Space is quickly becoming the next big growth story in global markets. Once dominated by governments, the aerospace economy is now driven by private companies launching rockets, building satellites, and turning orbital data into real-world business.

Today’s space ecosystem goes far beyond rockets. It includes:

- Launch providers putting satellites and payloads into orbit

- Manufacturers building the hardware and systems that keep them running

- Data and analytics firms turning satellite signals into tools for mapping, logistics, defense, and communications

Around these core players, defense giants and next-generation aviation companies are investing heavily in aerospace technologies. Together, they’re creating a fast-growing industry at the crossroads of innovation, infrastructure, and national security.

For investors, the key is to match risk with maturity.

- Early-stage areospace stocks can soar but carry high uncertainty.

- Growth-stage companies have contracts and backlogs, offering more balance.

- Established aerospace and defense firms provide stability, steady cash flow, and long-term exposure to the expanding space market.

In this guide, we break down leading aerospace stocks, explain what each company does, how mature it is, and the catalysts to watch in 2026 and beyond.

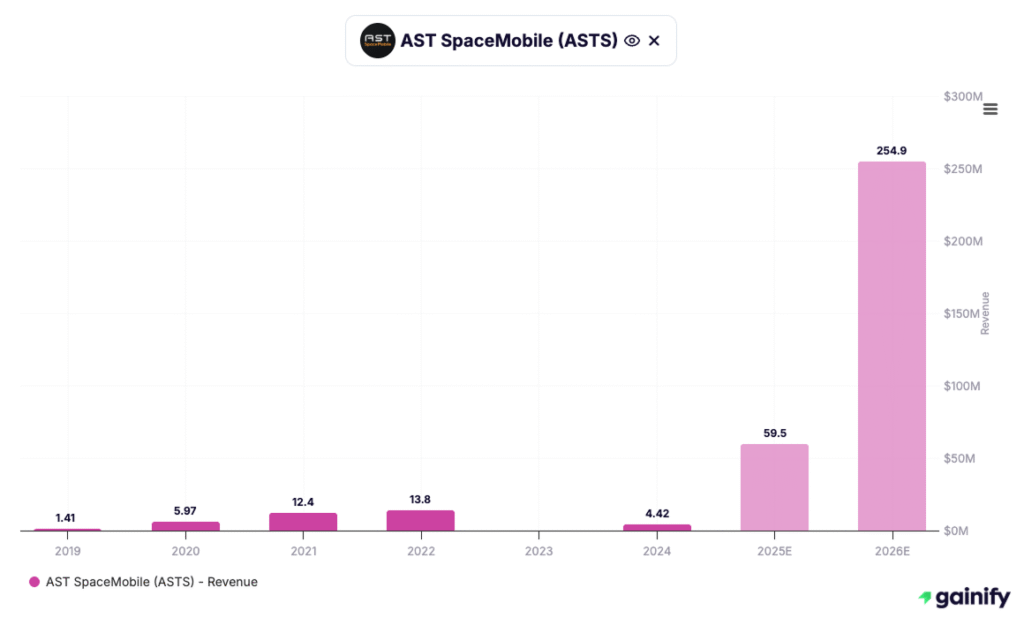

1. AST SpaceMobile (ASTS) — Market Cap: $26.0 Billion

What they do:

AST SpaceMobile (NASDAQ: ASTS) is building the first space-based cellular network designed to connect standard smartphones directly to satellites, without any special equipment. Its BlueBird constellation acts as a space-based cell tower network, extending mobile coverage to remote and underserved areas across the globe.

Maturity level:

ASTS remains in the early-revenue stage, now moving closer to commercial rollout. The company successfully launched its first test satellite, BlueWalker 3, and successfully deployed its first Block 2 BlueBird satellites in late 2025. Global service expansion is now expected to unfold through 2026.

Why it matters:

If AST SpaceMobile delivers on its promise, it could reshape the global telecom market by offering true universal mobile coverage. The company already counts AT&T, Vodafone, and Rakuten among its major partners and received strategic investment from Google earlier this year, signaling strong industry support and commercial interest.

What to watch:

- Execution and performance of Block 2 satellite launches over the next two quarters.

- Progress on regulatory approvals and frequency licensing in key global markets.

- The company’s ability to secure additional funding or partnerships to sustain production at scale.

Key risk:

ASTS remains a high-risk, capital-intensive venture. Despite strong momentum, it is still generating limited revenue and relies on external financing to fund operations. Any launch delays, technical setbacks, or regulatory issues could push back commercialization and test investor confidence.

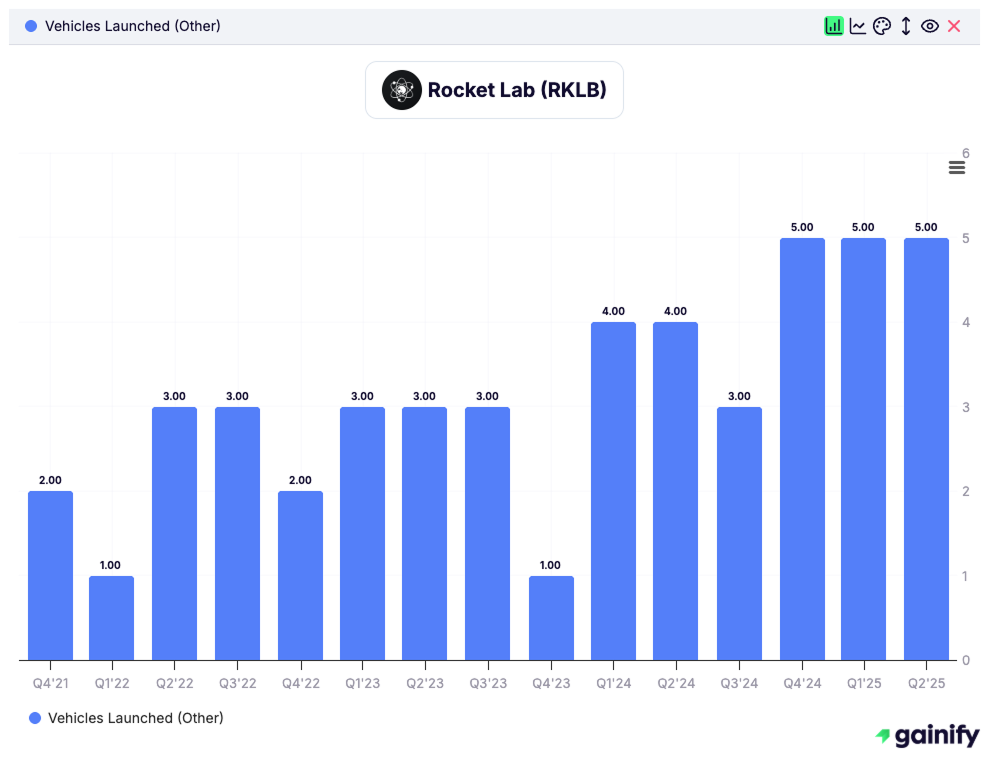

2. Rocket Lab (RKLB) — Market Cap: $33.5 Billion

What they do:

Rocket Lab (NASDAQ: RKLB) is one of the leading small-satellite launch and space systems companies, offering end-to-end solutions that include rocket launches, satellite manufacturing, and on-orbit operations. Its Electron rocket is among the most frequently launched commercial vehicles in the world, and its upcoming Neutron rocket aims to serve larger payload markets and reusable missions.

Maturity level:

Rocket Lab is in the growth and scaling stage. The company has moved beyond being a pure launch provider to a broader space infrastructure and manufacturing business, generating steady revenue from satellite components, spacecraft platforms, and mission operations. It continues to expand margins as flight cadence and satellite production increase through 2025.

Why it matters:

Rocket Lab is one of the few commercial players with proven orbital launch capability and a diversified revenue base. Its growing footprint in defense, civil, and commercial contracts (including work with NASA, the U.S. Space Force, and private constellation operators) positions it as a critical supplier in the emerging low-Earth orbit (LEO) economy.

What to watch:

- Progress toward the first Neutron rocket launch, now expected in early 2026.

- Expansion of defense and government contracts, which currently represent a large portion of its backlog.

- Ongoing margin improvement as Rocket Lab ramps up satellite manufacturing capacity and recurring service revenue.

Key risk:

Rocket Lab operates in a competitive and capital-intensive market. Launch delays, cost overruns, or slower adoption of its Neutron vehicle could impact growth expectations. While diversification helps reduce volatility, profitability still depends on consistent launch cadence and demand for small-satellite deployment.

3. Intuitive Machines (LUNR) — Market Cap: $1.5 Billion

What they do:

Intuitive Machines (NASDAQ: LUNR) builds and operates lunar landers and infrastructure for scientific, government, and commercial missions. Its Nova-C lander family delivers payloads to the Moon and supports early lunar infrastructure (navigation, communications, prospecting).

Maturity level:

LUNR is in the early-commercial stage, with one successful mission completed (IM-1 in 2024) and its second mission (IM-2/Athena) flown in 2025. The company is transitioning from one-off missions toward recurring services under long-term contracts.

Why it matters:

Intuitive Machines is a key player in the NASA Commercial Lunar Payload Services (CLPS) program. Its contracts include a major $4.82B Near Space Network Services (NSNS) agreement and other task orders, giving it a foundation of demand and a unique foothold in lunar logistics.

What to watch:

- Results and post-landing performance of IM-2 / Athena (launched Feb 2025) and any mission anomalies.

- Backlog trends: as of September 30, 2025, backlog was $235.9M, down from ~$328.3M at year end 2024, reflecting contract fulfillment and slower new awards.

- Execution of NSNS contract revenue recognition (only small portion recognized so far).

Key risk:

The IM-2 mission encountered serious issues and ultimately tipped over, rendering it nonfunctional. That raises concerns about reliability and design robustness. Additionally, declining backlog, high execution risk, and significant capital requirements remain major headwinds.

4. BlackSky (BKSY) — Market Cap: $1.1 Billion

What they do:

BlackSky (NYSE: BKSY) delivers real-time satellite imagery and AI-powered analytics to government and commercial clients. Its constellation provides high-frequency, high-resolution images used for defense intelligence, infrastructure monitoring, and disaster response.

Maturity level:

BlackSky is in the growth stage, with a recurring-revenue model and expanding analytics platform. The company is deploying its new Gen-3 satellites, which improve image clarity and revisit time, making its data more valuable and time-sensitive.

Why it matters:

BlackSky’s strength lies in speed and automation. It can capture and analyze imagery within minutes of an event, giving it a technological edge in real-time geospatial intelligence. Its long-term contracts with U.S. and international defense agencies provide visibility and credibility in a sector where barriers to entry are high.

What to watch:

- Gen-3 satellite rollout — continued successful launches and performance of next-generation satellites will determine image quality, revisit rates, and cost efficiency.

- Analytics adoption — growth in recurring software-based analytics contracts is key to improving margins and moving beyond one-off image sales.

- Government and international demand — sustained procurement from defense and allied agencies remains the biggest driver of backlog and revenue visibility.

Key risk:

BlackSky still operates at a net loss (Q3 2025: –$15.3 million) and faces execution risk in converting backlog into recurring cash flow. A slowdown in government budgets, satellite deployment delays, or competition from peers like Planet Labs and Maxar could impact growth momentum.

5. Redwire (RDW) — Market Cap: $1.4 Billion

What they do:

Redwire (NYSE: RDW) builds the infrastructure that powers space operations – everything from satellite components and avionics to deployable structures and power systems. It also develops in-space manufacturing technologies, enabling production of materials and components in microgravity environments.

Maturity level:

Redwire is in the growth stage, generating steady revenue from NASA, the U.S. military, and commercial space partners. It’s scaling production and expanding into commercial space station projects and on-orbit manufacturing, positioning itself as a key supplier for the post-ISS era.

Why it matters:

Redwire is the “hardware backbone” of the new space economy. It supplies essential components to nearly every major space initiative, giving investors exposure to industry growth without betting on a single launcher or satellite operator. Its push into microgravity manufacturing could unlock entirely new markets in high-value materials and biotech.

What to watch:

- Commercial station contracts — participation in Starlab and other private station programs will determine long-term growth.

- In-space manufacturing progress — successful demonstrations of optical fiber or biotech production could validate a new recurring business model.

- Backlog conversion and margins — turning contract wins into consistent, higher-margin revenue remains the key path to profitability.

Key risk:

Redwire’s growth depends on external project timelines and government funding. Any delays, contract losses, or slow adoption of in-space manufacturing could pressure cash flow. As a smaller supplier, it also faces scale challenges competing against large aerospace primes.

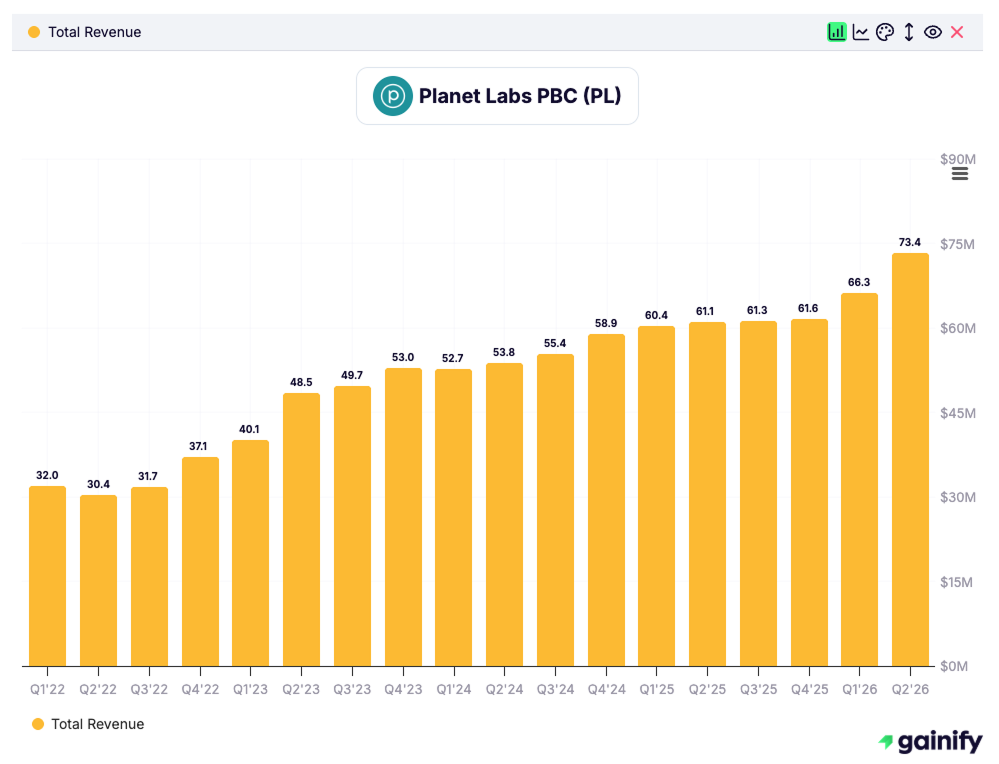

6. Planet Labs (PL) — Market Cap: $4.7 Billion

What they do:

Planet Labs (NYSE: PL) operates the world’s largest Earth-imaging satellite constellation, capturing daily images of nearly every point on Earth. Its satellites provide high-frequency, high-resolution data used in agriculture, environmental monitoring, defense intelligence, and infrastructure management.

Maturity level:

Planet is in the growth and monetization stage. It generates recurring revenue from long-term data and analytics subscriptions and is expanding its offering through the new Pelican and Tanager constellations, which deliver sharper images and faster revisit times.

Why it matters:

Planet Labs is the market leader in geospatial data at scale. Its ability to deliver updated global imagery daily gives it unique value in government intelligence, ESG monitoring, and AI-driven analytics. As demand for real-time Earth data rises, Planet sits at the intersection of space infrastructure and data-as-a-service.

What to watch:

- Contract execution and backlog growth — as of 3Q 2025, Planet reported record backlog and remaining performance obligations (RPO) exceeding $734 million.

- Commercial adoption — expanding into private sectors like agriculture, insurance, and energy will diversify revenue beyond government contracts.

- Analytics and AI integration — Planet’s move from imagery sales to data insights is key for margin improvement and long-term stickiness.

Key risk:

Planet is still unprofitable and faces execution risk in converting backlog into recurring cash flow. Competition from newer satellite startups and government imagery providers could pressure pricing. Maintaining capital discipline while upgrading its fleet will be crucial through 2026.

7. Virgin Galactic (SPCE) — $Market Cap: 265 Millions

What they do:

Virgin Galactic (NYSE: SPCE) is a space tourism company that flies paying passengers to suborbital space for a few minutes of weightlessness and a view of Earth’s curvature. The company’s spacecraft, VSS Unity, completed its final flights in early 2025, while the next-generation Delta Class vehicles are under development.

Maturity level:

SPCE is in the rebuild and pre-revenue stage. Commercial flights have been paused since early 2025 as the company shifts its focus to completing and testing the Delta fleet, expected to enter service in late 2026.

Why it matters:

Virgin Galactic pioneered the commercial human spaceflight market, creating a brand synonymous with space tourism. The Delta fleet is designed to cut turnaround time and operating costs, potentially allowing multiple flights per month and moving the business closer to scalability.

What to watch:

- Delta Class production and test milestones — manufacturing and flight-test progress will determine when commercial service resumes.

- Cash runway and financing — The company ended the third quarter of 2025 with approximately $424 million in cash, cash equivalents, and marketable securities. Additional funding may be required before revenue restarts.

- Ticket demand and pricing — tracking new reservations and repeat interest will show whether public enthusiasm for space travel remains strong.

Key risk:

Virgin Galactic remains a high-burn, speculative venture with no current revenue. Any delay in Delta’s certification or further cost overruns could lead to additional dilution or debt financing. The company’s long-term viability depends on achieving reliable, repeatable flight operations at sustainable margins.

8. Kratos Defense & Security Solutions (KTOS) — Market Cap: $15.3 Billion

What they do:

Kratos (NASDAQ: KTOS) designs and manufactures tactical drones, satellite communications systems, and space infrastructure for defense and commercial use. Its products include unmanned aerial systems (UAS), satellite ground stations, and network control systems that support military and space operations.

Maturity level:

Kratos is in the growth and execution stage. The company generates steady revenue from U.S. defense contracts and is expanding its footprint in affordable tactical drones and space-based communication systems.

Why it matters:

Kratos fills a crucial gap in defense and space by providing low-cost, high-performance systems that can be produced faster than traditional primes. Its tactical drones (like Valkyrie and Erinyes) and satellite ground solutions position it as a flexible partner for both the Department of Defense and commercial space operators.

What to watch:

- Backlog growth and execution — as of 3Q 2025, Kratos reported a record backlog above $1.0 billion, driven by new drone and satellite wins.

- Drone production scaling — successful production ramp of the Valkyrie and other tactical UAS platforms will determine near-term revenue acceleration.

- Space and ground system demand — continued investment in satellite command, control, and networking systems could expand recurring, high-margin revenue.

Key risk:

Kratos operates in a competitive, contract-driven market with lumpy revenue and exposure to government funding cycles. Program delays, cost inflation, or slow scaling of new drones could pressure margins. Maintaining execution discipline across multiple growth programs is essential through 2026.

9. L3Harris Technologies (LHX) — Market Cap: $54.3 Billion

What they do:

L3Harris (NYSE: LHX) is a leading defense and aerospace technology company specializing in communications, sensors, and space systems. It provides critical technology for satellites, missile defense, surveillance, and tactical communications across defense and intelligence missions.

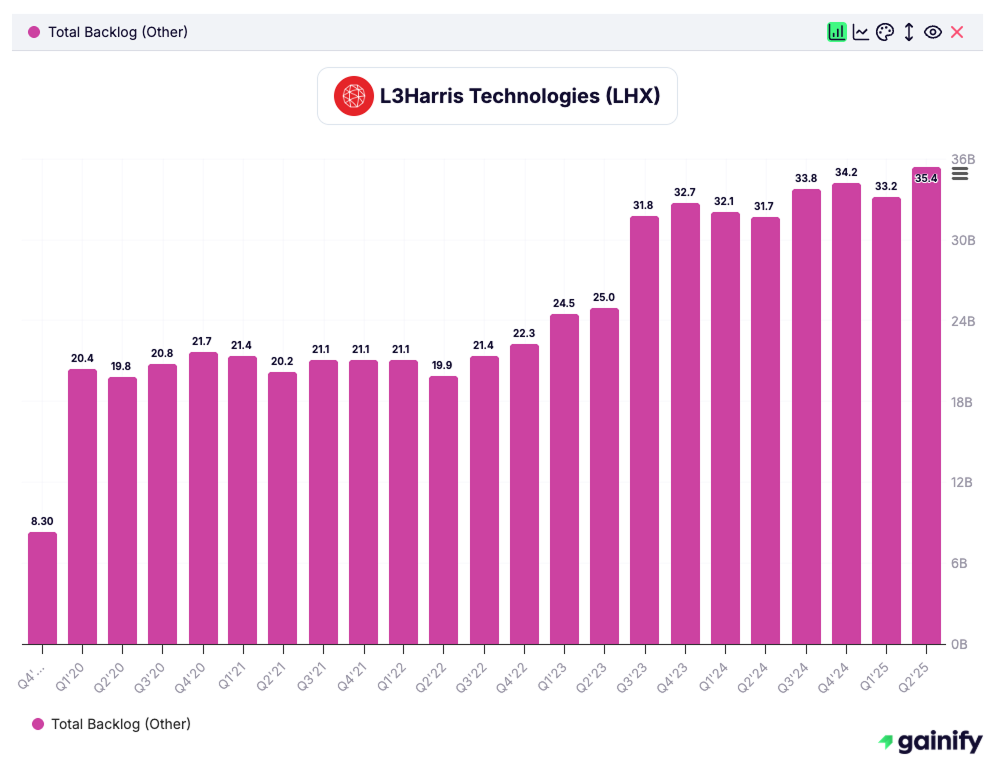

Maturity level:

L3Harris is a mature, diversified defense prime. It generates consistent cash flow and has integrated recent acquisitions like Aerojet Rocketdyne, strengthening its position in space propulsion and defense systems.

Why it matters:

L3Harris offers investors stable exposure to defense-driven space programs. Its systems support satellite command and control, secure communications, and missile-warning networks, making it one of the most vertically integrated players bridging defense and space infrastructure. The company also benefits from growing demand in electronic warfare and classified space programs.

What to watch:

- Integration of Aerojet Rocketdyne — continued cost and technology synergies in propulsion and space systems will determine long-term earnings growth.

- Classified space and missile-defense contracts — expansion of high-margin, defense-space programs could boost revenue visibility.

- Capital allocation — watch for debt reduction progress and ongoing share repurchases as L3Harris rebalances post-acquisition leverage.

Key risk:

While L3Harris has diversified exposure, it faces margin pressure from supply chain costs and integration expenses. Its reliance on large U.S. defense budgets and potential contract delays could affect growth. Continued execution on Aerojet integration remains key to maintaining profitability through 2026.

10. Lockheed Martin (LMT) — Market Cap: $116.6 Billion

What they do:

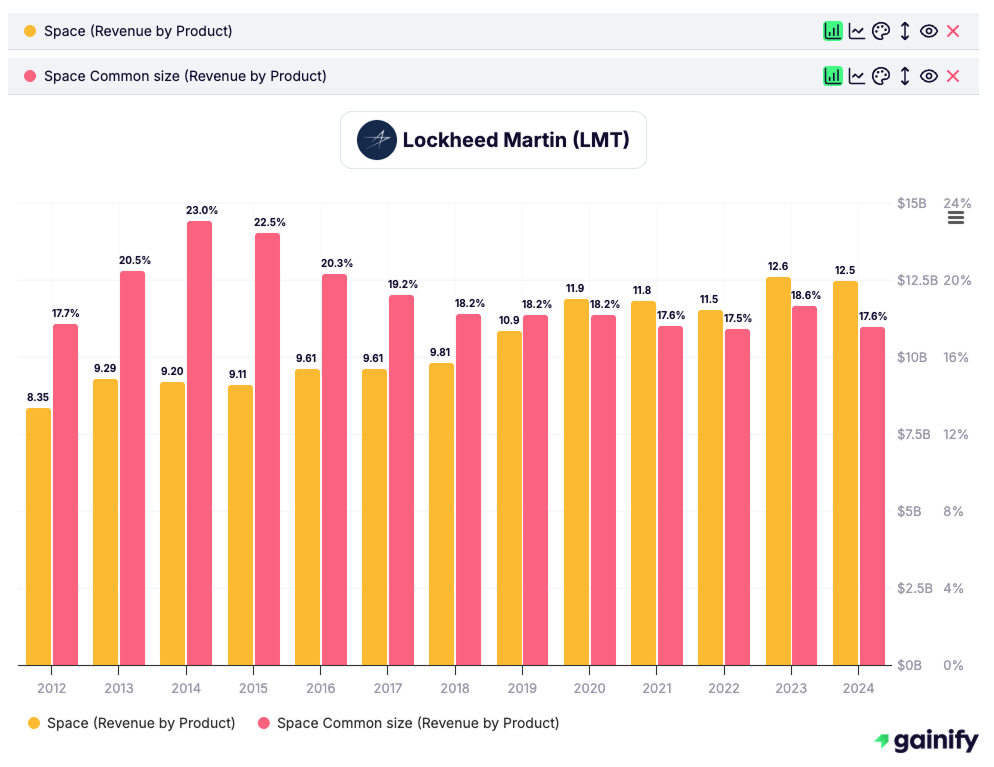

Lockheed Martin (NYSE: LMT) is the world’s largest defense and aerospace contractor, leading in satellite systems, space exploration, missile defense, and advanced aircraft. Its Space division builds satellites, propulsion systems, and components for NASA, the U.S. Space Force, and global allies.

Maturity level:

LMT is a fully mature defense prime, generating strong cash flow and consistent dividends. Its growing space segment now represents over 20% of total revenue, driven by satellite and deep-space programs.

Why it matters:

Lockheed offers investors stable exposure to space and defense megatrends, including hypersonics, missile defense, and exploration. Its work on NASA’s Artemis lunar program, military satellite constellations, and next-gen defense tech secures multi-year visibility and resilient demand.

What to watch:

- Space systems growth — continued expansion in government and commercial satellite contracts.

- Hypersonics and defense modernization — major long-term revenue driver.

- Cash flow deployment — steady dividend growth and buybacks remain investor anchors.

Key risk:

LMT’s performance depends heavily on U.S. defense budgets. Supply-chain delays or slower international orders could weigh on revenue, though backlog strength provides insulation through 2026.

11. Northrop Grumman (NOC) — Market Cap: $87.2 Billion

What they do:

Northrop Grumman (NYSE: NOC) is a top-tier defense and space systems contractor, best known for its leadership in missile defense, space launch, and advanced aerospace systems. Its Space Systems segment builds satellites, propulsion systems, and the Solid Rocket Boosters for NASA’s Artemis and military programs.

Maturity level:

NOC is a mature defense prime with balanced exposure across aerospace, defense, and space infrastructure. It continues to generate strong free cash flow and sustain a growing dividend.

Why it matters:

Northrop is one of the most space-exposed defense contractors, serving as a prime contractor on projects like the James Webb Space Telescope, Next-Gen missile warning systems, and tactical satellite constellations. It also leads in propulsion and autonomous defense systems – key growth areas under U.S. modernization efforts.

What to watch:

- Space Systems expansion — continued growth in missile warning, space domain awareness, and commercial satellite work.

- B-21 Raider bomber program — on-time production and cost control are vital for margins.

- Capital discipline — focus on debt reduction and maintaining industry-leading returns on capital.

Key risk:

NOC faces program cost and timing risks, especially around large, fixed-price defense contracts. Any delays in B-21 or space segment deliveries could pressure cash flow, though long-term demand remains solid.

12. Boeing (BA) — Market Cap: Market Cap: $161.2 Billion

What they do:

Boeing (NYSE: BA) is a global leader in aerospace and defense, operating through three core segments: Commercial Airplanes, Defense & Space, and Global Services. Its Space and Defense division produces spacecraft, launch systems, and satellite technologies for NASA, the U.S. military, and commercial operators.

Maturity level:

Boeing is a mature aerospace company in a recovery phase. Its space segment remains steady, while the commercial aircraft business continues to rebound after years of production and certification challenges.

Why it matters:

Boeing is one of the few companies active across commercial aviation, defense, and space exploration. It’s a key contractor for NASA’s Artemis program, building the Space Launch System (SLS) and Starliner crew spacecraft. Successful execution of these programs could restore confidence and reinforce its long-term space credibility.

What to watch:

- Starliner service flights — consistent performance post-crew flight test will be critical for NASA trust and future missions.

- SLS production schedule — managing costs and maintaining launch cadence through Artemis IV–VI.

- Commercial recovery — improved aircraft deliveries and cash generation support investment across divisions.

Key risk:

Boeing remains under pressure from manufacturing issues and debt levels. Any new setbacks in Starliner or commercial jet production could delay recovery and restrict capital available for space initiatives.

Comparative Takeaways & Investment Lens

Type of Exposure | Pros | Risks |

Pure-Play Space / Satellite / Launch (ASTS, RKLB, LUNR, BKSY, SPCE) | – High potential upside if execution and technology succeed- Direct exposure to fast-growing segments like satellite networks, launch, and lunar logistics- First-mover advantage in emerging markets | – High capital intensity and long development cycles- Execution and regulatory risk- Volatile funding and cash flow outlooks |

Infrastructure & Component Providers (RDW, KTOS, LHX) | – More predictable revenue through diversified contracts- Exposure to both defense and commercial space projects- Positioned as critical suppliers (“picks and shovels” play) | – Margin pressure from cost inflation and contract pricing- Dependent on government and prime contractor budgets- Limited upside versus pure plays |

Large Aerospace & Defense Primes (LMT, NOC, BA) | – Strong balance sheets and recurring government contracts- Proven track records, scale, and steady cash flow- Offer long-term exposure to defense and space infrastructure | – Slower growth relative to emerging space companies- Tied to defense budget cycles and geopolitical risk- Less direct leverage to commercial space growth |

Investing in Space Through ETFs (January 2026)

For investors who prefer diversified exposure rather than picking individual stocks, several ETFs now offer access to the growing space and aerospace sector. These funds combine early-stage innovators with established defense and technology leaders, providing a simple way to participate in the expanding space economy.

Two of the most widely followed options are:

- ARK Space Exploration & Innovation ETF (ARKX) focuses on companies involved in space launch, satellite technology, drones, and geospatial analytics. It includes a mix of emerging players such as Rocket Lab and Kratos alongside established industrial names like L3Harris and Trimble. ARKX suits investors looking for higher growth potential within a single thematic fund.

- iShares U.S. Aerospace & Defense ETF (ITA) tracks major defense and aerospace contractors such as Lockheed Martin, Northrop Grumman, and Boeing. It provides indirect exposure to space through government programs and satellite systems and is designed for investors seeking stability and consistent dividends.

In short, ETFs allow investors to access the space sector without the risk of picking individual stocks. Growth-oriented investors may lean toward ARKX, while those seeking more predictable returns and lower volatility often prefer ITA.

Conclusion: Positioning for the Next Phase of the Space Economy

The space industry in 2026 is no longer a distant vision — it’s a maturing ecosystem that blends cutting-edge innovation with the stability of global defense and infrastructure. From pure-play launch and satellite operators to hardware suppliers and aerospace primes, investors now have a range of options to match their risk appetite.

For higher-growth potential, companies like AST SpaceMobile, Rocket Lab, and BlackSky offer exposure to the frontier of connectivity and data-from-orbit markets. Those seeking steadier performance can find more predictable cash flow and government-backed demand through firms like L3Harris, Lockheed Martin, and Northrop Grumman.

Finally, ETFs such as ARKX and ITA provide an accessible way to participate in the broader space economy without the need to pick individual winners. They blend innovation with diversification — a balanced approach for investors who believe in the long-term trajectory of space but prefer measured exposure.

As the next decade unfolds, space will increasingly intersect with communications, defense, and data infrastructure on Earth. For investors, the opportunity is clear: build exposure now, but do so with an understanding of where each company sits on the risk and maturity curve.