The solar stocks are shining brightly of late, and solar stocks are heating up in 2025 alongside it. With record-breaking global installations and growing demand for clean energy, investors are turning their attention to this fast-growing sector.

The Invesco Solar ETF (TAN) is up almost 38.6% year to date, compared to 15.7% for the broader market, showing how strongly solar stocks are out-performing this year.

Whilst China may lead the charge in production, innovation from the United States and other regions is reshaping the competitive landscape. From large-scale solar projects to smart energy technologies for residential installations, opportunities are emerging across the entire value chain.

In this article, we highlight the top 10 solar stocks to watch in 2025, exploring the companies driving growth, embracing innovation, and positioning themselves at the forefront of the solar energy revolution.

🔆 Highlights

- Solar Market Surges: Global solar capacity jumped 64% in early 2025, signaling accelerating demand and a bullish outlook for the sector.

- China Dominates, U.S. Innovates: China leads production, while U.S. and global firms drive cutting-edge solar innovation and efficiency gains.

- Top Solar Stocks Heating Up: From First Solar to Nextracker, leading solar stocks are outperforming the market and poised for continued growth into 2026.

Why Solar Power?

Despite setbacks in some countries much of the world is pushing ahead with renewable energy solutions.

The cost of solar panels has dropped significantly of late and this makes solar power an appealing option.

Solar energy needs less maintenance than wind energy and with a warming world there is no shortage of new locations that would suit solar energy projects.

Although there has been over production, there is also a surge in demand taking place. There is a drive by many nations to diversify their power generation abilities to ensure power independence.

With solar now cheaper to install than nuclear, natural gas or oil, the future looks bright for growth in the solar sector and therefore for solar stocks.

Key Opportunities

There are many opportunities in the market now that installation costs have come down.

In the first 6 months of 2025, 380 GW of new solar capacity was installed vs. 232 GW in the same period in 2024 (a 64 per cent increase), with the full year expectations expected to be in the range of 655 GW. This compares favorably to 2024 when 597 GW was installed.

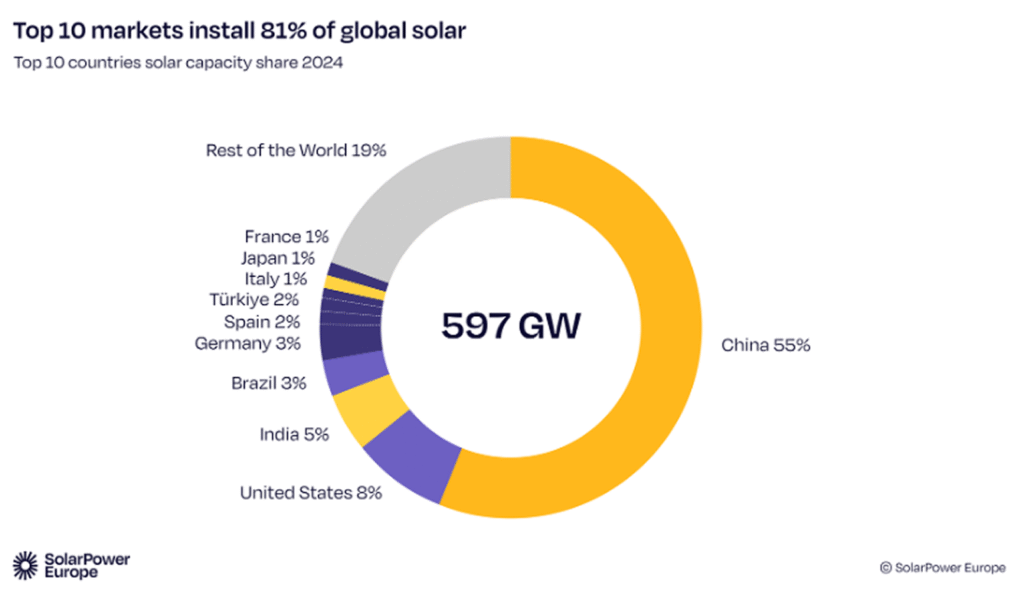

One country that stands out as embracing solar energy in particular is China. As of 2024 China commanded 55% of global solar power installations alone, more than the rest of the world combined. In the first half of 2025, China installed 256 GW out of the 380 GW worldwide, cementing its place as the leading destination for solar power installations. The U.S. made up 8% of the global market, with India at 5%, Brazil at 3% and major European countries making up 9% in total. The rest of the world stood at 19% combined which included Australia, Africa, Asia, the rest of Latin America and the Middle East.

Image Source: SolarPower Europe

Potential financial returns for utility-scale projects are catching the attention of investors.

Other investment opportunities are the producers of the various other components that make up a system, including products such as inverters, tracking systems, software, connectors, batteries and installation hardware.

Top 10 Solar Stocks

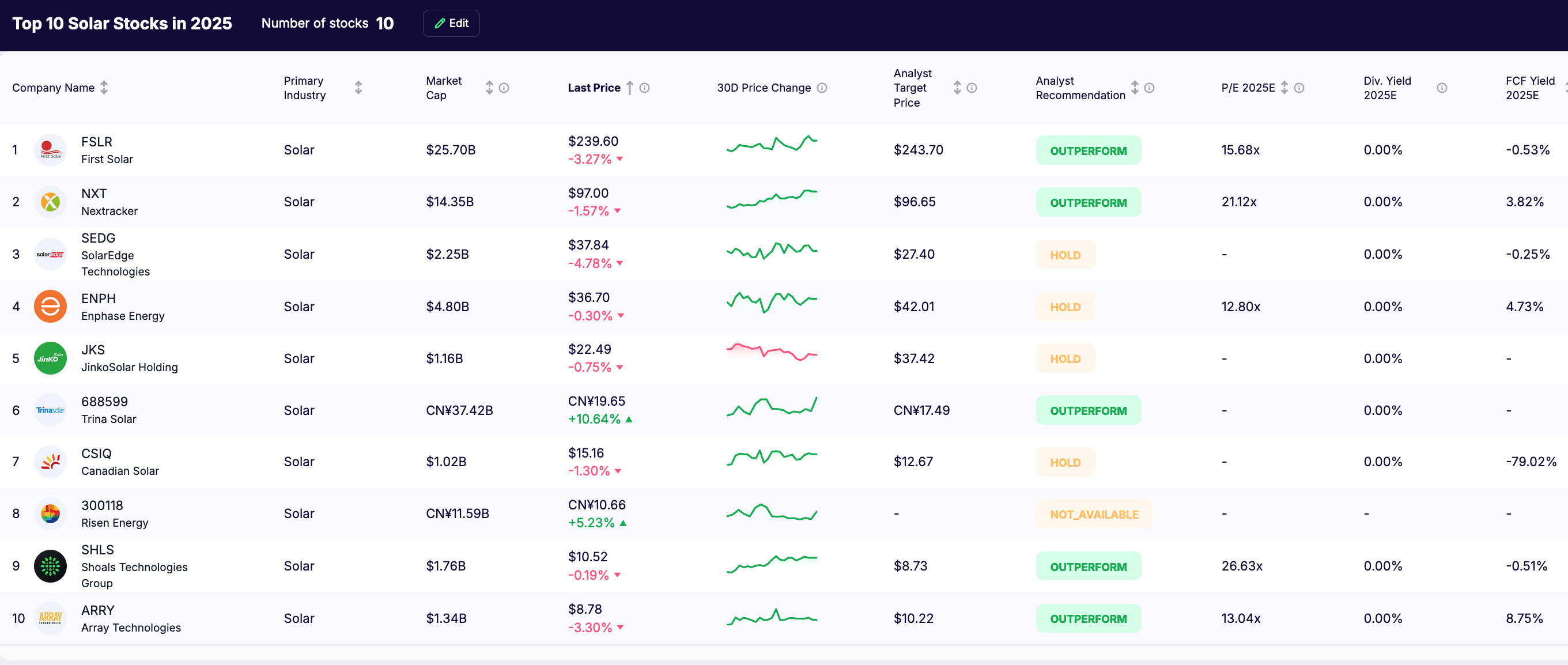

On balance, the future path of least resistance for solar stocks is up and this is based on the strongly growing market for solar. Here are the top stocks that would warrant a closer look.

Solar panel producers may be considered the pure plays for solar. However, as noted above, it is a very competitive market, and very sensitive to tariffs. Other solar component manufacturers are also in the top 10 list of solar stocks for 2025 as these have a strong foothold in the market and are less susceptible to production volatility.

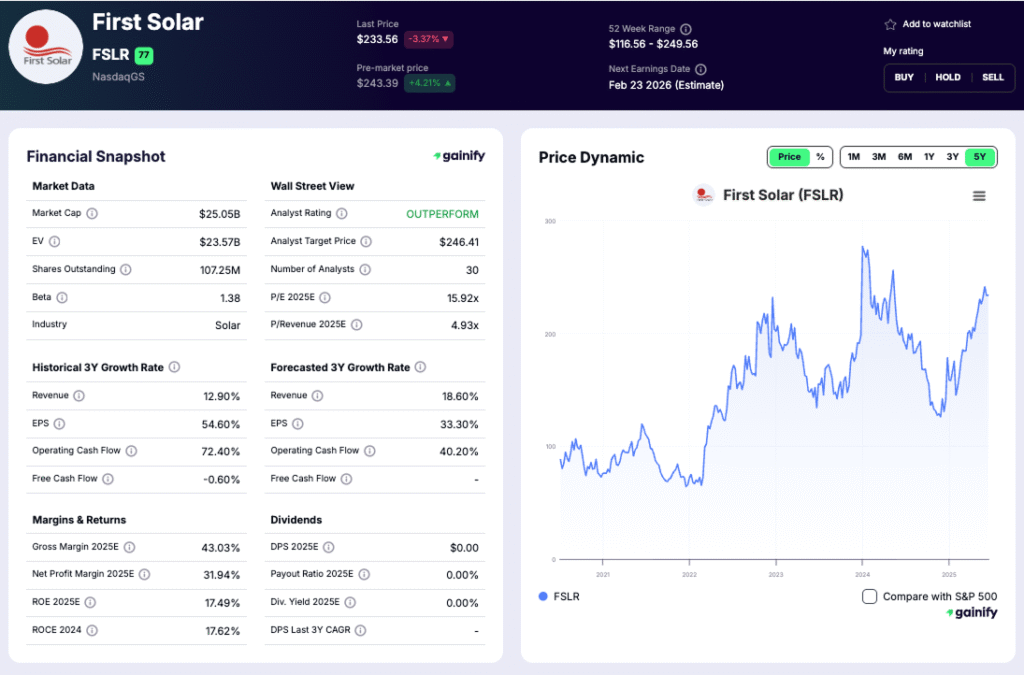

1. First Solar (NASDAQ: FSLR)

Market Cap: $25.05B

Analysts Target Price: $243.70

P/E 2025: 15.92x

Analysts Recommendation: Outperform

What it does: Well established, First Solar is one of the Western hemisphere’s biggest solar panel manufacturers, producing enhanced thin film semiconductor panels and modules that are superior to traditional silicon panels. They work well under diffused light on, for example, cloudy days and also can weather extreme temperatures better.

Recent Developments:

- Record Backlog: Contracted orders exceeded 80 GW as of mid-2025, providing multi-year revenue visibility valued at more than $20 billion.

- Capacity Growth: Global manufacturing capacity is expected to reach 25 GW by 2026, up from 16 GW in 2024, driven by new facilities in Alabama and India.

- Earnings Momentum: Operating income rose over 60% year-over-year in Q2 2025, supported by higher average selling prices and improved production efficiency.

Investment Theme: First Solar’s proprietary thin-film technology and U.S. manufacturing base provide a lasting competitive advantage. With increasing demand for domestically produced renewable energy components, the company is positioned for sustained margin growth and policy support.

Key Risks: First Solar’s main market is the U.S., which is considered more of an evolving market due to policy shifts. However, it is expanding its footprint internationally. It has manufacturing facilities in the U.S. and also in Vietnam, India and Malaysia to ensure it can complete in international markets.

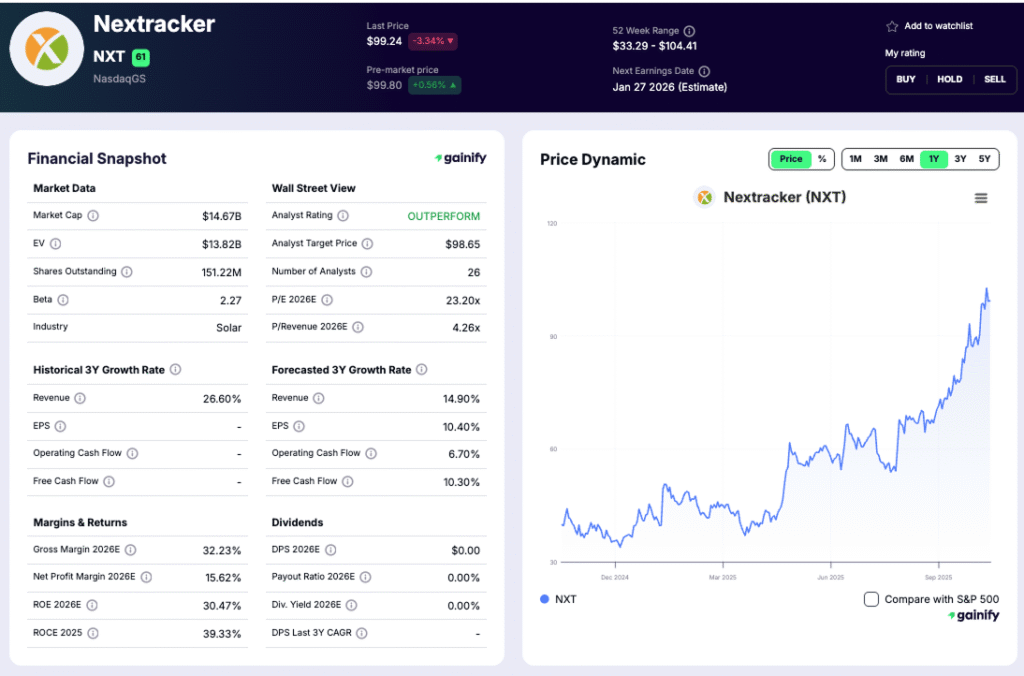

2. Nextracker (NASDAQ: NXT)

Market Cap: $14.67B

Analyst Target Price: $96.65

2025 P/E: 23.20x

Analyst Recommendation: Outperform

What it does: California-based Nextracker designs and manufactures solar tracking systems used in large-scale photovoltaic projects across more than 40 countries. Its technology automatically positions solar panels to follow the sun’s path, improving energy yield and system efficiency. The company also provides proprietary software that monitors performance and optimizes operations for long-term output.

Investment Theme: Nextracker sits at the center of utility-scale solar expansion. Its intelligent tracking systems reduce project costs per watt and deliver measurable efficiency gains, making it a preferred partner for developers and EPCs. With accelerating renewable deployments in the U.S., India, and Latin America, the company’s growth outlook remains robust.

Recent Developments (Q2 FY2026):

- Revenue Growth: Quarterly revenue reached $835 million, up 22% year-over-year, supported by strong shipments in North America and India.

- Profitability Gains: Adjusted EBITDA margin improved to 16.4%, compared with 13.9% in Q2 FY2025, reflecting cost optimization and higher software contribution.

- Record Backlog: Contracted backlog exceeded $3.9 billion, providing visibility into more than 12 months of forward production.

Key Risks: Nextracker’s reliance on large-scale solar projects exposes it to potential permitting delays and policy changes. However, diversification across multiple geographies and the ability to retrofit existing systems provide additional resilience and recurring revenue potential.

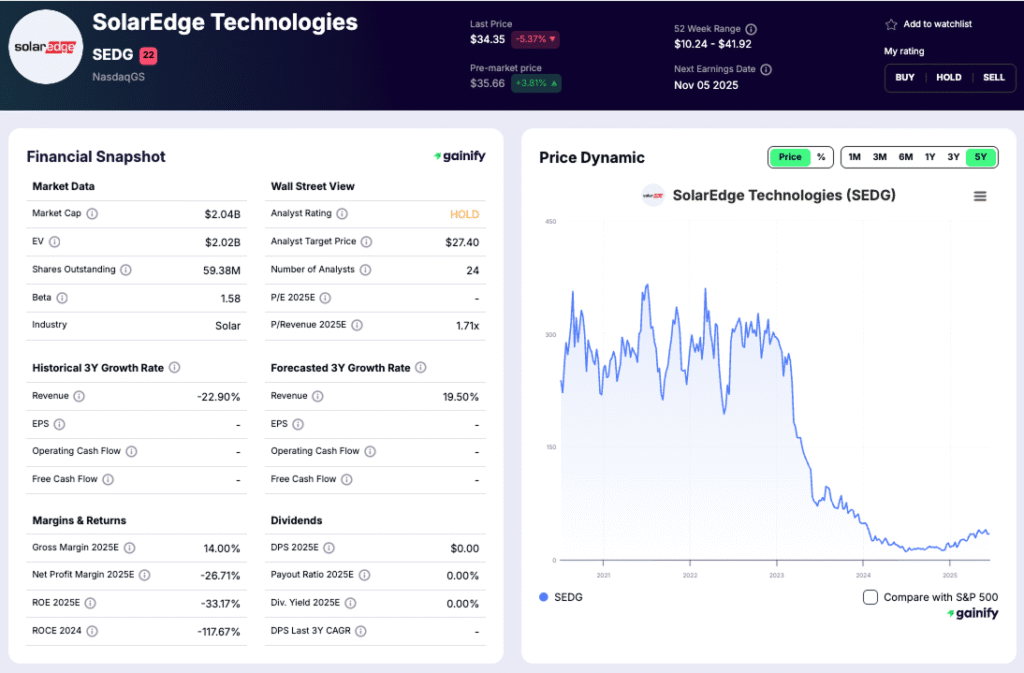

3. SolarEdge Technologies (NASDAQ: SEDG)

Market Cap: $2.04B

Analysts Target Price: $27.40

Analysts Recommendation: Hold

What it does: SolarEdge Technologies develops advanced energy solutions for residential and commercial solar projects. Its products include inverters, battery storage systems, power optimizers, smart tracking systems, and software platforms for installation and energy management. The company operates globally with a strong presence in the United States, Europe, and Asia-Pacific.

Investment Theme: SolarEdge provides broad exposure to both the solar hardware and energy storage markets. Its intelligent systems enhance power generation efficiency and grid stability, positioning it to benefit from rising global demand for distributed energy and storage solutions.

Recent Developments (Q2 2025):

- Revenue: Reported $289.4 million, up 9% year over year from $265.4 million, driven by stable demand across commercial segments.

- Profitability: GAAP net loss narrowed to $124.7 million, compared with a loss of $130.8 million in the prior year.

- Shipments: Delivered 1.19 GW AC of inverters and 247 MWh of energy storage capacity during the quarter, reflecting ongoing product adoption.

Key Risks: SolarEdge’s performance remains sensitive to policy shifts, installation cycles, and price competition. While not a solar cell manufacturer, it is affected by changes in solar module pricing and consumer demand. Continued expansion into commercial storage and software-based services supports diversification and potential margin recovery.

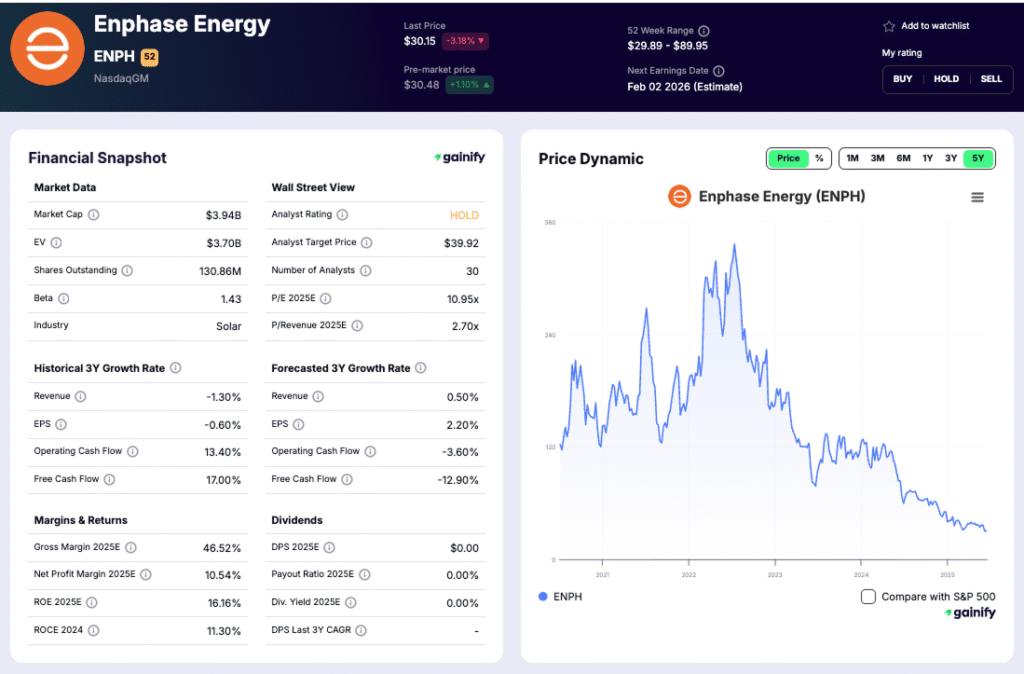

4. Enphase Energy (NASDAQ: ENPH)

Market Cap: $3.94B

Analyst Target Price: $42.01

2025 P/E: 10.95x

Analyst Recommendation: Hold

What it does: California-based Enphase Energy provides microinverters, battery storage systems, and monitoring software primarily for residential solar installations. Its technology converts and manages solar energy at the individual panel level, offering improved efficiency, safety, and scalability.

Investment Theme: Enphase gives investors focused exposure to the residential solar segment. The company’s strong brand, software ecosystem, and premium microinverter technology provide a competitive edge in home energy management and backup power solutions.

Recent Developments (Q3 2025):

- Revenue: $410 million, up from $363 million in the previous quarter.

- Margins: Non-GAAP gross margin reached 49 percent, the highest in two years.

- Outlook: Management guided Q4 2025 revenue between $310 million and $350 million, citing near-term demand normalization and tariff-related headwinds.

Key Risks: Demand for residential systems is sensitive to financing costs, policy incentives, and installer inventory levels. However, a rebound could occur as interest rates stabilize and battery attachment rates rise.

5. JinkoSolar Holding (NYSE: JKS)

Market Cap: $1.21B

Analyst Target Price: $37.42

2025 P/E: 7.59x

Analyst Recommendation: Hold

What it does: JinkoSolar is one of the world’s largest producers of solar modules, with vertically integrated manufacturing operations across China and other markets. The company has a module production capacity exceeding 110 GW annually.

Investment Theme: As a global scale leader, JinkoSolar is positioned to benefit from accelerating solar adoption and cost leadership through manufacturing efficiency. Continued capacity expansion supports its strategy to serve both domestic and international demand.

Recent Developments (Q1 2025):

- Shipments: 19.1 GW of solar products, including 17.5 GW of modules.

- Revenue: RMB 13.8 billion for the quarter.

- Outlook: Expects full-year 2025 shipments of 85 GW to 100 GW, driven by strong international orders.

Key Risks: Earnings remain sensitive to panel price volatility and global trade policy shifts. The company also faces margin pressure from overcapacity and rapid technological change in the Chinese solar sector.

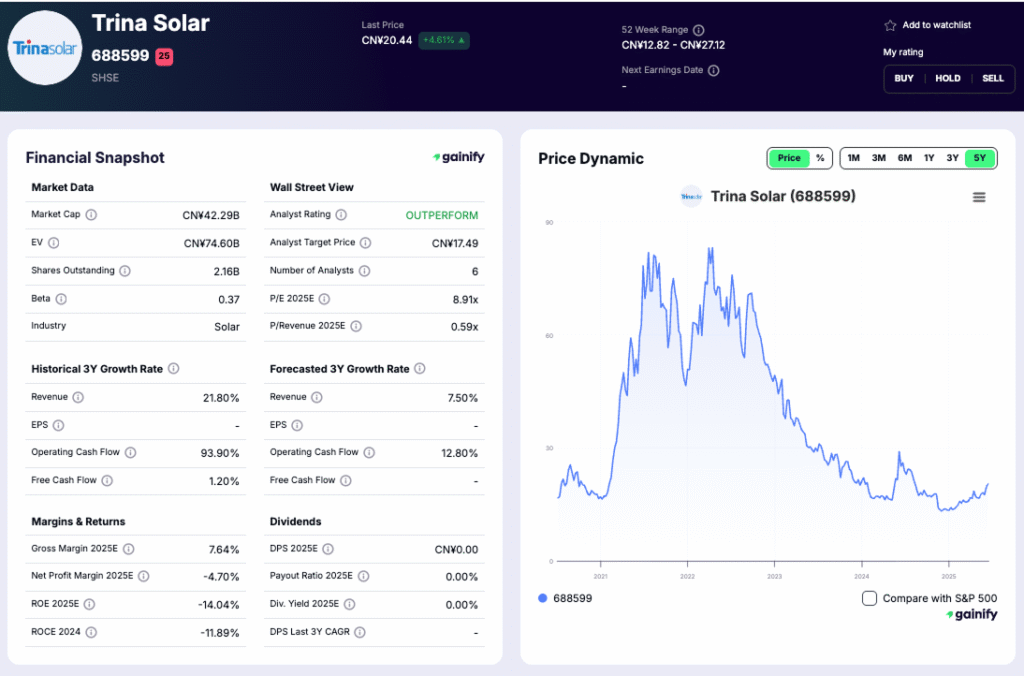

6. Trina Solar (SSE: 688599.SS)

Market Cap: CNY 42.29B

Analyst Target Price: CNY 17.49

2025 P/E: 8.91x

Analyst Recommendation: Outperform

What it does: Trina Solar is a global manufacturer of silicon PV panels, modules, and integrated energy solutions. Established in 1997, it has become one of China’s most recognized solar brands.

Investment Theme: A mature industry player with strong R&D capabilities, Trina Solar continues to advance high-efficiency cell technologies and expand into energy storage. Its scale and experience give it resilience in a competitive market.

Recent Developments (2025):

- Innovation: Achieved record heterojunction (HJT) module efficiency of 25.44 percent.

- Profitability: Reported a net loss of approximately CNY 2.9 billion in the first half of 2025 due to declining module prices.

- Market Environment: Continued pricing pressure across China’s solar industry weighed on margins and utilization rates.

Key Risks: Exposure to industry overcapacity and price competition may constrain profitability. However, technological leadership could support recovery as market conditions normalize.

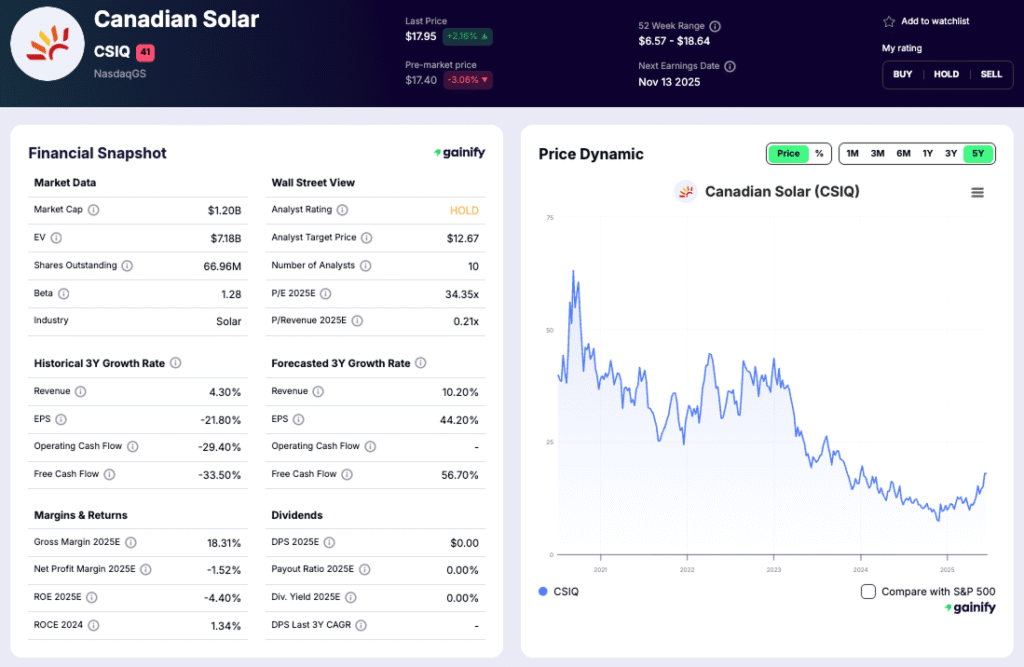

7. Canadian Solar (NASDAQ: CSIQ)

Market Cap: $1.20B

Analyst Target Price: $12.67

2025 P/E: 34.35x

Analyst Recommendation: Hold

What it does: Canadian Solar operates through two main segments: CSI Solar, which manufactures modules and storage systems, and Recurrent Energy, which develops and operates utility-scale solar and battery projects.

Investment Theme: The company provides diversified exposure across manufacturing and project development. Its international footprint and integration into the energy storage market position it to capture both production and recurring revenue opportunities.

Recent Developments (Q2 2025):

- Revenue: $1.7 billion, up 4 percent year over year and 42 percent sequentially.

- Gross Margin: 29.8 percent, reflecting stronger pricing and mix improvement.

- Storage Growth: The e-STORAGE business reported a contracted backlog of $3 billion with a development pipeline exceeding 80 GWh.

Key Risks: Earnings are influenced by project timing, cost inflation, and changes in storage pricing. However, geographic diversification and long-term project contracts mitigate some volatility.

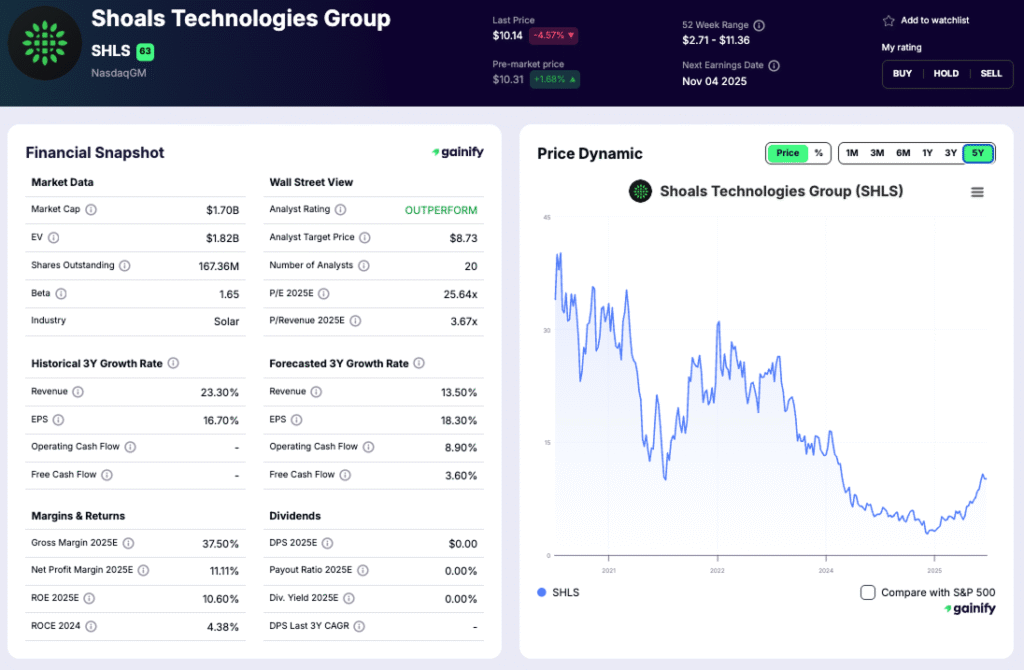

8. Shoals Technologies (NASDAQ: SHLS)

Market Cap: $1.70B

Analyst Target Price: $8.73

2025 P/E: 25.64x

Analyst Recommendation: Outperform

What it does: Shoals Technologies designs and manufactures electrical balance-of-system (EBOS) components for solar installations, including connectors, junction boxes, protection systems, and cable assemblies.

Investment Theme: Shoals occupies a critical niche in solar construction, supplying essential components with fewer direct competitors than module makers. Its strong customer base and engineering expertise support high recurring demand.

Recent Developments (Q2 2025):

- Revenue: $111 million, up nearly 12 percent year over year.

- Gross Margin: 37 percent, supported by production efficiency.

- Backlog: Record $671 million in combined backlog and awarded orders, reflecting continued industry growth.

Key Risks: Results are tied to large-scale solar buildouts and utility project schedules. However, healthy order visibility provides a buffer against short-term fluctuations.

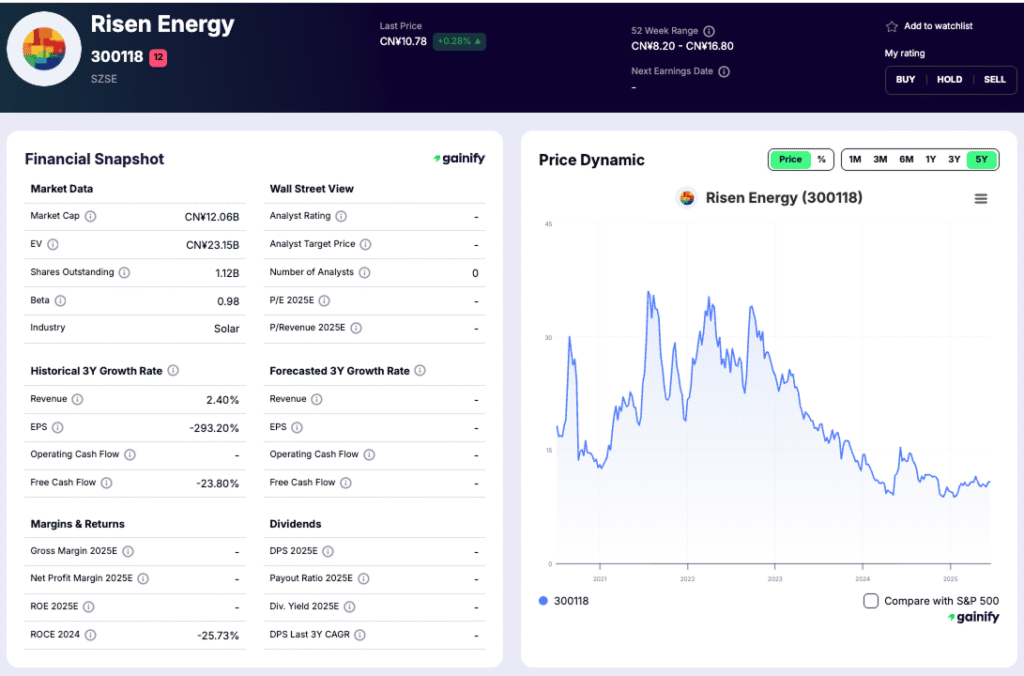

9. Risen Energy (SHE: 300118)

Market Cap: CNY 11.59B

What it does: Risen Energy is a Chinese solar module producer and project developer with operations across Asia and Europe. It manufactures high-efficiency modules and also participates in utility-scale solar construction.

Investment Theme: The company stands to benefit from China’s strong domestic installation growth and the global shift toward low-cost, large-scale solar projects.

Recent Developments (2025):

- Revenue: Approximately CNY 10.5 billion for the first nine months of 2025.

- Industry Conditions: Sector-wide price declines pressured profitability across Chinese manufacturers.

- Operational Focus: Continued expansion in project development to diversify revenue sources beyond module sales.

Key Risks: Exposed to commodity price swings, currency movements, and regulatory shifts in China’s renewables market.

10. Array Technologies (NASDAQ: ARRY)

Market Cap: $1.34B

Analyst Target Price: $10.22

2025 P/E: 13.04x

Analyst Recommendation: Outperform

What it does: Array Technologies designs and manufactures solar tracking systems that maximize energy yield for utility-scale installations. Founded in 1987 and headquartered in New Mexico, it serves customers worldwide.

Investment Theme: Array benefits directly from the growth of large-scale solar. Its smart tracking systems, integrated software, and weather-responsive controls help improve project efficiency and long-term output.

Recent Developments (Q2 2025):

- Revenue: $362 million for the quarter.

- Gross Margin: 26.8 percent, reflecting improved cost management and mix.

- Profitability: Net income of $28.5 million, marking continued operational recovery.

Key Risks: Dependent on utility-scale project pipelines and construction timing. While competition is increasing, technology differentiation and international expansion support future growth.

Key Risks

The home installation market has been challenging of late due to inventory build up in Europe and also due to uncertainty regarding tax credits in the U.S., but may show signs of a rebound. This is especially so in Europe where very high energy prices make alternative residential installations more enticing.

Subsidized manufacturing in China has caused issues for U.S. manufacturers, with China now commanding an 80% market share of production. In response to the American Alliance for Solar Manufacturing Trade Committee’s call to address the situation, special varying rates of U.S. tariffs of up to 3,521% were being put in place as of August 2025 to try to level the playing field.

Of course this did not help the situation in the EU, with cheaper Chinese modules still flooding into Europe, making this continent a difficult place for U.S. manufacturers to sell into.

U.S. policy for renewable energy is still evolving and this may affect the appetite for solar tax credits etc. As such there may be a waiting period to see how policy progresses.

Finally, away from the residential market, the main factor here is the requirement for planning permission to provide the space needed for large-scale installations. Resistance to large-scale projects in countries where open spaces are coveted may delay or impede these projects. Yet inventory in this channel is low as most of these projects are built to order, with components often sourced directly from manufacturers.

Key takeaways for Investors

- Solar demand is still expanding as clean energy adoption continues globally, though growth has normalized after earlier surges.

- China leads the industry in both production and installation, setting global pricing and influencing supply chains worldwide.

- Panel oversupply is easing, with inventories beginning to clear and margins expected to recover as demand strengthens.

- Policy and trade decisions remain critical for solar valuations, affecting costs, access to markets, and investor sentiment.

- Volatility is high. Sharp daily price movements are common, making selective positioning and strong risk management essential.