Buffett’s investment principles are more than just a strategy. They represent a mindset grounded in discipline, patience, and a deep understanding of business fundamentals. With a record of success spanning more than six decades, Warren E. Buffett has transformed Berkshire Hathaway Inc. into one of the most iconic and consistently successful American investment conglomerates.

His approach to investing emphasizes rational decision-making, thoughtful risk management, and a long-term perspective. Instead of reacting to market noise or pursuing speculative trends, Buffett focuses on acquiring shares of strong companies with durable competitive advantages and holding them over extended periods. This style of investing has delivered substantial returns for both professional investors and individual investors alike.

As Buffett once remarked: “The stock market is designed to transfer money from the Active to the Patient”

Central to Buffett’s philosophy is the belief that investors should act like business owners. This means prioritizing company fundamentals, assessing the strength of financial statements, and evaluating the quality of management teams. Buffett often applies a contrarian mindset, buying during periods of widespread fear and selling when markets become overly euphoric. His method revolves around identifying ably-managed businesses, purchasing them at fair or discounted prices, and allowing time to do the heavy lifting.

His investment framework includes:

- Prioritizing high-quality businesses with predictable earnings

- Seeking a margin of safety by purchasing below intrinsic value

- Holding through market cycles to benefit from compounding

- Limiting holdings to only the strongest ideas in a concentrated portfolio

This article provides a deep dive into Buffett’s investment philosophy. We will explore how he applies these timeless principles, how investors can adopt similar strategies in today’s environment, and what insights can be drawn from the current composition of Berkshire Hathaway’s holdings. From a focus on American companies and partnerships with outstanding managers like Charlie Munger, to cornerstone positions in companies such as Apple and Coca-Cola, Buffett’s actions offer a blueprint for long-term investing success.

As Warren Buffett prepares to step down from his role at the end of the year, his enduring legacy serves as a compass for investors navigating an increasingly complex financial landscape. Whether you are saving for retirement, building a diversified portfolio, or seeking clarity amid market uncertainty, Buffett’s philosophy remains a powerful guide. Rooted in simplicity, conviction, and a disciplined focus on value, his approach has helped generations of investors achieve long-term success and it is poised to continue shaping smart investment strategies well into the future.

Principle No. 1: Think Like a Business Owner, Not a Trader

Buffett doesn’t view individual stocks as mere pieces of paper or speculative bets. He sees them as partial ownership in strong companies. This mindset helps avoid impulsive decisions and encourages investors to base actions on company performance, not market noise.

Key Questions Buffett Asks:

- Is the business simple and understandable?

- Does it generate consistent earnings?

- Are the chief executives competent and aligned with shareholders?

- Is the company fairly priced relative to its future performance?

As Buffett famously said: “Buy into a company because you want to own it, not because you want the stock to go up”

This philosophy, which dates back to Buffett’s training at Columbia Business School and mentorship under Benjamin Graham, remains a foundational part of his investment approach.

Principle No. 2: Invest in What You Understand

Buffett and his longtime business partner Charlie Munger emphasize the importance of staying within your circle of competence. Investors should stick with industries and companies they can clearly evaluate. Buffett has famously avoided tech stocks for decades until Apple, because of their complex nature.

Buffett captured it best: “Risk comes from not knowing what you’re doing”

Understanding a business model helps assess future earnings, management quality, and competitive position. For the average investor, this may include blue-chip companies like Coca-Cola Company or American Express – businesses with predictable earnings and strong fundamentals.

Principle No. 3: Focus on Intrinsic Value

Buffett buys when stocks are trading below their intrinsic value. This involves company analysis, reviewing financial statements, and comparing fair value to market price. He looks for undervalued stocks that offer both capital gains and income generation.

In Buffett’s own timeless words: “Price is what you pay; value is what you get”

This method of identifying undervalued companies has defined Buffett’s investing strategies since his early years at Buffett Associates and later through Berkshire Hathaway.

Principle No. 4: Look for Economic Moats

Buffett targets companies with durable competitive advantages. These economic moats might come from branding, patents, network effects, or low production costs. He prefers businesses that are hard to disrupt and can maintain pricing power across market conditions.

Buffett put it best when he said: “In business, I look for economic castles protected by unbreachable moats”

Examples include Coca-Cola stock and Moody’s, both of which are supported by wide brand recognition and long-term customer loyalty.

Principle No. 5: Practice Patience and Discipline

Buffett’s long-term investing philosophy includes patience during bear markets and discipline during bull market euphoria. This has been key to avoiding investment mistakes driven by emotion or speculation.

As Buffett famously said: “Our favorite holding period is forever”

His investment success is rooted in thinking long-term, ignoring short-term market fluctuations, and trusting in the compounding power of consistent earnings.

Principle No. 6: Prioritize Capital Efficiency

Buffett prefers quality companies with strong cash flow and low capital expenditure needs. These companies reinvest profits efficiently or return capital to shareholders through dividends or share buybacks.

These ably-managed businesses can scale without excessive spending, improving return on equity and long-term shareholder value.

Principle No. 7: Manage Behavior and Emotions

Buffett emphasizes investor psychology. He believes emotional control is a key trait of successful investors. Following media headlines or reacting to price of stocks rather than fundamentals often leads to poor investment decisions.

Buffett’s words drive the point home: “Be fearful when others are greedy and greedy when others are fearful”

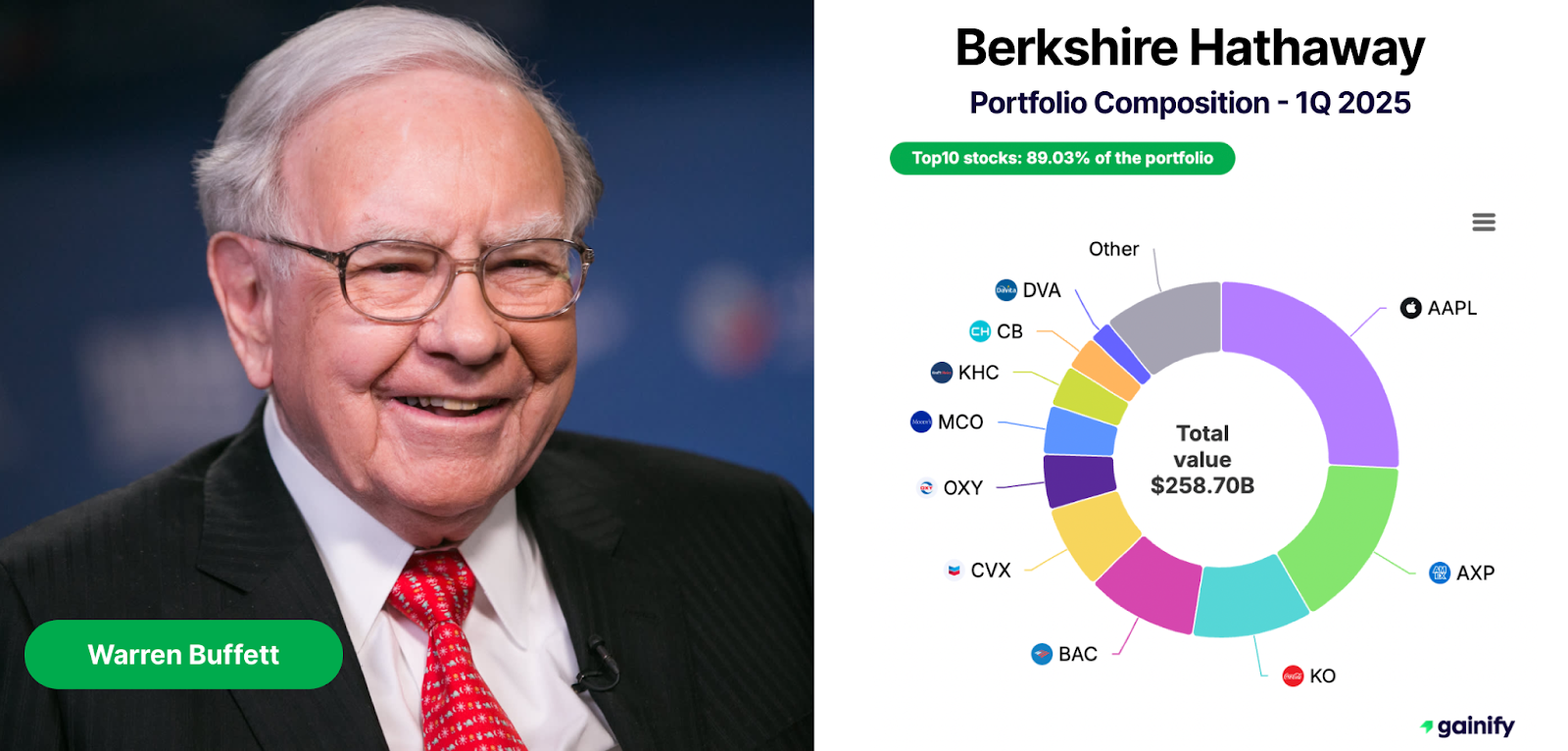

What Buffett’s Current Portfolio Tells Us (Q1 2025)

Buffett’s investment portfolio, as seen in the latest 13F Filings for Q1 2025, reflects a high level of concentration:

- The top 10 holdings account for more than 89% of total assets under management.

- Apple alone comprises 25.76% of the portfolio, demonstrating Buffett’s focus investing philosophy.

- Many positions, like Coca-Cola and American Express, have been held for more than 48 quarters.

- Buffett tends to hold onto stocks with consistent earnings and management quality, regardless of market conditions.

- Despite increased exposure to technology companies such as Apple and Verisign, his portfolio remains grounded in fundamentals.

Buffett’s current portfolio is a case study in how a concentrated portfolio of high-quality businesses can outperform broader markets over time.

Lessons from a Legendary Investor

Warren Buffett’s investment philosophy has been shaped by decades of disciplined practice, successful business ventures, and contrarian decisions made during times of financial crisis. His strategy emphasizes low-cost operations, efficient management, and a focus on high-quality companies with strong fundamentals.

Buffett invests in American companies with long records of profitability and in dividend-paying stocks that provide consistent annual returns. His primary goal is long-term success, not short-term speculation or market timing.

As Buffett famously said: “You only have to do a few things right in your life so long as you don’t do too many things wrong”

From his early education at Columbia University to widely watched interviews with Charlie Rose, Buffett’s insights continue to influence generations of individual investors, professional fund managers, and business partners. The portfolio at Berkshire Hathaway still reflects the values he has always promoted: simplicity, patience, and investing within your circle of competence.

Final Thoughts

Warren Buffett’s investment philosophy stands as one of the most enduring blueprints for building lasting wealth. His disciplined focus on quality companies, understandable businesses, and long-term value creation has consistently delivered results through decades of economic cycles.

For individual investors, his approach provides more than just stock-picking tips. It is a comprehensive framework grounded in rationality, patience, and a deep respect for fundamental analysis. Whether you’re allocating retirement savings, managing a diversified portfolio, or navigating volatile markets, Buffett’s principles serve as a practical guide for sound decision-making.

His partnership with Charlie Munger and the legacy of the Buffett investment style continue to influence some of the world’s most successful investors, professional analysts, and institutional managers. As Buffett once said:

“Someone is sitting in the shade today because someone planted a tree a long time ago”

That long-term mindset combined with clarity of purpose and resistance to market fads is what separates sustainable wealth builders from short-term speculators. Let these principles shape not just your portfolio, but your financial thinking for decades to come.

Q&A: Understanding Buffett’s Investment Philosophy

Q: What is the core of Warren Buffett’s investing strategy?

A: Buffett focuses on buying high-quality businesses with strong fundamentals at reasonable prices, then holding them for the long term. He avoids speculation and emphasizes patience and discipline.

Q: How important is diversification to Buffett?

A: While diversification can help mitigate risk, Buffett believes in a concentrated portfolio of well-understood businesses. He famously said, “Diversification is protection against ignorance”

Q: What role does management quality play in Buffett’s investments?

A: Management is central. Buffett invests in companies with skilled and trustworthy executives who think like owners and are committed to long-term performance.

Q: Does Buffett invest in technology companies?

A: Traditionally, Buffett avoided tech due to its complexity, but he made a notable exception with Apple, which he considers a consumer products company with a strong brand and loyal customer base.

Q: How can individual investors apply Buffett’s philosophy?

A: Focus on companies with clear competitive advantages, consistent earnings, and strong leadership. Think long-term, avoid emotional decision-making, and invest only in what you understand.