Dividends are the quiet powerhouse of investing, offering small but steady payouts that can grow into significant wealth over time.

While stock prices move up and down with market swings, dividends keep paying. They reward shareholders directly, often through cash deposits or additional shares, providing a reliable stream of income even when markets are uncertain.

Understanding how dividends work, why companies choose to pay them, and when you need to own a stock to qualify for a payment is an essential part of building a strong, income-focused investing strategy.

What Is a Dividend?

A dividend is a portion of a company’s profits that is paid out to shareholders as a reward for owning its stock. It reflects a company’s financial strength, consistent cash flow, and commitment to returning value to investors.

Dividends are most often paid in cash, but companies can distribute them in different ways:

- Cash dividends: Regular payments made directly to shareholders, usually every quarter.

- Stock dividends: Additional shares issued to investors instead of cash.

- Special dividends: One-time payments made after exceptionally strong earnings or major asset sales.

Companies with stable earnings and mature business models, such as those in utilities, consumer goods, and financial services, often use dividends to attract and retain long-term investors who value steady income and reliability.

How Companies Decide to Pay Dividends

Not every company pays dividends, and the decision to do so requires a careful balance between reinvesting for growth and returning profits to shareholders.

Here is how the process typically works:

- Profitability review: The board of directors evaluates earnings, free cash flow, and debt levels to assess whether the company can support regular dividend payments.

- Management recommendation: Senior management reviews financial forecasts and proposes a dividend policy or adjustment to the board.

- Payout policy: The board considers the dividend payout ratio, which shows what portion of profits will be paid to shareholders compared with what will be reinvested in the business.

- Approval: The board votes on the proposed dividend amount, frequency, and payment schedule based on the company’s financial position and strategic goals.

- Announcement: The company issues a formal announcement with details of the dividend amount, record date, ex-dividend date, and payment date.

Companies with consistent earnings and strong cash flow, such as Coca-Cola ($KO) and Procter & Gamble ($PG), often prioritize steady dividend payments to reward shareholders and demonstrate financial discipline.

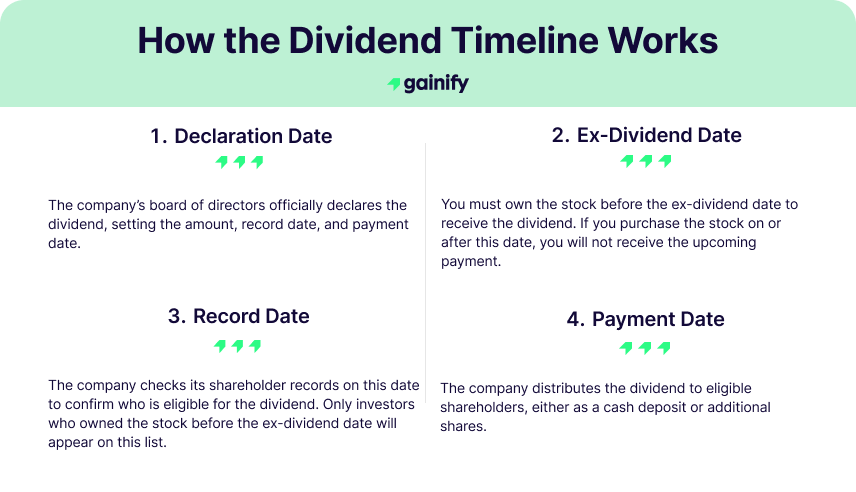

Key Dividend Dates: When You Need to Own the Stock

Timing is one of the most important parts of dividend investing.

To receive a dividend, you must own the stock before a specific cutoff point in the dividend timeline. Missing that date means you will not qualify for the next payout.

Below are the four key dates every investor should understand:

Date | Description |

Declaration Date | The company’s board of directors officially declares the dividend, setting the amount, record date, and payment date. |

Ex-Dividend Date (Ex-Date) | This is the most important date for investors. You must own the stock before the ex-dividend date to receive the dividend. If you purchase the stock on or after this date, you will not receive the upcoming payment. |

Record Date | The company checks its shareholder records on this date to confirm who is eligible for the dividend. Only investors who owned the stock before the ex-dividend date will appear on this list. |

Payment Date | The company distributes the dividend to eligible shareholders, either as a cash deposit or additional shares. |

Example: How the Dividend Timeline Works

Imagine a company announces a quarterly dividend with the following schedule:

- Declaration Date: May 20

- Ex-Dividend Date: June 10

- Record Date: June 11

- Payment Date: July 1

Here’s what this means for you as an investor:

- Buy before June 10: You must purchase shares by the end of trading on June 9 to be eligible.

- Hold through June 11: You must still be a shareholder on the record date.

- Receive payment on July 1:The dividend will appear in your brokerage account as cash or reinvested shares.

IMPORTANT: If you buy on or after June 10, you will not receive this dividend and will need to wait for the next distribution.

How Dividend Amounts Are Determined

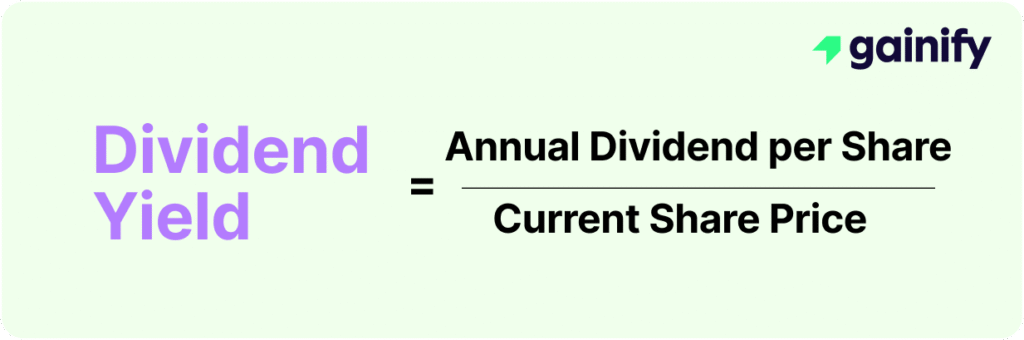

A company’s dividend is usually stated in dollars per share, such as $0.50 per share, or shown as a dividend yield, which measures the annual dividend compared with the current stock price.

The dividend yield helps investors understand how much income they earn relative to the stock’s price.

Dividend Yield = Annual Dividend per Share ÷ Share Price

Example

If a stock pays $2.00 per year in dividends and trades at $40 per share, the calculation is: 2÷40=5%

The dividend yield in this case is 5%, meaning investors earn $5 in dividends each year for every $100 invested at that price.

Companies typically aim for a sustainable payout ratio, which shows how much of their earnings are distributed as dividends. Most healthy payout ratios fall between 30% and 60% of net income, allowing businesses to reward shareholders while still reinvesting enough profits to support future growth.

Why Dividends Matter

Dividends reflect a company’s financial health and management confidence. Firms that consistently raise dividends (known as Dividend Aristocrats) signal stability and shareholder focus.

For investors, dividends:

- Provide steady income regardless of market volatility

- Help smooth long-term returns

- Serve as a signal of company strength

Even in uncertain markets, dividend-paying stocks often outperform because they deliver tangible returns while investors wait for prices to recover.

The Bottom Line

Dividends are one of the most powerful tools for building wealth through consistency rather than speculation.

Understanding how dividends work, when to buy before the ex-dividend date, and how companies decide to pay them gives investors a practical edge. Whether you prefer cash payouts or reinvestment, dividends can turn a portfolio into a steady engine of long-term growth and income.