Copper isn’t just another industrial metal. It’s the wiring, circulation system and structural backbone of the energy transition.

Every EV motor.

Every transformer.

Every AI data center.

Every solar and wind installation.

Every kilometer of upgraded grid infrastructure.

All of it requires copper, often in far greater quantities than legacy systems ever used. As electrification accelerates across continents and supply growth remains constrained by geology, permitting hurdles and years of underinvestment, the long-term fundamentals for copper stay structurally tight.

For investors, large-cap copper stocks provide one of the most direct and reliable ways to capture this multi-decade trend. The analysis below covers five of the world’s largest copper producers by output, including their core assets, current positioning, analyst expectations and key risks.

Highlights:

- Copper demand is accelerating while supply stays constrained, creating a durable long-term tightness.

- Large-cap copper producers offer the most direct and reliable exposure to the electrification megatrend.

- Each major producer carries distinct upside and risks, allowing targeted and balanced portfolio construction.

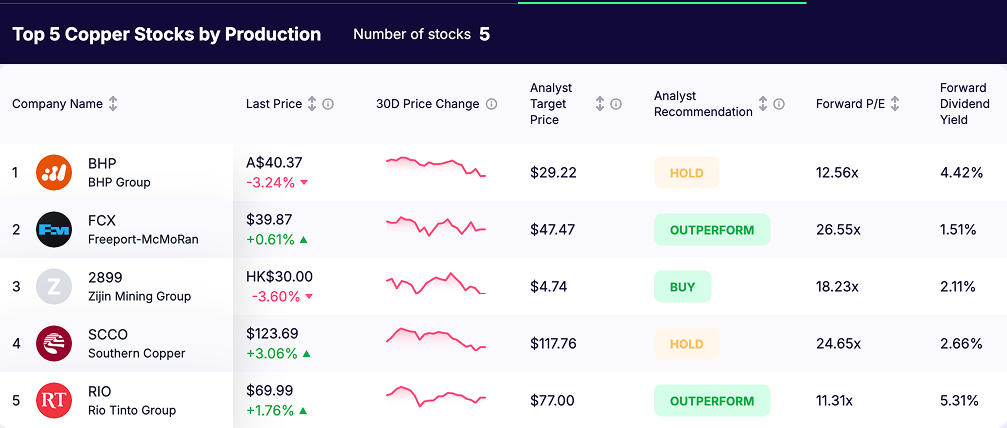

Top 5 Listed Copper Stocks by Production

As global electrification accelerates, only a handful of publicly traded miners have the scale, reserves and operational depth to meet the world’s rising copper needs. These industry leaders consistently rank among the largest producers on the planet, shaping supply dynamics and driving long-term investment trends across energy, infrastructure and technology. Below is a closer look at the top five listed copper stocks by production, each offering unique exposure to the structural copper shortage and the multi-decade electrification boom.

You can identify stocks in this category by filtering for ‘Copper’ in the Industry input of the Gainify stock screener.

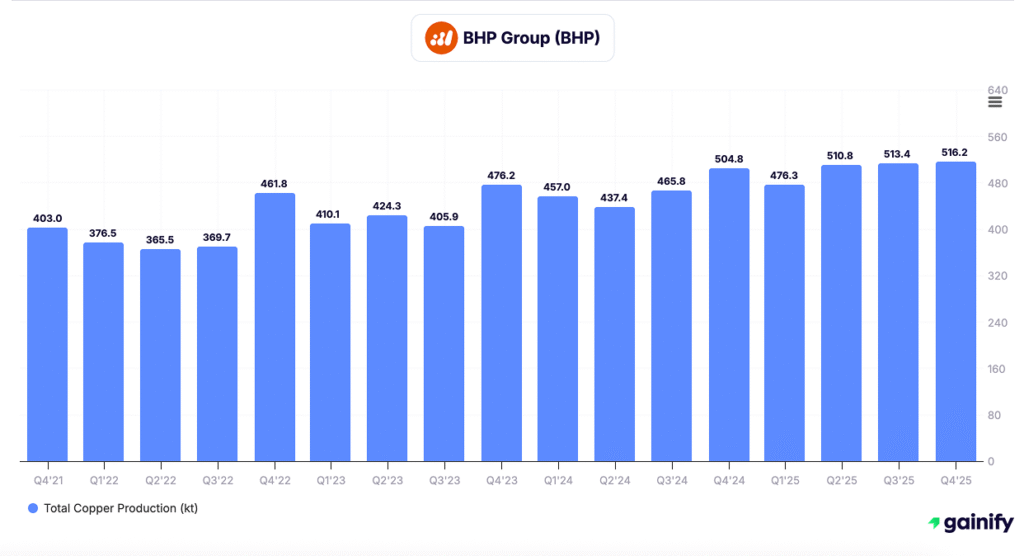

1. BHP Group (BHP)

A diversified major with industry-leading copper scale

Key Financials (Nov 2025)

- Analyst Target Price: A$29.22

- Analyst Rating: Hold

- P/E 2025E: 12.56x

- Dividend Yield 2025E: 4.42%

Overview

BHP entered FY26 with solid operating momentum, particularly in copper. Group copper output reached 493.6 kt in the September 2025 quarter, a 4 percent year-on-year increase supported by strong performance at Escondida and stable operations in Australia and Peru. The company continues to prioritize reliability, incremental growth and disciplined capital allocation. Regulatory progress at key Chilean assets further improves medium-term visibility.

Core Assets and Production

Escondida (Chile):

Quarterly production increased to 328.9 kt. Record concentrator throughput and better recoveries offset grade softness, while cathode volumes improved as leaching upgrades ramped.

Spence / Pampa Norte (Chile):

Produced 55.8 kt, slightly lower due to expected grade transitions. Processing performance remains stable and annual guidance is unchanged.

Copper South Australia:

Olympic Dam, Prominent Hill and Carrapateena contributed 72.6 kt. Strong smelting and refining throughput helped balance normal grade variability, and major maintenance at Olympic Dam was completed on schedule.

Antamina (Peru):

Delivered 33.9 kt of copper. Higher zinc by-products supported unit costs and operations remained consistent.

Recent Developments

BHP secured environmental approval for the Laguna Seca Expansion at Escondida, enabling early infrastructure work and supporting future throughput growth. The permit application for the new Escondida concentrator remains on track for submission later in FY26. The company also strengthened its balance sheet through multi-currency bond issuances and a renewed credit facility. Construction at the Jansen potash project continued to advance, though copper remains the primary strategic driver in the current cycle.

Investment View

BHP offers a combination of scale, stability and credible copper growth. Its largest assets are long-life, competitively positioned and supported by consistent operational execution. This provides meaningful exposure to tightening copper fundamentals while keeping portfolio volatility lower than pure-play miners.

Key Risks

The company remains sensitive to Chilean fiscal and regulatory conditions. Diversification across iron ore and coal reduces direct copper torque. Large multi-year projects, including expansions at Escondida and the build-out at Jansen, carry execution risk.

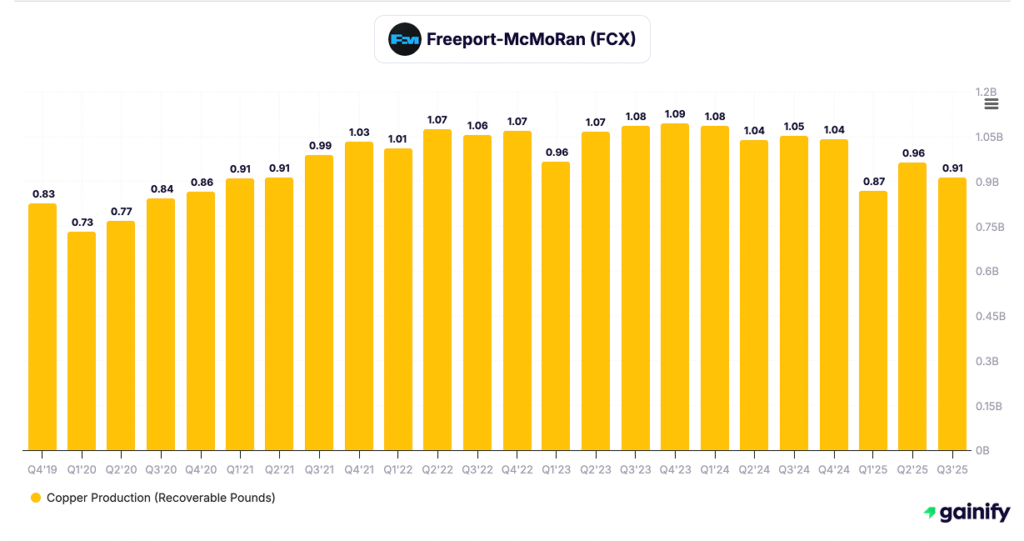

2. Freeport-McMoRan (FCX)

A pure-play copper leader with stable U.S. volumes and improving Indonesian visibility

Key Financials (Nov 2025)

- Analyst Target Price: $47.47

- Analyst Rating: Outperform

- P/E 2025E: 26.55x

- Dividend Yield 2025E: 1.51%

Overview

Freeport-McMoRan remains one of the most direct ways to gain exposure to global copper fundamentals. The company entered the final quarter of 2025 with consistent operating performance and a clearer recovery path at Grasberg following the mud-rush incident earlier in the year. Consolidated copper sales for 3Q25 totaled 977 million pounds compared with 1,035 million pounds a year earlier, reflecting lower ore grades and temporary constraints in Indonesia. U.S. and South American volumes remained steady, while gold volumes increased materially as Grasberg continued to normalize.

Core Assets and Production

United States: U.S. operations delivered 339 million pounds of copper in the quarter, matching last year’s levels. Margins remain stable, aided by by-product credits and cost control. The region continues to be Freeport’s most predictable source of production.

South America: Operations in Peru and Chile produced 278 million pounds of copper, slightly below last year’s 293 million pounds. Cerro Verde performed well, and gold by-products from South America helped support unit costs.

Indonesia (Grasberg): Grasberg sales totaled 360 million pounds of copper and 554 thousand ounces of gold. Copper volumes declined year over year, but gold volumes rose sharply as underground production sequencing improved. The site’s cost profile benefited from strong by-product credits, which reduced unit cash costs for the region to a negative number.

Recent Developments

Freeport generated $1.7 billion in operating cash flow in the quarter and maintained a conservative balance sheet with $4.3 billion in cash and net debt of $5.0 billion. Liquidity across all credit lines remained strong. Unit net cash costs for the group held at $1.40 per pound, supported by higher gold prices and improved recovery rates. The company reiterated its FY25 copper sales outlook of 3.5 billion pounds, although execution will depend on continued stability at Grasberg and shipment timing into year-end.

Investment View

Freeport offers clean leverage to copper prices supported by long-life assets in the United States, South America and Indonesia. Grasberg’s gold by-product strength continues to underpin cash costs, while U.S. leaching initiatives provide upside in the medium term. The balance sheet is strong, capital discipline remains firm and the company continues to favor organic growth over acquisitions.

Key Risks

Operational sequencing remains a factor at Grasberg. Indonesia carries regulatory and export-duty risk. The company maintains high sensitivity to copper and gold prices due to its pure-play exposure.

3. Zijin Mining Group (2899)

High-growth global producer with expanding output and rising asset depth

Key Financials (Nov 2025)

- Analyst Target Price: HK$4.74

- Analyst Rating: Buy

- P/E 2025E: 18.23x

- Dividend Yield 2025E: 2.11%

Overview

Zijin Mining continues to position itself as one of the fastest-growing diversified metals producers. Through the first nine months of 2025, the company reported strong operational momentum driven by higher production, new asset contributions and disciplined financial management. Revenue for the period reached USD 3.41 billion, with net profit attributable to shareholders of USD 905 million. Operating cash flow totaled USD 1.08 billion, reflecting solid margins during a year of elevated commodity prices.

Core Assets and Production

The group’s portfolio spans large copper, gold and battery-metals operations across China, Africa, Central Asia and Europe. For the nine months ended September 2025, Zijin’s gold subsidiary produced 32 tonnes of mined gold, supported by improved performance across legacy assets and the addition of new producing mines. The Porgera Mine more than doubled its contribution, adding 767 kilograms of attributable output in the third quarter following its operational restart.

Two major acquisitions closed during the year: the Akyem Gold Mine in Ghana and the Raygorodok Mine in Kazakhstan. Both have begun contributing to production and earnings. These assets materially expand the company’s reserve base and reinforce Zijin’s long-term production profile.

Recent Developments

Total assets increased to USD 10.9 billion by September 2025, compared with USD 5.4 billion at year-end 2024, reflecting the addition of new mines and strong operating cash generation. Net current assets rose to USD 3.84 billion, while the debt-to-asset ratio declined to 28.5 percent, indicating a stronger balance sheet and lower leverage risk. All-in sustaining costs increased to USD 1,574 per ounce, mainly due to higher royalty expenses linked to elevated gold prices.

Management expects a strong fourth quarter, supported by favorable pricing, higher throughput at recently acquired assets and ongoing efforts to improve recovery rates and operational efficiency.

Investment View

Zijin offers a high-growth production profile backed by a broad global footprint and a strong acquisition pipeline. The company remains well aligned with China’s strategic metals priorities and continues to generate solid cash flow, supporting further expansion. Its diversified portfolio provides exposure to copper, gold and emerging battery metals at scale.

Key Risks

Exposure to higher-risk jurisdictions adds political, regulatory and community-relations considerations. Integration of newly acquired assets requires consistent execution. Governance practices and transparency remain areas closely watched by institutional investors.

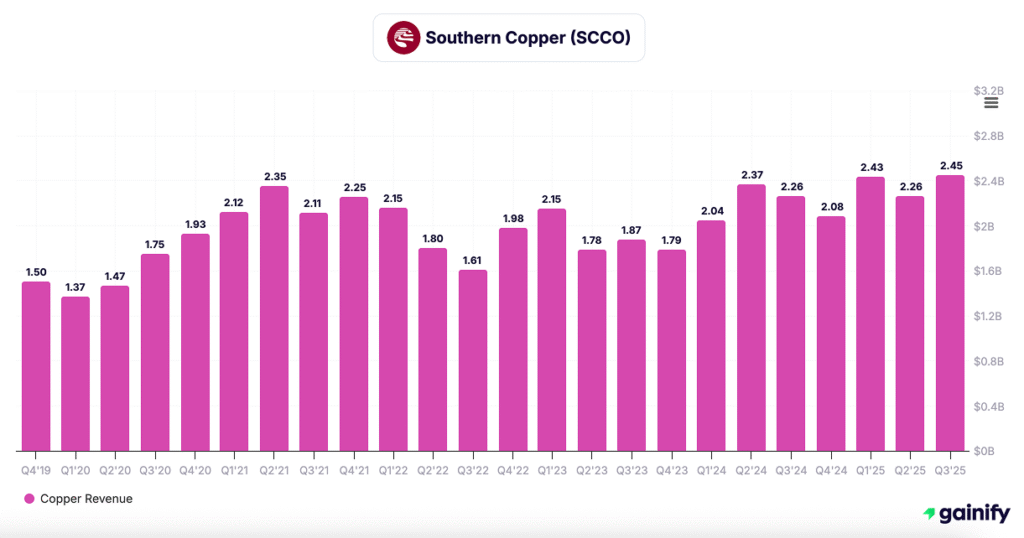

4. Southern Copper (NYSE: SCCO)

Long-life, low-cost producer with unmatched reserves and visible growth

Key Financials (Nov 2025)

- Analyst Target Price: $117.76

- Analyst Rating: Hold

- P/E 2025E: 24.65x

- Dividend Yield 2025E: 2.66%

Overview

Southern Copper enters 2026 with one of the strongest structural positions in the global copper sector. The company maintains the largest copper reserves of any listed miner, at 51.1 million tonnes as of December 2024, and delivered 959 thousand tonnes of copper production in 2025 based on management estimates. The asset base spans large-scale open-pit operations in Mexico and Peru, supported by integrated smelting and refining capacity. SCC’s portfolio continues to demonstrate stability, low unit costs and clear visibility into future volume growth.

Core Assets and Production

Production remains balanced across two major jurisdictions. According to the company’s operational profile on page 11, Mexico accounted for 547.9 kt of copper in 2025E, led by Buenavista (418.1 kt) and La Caridad (87.3 kt). Peru contributed 410.9 kt, driven primarily by Toquepala (249.5 kt) and Cuajone (161.4 kt). These four large open-pit mines anchor SCC’s volume and provide long mine life and operating leverage.

The company also operates smelters, refineries and regional underground mines that support integration and help stabilize unit costs. By-products, including molybdenum, zinc and silver, contribute meaningful credits. Zinc production reached 174.7 kt in 2025E, while molybdenum totaled 30 kt, supporting one of the lowest cost structures in the industry.

Cost Performance

Southern Copper continues to deliver one of the industry’s most competitive cost positions. Cash cost net of by-products was USD 0.61 per pound for the first nine months of 2025, placing SCC at the lower end of the global copper producer cost curve. Operating cash cost before credits was USD 2.13 per pound, consistent with multi-year averages and reflecting stable smelting and refining performance. These metrics highlight SCC’s ability to generate strong margins even during periods of price volatility.

Recent Developments

The company reinforced its balance sheet through strong operating cash flow and maintained conservative leverage. 2025 EBITDA is expected to reach USD 6.6 billion with an EBITDA margin of 56 percent, placing SCC among the top-performing majors. Capital expenditures continue to scale, with a planned USD 1.38 billion in 2025 rising significantly over the next decade as SCC accelerates investment in its pipeline. Key growth projects include Tía María, Los Chancas, Michiquillay and El Arco, all of which appear in the long-term production and capex schedule. According to the project roadmap on pages 19–20, copper production is projected to approach 1.7 million tonnes by 2033.

Investment View

Southern Copper offers one of the clearest multi-decade copper exposures in the market. Its combination of long-life reserves, low costs, high integration and a robust pipeline positions the company as a structural winner in a tightening copper market. SCC’s capital discipline, strong free cash flow generation and consistent dividend history continue to attract long-term institutional investors.

Key Risks

The company faces above-average exposure to Peru, where social and permitting disruptions remain a recurring issue. Large-scale projects such as Tía María and Michiquillay require long permitting cycles and community alignment. Market sensitivity to copper prices remains high despite low costs.

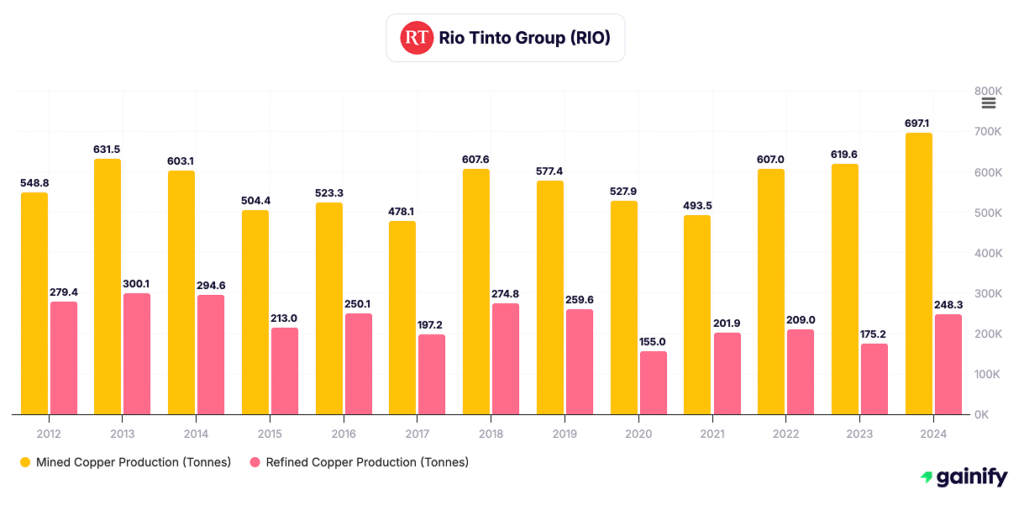

5. Rio Tinto (NYSE: RIO)

A diversified miner with accelerating copper growth from Oyu Tolgoi

Key Financials (Nov 2025)

- Analyst Target Price: $77.00

- Analyst Rating: Outperform

- P/E 2025E: 11.31x

- Dividend Yield 2025E: 5.31%

Overview

Rio Tinto enters late 2025 with improving operational performance and growing exposure to energy-transition metals. Copper production accelerated meaningfully in the first half of the year, supported by the ongoing ramp-up at Oyu Tolgoi and solid performance at Escondida. The company delivered resilient financial results despite weaker iron ore pricing, with copper and aluminium providing a larger share of earnings. According to the copper segment data on page 30, segmental revenue rose 41 percent year on year, underlying EBITDA increased 69 percent, and operating cash flow jumped 39 percent, reflecting stronger volumes and higher realized prices.

Core Assets and Production

Rio Tinto’s copper business is anchored by three major regions: Mongolia, Chile and the United States. According to the production table on page 30, mined copper on a consolidated basis reached 438 kt in the first half of 2025, positioning RIO on track for full-year production of 780–850 kt, toward the upper end of guidance.

Oyu Tolgoi (Mongolia) continued its multi-year ramp. As highlighted on pages 4 and 11, copper production rose more than 50 percent year on year, driven by higher underground volumes, strong grades and more efficient mining cycles. This asset remains on track to average approximately 500 kt per year from 2028 through 2036.

Escondida (Chile) delivered higher grades and improved plant throughput, contributing visible gains to consolidated volumes.

Kennecott (United States) advanced its restructuring program, reducing its full-time workforce by around 10 percent compared with H1 2024. This helped lower C1 unit costs, which have now been revised downward to 110–130 cents per pound for 2025.

Recent Developments

Rio Tinto delivered 6 percent copper-equivalent production growth in the first half of 2025, according to the chart on page 4, driven by the strength of Oyu Tolgoi and improving grades at Escondida. The group also benefited from higher aluminium prices and record bauxite production.

Financially, the company generated USD 6.9 billion in operating cash flow and maintained strong liquidity with no major bond maturities until 2027 . Capital investment of USD 4.5 billion in the first half reflects increased spending on growth and decarbonization projects, all delivered within planned budgets.

Investment View

Rio Tinto provides diversified and growing exposure to copper at a time when the market is tightening. Oyu Tolgoi is shifting from a multi-year investment to a major free cash flow contributor. Escondida continues to perform well, and Kennecott’s cost improvements support margin recovery. The broader portfolio adds resilience, while the balance sheet supports continued investment across copper, lithium and iron ore.

Key Risks

Rio Tinto faces permitting and geopolitical complexity in Mongolia, grade variability in Chile, and ongoing sensitivity to iron ore prices, which still dominate group earnings. Large-scale projects such as Simandou and Oyu Tolgoi require sustained execution discipline.

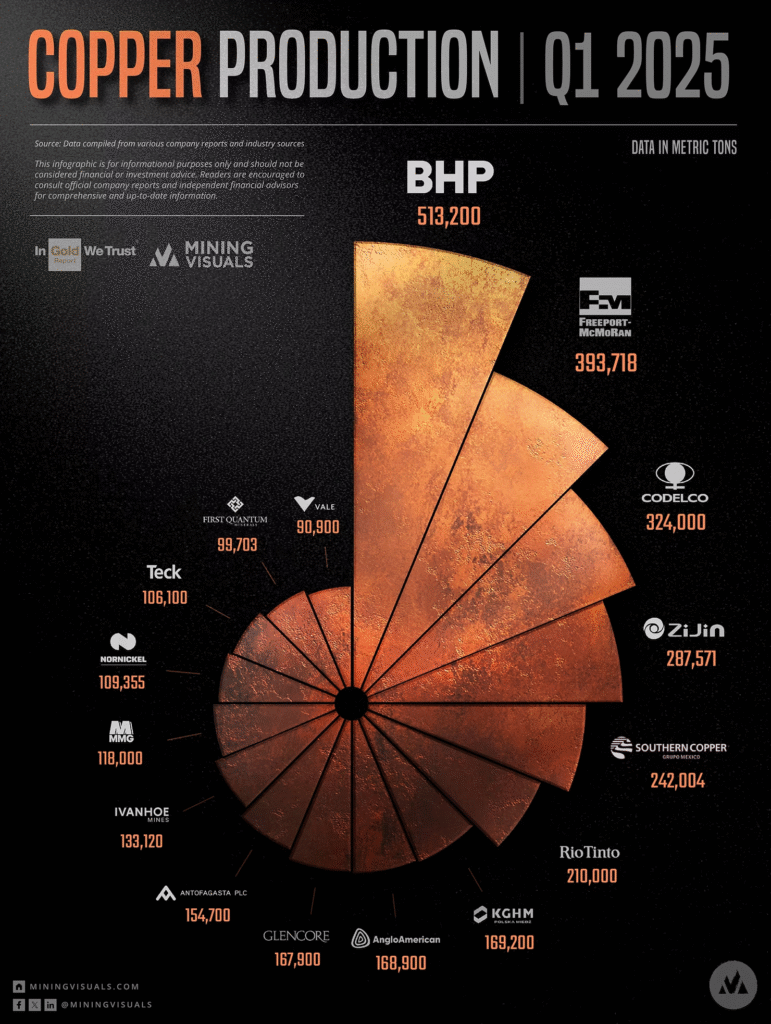

Global Copper Miners: Market Overview

Copper production remains concentrated among a select group of large operators with the scale to influence global supply. Q1 2025 results confirm a stable leadership structure at the top of the industry. BHP reported the highest quarterly output among publicly listed companies with 513,200 tonnes. Freeport-McMoRan followed with 393,718 tonnes despite a temporary decline linked to grade transitions at Grasberg. Chile’s Codelco ranked third with 324,000 tonnes. Codelco remains one of the most important producers globally, but it is not publicly listed, which limits direct investor access.

Beyond the top three, output is distributed across a group of diversified multinationals and regionally focused operators. Zijin Mining delivered 287,571 tonnes supported by strong operational performance across Asia, Europe and Africa. Southern Copper produced 242,004 tonnes, maintaining its position as one of the lowest-cost and longest-life operators in the sector. Glencore reported 167,900 tonnes following a weaker quarter driven by mine-specific constraints.

Together, these producers form the investable core of the copper supply chain. Their performance provides visibility into industry trends, including grade variability, asset ramp-ups, and long-term production optionality. The list below outlines the largest copper producers by Q1 2025 output and highlights the relative scale of each operator.

Top Copper Producers by Output (Q1 2025)

Tonnes of copper produced

- BHP Group: 513,200

- Freeport-McMoRan: 393,718

- Codelco*: 324,000

- Zijin Mining: 287,571

- Southern Copper: 242,004

- Rio Tinto: 210,000

- KGHM Polska: 169,200

- Anglo American: 168,900

- Glencore: 167,900

- Antofagasta: 154,700

Where Copper Is Used: The Core Drivers of Global Demand

Copper is critical to the functioning of modern industrial systems. Its combination of conductivity, durability and recyclability makes it the preferred metal for virtually all electrical infrastructure. As electrification accelerates, copper’s demand profile becomes increasingly tied to long-term structural themes rather than cyclical industrial activity.

Electrification and Power Infrastructure

Copper is fundamental to the transmission, distribution and transformation of electricity. It is used extensively in power cables, transformers, substations, switchgear and grid upgrades. With global grids aging and renewable penetration increasing, utilities are expanding copper-intensive investments at the fastest pace in decades. Grid modernization alone is expected to remain one of copper’s largest and most durable demand pillars.

Electric Vehicles and Charging Networks

EVs require significantly more copper than internal combustion vehicles. Battery packs, inverters, motors, wiring harnesses and thermal management systems all depend on copper. A typical EV contains two to four times more copper than a conventional vehicle. Charging infrastructure adds another layer of structural demand, with each fast-charging station requiring substantial amounts of high-grade copper wiring and power electronics.

Renewable Energy Systems

Wind and solar installations are copper-heavy. Wind turbines require large quantities of copper in their generators, power cables and transformers, particularly offshore models with long subsea transmission lines. Solar PV systems use copper in panel connections, inverters and grid interconnection systems. As the global build-out of renewables scales, copper remains a non-substitutable input.

Data Centers and Digital Infrastructure

The rapid growth of AI and cloud computing is increasing the intensity of electrical demand in data centers. Copper is used in power distribution units, cooling systems, high-capacity busbars and backup generation infrastructure. While fiber optics support long-distance data movement, short-range, high-capacity electrical systems inside data centers remain copper-based.

Construction and Industrial Applications

Traditional demand sources remain stable. Plumbing, HVAC systems, building wiring and industrial machinery all rely on copper’s thermal and electrical properties. Industrial automation, robotics and semiconductor manufacturing also require copper-rich components.

Final Take: Positioning Copper Stocks in a Portfolio

These five companies offer distinct ways to participate in the copper cycle as demand accelerates across electrification, transport, renewables and digital infrastructure.

High leverage to copper: FCX and SCCO

Diversified, lower-volatility exposure: BHP and Rio Tinto

High-growth emerging market exposure: Zijin

The structural backdrop is intact. Demand continues to rise. Supply remains constrained. Electrification is not optional. These fundamentals support a long multi-year trend in which large-cap producers hold a central role.

For investors building exposure, a balanced allocation across these names provides a blend of stability, growth and price torque. Together, they represent the investable core of the global copper supply chain and a clear way to participate in the next phase of the energy and infrastructure transition.

Disclaimer

This material is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations or an offer to buy or sell any securities. Readers should conduct their own research or consult a qualified financial professional before making any investment decisions.