Every market cycle revives the same debate: Should investors favor growth or value?

Growth stocks promise rapid expansion, fueled by innovation and earnings acceleration. Value stocks offer stability, cash flow, and a chance to buy strong businesses at a discount. Both can outperform, but rarely at the same time.

Since 1970, value stocks have led about 55% of the time, while growth has dominated during the past decade, especially in an era of low interest rates and technology disruption. With interest rates, inflation, and liquidity shifting again, understanding the difference between the two has never been more important.

This guide breaks down what drives each style, when they work, and how experienced investors combine them to build more resilient portfolios.

1. Understanding the Core Difference

Growth Stocks | Value Stocks | |

Goal | Capture future earnings growth | Buy at a discount to intrinsic value |

Sectors | Semiconductors, Software, E-commerce, Fintech | Financials, energy, industrials, Healhcare |

Valuation | Higher P/E and P/S ratios | Lower P/E and P/B ratios |

Rarely pay | Often consistent | |

Volatility | High | Lower |

When They Shine | Low-rate, expansionary periods | Rising-rate, recovery periods |

2. What Drives Growth Stocks

Growth companies reinvest profits to scale faster than the economy. Investors pay a premium for future earnings potential and competitive advantages.

Typical characteristics:

- Rapid revenue and earnings growth (often double-digit).

- Expanding margins and reinvestment into innovation.

- High valuation multiples justified by market share expansion.

- Low or no dividend payouts.

Examples:

- NVIDIA (NVDA): The dominant force in AI and GPU computing. Its data center revenue has surged more than 100% year-on-year, driven by global demand for AI infrastructure and accelerated computing.

- Palantir Technologies (PLTR): Specializes in data analytics and artificial intelligence platforms for both government and enterprise clients. Its profitability and commercial client base have expanded significantly since 2023 as AI adoption accelerates.

- SoFi Technologies (SOFI): A fintech innovator offering digital banking, lending, and investment services. SoFi continues to grow revenue double digits annually while moving toward sustained profitability, positioning itself as a leader in next-generation financial platforms.

Favorable Conditions for Growth Stocks

Growth stocks tend to outperform when the market rewards future earnings potential over current profitability. This usually happens when:

- Interest rates are low: The present value of long-term cash flows rises, supporting higher valuations.

- Credit is easily available: Cheap capital fuels expansion, M&A activity, and innovation spending.

- Liquidity is abundant: Central bank support or investor inflows lift risk appetite and equity multiples.

- Investor sentiment is optimistic: Markets favor companies driving technological change and productivity gains.

Key Risks

However, growth stocks can underperform sharply when market dynamics reverse. Main vulnerabilities include:

- Valuation compression: High-multiple stocks are most exposed when discount rates or yields rise.

- Earnings disappointments: Even small misses on aggressive forecasts can trigger sharp price corrections.

- Monetary tightening: Higher interest rates shift preference toward companies with immediate, predictable cash flow.

- Concentration risk: Leadership often narrows to a few mega-cap names, amplifying volatility if sentiment turns.

3. What Drives Value Stocks

Value investing targets companies trading below intrinsic worth. The goal is mean reversion – buying when pessimism is priced in and selling when sentiment recovers.

Typical characteristics:

- Low valuation ratios (P/E, P/B, EV/EBITDA).

- Steady cash flow and strong balance sheets.

- Dividend income provides downside protection.

- Often found in cyclical or mature sectors.

Examples:

- Berkshire Hathaway (BRK.B): A core value benchmark combining insurance, energy, and industrial holdings. Its disciplined capital allocation and strong free cash flow make it a model of long-term intrinsic value investing.

- JPMorgan Chase (JPM): A global financial leader benefiting from higher interest margins and diversified revenue streams. Offers steady earnings, solid dividends, and balance-sheet strength typical of quality value stocks.

- Johnson & Johnson (JNJ): A defensive healthcare giant with reliable cash flow and decades of dividend growth. Its diversified business and stable demand provide income and resilience in uncertain markets.

Favorable Conditions for Value Stocks

Value stocks tend to outperform when markets shift focus from future potential to current earnings strength and cash flow. They perform best when:

- Economic activity is recovering: Early-cycle rebounds lift cyclical sectors such as financials, energy, and industrials.

- Inflation and real yields are rising: Companies with pricing power and tangible assets benefit as money becomes more expensive.

- Credit conditions tighten: Investors rotate toward firms with strong balance sheets and visible cash generation.

- Earnings leadership broadens: When profit growth extends beyond a handful of mega-cap names, value typically gains relative strength.

Key Risks

Despite their defensive appeal, value stocks face several structural and cyclical risks:

- Value traps: Low valuation may reflect genuine business decline or structural disruption rather than opportunity.

- Prolonged lag periods: During liquidity-driven or momentum-led rallies, value can underperform for extended stretches.

- Sector concentration: Value indices are often heavy in financials and energy, increasing exposure to macro cycles.

- Limited innovation premium: Slower growth in secular trends can limit upside in prolonged bull markets.

4. Historical Performance

The relationship between growth and value follows clear cycles:

Period | Leadership | Drivers |

1970s–1980s | Value | High inflation, rising interest rates, capital-intensive industries |

1990s | Growth | Tech boom, productivity expansion, falling rates |

2000s | Value | After dot-com crash, focus on cash flow and value recovery |

2010s | Growth | Prolonged low rates, digital disruption, platform dominance |

2022–2023 | Value | Inflation shock, rate increases, rotation into cyclical value sectors |

2024 onward | Growth | AI-driven growth continues, selective value rebound in cyclicals and financials |

As of late 2025, the S&P 500 Growth Index trades near 25x forward earnings, compared to 16x for the Value Index. That gap reflects optimism for AI-related growth but leaves room for rotation if the U.S. economy weakens.

5. When to Tilt Toward Each

Timing growth versus value often depends on the macro backdrop and investor sentiment.

Growth Stocks Outperform When…

Market environment: Stable or easing monetary conditions favor long-term earnings potential.

Key signals to watch:

✅ Falling or stable inflation levels

✅ Central banks cutting or pausing rate hikes

✅ Steady economic expansion without overheating

✅ Strong earnings momentum in tech and communication sectors

✅ Rising liquidity and risk appetite in equity markets

In short: Growth thrives when money is cheap, optimism is high, and investors pay up for the future.

Value Stocks Outperform When…

Market environment: Early-cycle recoveries and tighter financial conditions reward companies generating cash today.

Key signals to watch:

✅ Inflation and rates moving higher

✅ Economic rebound lifting cyclical sectors

✅ Broader earnings growth across industries

✅ Rotation toward dividends and balance-sheet strength

✅ Tightening credit conditions and rising real yields

In short: Value leads when markets refocus on fundamentals, cash flow, and tangible earnings power.

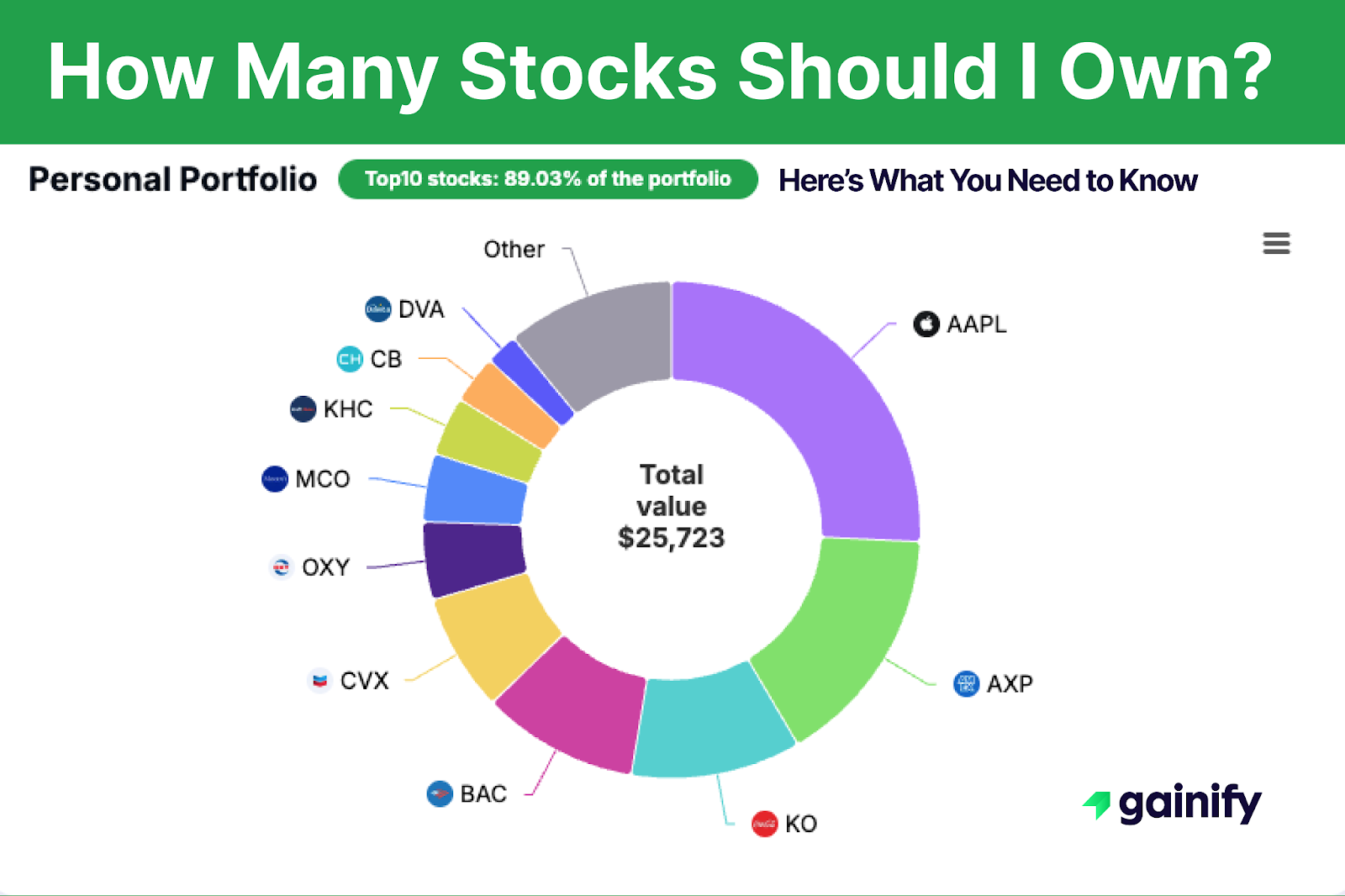

6. How to Combine Growth and Value

Most professional investors don’t choose one style over the other.

Instead, they blend both and adjust exposure based on the economic cycle.

Approach 1: Core Blend

A steady, long-term allocation designed for balance and simplicity.

- 50% in a broad market index (e.g., S&P 500 or MSCI World).

- 25% in a growth ETF such as Vanguard Growth ETF (VUG).

- 25% in a value ETF such as iShares Russell 1000 Value (IWD).

- Rebalance every 6–12 months to keep weights consistent.

💡 Best for investors who want diversification without constant monitoring.

Approach 2: Barbell Strategy

Combine offense and defense within the same portfolio.

- Hold high-quality growth leaders with strong balance sheets.

- Pair them with deep-value names that have visible catalysts (e.g., buybacks or restructuring).

- Keep sector balance in check and avoid letting tech exceed 30–35% of total exposure.

💡 This method works well when markets are uncertain or rotating between styles.

Approach 3: Dynamic Tilt

Actively shift between growth and value based on macro conditions.

- Track indicators like the yield curve, PMI trends, inflation, and real rates.

- Tilt 10–15% toward value when inflation rises and rates move higher.

- Shift back toward growth when liquidity expands or central banks start cutting rates.

💡 Ideal for investors who follow macro trends and are comfortable making tactical adjustments.

7. Avoiding Common Mistakes

For growth investors:

- Do not ignore valuation. Even great companies can be poor investments at extreme prices.

- Avoid concentration in a handful of mega-caps.

- Track free cash flow trends, not just revenue growth.

For value investors:

- Cheap is not always good. Confirm that earnings and margins are stabilizing.

- Demand catalysts: buybacks, management change, or improving fundamentals.

- Diversify across sectors to avoid cyclical traps.

For everyone:

- Define your time horizon. Growth’s payoff can take years.

- Review style exposure at least twice per year.

- Focus on total return, not short-term relative performance.

7. Avoiding Common Mistakes

Even experienced investors fall into style traps.

Use these simple rules to stay balanced, whether you prefer growth, value, or a mix of both.

For Growth Investors

⚠️ Don’t ignore valuation: High expectations can erase returns fast when multiples compress.

⚠️Focus on free cash flow: Revenue growth means little without profitability and cash conversion.

⚠️ Avoid overconcentration: Too much exposure to a few mega-cap names increases volatility and correlation.

⚠️Stick to fundamentals: Prioritize durable business models, pricing power, and balance-sheet strength over hype.

For Value Investors

⚠️ Cheap isn’t always good: Low multiples can signal weak demand or declining relevance. Confirm that earnings are stabilizing.

⚠️ Look for catalysts: Buybacks, margin recovery, or management changes help unlock value.

⚠️ Diversify smartly: Balance cyclicals (energy, financials) with defensives (healthcare, staples) to reduce downside risk.

⚠️ Prioritize quality: Target companies with low debt, positive cash flow, and consistent dividend records.

For All Investors

⚠️ Define and revisit your time horizon: Growth rewards patience, value rewards discipline. Align exposure with your goals and tolerance for volatility.

⚠️ Rebalance regularly: Market rotations happen quickly, review your style mix at least twice a year.

⚠️ Focus on total return: Blend capital gains, dividends, and risk management. Avoid chasing quarterly performance.

⚠️ Stay consistent: Follow a defined process. Over time, discipline outperforms prediction.

8. Summary: Balancing Risk and Opportunity

- Growth stocks capture innovation and earnings acceleration, but carry valuation and interest rate risk.

- Value stocks provide stability, dividends, and protection in high-rate environments, but can lag in technology-led rallies.

- Market leadership alternates. Neither style wins forever.

- Diversification works best: blending both helps manage risk through changing cycles.

- Smart investors adapt. Use data, discipline, and clear rebalancing rules to decide when to tilt.

In the end, the most effective strategy is not to choose sides but to understand why each style works, when it leads, and how it fits within your broader investment framework.