For decades, the world of investing often felt like an exclusive club, reserved for those with substantial savings or extensive financial knowledge. Traditional investing typically demanded high minimum deposits and complex procedures, creating significant barriers to entry for millions of aspiring investors. This meant many individuals, particularly those with limited resources or who felt their financial situation wasn’t ready, believed the path to wealth accumulation through financial markets was simply beyond their reach.

However, a quiet yet profound revolution has reshaped this landscape: the emergence of micro investing. This innovative approach breaks down conventional barriers, democratizing access to various financial instruments by allowing individuals to begin their investment journey with remarkably small amounts of capital. It turns the intimidating concept of “investing” into something intuitive, mobile-first, and accessible for daily life.

It is consistently observed that micro investing apps and platforms are fundamentally changing how people perceive and engage with their money. It shifts the focus from large lump sums to consistent, manageable contributions, fostering disciplined habits from the outset. This strategy is not about getting rich quickly; it is about building sustainable wealth over time through compounding, one small step at a time, towards concrete long-term goals.

This article will demystify the concept of micro investing. We will unpack how it works, explore its significant advantages for financial inclusion, and critically examine its nuances. Prepare to gain a clear understanding of how this accessible approach can empower almost anyone to begin their financial journey towards long-term financial security through simplified investment options.

What is Micro Investing? The Path to Fractional Ownership

Micro investing fundamentally involves investing very small amounts of money on a regular basis, sometimes as little as a few dollars at a time. This approach contrasts sharply with traditional investing, which often requires minimum deposits of hundreds or thousands of dollars. It’s specifically designed to remove those initial hurdles, making investing feel possible no matter the size of your paycheck or savings.

The core mechanism enabling micro investing is often fractional investing, where an investor buys a mere slice of a high-priced stock or an Exchange Traded Fund (ETF), rather than needing enough capital for an entire share. This innovation means that even the most expensive stocks, like Amazon or Alphabet, become accessible to first-time investors.

Micro investing apps like Robinhood or Public.com typically offer various micro investing strategies for small contributions. These include auto-investment tools that make recurring investments (e.g., $5 per week), or popular round-up programs that invest spare change from everyday purchases, directly linked to your checking account. These features are designed to integrate saving and investing seamlessly into daily financial routines, often managed through user-friendly mobile applications. Many now also allow one-time buys, themed portfolios, and even crypto or retirement accounts, bringing choice and flexibility into the experience.

These small, recurring investments often go into diversified vehicles such as broad ETFs, thematic portfolios, or even fractional shares of individual stocks. This flexible approach gives micro investors broad exposure across sectors, helping them participate in the market meaningfully without needing large capital or advanced expertise.

The Appeal of Micro Investing: Building Habits and Wealth

The appeal of micro investing extends far beyond its low entry point. Its accessibility serves as a powerful catalyst for financial inclusion, enabling millions who previously felt excluded from financial markets to begin their wealth-building journey. This democratizes the process, making it a viable option for virtually any budget.

One of its most significant benefits is the encouragement of dollar-cost averaging. By investing small, fixed amounts regularly, regardless of market fluctuations, investors automatically buy more shares when prices are low and fewer when prices are high. This systematic approach can help reduce the impact of market volatility over time and builds consistent saving habits that are sometimes harder to maintain with larger, less frequent traditional investing commitments. This is a powerful tool for managing risk.

Micro investing apps typically guide users towards diversified portfolios, often through robo-advisors or pre-built ETF portfolios. This means even with modest contributions, individuals gain exposure to numerous companies and industries, mitigating concentration risk. This inherent diversified selection is crucial for prudent risk management, especially for new investors navigating unfamiliar territory.

Perhaps its most transformative impact lies in harnessing the power of compounding. Even seemingly insignificant contributions, when invested consistently over decades, can grow exponentially as earnings generate further earnings. Using a compound interest calculator can vividly illustrate this. This long-term growth potential makes micro investing a foundational strategy for achieving substantial financial goals like retirement savings or a down payment on a home.

Evolving Beyond the Basics: How Micro-Investing Platforms Have Matured

Micro-investing has shed its “training wheels” label. What began as a gateway for new investors as limited, passive, and simplified, now has rapidly matured. Today’s platforms offer tools once exclusive to full-service brokerages, making them increasingly viable for long-term, hands-on investing.

Commission-free trading is now the norm, not the exception. Apps like Robinhood, Public, and SoFi helped set the standard, eliminating trading costs across stocks, ETFs, and even crypto. What once made micro platforms feel “pricey” on small balances is now a non-issue.

Access to investment products has exploded. Users can now buy:

- Fractional shares of high-priced stocks like $AMZN or $GOOGL

- Thematic portfolios (e.g., clean energy, AI, dividend income)

- Crypto assets, REITs, and select bond ETFs

- Retirement accounts like IRAs or Roth IRAs

- Custodial accounts for minors, in some cases

No longer are investors locked into rigid robo portfolios. Many apps now offer a hybrid experience: automation when you want it, and full control when you don’t.

Meanwhile, portfolio management tools have matured. Features like auto-rebalancing, dividend reinvestment (DRIP), and goal-based tracking are standard. Some platforms even include tax-loss harvesting, real-time market data, and advanced screeners – tools once found only on legacy brokerage platforms.

Micro-investing used to be a foot in the door. Today, it’s often the entire room.

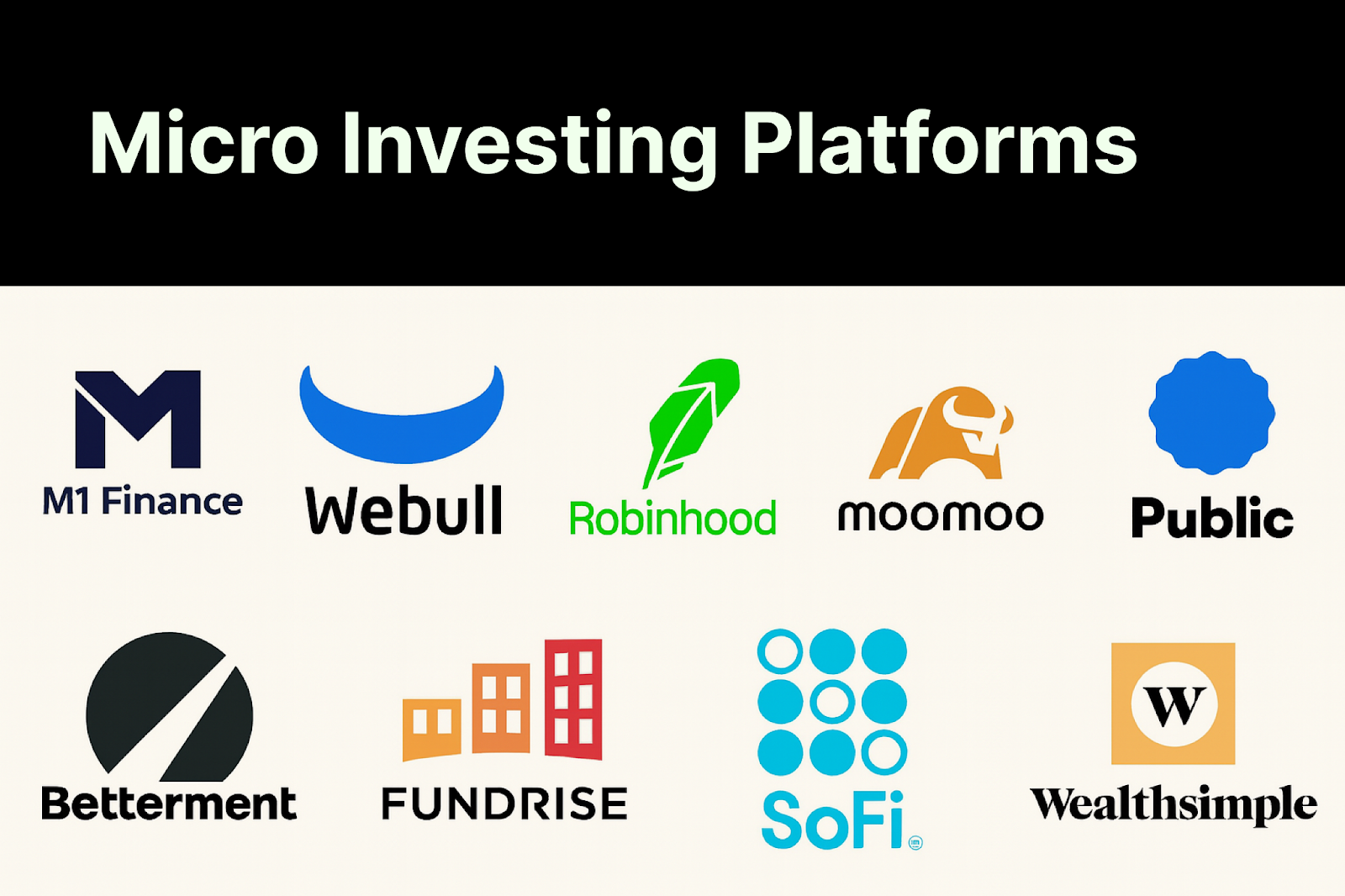

Key Micro-Investing Platforms: Who’s Leading the Way?

Micro-investing has grown into a competitive and innovative space. Today’s platforms serve a wide range of users, from hands-off savers to active traders. Many now offer features that were once limited to full-service brokerages. Below is a look at some of the top apps and what each one does best, depending on your goals and investing style.

Robinhood

Best for: Active traders and stock pickers

Robinhood helped popularize commission-free trading. It offers stocks, ETFs, crypto, options, and fractional shares with a fast and easy interface. Retirement accounts and recurring investments have recently been added, making it more robust for long-term investors too.

Acorns

Best for: Automated saving and long-term passive investing

Acorns rounds up spare change from daily purchases and automatically invests it in a diversified ETF portfolio. It also offers checking accounts, retirement accounts, and custodial accounts for kids. A great choice for hands-off savers.

Stash

Best for: Beginners who want guidance and choice

Stash allows you to start investing with as little as $5 and choose from curated ETFs or individual stocks. It includes learning tools, automatic deposits, and banking features. Offers IRAs and themed portfolios for easy diversification.

Public

Best for: Social investing and transparency

Public lets you buy fractional shares and follow other investors in a built-in social feed. It avoids payment-for-order-flow and adds alternative assets like collectibles. Designed for long-term investing with a strong community feel.

SoFi Invest

Best for: Managing everything in one place

SoFi offers active and automated investing with no commissions. It supports stocks, ETFs, crypto, retirement accounts, and even IPO access. Ideal if you want to manage investing, loans, and banking all in a single app.

Key Definitions for Micro Investing

To fully comprehend the landscape of micro investing, understanding specific financial terms is beneficial.

- Micro Investing: An investment strategy involving regular, very small sums of money, often facilitated by mobile apps and fractional shares, providing an accessible entry point to financial instruments.

- Fractional Investing: The practice of buying portions of a single stock or ETF share, allowing investors to buy based on a dollar amount rather than whole shares.

- Micro Investing Apps: Mobile applications designed specifically to facilitate micro investing, often featuring round-ups, automated investing, and fractional shares.

- Traditional Investing: Conventional platforms offering higher customization, broader asset selection, and sometimes higher minimums. Better suited for seasoned investors.

- Financial Instruments: Assets like stocks, bonds, ETFs, crypto, and derivatives that can be traded or held for value growth.

- Round-Up Programs: Features offered by some micro investing apps that automatically invest spare change from everyday purchases from a checking account.

- Dollar-Cost Averaging: An investment strategy of investing a fixed amount of money at regular intervals, regardless of the asset’s price, to reduce the impact of market volatility.

- Robo-Advisor: Digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision, often associated with micro investing strategies.

- Compounding: The process where an investment’s earnings generate their own earnings over time, leading to exponential growth, best visualized with a compound interest calculator.

- Investment Minimums: The smallest amount of money required to open an investment account or purchase a particular security in both Traditional investing and micro investing contexts.

- Expense Ratio: The annual fee charged by a fund (like an ETF or mutual fund) as a percentage of the investor’s assets under management.

- Diversification: The strategy of spreading investments across various assets, industries, and geographical regions to reduce risk, enabling a diversified selection.

- Financial Goals: Specific, measurable objectives an individual or family plans to achieve through financial planning, such as retirement or a down payment.

- Tax Obligations: The legal requirement for individuals or entities to pay taxes on income, capital gains, or other taxable events.

- Record Keeping: The systematic process of organizing and maintaining financial documents and transaction details, crucial for tax reporting and financial management.

- Long-Term Goals: Financial objectives that are typically planned for many years into the future.

- Realistic Expectations: An understanding that investment growth takes time and isn’t guaranteed, leading to realistic expectations for future returns.

- Limited Resources: A situation where an individual or entity has restricted financial means.

- Risk Tolerances: An individual’s comfort level with the potential for financial loss in their investments.

- Portfolio Value: The total current worth of an investor’s holdings.

- High-Value Assets: Investments, like certain stocks or properties, that have a significant per-unit cost.

- Seasoned Investors: Individuals with extensive experience and knowledge in financial markets.

- UTMA / UGMA: Uniform Transfers to Minors Act / Uniform Gifts to Minors Act accounts, used for investing for minors.

Key Takeaways: Micro Investing Has Come of Age

- Micro investing has matured from a basic entry tool into a powerful, flexible strategy for everyday investors. What began as a workaround for high barriers is now a robust ecosystem with full-service features.

- The rise of commission-free trading, broader access to diverse assets, and seamless automation means micro platforms now compete head-to-head with traditional brokerages, without the friction or high entry points.

- It builds wealth through habit, not hype. With tools like round-ups, recurring deposits, and dollar-cost averaging, micro investing reinforces consistent behavior—one of the most proven paths to long-term success.

- It is no longer “just for beginners.” Platforms now offer advanced tools, IRAs, custodial accounts, tax optimization, and portfolio customization that suit investors well beyond the starting line.

- Education, automation, and control coexist. Whether you’re hands-off or hands-on, modern micro platforms adapt to your needs, making investing not only more inclusive but also more empowering.

- While not a substitute for deep portfolio strategies or large-scale investing, micro investing now stands as a legitimate, scalable part of wealth building, especially for those starting with limited resources or seeking to build strong financial habits.

In short: Micro investing isn’t just where people start. For millions, it’s where they grow.