Cathie Wood has built one of the most distinctive investment franchises in global markets by committing to a single idea and refining it through multiple market cycles. At ARK Invest, she does not attempt to predict recessions, time interest rates, or rotate between fashionable sectors. Instead, capital is allocated to companies she believes sit at the center of long-term technological shifts that can reshape entire industries.

That consistency makes the Q3 2025 portfolio particularly revealing. The quarter does not represent a change in philosophy, but it does show how conviction is being expressed as volatility returns and dispersion widens. ARK’s portfolio remains concentrated, thematic, and unapologetically forward-looking, yet the way capital moved during the quarter highlights where confidence strengthened and where position sizing discipline took precedence.

As of Q3 2025, ARK Invest reported approximately $16.8 billion in public equities across 196 holdings, with an average holding period of roughly 18 quarters. The top 10 positions account for 46.16 percent of total portfolio value.This portfolio is intentionally constructed around concentration rather than dispersion. Capital is directed toward a limited number of platforms that Wood believes possess the structural characteristics required to compound value at exceptional rates over extended time horizons. Portfolio outcomes are therefore driven less by short-term smoothing and more by the long-term success of a small set of high-conviction ideas.

What follows is a detailed examination of how Cathie Wood’s investment framework is being expressed through Q3 2025 positioning, with particular attention to the top holdings and the capital allocation decisions that define ARK’s current opportunity set.

Who Is Cathie Wood and Why Her Positioning Still Matters

Cathie Wood founded ARK Invest in 2014 after decades in traditional asset management, including senior roles at AllianceBernstein. Her decision to launch ARK was driven by a belief that conventional benchmarks and sector classifications systematically underweight disruptive innovation. Rather than build diversified growth funds, Wood designed ARK as a collection of actively managed portfolios centered on themes such as autonomous technology, artificial intelligence, genomic medicine, fintech, and digital platforms.

Wood’s approach is often misunderstood as purely speculative. In reality, it is deeply research-driven and anchored in long-duration forecasts. ARK’s analysts build detailed models projecting how technologies could scale over five to ten years, then work backward to identify companies positioned to capture that value. This leads to portfolios that can look uncomfortable in the short term but coherent when viewed through a longer lens.

Cathie Wood has been explicit about this tradeoff. She has repeatedly argued that volatility is not a flaw in innovation investing, but an inevitable feature of owning early-stage platforms before their economics stabilize. That mindset shapes both position sizing and turnover. Holdings are allowed to fluctuate, but conviction is expressed through repeated adds when prices move against long-term expectations.

Q3 2025 fits squarely within that tradition.

Cathie Wood Portfolio Overview: Q3 2025

As of the Q3 2025 filing, ARK Invest reported:

- Total public equity value: $16.8 billion

- Number of holdings: 196

- Average holding period: 18 quarters

- Top 10 concentration: 46.16 percent of portfolio value

Performance over shorter horizons remains volatile, but over three years the portfolio has delivered strong gains, reflecting the asymmetric nature of ARK’s strategy. The structure of the portfolio suggests that Wood continues to prioritize concentration in core ideas rather than expanding breadth.

Portfolio Structure: Concentration Around Innovation Platforms

ARK’s top holdings are not selected to balance sectors or smooth earnings. They are chosen because they represent platforms with potential to scale across large addressable markets. The portfolio blends companies at different stages of maturity, from profitable large caps to earlier-stage businesses still investing heavily in growth.

What changed in Q3 was not the themes themselves, but the intensity of capital allocation within them. Adds were concentrated in names where long-term conviction increased, while trims reflected risk management around position size rather than deteriorating fundamentals.

The Biggest Moves in Q3 2025

Adds: Conviction concentrated, not broad-based

The most informative activity in Q3 2025 came from additions to a very narrow set of holdings. These were not incremental rebalancing trades. They represented deliberate capital deployment into names where long-term conviction strengthened despite ongoing volatility.

- Tesla (Nasdaq: TSLA): ARK increased its Tesla position by approximately 16.6 percent, deploying roughly $178 million during the quarter. This was the single most important capital decision in Q3 and reinforces Tesla’s role as the central expression of ARK’s autonomy, energy, and platform thesis.

- Advanced Micro Devices (Nasdaq: AMD): The AMD position was increased by approximately $56 million, reflecting continued confidence in long-term AI compute demand and AMD’s positioning within high-performance and accelerator markets.

Notably, Tesla and AMD were the only major platform holdings to see clear net reinforcement during the quarter.

Additional adds were smaller and thematic in nature:

- Exact Sciences (Nasdaq: EXAS): approximately $109 million added, tied to diagnostics and precision medicine

- Teradyne (Nasdaq: TER): roughly $60 million deployed into semiconductor testing infrastructure

- Trade Desk (Nasdaq: TTD): approximately $53 million added, maintaining exposure to data-driven digital advertising

Taken together, the pattern is clear: conviction was reinforced selectively, not broadly, with capital funneled toward a small number of core ideas.

New Buys: Selective New Positions

ARK initiated several new positions during Q3 2025, with capital directed toward areas that align with its long-standing themes around digital assets, software platforms, and next-generation infrastructure. While the number of new entries was notable, their portfolio impact was intentionally limited, underscoring that these moves were exploratory rather than transformational.

The most significant new positions included:

- Bitmine Immersion Technologies (NYSE: BMNR): approximately $378.5 million invested. This was the largest new position of the quarter and reflects ARK’s continued interest in crypto-related infrastructure, particularly businesses tied to computing intensity and digital asset ecosystems.

- Bullish (NYSE: BLSH): roughly $158.0 million deployed. The Bullish position adds exposure to digital asset trading platforms and market infrastructure, reinforcing ARK’s belief in the long-term institutionalization of crypto markets.

- Brera Holdings (SLMT): approximately $67.0 million invested. A smaller but thematic allocation, adding optionality within digital and alternative asset frameworks.

- GeneDx Holdings (Nasdaq: WGS): around $48.7 million deployed. This position aligns with ARK’s genomic and precision medicine theme, offering exposure to diagnostics and data-driven healthcare.

- Figma (NYSE: FIG): approximately $40.2 million invested. Figma represents ARK’s interest in collaborative, cloud-native software platforms that sit at the center of modern digital workflows.

Despite the headline size of some of these investments, particularly Bitmine, none of the new positions altered the portfolio’s overall concentration profile. Collectively, they remain small relative to ARK’s core holdings and do not displace capital from the top tier of conviction names.

The signal here is nuanced. ARK is testing the surface area of new opportunities, establishing exposure where optionality exists, while deliberately avoiding the kind of scale that would indicate a shift in strategic focus.

Sold Outs: Minor Exits

Positions fully exited during Q3 were small and operational in nature. The exits do not signal a shift in thematic priorities, nor do they materially affect portfolio risk exposure. From a capital-allocation perspective, sold outs were immaterial to ARK’s core thesis.

Cuts: Position Sizing and Risk Control

In contrast to the narrow set of adds, most major holdings outside of Tesla and AMD were reduced. These trims were significant in dollar terms and appear driven by position sizing discipline rather than a change in long-term outlook.

The largest reductions included:

- Robinhood (Nasdaq: HOOD): approximately $302 million trimmed

- Roblox (NYSE: RBLX): roughly $181 million reduced

- Guardant Health (Nasdaq: GH): about $110 million trimmed

- Roku (Nasdaq: ROKU): approximately $102 million reduced

- Coinbase (Nasdaq: COIN): roughly $77 million trimmed

These reductions collectively freed substantial capital while keeping exposure intact. Importantly, none of these positions were abandoned, and all remain part of ARK’s innovation framework.

The pattern suggests active risk management around position size, particularly after sharp price moves, rather than declining confidence in the underlying platforms.

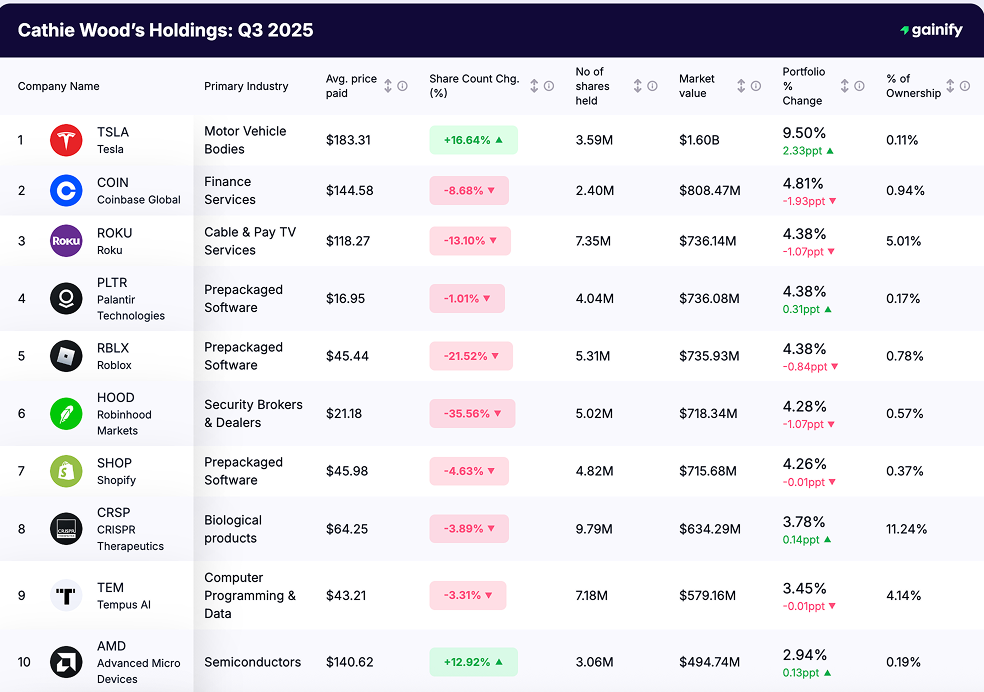

Top 10 Holdings: The Core of ARK’s Conviction

Together, ARK’s ten largest positions account for approximately 46% of total portfolio value, or roughly $7.7 billion of assets. Portfolio outcomes remain driven by a concentrated group of platform-level bets.

1. Tesla (NASDAQ: TSLA)

Market value: $1.60B

Portfolio weight: 9.50%

Q3 share change: +16.64%

Tesla remains ARK’s largest and most strategically important holding. The increased share count in Q3 reflects renewed conviction in Tesla as a multi-platform business spanning autonomy, energy storage, AI-driven manufacturing, and software-defined vehicles. The add stands out as one of the clearest expressions of confidence in the portfolio.

2. Coinbase Global (NASDAQ: COIN)

Market value: $808.47M

Portfolio weight: 4.81%

Q3 share change: -8.68%

Coinbase continues to anchor ARK’s exposure to digital asset infrastructure. The reduction in shares suggests position-sizing discipline rather than a change in thesis, with the holding still reflecting long-term belief in regulated crypto access, custody, and financial services.

3. Roku (NASDAQ: ROKU)

Market value: $736.14M

Portfolio weight: 4.38%

Q3 share change: -13.10%

Roku remains a core platform bet on connected television and the long-term shift of advertising budgets toward streaming. The trim reflects valuation and risk management considerations rather than reduced confidence in Roku’s role within the advertising ecosystem.

4. Palantir Technologies (NASDAQ: PLTR)

Market value: $736.08M

Portfolio weight: 4.38%

Q3 share change: -1.01%

Palantir continues to represent ARK’s exposure to enterprise and government AI deployment. The position was largely maintained, signaling steady conviction in Palantir’s data platforms and long-duration contracts.

5. Roblox (NYSE: RBLX)

Market value: $735.93M

Portfolio weight: 4.38%

Q3 share change: -21.52%

Roblox remains a long-term platform investment focused on immersive digital environments and user-generated economies. The sizable reduction suggests tighter risk controls amid volatility rather than abandonment of the long-term platform thesis.

6. Robinhood Markets (NASDAQ: HOOD)

Market value: $718.34M

Portfolio weight: 4.28%

Q3 share change: -35.56%

Robinhood saw one of the largest trims in the top 10. The reduction reflects position sizing after strong performance and ongoing reassessment of competitive and regulatory dynamics, while the holding remains part of ARK’s digital finance framework.

7. Shopify (NASDAQ: SHOP)

Market value: $715.68M

Portfolio weight: 4.26%

Q3 share change: -4.63%

Shopify continues to serve as ARK’s exposure to decentralized commerce infrastructure. The modest trim indicates portfolio balancing rather than weakening belief in Shopify’s long-term operating leverage and ecosystem growth.

8. CRISPR Therapeutics (NASDAQ: CRSP)

Market value: $634.29M

Portfolio weight: 3.78%

Q3 share change: -3.89%

CRISPR anchors ARK’s exposure to genomic medicine. The position reflects a platform-level view of gene editing rather than reliance on single-product outcomes, with minor trimming consistent with volatility management.

9. Tempus AI (NASDAQ: TEM)

Market value: $579.16M

Portfolio weight: 3.45%

Q3 share change: -3.31%

Tempus AI represents ARK’s belief in data-driven healthcare and AI-enabled diagnostics. The position remains meaningful, with only slight reduction, underscoring continued confidence in AI applications within medicine.

10. Advanced Micro Devices (NASDAQ: AMD)

Market value: $494.74M

Portfolio weight: 2.94%

Q3 share change: +12.92%

AMD was the only top-10 holding alongside Tesla to see a clear increase in shares. The add reinforces ARK’s view that high-performance computing and AI acceleration will remain structurally undersupplied over long horizons.

What the Cathie Wood Portfolio Ultimately Says

The Cathie Wood portfolio in Q3 2025 is not a reaction to macro conditions or market sentiment. It is a continuation of a framework built around conviction, research depth, and long time horizons. Capital was added where long-term opportunity expanded and trimmed where position sizes had grown faster than conviction.

ARK remains willing to look wrong in the short term in order to be positioned for outsized outcomes over longer horizons. The concentration in the top ten holdings underscores that belief. For observers of ARK, the most important signal is not volatility or quarterly performance, but where capital is being added during periods of uncertainty.

In Q3 2025, Cathie Wood made that signal clear.