Fintech is rewriting the rules of modern finance. What began as a handful of start-ups challenging old banks has grown into a global movement that is reshaping how money moves, how people invest, and how businesses operate.

The leading fintechs are no longer chasing attention; they are building scale, turning profits, and defining what the future of financial services looks like.

From mobile banking and online lending to crypto exchanges and AI-driven insurance, fintech is touching every corner of the economy. Investors are watching closely as these firms scale globally, redefine how people manage money, and create new opportunities for financial growth.

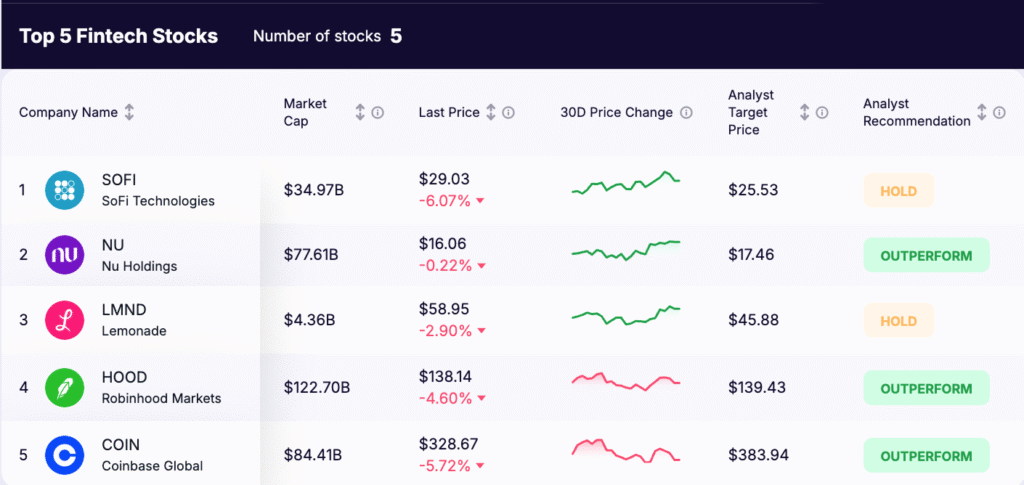

The five fintech stocks in focus — SoFi, Nu Holdings, Lemonade, Robinhood, and Coinbase — show how technology, data, and design are combining to challenge decades of financial tradition. Each one offers a unique window into where finance is heading next.

Highlights

- Fintech is maturing. After years of growth and volatility, top players like SoFi and Nu Holdings are delivering profits, scale, and lasting customer engagement.

- Opportunities span from banking to crypto. Real growth lies in diversification from SoFi’s full-stack platform to Coinbase’s push into institutional crypto services.

- Balance is key. These stocks offer high potential returns, but also higher risk. The best strategies combine selective exposure with a long-term mindset.

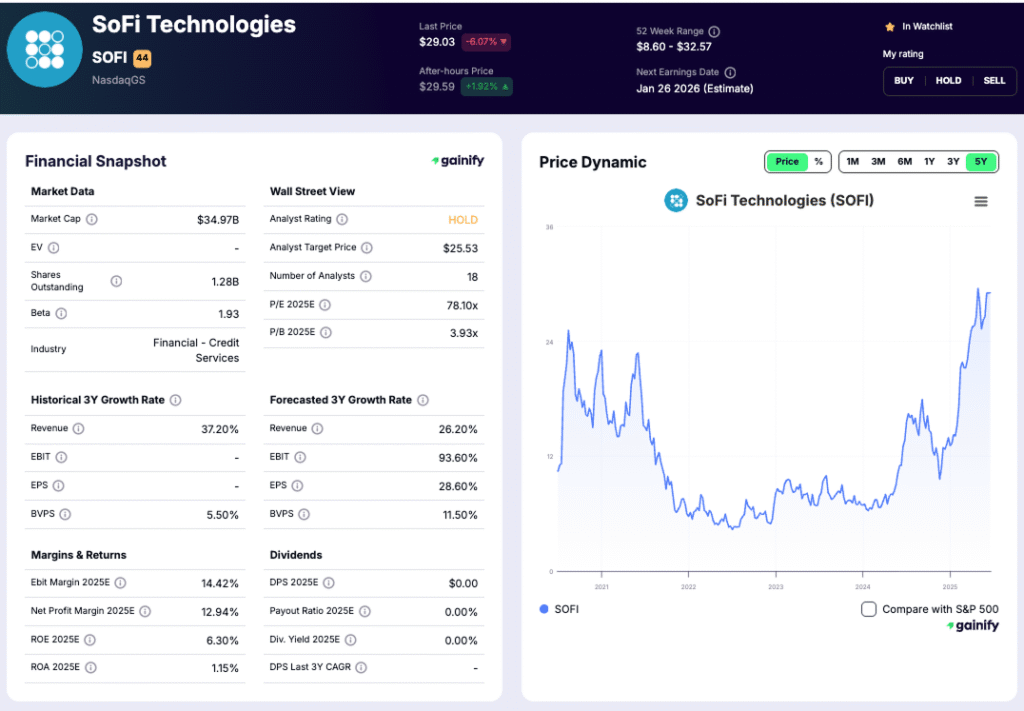

1. SoFi Technologies (NASDAQ:SOFI)

Market Cap: ~$35 B | P/E (2025E): ~78x | Analyst Rating: Outperform

Overview: SoFi Technologies has evolved from a niche student-loan originator into a full-scale digital financial platform offering loans, investing, insurance, and crypto trading. Its tech arm, Galileo, powers other fintechs and banks, creating multiple revenue streams. SoFi now serves more than 12.6 million members and manages over $32 billion in deposits.

Core strength: A vertically integrated platform combining banking, lending, and tech infrastructure.

Investment thesis: Q3 2025 marked another record quarter with net revenue of ~$950 million (+38% YoY) and net income of $139 million, driven by higher personal-loan originations and growing fee-based revenue. Management raised full-year 2025 guidance, reflecting strong growth in both financial services and technology.

Recent highlights:

- Member additions topped 905,000 in Q3.

- Galileo platform revenue grew to $114 million as new partners joined.

- Improved efficiency ratio and rising product cross-selling.

Key risks: Credit quality pressure if unemployment rises, plus fierce competition across lending and banking.

Bottom line: SoFi is emerging as a diversified financial-tech powerhouse — expensive, but increasingly justified by performance.

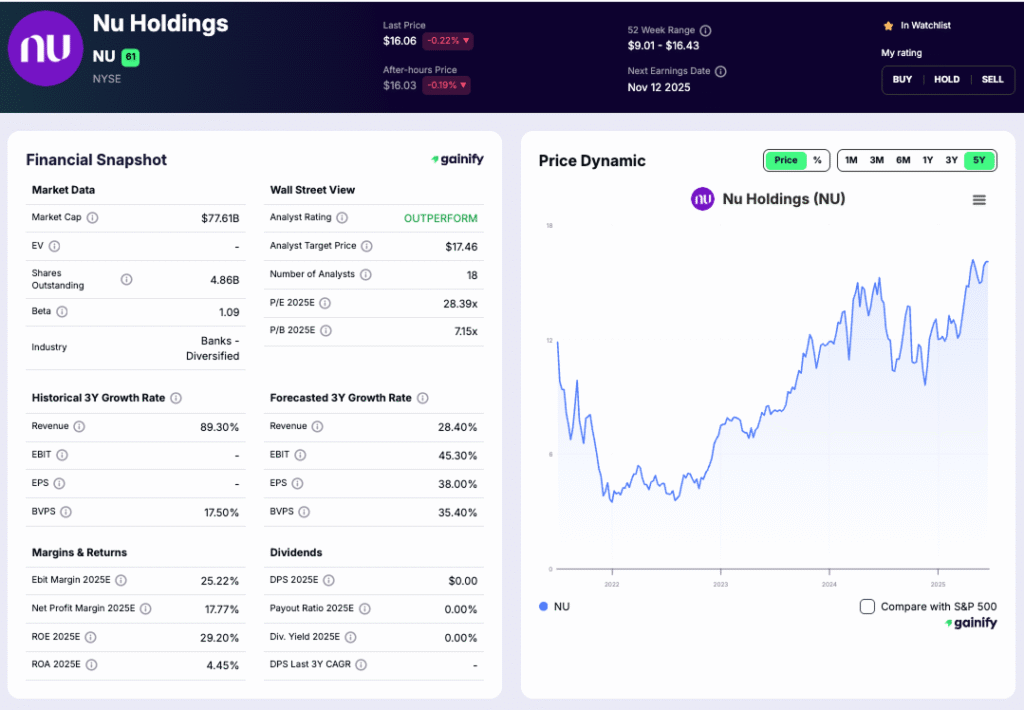

2. Nu Holdings (NYSE:NU)

Market Cap: ~$77.6 B | P/E (2025E): 28.4x | Analyst Rating: Outperform

Overview: Nu Holdings, the parent of Nubank, dominates digital banking across Latin America, serving more than 123 million customers in Brazil, Mexico, and Colombia.

Core strength: Access to massive underbanked markets where digital adoption is accelerating rapidly.

Investment thesis: Nu reported Q2 2025 net income of $637 million on revenue of $3.7 billion (+40%), showing expanding profitability. Deposit growth (+41%) and improved net interest margins highlight a clear path to sustainable earnings.

Recent highlights:

- Customer activity rate above 80%.

- Return on equity near 28%, up sharply from last year.

- Operating efficiency and credit quality improving across regions.

Key risks: Latin American macro instability, FX volatility, and regulatory uncertainty.

Bottom line: Nu is building one of the most profitable digital banks in the world. It offers scale, brand loyalty, and exposure to fast-growing emerging markets.

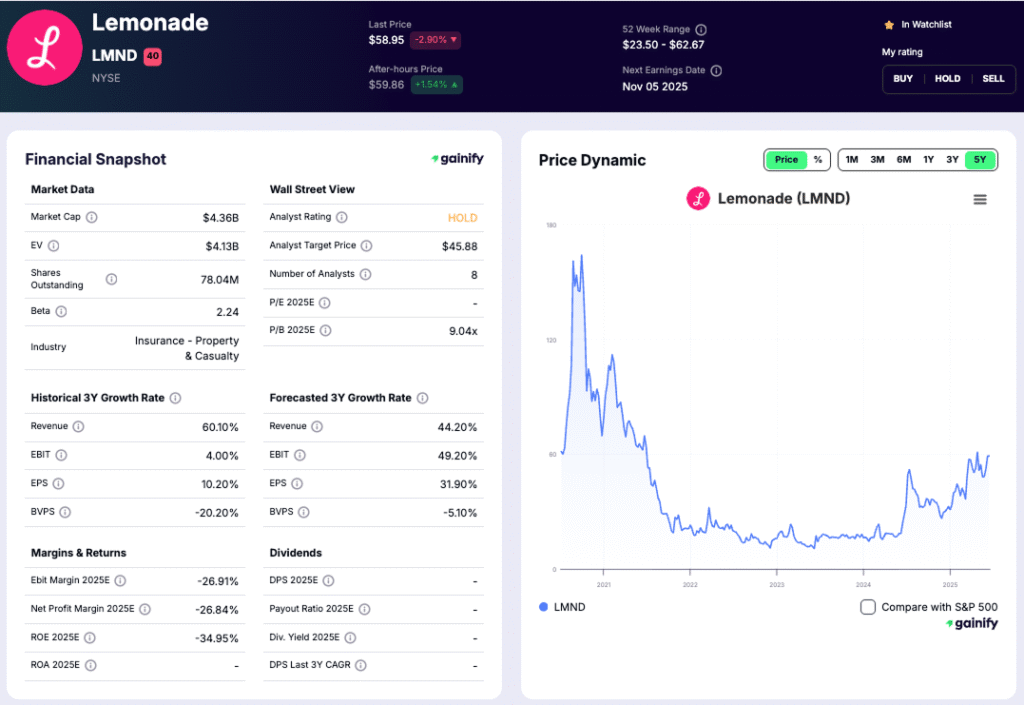

3. Lemonade (NYSE:LMND)

Market Cap: ~$4.3 B | P/E (2025E): N/A | Analyst Rating: Hold

Overview: Lemonade uses artificial intelligence to underwrite and manage renters, homeowners, pet, and auto insurance. Its technology-first model replaces traditional agents with data-driven automation.

Core strength: Fast digital onboarding, transparent pricing, and a millennial-friendly brand.

Investment thesis: Lemonade’s in-force premium rose 29% YoY in Q2 2025 to $1.08 billion, with revenue up 35% to $164 million. The company expects revenue near $710 million for 2025 while narrowing losses. A reduction in reinsurance from 55% to 20% starting mid-2025 should lift margins further.

Recent highlights:

- European markets growing triple digits.

- Average premium per customer up 4% YoY to $402.

- AI integration improving claim accuracy and reducing costs.

Key risks: High customer acquisition costs and uncertain profitability timeline.

Bottom line: Lemonade remains an innovative but speculative bet on how AI can transform insurance economics.

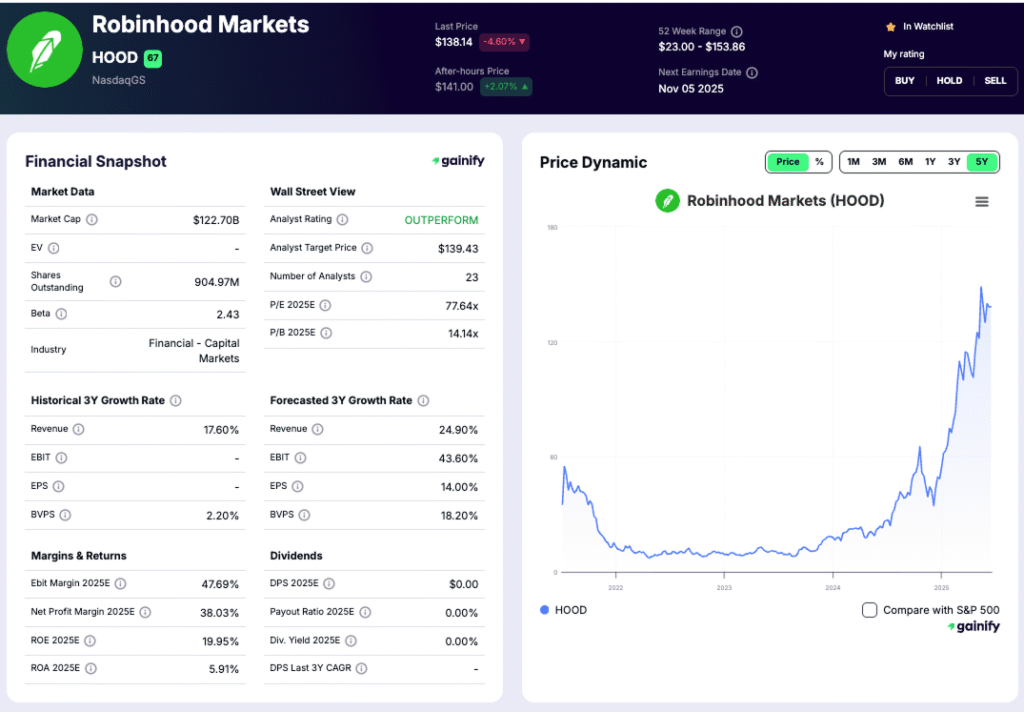

4. Robinhood Markets (NASDAQ:HOOD)

Market Cap: ~$43.5 B | P/E (2025E): 77.6x | Analyst Rating: Outperform

Overview: Robinhood turned the brokerage industry upside down by making trading free and easy for millions of retail investors. It now offers options, crypto, and retirement accounts, and is expanding internationally.

Core strength: A highly engaged retail user base and a broadening suite of products beyond trading.

Investment thesis: Robinhood’s Q2 2025 revenue rose to $989 million, while EPS doubled to $0.42. Interest income, crypto trading, and cash-management products are driving consistent growth. Upcoming Q3 results (November 5, 2025) are expected to show continued momentum.

Recent highlights:

- Platform assets up 112% YTD.

- Funded accounts and average balances rising.

- Crypto and options activity remains elevated.

Key risks: Regulatory oversight of crypto and trading practices; dependence on market activity levels.

Bottom line: Robinhood is maturing into a diversified retail-finance platform, but investors must accept volatility as part of the ride.

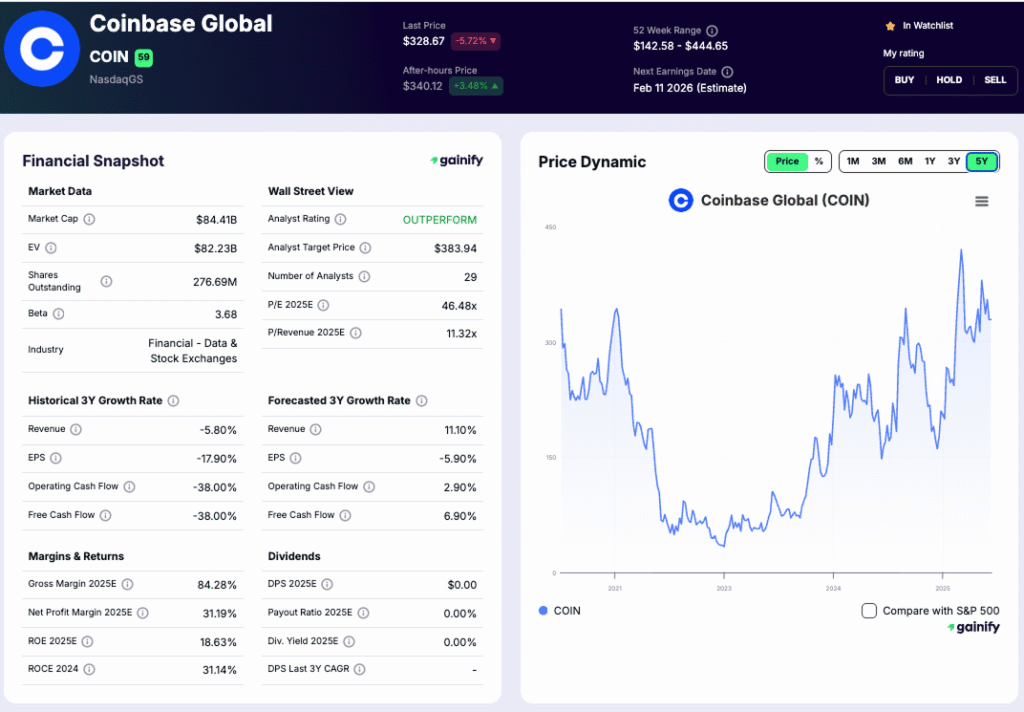

5. Coinbase Global (NASDAQ:COIN)

Market Cap: ~$84.4 B | P/E (2025E): 41.5x | Analyst Rating: Outperform

Overview: Coinbase is the leading U.S. cryptocurrency exchange, serving both retail and institutional investors. Beyond trading, it’s becoming a full-stack crypto-infrastructure provider through custody, staking, and stablecoin partnerships.

Core strength: Regulatory credibility and deep institutional relationships, giving it an edge over competitors.

Investment thesis: Q3 2025 results showed revenue of $1.87 billion (+55% YoY) and net income of $433 million. Service-based revenue (staking, custody, subscriptions) now makes up nearly half of total income, reducing dependence on trading volumes.

Recent highlights:

- Stablecoin revenue surged 43% YoY to $355 million.

- Institutional custody segment expanding rapidly.

- New services targeting corporate and DeFi clients.

Key risks: Crypto market cycles and regulatory pressure in the U.S. and EU.

Bottom line: Coinbase is evolving into the backbone of regulated crypto finance. It offers strong leverage to the next phase of digital-asset adoption, but it remains cyclical.

Key Takeaways

The fintech sector is entering a new era where profitability, scale, and trust separate winners from hype.

- SoFi and Nu Holdings are proving digital banking can be both massive and profitable.

- Lemonade continues to test AI-driven insurance at scale.

- Robinhood and Coinbase are building the digital investing infrastructure of the next decade.

For investors, these five fintech leaders represent different corners of the same transformation — where technology is permanently changing how money works.