Dividend investing is often treated as simple math, but the underlying mechanics are anything but simple.

A yield is not a coupon. It is a market signal reflecting cash flow quality, capital allocation discipline, sector risk, and long-term earnings durability.

When evaluated correctly, dividends can anchor volatility, support multi-year compounding and improve risk-adjusted returns.

When evaluated poorly, they push investors into structurally impaired businesses with payouts that are one board vote away from disappearing.

To separate genuine income generators from yield traps, investors must understand not only what is a good dividend yield represents but also how it interacts with free cash flow, balance sheet strength and competitive structure.

What Dividend Yield Actually Measures

Dividend yield is usually presented as a simple formula, annual dividends divided by share price, but in practice it behaves more like a real-time assessment of a company’s financial health. It reflects two signals at once.

What Management Is Telling You

A dividend only exists when management believes the business generates enough durable, repeatable excess cash after:

- operating costs

- growth investments

- debt service

- reserves for uncertainty

A stable or rising dividend is management saying, “We can fund the business and still return cash without weakening our position.”

What the Market Is Telling You

The yield also reflects how investors judge that signal.

- If earnings are growing and the dividend rises, a higher yield often signals strength.

- If the stock price is falling while the payout stays flat, the same higher yield can signal concern about future cash flows.

The math looks identical. The meaning is not.

Why This Matters

Dividend yield is the point where corporate confidence meets market skepticism. A rising yield can be a green light or a warning light. The difference depends on whether:

- cash generation is stable,

- capital needs are predictable,

- and management can support the payout through cycles.

Chasing yield without understanding its source is how investors end up owning companies that look attractive on paper until the dividend is suddenly cut.

The Real Skill

A good dividend investor is not someone who finds the highest yield.

It is someone who can look at a yield and understand whether it represents strength or fragility.

What Is a Good Dividend Yield in 2026

Dividend yield may look like a simple percentage, but in practice it behaves like a reading on the health of a company’s cash engine. Once you understand that, yields naturally fall into three categories that matter to investors.

1. Too Low to Matter (below roughly 2 percent)

- Income contribution is minimal relative to the risk of owning the stock.

- The business is usually prioritizing reinvestment, buybacks or debt reduction.

- Dividend growth must be exceptional for the yield to influence long-term returns.

This zone is rarely relevant for income-focused portfolios.

2. The Productive Middle (roughly 2 to 5 percent)

- Most high-quality large caps sit here when cash flows are steady.

- The payout is meaningful without compromising balance-sheet flexibility.

- Dividend increases tend to be consistent, allowing compounding to work over time.

This range typically offers the most balanced mix of income and sustainability.

3. Too High to Ignore, Too High to Trust (above roughly 6 to 7 percent)

- The market is often pricing in risk such as weakening cash flows, rising leverage or structural pressure.

- A few sectors like pipelines and REITs can sustain high yields because their cash flows are contractual.

- Outside those categories, elevated yields can signal that the payout is vulnerable.

Yields in this bucket require careful analysis, not optimism.

The Two Questions That Matter

Dividend yield only works as an investing tool when you understand what drives it. Ask:

Is the yield rising because the business is improving, or because the share price is falling?

Is the dividend covered by reliable cash flow, or is it exposed to future cuts?

A yield backed by genuine cash strength is an asset. A yield created by market stress is a liability.

Three Metrics More Important Than Yield Alone

1. Dividend Payout Ratio

The payout ratio measures how much of earnings are paid out as dividends. A sustainable payout for most mature companies sits near 40 to 60 percent. Above this level, flexibility narrows. Below it, management is likely prioritizing reinvestment or buybacks.

High payout ratios can be acceptable in REITs and MLPs where structure requires it, but even there, free cash flow must cover the dividend with a margin of safety.

2. Dividend Growth (DPS Growth)

The strongest dividend names are not those with the highest starting yield but those that raise their dividends consistently.

Dividend growth signals:

- Expanding free cash flow

- Competitive advantage retention

- Confidence in future earnings

- A business model capable of absorbing shocks

A modest yield with high dividend growth often outperforms a high but stagnant yield.

3. Free Cash Flow Coverage

Accounting earnings can be managed. Free cash flow cannot. A durable dividend must be supported by actual cash after capex, working capital needs and debt service.

Strong FCF coverage indicates:

- Capital discipline

- Predictable operations

- Headroom for growth initiatives

- Lower probability of dividend cuts in downturns

This is the mechanism analysts trust most.

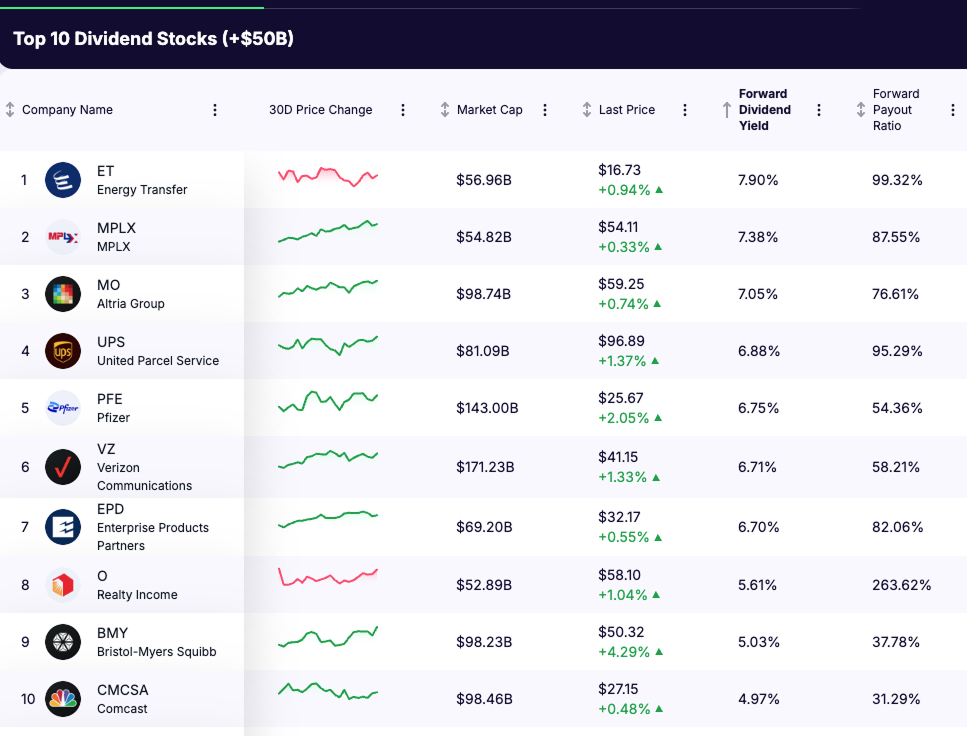

Top 10 Dividend Stocks Over 100 Billion Dollars in Market Cap

Based on your dataset. These yields represent a cross section of defensible income across energy, telecom, healthcare and consumer sectors.

*REITs operate under different payout structures, so the ratio is not directly comparable.

Examples That Reveal the Difference Between Strong and Fragile Yields

Verizon: High Yield, Strong FCF, Manageable Risk

Verizon’s yield reflects slow growth, not weak cash flow. FCF remains robust, the payout ratio is below 60 percent and wireless service revenue is noncyclical. This is a classic example of a high yield that is sustainable.

Altria: High Yield Supported by Pricing Power

Altria has elevated payout ratios but industry leading pricing power and exceptional FCF generation. The risk is regulatory, not cash flow, which is why the market discounts the yield.

Energy Transfer and MPLX: Yield Supported by Long Contracts

Pipeline operators generate steady cash flow anchored by long-term volume commitments. Their elevated yields make sense in context and are typically safer than similarly high yields in cyclical sectors.

UPS: High Yield With High Payout Ratio

UPS offers an attractive yield but a payout ratio near 95 percent is a signal that dividend growth will be limited unless margins expand. This is yield that requires close monitoring.

So What Is a Good Dividend Yield in Practice

The best dividend yield is one supported by:

- Consistent free cash flow

- A payout ratio that allows flexibility

- A track record of dividend growth

- A business model with pricing power and predictable demand

- A balance sheet that can withstand shocks

A yield between 2 and 5 percent is usually optimal for investors seeking both income and compounding. Yields above 7 percent can be attractive but must be justified by structural cash flow stability.

Dividend yield becomes meaningful only when placed inside the broader financial and competitive context. High yield without stability is a liability. Moderate yield with growth is an asset.

Final Takeaway

A good dividend yield is not calculated. It is underwritten.

The strongest income strategies look past the yield number and evaluate the durability of the cash flows behind it. Investors who integrate payout ratio discipline, long-term dividend growth, balance sheet strength and free cash flow reliability consistently outperform simple high-yield strategies.

Dividend investing is not about chasing the highest number. It is about owning the companies most capable of paying, protecting and growing those dividends over time.