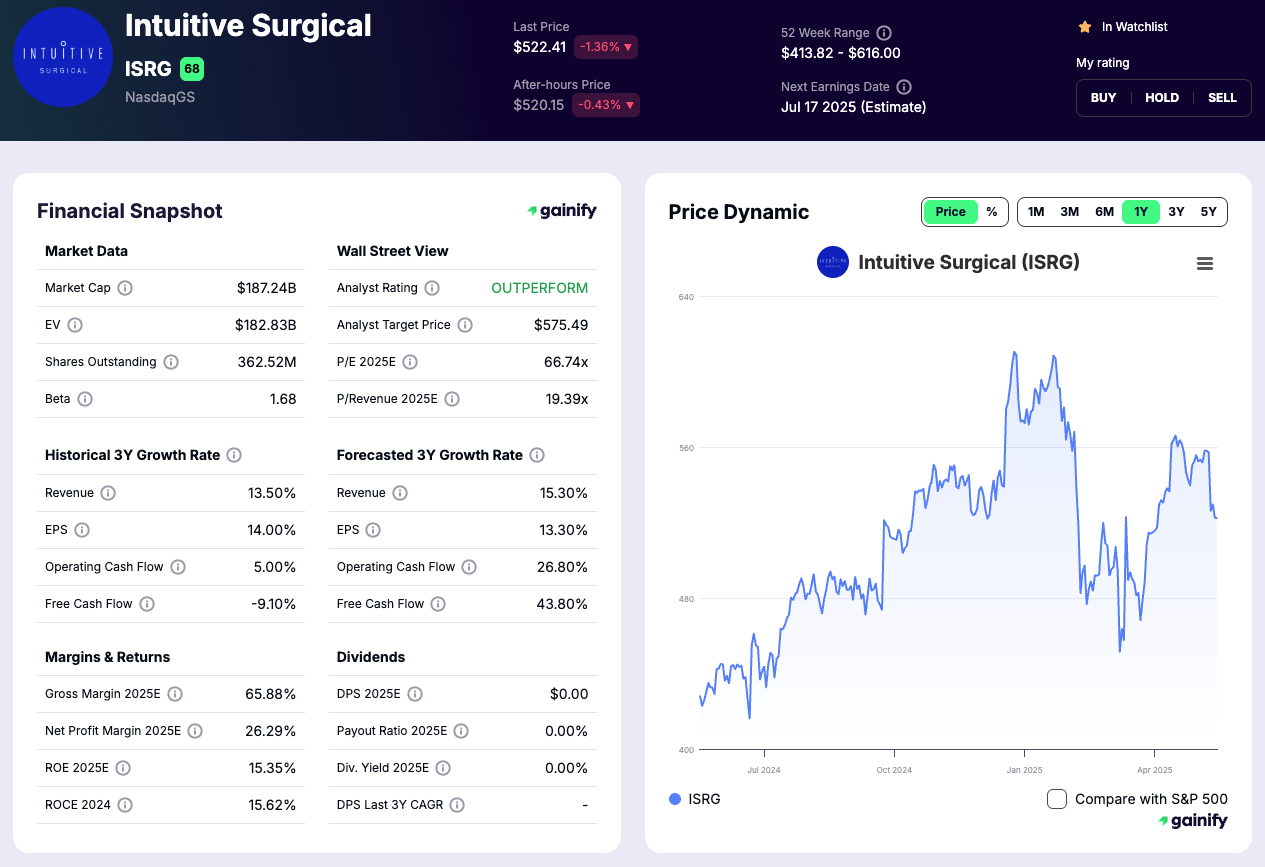

2. Intuitive Surgical (ISRG)

Market Cap: $199 billion

Why: A pioneer in robotic-assisted surgeries, ISRG’s da Vinci system supports precise diagnostics, minimally invasive procedures, and advanced imaging technologies.

Expert View: ISRG continues to lead medical device companies in surgical AI, shaping the future of personalized healthcare through AI-enabled robotic systems.

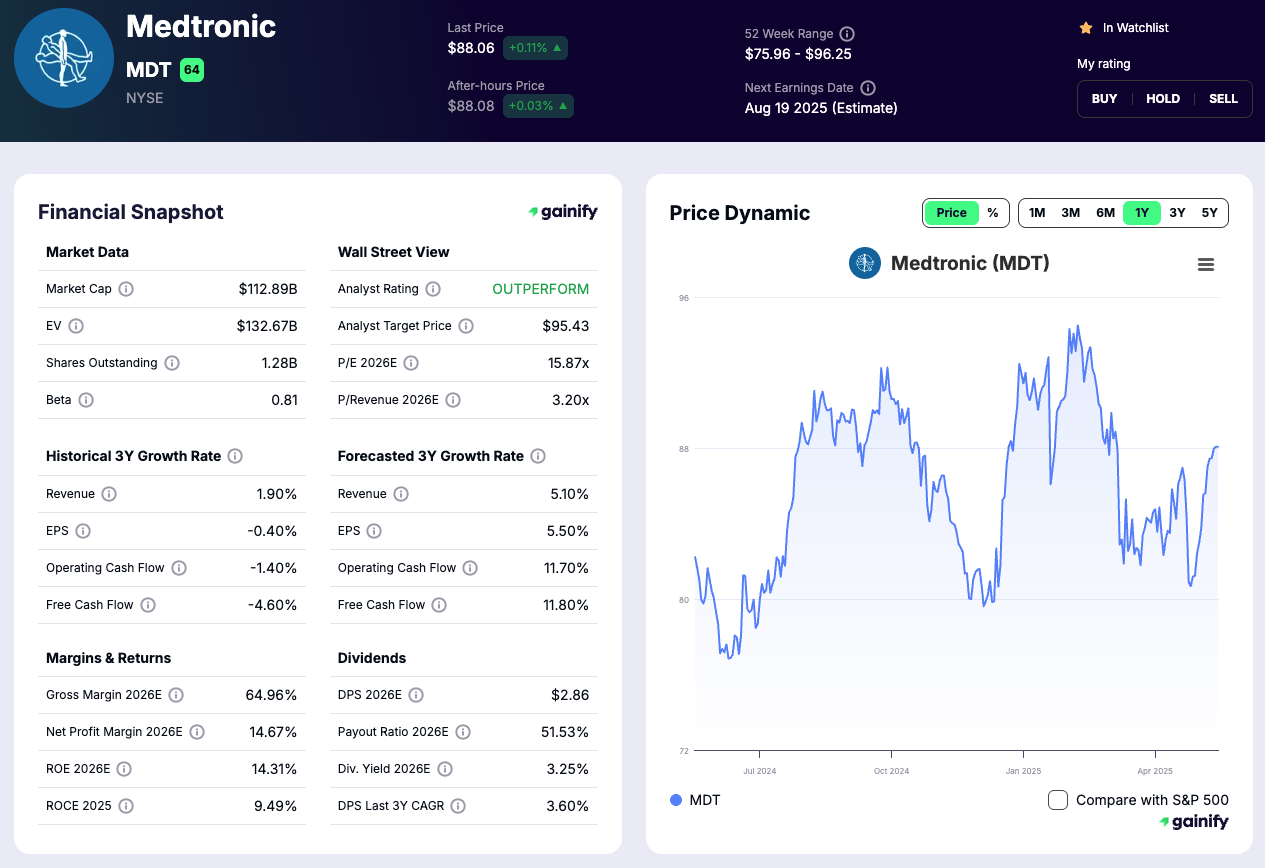

3. Medtronic (MDT)

Market Cap: $123.6 billion

Why: MDT integrates AI into insulin delivery systems and cardiac devices for dynamic, data-driven chronic disease management.

Expert View: Among the top medical device giants applying deep learning technology to improve patient safety and health outcomes.

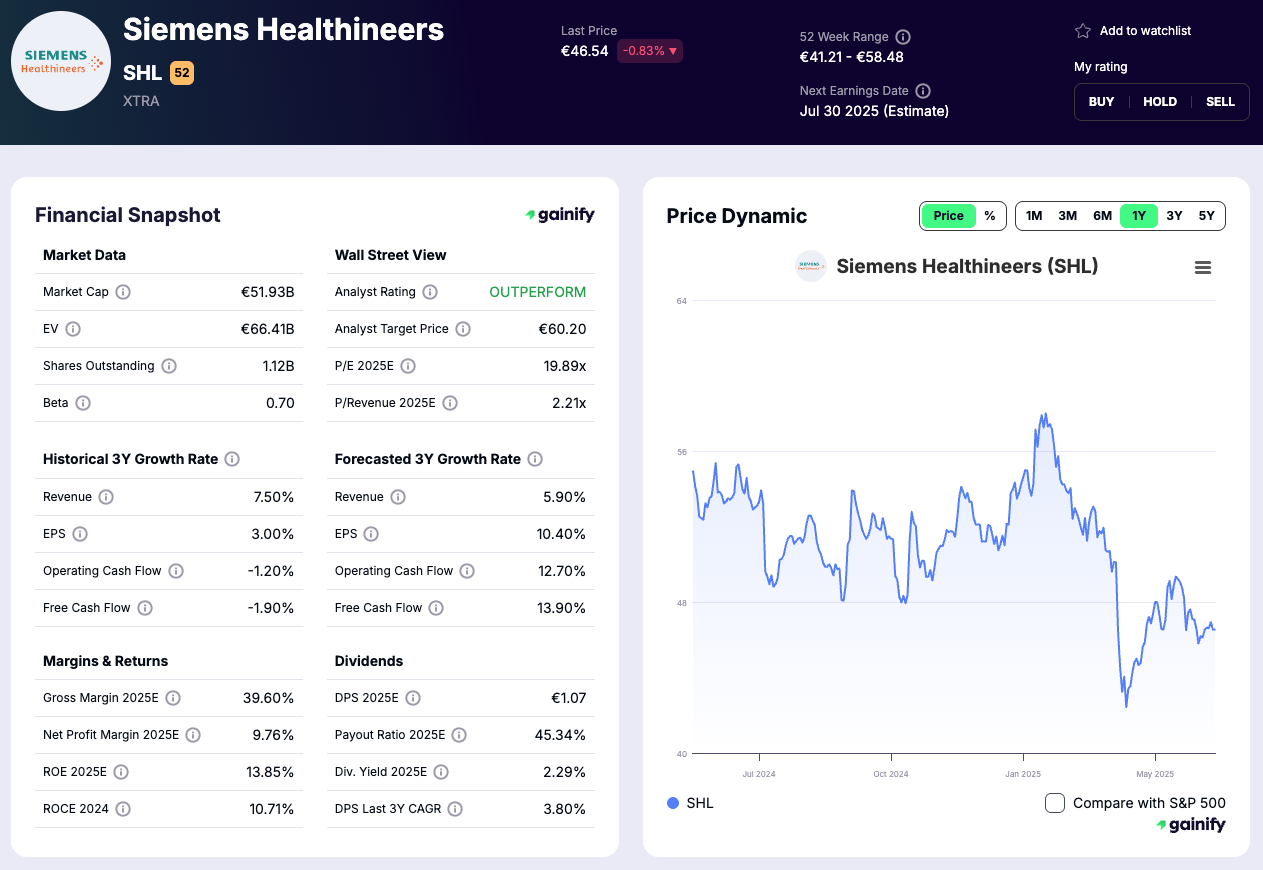

4. Siemens Healthineers (SHL.DE)

Market Cap: $52.2 billion

Why: Leads in Medical Imaging and lab automation, using AI to detect heart disease, colorectal polyps, and other conditions.

Expert View: Strong in imaging, with FDA-cleared AI tools and a competitive advantage in clinical workflows.

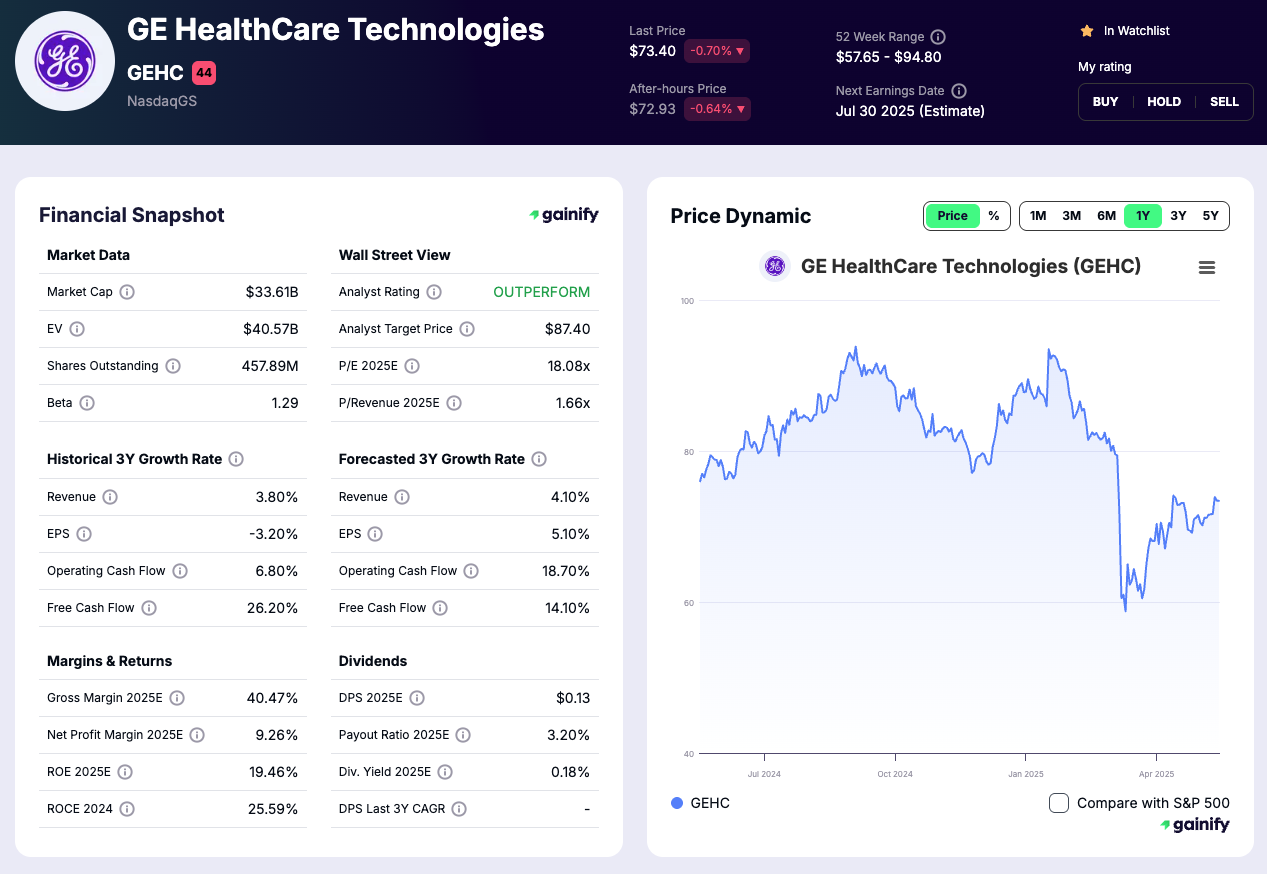

5. GE HealthCare (GEHC)

Market Cap: $36.8 billion

Why: GEHC’s Edison AI platform enhances image quality and predictive analytics in diagnostics. It supports applications in healthcare across radiology, cardiology, and digital healthcare.

Expert View: A medical technology company using AI to reshape value-based care and reduce diagnostic delays.

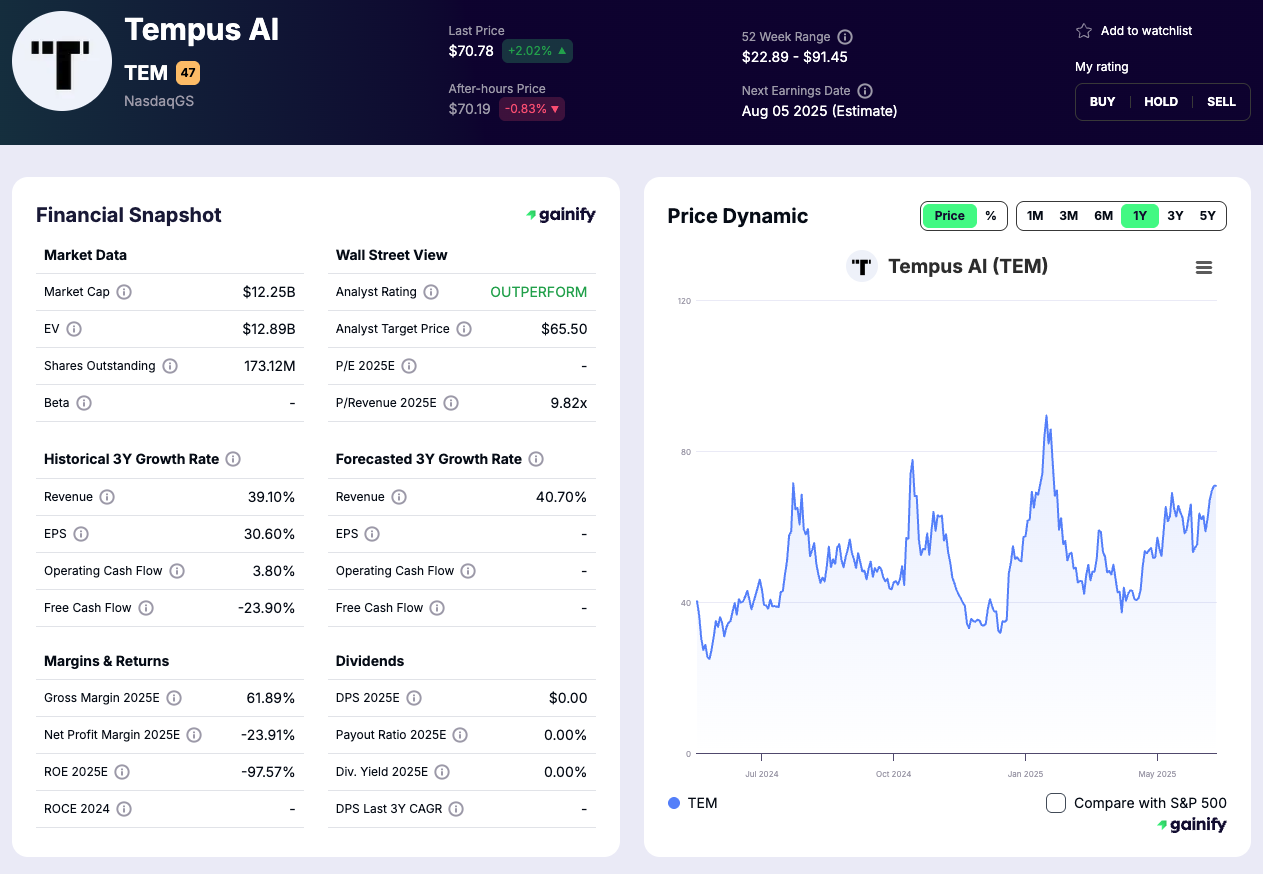

6. Tempus AI (TEM)

Market Cap: $12 billion

Why: Tempus combines clinical data, medical images, and AI-powered analytics to help healthcare companies develop next-generation drug candidates and treatment plans.

Expert View: An artificial intelligence company deeply embedded in AI-driven drug discovery and personalized recommendations for oncology.

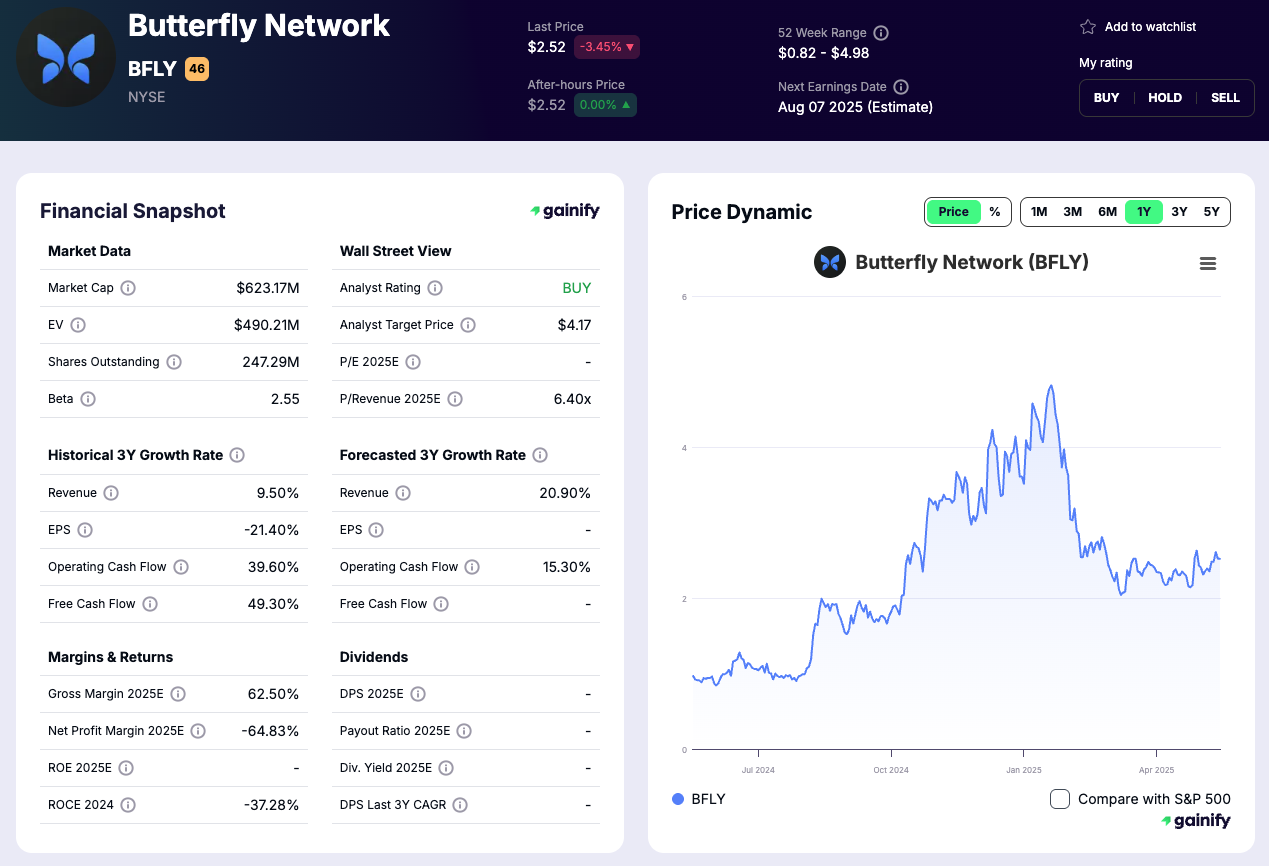

7. Butterfly Network (BFLY)

Market Cap: $1.11 billion

Why: Known for AI-assisted handheld ultrasound with real-time image analysis, BFLY democratizes access to medical diagnostics in underserved areas.

Expert View: Innovative and speculative, but gaining traction in healthcare delivery and accessibility in healthcare.

Conclusion

The medical AI sector is not just about disruptive technologies. It’s about transforming how healthcare providers, pharmaceutical giants, and medical device companies operate from drug to market strategies to precise diagnostics and real-time health monitoring. AI-powered health solutions are becoming foundational across applications in healthcare, from administrative automation to detection of diseases.

Whether you’re tracking medical stocks for earnings growth rates or aligning with a personalized investment objective, the opportunities in this space are vast. Backed by institutional support, cutting-edge technology, and increasing healthcare adoption, these stocks stand at the forefront of a new era. Always seek financial advice tailored to your risk profile and long-term goals before diving into this high-impact sector.

FAQs

Q: What is medical AI?

A: Medical AI refers to the use of artificial intelligence technologies such as deep learning algorithms and language models to improve medical diagnostics, healthcare delivery, and drug development processes.

Q: Are medical AI stocks risky?

A: Yes. There are risks including regulatory uncertainty, high research and development costs, and challenges with widespread adoption. Many companies also rely on FDA approvals and consistent performance in real-world patient populations.

Q: How do I assess growth potential in this sector?

A: Evaluate factors such as earnings growth rates, competitive advantages, product pipeline strength, and the company’s role in advancing the healthcare landscape.

Q: Can AI help reduce healthcare costs?

A: Yes. AI can improve diagnostic accuracy, streamline treatment protocols, and automate time-consuming tasks, which contributes to lower healthcare costs across institutions.