Investing has always been about one big question: how do you make the smartest possible decision with your money? For centuries, investors relied mostly on intuition, experience, and careful study of companies. But over the past few decades, a new approach has transformed how professionals think about financial markets: quantitative investing.

The term might sound intimidating, but the concept can be broken down into very simple terms. Quantitative investing (often shortened to “quant investing”) is an investment process that uses mathematics, statistical analysis, and computer systems to evaluate investment opportunities and manage portfolios systematically.

Unlike traditional active equity investment strategies, where analysts may study a company’s annual report or meet with management, quantitative investing relies on data-driven decision making. This includes building securities selection models, applying portfolio theory, and executing trades through algorithmic trading systems.

In this expanded guide, we’ll cover:

✅ What quantitative investing actually means in practice

✅ How the investment process works step by step

✅ The most common quantitative investment strategies (with examples)

✅ The benefits and risks of systematic investing

✅ Who uses quant methods (from institutional investors to individuals)

✅ A closer look at Renaissance Technologies and other legendary quant funds

✅ How beginners can apply quant principles in their own portfolios

✅ Key takeaways for building wealth with quantitative finance

By the end, you’ll see why quantitative investing has become one of the most powerful forces in modern asset management and how it is reshaping investment research globally.

What Is Quantitative Investing?

At its core, quantitative investing is about using data analysis instead of gut feelings.

- “Quant” refers to quantitative finance, meaning the use of mathematics, probability, and statistical analysis to evaluate investment opportunities.

- “Investing” means allocating money into asset classes such as stocks, bonds, derivatives, and index funds with the goal of long-term growth.

Put together, quant investing is about replacing subjective judgment with objective, repeatable, and systematic investing rules.

👉 Quantitative investing applies mathematical modelling, statistical techniques, and algorithmic trading to identify opportunities and manage risk.

These models can be simple (like a valuation metrics screen looking for low P/E ratios) or extremely complex (using stochastic calculus, Monte Carlo methods, or deep learning to forecast price momentum and market sentiment).

How Does Quantitative Investing Work?

At its heart, quantitative investing is about turning numbers into decisions. To do this, investors follow a clear step-by-step process:

1. Gathering the Data

Quantitative investors start with information. They collect huge amounts of market data such as stock prices, trading volumes, and financial statements. They also look at economic indicators like interest rates or inflation, and sometimes use alternative data such as credit card spending, shipping patterns, or even satellite images.

The rule is simple: the cleaner and broader the data, the better the insights.

2. Building the Models

Once the data is in place, analysts create mathematical models to search for patterns. These models may be simple, like looking for undervalued stocks, or highly complex, involving advanced probability and statistics.

Some examples include:

- Pricing models like the Black–Scholes model for options.

- Portfolio optimization ideas from Harry Markowitz and William Sharpe.

- Factor investing models that look at characteristics such as value, momentum, or quality.

- Smart Beta strategies that adjust index fund weights based on measurable factors instead of just size.

In plain English: these models are like recipes – they combine ingredients (data points) in different ways to find investment opportunities.

3. Testing the Strategy (Backtesting)

Before real money is put to work, strategies are tested using historical data. This step, called backtesting, asks the question: “If we had used this strategy in the past, how would it have performed?”

Backtesting helps catch problems, such as a model that only works in certain market conditions or one that looks great on paper but would collapse once trading costs are included.

4. Putting It Into Action

When the model passes the tests, it’s time to invest. Most quantitative strategies use computer systems and algorithmic trading to place orders automatically. These systems can react to market changes in milliseconds, something humans simply can’t do.

Some strategies focus on building market-neutral portfolios, meaning they try to profit from relative differences between securities while reducing exposure to the overall market.

5. Ongoing Monitoring and Improvement

Markets never stay the same. Interest rates change, new technologies emerge, and investor behavior shifts. For this reason, quant strategies are constantly monitored. If the model stops working or conditions change, it is adjusted or replaced.

Think of it as a living process: data feeds the model, results are tested, money is invested, and then everything is refined as markets evolve.

Common Quantitative Investment Strategies

Quantitative finance covers a wide range of systematic investing styles. Some of the most popular include:

- Factor Investing / Quantitative Value Investing → Focuses on measurable factors such as value, momentum, quality, or low volatility.

- Risk Parity Investing → Balances exposure across asset classes by risk contribution instead of capital allocation.

- Statistical Arbitrage & Dividend Arbitrage → Uses short-term mispricings or dividend-related opportunities in securities.

- Managed Futures Strategies → Trend-following in futures contracts across commodities, bonds, and currencies.

- Event-Driven Arbitrage → Exploits pricing inefficiencies from corporate events such as mergers and spin-offs.

- Market-Neutral Portfolios → Long/short strategies designed to isolate stock-specific returns independent of overall market direction.

Advantages of Quantitative Investing

Quantitative finance is powerful because it offers unique benefits:

- Objectivity – Removes emotional bias by relying on rules and data analysis.

- Scale – Models can analyze thousands of securities simultaneously, far beyond human capability.

- Consistency – Strategies are applied systematically every time, avoiding random behavior.

- Risk Analytics – Advanced risk models track exposures to systemic risks, tail risk, and volatility shocks.

- Innovation – Quantitative trading methods continuously evolve, incorporating AI, machine learning, and deep learning to unlock new investment opportunities.

Risks and Limitations

However, quantitative investment strategies are not foolproof:

- Model Risk → Over-optimized models can collapse in live trading.

- Data Dependence → Incomplete or poor-quality market data produces flawed outcomes.

- Overfitting → Models that fit the past too perfectly may fail in the future.

- Crowded Trades → When many institutional investors adopt the same systematic investing style, opportunities vanish.

- Systemic Risks → Quant strategies can amplify volatility during stress events, contributing to flash crashes.

Renaissance Technologies and Legendary Quant Funds

The most famous case study in quant investing is Renaissance Technologies, founded by mathematician James Simons in 1982. Its Medallion Fund has achieved average annual returns of over 60% before fees, making it one of the most successful funds in history.

Renaissance hires physicists, mathematicians, and computer scientists to build mathematical modelling systems. These capture hidden patterns in financial markets that traditional analysts cannot see.

Other notable firms include:

- D.E. Shaw → Early pioneer in quantitative trading and derivatives pricing models.

- Two Sigma → Uses AI and big data to design sophisticated investment solutions.

- AQR Capital Management (Cliff Asness) → Popularized factor investing and Smart Beta strategies based on academic research from Eugene Fama and others.

Together, these funds illustrate the full spectrum of quantitative trading from short-term arbitrage to long-term risk parity strategies.

How Beginners Can Apply Quant Principles

You don’t need a PhD in quantitative finance or a room full of supercomputers to benefit from quant investing. Everyday investors can apply simplified versions of the same ideas to improve their portfolios. Here are some practical ways to get started:

- Quantitative ETFs and Index Funds → Many funds now use quantitative investment strategies to target factors like value, momentum, or quality. For example, you can invest in a Smart Beta strategy ETF that systematically tilts toward undervalued stocks or those with strong price momentum. These funds make it easy to tap into quant-style investing without building your own models.

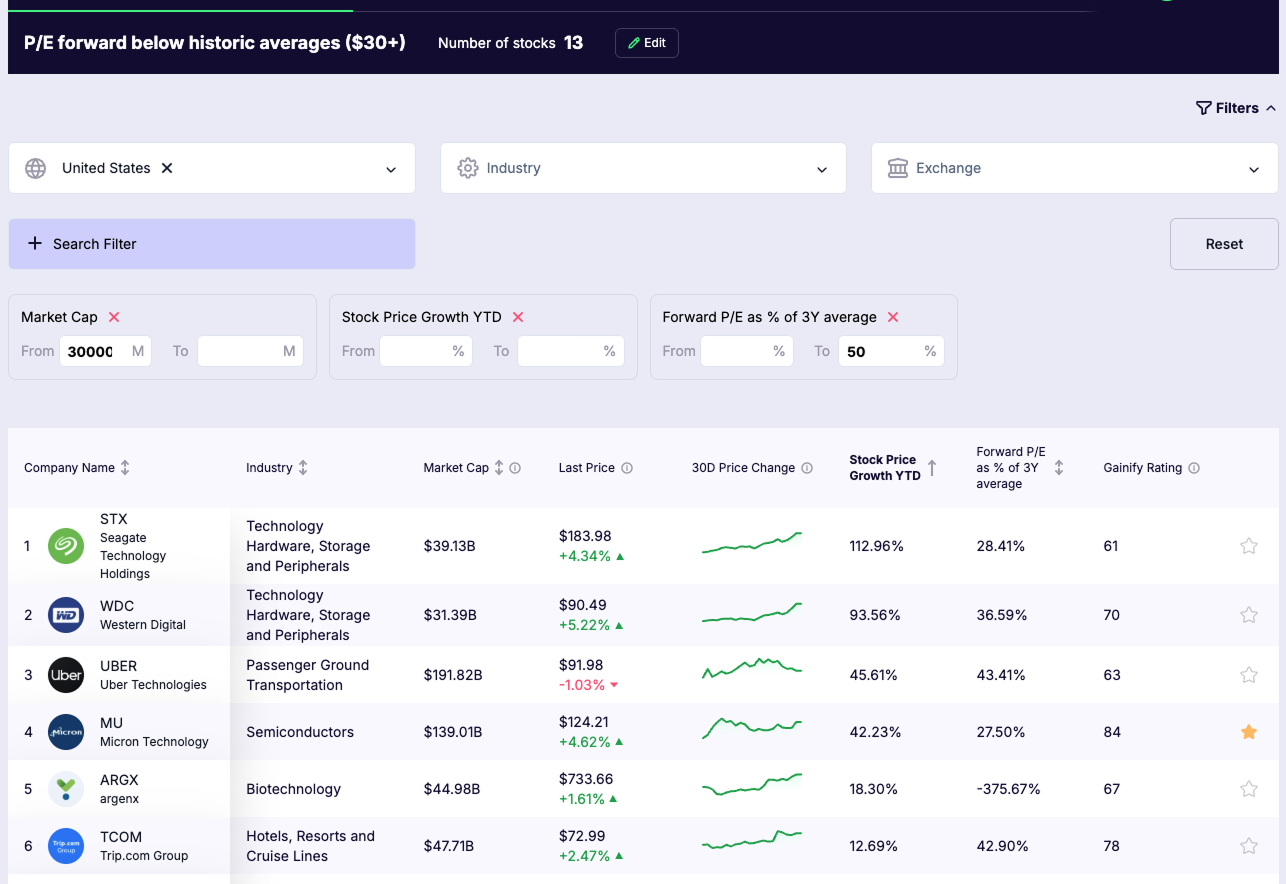

- Robo-Advisors → Services such as Betterment, Wealthfront, or Schwab Intelligent Portfolios use algorithmic trading principles and portfolio theory to create diversified portfolios automatically. You answer a few questions about your risk tolerance and investment goals, and the system applies quantitative models to manage your money consistently.Gainify, Yahoo Finance, Finviz, or Morningstar let you apply securities selection models by filtering companies based on valuation metrics, revenue growth, or price momentum. This is a beginner-friendly way to practice systematic investing and see how professional analysts apply filters to identify investment opportunities.

- Backtesting Tools → Platforms like Portfolio Visualizer or TradingView allow you to run backtests. This means you can test a simple rule (e.g., “buy the S&P 500 when the 200-day moving average is above price”) against historical market data. Backtesting helps you learn which strategies are robust and which might fail in different market conditions.

- Diversification Across Asset Classes → One of the most powerful ideas from quantitative investing is risk parity investing. You don’t put all your money into one asset class (like stocks). Instead, you spread across bonds, stocks, real estate, and sometimes commodities. This helps smooth returns and reduces exposure to systemic risks. Even a basic mix of index funds across asset classes applies this principle.

👉 Pro Tip for Beginners: Start small. Try adding one factor ETF to your portfolio, experiment with an online screener, or run a simple backtest. The goal isn’t to build Wall Street–level trading systems, but to apply the discipline and structure of quantitative investing to your personal finances.

Key Takeaways

- Quantitative investing is systematic investing based on statistical analysis, mathematical methods, and data-driven decision making.

- It offers objectivity, scale, and discipline compared with traditional discretionary investing.

- Strategies range from Smart Beta strategies to complex arbitrage such as risk parity, dividend arbitrage, and event-driven arbitrage.

- Institutional investors like Renaissance Technologies prove its power, but everyday investors can apply simplified approaches via ETFs and robo-advisors.

- Risk models are critical to manage tail risk, systemic risks, and market sentiment shifts.

Final Word

Quantitative investing has changed the way we think about markets. By bringing structure, discipline, and data into the investment process, it removes much of the guesswork that has historically led investors astray. At its best, it is less about flashy predictions and more about patiently applying rules that stand the test of time.

For individual investors, the lesson is clear: you don’t need to become a mathematician or build complex algorithms to benefit from quant principles. What matters is the mindset — focus on evidence over emotion, process over impulse, and consistency over luck.

Used thoughtfully, quantitative investing offers more than just higher returns. It provides a framework for making decisions with confidence, staying calm in volatile markets, and building wealth that lasts. And in a world that often feels unpredictable, that kind of clarity is one of the most valuable investments you can make.