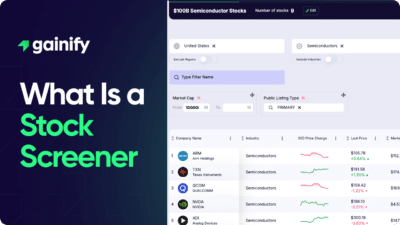

How to Use a Stock Screener in 2026: Step-by-Step Guide to Analyze Stocks and Identify Investment Opportunities

Investors searching for individual stocks face a structural problem: the global equity market contains tens of thousands of publicly listed companies,…