Brad Gerstner, the founder of Altimeter Capital, has built his reputation on bold, technology-driven investments that anticipate long-term trends. His approach blends deep fundamental research with crossover strategies that straddle both private and public markets, making Altimeter a high-profile player in the tech investing world.

In the third quarter of 2025, Altimeter reported a portfolio valued at $7.58 billion across 23 holdings, maintaining its strong concentration in software, semiconductors, and next-generation internet platforms. This quarter’s filing showcased a decisive rotation across key tech segments, including a sharper tilt toward China-driven growth names and a strategic reshuffling within semiconductors. These additions signal Gerstner’s belief that the next leg of technology leadership will be shaped by global AI demand and next-generation compute infrastructure.

At the same time, Altimeter pulled back from several higher-valuation cloud and software names, including full exits from Datadog and Samsara and cuts to positions such as Snowflake and Confluent. These reductions point to a clear shift toward companies with more predictable earnings power and away from segments where elevated multiples have become harder to defend.

The quarter also featured a notable rotation among the largest US tech platforms. Altimeter increased its exposure to companies like Amazon and Microsoft while letting positions such as NVIDIA drift lower in portfolio weight.

In the sections ahead, we will break down Altimeter’s Q3 2025 changes, examine its top holdings, and highlight how Gerstner’s technology-first philosophy is shaping one of the most concentrated and forward-looking hedge fund portfolios on the market today.

Who Is Brad Gerstner?

Brad Gerstner is a hedge fund manager, venture investor, and the founder of Altimeter Capital, which he launched in 2008. The firm is best known for its crossover investment strategy, backing fast-growing private technology companies ahead of their IPOs and holding them through their public expansion.

Gerstner built his reputation by making early, high-conviction investments in transformative companies such as Uber, Snowflake, and Airbnb, while also maintaining long-term public market stakes in leaders like Amazon, Microsoft, and NVIDIA. His approach combines venture-style foresight with public market discipline, allowing Altimeter to capture growth at multiple stages of a company’s lifecycle.

Unlike short-term-oriented funds, Gerstner demonstrates patience in compounding growth. The average holding period in Altimeter’s portfolio is around eight quarters, with core positions such as Meta and Microsoft held for over 30 quarters. At the same time, he is pragmatic and willing to pivot, trimming or exiting lower-priority holdings when conditions change.

Over the past decade, Gerstner has become one of the most closely followed technology investors, with Altimeter frequently cited as a bellwether for long-term conviction in software, cloud infrastructure, and artificial intelligence.

Investment Philosophy

Brad Gerstner’s investment philosophy is shaped by a technology-first worldview and a belief that innovation cycles in software, cloud, and artificial intelligence will continue to drive outsized equity returns. Altimeter Capital is structured around a crossover model, enabling the firm to back high-growth companies in their private stages and hold them into public markets, bridging the gap between venture capital and hedge fund investing.

At the core of his approach are three principles:

- High-Conviction Concentration – Gerstner prefers to build large, focused positions in companies he believes have enduring competitive advantages, rather than spreading capital too thin across many names. This conviction has led to multi-billion-dollar stakes in firms like Meta, Microsoft, and Snowflake.

- Long-Term Compounding – While trading activity is a tool, Gerstner emphasizes patience. Core holdings are often kept for years, allowing secular growth trends in cloud infrastructure, data, and AI to compound over time.

- Adaptability and Opportunism – Despite his long-term orientation, Gerstner is not rigid. He reallocates aggressively when the opportunity set changes, which was evident in Altimeter’s move into Alibaba Group, Google, and PDD Holdings while rotating capital out of holdings such as NVIDIA, Snowflake, and Datadog during Q3 2025.

This combination of patience and flexibility reflects Gerstner’s broader belief that the best returns come from holding the right companies through innovation cycles, while still keeping discipline to rotate away from lower-priority or overvalued positions.

Q3 2025 Trades: Brad Gerstner’s Altimeter Capital

Altimeter Capital’s Q2 2025 filing revealed a period of active repositioning, with over $1.0 billion in capital reallocated. The firm doubled down on AI, semiconductors, and cloud platforms while exiting several legacy positions.

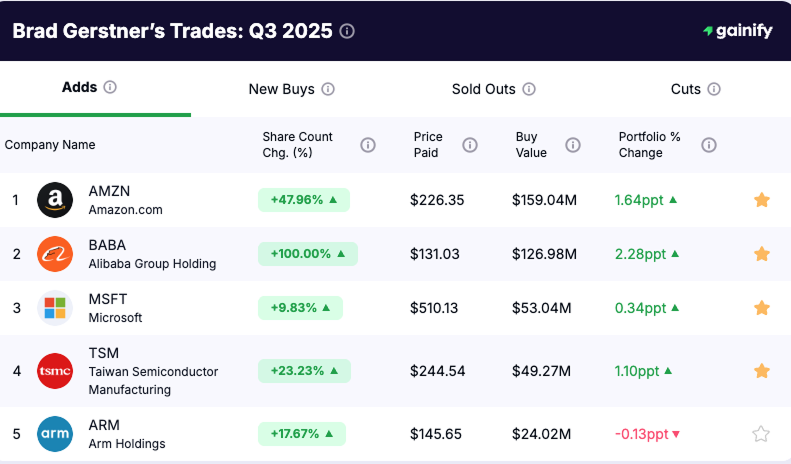

1. Major Additions

- Amazon (AMZN): Increased position with a 159.0 million dollar buy, reinforcing Altimeter’s conviction in one of the strongest large-cap compounding engines.

- Alibaba (BABA): Fully scaled into the position with a 126.98 million dollar purchase, expanding exposure to China’s major e-commerce and cloud ecosystem.

- Microsoft (MSFT): Added 53.04 million dollars, strengthening the fund’s footing in enterprise cloud and accelerating AI demand.

- Taiwan Semiconductor (TSM): Expanded the position with a 49.27 million dollar buy, deepening Altimeter’s investment in global semiconductor manufacturing leadership.

- Arm Holdings (ARM): Increased the stake through a 24.02 million dollar addition, reflecting confidence in ARM’s growing influence in next-generation chip design.

➡️ In total, Altimeter added over $400M across high-growth technology and platform companies.

2. New Buys

- Broadcom (AVGO): Initiated a 228.48 million dollar position, expanding Altimeter’s exposure to AI-enabling semiconductor and networking infrastructure.

- PDD Holdings (PDD): Established a 162.37 million dollar stake, reflecting growing interest in China’s leading cross-border and value-driven e-commerce platform.

- Synopsys (SNPS): Added a 146.01 million dollar position, strengthening the fund’s participation in the chip design and EDA software ecosystem.

- Alphabet (GOOGL): Opened a 65.59 million dollar position, reinforcing conviction in large-scale AI deployment across cloud, search, and productivity tools.

- Gemini Space Station (GEMI): Initiated a 41.30 million dollar buy, adding exposure to emerging space and satellite-based data infrastructure.

- Pattern Group (PTRN): Built a 10.06 million dollar position, a smaller but targeted move into next-generation analytics and pattern-recognition technology.

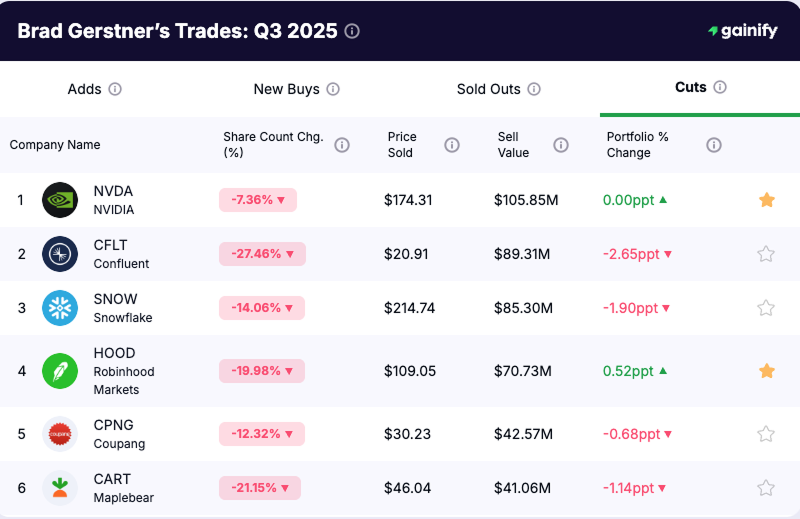

3. Reductions

Altimeter trimmed several positions this quarter, freeing capital from higher-valuation names and reallocating toward stronger AI and semiconductor opportunities.

- NVIDIA (NVDA): Reduced the position by 105.85 million dollars, a modest trim that lowers concentration while keeping NVDA as a core holding.

- Confluent (CFLT): Cut 89.31 million dollars, reflecting more caution around consumption-based software models in a slower enterprise spending environment.

- Snowflake (SNOW): Trimmed 85.30 million dollars, continuing the shift away from premium-valued cloud data platforms.

- Robinhood (HOOD): Lowered exposure by 70.73 million dollars, capturing gains after a period of strong performance.

- Coupang (CPNG): Reduced by 42.57 million dollars, signaling tighter positioning in global e-commerce.

- Maplebear (CART): Cut 41.06 million dollars, aligning the position size with a more selective view on consumer technology valuations.

➡️ Reductions freed capital for higher-conviction bets in semiconductors and cloud infrastructure.

4. Exits

Altimeter fully exited three positions, releasing nearly $310M in capital:

- Datadog (DDOG): Closed a 121.41 million dollar position, stepping back from premium-valued observability software.

- Samsara (IOT): Exited a 111.07 million dollar stake, reducing exposure to asset-heavy IoT and fleet management platforms.

- CoreWeave (CRWV): Sold a 76.85 million dollar position, trimming risk within next-generation cloud infrastructure.

➡️ These exits created liquidity that Altimeter redirected into AI infrastructure, semiconductor design, and large-scale platform companies with clearer monetization pathways.

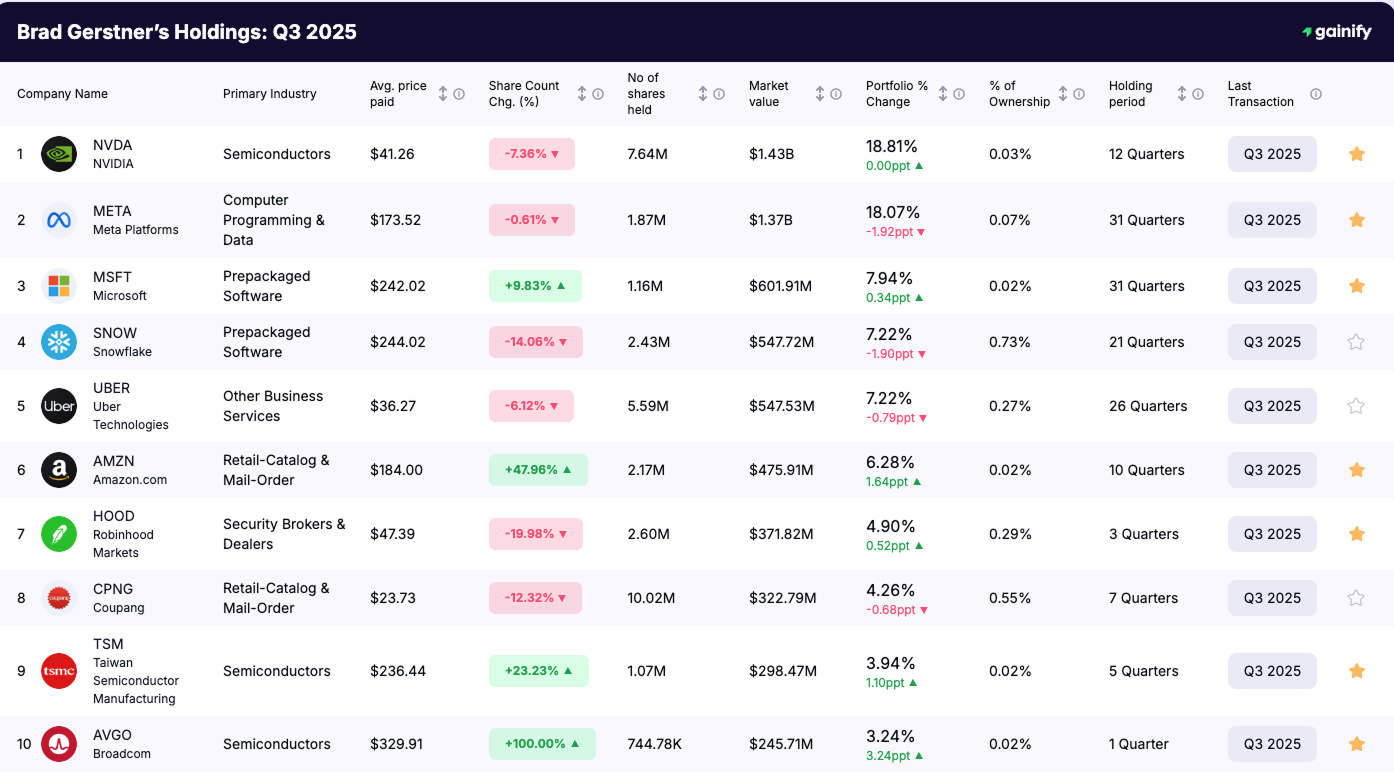

Top 10 Holdings: Q2 2025

Rank | Company | Market Value | % of Portfolio | Shares Held | Holding Period | Notes |

|---|---|---|---|---|---|---|

1 | NVIDIA (NVDA) | $1.43B | 18.81% | 7.64M | 12 Quarters | Largest holding, slight trim, core AI infrastructure bet |

2 | Meta Platforms (META) | $1.37B | 18.07% | 1.87M | 31 Quarters | Long-term AI and scaled data platform leader |

3 | Microsoft (MSFT) | $601.9M | 7.94% | 1.16M | 31 Quarters | Anchor compounder with strong cloud and AI monetization |

4 | Snowflake (SNOW) | $547.7M | 7.22% | 2.43M | 21 Quarters | Trimmed, still key enterprise data exposure |

5 | Uber (UBER) | $547.5M | 7.22% | 5.59M | 26 Quarters | Long-term mobility and logistics winner |

6 | Amazon (AMZN) | $475.9M | 6.28% | 2.17M | 10 Quarters | Added this quarter, AWS and retail strength |

7 | Robinhood (HOOD) | $371.8M | 4.90% | 2.60M | 3 Quarters | New fintech bet rising quickly |

8 | Coupang (CPNG) | $322.8M | 4.26% | 10.02M | 7 Quarters | Trimmed, high-conviction e-commerce name |

9 | Taiwan Semiconductor (TSM) | $298.5M | 3.94% | 1.07M | 5 Quarters | Increased semiconductor exposure |

10 | Broadcom (AVGO) | $245.7M | 3.24% | 744.8K | 1 Quarter | New top-ten entrant, strong AI and connectivity exposure |

Conclusion

Altimeter Capital’s Q3 2025 filing reflects a portfolio that blends high conviction with active, forward-looking repositioning across the technology landscape.

Leaning further into AI and semiconductors: New allocations to Broadcom, Synopsys, and Gemini Space Station, along with increased exposure to Microsoft, Amazon, Arm, and Taiwan Semiconductor, reinforce a deeper commitment to global AI infrastructure and next-generation chip design.

Selective rotations and valuation discipline: Reductions in NVIDIA, Snowflake, Confluent, Coupang, and Maplebear highlight a disciplined approach to trimming higher-valuation names while reallocating toward businesses with more durable earnings and clearer AI monetization paths.

Decisive exits: Full divestments from Datadog, Samsara, and CoreWeave released more than 300 million dollars of capital, which was redeployed into higher-conviction platforms and semiconductor leaders.

Core conviction maintained, especially within the Magnificent Seven: Meta, Microsoft, Amazon, and NVIDIA remain central pillars of the portfolio. The shifts among these mega caps demonstrate Gerstner’s view that not all members of the Magnificent Seven are equally positioned for the next phase of AI-driven growth, and the portfolio weights reflect that nuance.

Bottom line: Brad Gerstner continues to refine a strategy anchored in AI, cloud, and global internet platforms, while rotating decisively to capture emerging advantages. Q3 underscores a manager balancing long-term belief in the dominant tech platforms with tactical adjustments designed to stay ahead of where the innovation curve is moving.

Bottom line: Brad Gerstner continues to balance long-term conviction with tactical repositioning, leaning harder into AI, data, and cloud platforms — the technologies he sees driving the next decade of growth.