The US electric-utilities sector enters 2026 from a position of unusual strength. At a time when many industries are still digesting inflation, interest-rate swings and uneven economic signals, utilities stand out for one simple reason: their fundamentals are anchored in stability.

Electricity demand continues to rise across the country, driven by population growth, data centres, AI load, electric-vehicle adoption and expanding industrial activity. At the same time, utilities benefit from predictable regulated earnings, long-term capital programs and some of the most dependable cash flows in public markets.

For investors, this combination makes electric utilities one of the few sectors where visibility, predictability and defensive strength remain intact heading into 2026. But not all utilities are created equal. The companies that dominate today pair strong regulation with expanding rate bases, clean-energy development, modern grid infrastructure and disciplined capital planning.

Below are the five US utility stocks best positioned for the years ahead — the names that combine scale, financial resilience and the structural advantages needed to outperform in a fast-changing energy landscape.

Highlights

- Electric utilities remain one of the most stable cash-flow sectors heading into 2026, supported by predictable regulation and long-duration capital programs.

- Electricity demand is accelerating due to AI data centers, electrification and population growth, strengthening long-term rate-base expansion.

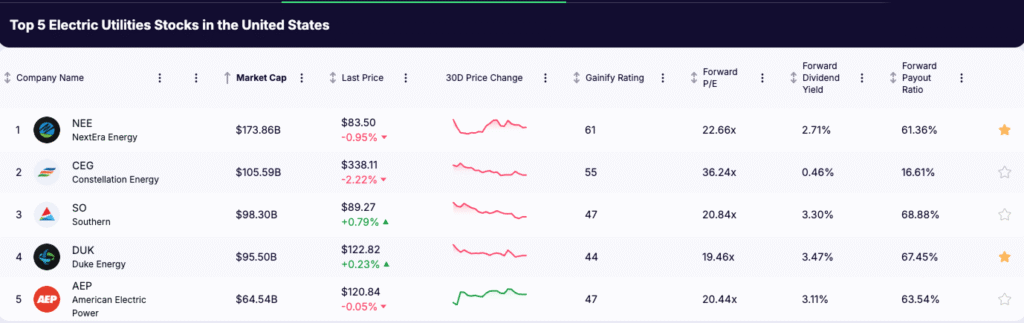

- Five leaders stand out for scale, financial strength and long-term earnings visibility: NextEra Energy, Constellation Energy, Southern Company, Duke Energy and American Electric Power.

Just open the Gainify stock screener to spot similar stocks.

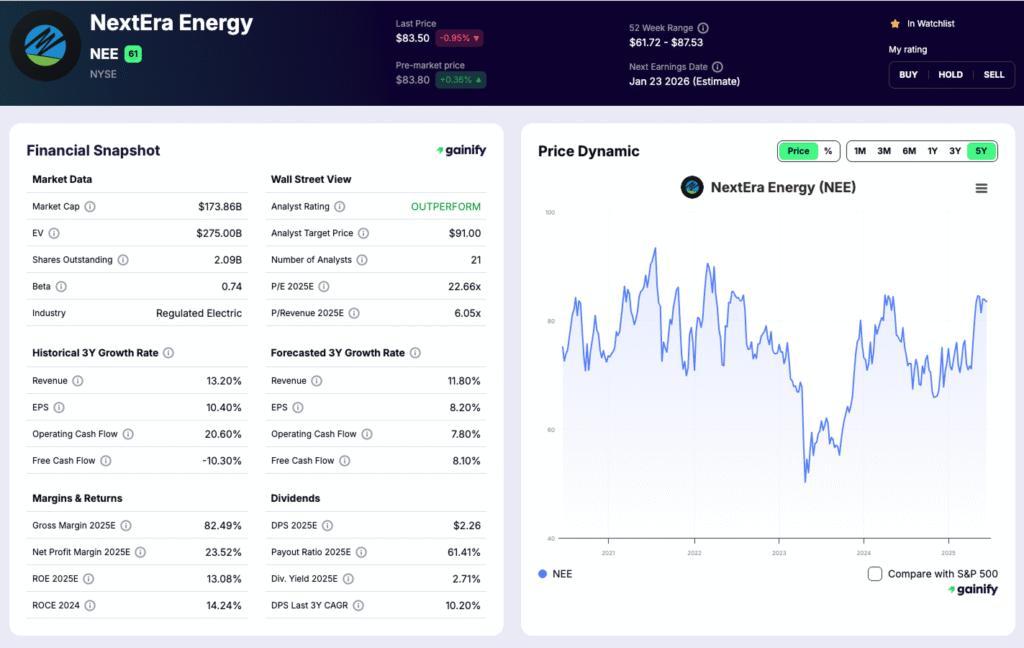

1. NextEra Energy (NEE)

Market cap: $173.9B

Forward P/E: 22.66x

Forward dividend yield: 2.71%

Payout ratio: 61.36%

Overview

NextEra Energy is the largest electric utility in the US and the leading clean-energy developer in North America. Its structure combines a stable regulated Florida utility with the country’s biggest contracted renewables platform. With rate-base growth running near 8–10 percent, customer additions around 2 percent, and a renewables backlog measured in tens of gigawatts, NEE offers one of the clearest long-term growth runways in the sector.

Recent Developments (Q3 2025)

- Florida Power & Light delivered steady earnings supported by multi-year rate-base expansion.

- The renewables pipeline added several gigawatts of new contracted solar and storage capacity.

- Operating cash flow improved on stronger regulated contributions and working-capital normalization.

Investment Thesis

NextEra remains the sector’s strongest growth compounder. Its renewables scale, cost leadership and supportive Florida regulation provide high visibility, with the potential for high-single-digit earnings growth and lower volatility than peers. As grid investment and decarbonization accelerate, NEE is positioned to capture an outsized share of US clean-energy development.

Key Risks

Execution on renewables development, regulatory outcomes in Florida and capital-cost inflation that could pressure project economics.

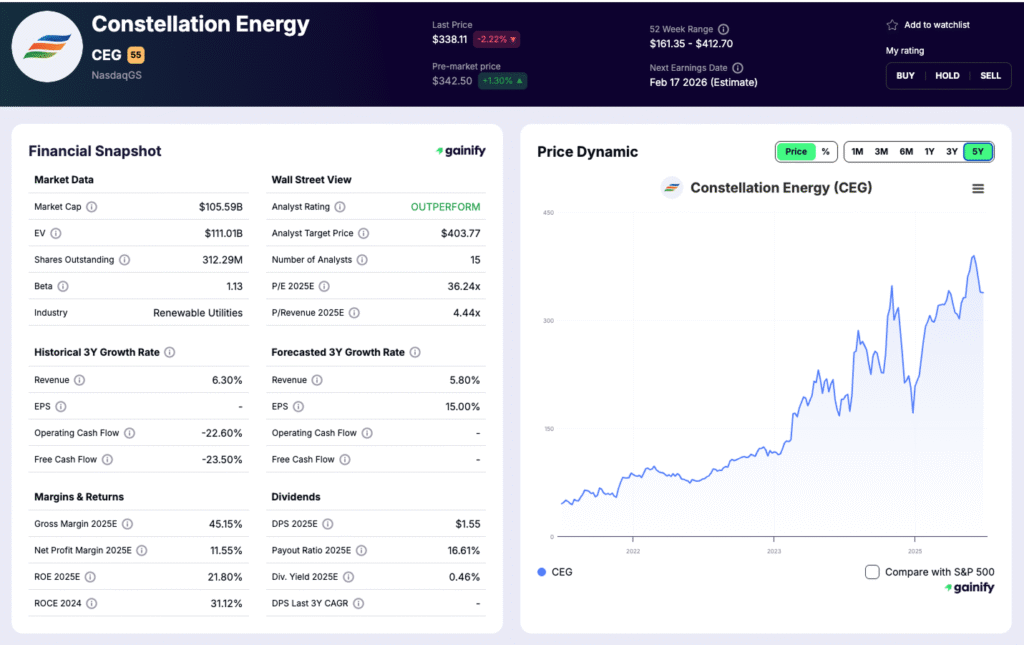

2. Constellation Energy (CEG)

Market cap: $105.6B

Forward P/E: 36.24x

Forward dividend yield: 0.46%

Payout ratio: 16.61%

Overview

Constellation Energy is the largest producer of carbon-free baseload power in the US, anchored by a high-performing nuclear fleet that consistently delivers industry-leading availability. Its business model carries more merchant exposure than regulated peers, giving CEG enhanced earnings leverage to power pricing, load growth and zero-carbon demand. With a nuclear fleet generating more than 20% of the nation’s clean power, and long-dated production credits supporting cash flow, CEG sits at the center of rising system-reliability needs.

Recent Developments (Q3 2025)

- Operating earnings improved on stronger realized pricing and well-timed hedges across the nuclear fleet.

- Fleet availability remained above 90%, supporting stable generation and cost performance.

- Cash flow benefited from production-tax-credit uplift and an improved hedge profile for 2026–2027.

Investment Thesis

CEG offers one of the purest ways to own zero-carbon baseload power at scale. Its nuclear assets provide scarcity value as data-center and industrial load accelerate across key markets. Strong fleet performance, tax-credit benefits and disciplined hedging translate into high cash-flow conversion. For investors seeking clean-energy leverage with real operational depth, CEG remains a top-tier choice.

Key Risks

Merchant-price volatility, regulatory changes affecting nuclear incentives and outage-timing variability that can affect quarterly results.

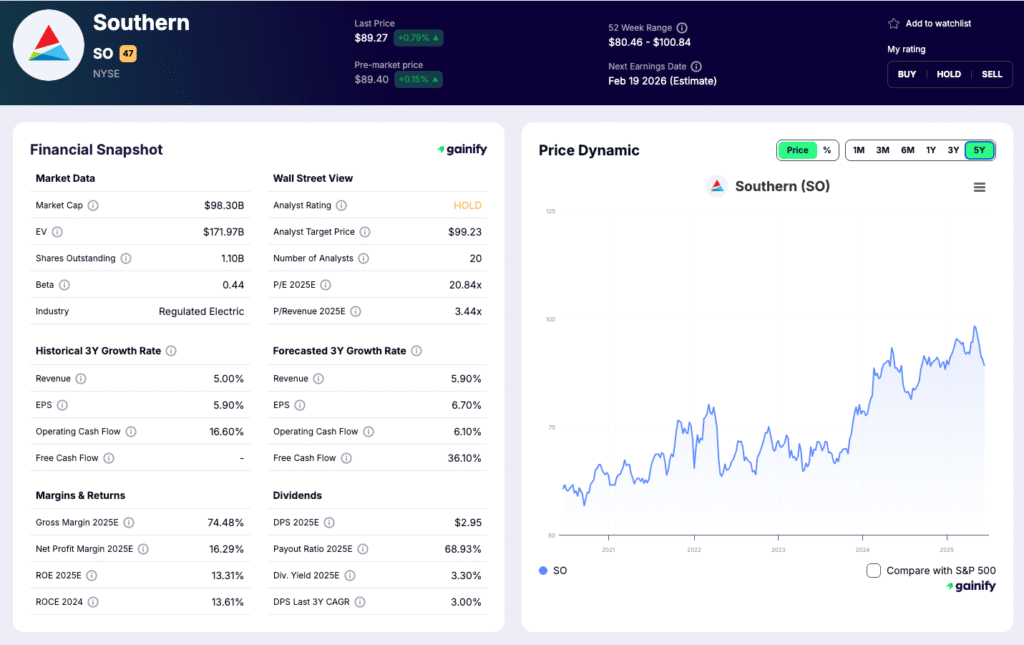

3. Southern Company (SO)

Market cap: $98.3B

Forward P/E: 20.84x

Forward dividend yield: 3.30%

Payout ratio: 68.88%

Overview

Southern Company is one of the most stable regulated utilities in the US, serving fast-growing Southeastern regions with constructive regulatory frameworks. Its earnings base is anchored in regulated electric and gas operations with rate-base growth running in the mid-single digits and customer growth consistently above 1% across key service territories. With Vogtle Units 3 and 4 now online, SO benefits from newly added long-duration, carbon-free baseload capacity.

Recent Developments (Q3 2025)

- Regulated utilities delivered steady earnings expansion supported by continued customer growth and multi-year capital programs.

- Vogtle Unit 4 continued to ramp toward full operational output, providing incremental nuclear baseload.

- Operating costs remained controlled, contributing to modest margin improvement across the regulated portfolio.

Investment Thesis

Southern Company remains a core defensive holding for investors seeking predictable earnings and dependable income. With major construction overhangs now resolved and a clearer capital-investment path, SO is positioned for more stable free-cash-flow generation into 2026. Strong population inflows, constructive regulation and improving cost discipline support consistent long-term performance.

Key Risks

Performance of newly added nuclear units, storm-driven variability in service territories and the timing and outcomes of regulatory proceedings.

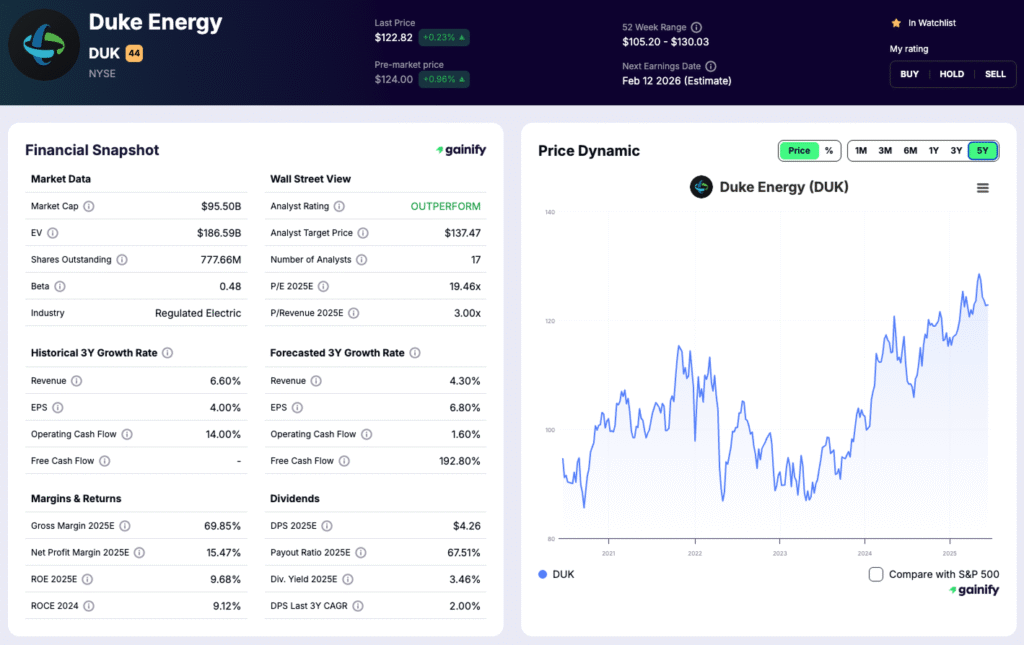

4. Duke Energy (DUK)

Market cap: $95.5B

Forward P/E: 19.46x

Forward dividend yield: 3.47%

Payout ratio: 67.45%

Overview

Duke Energy is one of the largest regulated electric utilities in the US, serving the Carolinas, Florida, Indiana, Ohio and Kentucky. Its earnings base is built on diversified regulated operations with rate-base growth tracking in the 5–7% range, supported by grid modernization, transmission upgrades and ongoing coal retirements. Customer growth in the Carolinas and Florida remains a structural advantage, contributing to steady load expansion.

Recent Developments (Q3 2025)

- Adjusted earnings increased on strong electric-utilities performance and improving commercial and industrial load.

- Grid-modernization and clean-energy investments stayed on schedule, supported by constructive regulatory decisions across core states.

- Efficiency and cost-control initiatives continued, helping maintain margin stability despite rising capital needs.

Investment Thesis

DUK offers a balanced mix of income stability, regulated growth and defensive characteristics. Its multi-state regulatory footprint reduces single-jurisdiction risk, while demographic trends across the Southeast reinforce long-term load growth. With a multi-year capital plan focused on grid resiliency and clean-generation transition, Duke delivers predictable earnings visibility and a secure dividend profile.

Key Risks

Regulatory-case outcomes, execution risk across large capital programs and storm-related cost variability across its geographically broad footprint.

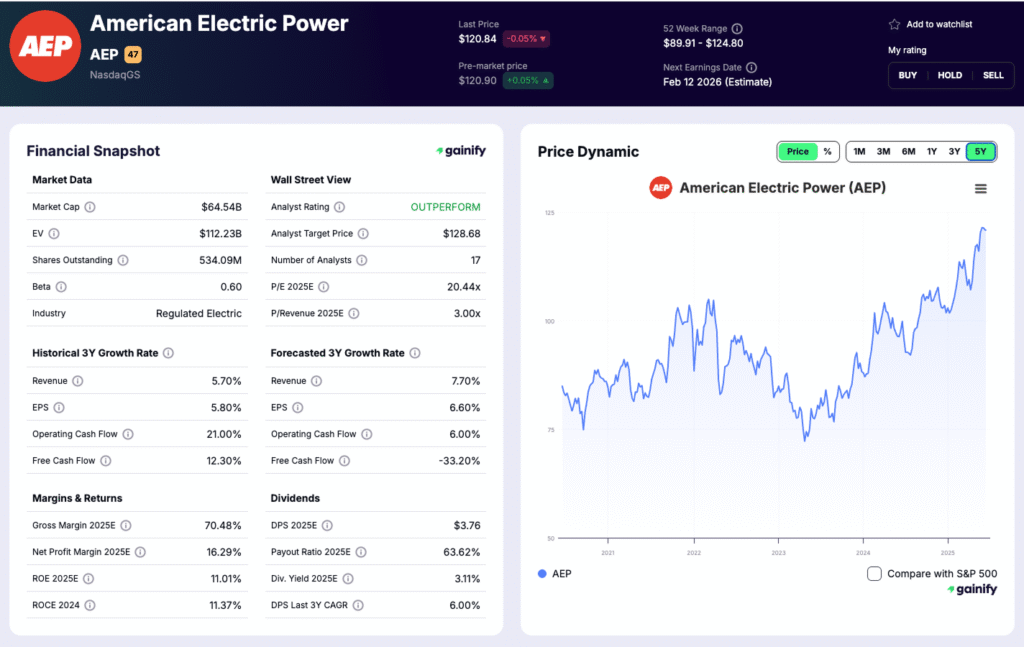

5. American Electric Power (AEP)

Market cap: $64.5B

Forward P/E: 20.44x

Forward dividend yield: 3.11%

Payout ratio: 63.54%

Overview

American Electric Power is one of the largest regulated transmission and distribution utilities in the US, operating across 11 states with a diversified regulatory footprint. Transmission remains its highest-return business, supporting high-single-digit rate-base growth and giving AEP one of the most stable long-term earnings profiles in the sector. Continued grid modernization, system hardening and aging-infrastructure replacement underpin the company’s multi-year visibility.

Recent Developments (Q3 2025)

- Earnings benefited from transmission-driven rate-base expansion and improving distribution performance across several jurisdictions.

- Industrial and commercial load trends remained steady, supported by regional manufacturing and data-center activity.

- Operating cash flow strengthened as regulatory outcomes improved and cost discipline offset ongoing capital needs.

Investment Thesis

AEP’s investment case rests on its long-duration transmission strategy, which delivers above-average returns and stable year-over-year visibility. The company’s broad regulatory exposure reduces concentration risk, while its capital plan is closely aligned with national grid-expansion needs. For investors seeking defensive earnings, a reliable dividend and predictable growth, AEP remains a high-quality core utility holding.

Key Risks

Rate-case timing, cost inflation in transmission projects and weather-driven volume fluctuations across its multi-state service territory.

2026 Outlook for US Electric Utilities

The strategic landscape in 2026 is shaped less by macro policy and more by the evolving demands placed on the grid:

- Electricity demand is accelerating, led by data-center expansion, electrification and AI-driven load requirements.

- Affordability pressure is rising as capital spending outpaces household income growth.

- Digital modernization and cybersecurity are now essential, not optional.

- Data governance and analytics increasingly determine a utility’s ability to plan and justify rate-base growth.

- Regulatory alignment and public trust remain decisive in approving capital programs and securing cost recovery.

Utilities that execute efficiently, maintain regulatory credibility and deploy capital strategically will lead the sector into the next growth cycle.

Final Take: The Strongest Names in US Electric Utilities

NextEra Energy, Constellation Energy, Southern Company, Duke Energy and American Electric Power stand out as the sector’s most resilient and strategically positioned utilities. Together, they offer the strongest blend of regulated earnings stability, long-term capital-program visibility and structural demand growth as the US grid modernizes.

Each company provides a distinct investment profile:

- NextEra Energy delivers unmatched clean-energy scale paired with a highly stable regulated base.

- Constellation Energy offers scarce carbon-free baseload generation with significant operating leverage.

- Southern Company provides a reliable dividend and enduring regulated visibility across fast-growing regions.

- Duke Energy benefits from population-driven load growth and a multi-year grid-modernization runway.

- American Electric Power anchors its strategy in high-return transmission investment and broad regulatory diversification.

For investors seeking predictable cash flow, defensive positioning and dependable long-term growth, these five companies form the core of the US electric-utilities landscape heading into 2026.

Disclaimer

This article is provided for informational and educational purposes only and does not constitute financial, investment or trading advice. The information reflects publicly available data and general market commentary and may not account for the most recent developments. Investors should conduct their own research or consult a qualified financial professional before making any investment decisions.