Japan’s corporate leaders are entering 2026 with stronger business models and clearer long-term growth drivers. Instead of relying mainly on exports or currency trends, many Japan stocks are now building momentum through technology, digital services and modernized infrastructure. This shift is redefining how value is created across the country’s largest companies.

Toyota is moving toward electrified and connected mobility. MUFG is upgrading financial services through digital platforms and AI. SoftBank is investing in AI capabilities while strengthening its telecom network. Sony is expanding its global entertainment ecosystem and imaging technology. Hitachi is scaling digital and industrial solutions that support energy systems, mobility and automation.

These five companies sit at the center of Japan’s economic transformation. Each benefits from durable demand, each is adding higher-value digital or service layers and each contributes to Japan’s transition toward a more technology-driven and globally competitive model.

Together, Toyota, MUFG, SoftBank, Sony and Hitachi represent the core themes shaping Japan’s equity landscape in 2026.

Key Takeaways

- Japan’s leading companies are shifting toward software, data and services, which supports more stable and recurring revenue on top of their traditional industrial or financial businesses.

- Financial and technology groups are adopting AI to improve customer experience, strengthen efficiency and increase the value of their platforms.

- Industrial and mobility leaders are advancing electrification, digital infrastructure and system modernization, creating long-term growth drivers that extend well beyond short economic cycles.

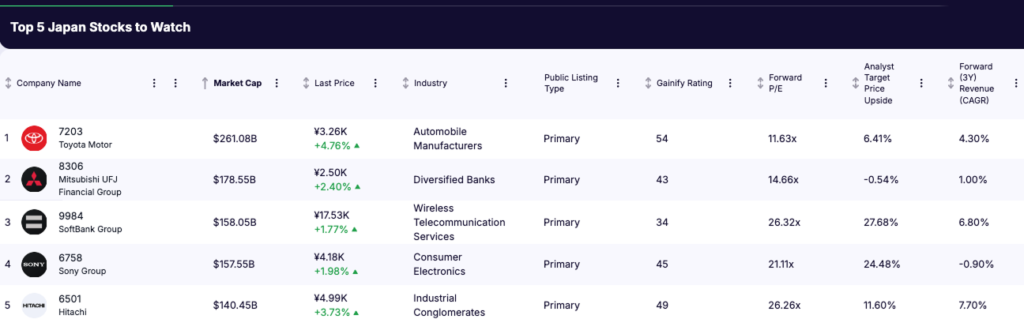

1. Toyota Motor (TSE: 7203)

Market Cap: 261.08 billion USD

Forward P/E: 11.63x

Analyst Target Price Upside: 6.41%

Forward Revenue CAGR (3Y): 4.30%

Theme: electrified mobility, diversified profit base, global scale

Toyota remains the anchor of Japan’s mobility ecosystem, supported by strong global demand and one of the broadest electrified portfolios in the world. In its most recent disclosures, management highlighted that consolidated vehicle sales continued to expand, helped by product competitiveness and a strengthened value-chain profit base. Operating income trends reflect the company’s effort to build a profit structure more resilient to macro swings and geopolitical pressures.

Toyota is also deepening its strategic foundation through brand differentiation, connected vehicle services and long-term investment in next-generation mobility. The shift toward electrified vehicles and software-defined architectures represents a multi-year catalyst for margins and customer lifetime value.

Toyota Highlights

- Strong demand across Japan and North America supported higher vehicle volumes and improved value-chain profitability.

- Electrified models continue to scale, reinforcing Toyota’s leadership in hybrid and next-gen mobility.

- Ongoing investment programs aim to improve productivity and lower break-even levels.

Investment Thesis

Toyota offers diversified exposure to global mobility, with stable earnings, strong cash generation and a multi-decade roadmap for electrification and connected services.

Risks

Toyota faces a mix of external and strategic risks. Tariff and regulatory uncertainty in major markets can affect pricing and profitability, and supply-chain disruptions or raw-material inflation may pressure its cost structure. At the same time, the shift toward software-defined vehicles demands consistent execution, since long-term competitiveness will increasingly depend on Toyota’s ability to deliver connected, intelligent mobility platforms.

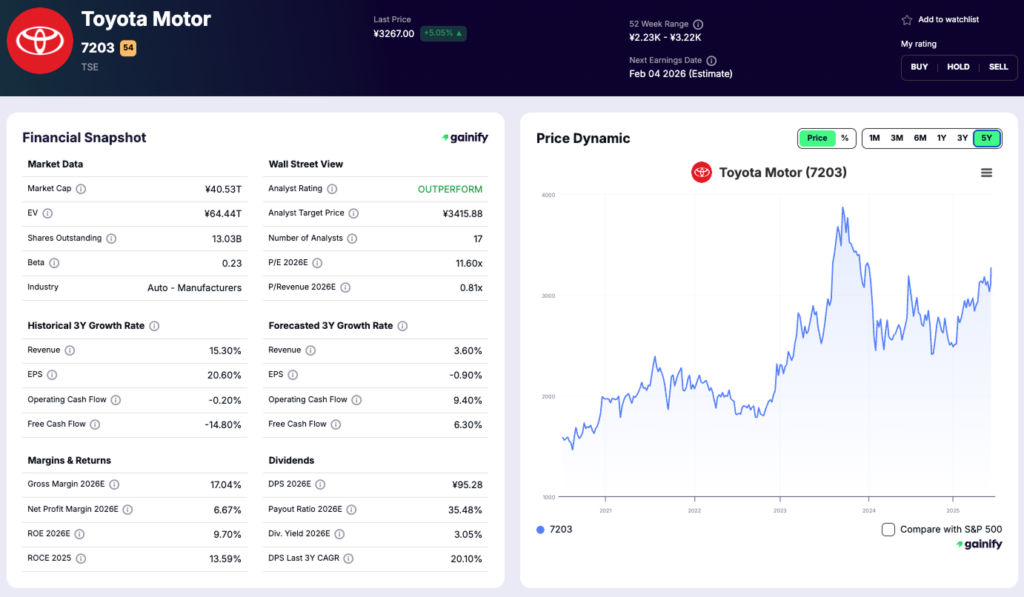

2. Mitsubishi UFJ Financial Group (TSE: 8306)

Market Cap: 178.55 billion USD

Forward P/E: 14.66x

Analyst Target Price Upside: –0.54%

Forward Revenue CAGR (3Y): 1.00%

Theme: AI-native financial services, global fee income, platform expansion

MUFG is undergoing a significant transformation to become an AI-native financial institution. Recent results show historically high profitability driven by strong fee income growth, disciplined cost management and progress across global corporate banking. Management also emphasized continued improvements in capital efficiency and expanded earnings contribution from asset management and digital financial platforms.

Domestically, the launch of MUFG’s “M-tto” ecosystem accelerated cross-group engagement and customer acquisition, reflecting meaningful early traction in digital banking and wealth services. Internationally, MUFG continues deepening its ASEAN presence, strengthening long-term growth optionality.

MUFG Highlights

- Historical-high profits driven by fee income strength across domestic and overseas corporate operations.

- “M-tto” ecosystem accelerated digital customer acquisition and platform usage.

- Clear progress toward an AI-native operating model as outlined in the medium-term plan.

Investment Thesis

MUFG offers stable income, improving capital returns and attractive optionality through digital finance, cross-border banking and AI-driven productivity enhancements.

Risks

MUFG’s outlook is influenced by several factors. Credit conditions in overseas markets can affect fee generation and lending momentum, while rising competition in domestic digital banking may pressure customer acquisition and pricing. In addition, shifts in regulation or capital requirements have the potential to reshape return profiles, making consistent balance-sheet discipline increasingly important.

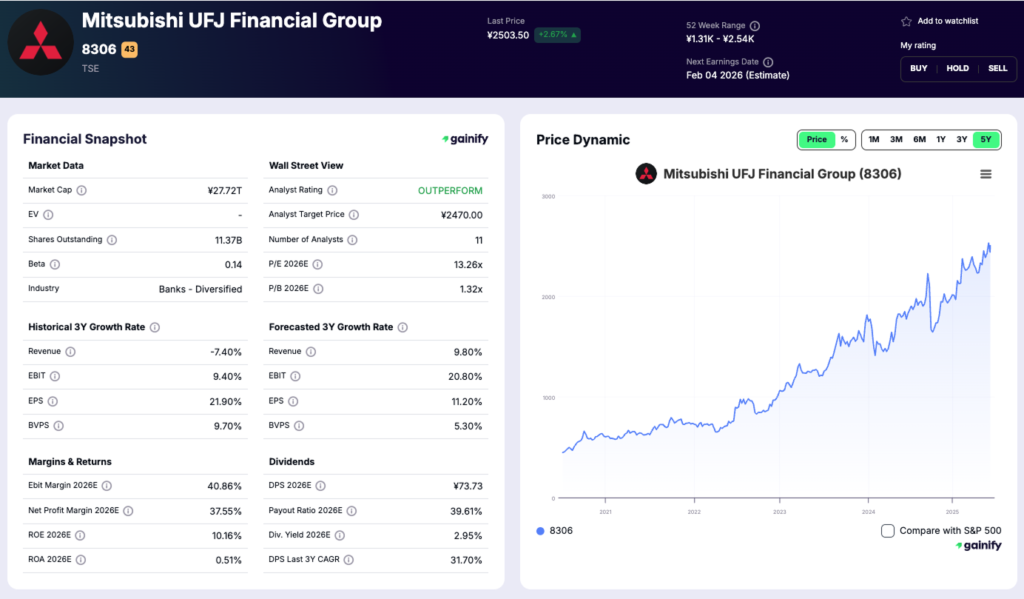

3. SoftBank Group (TSE: 9984)

Market Cap: 158.05 billion USD

Forward P/E: 26.32x

Analyst Target Price Upside: 27.68%

Forward Revenue CAGR (3Y): 6.80%

Theme: AI infrastructure, telecommunications scale, portfolio optionality

SoftBank is positioning itself at the intersection of telecom infrastructure and AI-enabled services. In its latest materials, the company emphasized continued investments in AI capabilities across its domestic operations and portfolio companies, supporting both customer experience and enterprise solutions. SoftBank’s network modernization and digital transformation initiatives remain core to strengthening its cost base and service competitiveness.

The company also continues refining its strategic investment activities, enhancing value creation through partnerships and disciplined capital allocation. This positions SoftBank as both a large-scale operator and a technology-focused holding company with exposure to AI, automation and digital platforms.

SoftBank Highlights

- Ongoing transformation programs include increased AI adoption to enhance network performance and customer services.

- Domestic telecommunications business benefits from modernization and operational efficiencies.

- Strategic investment activities provide long-term optionality in next-generation technology.

Investment Thesis

SoftBank provides a unique combination of stable domestic telecom cash flows and exposure to global AI-related innovation through its investment activities. The company’s push to modernize its network and embed AI across services enhances operational efficiency and strengthens customer engagement. This creates a portfolio profile where core earnings provide stability, while selective technology investments offer meaningful long-term upside.

Risks

SoftBank’s performance is sensitive to market conditions, which can influence the valuation of its investment holdings and create earnings volatility. Competition in the telecom market may also pressure revenue and margins if pricing intensity increases. The success of AI and digital transformation initiatives is critical, since weaker integration or slower adoption could limit expected efficiency gains and profitability improvements.

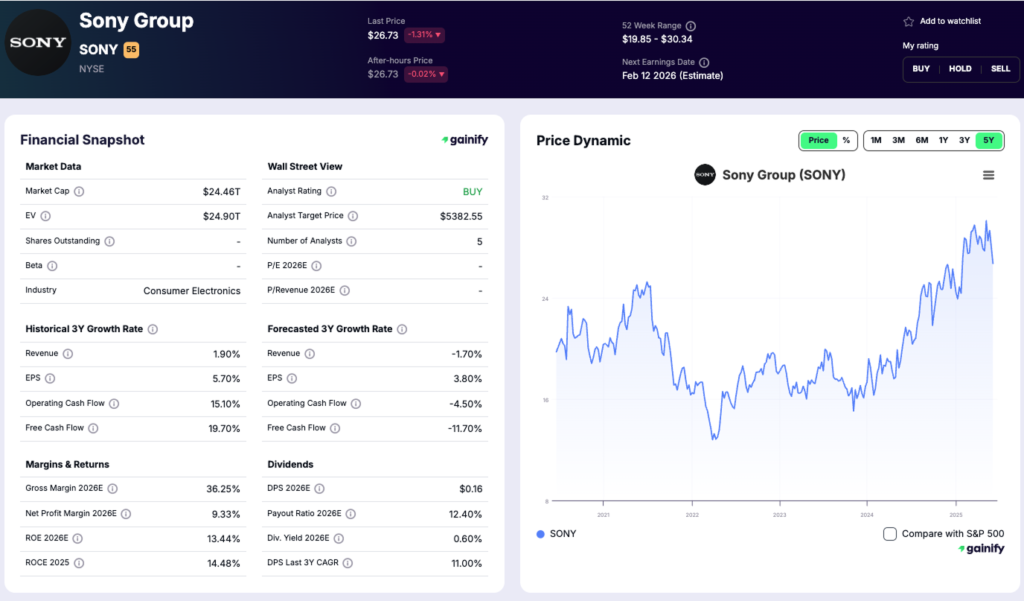

4. Sony Group (TSE: 6758)

Market Cap: 157.55 billion USD

Forward P/E: 21.11x

Analyst Target Price Upside: 24.48%

Forward Revenue CAGR (3Y): –0.90%

Theme: content ecosystem, sensor leadership, platform diversification

Sony continues to demonstrate the resilience of its multi-segment entertainment and technology ecosystem. Recent disclosures show solid growth in Music and Imaging & Sensing Solutions (I&SS), with the latter benefiting from strong demand for mobile and camera sensors. Management also noted a stable profitability profile supported by higher operating income across several core segments.

While the Games & Network Services business experienced mixed performance due to hardware and tariff-related pressures, the broader content ecosystem, including music streaming and global anime IP, continues to build durable engagement. Sony’s deepening investment in sensors and content distribution positions the company as a long-term enabler of digital entertainment and device intelligence.

Sony Highlights

- Revenue growth in Music and I&SS supported by strong global demand for streaming and advanced imaging sensors.

- Content franchises and platform services continue compounding engagement.

- Sensor business benefits from mix improvements and technology leadership.

Investment Thesis

Sony provides a balanced mix of premium content, consumer electronics, gaming ecosystems and advanced image sensors, giving it exposure to several of the strongest secular trends in global digital consumption. Its leadership in sensors and its growing library of entertainment and gaming IP create recurring engagement across devices and platforms. This diversified foundation supports steady long-term growth and helps reduce reliance on any single segment or hardware cycle.

Risks

Sony’s results can be affected by hardware cycles, which influence demand for gaming consoles and related content. Tariff shifts or cost pressures may impact margins across device categories. Changes in global content consumption habits could also challenge certain media businesses and require continued adaptation.

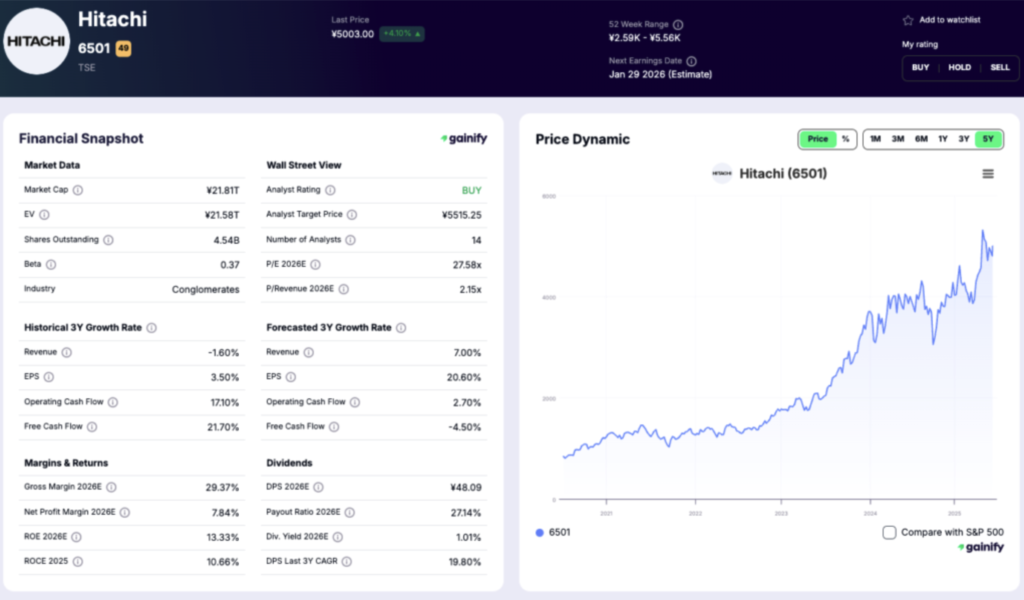

5. Hitachi (TSE: 6501)

Market Cap: 140.45 billion USD

Forward P/E: 26.26x

Analyst Target Price Upside: 11.60%

Forward Revenue CAGR (3Y): 7.70%

Theme: industrial digitalization, energy infrastructure, Lumada expansion

Hitachi has transformed into one of Japan’s most important digital-industrial companies. Recent results highlight strong momentum in its Energy and Digital Systems & Services (DSS) businesses, supported by record-high adjusted EBITA and significant free-cash-flow improvement. The company’s Lumada platform continues to deliver substantial growth through digital services, AI-based solutions and high-value industrial deployments.

GlobalLogic (a key digital acquisition) is expanding synergies across mobility, energy and industrial automation, further accelerating Lumada’s scale. Hitachi’s portfolio is now more service-driven, recurring and internationally diversified, positioning it at the center of digital infrastructure modernization.

Hitachi Highlights

- Energy and DSS posted strong revenue and profit momentum, contributing to record adjusted EBITA.

- Lumada revenue grew across multiple sectors, driven by AI-enhanced digital services.

- GlobalLogic continues to strengthen digital capability and cross-business synergies.

Investment Thesis

Hitachi is well positioned to benefit from the global shift toward industrial digitalization, supported by strong capabilities in energy grids, mobility systems and AI-driven digital services. Its Lumada platform provides a scalable foundation for expanding high-value software and analytics offerings across multiple industries. This combination of industrial depth and digital growth potential creates a resilient and forward-looking earnings profile.

Risks

Hitachi’s project-based businesses can be influenced by overseas demand cycles, which may affect timing and revenue recognition. Successful integration of digital and industrial assets is essential to sustain operational efficiency and strategic momentum. In addition, currency movements or tariff changes can impact profitability in internationally exposed segments.

Conclusion

Japan’s largest and most influential companies are entering 2026 with clearer strategic direction and stronger structural tailwinds than at any point in the past decade. Toyota, MUFG, SoftBank, Sony and Hitachi are no longer competing solely on hardware, scale or legacy operations. Instead, they are building advantage through software, AI, digital services and modernized infrastructure that position them at the center of Japan’s economic renewal. For investors seeking exposure to the next phase of Japan’s growth story, these companies represent the most compelling and durable expressions of the country’s shift toward a more technology-driven and globally competitive model.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial, investment or trading advice. The companies discussed are provided as illustrative examples and should not be interpreted as recommendations to buy or sell any securities. All information is based on publicly available data at the time of writing and may change without notice. Investors should conduct their own research, consider their individual financial circumstances and consult a qualified professional before making investment decisions. All investments carry risk, including the potential loss of principal.