For income-focused investors, dividends are more than just payouts; they are a cornerstone of financial stability and long-term wealth creation. Whether you’re planning for retirement, building a robust investment portfolio, or simply seeking predictable income streams, understanding and leveraging stocks with the highest dividends can significantly enhance your financial journey.

These recurring payments from companies offer a cushion during market volatility. While stock prices move up and down, dividend income can remain steady. This stability is why high dividend stocks often sit at the core of a well-balanced income strategy. But knowing where to look and what to avoid is just as important as the dividends themselves.

It’s tempting to chase the highest yield. A stock offering 7% or more can seem like a no-brainer. But a yield alone doesn’t guarantee reliability. In fact, a yield that’s too high may be signaling stress inside the business. And that’s where understanding the core principles of dividend investing becomes essential.

In this guide, I’ll walk you through how dividend income works, how to identify sustainable opportunities, and how to avoid traps that look attractive on the surface. We’ll also explore exchange-traded funds (ETFs), real estate investment trusts (REITs), and other income-generating investments that give your strategy a longer runway.

Understanding Dividends: What They Truly Represent

At its core, a dividend is a company’s way of sharing its profits with its shareholders. When a business generates earnings, it has several options: reinvest in growth, pay down debt, or distribute a portion back to investors as cash payments. These payments are typically made quarterly and are common among established, large-cap companies with stable market capitalizations.

A dividend, fundamentally, is a portion of a company’s profit paid directly to its shareholders. Based on information from the SEC and common financial understanding, here are some key aspects of what dividends represent:

- Distribution of Profits: Dividends are a direct distribution of a company’s accumulated profits or retained earnings to its owners (shareholders).

- Approval by Board of Directors: The decision to declare a dividend, its specific amount, and the payment schedule are typically determined and approved by the company’s board of directors. For common stocks, shareholders may also need to approve this at an annual general meeting (AGM).

- Types of Dividends: While most commonly paid in cash (known as cash dividends), dividends can also be issued in the form of additional shares (stock dividends or bonus shares) or, less frequently, as property or other assets.

- Not an Expense: For accounting purposes, dividend payments are not treated as an expense on a company’s income statement. Instead, they are considered a distribution of capital and are recorded as a reduction in retained earnings on the balance sheet.

- Disclosure and Reporting: Publicly traded companies are mandated to disclose comprehensive information about their dividend policies and payments in their financial reports filed with the SEC (such as annual 10-K reports and quarterly 10-Q reports).

- Shareholder Entitlement: Shareholders are entitled to receive dividends in proportion to the number of shares they own. Eligibility for a specific dividend payment is determined by key dates like the “record date” and “ex-dividend date.”

This mechanism creates a powerful dynamic: you can generate income simply by holding a stock, independent of its short-term price movements. Furthermore, when those dividends are reinvested, they purchase more shares, fueling the potent force of compound growth over time. This principle is fundamental to passive income strategies aimed at building substantial wealth predictably over decades.

For example: If you own 200 shares of a company paying $2 in annual dividends, you’ll receive $400 a year. Reinvesting this income intelligently transforms it into a self-perpetuating flywheel for wealth accumulation. Dividends truly reward patience, discipline, and consistency, allowing your capital to work harder for you.

Dividend Yield Explained: More Than Just a Number

The most commonly cited metric in income investing is dividend yield. It represents the annual dividend payment per share as a percentage of the stock’s current market price.

How to calculate dividend yield:

The formula is straightforward:

Dividend Yield = Annual Dividend Per Share / Current Stock Price Per Share × 100%

So, if a company pays $5 per share annually and its stock trades at $100, its dividend yield is calculated as: ($5/$100)×100%=5%.

While a high yield is attractive, it’s crucial to look beyond this single figure. Savvy investors consider several other vital factors:

- Payout Ratio: This metric reveals how much of a company’s earnings are being paid out as dividends. A payout ratio consistently above 80% can signal that the dividend might be unsustainable, as the company is retaining very little for reinvestment or emergencies.

- Dividend Growth History: Has the company consistently increased its dividends over time? A track record of rising payouts indicates financial health and a commitment to shareholder returns.

- Free Cash Flow Coverage: This assesses whether the company generates enough cash from its operations to comfortably cover its dividend payments, even if earnings experience a temporary dip.

Platforms such as the Fidelity stock screener or specialized tools like Gainify can help investors efficiently apply these crucial filters and uncover genuinely robust dividend opportunities.

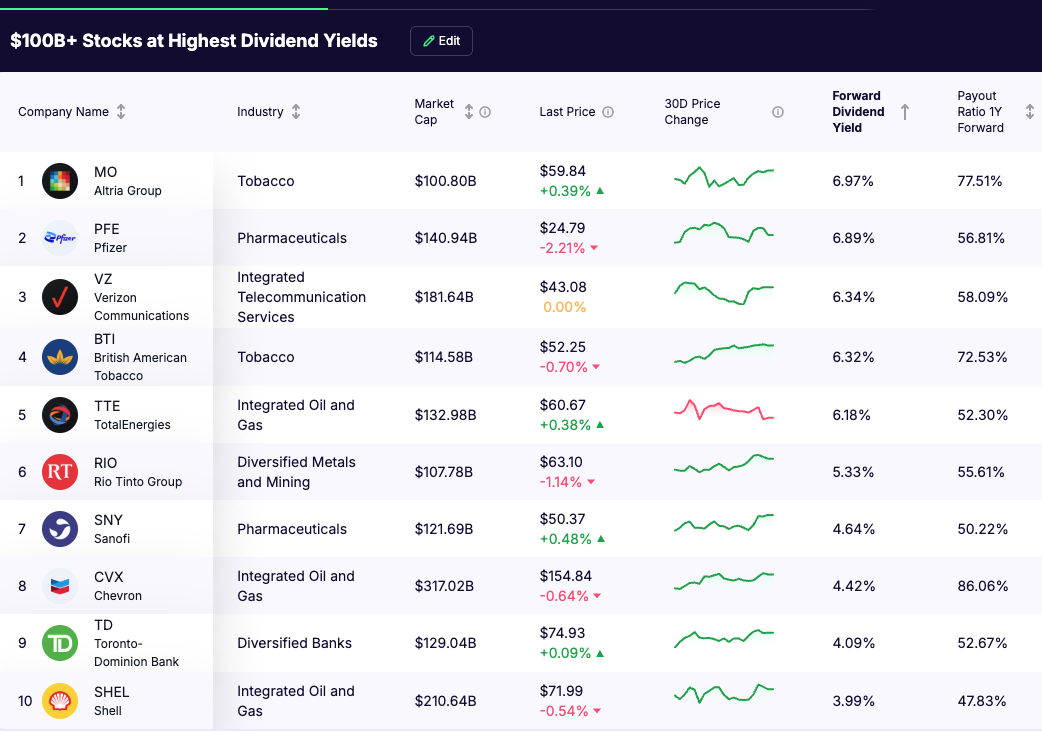

Top 10 Highest Dividend Yield Stocks ($100B+ Market Cap)

Here are ten established companies with significant market capitalization ($100B+) and attractive dividend profiles, providing more detail on their operations and dividend metrics:

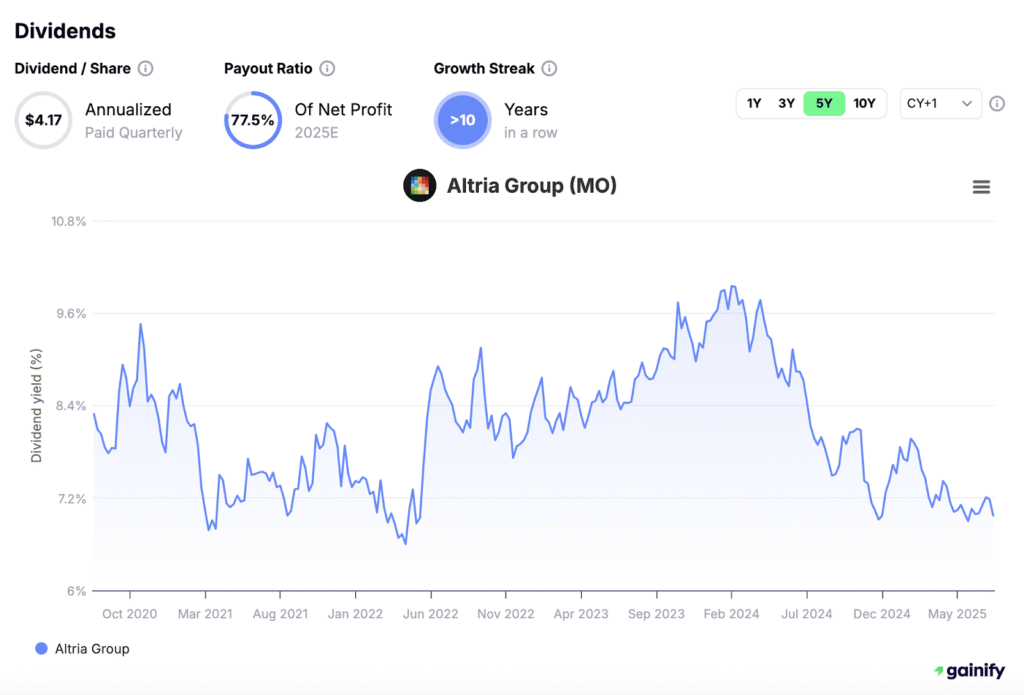

1. Altria Group (NYSE: MO)

- Market Cap: $100.80B

- Div. Yield: 6.97%

- Payout Ratio: 77.51%

- About: Altria Group is a leading American tobacco company, known for brands like Marlboro. It operates primarily in the tobacco and related products sector, generating significant cash flow that supports its high dividend payments. Investors often consider MO for its strong dividend history, though it operates in an industry facing long-term secular decline and regulatory scrutiny.

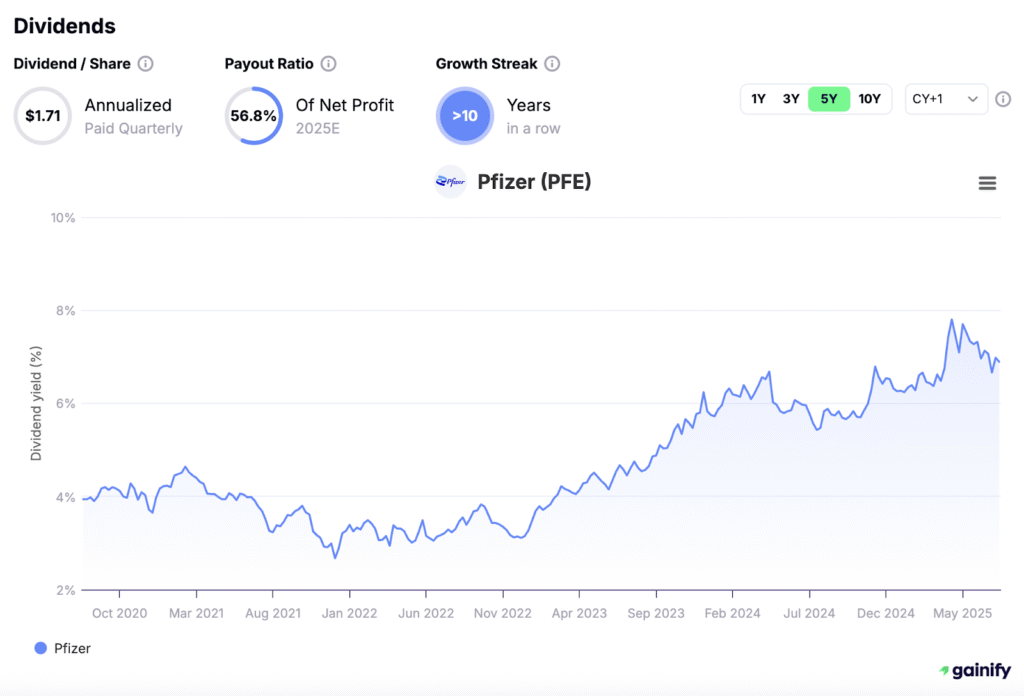

2. Pfizer (NYSE: PFE)

- Market Cap: $140.94B

- Div. Yield: 6.89%

- Payout Ratio: 56.81%

- About: Pfizer is a global pharmaceutical and biotechnology corporation. It develops and produces medicines and vaccines for a wide range of medical disciplines. As a large-cap pharmaceutical company, Pfizer is often recognized for its consistent dividend payouts, supported by a diverse product pipeline and global sales.

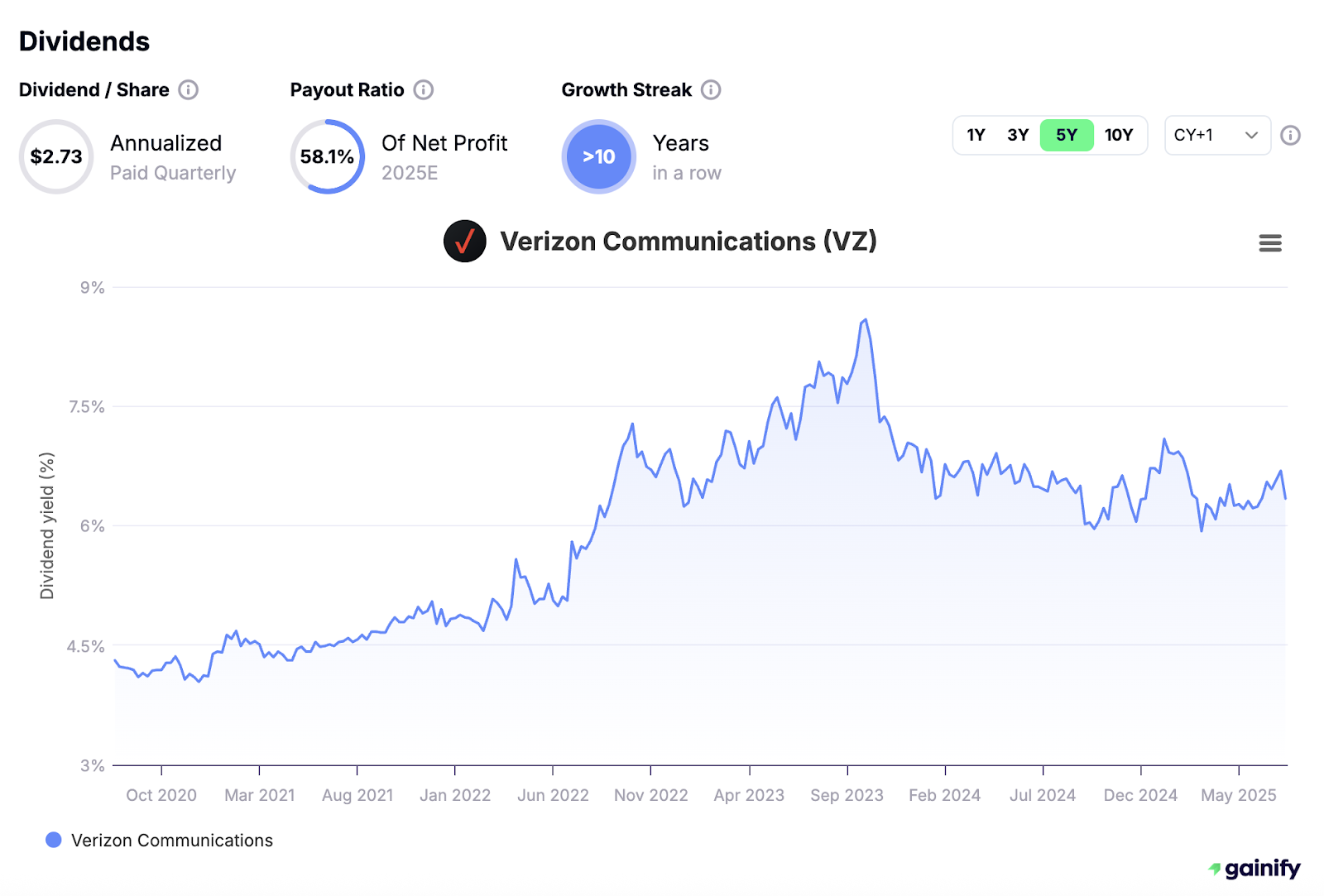

3. Verizon Communications (NYSE: VZ)

- Market Cap: $181.64B

- Div. Yield: 6.34%

- Payout Ratio: 58.09%

- About: Verizon is one of the largest telecommunications companies in the United States. It provides wireless network services, broadband, and other communication solutions to consumers and businesses. Verizon is a popular choice for income investors due to its essential service offerings, significant market share, and history of stable dividend payments.

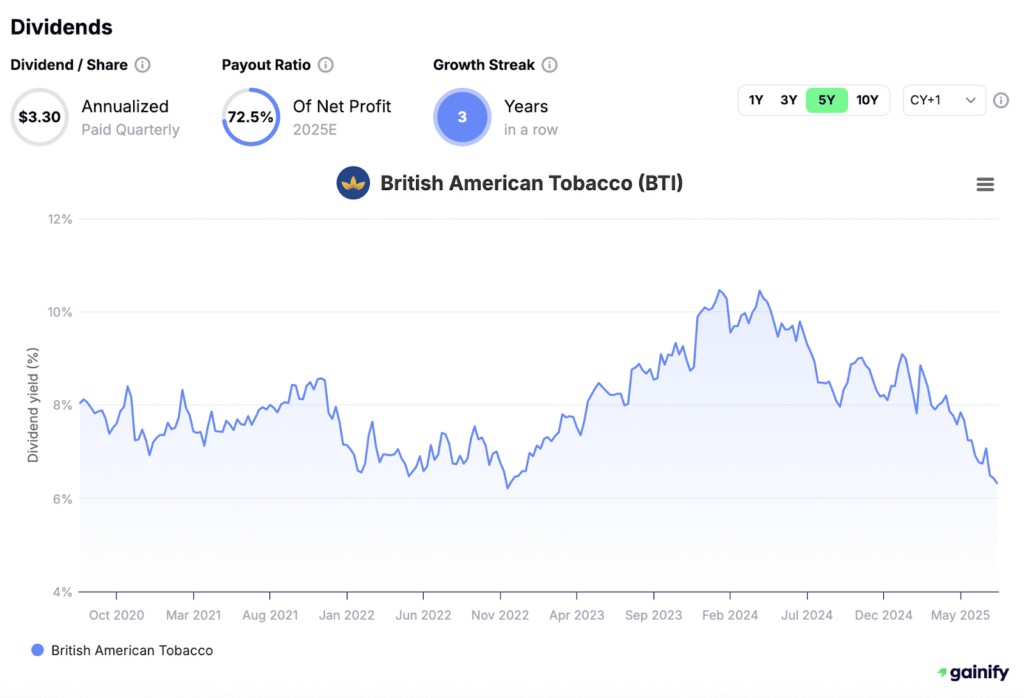

4. British American Tobacco (NYSE: BTI)

- Market Cap: $114.58B

- Div. Yield: 6.32%

- Payout Ratio: 72.53%

- About: British American Tobacco is a multinational investment holding company that manufactures and sells cigarettes and other tobacco products. Similar to other tobacco giants, BTI attracts dividend investors with its high yield, stemming from strong brand recognition and consistent cash generation in its established markets.

5. TotalEnergies (NYSE: TTE)

- Market Cap: $132.98B

- Div. Yield: 6.18%

- Payout Ratio: 52.30%

- About: TotalEnergies SE is a broad energy company that produces and markets fuels, natural gas, and electricity. As one of the world’s largest oil and gas companies, it offers a solid dividend yield, backed by its integrated operations from exploration to power generation, and is also investing in renewable energies.

6. Rio Tinto Group (NYSE: RIO)

- Market Cap: $107.78B

- Div. Yield: 5.33%

- Payout Ratio: 55.61%

- About: Rio Tinto is a leading global mining group focused on finding, mining, and processing mineral resources. Its portfolio includes iron ore, aluminum, copper, diamonds, and industrial minerals. The company’s dividends can be highly cyclical, reflecting commodity price fluctuations, but it generally aims to provide significant shareholder returns during periods of strong performance.

7. Sanofi (NASDAQ: SNY)

- Market Cap: $121.69B

- Div. Yield: 4.64%

- Payout Ratio: 50.22%

- About: Sanofi is a French multinational pharmaceutical and healthcare company. It focuses on human vaccines, rare diseases, multiple sclerosis, oncology, immunology, and cardiovascular diseases. Sanofi is a well-established player in the healthcare industry, offering a respectable dividend yield supported by its global presence and ongoing drug development.

8. Chevron Corp (NYSE: CVX)

- Market Cap: $317.02B

- Div. Yield: 4.42%

- Payout Ratio: 86.06%

- About: Chevron Corporation is one of the world’s largest integrated energy companies. It is involved in every aspect of the oil and natural gas industry, including exploration, production, refining, and marketing. Chevron is a popular dividend stock due to its large scale, stable operations, and commitment to returning value to shareholders, though its payout ratio is notably higher than others on this list.

9. Toronto-Dominion Bank (NYSE: TD)

- Market Cap: $129.04B

- Div. Yield: 4.09%

- Payout Ratio: 52.67%

- About: Toronto-Dominion Bank is a major Canadian multinational banking and financial services corporation. It offers a wide range of retail, commercial, and wealth management services. Canadian banks, including TD, are often favored by income investors for their stable, well-regulated environments and long histories of consistent dividend payments.

10. Shell plc (NYSE: SHEL)

- Market Cap: $210.64B

- Div. Yield: 3.99%

- Payout Ratio: 47.83%

- About: Shell plc is a global energy and petrochemical company. It engages in oil and gas exploration and production, refining, marketing, and petrochemical manufacturing. Shell is known for its strong cash flow generation from its vast global operations, which supports its significant dividend to shareholders, and is increasingly investing in renewable energy solutions.

Why Dividend Growth Matters More Than Just Yield

While an attractive current dividend yield is undoubtedly a great starting point for income investors, a company’s dividend growth history is arguably an even more critical indicator of its long-term financial health and future prospects. A static high yield can be deceptive; sustainable income isn’t just about the current payout, but its ability to grow and adapt over time.

Companies that consistently increase their dividend payouts year after year demonstrate several vital characteristics: they typically possess robust balance sheets, strong operational histories, and management teams confident in their ongoing profitability and cash flow generation. This commitment to rising dividends not only signals financial resilience but also significantly builds shareholder trust over the long run, as it implies a stable and growing business capable of sharing its increasing success. Crucially, a rising dividend stream also provides a vital hedge against inflation, ensuring your income’s purchasing power grows over time.

Consider these examples of companies demonstrating strong 3-year Dividend Compound Annual Growth Rates (CAGR), reflecting their commitment to growing shareholder returns:

- Shell (NYSE: SHEL): 15.9% 3-Year Dividend CAGR

- Chevron (NYSE: CVX): 7.1% 3-Year Dividend CAGR

- Toronto-Dominion Bank (NYSE: TD): 4.7% 3-Year Dividend CAGR

In stark contrast, a company like Rio Tinto showing a negative 27.2% growth rate in its dividend payout is a significant red flag for future consistency and a warning sign about underlying business health. While its current yield might initially appear appealing, a declining dividend growth rate suggests potential financial distress or an inability to sustain payouts, which could lead to cuts and erode investor confidence and capital over time.

This vital emphasis on dividend growth over a static yield aligns with a core principle of smart income strategies: focusing on total return. Total return encompasses not just the immediate dividend income but also the potential for capital appreciation derived from a healthy, growing business and the compounding effect of reinvested, increasing dividends. This holistic approach ensures your investment strategy builds genuine, sustainable wealth.

Where a High Yield Becomes a Red Flag: Avoiding Dividend Traps

If a dividend yield appears “too good to be true”, it often is. An excessively high dividend can frequently signal a company in distress, particularly if its stock price is plummeting faster than its earnings. These are known as “dividend traps”, and they can severely erode your capital.

Be wary of these tell-tale signs of potential yield traps:

- Dividend increases funded by debt: A company borrowing heavily just to maintain or increase its dividend is unsustainable.

- Declining sales or shrinking market share: A business that isn’t growing its top line will struggle to maintain payouts.

- Heavy reliance on cyclical industries: Sectors like automotive parts or traditional energy can be highly sensitive to economic downturns, making their dividends less reliable during lean times.

- Industries facing secular decline or significant regulatory headwinds: Telecom and tobacco, while historically high-dividend payers, face ongoing disruption and macro uncertainties that could impact future payouts.

Remember: don’t confuse temporary, inflated income with lasting value. Sustainable income comes from fundamentally strong businesses.

Beyond Individual Stocks: A Broader Toolkit for Income Generation

You don’t need to be ultra-wealthy or have access to private funds to build a solid income-generating portfolio. With the right mix of public market tools, anyone can create steady cash flow without overexposing themselves to just a handful of dividend stocks.

Here’s how everyday investors can expand their income toolbox:

- Dividend ETFs – Diversification Made Simple

Instead of buying individual stocks, Dividend ETFs give you instant exposure to dozens of companies with strong dividend histories. They’re low-cost, liquid, and perfect for hands-off investors.

Examples:

- NOBL – ProShares S&P 500 Dividend Aristocrats ETF

- VIG – Vanguard Dividend Appreciation ETF

- SCHD – Schwab U.S. Dividend Equity ETF (popular for yield + growth)

Great for: Broad market exposure, dividend growth, reduced risk.

- REITs – Real Estate Income Without Owning Property

REITs trade just like stocks and pay out high dividends, since they’re required to distribute most of their earnings. You get access to real estate income without needing to be a landlord.

Examples:

- O – Realty Income (monthly payer, retail & industrial)

- AGNC – AGNC Investment Corp (residential mortgage REIT)

- EPR – EPR Properties (entertainment & experiential properties)

Great for: Passive income from real estate with liquidity.

- BDCs – High Yield from Private Lending

Business Development Companies lend to small and mid-sized private companies. They tend to pay high dividends and are easy to buy on public markets.

Examples:

- MAIN – Main Street Capital (monthly payer, very stable)

- ARCC – Ares Capital Corp (largest BDC, strong track record)

- PNNT – PennantPark Investment (higher yield, more risk)

Great for: Enhanced yield through private credit exposure.

- Monthly Dividend Stocks & Funds – For Regular Cash Flow

Prefer income that matches your bills? Monthly dividend payers smooth out cash flow and reinvestment timing.

Examples:

- JEPI – JPMorgan Equity Premium Income ETF (uses covered calls)

- STAG – STAG Industrial (monthly-paying REIT)

- SLVO – Credit Suisse Silver Covered Call ETN (high income, more niche)

Great for: Consistent monthly income, retirees, reinvestors.

- Covered Call ETFs – Generate Extra Yield from Stocks

These ETFs use options to boost income. You trade some upside for higher yield, which can be perfect in sideways or slow-growth markets.

Examples:

- XYLD – Global X S&P 500 Covered Call ETF

- QYLD – Nasdaq-100 Covered Call ETF (very high yield)

- JEPI – JPMorgan Equity Premium Income ETF (also monthly)

Great for: Income-focused investors in choppy markets.

FAQ: Dividend Investing, Simplified

Q: What’s considered a “good” dividend yield?

A: A reasonable dividend yield typically falls in the range of 3% to 6%. Much higher than that can signal elevated risk unless the company demonstrates exceptionally strong financials and growth prospects.

Q: Are monthly dividends better than quarterly dividends?

A: Monthly dividends can be beneficial for retirees and budget-conscious investors as they provide more frequent cash flow, helping to better align income with recurring expenses. However, the quality of the underlying company is always more important than the payment frequency.

Q: Can I use a dividend calculator?

A: Absolutely! Dividend calculators are excellent tools for projecting your future cash flow based on your invested amount, the dividend yield, and the power of compounding. They help visualize the long-term impact of your dividend reinvestment strategy.

Q: Do high dividends always mean high risk?

A: Not always, but caution is warranted. A very high yield coupled with declining earnings or a deteriorating business outlook often signals trouble ahead and could be a “dividend trap.” Always conduct thorough due diligence.

Q: How do I start investing in dividend stocks?

A: Start by opening a brokerage account. Then, utilize stock screeners (like the Fidelity or Gainify stock screener) to identify dividend-paying companies that align with your financial goals and risk tolerance. Begin with established companies that have a strong history of consistent payouts.

Insights for Robust Income Portfolios

The pursuit of stocks with the highest dividends is a valid strategy for income-focused investors, but it requires analysis that extends beyond the initial yield percentage.

- Dividend yield is the initial filter, but not the final judgment; a deeper dive into company financials and sustainability is essential.

- Assess dividend sustainability by scrutinizing the payout ratio, cash flow, and the company’s overall financial health and operational histories.

- Prioritize consistent dividend growth and a strong track record over static high yields for more resilient long-term income streams.

- Always consider the company’s industry context, credit rating, and total return potential, avoiding “yield traps” where high income is offset by capital depreciation.