If you’re trying to find winning stocks hiding among hundreds of thousands of global opportunities, it can feel like searching for a needle in a haystack.

You open multiple screening platforms, spend hours configuring complex filters, and then hit result limitations on free plans. You know you’re still missing opportunities that could transform your portfolio.

The stock screening market has exploded with options. It’s understandable if you find it difficult to research and compare them all – especially when each platform has different limitations, pricing structures, and feature restrictions that affect your research workflow.

After analyzing 8+ leading stock screening platforms, we’ve identified clear winners for every investor type and research need. Whether you need basic filtering, technical analysis integration, or AI-powered insights, this guide helps you find the perfect screening tool for your investment strategy.

In this analysis, you’ll discover the capabilities and limitations of each platform, compare their pricing and features, and learn why AI-enhanced screening is changing how you can discover opportunities in 2026.

Quick Decision Framework: Choosing Your Stock Screener

Need immediate results? Here’s your quick decision framework based on specific screening requirements:

Best Stock Screeners by Use Case

Investor Type | Best Platform | Why It Works | Key Limitation |

Screener Pro | Gainify | Pre-built screens + over 1000 custom filters + AI stock discovery | No broker sync |

Technical Traders | TradingView | Superior charting integration, global markets | Limited free screener features |

Visual Learners | Best data visualization and heat maps | 15-minute delayed data, ads | |

Stock Rover | Deep fundamental metrics and scoring | US markets primarily, technical limitations | |

Active Day Traders | Trade Ideas | AI-powered Holly signals, real-time scanning | Expensive, US markets only |

Complete Beginners | TC2000 | User-friendly interface, step-by-step wizard | Steeper pricing, US/Canada only |

The Bottom Line for 2026

Stock screening allows investors to filter markets based on specific criteria rather than relying solely on analyst recommendations or newsletter picks.

But many traditional screeners impose frustrating limitations. Either you’re dealing with delayed data, or the screener you spent 15 minutes configuring only returns a limited subset of results.

Newer platforms like Gainify remove the bottlenecks. Pre-built screeners give you quick results. Custom filtering offers you unlimited possibilities. Data is updated 4 times daily. Free plans are generous, giving you incredible value.

Why Stock Screening Matters More Than Ever in 2026

Finding undervalued stocks requires systematic analysis across thousands of potential investments. You need screening tools that filter markets based on your specific criteria and analytical framework.

Traditional stock picking relies on analyst recommendations and newsletter suggestions that drive your decisions. These approaches limit your options. Predetermined selections may not align with your investment thesis, your risk tolerance, or your timeline requirements.

Stock screeners open up investment research by giving you the same institutional-level filtering capabilities professionals use. You can discover opportunities across global markets before they become obvious to mainstream investors.

Three key factors determine whether a screener serves your investment goals: number of stocks covered, filters available, and analytical capabilities.

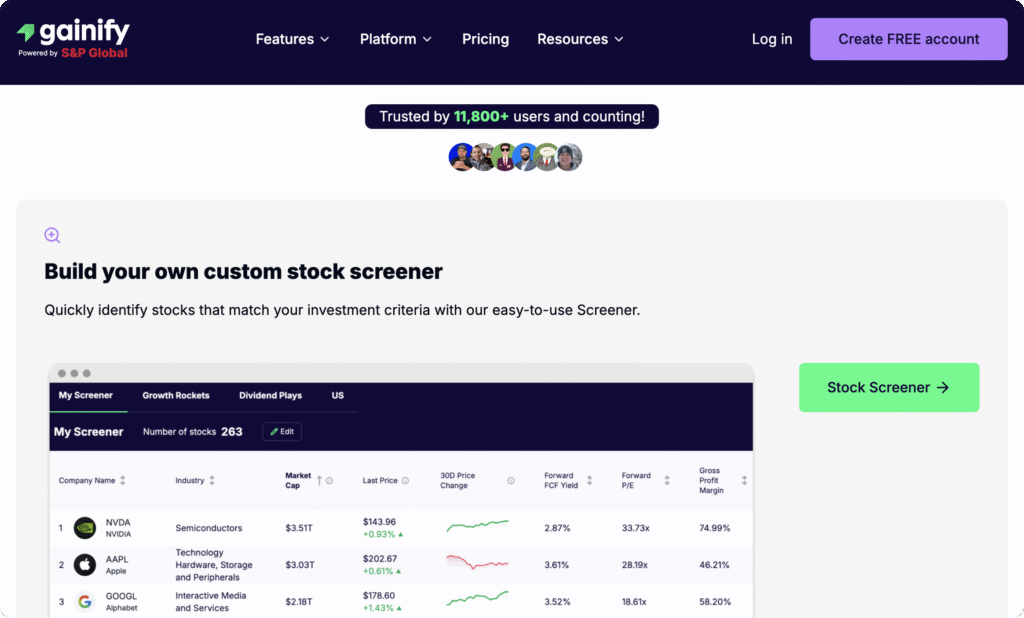

1. Gainify: Custom and Pre-Built Stock Screening

Best for you if you want the most powerful and flexible stock screener on the market – or if you’re tired of platform limitations, delayed data, and restricted filtering options that block your research.

Gainify delivers next-generation stock screening. It offers unmatched depth and precision to your research process. Filter across 1000+ criteria (potentially the broadest screening capability available in the industry).

With data updated 4 times daily, you get access to S&P Global Intelligence’s institutional-grade information that’s always current.

Access pre-built screeners for instant thematic insights, or build unlimited custom screens using historical data, forward estimates, and unique filters like PEG estimates, drawdowns, and valuation multiple comparisons.

Pre-Built Screeners for Instant Results

Gainify’s Stock Ideas section delivers thematic investing opportunities via over 20 curated stock screens. These are organized into two main categories – hot growth stocks, and value & fundamental screeners.

Hot growth stock screeners include:

- Semiconductor stocks – Chipmakers powering smartphones to AI supercomputers

- Founder-led companies – Visionary founders still at the helm

- Quantum computing – Early-stage leaders commercializing quantum hardware/software

- Space exploration – Space tech firms enabling satellite and rocket launch growth

- Nuclear energy – Nuclear innovators driving clean energy adoption

- Cybersecurity – Leaders protecting digital data, cloud, and critical systems

- 3D printing – Firms powering next-gen, on-demand industrial manufacturing

- AI stocks – Companies leading in artificial intelligence innovation

An industry-agnostic Attractive High Growth Companies screener uncovers additional top opportunities that fall outside Nuclear, Cybersec, etc.

Value & fundamental screeners include those covering Cash Cows, Pivot Year Stocks, Dividend Champions, Valuation Opportunities, and Strong Past Performance.

These pre-built screeners save you hours of manual configuration – ensuring you never miss emerging investment opportunities that could benefit your portfolio.

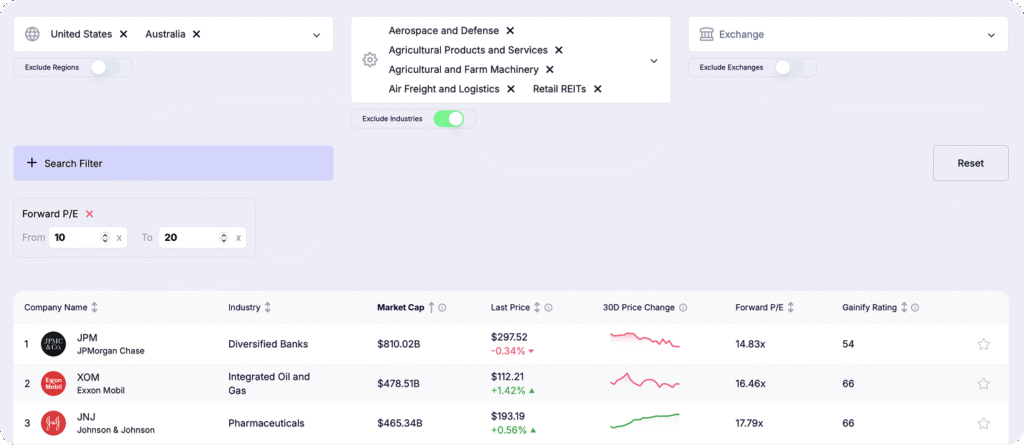

Custom Screening Without Limitations

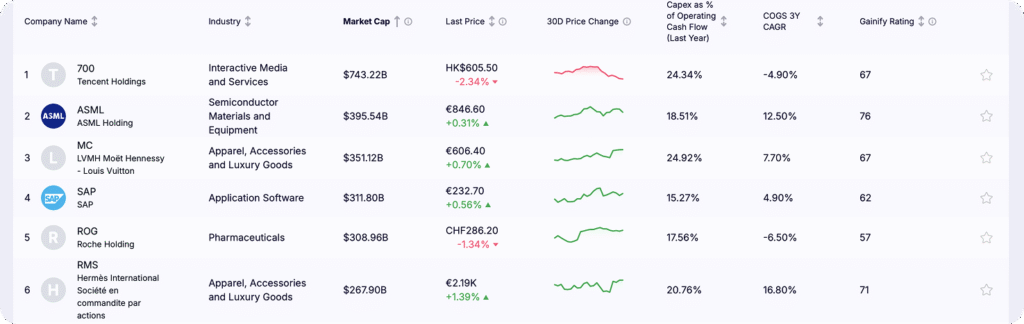

Gainify’s custom screening lets you search across industry, country, exchange, and financial metrics simultaneously with serious depth.

You can filter by 1,000+ criteria, and data is updated 4 times per day to ensure you’re working with the freshest information.

Custom stock screening features include:

- 33,000+ stocks across 40+ global exchanges

- 150+ industries for sector-specific filtering

- Global regions and individual exchanges

Filter using historical data from the last quarter, last year, or LTM (last twelve months) – or look forward using NTM (next twelve months), 1-year, 2-year, and 3-year forward estimates. This lets you identify stocks based on both past performance and future expectations.

Gainify also enables precise targeting through inclusion and exclusion filters. You can both include and exclude specific industries, countries, and exchanges simultaneously – ensuring your results contain only the exact market segments you want.

You can even filter by proprietary Gainify Rating metrics covering:

- Momentum – A stock’s current market strength and potential future performance

- Performance – Management’s consistency in delivering growth and shareholder value

- Outlook – A stock’s expected financial trajectory relative to industry peers and the broader market

- Health – Shows a stock’s ability to weather economic downturns and continue meeting long-term obligations

- Valuation – Whether a stock is undervalued, fairly priced, or overvalued compared to historical valuation and market benchmarks

Both pre-built and custom screeners integrate seamlessly with Gainify’s broader stock research capabilities. Save stocks to your watchlist, dive deeper into growth and outlook with stock reports, or ask Gainify AI to analyze and compare other industry players.

Advantages

Gainify is ripe with features to help you find and monitor the world’s fastest growing stocks. Its screening capabilities are no different.

- Always-current data updates 4 times per day

- Screen across 33,000+ stocks on 40+ exchanges worldwide

- Include AND exclude specific industries, countries, and exchanges

- 20+ curated pre-built screens for instant access to top opportunities

- Build and store unlimited custom screening strategies to revisit anytime

- Over 1,000 screening criteria, potentially the largest set of screening filters available

- Unique proprietary filters like PEG estimates, Gainify ratings, valuation multiple averages vs. current values, and drawdowns

Limitations

Gainify is one of the best stock research platforms available today. In fact you will be hard pressed to find another that is as easy to use, with features built to such a high quality. But it is not without its limitations.

The platform’s main limitation for now is its lack of broker integration. However, that may change in the near future.

Pricing

Gainify offers strong value with screening capabilities available on the free Starter plan that costs you nothing.

Paid plans starting at $7.99/month include more AI analysis credits, top investor trade alerts, and full access to Gainify’s extended stock research & screening capabilities.

The Gainer Pro plan at $26.99/month includes maximum AI query limits (500 per month) and priority support.

2. TradingView: Global Markets with Chart Integration

Best for you if you’re a technical trader who needs advanced charting alongside screening – or if you trade international markets, forex, and crypto.

TradingView combines screening capabilities with industry-leading technical analysis charting tools.

All up it covers 100+ international exchanges and millions of investable instruments. It’s hard to find a broader range of assets elsewhere.

Asset classes available include:

- Forex

- Bonds

- Stocks

- Commodities

- Cryptocurrencies

When it comes to screening for opportunities, your screening results connect directly to professional-grade charting capabilities.

You can perform immediate visual analysis without platform switching or interrupting your workflow.

Advanced charting includes 90+ technical indicators, custom drawing tools, and multi-timeframe analysis. You use both screening and technical evaluation in one smooth workflow.

Advantages

TradingView is one of the better established companies in the stock research industry. It has a huge range of features that are tough to surpass.

- Screening-to-charting workflow

- Global market coverage spanning 100+ exchanges

- Screening covers stocks, forex, crypto, bonds, and commodities

- Technical analysis tools with 90+ indicators and custom drawing

- Pine Script allows you to create proprietary indicators and screening logic

- Active trading community with shared ideas and strategies from millions of users

Limitations

Free plan restrictions limit your screening capabilities with delayed data feeds and advertisement interruptions. Other limitations include:

- 15-20 minute delayed quotes reduce your trading effectiveness

- Advertisement interruptions disrupt your research sessions

- You get only 2 technical indicators per chart on free plan

- Limited export capabilities restrict your screening results

- Limited free features force you into expensive upgrades

Pricing

TradingView offers free plans but these come with ads. To remove ads and get valuable screening functionality, you will need a paid plan. These start at $16.95/month and can cost up to plans from free to $239.95/month.

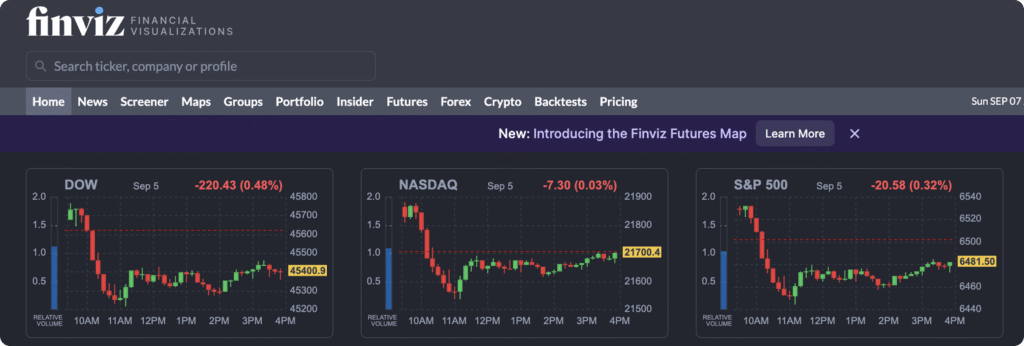

3. Finviz: Visual Screening Excellence

Best for you if you’re a visual learner who needs heat maps and charts to spot opportunities – or if you want free screening.

Finviz stands out among other visual screening apps with its heat maps. With them you can quickly see which stocks are trending up (or down) and assess their market size.

Not many other platforms offer the heatmap view for stock screeners, so it is a nice touch. Even better, you can use it for free.

Within the heat map, hover over any stock to see key metrics and price charts without clicking.

The free version includes fundamental and technical filters, visualization tools, and basic screening capabilities.

You have a range of filters to choose from, including:

- Dividend Yield

- Target Price

- Market Cap.

- Exchange

- Industry

- Country

- Sector

- Index

Finviz Elite (paid) adds real-time data, advanced filtering, backtesting capabilities, and export functions.

Advantages

It’s FinViz’s heatmap feature that makes it stand out. But that’s not all the platform has to offer.

- 1-day to YTD returns visible at a glance

- Industry-leading heat maps provide visual cues

- Relevant news headlines alongside screening results

- Free screening with no registration required for basic features

- Insider trading data shows what company executives are buying and selling

Limitations

Free version limitations restrict your capabilities with 15-minute delayed data and in-app advertisement.

- Advertisement-heavy interface disrupts your experience

- Delayed data reduces your day trading effectiveness

- Limited fundamental metrics restrict your analysis

- Only 4 exchanges available for free tier filtering

Pricing

Finviz Elite costs you $39.50/month or $24.96/month when billed annually. You unlock real-time data, advanced filtering, and increased filtering options within the stock screener.

4. Stock Rover: Fundamental Analysis Champion

Best for you if you’re a buy-and-hold investor focused on fundamentals – or if you need deep financial metrics and portfolio management tools beyond basic screening.

Stock Rover specializes in fundamental analysis screening with financial metrics and proprietary scoring systems.

The platform allows you to analyze 700+ financial metrics across 8,500 North American stocks. That might sound like a lot – but keep in mind that Gainify covers 25,000+ global stocks (3x more).

There are over 140 pre-built screeners available, and custom screening is enhanced by a huge range (600+) of filtering criteria.

However the stock screener is not available on the free plan. If you’re willing to pay up, you will gain access to complete fundamental screening with 10+ years of historical financial data.

Advantages

Stock Rover provides a solid range of stock screening features.

- Screen for ETFs

- Broker integration available

- Hundreds of filtering options

- Large range of pre-built screeners

Limitations

Stock Rover limits you primarily to US and Canadian markets.

- Few stocks available compared to other platforms

- Old and outdated user interface can be hard to use

- US/Canadian market focus restricts your international exposure

- Need to pay to access the stock screener (many competitors offer it free)

Pricing

Stock Rover offers you plans from free to $27.99/month for Premium Plus. The Essentials plan at $7.99/month provides you with substantial fundamental screening capabilities at an affordable price.

5. Trade Ideas: AI-Powered Active Trading

Best for you if you’re an active day trader who needs real-time scanning and AI-generated trade ideas – or if you value live trading room education with professional traders.

Trade Ideas combines artificial intelligence screening with live trading room features.

You receive real-time scanning designed specifically for active day trading and swing trading strategies.

Trade Ideas’ Holly AI is a unique feature in the stock screening world. It gives you automated screening using 60+ proprietary strategies. Great if you want trade ideas but don’t want to spend lots of time building custom screeners.

Holly AI delivers you 5-25 trade ideas daily – each with precise entry and exit recommendations.

Live trading rooms operate from 8am to 3:30pm ET – giving you the ability to learn from real-world trading while interacting with the community during market hours.

Advantages

Trade Ideas is a solid choice if the emerging capabilities of AI excite you. Not many platforms offer AI features – with Gainify standing out as another of the few integrating AI into stock research workflows.

- Live trading room education lets you learn from professional traders

- Holly AI generates 5-25 daily trade ideas with precise entry/exit points

- Alert automation notifies you instantly when screening conditions trigger

- Real-time scanning captures opportunities as they emerge during market hours

Limitations

Trade Ideas restricts you to US and Canadian exchanges only.

- Expensive pricing starting at $127/month ($89 annually)

- US and Canadian markets only limit diversification

Pricing

Trade Ideas offers you plans from free to $228/month. The Standard plan at $127/month ($89/month billed annually) gives you essential features, while Premium at $228/month provides you with AI screening and backtesting capabilities.

6. TC2000: Interactive Charting Excellence

Best for you if you want user-friendly screening with interactive charting – or if you need alert systems to monitor multiple screening conditions simultaneously.

TC2000 brings you award-winning screening combined with powerful charting capabilities.

The platform includes EasyScan functionality and guided condition building. You can easily create screens even if you don’t have technical knowledge – the platform guides you through each step.

Market coverage is quite limited though, with only US and Canadian exchanges available. That being said, you can screen both stocks and ETFs which is more than some platforms.

TC2000 is one of the few platforms to also offer options screening.

Once your EasyScans are set up, monitor results with automated alerts/notifications – stay up to date on changes without constantly checking the web app.

However, there is no free plan. To access most of the stock screener functionality you will need to pay at least $50/month.

Advantages

For an advanced platform, TC2000 is quite beginner friendly, bringing you features like EasyScan screener building and trading simulation.

- Trading simulator for practice trading

- Ability to screen stocks, ETFs, and options

- EasyScan makes setting up screeners simple

- Construct and monitor options trading strategies

Limitations

TC2000 is a solid all round platform, but it does have a few limitations.

- No free plan

- Higher pricing for premium features

- Restricts you to US and Canadian exchanges

- No broker integration like other industry players

- No backtesting capabilities like some other competitors

Pricing

TC2000 offers you plans from $24.99/month to $99.99/month. The Premium plan at $49.99/month provides you with full screening capabilities.

7. ZACKS: Research-Powered Free Option

Best for you if you want free screening backed by professional research – or if you prefer fundamental analysis without mandatory subscriptions or hidden costs.

Zacks Investment Research offers both free and premium stock screening services – with the Custom Stock Screener available to you at no cost.

The free screener is however, limited – you will only be able to utilize 150 metrics for filtering (compared to several hundred offered by Gainify for free.)

As a free user, you will not be able to access:

- The 45+ premium screens

- Detailed equity research reports

- Zacks #1 Rank List of approximately 220 Strong Buy stocks

To access these features, you will need ZACKS Premium, costing $249 annually.

Coverage is limited, however – you’ll only find data for 6,750 companies (mostly US and Canada.)

Advantages

As a free tool, ZACKs is quite generous in its offering. It’s a good place to start if you’re learning the ropes of custom stock screening and want to try before you buy.

- Proprietary Zacks Rank system

- 150 screening metrics available free

- Completely free Custom Stock Screener

- Professional research from Zacks’ analyst team

- No ads or interruptions unlike some other free platforms

Limitations

ZACKs may be best used as a free tool, where its limitations are easier to stomach. As a paid stock screener, it is lacking compared to competitors

- Only 6,750 companies covered

- Primarily US and Canadian focus

- Premium features expensive at $249 annually

- Interface feels dated compared to modern screening platforms

Pricing

ZACKS offers a free Custom Stock Screener with no cost. Premium membership costs $249 annually and unlocks 45+ premium screens, detailed equity research reports, and the Zacks #1 Rank List.

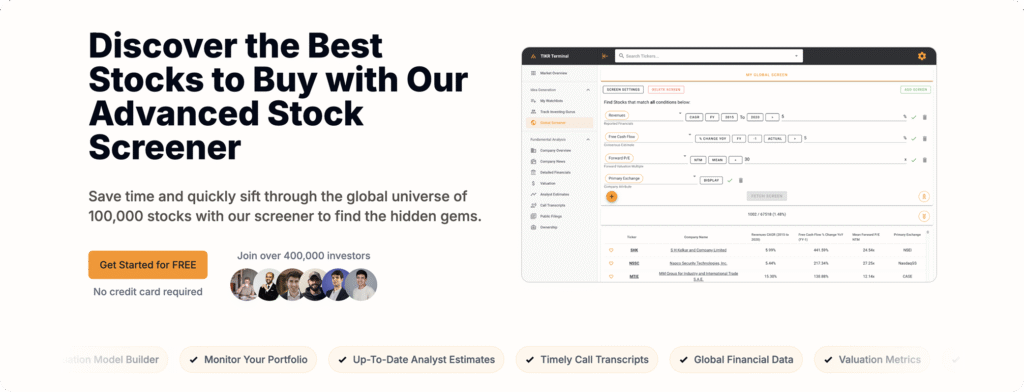

8. TIKR: Huge Global Coverage

TIKR offers 400+ screening filters covering 100,000+ stocks across 92 countries.

Screening filters focus on financial health, valuation, and long-term performance – contrasting the technical indicator focus of TradingView.

Screening integrates with TIKR’s other features – you can:

- Add screened stocks directly to watchlists

- Access detailed company analysis from results

- Track whether top investors own filtered stocks

Pre-built screening lets you follow the strategies of Joel Greenblatt’s Magic Formula, Peter Lynch’s GARP, Ben Graham’s Net-Nets, and more.

Advantages

It’s hard to find a platform better equipped for stock screening than TIKR. Although its free tier is very limiting when it comes to screener capabilities, paid tiers give you access to:

- 400+ screening filters

- Pre-built screening template

- Global coverage of 100,000+ stocks

- Up to 20 years of historical data for trend analysis

Limitations

TIKR’s screening capabilities overall are quite strong. But if you want to access them you will need to pay. The free tier limits you to:

- US-only data

- Just 1 saved screen

- Basic screening with 300+ filters

Even Plus subscribers can only save 5 screens. Only Pro subscribers get unlimited screens and full historical data.

Pricing

TIKR offers three pricing tiers. Free has some screening capabilities. But to unlock global coverage of 100,000+ stocks you will need the Plus tier ($19.95 monthly.) The Pro tier at $39.95 monthly includes unlimited saved screens and 5-year forward estimates.

Your Complete Platform Comparison Matrix

Below is a quick comparison of the leading stock screening platforms available in 2026. Quickly assess each tool’s strengths, limitations, and pricing – so you can make an informed decision tailored to your needs.

Platform | Best For | Key Strength | Primary Limitation | Monthly Cost |

Gainify | 1000+ Screener filters | Pre-built + Custom + AI Analysis | Lacks broker sync | $7.99-$26.99 |

TradingView | Global Technical Trading | Chart integration, worldwide markets | Limited free features | $16.95-$239.95 |

Finviz | Visual Analysis | Heat maps, user interface | Delayed free data | $0-$39.50 |

Stock Rover | Fundamental Research | Deep metrics, scoring system | US markets primarily | $7.99-$27.99 |

Trade Ideas | Active Day Trading | AI Holly, live trading room | Expensive, US only | $127-$228 |

TC2000 | Interactive Charting | User-friendly, alert systems | No backtesting | $24.99-$99.99 |

ZACKS | Free Fundamental Research | Research integration, no cost | Limited technical tools | $0-$59/month |

Gainify | AI-Enhanced Research | Pre-built + Custom + AI Analysis | Newer platform | $7.99-$26.99 |

TradingView | Global Technical Trading | Chart integration, worldwide markets | Limited free features | $16.95-$239.95 |

Finviz | Visual Analysis | Heat maps, user interface | Delayed free data | $0-$39.50 |

Stock Rover | Fundamental Research | Deep metrics, scoring system | US markets primarily | $7.99-$27.99 |

Trade Ideas | Active Day Trading | AI Holly, live trading room | Expensive, US only | $127-$228 |

TC2000 | Interactive Charting | User-friendly, alert systems | No backtesting | $24.99-$99.99 |

ZACKS | Free Fundamental Research | Research integration, no cost | Limited technical tools | $0-$59/month |

TIKR | Fundamental Research | Global financials, transcripts | Limited technicals | $20-$40/month |

Choosing Your Ideal Screener: Your Decision Framework

You need a screener that aligns with your specific investment goals. This section outlines critical factors – from data quality and investment style to budget – to help you make an informed decision.

Data Quality and Coverage

Data quality is a big deal. You need to know you can trust the insights from a stock screener – that they are not out of date, and that datapoints are accurate.

Gainify stands out here by updating its institutional-grade data 4 times per day – ensuring you’re always working with current information rather than stale overnight updates.

Premium data sources like S&P Global Market Intelligence ensure your screening accuracy and reliability. Gainify, TIKR, and professional platforms use this institutional-quality information.

Gainify provides access to 33,000+ stocks across 40+ global exchanges, putting it among the top tier for international coverage alongside TradingView and TIKR. Others limit you primarily to US and Canadian markets.

Investment Style Alignment

Investment style plays a big part in which platform you will choose. If you need technical analysis tools, that will narrow your search down a lot. Only a few platforms offer them. Likewise, not all platforms are as strong for value investors.

If you’re a day trader, TradingView or Trade Ideas deliver the real-time data and advanced technical indicators you need.

If you’re a swing trader, Finviz Elite or TradingView Premium combine fundamental screening with technical analysis tools.

If you’re a long-term fundamental investor, Gainify delivers exceptional value for money. You get up to 1,000+ screening criteria, historical and forward-looking data filters, and unique proprietary metrics like drawdowns and valuation multiple comparisons.

Zacks Premium also offers strong fundamental research depth, however it has more limited screening flexibility.

Budget Considerations

It’s hard to go past free platforms if you’re just starting out. Many of them also offer paid tiers with a gradual improvement in screening capabilities.

By far the best free screener (and a top paid option too) is Gainify. It’s far less restrictive than other platforms, giving you strong capabilities on the free plan.

Once you’re ready to move to a paid option, you may look to Gainify (again), TradingView (for Crypto screening), or TIKR (for broadest global coverage).

The Future of Stock Screening Is Already Here

Today’s stock screeners offer everything from heat maps and technical indicators to AI-powered analysis and institutional-grade data.

What once required Bloomberg terminals and institutional access is now available to individual investors. You’re lucky to be a retail investor today, and not 10-20 years ago when all of the above was just a pipe dream.

Platforms like Gainify deliver up to 1,000 screening criteria with 4x daily data updates starting at just $7.99/month. TIKR offers comprehensive global coverage at $20/month.

Even free tiers provide capabilities that rival paid platforms from just a few years ago.

Whatever it is you want to screen for – be it stocks, ETFs, options (or even crypto!) you can.

Pre-built and customizable screeners come standard for many of the industry’s top players.

The tools are here. The data is accessible. The only question is which platform matches your investment style best.

Ready to Try Custom Screening?

Ready to discover your next winning stock? Gainify brings together powerful screening tools that institutional investors use. Screen smarter, not harder – with:

✅ 33,000+ stocks across 40+ global exchanges – Find opportunities worldwide, not just US markets

✅ Pre-built screeners for instant results – From AI stocks to dividend champions

✅ Unlimited custom filtering – Screen by 1000+ metrics without result restrictions

✅ Top investor tracking – See what Buffett and other legends are buying

✅ AI-powered analysis – Get intelligent insights beyond basic filtering

✅ Free tier with real capabilities – No credit card required to start

✅ Institutional S&P data – Access the same data Wall Street uses

Start Screening Smarter with Gainify – Free Account, No Credit Card Required →

Find your next winning stock in minutes.

Frequently Asked Questions

What exactly is a stock screener?

A stock screener is a research tool that filters thousands of stocks based on specific criteria you set – like P/E ratio, market cap, dividend yield, or revenue growth. Instead of manually reviewing individual stocks, you can instantly find companies that match your investment strategy.

For context on how this differs from real-time tools, see stock scanner vs screener, and for a deeper explanation, see what is a stock screener.

Do I really need a paid stock screener?

Not necessarily. Several platforms offer robust free screening capabilities. Gainify, Finviz, and ZACKS provide free tiers that can handle basic to intermediate screening needs. However, paid plans typically unlock real-time data, more filtering options, export capabilities, and advanced features like backtesting or AI analysis.

What’s the difference between pre-built and custom screeners?

Pre-built screeners are ready-made filters created by the platform (like “High Growth Tech Stocks” or “Dividend Champions”). You get instant results without configuration. Custom screeners let you build your own filters from scratch using any combination of metrics. Most platforms offer both options.

How important is real-time data vs. delayed data?

It depends on your trading style. Day traders and active traders need real-time data to capture intraday opportunities. Long-term investors can work effectively with 15-20 minute delayed data since they’re focused on fundamental value rather than minute-by-minute price movements.

Can I screen international stocks or just US markets?

Platform coverage varies significantly. TradingView and TIKR offer the broadest global coverage (100+ exchanges). Gainify covers 40+ global exchanges. Others like Stock Rover, Trade Ideas, and TC2000 focus primarily on US and Canadian markets.

What’s the advantage of AI-powered screening?

AI screening tools analyze patterns and relationships that traditional filters might miss. Platforms like Gainify and Trade Ideas use AI to identify opportunities, predict trends, and provide context beyond simple metric matching. This can uncover non-obvious investment opportunities.

How many stocks should a good screener cover?

For US-focused investors, 5,000-10,000 stocks provides solid coverage. For global investors, look for platforms covering 25,000+ stocks. Gainify covers 33,000+ stocks, TIKR covers 100,000+ stocks, while Stock Rover covers 8,500 North American stocks.

Can I save and reuse my screening criteria?

Most paid platforms let you save multiple custom screens. Free tiers often limit saved screens – for example, TIKR’s free plan allows just 1 saved screen. Check this feature if you plan to run regular screens with different strategies.