Global shipping enters 2026 at a pivotal moment. After one of the deepest freight recessions in a decade, spot rates have shown their first sustained stabilization. Carriers slashed capacity, blanked sailings, and rerouted vessels around geopolitical chokepoints, all of which helped tighten utilization and slow price erosion.

At the same time, the next contract cycle is setting up differently: shippers are approaching 2026 tenders from a position far weaker than they were in 2025, while carriers show early signs of discipline returning.

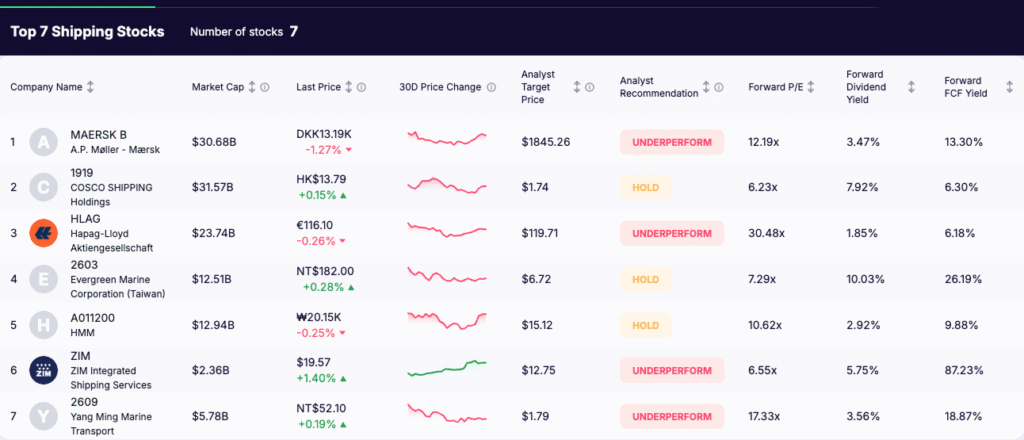

Against this backdrop, the seven shipping stocks below represent the most powerful publicly listed shipping companies on the planet. These carriers dictate global capacity, set the tone for spot-rate behavior, and ultimately shape how the entire container market functions.

The skew toward Hold and Underperform ratings reflects a market that still doubts the durability of the rate rebound. Expectations remain low heading into 2026, and that creates the setup for the widest dispersion in years: if freight stabilizes or supply tightens unexpectedly, the leaders will recover long before the laggards catch up.

Here is a critical, data-driven breakdown of the seven shipping names most worth tracking into 2026.

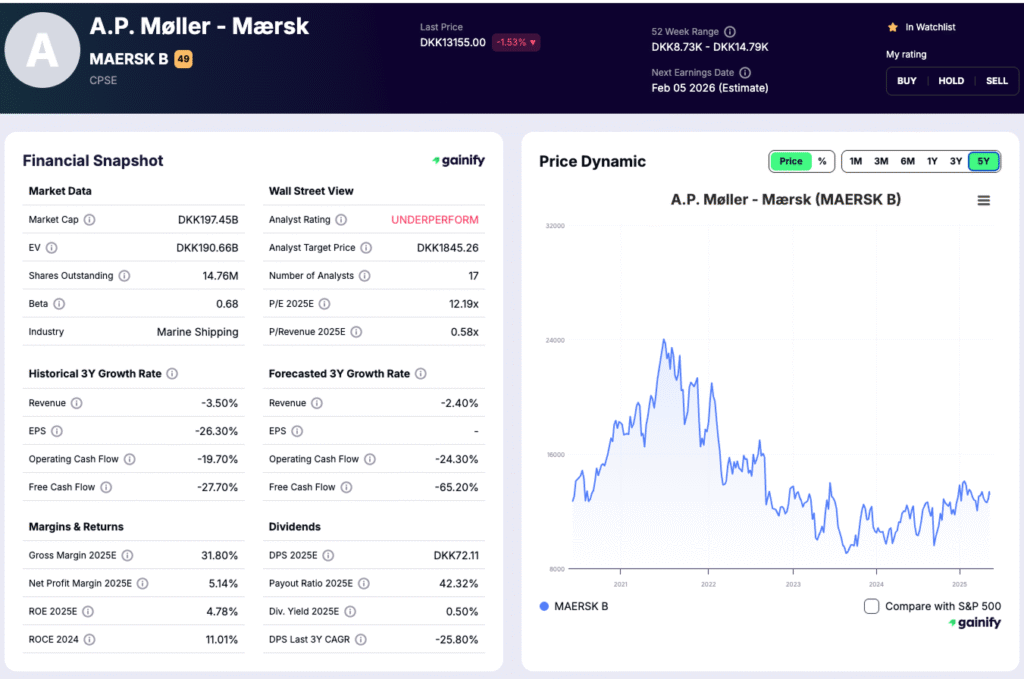

1. A.P. Møller – Maersk (MAERSK B)

Forward P/E: 12.19x | Dividend Yield: 3.47% | Analyst Rating: Underperform

Investment Thesis

Maersk remains the defining publicly listed company in global container shipping. Its scale, contract share and network control allow it to influence industry pricing, capacity discipline and cost behavior more than any peer.

Q3 2025 showed the underlying mechanics of that leadership: volumes grew about 7 percent, fleet utilisation reached 94 percent, and the Terminals segment delivered a 39 percent EBIT margin. Terminal ROIC held near 17 percent, reinforcing that Maersk’s multi-segment structure now cushions the volatility of Ocean earnings.

Strategically, Maersk is further than any competitor in repositioning itself as an end-to-end logistics provider. Logistics and Terminals increasingly smooth earnings, while Ocean provides leverage to any freight-rate recovery. This mix supports a more durable long-term equity story than a pure-container operator.

What to Watch into 2026

2026 contract negotiations: shippers are pushing for resets on Asia–Europe and Transpacific lanes. Where Maersk decides to anchor the floor will heavily influence the rest of the industry.

Cost discipline and network simplification: the new network structure and ongoing asset rationalization are critical. Q3 showed meaningful progress through lower unit costs at fixed bunker.

Terminals as a stabilizer: Terminals continue to deliver high-margin, high-return performance. This segment increasingly acts as Maersk’s earnings buffer during weak freight cycles.

Energy-transition fleet strategy: methanol-capable vessels offer a competitive edge, but only if capex remains constrained and aligned with demand realities.

Key Risks

- Freight-rate fragility: oversupply and soft demand, particularly in Europe, could weigh on contract pricing throughout 2026.

- Scale amplification: Maersk’s size works both ways. It captures upside early in a recovery, but it also magnifies downside when rates remain compressed.

- Regulatory uncertainty: emissions-pricing frameworks are evolving and could complicate long-term fleet economics or accelerate required investment.

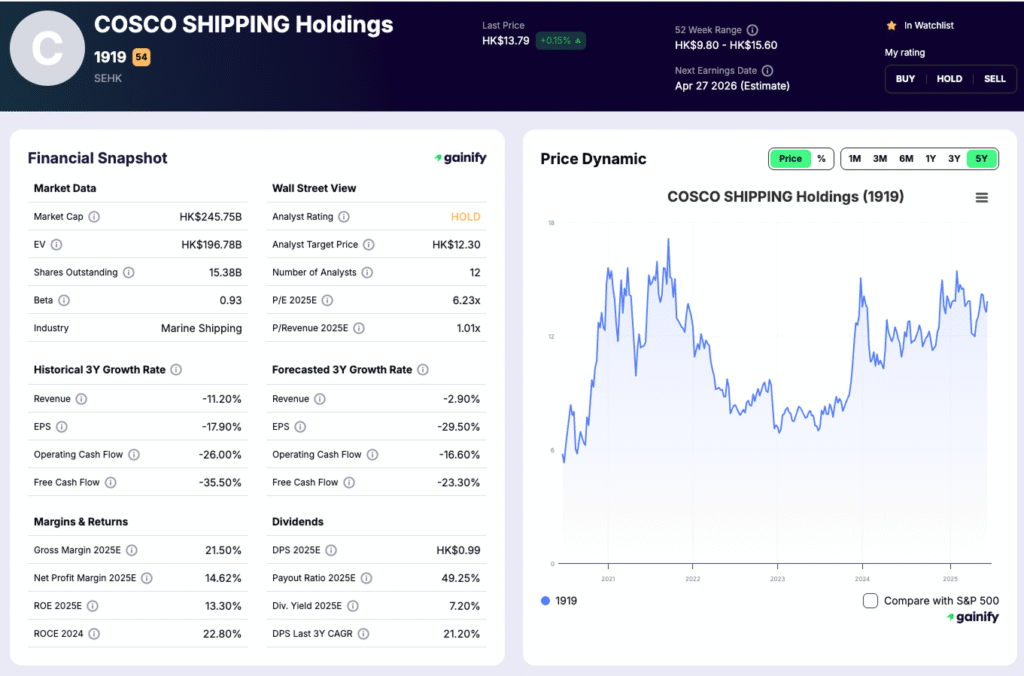

2. COSCO Shipping Holdings (1919)

Forward P/E: 6.23x | Dividend Yield: 7.92 percent | Analyst Rating: Hold

Investment Thesis

COSCO remains one of the most strategically important players in global shipping. Its position at the center of China’s export engine, combined with state-backed scale and disciplined cost control, gives it resilience that most peers cannot replicate. Q3 results reaffirmed this stability, with container volumes holding firm and operating cost efficiency improving despite a soft pricing environment. COSCO’s vertically integrated network, strong cash generation during the prior super-cycle and access to low-cost financing allow it to absorb prolonged rate weakness better than nearly any other carrier.

What to Watch

- Export momentum on China outbound lanes, particularly Asia – EU, where COSCO’s share is structurally high

- Capacity moves within the Ocean Alliance and whether COSCO pushes for tighter utilization

- Dividend sustainability given the company’s history of high payouts and investor expectations

- The degree to which geopolitical rerouting (Red Sea, Taiwan Strait) shifts COSCO’s volume and pricing dynamics

Key Risks

COSCO’s fortunes remain tied to China’s manufacturing cycle, which is still uneven. Excess capacity across the industry continues to pressure rates, and COSCO’s expanding fleet could limit margin recovery if pricing remains soft. Geopolitical disruptions introduce both upside and downside volatility, while regulatory scrutiny over Chinese exporters could influence shipment flows. Analysts maintain Hold ratings because COSCO offers income stability rather than a near-term rerating catalyst.

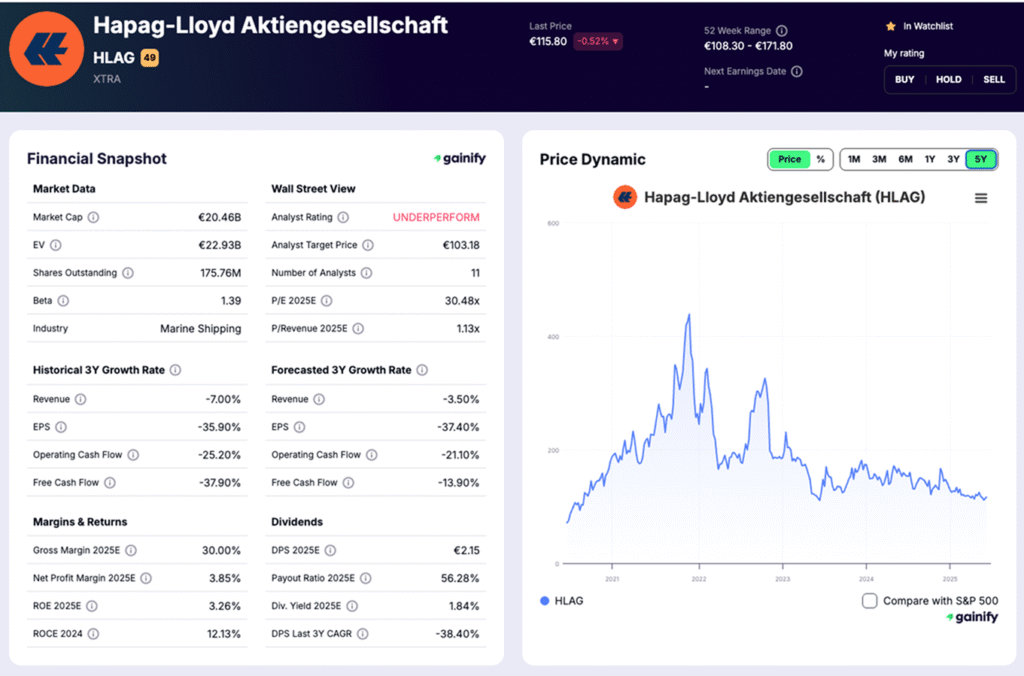

3. Hapag-Lloyd (HLAG)

Forward P/E: 30.48x | Dividend Yield: 1.85% | Analyst Rating: Underperform

Investment Thesis

Hapag-Lloyd sits at the center of Europe’s container network and is becoming one of the most strategically important carriers globally. The company is shifting from a pure volume operator toward a reliability-driven model through the new Gemini Cooperation, which restructures its schedule, cost base and service promise. Transport volumes rose to more than 10 million TEU in the first nine months of 2025, showing HLAG’s ability to deploy fleet capacity even in a soft rate environment.

However, the rate backdrop remains weak and the cost environment elevated. Operating expenses increased meaningfully year over year, reflecting port disruptions, rerouting, congestion and transition costs related to Gemini. EBITDA margins compressed into the mid-teens, well below the highs of the past cycle. The investment case now centers on whether HLAG can turn scale and network redesign into sustainable cost advantages by 2026.

What to Watch

- Execution and cost normalization under the Gemini Cooperation, where reliability targets are materially higher than legacy alliances

- Freight rate stability, with average 2025 rates still below USD 1,400 per TEU

- Unit cost trends, particularly fuel, charter rates and handling costs, which rose materially this year

- Net debt, which increased during 2025 following capex, dividends and FX movements

- Demand strength on Europe-linked trades, which remain the most fragile in the global network

Key Risks

Hapag-Lloyd is one of the most freight-rate-sensitive carriers in the sector. A prolonged period of oversupply or weak European demand would continue to pressure earnings. Elevated operating costs from port congestion and rerouting could persist longer than expected, reducing the benefit of network redesign. HLAG also has a sizable newbuild pipeline, which adds fixed-cost absorption risk if rates fail to firm. Finally, geopolitical instability on key corridors can rapidly undermine utilization, leaving HLAG exposed during a period of elevated strategic investment.

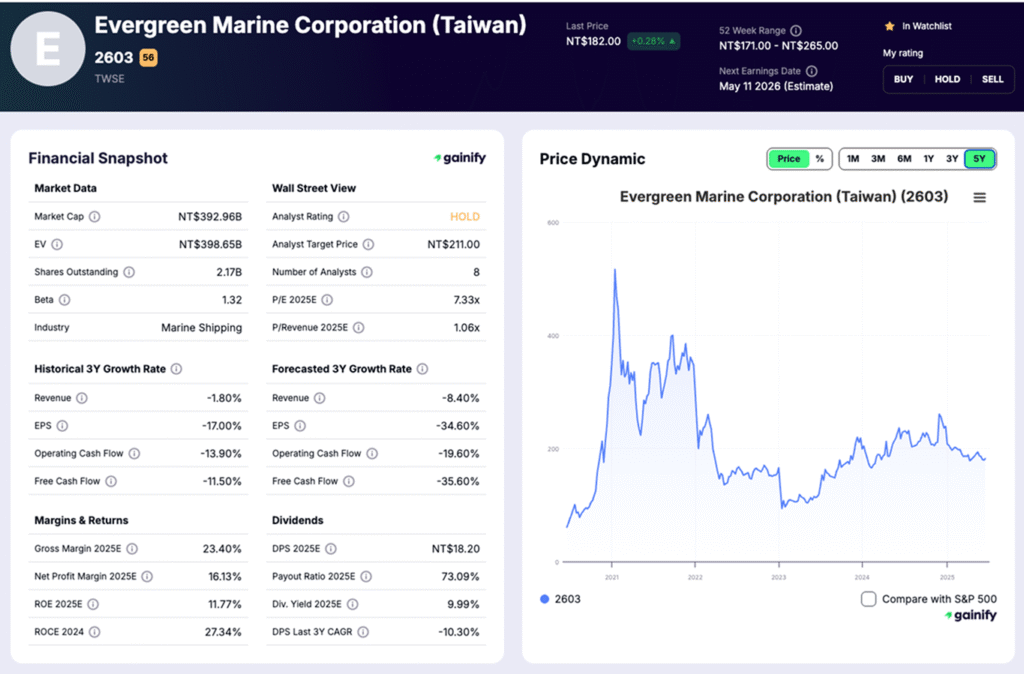

4. Evergreen Marine (2603)

Forward P/E: 7.29x | Dividend Yield: 10.03% | Analyst Rating: Hold

Investment Thesis

Evergreen remains one of the most operationally disciplined shipping carriers in Asia, supported by a structurally lean cost base and one of the strongest balance sheets in the sector. The company ended the first half of 2025 with roughly NT$225B in cash, giving it uncommon resilience and strategic flexibility. Despite a soft rate environment, Evergreen generated about NT$196B in operating revenue in the same period, demonstrating solid contract coverage and efficient network management. Cost control kept profitability intact, and the company’s multi-year fleet renewal program positions it to expand margins as fuel efficiency standards tighten globally.

Among Asian liners, Evergreen stands out as a stable operator with the financial capacity to absorb prolonged rate pressure and capitalize aggressively when utilization improves.

What to Watch

- Cash allocation decisions. With around NT$56B in operating cash flow in the first half of 2025, investors will watch how Evergreen balances capex, liquidity, and potential returns to shareholders.

- 2026 contract resets. Evergreen’s Asia–Europe and Transpacific contract negotiations offer early signals for regional pricing trends.

- Fleet efficiency gains. Integration of newer, lower-emission vessels remains a key margin driver.

- Currency exposure. The company reported significant FX translation losses in the first half of 2025, highlighting earnings sensitivity to USD and TWD movements.

Key Risks

- High rate sensitivity. Evergreen’s earnings remain tightly correlated with Asia long-haul spot rates, which continue to swing sharply.

- Currency volatility. Large FX translation losses in 2025 indicate real volatility in reported earnings.

- Potential oversupply. If vessel deliveries accelerate in late 2025 or early 2026, Evergreen’s cost advantage narrows quickly.

- Regulatory pressure. Rising carbon costs across Asia could lift both operating expenses and capital requirements.

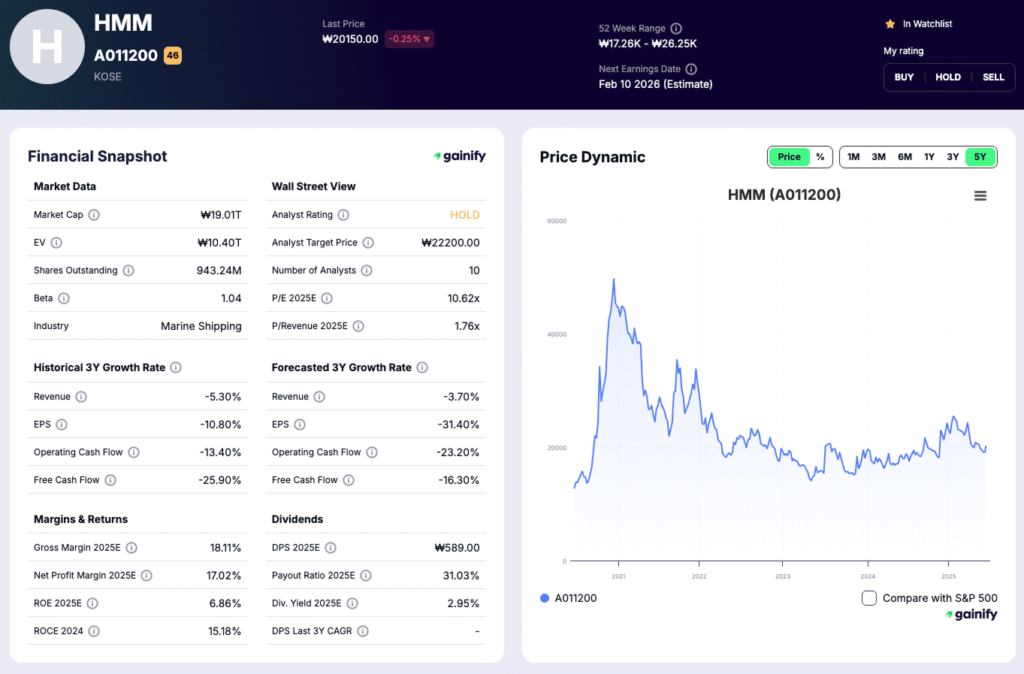

5. HMM (A011200)

Forward P/E: 10.62x | Dividend Yield: 2.92% | Analyst Rating: Hold

Investment Thesis

HMM operates with a fundamentally different profile from the larger European and Chinese liners. Its network is concentrated in Transpacific and Asia-focused trades, which makes earnings more sensitive to rate cycles but also gives the company tactical agility. After a period of exceptional profitability during the supply shocks of prior years, HMM is now in a normalization phase where cost discipline, fleet strategy and long-term contracting matter more than volume gains.

Through the first nine months of 2025, HMM generated around 8.18 trillion KRW in revenue and 1.14 trillion KRW in operating income. Container volume increased modestly, yet lower freight rates pulled down segment margins, underscoring how dependent performance remains on the industry’s supply balance. Bulk and tanker divisions added stability, each contributing to a more diversified earnings base. Management’s priorities are clear: protect profitability, modernize the fleet and gradually shift toward cleaner propulsion technologies, including methanol dual-fuel vessels.

HMM’s ability to maintain profitability in a weaker market reflects a more balanced business than in prior cycles. The focus now is to strengthen cost competitiveness and secure multi-year customer relationships that reduce the amplitude of earnings swings.

What to Watch

- Cost control as port handling and chartering expenses continue to rise

- Utilization impact from new vessel deliveries and charter conversions

- Long-term contract wins in bulk and tanker segments that smooth earnings

- Fleet modernization progress and deployment into higher-margin trade lanes

Key Risks

HMM remains highly exposed to global freight rate volatility, and a prolonged oversupplied market could erode margins quickly. Port and chartering costs have risen faster than revenue, lifting the company’s cost-to-sales ratio. Scale disadvantage versus the largest global carriers limits pricing power in downcycles. Government ownership influences large capital decisions and introduces uncertainty around strategic direction. A rapid increase in industry-wide capacity across Asia poses additional risk to utilization and rate stability.

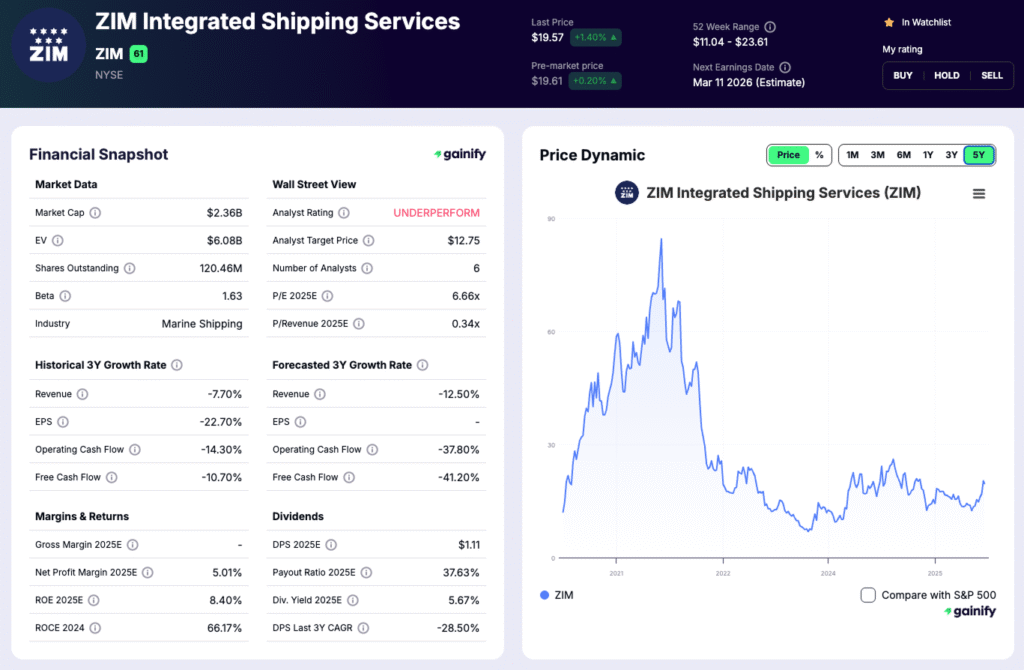

6. ZIM Integrated Shipping (ZIM)

Forward P/E: 6.55x | Dividend Yield: 5.75% | Analyst Rating: Underperform

Investment Thesis

ZIM remains the most tactically flexible operator among global carriers, but also the most exposed to freight-rate volatility. Its asset-light model relies heavily on chartered vessels and short-cycle network adjustments rather than long-term contract buffers. The latest quarterly results illustrate this profile clearly. Revenue for the first nine months of 2025 was 5.4 billion dollars, net income reached 443 million dollars, and cash from operations totaled 1 billion dollars. These figures represent a stabilization from the lows of 2023 but remain far below super-cycle levels, highlighting how sensitive ZIM is to shifts in spot pricing.

The company continues to reshape its fleet and partnerships. The cooperation with MSC on Asia to US East Coast and Gulf lanes provides network depth ZIM could not replicate alone and has become a strategic counterweight to its rate exposure. Fleet renewal remains a defining theme. ZIM has committed to long-duration LNG dual-fuel charters, with more than 2.3 billion dollars in future lease obligations already contracted. Lease liabilities now total 4.4 billion dollars, which reduces balance sheet flexibility but positions the fleet toward a lower-cost, more environmentally aligned profile over the next decade.

What to Watch

- Performance of the MSC partnership as a stabilizer for Transpacific volumes

- Cash discipline and the sustainability of dividends after distributing more than 470 million dollars in 2025

- Exposure to charter-rate inflation as older contracts roll

- Operational impact of Red Sea rerouting and longer voyage durations

Key Risks

ZIM remains highly rate dependent with limited downside insulation compared to asset-heavy peers. The company’s large long-term charter commitments and high lease liabilities amplify operating leverage in both directions. Regulatory inquiries, including a proposed fine related to cargo practices, add another layer of uncertainty. A prolonged period of weak spot rates, combined with elevated voyage costs and bunker volatility, would directly pressure earnings and could materially reduce dividend capacity.

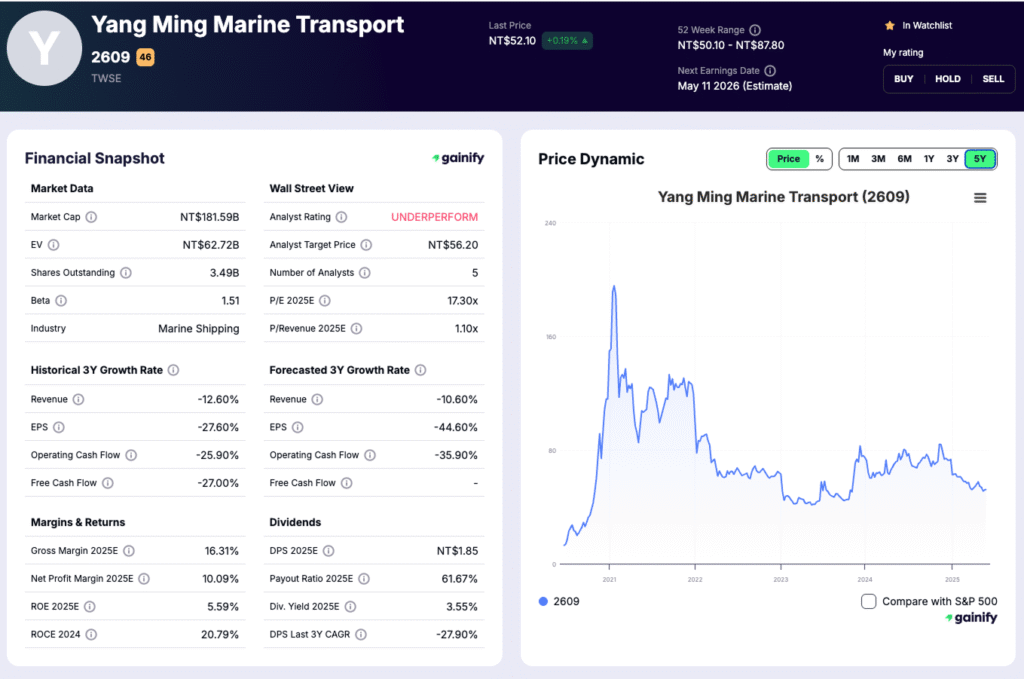

7. Yang Ming Marine (2609)

Forward P/E: 17.33x | Dividend Yield: 3.56% | Analyst Rating: Underperform

Investment Thesis

Yang Ming remains one of the most operationally disciplined carriers in Asia. Its network strength in Intra-Asia, Trans-Pacific and Middle East lanes gives it exposure to demand pockets that are more stable than long-haul Europe routes. The company reported 42.09 billion NT dollars in Q3 revenue and 6.05 billion NT dollars in after-tax profit, with cumulative nine-month profit reaching 14.81 billion NT dollars. These results confirm the business is still profitable despite structurally weaker freight rates compared to 2024.

The broader environment shaping Yang Ming is defined by persistent oversupply, regulatory tightening and geopolitical rerouting. Alphaliner estimates 6.8 percent global capacity growth against only 2.0 percent demand growth in 2025, creating pressure on operators that lack cost control. However, environmental rules such as EU ETS and FuelEU Maritime, combined with the need for fleet renewal, are expected to accelerate scrapping and slow steaming. Carriers with modern fleets and tighter networks stand to benefit, and Yang Ming is positioned toward that cohort.

Unlike the more aggressive operators, Yang Ming has emphasized operational consistency. The company has maintained schedule reliability despite Red Sea disruptions and longer voyages via the Cape, which has helped preserve customer stickiness and utilization levels. Stable performance across Intra-Asia and Middle East markets gives Yang Ming a smoother earnings base than carriers heavily tied to Asia–EU volatility.

What to Watch

- How Yang Ming adjusts its service network as Red Sea rerouting and European congestion persist

- The impact of environmental regulations on effective industry capacity and competitive positioning

- Pre-Lunar New Year shipment demand on Trans-Pacific routes

- Cost control and vessel-efficiency initiatives in a multi-year oversupply cycle

Key Risks

Global oversupply remains the principal headwind. Yang Ming’s earnings are highly sensitive to spot rate weakness, and a 2 percent demand environment leaves little room for missteps. Trade-policy swings could quickly affect Asia-centric volumes. Continued geopolitical disruptions, extended Cape routing and bunker volatility may weaken margins further. With analyst ratings skewed toward Underperform, the market is signalling limited near-term upside without a clear tightening in supply–demand balance.

Conclusion: What the Top Shipping Stocks Signal for 2026

The global container shipping industry heads into 2026 shaped by three forces oversupply, regulatory pressure and a freight market that is still trying to find equilibrium after years of volatility. Against this backdrop, the seven companies profiled in this article represent the most influential publicly listed carriers in the sector. Their decisions on capacity, network deployment and pricing will set the tone for the entire industry.

Maersk, COSCO, Hapag-Lloyd, Evergreen, HMM, ZIM and Yang Ming together account for a large share of global liner capacity, and each offers a different exposure profile. Some provide stability through integrated logistics or state-supported balance sheets. Others offer leverage to freight rate rebounds, tighter regional networks or aggressive cost discipline. Monitoring this group gives investors early visibility into where rates, volumes and margins are heading.

As carriers adapt to environmental regulation, geopolitical rerouting, and persistent equipment imbalances, the spread between winners and underperformers is likely to widen. Companies that manage capacity tightly, prioritize fleet modernization, and maintain financial flexibility will be better positioned for eventual recovery. Those that rely on spot markets or carry heavier balance-sheet risk may continue to struggle.

For investors seeking exposure to global trade, these seven shipping stocks provide a critical window into sector health and future pricing dynamics. While the immediate outlook remains mixed, the structural shifts underway today will define competitiveness for the next cycle. Staying focused on execution, balance-sheet strength and network strategy will be essential for identifying which carriers emerge stronger as the industry transitions into its next phase.