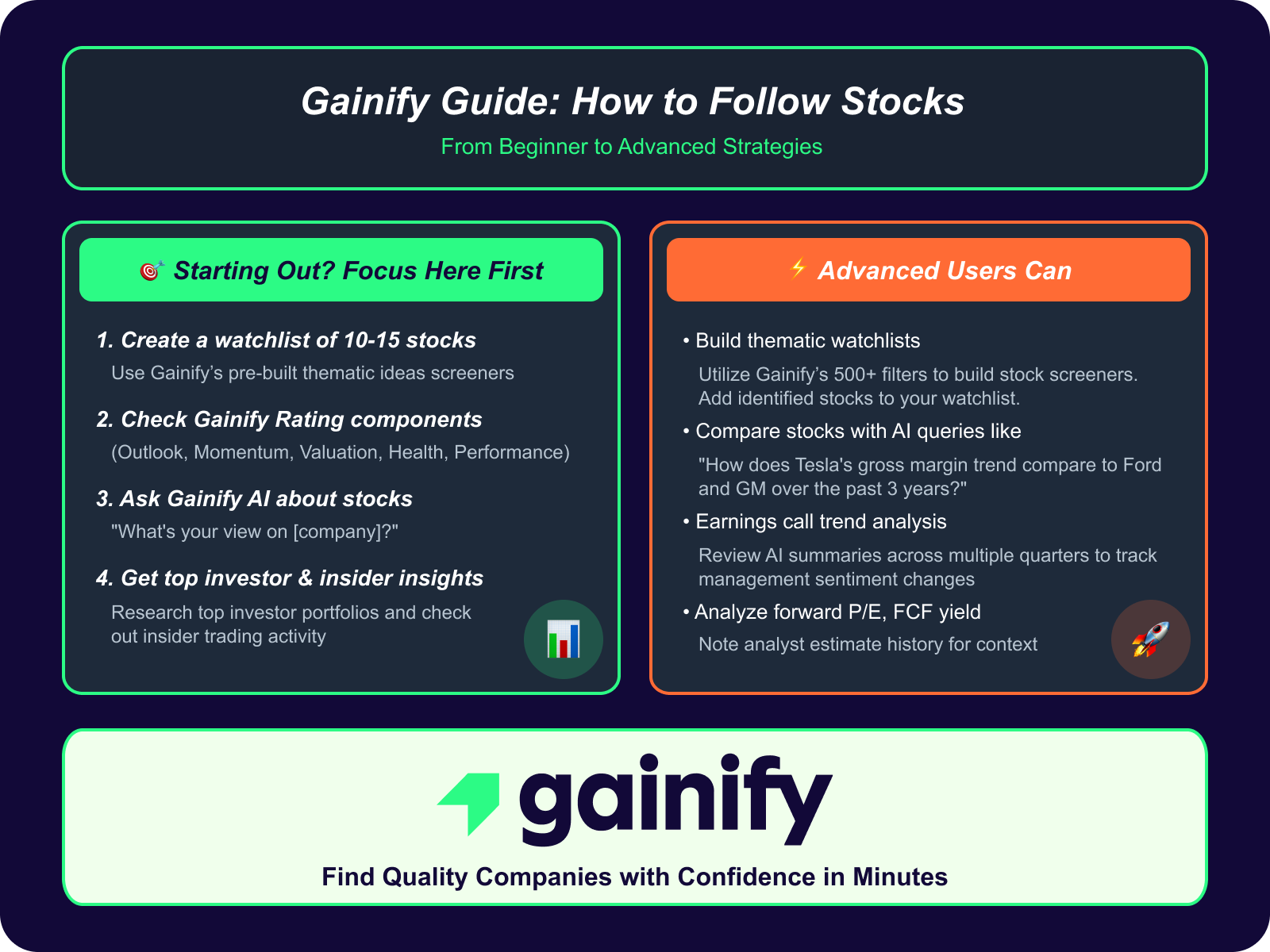

To get an edge in the stock market you need to uncover quality companies with strong fundamentals – companies poised for growth. You don’t need to become a corporate spy to achieve this. You don’t need to spend all day researching stocks, either. All you need to do is build a systematic approach to tracking stocks by utilizing smart tools to save you time without sacrificing research quality.

In this guide, you’ll learn how to follow stocks like a pro investor without spending thousands of dollars each year on subscriptions and stock pick newsletters. From setting up your first watchlist to powering up your research process with AI stock analysis.

Modern stock tracking requires:

- Real-time institutional-grade stock data

- AI stock analysis to speed up your research

- Fundamental analysis including forward estimates

- Customizable stock screening and pre-built screeners

- Institutional activity monitoring to follow Congress and insider trading

This might sound like a lot to wrap your head around. But following stocks effectively doesn’t require drowning in data or spending hours on research. With Gainify, all this is possible with just a few minutes each day.

Gainify gives you access to institutional-grade data and stock research functionality, including:

- Top investor tracking plus Congress and insider trading insights.

- Real-time market data through S&P Global Intelligence integration.

- Forward estimate tracking with 10+ years of analyst projections.

- AI stock analysis with Gainify AI, built by investors for investors.

- Proprietary metrics including Gainify’s 5-factor scoring system.

- Institutional-quality screeners with 500+ filtering criteria.

Step 1: Setting Up Strategic Watchlists

There are thousands of stocks available for you to research. Trying to track too much leads to paralysis and poor decisions. You need to get organized with a stock watchlist – a list of stocks that you’re interested in, and wish to stay up to date on.

There are a few ways you can go about creating your first watchlist:

- Search for stocks you’ve heard about and may be interested to invest in. Add these individually to your watchlist.

- Use pre-built or customized stock screener to uncover top growth stocks or industry leaders

- Copy winning portfolios from top investors like Warren Buffet or Ray Dalio to your own watchlist

Watchlist Organization Best Practices

- Limit each list to 20-25 stocks for manageable monitoring

- Name lists descriptively (e.g., “Q1 2025 Growth Picks” not “List 3”)

- Review and prune quarterly removing stocks that no longer fit criteria

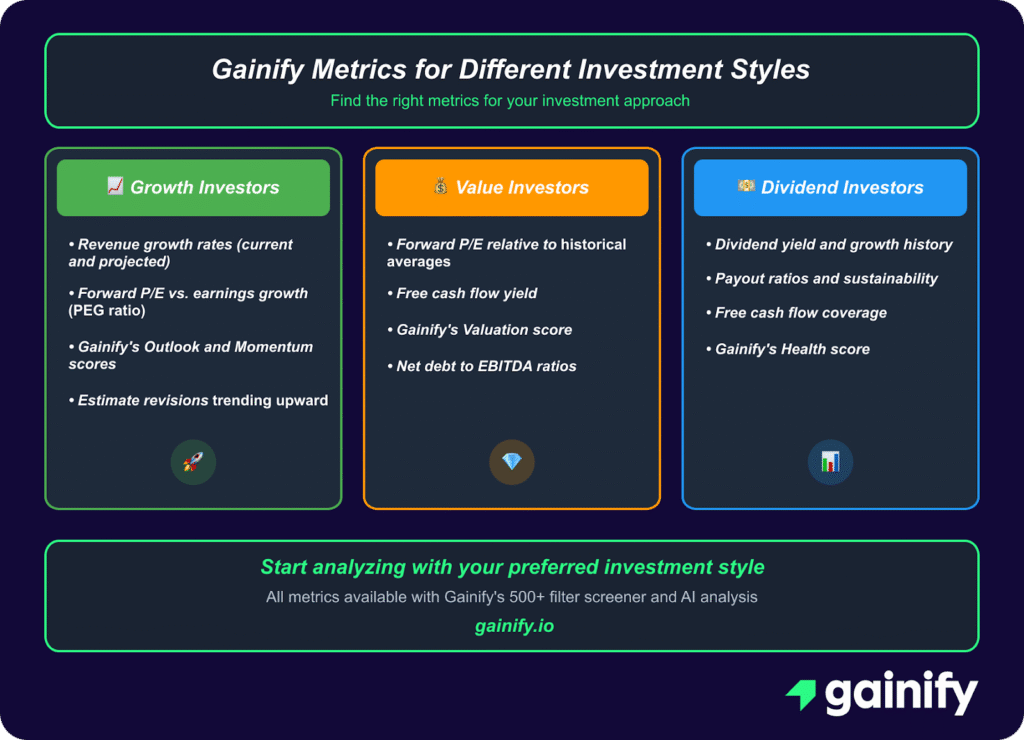

Step 2: Mastering Key Stock Metrics That Matter

When new to investing, you may be tempted to focus on price charts and technical analysis patterns. But there is a lot more to stock research than looking at candles on a chart.

Metrics you need to understand at least at a basic level include:

- Valuation metrics: Look out for a stock’s forward P/E ratio, PEG ratio, Price/Sales and EBITDA.

- Growth indicators: Revenue growth rate, free cash flow, and earnings estimates all give insights into a company’s growth.

- Financial health markers: Metrics like debt/equity ratio, return on equity, and Gainify’s proprietary financial health analysis give critical insights.

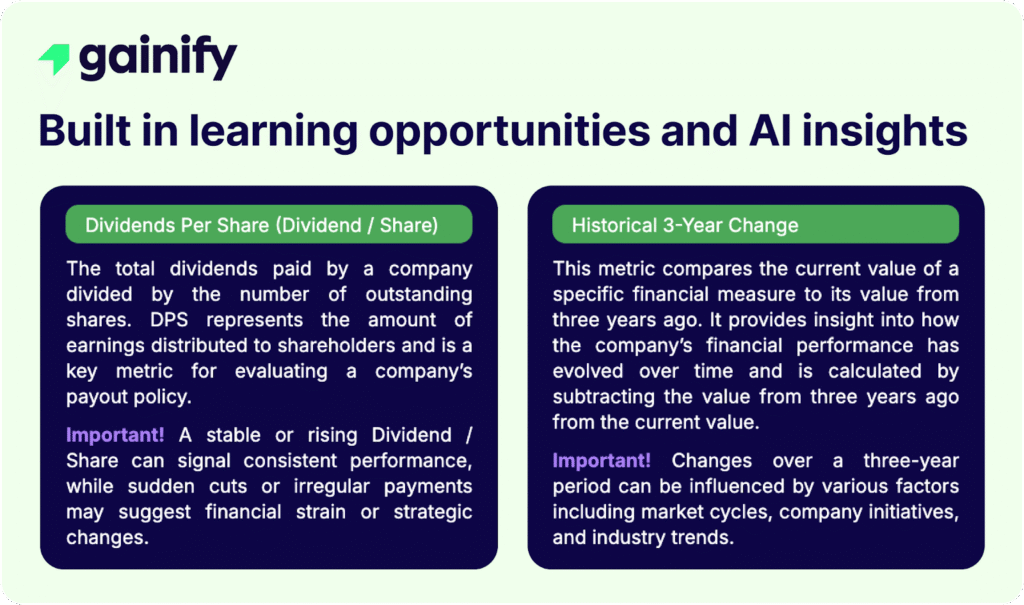

You’ll notice that Gainify has tooltips to explain every metric displayed in the platform. This helps you learn about stocks as you analyze them, and also serves as a helpful reminder if you need to refresh your knowledge about specific key metrics.

Leveraging Gainify’s Proprietary Metrics

Gainify provides you with 5 key proprietary metrics not found elsewhere. These track the key aspects of a company’s health and growth prospects.

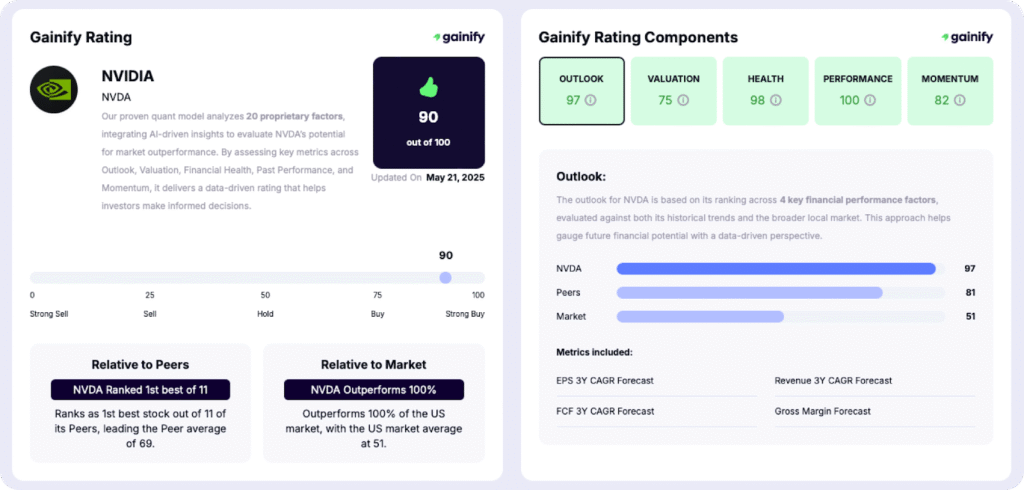

Each stock receives a proprietary Gainify score for:

- Performance: Analyzes management’s ability to consistently deliver growth and shareholder value. Gives you insights into how well leadership has navigated different market conditions and delivered results for investors.

- Momentum: A stock’s current market strength through 3 price-movement indicators. Helps you identify stocks that could deliver continued outperformance.

- Valuation: Allows you to assess whether a stock is undervalued, fairly priced, or overvalued relative to its own history and market benchmarks.

- Outlook: Synthesizes forward-looking analyst estimates to gauge future potential. Helps you understand a stock’s expected trajectory compared to industry peers and the broader market.

- Health: How well a company may be able to weather economic downturns and meet its long-term obligations. Helps you understand how well a company can weather tough market conditions.

Trying to track too many metrics at once will lead to analysis paralysis. Focus on the vital few metrics that actually drive returns – use Gainify’s 5 proprietary factor scores for fast yet informative analysis.

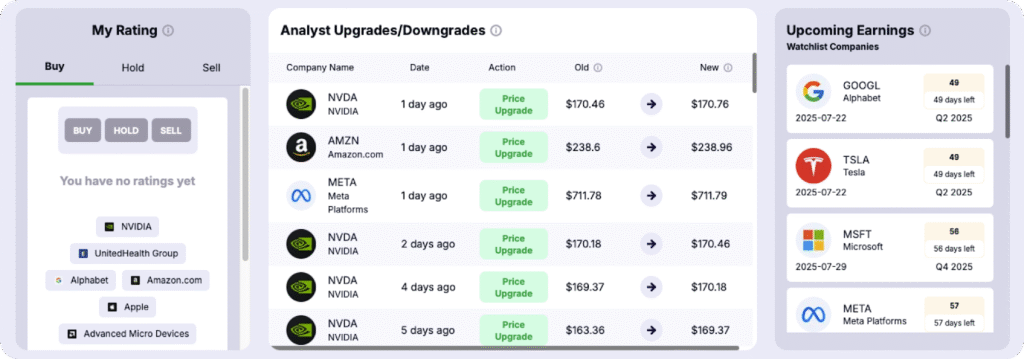

Step 3: Professional Earnings Tracking

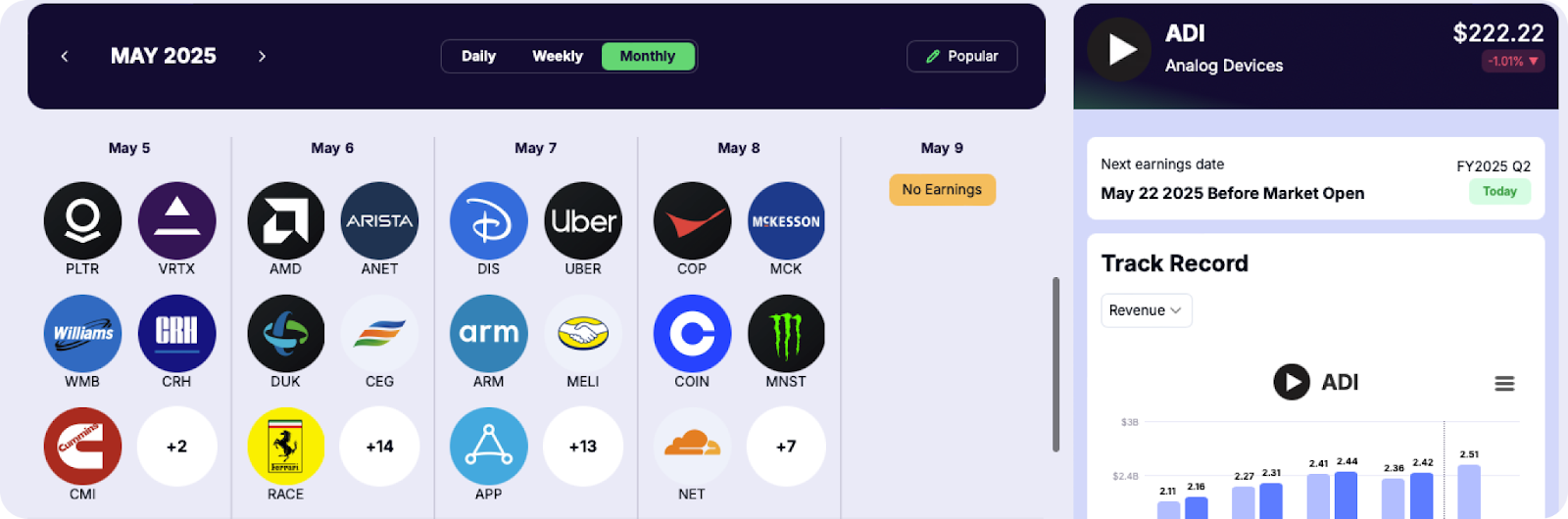

One thing you don’t want to miss is earnings announcements. If you do, you’ll be blindsided by surprises, and top opportunities will escape you.

A week or two before scheduled earnings calls you should:

- Review consensus estimates for EPS and revenue

- Check recent estimate revisions – are analysts raising or lowering?

- Analyze previous quarters – does the company typically beat?

- Monitor competitor results – sector trends often preview results

All this can be done in Gainify, with clear dashboards and data visualizations to help you analyze and compare in minutes.

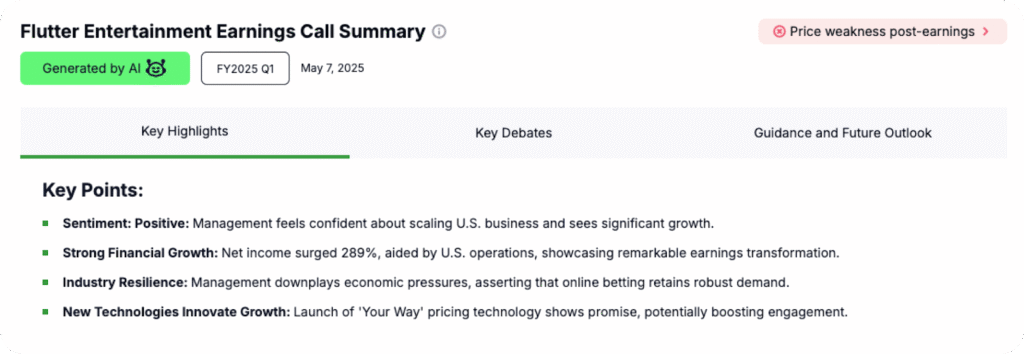

When earnings day rolls around, there’s no need to tune in for the call. Instead, check in later that day and review Gainify’s earnings call summary.

Earnings call summaries transform hour long calls into quick bullet points about the most important revelations – the things likely to drive stock price moving forward.

Step 4: Follow Top Investors and Insiders

Top investors invest hundreds of thousands of dollars in stock research. Sometimes even millions. This enables them to identify some of the best opportunities.

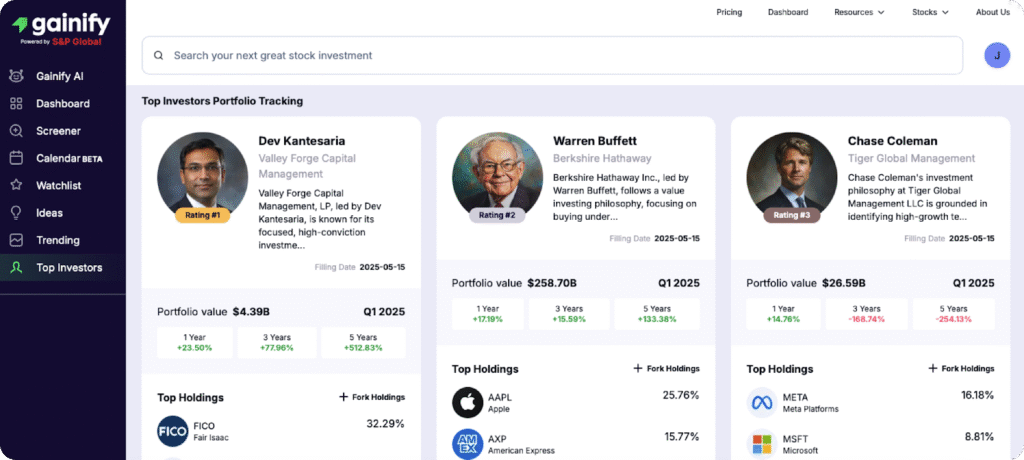

With Gainify’s top investor tracking, you can get insights into what and when the world’s best investors are buying or selling.

Track the portfolios of Warren Buffet (Berkshire Hathaway), Chuck Akre (Akre Capital Management), Li Lu (Himalaya Capital Management), Nicolai Tangen (Ako Capital), and more.

Additional useful features include:

- Compare top investors head to head: View side-by-side performance charts comparing how different top investors’ portfolios have performed over time.

- Fork top investor portfolios to your watchlist: Copy entire portfolios from top investors directly to your own watchlist for easy tracking.

- Real-time trade alerts: Get personalized notifications whenever the investors you choose to follow make new trades.

Gainify provides detailed portfolio breakdowns including portfolio values, number of holdings, industry allocations, and recent trading activity. You gain complete transparency into how market legends structure and manage their investments.

Step 5: Use Gainify AI for Advanced Analysis

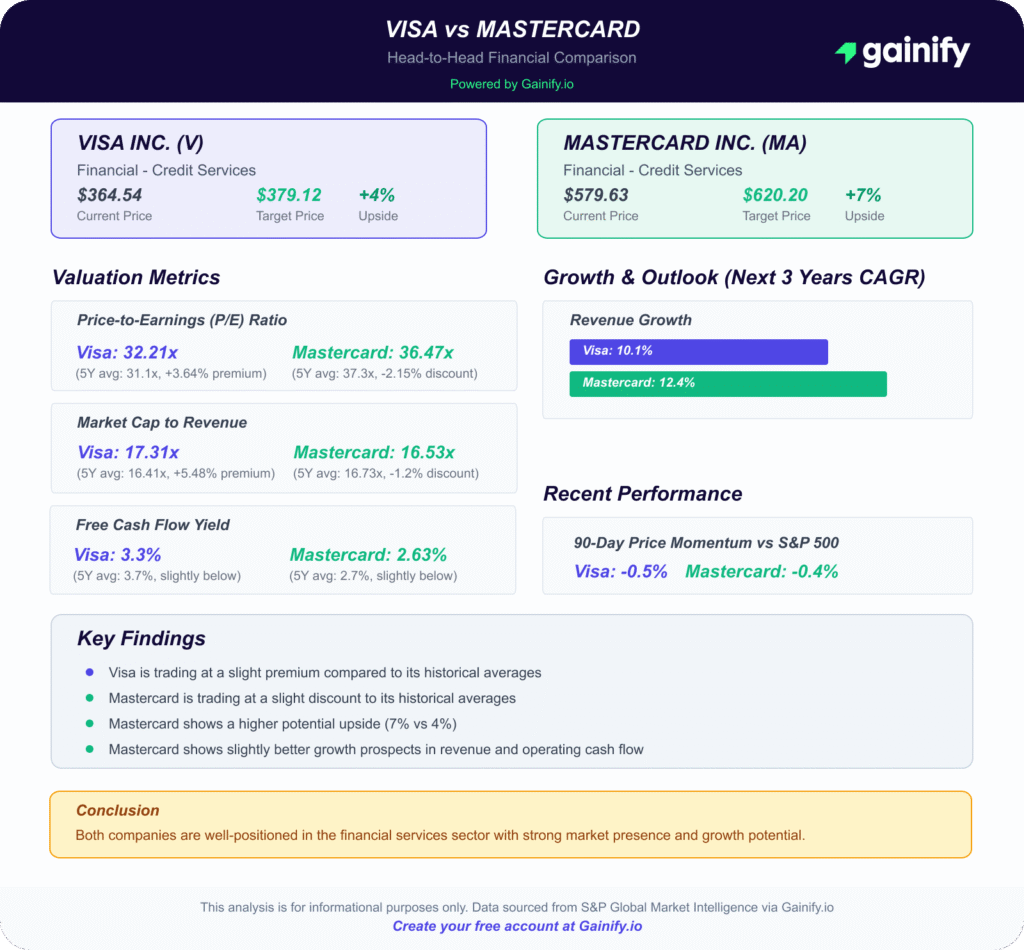

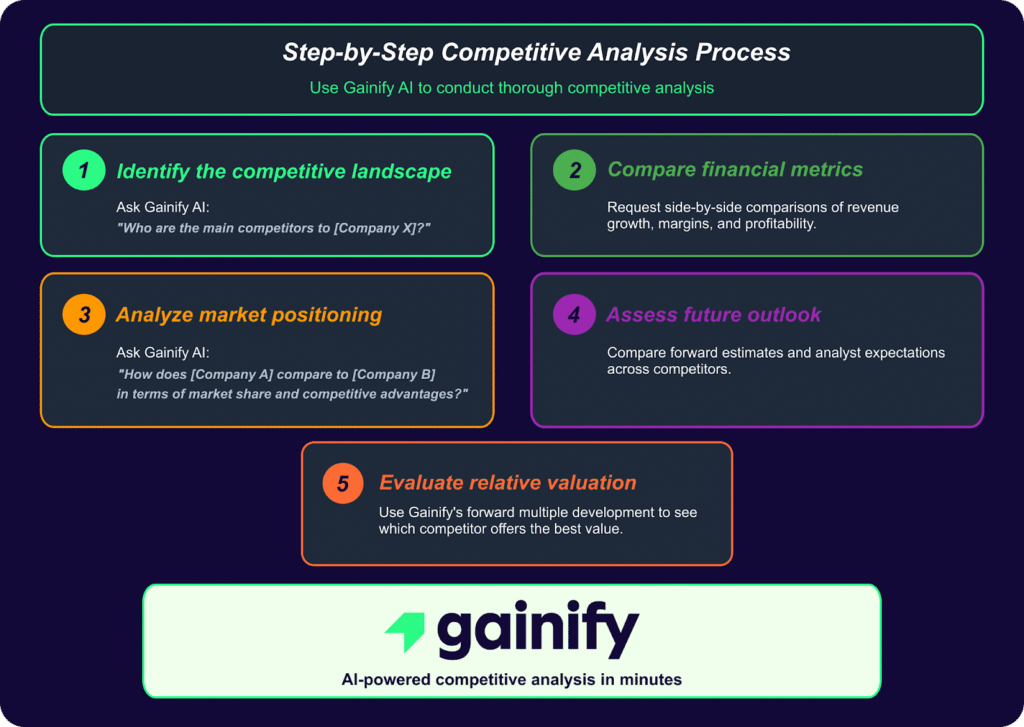

Gainify’s AI – purpose-built for stock research – is your personal investment analyst. Instead of manually sifting through hundreds of sources, just ask Gainify AI to deep dive into a stock or industry for you.

Gainify AI is perfect for:

- Auto-generating earnings call summaries with key takeaways

- Comparing competitors instantly across hundreds of metrics

- Analyzing forward estimates from the world’s largest analyst database

- Identifying sector trends through pattern recognition

- Answering specific questions about any stock in seconds

You can ask Gainify all your most important stock research questions, including:

- “What are Microsoft’s key growth drivers for 2025?”

- Compare Visa and Mastercard head-to-head

- Which semiconductor stocks have the best forward estimates?

Try it out for yourself with a free Gainify account (no credit card required). Below is an example of the kind of insights you will gain from head to head stock comparisons.

Another top use case for Gainify AI is in getting a second opinion. If you only analyze information that supports your existing thesis, you’re setting yourself up for some dangerous blind spots.

Ask Gainify AI: “What are the bear cases for this stock?” to get a comprehensive and unbiased look into each stock.

It’s also great if you’re just getting started in the world of stocks and investing. If you’re unsure about a key investing concept or metric, just ask Gainify AI. You’ll get a comprehensive explanation of investing strategies, industry jargon and terminology, the significance of specific metrics, and more.

Gainify AI is trained specifically for investment research and connected to S&P Global Intelligence data.

Step 6: Create Your Automated Stock Screener System

Finding quality companies to invest in can feel like trying to find a needle in a haystack. Stock screeners take much of the hard work out of stock research by automating stock discovery.

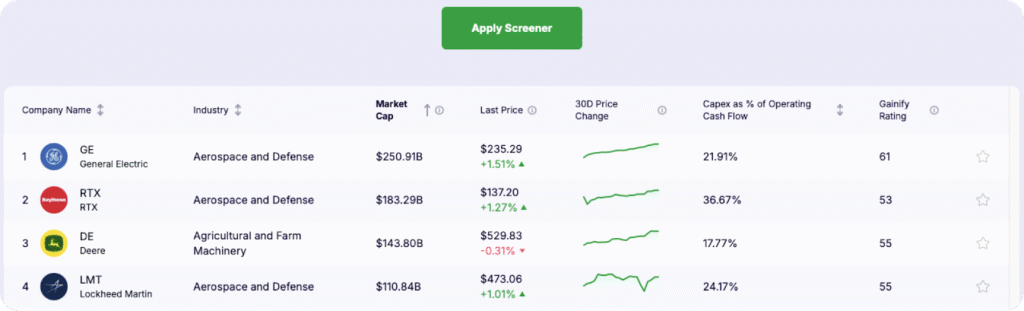

There are two ways you can use stock screeners within the Gainify platform. Either get quick insights from Gainify’s pre-built screeners, or use Gainify’s vast selection of filters to create your own custom screeners.

Pre-built screeners cover top industries and stock groups such as:

- AI Stocks: Companies at the forefront of artificial intelligence innovation

- Quantum Computing: Businesses developing quantum technologies and applications

- Space Exploration: Leading companies in the space industry and aerospace

- Nuclear Energy: Organizations focused on nuclear power and related technologies

- Semiconductor Stocks: Key players in the critical semiconductor industry

- Cash Cows: Companies generating strong, consistent free cash flow

- Dividend Champions: Reliable dividend-paying stocks with strong histories

- Valuation Opportunities: Potentially undervalued companies with strong fundamentals

- Companies in a Pivot Year: Businesses undergoing transformational changes

Custom screeners on the other hand enable you to find stocks meeting your specific criteria – no matter how unique it is. You will have access to over 500 filters spanning market data, fundamentals, forward estimates, and valuation multiples – enabling you to create highly targeted searches across 29+ global exchanges and 150+ industries.

Conclusion: How to Follow Stocks Like a Pro

Effective stock tracking in 2025 doesn’t require watching screens all day, or drowning in streams of stock data.

The difference between successful investors and everyone else isn’t intelligence or luck – it’s having the right system and sticking to it. Your edge isn’t in having more information – it’s in having better tools to process that information faster and more accurately.

Gainify gives you the stock research systems and tools you need, backed by institutional-grade data and breakthrough AI technology. You will be able to cover more stocks, and analyze them more deeply – in just a fraction of the time.

Get your free Gainify account today!

The six-step framework outlined in this guide gives you everything you need. Start with just 5-10 stocks in your first watchlist. Master the fundamentals. Use Gainify AI to accelerate your learning curve. Track what the smart money is doing. Before you know it, you’ll be identifying quality companies that others miss.

Remember: Every professional investor started as a beginner. The key is building good habits early and letting compound knowledge work in your favor. With just 10 minutes a day using Gainify’s systematic approach, you’ll be following stocks like a seasoned pro within months.

Frequently Asked Questions: How to Follow Stocks Like a Pro

How many stocks should I follow as a beginner?

Start with 10-20 stocks maximum. Following too many leads to analysis paralysis and poor decision-making. Focus on mastering the fundamentals with a smaller, manageable watchlist before expanding. You can always add more stocks as you become more experienced.

How often should I check my stock watchlist?

Check your watchlist 2-3 times per week, with one deeper review weekly. Daily monitoring often leads to emotional decisions based on short-term price movements. The most successful investors think in months and years, not hours and days.

What’s the difference between following stocks and day trading?

Following stocks focuses on fundamental analysis and long-term value creation through company performance. Day trading relies on short-term price movements and technical patterns. Following stocks is about building wealth; day trading is speculation.

Do I need expensive tools to follow stocks effectively?

No. While institutional grade tools can cost tens of thousands annually – Gainify provides institutional-grade data and AI analysis FREE. Paid plans enabling up to 500 AI queries per month are accessible, costing from $7.99–$26.99/month. The key is having reliable data sources and systematic analysis tools, not expensive subscriptions.

How do I know when to buy a stock I’m following?

Look for convergence of multiple positive factors: strong fundamentals (revenue growth, healthy margins), reasonable valuation (forward P/E, PEG ratio), positive analyst revisions, and insider/institutional buying. Never buy on a single metric – use Gainify’s 5-factor scoring system for comprehensive evaluation.

Should I follow what famous investors like Warren Buffett are buying?

Top investor tracking is valuable for learning and inspiration, but don’t blindly copy trades. By the time 13F filings are public, professionals may have already moved. Use top investor insights to understand their investment thesis and apply similar analysis to your own research.

How important are earnings calls for stock following?

Very important. Earnings calls reveal management sentiment, guidance changes, and strategic shifts that numbers alone can’t capture. Use Gainify’s AI earnings summaries to quickly extract key insights without listening to hour-long calls.

What’s the biggest mistake beginners make when following stocks?

Information overload. New investors often try to track everything – dozens of stocks, hundreds of metrics, constant news flow. This leads to poor decisions and burnout. Focus on quality over quantity: fewer stocks, key metrics, and systematic analysis using proven frameworks.