Blue chip stocks occupy a unique place in equity markets. They are often described casually as “safe” or “boring,” yet they sit at the core of nearly every institutional portfolio in the world.

Pension funds, sovereign wealth funds, insurance companies, and hedge funds allocate capital to blue chip companies because these businesses represent some of the most durable and reliable engines of cash flow in the global economy.

Blue chips are not owned for excitement. They are owned for reliability, scale, and strategic optionality. Understanding what truly makes a company a blue chip, and how to evaluate one properly, is essential for any serious investor.

This article breaks the concept down clearly, goes beyond surface definitions, and explains how blue chip stocks function inside real portfolios, with examples drawn from technology, consumer, financial, and healthcare leaders.

What Is a Blue Chip Stock, Really?

A blue chip stock is not simply a large company or a well-known brand. Size and name recognition help, but they are not sufficient.

At its core, a blue chip company is defined by economic durability.

A true blue chip business typically exhibits:

- A dominant or defensible competitive position within its core markets

- Sustained pricing power or structural cost advantages that protect margins over time

- A long operating history across multiple economic regimes, demonstrating adaptability and relevance

- Consistent free cash flow generation across cycles, reflecting underlying economic strength rather than peak conditions

- A strong and resilient balance sheet, with leverage aligned to long-term cash flow rather than short-term opportunity

- Disciplined capital allocation that preserves and compounds per-share value

- Deep market liquidity and institutional trust, reflected in long-term ownership by large pools of capital

Blue chips are businesses that societies, governments, and industries implicitly rely on. Their products or services are embedded into daily economic activity, often in ways that are difficult to replace.

This is why the term originated from poker, where blue chips carried the highest value. The analogy still holds.

What Blue Chip Stocks Are Not

This distinction matters.

Blue chip stocks ARE NOT:

- Guaranteed to outperform every year

- Immune to drawdowns or periods of underperformance

- Always attractively valued

- Defined by rapid or disruptive growth

A blue chip can lag the market for extended periods. It can face regulatory scrutiny, cyclical demand shifts, margin pressure, or execution challenges. Share prices can decline materially even while the underlying business remains sound.

What distinguishes a blue chip is not the absence of stress, but the capacity to withstand it. These companies tend to preserve balance sheet flexibility, retain customer relevance, and continue generating cash through difficult environments. Temporary setbacks do not typically compromise their long-term viability.

Professional investors therefore focus less on short-term returns and more on business continuity. Capital is allocated with an emphasis on survivability first, followed by the ability to participate in upside as conditions normalize over time.

Core Characteristics of Blue Chip Companies

1. Durable Competitive Position

At the foundation of every blue chip company is a competitive position that is difficult to displace. This advantage is rarely based on a single factor. Instead, it is usually the result of scale, network effects, switching costs, regulatory barriers, brand trust, or control over critical infrastructure. What matters most is not momentary leadership, but sustained relevance within an industry over long periods of time.

Blue chip companies tend to operate in markets where competitors cannot easily replicate their position without significant capital, time, or structural change. This durability allows the business to plan, invest, and operate with a longer time horizon than peers that must constantly defend share.

2. Sustained Pricing Power or Structural Cost Advantage

A durable competitive position expresses itself economically through pricing power, cost leadership, or a combination of both. Blue chip companies are typically able to protect margins over time, even as input costs rise or market conditions shift.

This does not require frequent or aggressive price increases. Instead, pricing power often appears through gradual adjustments, favorable product mix, long-term contracts, or customer behavior that prioritizes reliability over price. In other cases, scale and efficiency create cost advantages that allow margins to remain resilient even in competitive environments.

Over full business cycles, this economic control is a defining trait of blue chip businesses.

3. Proven Operating History Across Economic Cycles

Blue chip status is earned through time. These companies have demonstrated the ability to operate effectively across multiple economic regimes, including expansions, recessions, periods of inflation, and shifting regulatory environments.

A long operating history provides evidence of adaptability. Management teams have navigated disruptions, adjusted strategy, and preserved relevance as markets evolved. This track record reduces uncertainty around how the business might behave under future stress, which is a critical consideration for long-term capital.

Longevity alone is not sufficient, but longevity paired with continued relevance is a powerful signal of quality.

4. Consistent Free Cash Flow Generation

Over time, competitive strength and pricing power translate into cash flow. Blue chip companies tend to convert earnings into free cash flow reliably, not only during favorable conditions but across cycles.

This consistency matters more than peak profitability. Steady free cash flow allows companies to reinvest in their core businesses, pursue selective growth opportunities, return capital to shareholders, and absorb unexpected shocks without relying on external financing. It also provides management with flexibility to act when competitors are constrained.

For institutional investors, predictable cash generation is one of the most important attributes of a blue chip business.

5. Strong Balance Sheet and Disciplined Capital Allocation

Free cash flow supports financial strength, but capital allocation determines long-term outcomes. Blue chip companies typically maintain balance sheets designed for resilience rather than optimization. Leverage is aligned with long-term cash generation, not short-term opportunity.

Equally important is how capital is deployed. Disciplined management teams reinvest where returns justify it, return excess capital thoughtfully, and avoid actions that dilute long-term value. Over time, this discipline compounds per-share intrinsic value and reinforces the company’s blue chip status.

In practice, this combination of financial strength and capital allocation discipline separates enduring market leaders from companies that merely experience periods of success.

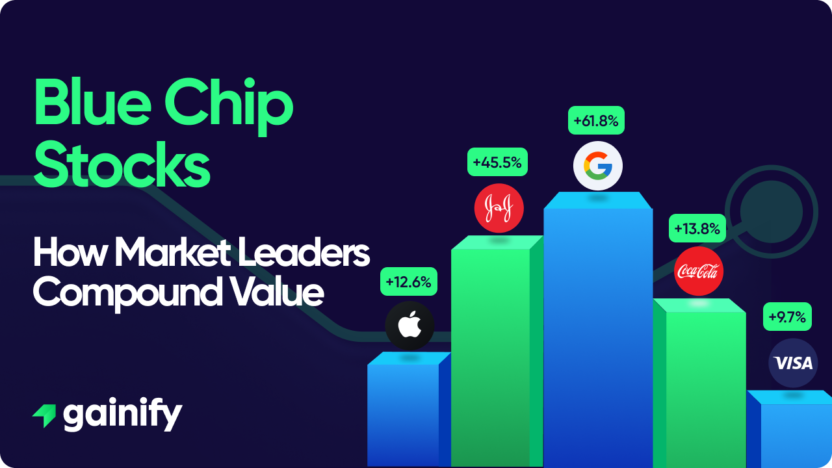

Examples of Blue Chip Stocks (Across Sectors)

These examples are illustrative, not recommendations. They highlight how blue chip characteristics show up across different parts of the economy.

Technology

- Microsoft (NASDAQ: MSFT) – Enterprise software and cloud infrastructure with deeply embedded workflows, recurring revenue, and high switching costs

- Apple (NASDAQ: AAPL) – Integrated hardware, software, and services ecosystem supported by brand strength and pricing power

- Alphabet (NASDAQ: GOOGL) – Core digital advertising platform combined with global data infrastructure and long-term optionality

- Oracle (NYSE: ORCL) – Mission-critical enterprise databases and applications with high customer lock-in

- SAP (XTRA: SAP) – Global enterprise resource planning software with long product cycles and recurring maintenance revenue

Technology blue chips tend to function as infrastructure rather than discretionary tools. Their products are deeply integrated into business and consumer activity.

Consumer & Staples

- Procter & Gamble (NYSE: PG) – Portfolio of global household brands with consistent demand and strong distribution

- Coca-Cola (NYSE: KO) – Concentrate-based model with unmatched global bottling and distribution reach

- Nestlé (SWX: NESN) – Diversified food, beverage, and nutrition exposure across geographies and income levels

- PepsiCo (NASDAQ: PEP) – Complementary snack and beverage businesses with strong pricing power

- Unilever (LSE: UL) – Broad consumer staples footprint with scale-driven efficiencies

Consumer blue chips benefit from repeat purchase behavior and brand trust that persists across economic cycles.

Financials

- JPMorgan Chase (NYSE: JPM) – Leading global bank with diversified earnings, scale advantages, and balance sheet strength

- Visa (NYSE: V) – Transaction network embedded in global commerce with high margins and minimal credit risk

- Berkshire Hathaway (NYSE: BRK.B) – Capital allocation platform combining operating businesses, insurance float, and long-term investments

- Mastercard (NYSE: MA) – Global payments infrastructure with strong network effects and pricing power

- BlackRock (NYSE: BLK) – Asset management scale supported by index leadership and advisory services

Financial blue chips tend to sit at the center of capital flows rather than depend on narrow lending or trading conditions.

Healthcare

- Johnson & Johnson (NYSE: JNJ) – Diversified healthcare exposure across pharmaceuticals, medical devices, and consumer health

- Roche (SWX: ROG) – Global leader in pharmaceuticals and diagnostics with deep R&D capabilities

- Merck (NYSE: MRK) – Innovation-driven pharmaceutical business with durable franchises

- UnitedHealth Group (NYSE: UNH) – Integrated healthcare services and insurance with scale-driven efficiencies

- Abbott Laboratories (NYSE: ABT) – Medical devices, diagnostics, and nutrition with recurring demand characteristics

Healthcare blue chips benefit from structural demand, regulatory barriers, and long product life cycles, supporting relatively resilient cash flows across economic conditions.

How Retail Investors Can Use Blue Chip Stocks

Blue chip stocks are not just for institutions. They can play an important role in retail portfolios when used intentionally rather than simply bought and forgotten.

1. Core Holdings

Blue chips can serve as the foundation of a portfolio. Their durability and cash generation make them suitable long-term holdings, allowing investors to add selective growth or higher-risk positions around them.

2. Stability in Volatile Markets

During periods of market volatility, blue chip stocks tend to hold up better than smaller or less established companies. While prices can still decline, these businesses are generally better positioned to recover as conditions normalize.

3. Long-Term Compounding

Retail investors often benefit most from holding blue chips over long periods. Consistent cash flow, dividends, and disciplined capital allocation can drive steady compounding when positions are allowed to run.

4. Risk Management Through Quality

Blue chip stocks can help reduce overall portfolio risk. Their strong balance sheets and established market positions make them less likely to suffer permanent damage, which can improve long-term, risk-adjusted returns.

Valuation: How Professionals Think About Blue Chips

Valuing blue chip stocks requires patience and a long time horizon. Professionals are less concerned with near-term earnings volatility and more focused on how valuation compares to a company’s own history and long-term cash-generating ability.

Rather than anchoring on a single metric, analysts typically evaluate blue chips through a range of normalized measures, including:

- Mid-cycle earnings, not peak or trough results

- Normalized operating margins, adjusted for temporary cost or demand distortions

- Long-term free cash flow yield, often assessed over a full cycle

- Return on invested capital, relative to cost of capital

- Durability of the competitive position, which determines how long excess returns can persist

For many established blue chip companies, long-run valuation ranges tend to be relatively stable. As a result, multiple divergence from historical averages becomes an important signal.

As an example:

- Large-cap blue chips often trade around 18 to 27 times normalized earnings over full cycles

- Enterprise value to EBITDA multiples frequently cluster in the 12 to 17 times range for high-quality franchises

- Long-term free cash flow yields typically settle between 3 and 4 percent, depending on growth and reinvestment needs

When a blue chip trades materially above these ranges, it can indicate elevated expectations and limited margin for error. When it trades well below them, the market may be discounting slower growth, temporary dislocation, or potential structural change.

Professionals do not treat either condition as automatic signals. A premium valuation is not inherently a reason to sell, just as a discounted valuation is not automatically an opportunity. What matters is whether the underlying cash flow stream is strengthening or weakening.

The core question remains the same across cycles:

Is this business becoming more reliable and more valuable over time, or less so?

Valuation only becomes actionable when it diverges meaningfully from long-term norms and the fundamentals either confirm or contradict the market’s implied assumptions.

Common Mistakes Investors Make With Blue Chips

- Treating them as risk-free. No stock is risk-free. Blue chips reduce risk; they do not eliminate it.

- Buying without valuation discipline. Even the best company can be a poor investment at the wrong price.

- Selling too early. Long-term compounding often happens slowly, then suddenly.

- Confusing brand strength with economic strength. Not every famous company is a blue chip.

Final Thoughts

Blue chip stocks are not exciting by design. They are essential by function.

They represent the companies that have already proven they can survive, adapt, and compound across economic cycles. For professional investors, blue chips are not a default choice, they are a strategic one.

Owning blue chips is not about avoiding risk. It is about choosing which risks are worth taking.

In a market that constantly shifts attention to the next narrative, blue chip stocks remain relevant because they are built on something more durable than stories. They are built on cash flow, scale, and time.

Disclaimer

This article is for educational purposes only and does not constitute investment advice. All investments involve risk, including loss of principal. Readers should conduct their own research or consult a qualified financial professional before making investment decisions.