David Abrams, the low-profile founder of Abrams Capital Management, has quietly built one of the most fascinating hedge fund portfolios on Wall Street. Unlike high-profile investors such as Warren Buffett or Ray Dalio, Abrams rarely gives interviews and avoids the spotlight. Yet his track record places him among the most respected value investors in the world.

Abrams’ reputation comes not just from strong performance but also from his unique style. Where most hedge funds hold hundreds of stock holdings, Abrams prefers to run an exceptionally concentrated portfolio. He is comfortable placing large bets on a few carefully chosen equity securities and holding them for years or even decades. His average holding period is 17 quarters (four years), a stark contrast to the short-term focus that dominates much of Wall Street.

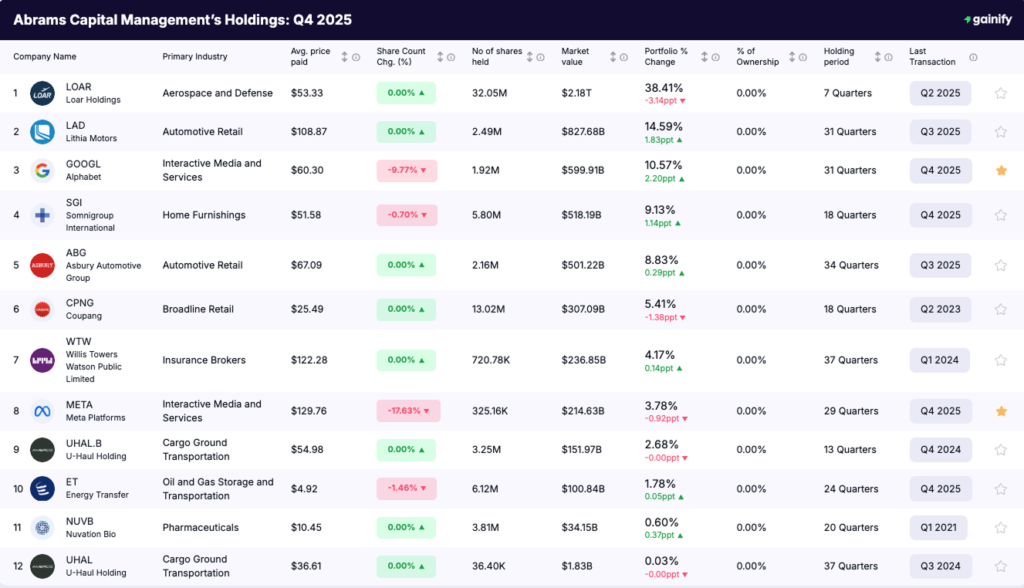

This discipline has paid off. Over the past decade, Abrams has delivered results that rival the best in the industry. As disclosed in the SEC Form 13F filed on February 14, 2026, for the quarter ended December 31, 2025, Abrams Capital reported a portfolio value of 5.67 billion dollars with only 12 portfolio holdings disclosed in his latest SEC 13F filing. The fund’s returns have been exceptional: +95% over the past three years, and +87.5% over the past five years.

What makes his current portfolio especially notable is its concentration in a single stock: Loar Holdings (LOAR). Nearly 40% of Abrams’ security holdings, worth 2.18 billion dollars, is tied to this one company. This extraordinary weighting underscores his conviction in Loar’s long-term value and sets Abrams apart from his peers.

In the sections that follow, we’ll explore Abrams’ background, the philosophy that guides his investment strategy, the major changes in his portfolio activity during Q4 2025, and a closer look at Loar Holdings – the company that has become his defining bet.

Key Insights from Abrams’ Q4 2025 Portfolio Update

- Concentrated Style: Only 12 holdings, with the top holdings making up 100 percent of the fund

- Dominant Position: Loar Holdings (LOAR) represents nearly 40% the portfolio value

- Minimal Portfolio Turnover: exit from Circle Internet Group, reduced positions in Alphabet, Meta, Energy Transfer and Somnigroup

- Performance: Strong compounding of +87.5% over 5 years proves the strength of his philosophy

- Approach: A value-oriented approach blending Klarman-style investing with a private equity mindset, occasionally adding distressed securities and illiquid investments

Who Is David Abrams?

David Abrams founded Abrams Capital Management in 1999 in Boston, Massachusetts. Prior to that, he worked for Seth Klarman’s Baupost Group, one of the most influential value investment firms in the world. That experience shaped Abrams’ investing DNA, teaching him the principles of margin of safety, disciplined capital allocation, contrarian thinking, and distressed debt investing.

From its inception, Abrams Capital was designed to be concentrated and patient. While many hedge funds expand assets and increase diversification to attract institutional clients, Abrams chose a different path. He runs a relatively small number of equity securities, focusing on opportunities where he sees clear mispricing and long-term value.

Outside investing, Abrams is known for his discretion. He rarely speaks at conferences or in the media, preferring to let his results speak for themselves. Despite his low profile, peers and industry insiders view him as a manager’s manager and a disciplined practitioner of the value-oriented approach in its purest form.

David Abrams’ Investment Philosophy

David Abrams’ investment philosophy blends classic value investing principles with a pragmatic and flexible approach. While he learned much from Klarman, Abrams has made the strategy his own by leaning even more into concentration and long holding periods.

Concentration Over Diversification

Abrams believes true value is rare. When he finds a company that meets his standards, he makes it a top holding. His portfolio often looks more like a private equity investor’s book than a traditional hedge fund, with just 10 to 20 stock holdings accounting for nearly all assets. Loar Holdings’ 45 percent weighting is a prime example.

Long-Term Orientation

With an average holding period of five years, Abrams avoids the short-term noise of quarterly earnings. He invests with the mindset of a business owner, willing to wait years for the thesis to play out. Patience, in his philosophy, is a source of competitive advantage in navigating the macro environment.

Contrarian Value Investing

Abrams is willing to buy when sentiment is negative and valuations are depressed. His background at Baupost instilled in him the discipline to go against the crowd when the margin of safety is sufficient. This contrarian streak has led him into sectors like the auto retail segment with Lithia Motors and Asbury Automotive, into technology with Meta and Alphabet, and into niche names like Cantaloupe before his full exit in Q2 2025.

Focus on Durable Cash Flow

Abrams prioritizes companies with strong free cash flow, efficient capital structures, and recurring service revenue. He looks for businesses capable of compounding capital internally without excessive leverage, whether in e-commerce growth like Coupang or in digital advertising from Meta and Alphabet.

Flexibility Across Sectors

Unlike thematic funds, Abrams is sector-agnostic. His current portfolio holdings span aerospace, autos, technology, retail, and insurance. He has historically dabbled in distressed securities, debt instruments, merger and risk arbitrage transactions, and private or illiquid investments, but the core remains concentrated equity bets.

This philosophy is evident in his current top holdings, where an aerospace supplier like Loar Holdings sits alongside Alphabet, Meta, Lithia Motors, Asbury, and Coupang.

Q4 2025 Portfolio Activity

Abrams’ Q4 2025 SEC 13F form revealed a handful of notable adjustments in his portfolio activity.

Sold Outs

- Circle Internet Group (CRCL): Abrams fully exited his position in Circle Internet Group during the quarter. The stake was sold at an average price of approximately $103.35 per share, with a total sell value of $28.4 million, reducing portfolio exposure by roughly 0.6 percentage points. This exit suggests either valuation discipline or a reassessment of risk-return dynamics rather than a broad shift away from the theme.

Cuts

Abrams trimmed several existing positions, with reductions varying in size and intent.

- Alphabet (GOOGL): The position was reduced by 9.77%, representing approximately $59.3 million in value. Despite the trim, Alphabet’s portfolio weight increased due to price appreciation, indicating portfolio rebalancing rather than declining conviction.

- Meta Platforms (META): Abrams cut 17.63% of the position, equal to roughly $46.5 million. The reduction lowered portfolio exposure modestly, consistent with risk management following strong performance.

- Somnigroup International (SGI): A minor trim of 0.70%, totaling about $3.6 million, appears tactical and does not materially change exposure.

- Energy Transfer (ET): The position was reduced by 1.46%, or approximately $1.5 million, a marginal adjustment with limited portfolio impact.

Loar Holdings: The Defining Bet

No discussion of Abrams’ portfolio holdings is complete without highlighting Loar Holdings (LOAR).

- Shares held: 32.05M

- Market value: 2.18B

- Portfolio weight: 38.41%

Loar specializes in aircraft equipment and components, serving both commercial and defense markets. Its products are mission-critical and benefit from:

- Secular defense tailwinds and rising demand for global air travel

- Sticky relationships through multi-year contracts

- High barriers to entry requiring technical expertise and regulatory certifications

By owning over a third of the company, Abrams has effectively taken a private equity-style stake in a public business. This is a hallmark of his investment strategy: not just investing in stocks but owning businesses outright in terms of influence and conviction.

Top 10 Holdings of Abrams Capital Management (Q4 2025)

Rank | Company | Ticker | Primary Industry | Portfolio Weight | Market Value |

|---|---|---|---|---|---|

1 | Loar Holdings | LOAR | Aerospace and Defense | 38.41% | $2.18B |

2 | Lithia Motors | LAD | Automotive Retail | 14.59% | $827.7M |

3 | Alphabet | GOOGL | Interactive Media and Services | 10.57% | $599.9M |

4 | Somnigroup International | SGI | Home Furnishings | 9.13% | $518.2M |

5 | Asbury Automotive Group | ABG | Automotive Retail | 8.83% | $501.2M |

6 | Coupang | CPNG | Broadline Retail | 5.41% | $307.1M |

7 | Willis Towers Watson | WTW | Insurance Brokers | 4.17% | $236.9M |

8 | Meta Platforms | META | Interactive Media and Services | 3.78% | $214.6M |

9 | U-Haul Holding (Class B) | UHAL.B | Cargo Ground Transportation | 2.68% | $152.0M |

10 | Energy Transfer | ET | Oil and Gas Transportation | 1.78% | $100.8M |

The top holdings represent over 100 percent of the portfolio, a level of concentration rarely seen in funds of this size.

Other historical portfolio activity has included positions in Tempur Sealy International, Teva, Camping World, and Lazydays, showing Abrams’ interest in consumer discretionary businesses alongside his core technology and defense bets.

Conclusion

David Abrams’ Q4 2025 SEC 13F filing shows a portfolio that is rare in today’s hedge fund industry: deeply concentrated, patient, and conviction-driven. His defining bet on Loar Holdings highlights his ability to make bold choices supported by strong fundamental economics.

Other top holdings such as Lithia, Asbury, Alphabet, and Somnigroup give exposure to the auto retail segment, consumer discretionary, cloud services, and digital advertising, offering balance across industries while maintaining focus.

By combining qualitative analysis, market discipline, and conviction, Abrams has proven that patient and concentrated investing can deliver outperformance. For investors and investment analysts studying his moves, the lesson is clear: in an era of over-diversification, focus and discipline remain Abrams’ competitive edge.