Terry Smith has earned his standing as the UK’s most widely followed fund manager by doing the same thing, repeatedly, for more than a decade. He buys high-quality businesses, avoids leverage and complexity, and holds them for years while their economics compound. The discipline is simple to describe but difficult to sustain, especially when markets reward speed, novelty, and constant action. Smith has never tried to outpace those forces. He has simply ignored them.

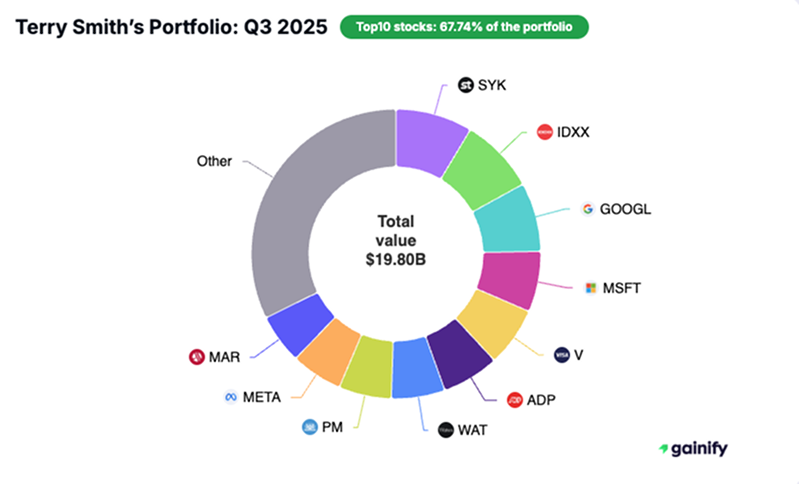

That long-standing discipline makes the Q3 2025 portfolio particularly revealing. Smith is not changing how he invests, but the way capital is currently deployed reflects a tightening opportunity set. As of Q3 2025, Fundsmith reported approximately 19.8 billion dollars in public equities, spread across 35 holdings, with an average holding period of around 20 quarters. This remains a portfolio built for long-term ownership, but equity exposure has quietly declined to its lowest level in roughly five years.

The shift did not come from a wave of selling or a search for new themes. It came from selective trims to large positions, a small number of targeted additions, and a decision not to replace every dollar that was freed up. Capital was allowed to step back as valuation discipline narrowed the number of opportunities that met Smith’s standards.

What follows is a closer look at how Terry Smith’s philosophy is being expressed through his Q3 2025 portfolio, and why doing less may be the most informative decision he has made this year.

Who Is Terry Smith and Why His Behavior Is a Signal

Long before Fundsmith existed, Terry Smith had already built a reputation in the UK financial world as an unusually direct and independent thinker. He began his career in the late 1970s as an analyst and spent the following decades across equity research, stockbroking, and senior corporate roles in London. Unlike many investors whose public profiles are built after launching a fund, Smith’s credibility was established earlier, through analysis, criticism, and an outspoken willingness to challenge industry norms.

In the 1990s and early 2000s, Smith became widely known not just as an investor, but as a critic of poor corporate governance and misleading accounting practices. His 2003 book Accounting for Growth was a direct attack on what he viewed as widespread financial manipulation and low-quality earnings in corporate reporting. The book cemented his reputation as someone deeply focused on cash flow, economic reality, and return on capital rather than headline profits or financial engineering. Those themes would later become the foundation of Fundsmith.

Before founding Fundsmith in 2010, Smith also held senior executive positions, including serving as chief executive of Collins Stewart, a publicly listed brokerage. That experience gave him firsthand exposure to market cycles, investor behavior, and the structural incentives that often encourage short-termism. By the time he launched Fundsmith, his philosophy was not theoretical. It had been stress-tested across multiple roles, market regimes, and crises.

When Smith founded Fundsmith, he did not present it as an innovation. Instead, it was framed as a distillation of lessons learned over more than thirty years in markets. He focused on owning companies with high returns on capital, strong free cash flow, low leverage, and simple, repeatable business models. These were businesses that could grow without constant acquisitions, financial restructuring, or optimistic assumptions.

Smith has always been explicit about what he avoids as much as what he buys. He is openly skeptical of macro forecasting, market timing, and diversification for its own sake. Fundsmith portfolios are intentionally concentrated, turnover is deliberately low, and holding periods are measured in years, not quarters. In one of his most frequently cited shareholder letters, he summarized the entire approach with characteristic bluntness: “Buy good companies, don’t overpay, and do nothing.”

That final instruction is often misunderstood. Doing nothing does not mean being passive. It means resisting the urge to act when prices no longer offer an attractive risk-reward tradeoff. Smith has repeatedly argued that the greatest threat to long-term compounding is not volatility, but overpaying for quality, especially after extended periods of strong performance.

This history makes Q3 2025 particularly informative. Fundsmith has a structural bias toward remaining invested in compounding businesses. When equity exposure declines meaningfully, it is not a philosophical shift or a market call. It is a consequence of discipline. It reflects a manager applying the same standards he has used for decades and finding fewer opportunities that meet them at current prices.

Terry Smith Portfolio Overview: Q3 2025

As of the Q3 2025 filing, Fundsmith reported:

- Total public equity value: ~19.80 billion dollars

- Number of holdings: 35

- Average holding period: ~20 quarters

- Top 10 concentration: ~67.7%

- Equity exposure: lowest level in approximately five years

Performance remains strong over longer horizons, but the portfolio structure suggests Smith sees fewer opportunities to deploy incremental capital without compromising return expectations.

Portfolio Structure: Concentration Without Complacency

Fundsmith’s portfolio in Q3 2025 remained anchored in a small number of global franchises that have compounded value over long periods. Microsoft, Alphabet, Meta Platforms, Stryker, IDEXX Laboratories, and Waters Corporation continue to define the economic profile of the fund. These businesses share key characteristics that sit at the core of Terry Smith’s framework: strong pricing power, recurring demand, high operating margins, and consistently high returns on invested capital.

What changed in Q3 was not the quality of the businesses owned, but the weight they carried within the portfolio. Several of Fundsmith’s largest and most successful positions had grown to dominate risk exposure after years of strong performance. Rather than allow that concentration to expand unchecked, Smith reduced exposure materially in a controlled and deliberate way. The result was a lower overall equity allocation without a deterioration in business quality.

This distinction matters. The portfolio did not become more defensive by shifting into lower-quality assets. It became more balanced by resizing winners whose valuations and position sizes had outpaced their contribution to future returns.

The Biggest Moves in Q3 2025

Activity during Q3 2025 was highly asymmetric. New capital was directed into a very small number of high-conviction holdings, while reductions were broad, deep, and intentional. These changes, taken together, explain why Fundsmith’s overall equity exposure declined to its lowest level in roughly five years.

Adds: Conviction Concentrated, Not Expanded

Despite a net reduction in equity exposure, Fundsmith deployed meaningful capital into a narrow group of businesses where long-term conviction remained intact.

- Share count change: +64%

- Capital deployed: ~170 million dollars

Intuit was the largest add of the quarter and one of the few places where Smith chose to meaningfully deploy capital. The increase reflects confidence in Intuit’s entrenched software ecosystem, high switching costs, and ability to compound earnings without balance sheet risk.

- Share count change: +25%

- Capital deployed: ~110 million dollars

The expansion of the Zoetis position reinforces Smith’s preference for healthcare businesses with durable demand and limited cyclicality. Animal health remains a structurally attractive niche with pricing power and long-term growth.

- Share count change: +9.6%

- Capital deployed: ~105 million dollars

Waters fits the Fundsmith template precisely. Specialized instrumentation, mission-critical applications, and long customer relationships. The add was meaningful but disciplined, consistent with valuation-aware reinforcement rather than enthusiasm.

Together, these three positions absorbed the majority of new capital deployed during the quarter.

New Buys: The Silence Is the Message

There were no new positions initiated in Q3 2025. For Fundsmith, this is unusual and telling. When Smith finds a business that meets both his quality and valuation criteria, he is willing to size it immediately. The absence of material new buys suggests that, at current prices, few opportunities met that bar.

Sold Outs: Exiting Without Ambiguity

Choice Hotels International (CHH)

- Position change: –100%

- Capital realized: ~90 million dollars

- Position change: –100%

- Capital realized: ~53 million dollars

- Position change: –100%

- Capital realized: ~48 million dollars

These positions were exited during the quarter. While modest in size relative to the overall portfolio, the sales reflect routine portfolio management rather than a shift in Fundsmith’s broader strategy.

Cuts: Trimming Success Before It Becomes Risk

The most consequential activity in Q3 2025 came from substantial reductions in Fundsmith’s largest and most successful holdings. These moves, more than any additions or exits, explain the decline in overall equity exposure and the shift in portfolio risk.

- Share count change: –56%

- Capital reduced: ~1.5 billion dollars

Meta was the single largest reduction of the quarter. After a period of strong performance, the position had grown into one of the portfolio’s dominant exposures. The scale of the trim materially lowered Fundsmith’s sensitivity to a single stock without removing exposure entirely.

- Share count change: –48%

- Capital reduced: ~1.2 billion dollars

Microsoft was reduced almost as aggressively. As one of Fundsmith’s longest-held and most successful investments, the position had expanded significantly in size. The reduction reflects position sizing discipline rather than any reassessment of Microsoft’s business quality.

Philip Morris International (PM)

- Share count change: –21%

- Capital reduced: ~317 million dollars

The trim to Philip Morris reduced exposure to a mature cash-generating business whose valuation had benefited from defensive demand. The position remains meaningful, but less dominant.

- Share count change: –7.6%

- Capital reduced: ~108 million dollars

Alphabet saw a more modest reduction, consistent with incremental risk management rather than a major repositioning.

These cuts were not signals of declining confidence in the underlying businesses. They were decisions about portfolio balance and forward return potential. When long-term winners grow to represent a disproportionate share of total exposure, Smith reduces size, even when the businesses themselves remain among the highest quality holdings in the portfolio.

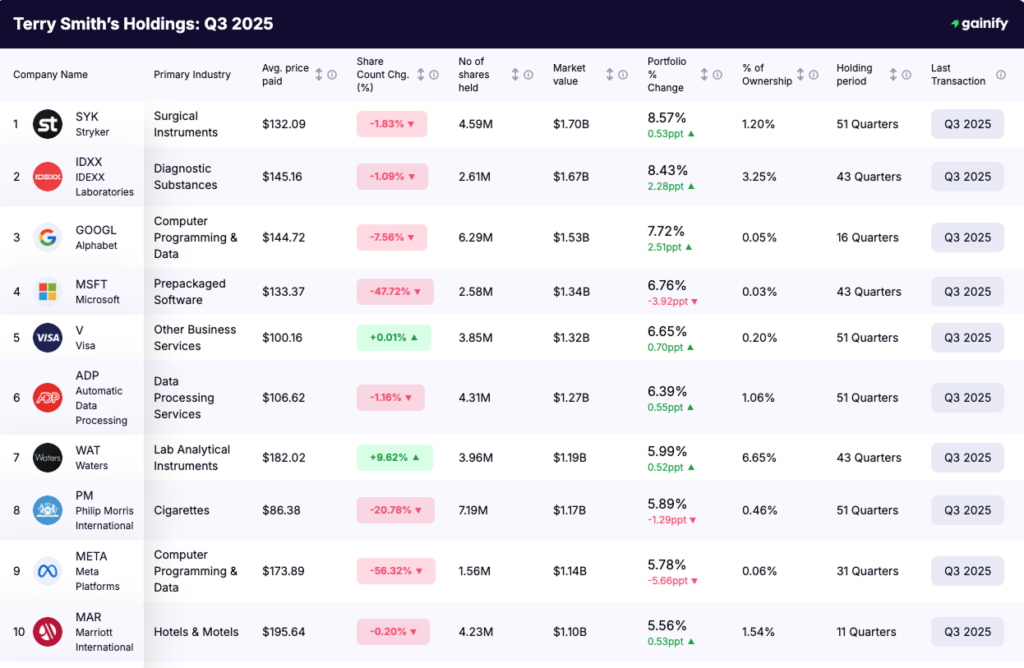

Top 10 Holdings: Q3 2025 With Portfolio Weights

Even after a quarter marked by large trims, Fundsmith’s portfolio remains highly concentrated at the top. The ten largest positions still account for approximately 67–68% of total equity value, reinforcing that Terry Smith continues to rely on a small number of high-quality compounders to drive long-term returns.

1. Microsoft (MSFT)

- Estimated value: ~4.1 billion dollars

- Portfolio weight: ~20.5%

Despite a significant reduction during the quarter, Microsoft remains the single largest holding. The position continues to anchor the portfolio due to its pricing power, recurring revenues, and capital-light growth profile.

2. Meta Platforms (META)

- Estimated value: ~3.3 billion dollars

- Portfolio weight: ~16.5%

Meta was trimmed aggressively in Q3, yet it remains a core holding. The scale of the remaining position reflects continued confidence in the business, balanced against concentration risk after strong performance.

3. Alphabet (GOOGL)

- Estimated value: ~2.2 billion dollars

- Portfolio weight: ~11.0%

Alphabet continues to rank among the largest holdings, with only modest reductions. The position reflects confidence in durable advertising economics and long-term cash generation.

4. Philip Morris International (PM)

- Estimated value: ~1.4 billion dollars

- Portfolio weight: ~7.0%

A long-standing cash-generative holding, Philip Morris remains an important contributor to portfolio stability even after trimming.

5. Intuit (INTU)

- Estimated value: ~1.3 billion dollars

- Portfolio weight: ~6.5%

One of the few positions increased meaningfully in Q3. Intuit’s move into the top five underscores Smith’s confidence in its software ecosystem and long-term compounding ability.

6. Zoetis (ZTS)

- Estimated value: ~1.1 billion dollars

- Portfolio weight: ~5.5%

Zoetis remains a core healthcare holding. The increased position size reflects the resilience and pricing power of the animal health market.

7. Stryker (SYK)

- Estimated value: ~950 million dollars

- Portfolio weight: ~4.8%

Stryker continues to feature prominently, reflecting steady demand and strong economics in medical technology.

8. Waters Corporation (WAT)

- Estimated value: ~900 million dollars

- Portfolio weight: ~4.5%

Waters sits firmly in the top tier after a meaningful add. Its specialized instrumentation and high switching costs align closely with Fundsmith’s quality criteria.

9. IDEXX Laboratories (IDXX)

- Estimated value: ~800 million dollars

- Portfolio weight: ~4.0%

A long-term compounder in veterinary diagnostics, IDEXX remains a stable, high-quality holding.

10. L’Oréal

- Estimated value: ~700 million dollars

- Portfolio weight: ~3.5%

L’Oréal rounds out the top ten, representing Fundsmith’s exposure to global consumer brands with strong pricing power and recurring demand.

What the Q3 2025 Portfolio Really Says

The Terry Smith Portfolio in Q3 2025 does not read as cautious or uncertain. It reads as selective. Equity exposure is lower because fewer opportunities meet Fundsmith’s valuation standards at meaningful scale. Rather than forcing capital into new positions, Smith has allowed exposure to drift down while tightening position sizes in his largest holdings.

This is not a pullback driven by market predictions. It is a response to prices. When valuations move ahead of fundamentals, capital is trimmed. When opportunities narrow, activity slows. That pattern is consistent with how Fundsmith has always been managed.

For investors looking at long-term capital allocation, the takeaway is straightforward. Discipline is not only about what you buy. It is also about what you choose not to own. In Q3 2025, Terry Smith’s portfolio shows that sometimes the most deliberate decision is simply to do less.