The global gaming industry in 2026 is more dynamic than ever. What was once a creative niche has become a central pillar of entertainment, technology, and media.

Artificial intelligence is reshaping how games are built, played, and monetized. Mobile and console platforms are converging. Streaming and virtual worlds are blending entertainment with community.

Global gaming revenue is expected to surpassed $240 billion in 2025, supported by over 3.7 billion active players worldwide. From AI-driven personalization to franchise-based cinematic universes, gaming has evolved into one of the most consistent and scalable segments of the digital economy.

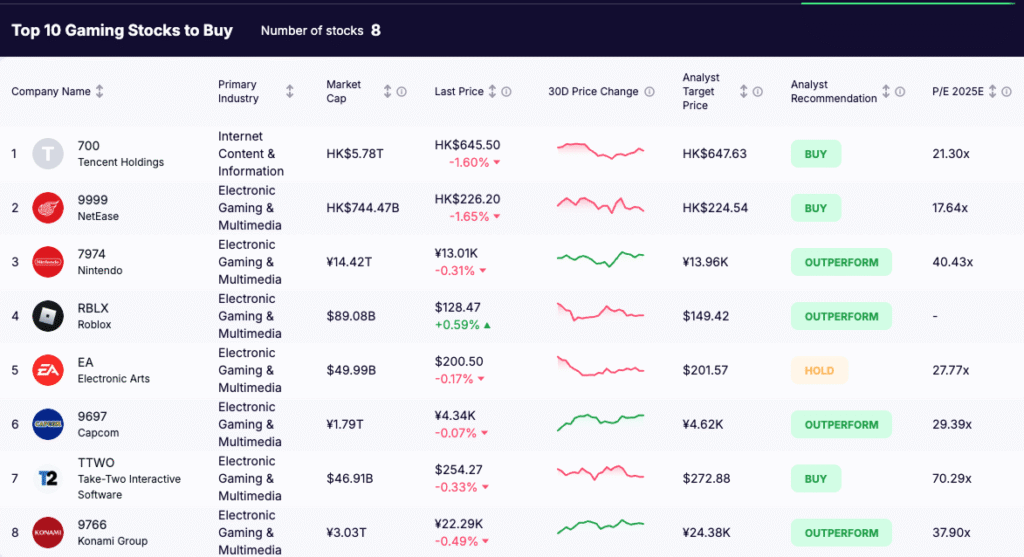

Below are the top 8 publicly traded gaming stocks to buy, representing the most influential studios and publishers in the world. Each has built enduring franchises, expanding ecosystems, and exposure to the next decade of interactive growth.

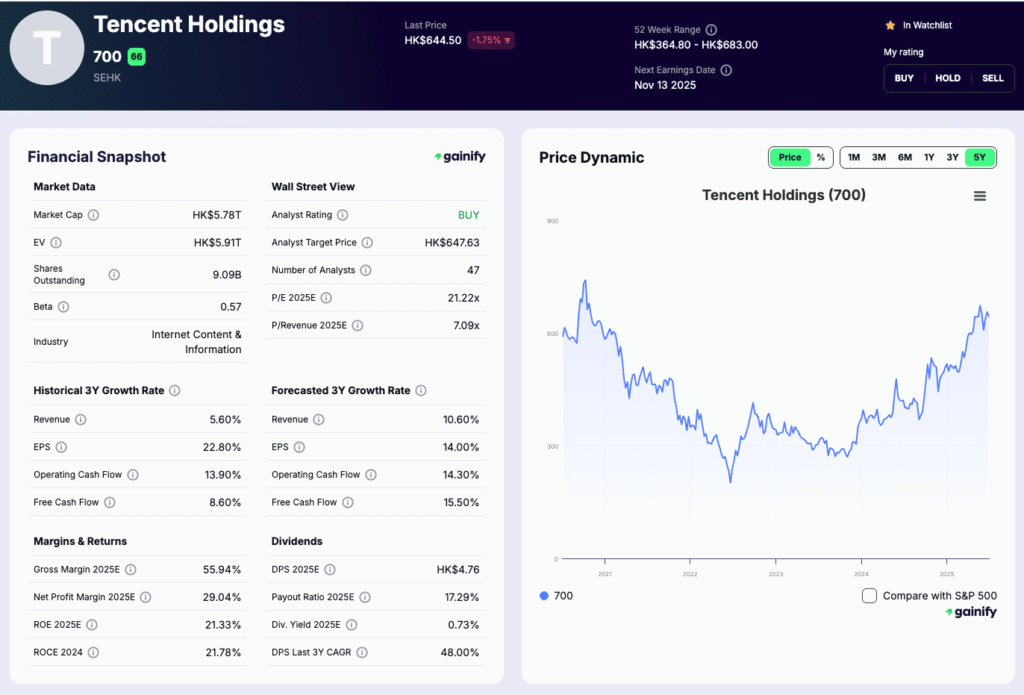

1. Tencent Holdings (700 HK)

Market Cap: HK$5.78 trillion

2025E P/E: 21.3x

Analyst Rating: Buy

What It Does: Tencent is the world’s largest gaming company and the dominant force in China’s digital entertainment market. It owns or holds major stakes in leading game developers across mobile, PC, and console.

Top Franchises:

Honor of Kings, PUBG Mobile, League of Legends (via Riot Games), Valorant, Fortnite (stake in Epic Games), and Call of Duty: Mobile.

Key Investment Theme: Tencent’s power lies in its diversified ecosystem of games, social media, and digital payments. Its integration of WeChat and gaming creates a frictionless environment for engagement and monetization. International expansion and cloud gaming investments continue to strengthen global reach.

Key Risks: Chinese regulatory oversight remains a key risk. Slower domestic approvals and rising international competition could limit near-term growth.

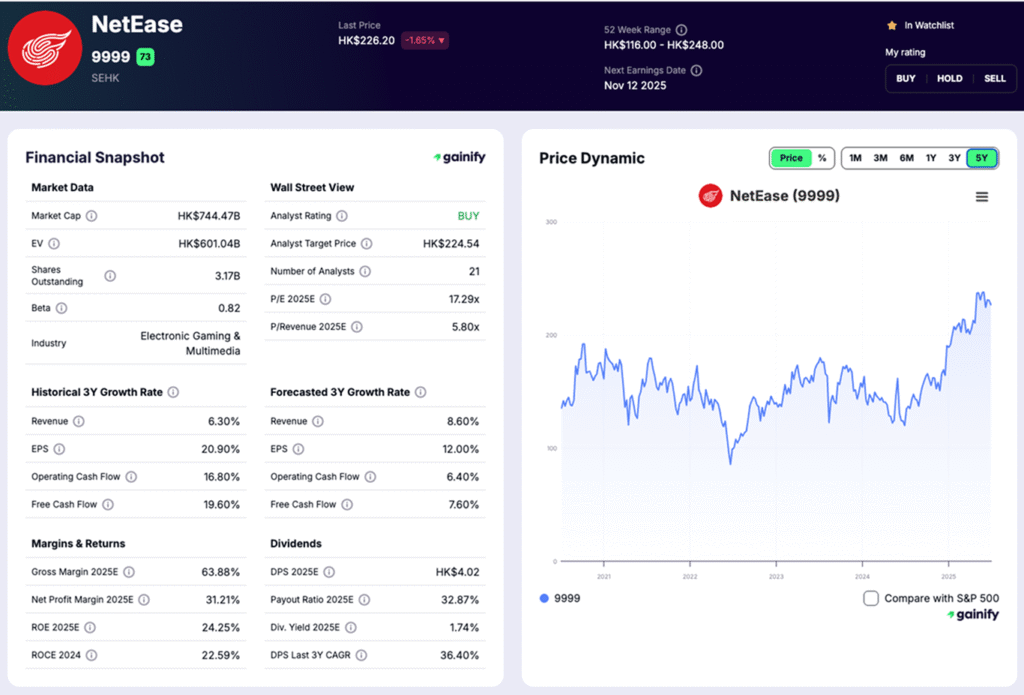

2. NetEase (9999 HK)

Market Cap: HK$744.47 billion

2025E P/E: 17.6x

Analyst Rating: Buy

What It Does: NetEase is one of China’s most creative and profitable game developers, specializing in large-scale online and mobile titles.

Top Franchises:

Fantasy Westward Journey, Identity V, Eggy Party, Naruto: Slugfest, and Diablo Immortal (under license).

Key Investment Theme: NetEase continues to deliver original IPs that resonate with domestic and international audiences. Eggy Party has become a breakout hit across Asia, while the company’s new Japanese and North American studios are expanding its global footprint. NetEase’s efficient monetization and strong in-house engine technology make it one of the most profitable developers in Asia.

Key Risks: Heavy exposure to China’s regulatory environment and slower licensing cycles. Overseas growth execution remains critical for long-term diversification.

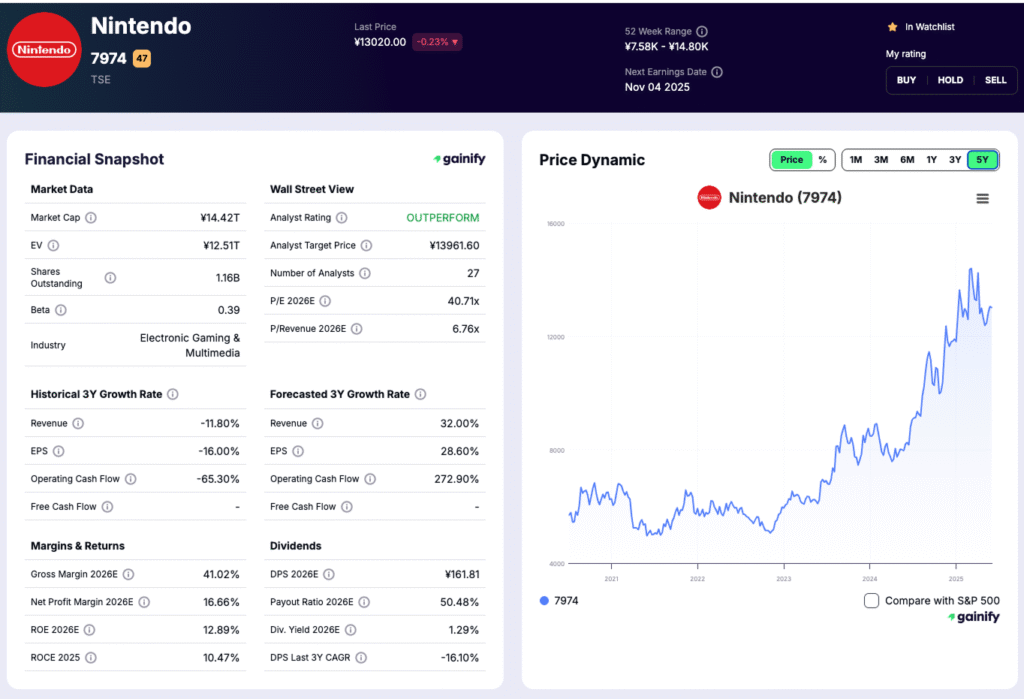

3. Nintendo (7974 JP)

Market Cap: ¥14.42 trillion

2025E P/E: 40.4x

Analyst Rating: Outperform

What It Does: Nintendo remains the gold standard in gaming creativity, combining hardware, software, and cultural icons that define generations of players.

Top Franchises:

Super Mario, The Legend of Zelda, Pokémon (jointly owned with The Pokémon Company), Animal Crossing, and Splatoon.

Key Investment Theme: Nintendo’s strength lies in evergreen franchises and cross-platform storytelling. Its Switch console continues to generate strong sales, while anticipation for Switch 2 in 2026 is driving renewed excitement. Expanding into film, theme parks, and mobile has created powerful new monetization channels beyond gaming.

Key Risks: Hardware dependence makes earnings cyclical. Any delay in new console releases or weaker software pipeline could affect profitability.

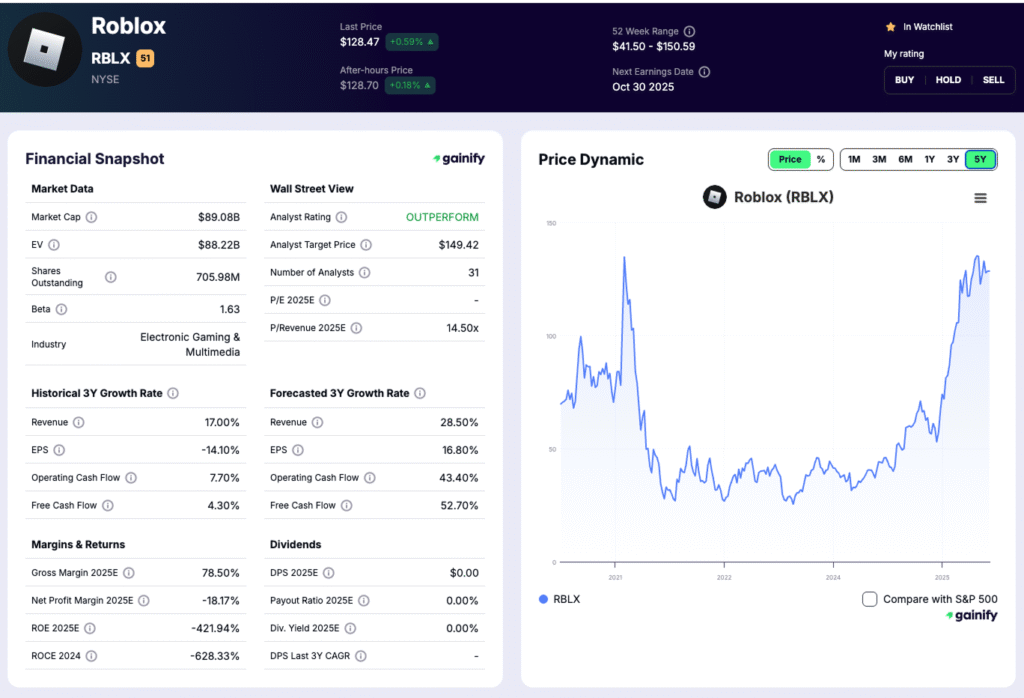

4. Roblox (RBLX US)

Market Cap: $89.08 billion

2025E P/E: N/A

Analyst Rating: Outperform

What It Does: Roblox is a global digital platform that allows users to create, share, and play games built by its community. It is one of the world’s largest online ecosystems for user-generated gaming content.

Top Experiences:

Brookhaven, Adopt Me!, Blox Fruits, Tower of Hell, and branded experiences from Nike, Netflix, and Spotify.

Key Investment Theme: Roblox is pioneering the metaverse and user-generated entertainment. Its young user base and developer community continue to expand globally. AI-driven creation tools are expected to significantly reduce development time and improve monetization efficiency.

Key Risks: Slowing user growth and dependence on younger demographics could limit monetization. Regulation around child safety and online transactions remains an area to monitor.

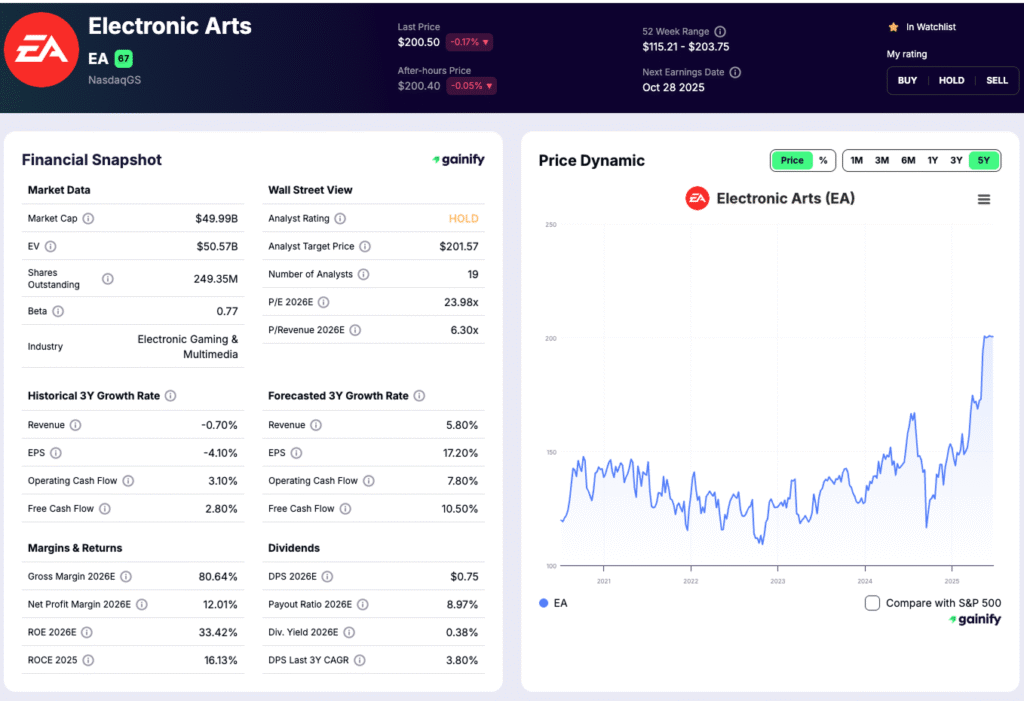

5. Electronic Arts (EA US)

Market Cap: $49.99 billion

2025E P/E: 27.8x

Status: Acquired in a $55 billion deal by a consortium led by PIF, Silver Lake, and Affinity Partners

What It Does: EA is a top global publisher with dominant positions in sports, simulation, and live-service gaming.

Top Franchises:

EA Sports FC (formerly FIFA), Madden NFL, Apex Legends, The Sims, Battlefield, and Need for Speed.

Key Investment Theme: EA’s focus on live-service games and annualized sports titles ensures stable recurring revenue. Its pivot toward AI-powered player personalization and new game modes is helping extend the lifecycle of its major franchises. EA’s subscription platform, EA Play, continues to add recurring cash flow.

Key Risks: Reliance on a few key franchises exposes it to volatility if releases underperform. Competitive pressure in sports and shooter categories is intense.

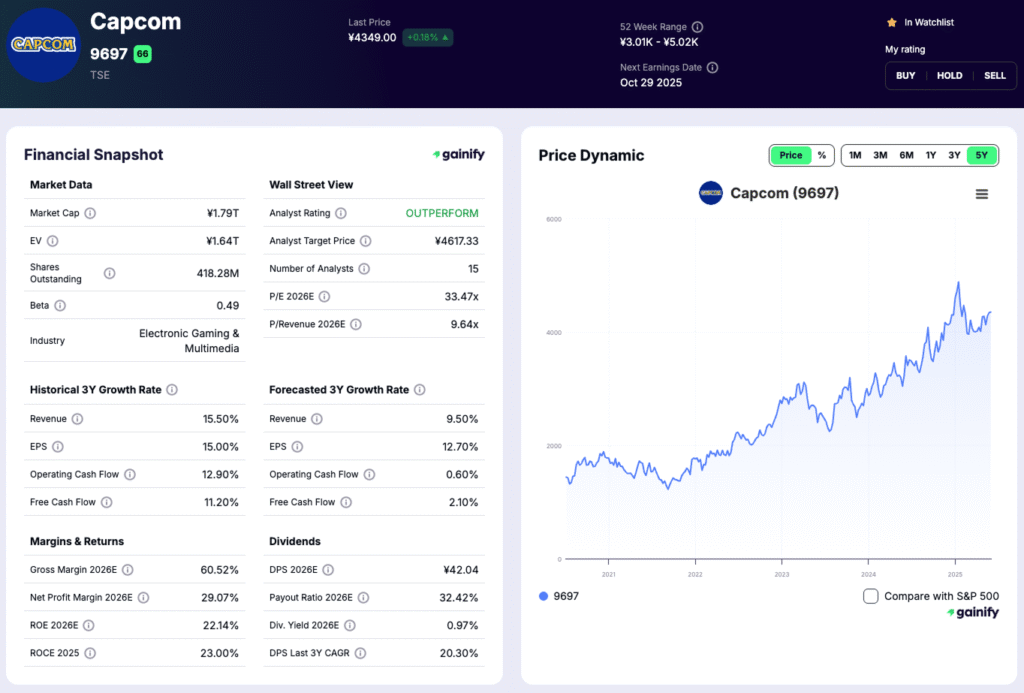

6. Capcom (9697 JP)

Market Cap: ¥1.79 trillion

2025E P/E: 29.4x

Analyst Rating: Outperform

What It Does: Capcom is a leading Japanese developer known for its deep catalog of globally successful franchises.

Top Franchises:

Resident Evil, Monster Hunter, Street Fighter, Devil May Cry, and Mega Man.

Key Investment Theme: Capcom’s strategy of revitalizing legacy franchises through remakes and sequels continues to deliver exceptional results. Resident Evil 4 Remake and Street Fighter 6 were standout performers, while Monster Hunter Wilds (2026 release) is highly anticipated. Its growing digital sales and global fan base create consistent profitability.

Key Risks: Concentration in a few IPs and slower development cadence could constrain near-term growth.

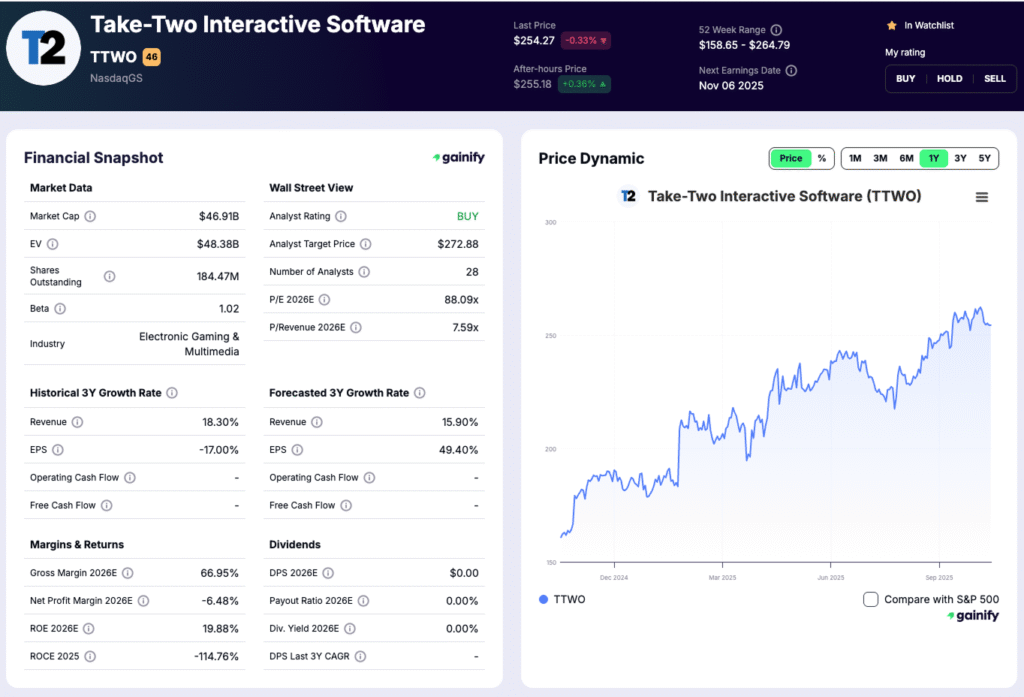

7. Take-Two Interactive (TTWO US)

Market Cap: $46.91 billion

2025E P/E: 70.3x

Analyst Rating: Buy

What It Does: Take-Two owns Rockstar Games and 2K Games, two of the most valuable studios in the industry.

Top Franchises:

Grand Theft Auto, Red Dead Redemption, NBA 2K, Borderlands, and Bioshock.

Key Investment Theme: Take-Two’s upcoming Grand Theft Auto VI, launching in 2026, is expected to set new industry revenue records. The company’s strategy of combining blockbuster console titles with live-service and mobile offerings (through Zynga) provides strong diversification. NBA 2K Online continues to perform exceptionally well in Asia.

Key Risks: The company’s valuation reflects high expectations for GTA VI. Any production delay or muted reception could pressure the stock.

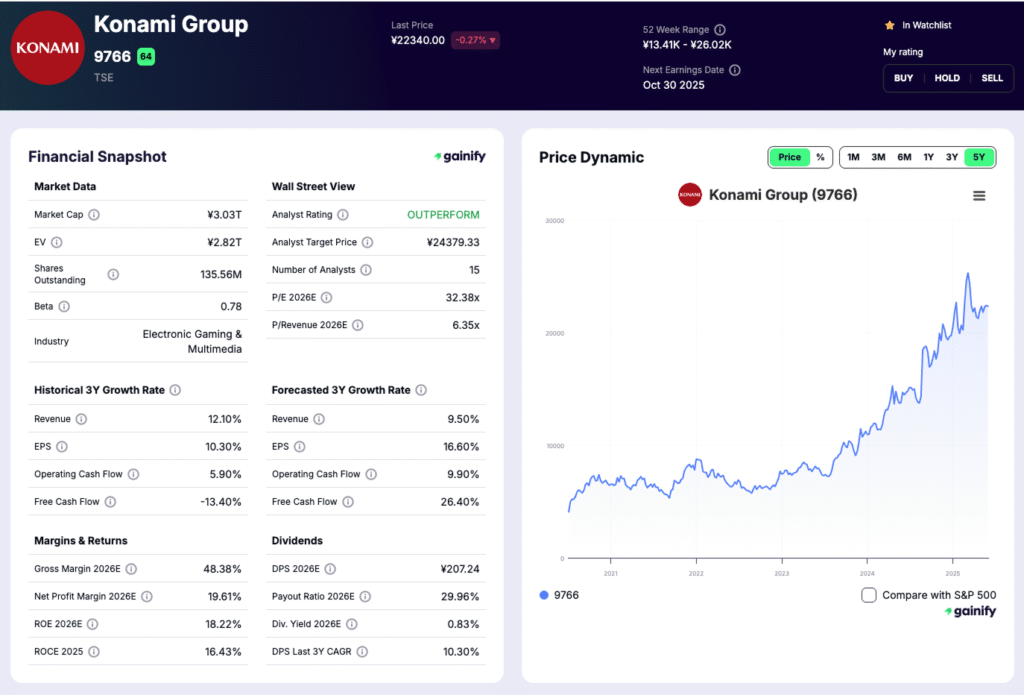

8. Konami Group (9766 JP)

Market Cap: ¥3.03 trillion

2025E P/E: 37.9x

Analyst Rating: Outperform

What It Does: Konami is a diversified Japanese entertainment company with deep roots in gaming, digital content, and sports technology.

Top Franchises:

Metal Gear, Silent Hill, Yu-Gi-Oh!, Castlevania, and eFootball.

Key Investment Theme: Konami is revitalizing its legacy IPs through remakes and modern adaptations. Metal Gear Solid Δ: Snake Eater and the Silent Hill revival have reestablished the brand’s global relevance. The Yu-Gi-Oh! Master Duel franchise remains one of the top-grossing digital card games globally.

Key Risks: Dependence on nostalgia-driven releases and limited new IP creation could cap long-term upside.

The State of Gaming in 2025

Gaming in 2025 was no longer just an entertainment business. It had become a global digital ecosystem where content, technology, and culture intersected. The world’s largest publishers were evolving into multimedia platforms that connected billions of players across devices, communities, and virtual economies.

Three powerful forces shaped this new phase of growth.

Artificial intelligence has transformed how games are made. Procedural generation, AI-assisted world-building, and dynamic storytelling have shortened development cycles and expanded creativity at scale. Studios can now build immersive, ever-evolving worlds that respond to player behavior in real time.

Franchise monetization has become the industry’s financial engine. Flagship series such as Grand Theft Auto, The Legend of Zelda, and League of Legends are no longer one-off releases. They have evolved into live ecosystems spanning updates, merchandise, esports, and streaming partnerships. The line between content and service has all but disappeared.

Cross-media expansion has redifined what a gaming company can be. Games now launch alongside films, series, and virtual experiences. Studios like Nintendo, Sony, and Take-Two are turning intellectual property into global storytelling franchises that compete directly with Hollywood for audience share and cultural relevance.

The result is a sector that is more diversified, data-driven, and globally integrated than ever before. Monetization is shifting from ownership to participation as players become contributors and co-creators in virtual economies that extend beyond the screen.

Gaming ETFs: Broader Exposure to the Industry

For investors who prefer diversified exposure instead of selecting individual gaming stocks, several exchange-traded funds (ETFs) provide access to the global video game and esports market. These funds invest across developers, hardware manufacturers, streaming platforms, and related technology providers that benefit from long-term growth in digital entertainment.

In 2025, gaming ETFs have delivered some of the strongest returns among thematic funds. Most major gaming ETFs have outperformed the S&P 500 by more than two times year to date, reflecting the sector’s renewed strength driven by AI-enhanced development, live-service monetization, and record engagement across global gaming platforms.

ETF Name | Ticker | Focus | Top Holdings (as of Jan 2026) | Expense Ratio |

VanEck Video Gaming and eSports ETF | ESPO | Global gaming and esports leaders | NVIDIA, Tencent, Nintendo, Roblox, Take-Two Interactive | 0.55% |

Global X Video Games & Esports ETF | HERO | Publishers, hardware, and streaming | 0.50% | |

Roundhill Video Games ETF | NERD | Gaming software, esports, and media | 0.60% | |

BITKRAFT Esports & Digital Entertainment ETF | GAMR | Interactive entertainment and virtual platforms | Tencent, Embracer Group, Roblox, Sea Limited, Bandai Namco | 0.59% |

Bottom Line

The world’s top gaming companies are building more than games; they are creating persistent worlds that anchor modern entertainment. Tencent and NetEase dominate live-service ecosystems across Asia, Nintendo continues to redefine creative longevity, and Take-Two is preparing the most anticipated release in a decade with GTA VI.

For investors, gaming remains one of the few industries combining creativity, recurring revenue, and technological leverage. The sector is moving from cycles of hits to networks of engagement, an evolution that makes gaming not just a trend but a structural pillar of the modern digital economy.