Oil remains the backbone of the global energy system. Even as renewables gain traction and electric vehicles expand, fossil fuels still power the majority of the world’s industry, logistics, and transport networks.

Global oil demand continues to rise in 2025, driven by energy intensive emerging markets and a full recovery in global air travel. At the same time, oil prices declined sharply, with crude prices broadly down around 20 percent over the course of 2025. Despite this pullback, disciplined supply management by major producers helped keep industry profitability resilient.

The policy backdrop is making headlines. After being elected, Donald Trump revived the “drill, baby, drill” slogan and declared a national energy-emergency aiming at accelerating domestic hydrocarbon production and easing regulatory constraints on US energy output.

Developments in Venezuela are particularly important as markets move into 2026. While near term uncertainty can influence sentiment, Venezuela holds the largest proven oil reserves in the world and currently represents only a fraction of its potential supply. If production capacity is gradually restored and brought back to global markets, it could become a meaningful source of incremental supply and act as a stabilizing force for oil prices over time.

Energy stocks have found renewed interest as investors seek value and cash-flow in a market dominated by lofty tech valuations. The largest oil companies are generating billions in free cash flow and channeling that into shareholder-friendly buybacks and dividends.

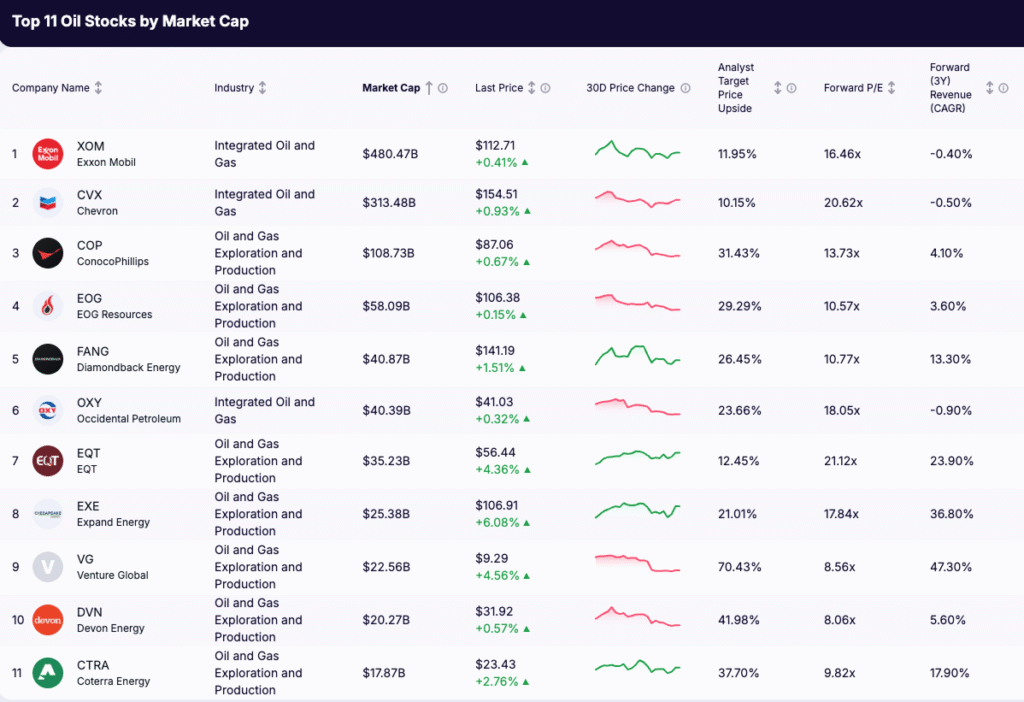

Below are the Top 11 Oil Stocks by Market Cap: the global leaders shaping the next phase of the energy transition.

Top 11 Oil Stocks by Market Cap

Rank | Company | Industry | Market Cap | Forward P/E | Analyst Upside | 3Y Revenue CAGR |

1 | Integrated Oil & Gas | $480.5B | 16.46x | +11.9% | -0.4% | |

2 | Integrated Oil & Gas | $313.5B | 20.62x | +10.2% | -0.5% | |

3 | Exploration & Production | $108.7B | 13.73x | +31.4% | +4.1% | |

4 | Exploration & Production | $58.1B | 10.57x | +29.3% | +3.6% | |

5 | Exploration & Production | $40.9B | 10.77x | +26.5% | +13.3% | |

6 | Integrated Oil & Gas | $40.4B | 18.05x | +23.7% | -0.9% | |

7 | Natural Gas & Production | $35.2B | 21.12x | +12.5% | +23.9% | |

8 | Exploration & Production | $25.4B | 17.84x | +21.0% | +36.8% | |

9 | LNG & Energy Infrastructure | $22.6B | 8.56x | +70.4% | +47.3% | |

10 | Exploration & Production | $20.3B | 8.06x | +42.0% | +5.6% | |

11 | Exploration & Production | $17.9B | 9.82x | +37.7% | +17.9% |

Source: Gainify, Wall Street analyst consensus

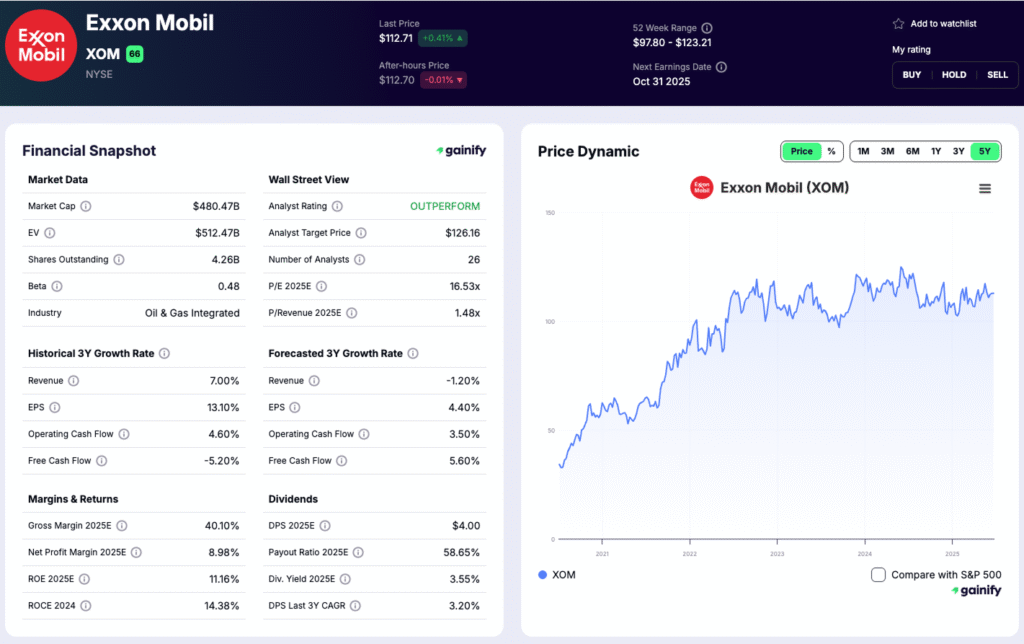

1️⃣ Exxon Mobil (XOM)

Market Cap: $480.5B | Forward P/E: 16.5x | Analyst Upside: +11.9%

What they do: Exxon Mobil is the world’s largest publicly traded energy company. Its operations span every link of the value chain, from exploration and refining to chemicals and carbon capture.

Why it matters: Exxon is reinforcing its focus on carbon capture, low-emission fuels and hydrogen, positioning the company for the next generation of energy demand. Its scale gives it unmatched efficiency and pricing leverage in global oil markets.

What to watch: Progress in low-carbon ventures, upstream production stability and continued shareholder payouts. For example, Exxon has signed agreements to store up to 2 million metric tons of CO₂ per year and plans to invest up to $30 billion in low-emissions technologies by 2030.

Key risk: Declining refining margins and growing political pressure to reduce fossil-fuel exposure could weigh on long-term growth.

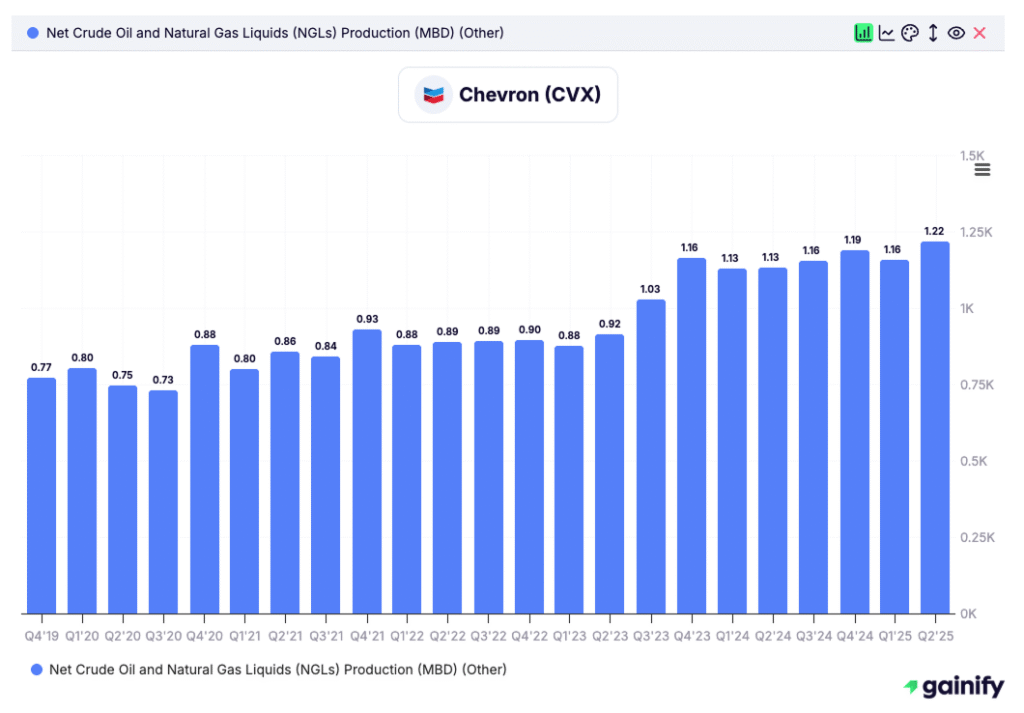

2️⃣ Chevron (CVX)

Market Cap: $313.5B | Forward P/E: 20.6x | Analyst Upside: +10.2%

What they do: Chevron is one of the world’s most diversified oil and gas majors, active in upstream production, refining, chemicals, and lower-carbon energy solutions.

Why it matters: The integration of Hess and expansion of LNG projects in the U.S. and Asia continue to strengthen Chevron’s long-term cash flow outlook. The company is also investing in renewable diesel, hydrogen, and carbon management to support its energy-transition strategy.

What to watch: Progress on capital spending discipline, cost efficiency, and sustained dividend growth, which remains a major draw for long-term investors.

Key risk: Sensitivity to oil price volatility and refining margins in a softer global demand environment.

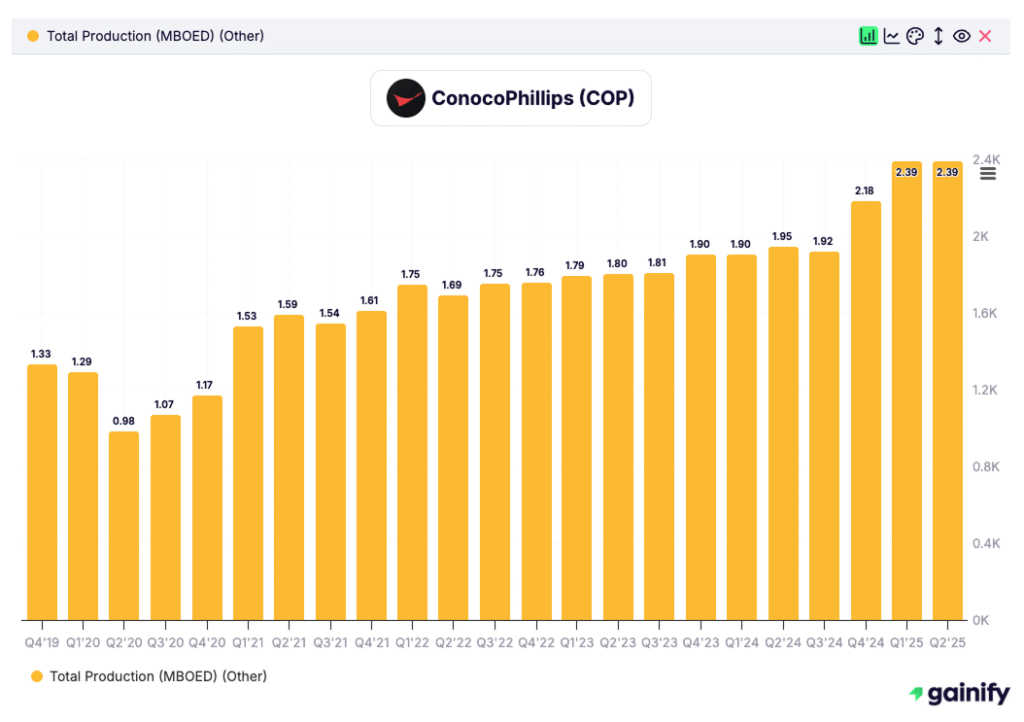

3️⃣ ConocoPhillips (COP)

Market Cap: $108.7B | Forward P/E: 13.7x | Analyst Upside: +31.4%

What they do: ConocoPhillips is a leading pure-play exploration and production company focused on oil and natural gas development across North America, Europe, and Asia.

Why it matters: With disciplined capital allocation and a portfolio of high-margin shale and LNG assets, ConocoPhillips remains one of the industry’s most efficient operators. The company continues to deliver strong returns on capital and consistent share buybacks while expanding its low-carbon initiatives.

What to watch: Development progress in the Permian Basin, LNG export growth, and margin resilience amid commodity price fluctuations.

Key risk: Heavy exposure to upstream operations leaves ConocoPhillips sensitive to oil and gas price volatility, with limited downstream diversification.

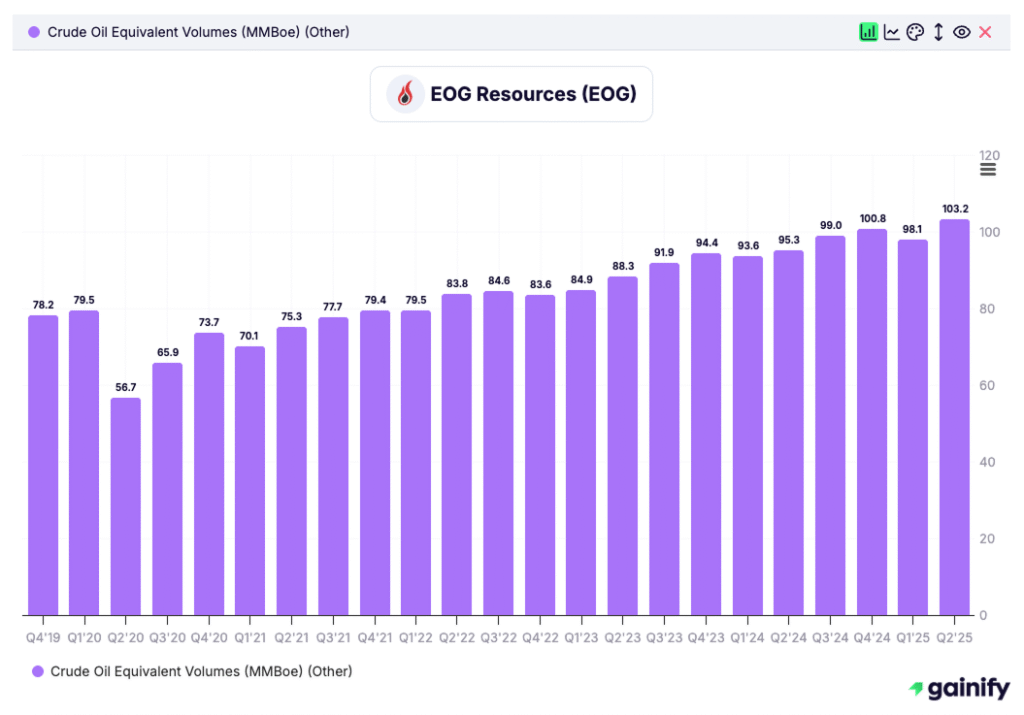

4️⃣ EOG Resources (EOG)

Market Cap: $59 B | Forward P/E: 10.4x | Analyst Upside: +27.8%

What they do: EOG Resources is one of the leading independent shale producers in the United States, recognized for its technical expertise, operational efficiency, and industry-low breakeven costs.

Why it matters: The company pioneered data-driven drilling techniques and controls highly productive acreage in the Permian, Eagle Ford, and Delaware basins. EOG maintains a disciplined capital strategy and a strong track record of shareholder returns through variable dividends and buybacks.

What to watch: Exploration results in emerging plays such as the Dorado gas field, progress on production growth, and consistency in cash returns.

Key risk: Concentration in U.S. onshore production leaves EOG exposed to domestic crude price swings and limits geographic diversification.

5️⃣ Diamondback Energy (FANG)

Market Cap: $40.9B | Forward P/E: 10.8x | Analyst Upside: +26.5%

What they do: Diamondback Energy is a leading independent oil and gas producer with a focused, high-quality position in the Permian Basin.

Why it matters: The company’s disciplined capital management, efficient operations, and low-cost structure make it one of the most profitable U.S. shale producers. Diamondback has become a preferred name for investors seeking a blend of growth, free cash flow, and reliable dividends.

What to watch: Successful integration of recent acquisitions, ongoing balance sheet strengthening, and sustained capital efficiency.

Key risk: Heavy reliance on the Permian Basin and limited diversification outside U.S. shale oil could increase exposure to regional and commodity-specific risks.

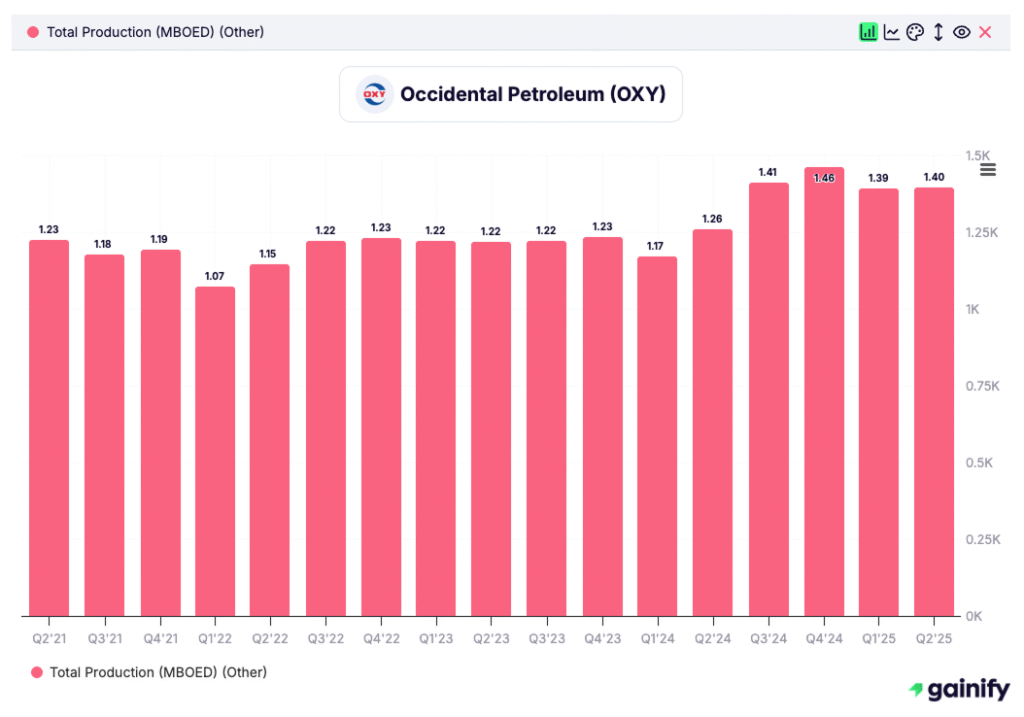

6️⃣ Occidental Petroleum (OXY)

Market Cap: $40.4B | Forward P/E: 18.1x | Analyst Upside: +23.7%

What they do: Occidental Petroleum is a diversified energy producer active in oil, gas, and chemicals, with a growing focus on carbon capture and low-emission technologies. Its operations span the United States, the Middle East, and Latin America.

Why it matters: Backed by Berkshire Hathaway’s multibillion-dollar investment, Occidental has become one of the most closely watched energy companies in the world. The firm is building the world’s largest Direct Air Capture (DAC) facility in Texas, aiming to remove up to one million tons of CO₂ annually. This initiative positions OXY as a frontrunner in carbon management at a time when the energy transition is reshaping corporate strategy.

What to watch: Execution of its DAC and carbon-storage projects, debt reduction following years of aggressive expansion, and continued share buybacks funded by robust free cash flow. Investors also monitor Warren Buffett’s incremental stake increases as a signal of long-term confidence.

Key risk: High leverage remains a structural challenge, and profitability still depends heavily on crude prices. If oil prices weaken for an extended period, OXY’s ambitious transition investments could strain returns.

7️⃣ EQT Corporation (EQT)

Market Cap: $35.2B | Forward P/E: 21.1x | Analyst Upside: +12.5%

What they do: EQT is the largest natural gas producer in the United States, with core operations in the Appalachian Basin.

Why it matters: With global LNG demand continuing to rise, EQT is well positioned to capitalize on expanding export capacity. Its disciplined cost structure, scale advantages, and active hedging program make it a key player in the U.S. natural gas value chain.

What to watch: Progress on LNG export partnerships, infrastructure investments, and emerging opportunities in gas-to-hydrogen conversion.

Key risk: Exposure to natural gas price volatility and regulatory uncertainty related to energy infrastructure and permitting.

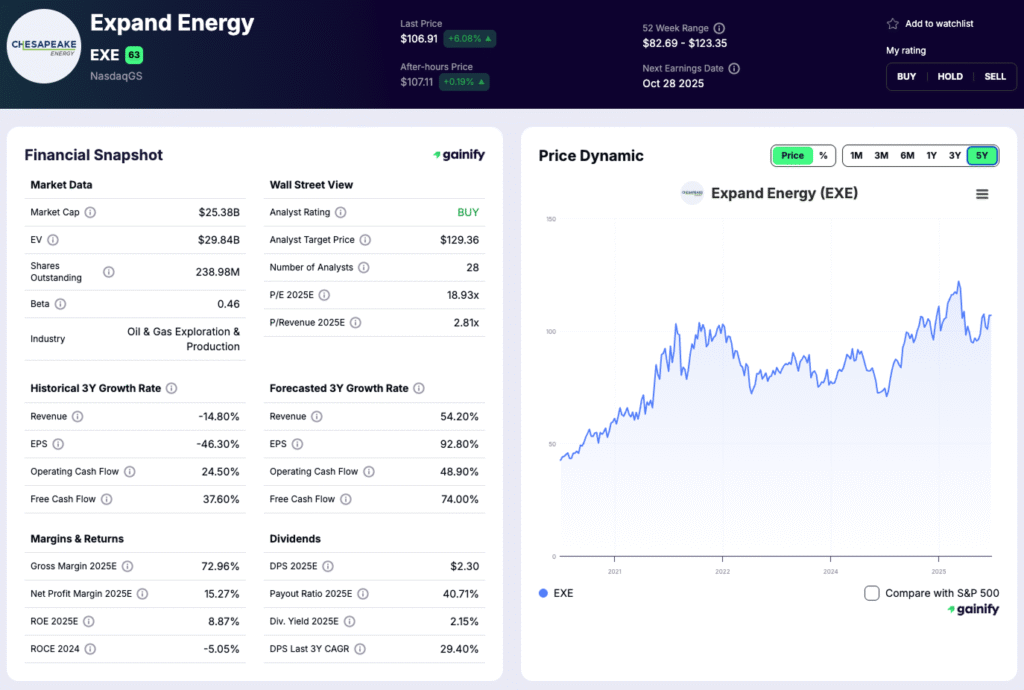

8️⃣ Expand Energy (EXE)

Market Cap: $25.4B | Forward P/E: 17.8x | Analyst Upside: +21.0%

What they do: Expand Energy is an independent oil and gas company focused on upstream exploration and production projects across emerging markets.

Why it matters: With a robust project pipeline in Africa and Southeast Asia, the company is positioned for some of the strongest production and revenue growth in the sector. Its strategy emphasizes securing long-term LNG and crude export contracts to enhance earnings stability.

What to watch: The rollout of new production expected in 2026, progress on LNG export agreements, and operational execution in new frontier markets.

Key risk: High exposure to geopolitical, regulatory, and currency risks associated with operating in developing economies.

9️⃣ Venture Global (VG)

Market Cap: $22.6B | Forward P/E: 8.6x | Analyst Upside: +70.4%

What they do: Venture Global builds and operates liquefied natural gas (LNG) export facilities on the U.S. Gulf Coast.

Why it matters: With global LNG demand soaring, Venture Global is one of the fastest-growing energy exporters in the world. Its long-term contracts with Europe and Asia create strong cash flow visibility.

What to watch: Progress on its Plaquemines and Calcasieu Pass expansion projects and global LNG pricing dynamics.

Key risk: Construction delays, regulatory uncertainty, and export infrastructure bottlenecks.

🔟 Devon Energy (DVN)

Market Cap: $20.3B | Forward P/E: 8.1x | Analyst Upside: +42.0%

What they do: Devon Energy is a leading independent oil and gas producer operating across major U.S. basins.

Why it matters: Devon’s variable dividend policy, tied to free cash flow, makes it one of the most shareholder-friendly energy companies. It offers high yield potential while maintaining capital discipline.

What to watch: Free cash flow generation, share repurchases, and cost control amid moderating oil prices.

Key risk: Dependence on U.S. crude markets and exposure to inflationary drilling costs.

1️⃣1️⃣ Coterra Energy (CTRA)

Market Cap: $17.9B | Forward P/E: 9.8x | Analyst Upside: +37.7%

What they do: Coterra Energy is a diversified oil and natural gas producer formed from the merger of Cabot Oil & Gas and Cimarex Energy.

Why it matters: Coterra offers balanced exposure to both oil and gas markets, supported by strong operational efficiency and a clean balance sheet.

What to watch: Expansion in the Permian and Marcellus basins and progress on capital returns to shareholders.

Key risk: Commodity price volatility and reduced drilling productivity in mature basins.

The Bottom Line

Oil remains the foundation of global energy and trade.

These 11 companies represent the industry’s leaders, combining efficiency, scale, and financial strength.

As investors look for balance between value and growth in 2026, energy stocks continue to offer both. While renewables grow, the world still needs reliable oil and gas to power economies and fund the transition.

For investors, these stocks stand at the crossroads of stability and innovation, delivering income today while investing in the energy systems of tomorrow.

Oil is a cyclical business. There will always be highs and lows, and the winners are those who plan for both.” — T. Boone Pickens, American oil magnate