The travel industry is entering a more disciplined, technology-driven phase as demand normalizes and competitive dynamics shift.

Platforms are moving toward tighter cost structures, stronger loyalty ecosystems, and deeper AI integration, creating a clearer separation between leaders and laggards. In this environment, travel booking stocks stand out as critical infrastructure assets tied to global mobility, digital commerce, and long-cycle consumer spending.

Travel behavior is also evolving. Mobile-first planning, flexible trip structures, and increased price transparency are reshaping how travelers search and book. At the same time, suppliers are prioritizing partners that deliver predictable, high-intent demand rather than volume at any cost. These trends reward platforms with scale, direct traffic strength, and the ability to personalize and package the entire trip.

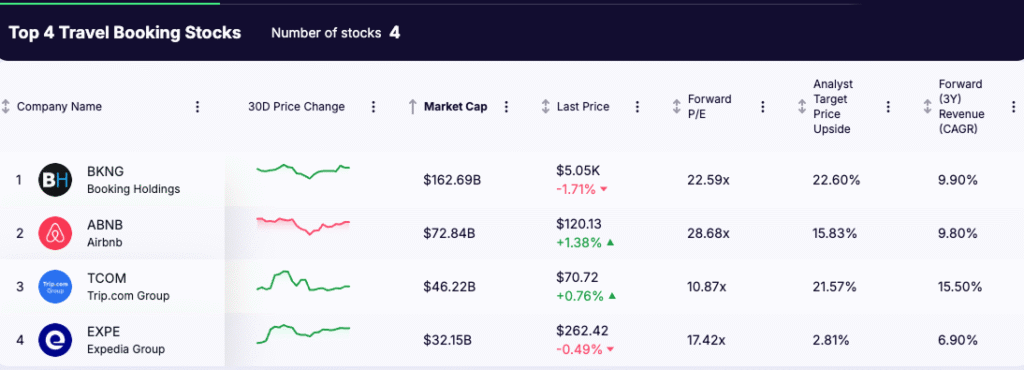

Four names in particular define the sector’s competitive core and remain essential for understanding where value is consolidating heading into 2026.

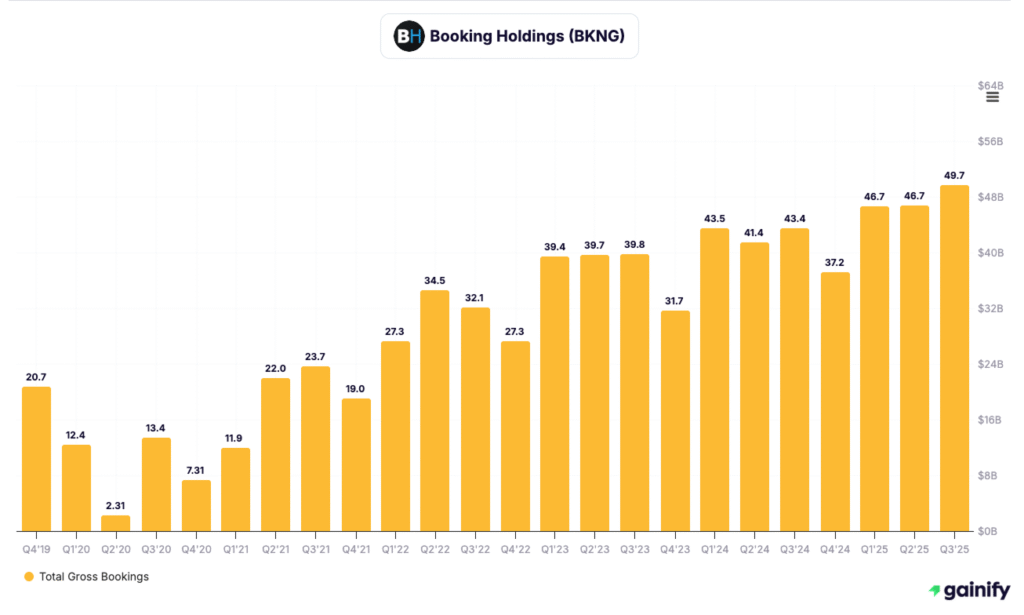

1. Booking Holdings (NASDAQ: BKNG)

Market Cap $162.69B | Forward P/E 22.59x | Revenue CAGR 9.90%

What Booking Holdings Does

Booking Holdings operates the largest global online travel ecosystem through Booking.com, Priceline, Agoda, Kayak, and Rentalcars. It connects travelers to an extensive range of accommodations and transportation options while driving increasing retention through its Genius loyalty program and integrated trip-planning architecture. The company’s focus on a seamless “Connected Trip” experience increases wallet share and strengthens user stickiness.

Why Investors Watch BKNG

- Scale and supply advantage. Deep hotel inventory and global distribution make the platform difficult to replicate.

- High operational efficiency. A disciplined cost structure consistently produces superior margin quality.

- Strong direct channel. Repeat and organic traffic reduce reliance on paid search.

- Balanced accommodation mix. Exposure to both hotels and alternative stays provides segment resilience.

Key Risks

- Regulatory exposure. Ongoing scrutiny across major jurisdictions may impact commission structures.

- Competitive encroachment. Pressure from alternative rental platforms and emerging OTAs could dilute share over time.

- Marketing leverage risk. Higher acquisition costs would pressure margins if direct traffic softens.

- Macro-travel sensitivity. Global footprint leaves results vulnerable to geopolitical or economic shocks.

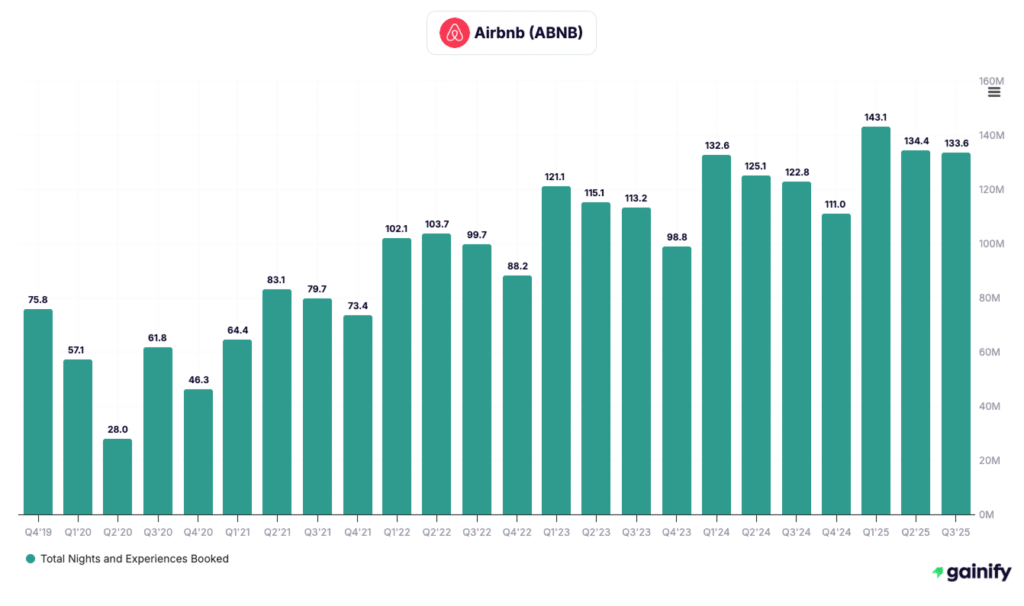

2. Airbnb (NASDAQ: ABNB)

Market Cap $72.84B | Forward P/E 28.68x | Revenue CAGR 9.80%

What Airbnb Does

Airbnb runs a global lodging marketplace built on unique, flexible, and longer-stay accommodations. Its model relies on hosts rather than owned assets, creating a scalable and resilient product ecosystem. Airbnb’s brand strength attracts organic demand and positions the platform as the default choice for remote workers, flexible travelers, and consumers seeking nontraditional lodging experiences.

Why Investors Watch ABNB

- Brand and demand strength. High organic traffic reduces dependency on paid acquisition.

- Asset-light scalability. Marketplace economics support strong cash generation without heavy capital requirements.

- Alignment with flexible travel. Shifts toward longer stays and hybrid travel strengthen the platform’s relevance.

- Global footprint. Broad geographic reach mitigates region-specific volatility.

Key Risks

- Regulatory tightening. Urban markets are increasingly restricting short-term rentals.

- Host supply volatility. Churn or dissatisfaction can weaken supply depth and consistency.

- Competitive pressure. OTAs expanding into home rentals intensify the fight for inventory.

- Consumer sensitivity. Longer-stay and discretionary travel are vulnerable to economic cycles.

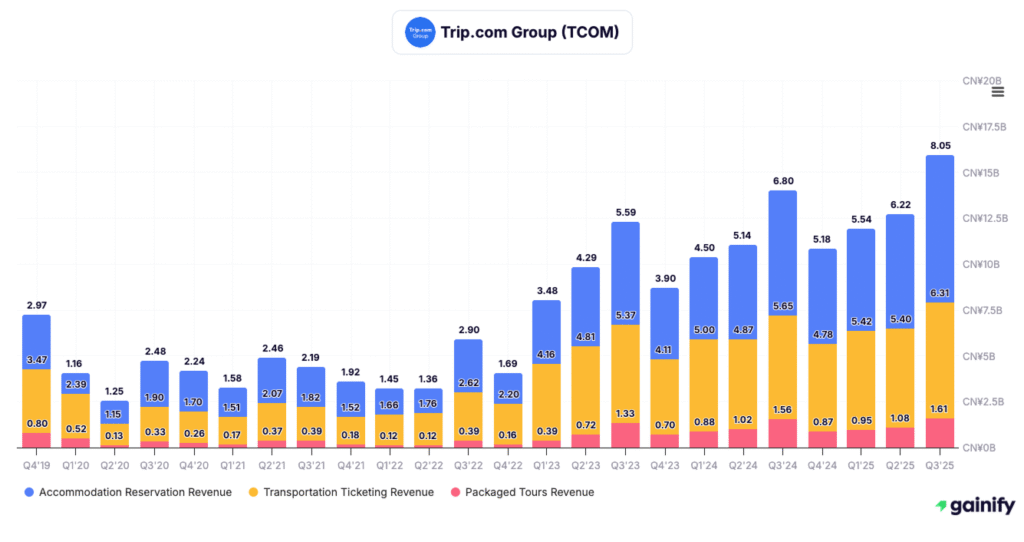

3. Trip.com Group (NASDAQ: TCOM)

Market Cap $46.22B | Forward P/E 10.87x | Revenue CAGR 15.50%

What Trip.com Does

Trip.com Group operates a full-spectrum travel superapp that bundles lodging, flights, trains, packages, and corporate travel services. Its brands include Trip.com, Ctrip, Skyscanner, and Qunar. The platform serves as a critical infrastructure layer for domestic and international travel flows in Asia. Trip.com continues investing in AI applications that strengthen customer support, optimize itineraries, and personalize search.

Why Investors Watch TCOM

- Asian travel leverage. Trip.com captures both domestic and cross-border travel growth as Asia normalizes and expands.

- Superapp engagement. A single-entry platform for multiple travel needs increases frequency, retention, and share of wallet.

- Technology-driven scale. AI upgrades enhance the efficiency of servicing large user volumes across multiple product lines.

- International expansion. Increasing outbound Asian travel allows Trip.com to build a stronger global footprint.

Key Risks

- China macro exposure. The company relies heavily on China’s economic health and domestic travel sentiment.

- Geopolitical travel disruptions. Shifts in visa policy, trade tension, or regional instability can quickly impact cross-border demand.

- Competitive fragmentation. Global OTAs, regional players, and superapps compete aggressively for Asian travelers.

- Currency variability. Multi-market operations expose the company to foreign-exchange swings that can influence profitability.

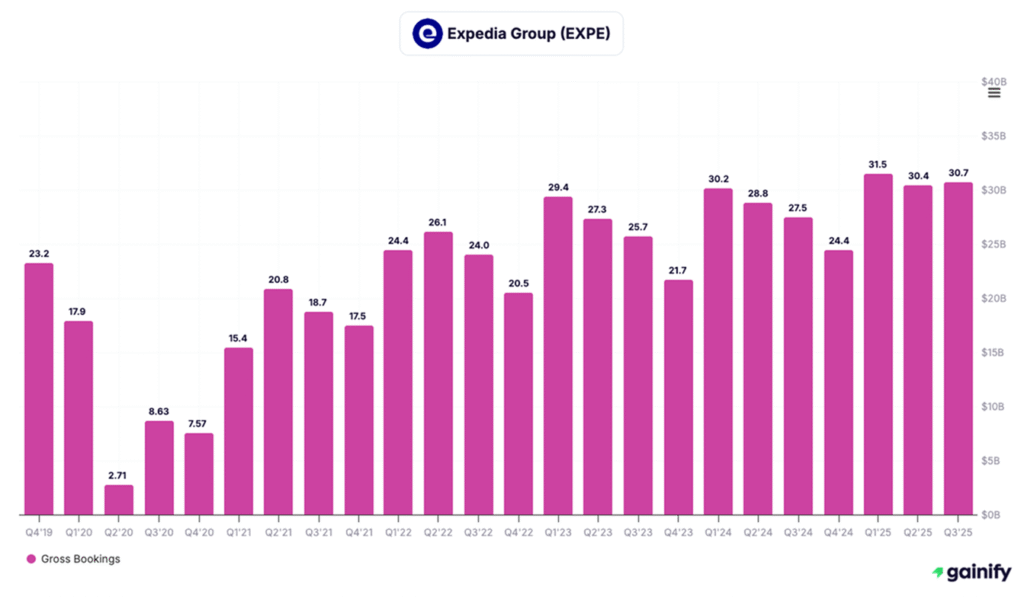

4. Expedia Group (NASDAQ: EXPE)

Market Cap $32.15B | Forward P/E 17.42x | Revenue CAGR 6.90%

What Expedia Group Does

Expedia Group operates a broad set of travel brands including Expedia, Hotels.com, Vrbo, Orbitz, and Travelocity. The company serves both consumers and suppliers through a mix of lodging, flights, packages, and vacation rentals. Its B2B segment underpins travel inventory for airlines, hotels, loyalty programs, and third-party agencies. Expedia has focused on modernizing its tech stack, unifying loyalty, and increasing product consistency across brands.

Why Investors Watch EXPE

- Dual revenue engine. B2C and B2B together create a more balanced and resilient revenue base across cycles.

- Strong domestic footprint. U.S. demand provides stability compared to more volatile international travel patterns.

- Technology modernization. Platform unification and AI tools enhance customer experience and reduce servicing cost.

- Strategic supplier value. The B2B distribution network positions Expedia as a critical infrastructure partner for major travel companies.

Key Risks

- Marketing dependency. Expedia still relies more heavily on paid channels than its larger rival, raising customer acquisition cost risk.

- Competitive intensity. The company faces pressure from both Booking in hotels and Airbnb in rentals.

- Execution complexity. Multi-brand integration and platform consolidation require precise execution to avoid operational drag.

- International exposure risk. Expansion outside the U.S. introduces regulatory and currency-related uncertainty.

Sector Outlook for 2026

Scale Advantage: the travel-booking landscape in 2026 increasingly rewards platforms that can convert scale into operating leverage. Market share is concentrating around companies with deep supply networks, strong global distribution, and the ability to monetize inventory more efficiently than smaller rivals. Scale now matters less for breadth and more for the data, pricing intelligence, and conversion economics it enables.

Mobile-First Execution: mobile continues to dominate the travel planning journey, and design, speed, and friction reduction have become decisive. Platforms that have modernized around mobile-first search, real-time pricing, and seamless checkout are capturing high-intent customers at the top of the funnel. Those still anchored to desktop-era infrastructure are losing share to more agile, mobile-optimized competitors.

AI-Driven Personalization: personalization is shifting from a competitive advantage to a baseline expectation. Travelers want dynamic recommendations based on behavior, context, and price sensitivity. Platforms deploying robust AI models in search ranking, itinerary generation, and pricing are seeing higher conversion and repeat rates. Companies without strong personalization capabilities face rising acquisition costs and weaker customer engagement.

Supplier Alignment: suppliers are prioritizing partners that deliver predictable, high-intent demand rather than volume at any cost. This favors platforms with strong direct traffic, high-quality users, and loyalty-driven repeat business. Hotels, hosts, and airlines increasingly direct inventory toward partners that improve occupancy and revenue yield, putting pressure on OTAs that rely heavily on paid channels.

Loyalty Ecosystems: loyalty programs are becoming central to competitive differentiation. Platforms with unified, data-rich loyalty systems can retain customers, increase booking frequency, and lower acquisition costs. Fragmented or weak loyalty frameworks create higher churn and weaker lifetime value, putting such platforms at a structural disadvantage.

Trip-Lifecycle Integration: control over the full trip lifecycle (from discovery to booking to on-trip engagement) has become a key strategic asset. Platforms that integrate lodging, transportation, activities, and post-trip reactivation capture greater wallet share while building richer data loops. Companies confined to single-product offerings risk commoditization as integrated players deliver more complete and personalized travel experiences.