Mohnish Pabrai, founder of Dalal Street LLC, is one of the most prominent disciples of Warren Buffett and Charlie Munger’s value investing principles. Known for his concentrated, high-conviction portfolio and long holding periods, Pabrai prefers to invest in a handful of companies he understands deeply rather than spreading capital across dozens of positions. His style blends patience with opportunism, seeking to buy durable businesses at significant discounts to intrinsic value.

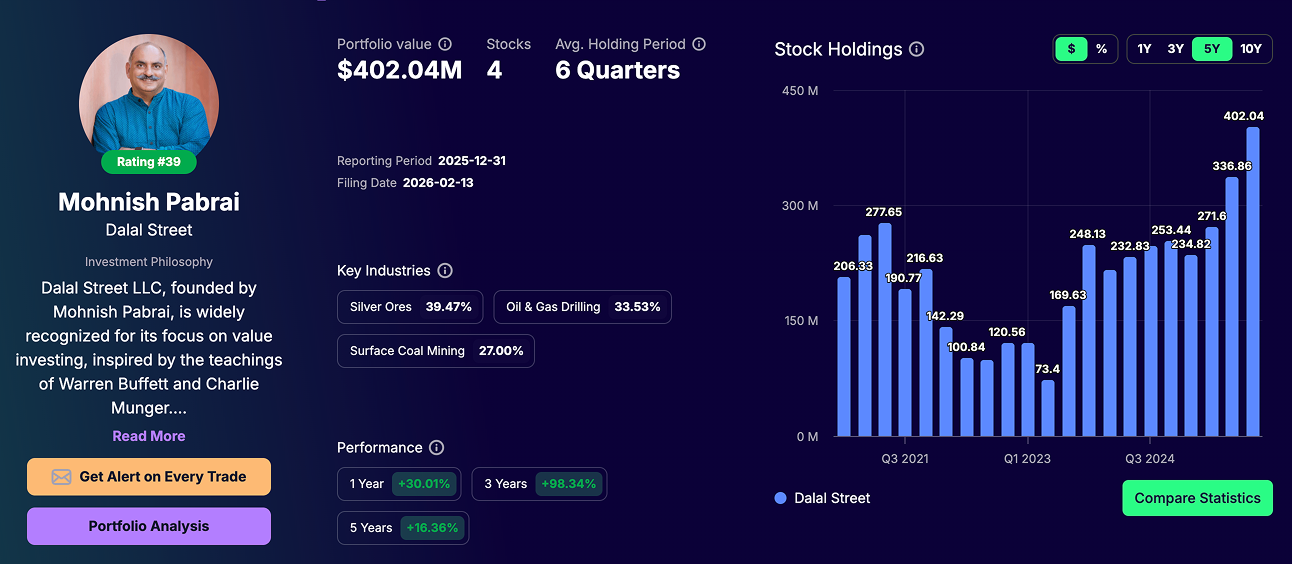

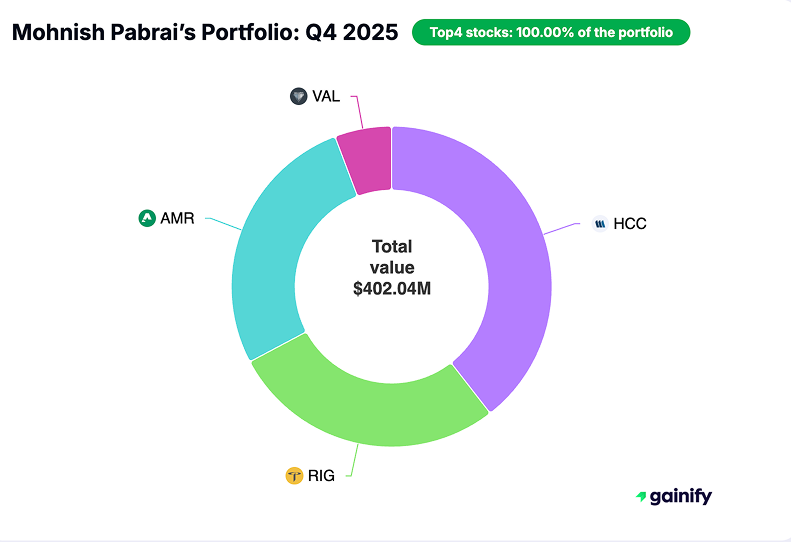

As of the December 31, 2025 13F filing, reported on February 13, 2026, Dalal Street’s U.S. public equity portfolio totaled $402.04 million, invested in just four positions, with an average holding period of six quarters. This marks a sharp increase from prior quarters and represents a five-year high in equity allocation, according to the portfolio history shown.

The portfolio’s one-year performance was up by 30.0%, largely a result of oil & gas exposure, but the moves in the latest quarter show a reaffirmation of his core thesis, maintaining heavy allocations to energy and steel, while selectively adding to these areas.

Activity during 4Q 2025 was concentrated in a small number of existing holdings rather than broad repositioning. Pabrai added to Transocean (RIG) and Alpha Metallurgical Resources (AMR), reinforcing exposure to offshore drilling and metallurgical coal where he continues to see asymmetric upside. At the same time, he fully exited Noble Corporation (NE) and made a sizable cut to Valaris (VAL), reducing exposure to one offshore name while maintaining the core thesis in the sector.

In the sections ahead, we will explore Mohnish Pabrai’s background, his investment philosophy, and the key Q4 2025 portfolio moves, including detailed commentary on the largest additions, one main trim, and his highly concentrated top holdings.

Who Is Mohnish Pabrai

Mohnish Pabrai founded Dalal Street LLC in 1999 after selling his IT services company, TransTech, for a substantial gain. Since then, he has become one of the most widely recognized value investors, often referred to as a “shameless cloner” for his willingness to study and replicate the best ideas of legendary investors like Buffett and Munger.

Pabrai’s approach is grounded in buying a small number of high-quality businesses at bargain prices, holding them for years, and letting compounding do the heavy lifting. He openly credits the Buffett–Munger framework for shaping his thinking on patience, temperament, and the avoidance of unnecessary risk.

Throughout his career, Pabrai has avoided the temptation to chase popular market trends, preferring instead to focus on businesses with predictable cash flows, competent management, and a margin of safety in valuation.

Over the years, he has built a reputation not only as a skilled investor but also as a teacher and author, sharing his methods through books like The Dhandho Investor and Mosaic. His disciplined, concentrated approach stands out in an industry dominated by index hugging and short-termism.

Mohnish Pabrai’s Investment Philosophy

At the core of Pabrai’s philosophy is the belief that few bets, big bets, and infrequent bets offer the best chance for market outperformance. He focuses on asymmetric opportunities where the downside is limited but the upside can be substantial.

His portfolios often hold fewer than ten positions, and in many cases just five or six. This concentration demands deep research and conviction but also allows each successful investment to have a meaningful impact on returns.

Pabrai is comfortable investing in cyclical industries like energy and steel when valuations are depressed, provided the companies have strong balance sheets and the ability to generate cash through the cycle. He has also shown a willingness to hold positions for years, riding out volatility in pursuit of long-term gains.

The Q2 2025 13F filing reflects this discipline – no major sector rotations, no large-scale exits, just incremental additions to core holdings and a single new position in a business he likely views as a dominant, cash-generating market leader.

Mohnish Pabrai’s Portfolio Changes in Q4 2025

1. Dalal Street Adds in Q4 2025

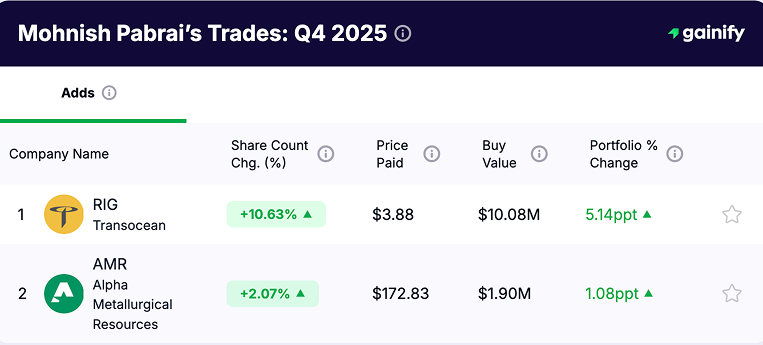

Dalal Street made additions to only two positions in Q4 2025, reinforcing Mohnish Pabrai’s continued focus on a narrow set of high-conviction, commodity-linked holdings rather than expanding the portfolio.

Transocean (RIG)

Dalal Street increased its Transocean position by 10.63%, deploying approximately $10.1 million at an average price of $3.88. The position now accounts for 27.78% of the portfolio, reflecting strong conviction in offshore drilling fundamentals as day rates recover and industry supply remains structurally constrained.

Alpha Metallurgical Resources (AMR)

The firm also added 2.07% to its Alpha Metallurgical Resources stake, investing roughly $1.9 million at an average price of $172.83. AMR now represents 27.00% of the portfolio, underscoring continued confidence in metallurgical coal as a critical, non-substitutable input for global steel production.

No other positions were increased during the quarter, highlighting Dalal Street’s disciplined, highly selective capital allocation approach.

2. Dalal Street New Buys in Q4 2025

Dalal Street did not initiate any new positions in Q4 2025. The portfolio remained concentrated in four existing holdings, and no additional companies were introduced during the quarter. This confirms that Mohnish Pabrai chose to deepen exposure to existing high-conviction ideas rather than expand into new sectors or themes.

3. Dalal Street Sold Outs in Q4 2025

Dalal Street executed one full exit in Q4 2025, selling its entire position in Noble Corporation (NE). The firm reduced its share count by 100%, exiting the position at an average price of $29.54, for total proceeds of approximately $7.1 million.

The sale reduced Noble’s portfolio contribution by 2.01 percentage points and marked a clean removal rather than a partial trim. This type of decisive exit aligns with Mohnish Pabrai’s framework of reallocating capital when the original risk reward profile no longer meets his required margin of safety or when superior opportunities exist within the same thematic bucket.

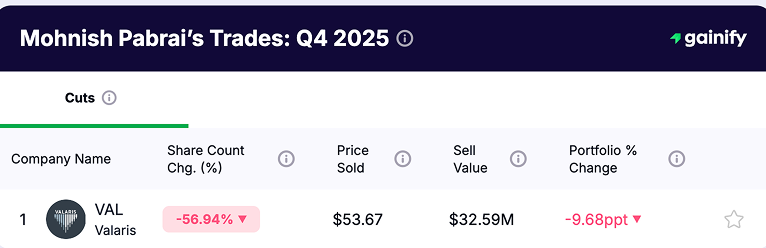

4. Dalal Street Cuts in Q4 2025

Dalal Street made one significant trim in Q4 2025, reducing its position in Valaris (VAL). The firm cut the share count by 56.94%, selling roughly $32.6 million worth of stock at an average price of $53.67. This single move lowered Valaris’ portfolio weight by 9.68 percentage points, marking a meaningful de-risking rather than routine rebalancing.

Importantly, this was not a full exit. Valaris remains a core holding, which suggests the cut reflects position sizing discipline after a strong run or a reassessment of near-term upside within the offshore drilling cycle, rather than a change in the long-term investment thesis.

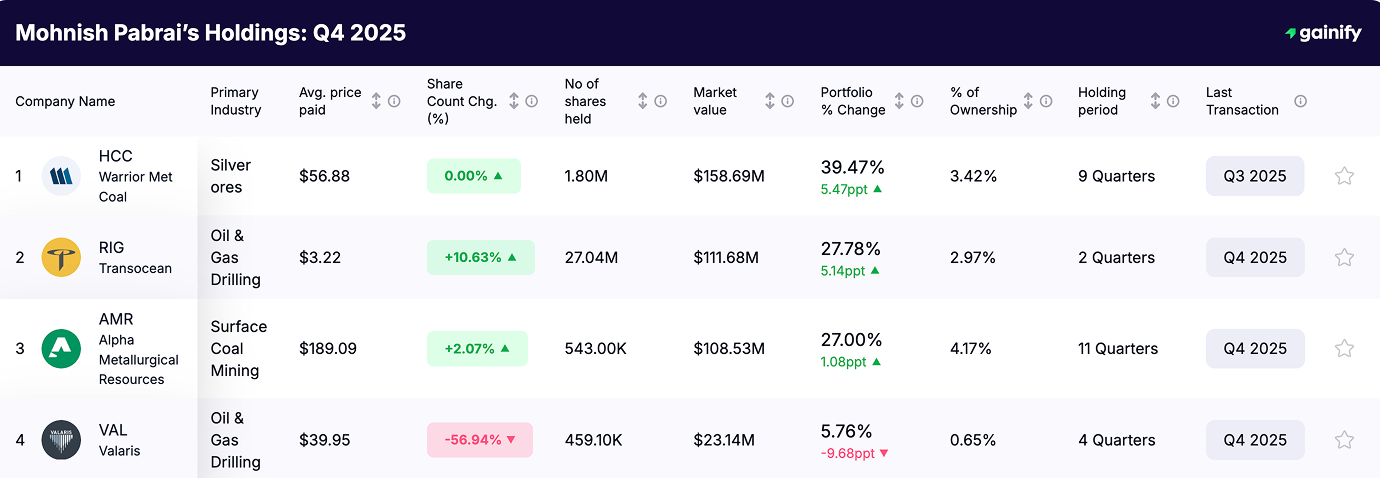

Mohnish Pabrai’s Portfolio Top Holdings in 4Q 2025

As of December 31, 2025, Dalal Street’s portfolio was concentrated in four holdings, representing 100% of reported U.S. equities.

- Warrior Met Coal (HCC) — $158.69M market value, representing 39.47% of the portfolio, making it the dominant position and the primary expression of Pabrai’s conviction in metallurgical coal cash flows.

- Transocean (RIG) — $111.68M invested, accounting for 27.78% of assets, reflecting a high-confidence bet on the offshore drilling recovery and tightening rig supply.

- Alpha Metallurgical Resources (AMR) — $108.53M position size, or 27.00% of the portfolio, reinforcing exposure to steelmaking coal with strong balance sheet support.

- Valaris (VAL) — $23.14M remaining exposure, now 5.76% of the portfolio, following a significant reduction that lowered its role without fully exiting the offshore theme.

The structure is clear and deliberate. Nearly 94% of capital is allocated to metallurgical coal and offshore drilling through HCC, RIG, and AMR. Valaris remains in the portfolio but at a significantly reduced weight following the Q4 trim.

There is no exposure to technology, consumer platforms, or financials. The portfolio is a direct expression of Pabrai’s high-conviction view on commodity-linked cash flows and cyclical industries trading below intrinsic value.

Key Takeaways: Mohnish Pabrai’s Q4 2025 Equity Portfolio

- Portfolio concentration at an extreme level. Dalal Street closed Q4 2025 with a $402.0 million portfolio allocated across only four equities.

- Commodity exposure at a five-year high. The portfolio is almost entirely allocated to energy and metallurgical coal. Warrior Met Coal, Transocean, Alpha Metallurgical Resources, and Valaris define a single macro-economic exposure to commodity supply tightness and cash-flow cyclicality. There is zero allocation to technology, growth, or AI-linked sectors.

- Incremental additions to core holdings. Capital was added exclusively to Transocean and Alpha Metallurgical Resources. These increases reinforce existing theses rather than expand the opportunity set.

- Targeted reduction in Valaris exposure. Valaris was reduced materially during the quarter. The adjustment lowers portfolio risk while preserving exposure to offshore drilling economics.

- Low turnover, high intentionality. Q4 2025 activity was limited to two adds, one cut, and no new positions. This execution pattern reflects a disciplined process focused on position sizing as the primary driver of portfolio change.