David Tepper, billionaire hedge fund manager and founder of Appaloosa Management LP, is one of the most influential investors on Wall Street. Famous for his contrarian instincts and willingness to make bold moves during times of market stress, Tepper has built a career on finding opportunity where others see risk.

Tepper first made his mark as a distressed debt specialist at Goldman Sachs before launching Appaloosa in 1993. His defining moment came during the 2008 financial crisis, when he famously bought billions in distressed bank stocks — a trade that returned billions in profits and cemented his reputation as a master of contrarian investing. Beyond finance, Tepper is also the owner of the Carolina Panthers (NFL) and Charlotte FC (MLS), but he remains best known for his sharp instincts in navigating volatile markets.

Appaloosa’s investment philosophy is built around flexibility, opportunism, and conviction. Unlike managers tied to rigid styles, Tepper rotates capital aggressively across sectors and geographies, often taking concentrated bets when he sees asymmetrical upside. His Q2 2025 filing reflects this approach: reducing overall equity exposure while doubling down on U.S. healthcare and semiconductor leaders and at the same time making deep cuts to Chinese equities, a striking pivot for someone long considered a China bull.

As of Q2 2025, Appaloosa reported an equity portfolio valued at $6.45 billion, spread across 38 holdings. That’s a notable drop from $8.38 billion in Q1, highlighting a more cautious stance. Yet within this smaller portfolio, Tepper made decisive moves: buying big into UnitedHealth (UNH) and NVIDIA (NVDA), while trimming a range of Chinese and U.S. names.

David Tepper’s Investment Philosophy

At the core of Tepper’s philosophy is opportunism. Unlike investors who stick to rigid value or growth labels, Tepper adapts his portfolio positioning based on macroeconomic conditions, sector rotations, and capital flows. He is willing to go all-in on sectors he believes are poised for outsized returns while exiting others entirely when risk/reward deteriorates.

Key principles include:

- Flexibility: No single sector or region is off-limits if opportunity arises.

- High Conviction: Tepper often takes large, concentrated bets when confidence is high.

- Macro Awareness: He pays close attention to interest rates, inflation, and global economic cycles.

- Distressed & Dislocated Assets: True to his roots, Tepper thrives in identifying mispriced securities created by market turmoil.

This Q2 2025 portfolio update showcases his opportunistic DNA: cutting Chinese stocks sharply while adding heavily to U.S. healthcare and semiconductor leaders.

Key Portfolio Metrics (Q2 2025)

✅ Total Portfolio Value: $6.45 Billion (down from $8.38B in Q1)

✅ Number of Holdings: 38 Stocks

✅ Top 10 Holdings: 64.65% of Portfolio

✅ Average Holding Period: 9 Quarters (2.25 Years)

✅ Largest Sector Allocations: Business Services (21.61%), Semiconductors (12.24%), Medical Services (11.85%)

✅ Performance: +13.37% (1Y), +99.02% (3Y), +151.20% (5Y)

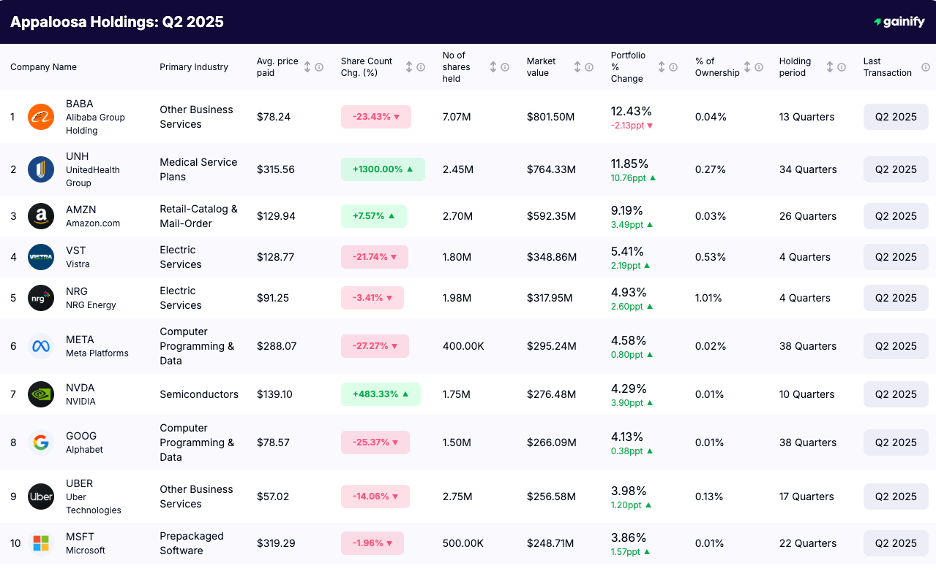

Top 10 Holdings: Q2 2025 Equity Portfolio

Rank | Company | Ticker | Market Value | Portfolio Weight | Shares Held | Change (Q2 2025) | Last Transaction |

1 | Alibaba Group | $801.5M | 12.43% | 7.07M | ▼ -23.4% | Cut | |

2 | UNH | $764.3M | 11.85% | 2.45M | ▲ +1300% | Added | |

3 | Amazon | $592.3M | 9.19% | 2.70M | ▲ +7.6% | Added | |

4 | Vistra | VST | $348.9M | 5.41% | 1.80M | ▼ -21.7% | Cut |

5 | NRG Energy | NRG | $318.0M | 4.93% | 1.98M | ▼ -3.4% | Cut |

6 | META | $295.2M | 4.58% | 400K | ▼ -27.3% | Cut | |

7 | NVIDIA | NVDA | $276.5M | 4.29% | 1.75M | ▲ +483% | Added |

8 | GOOG | $266.1M | 4.13% | 1.50M | ▼ -25.4% | Cut | |

9 | UBER | $256.6M | 3.98% | 2.75M | ▼ -14.1% | Cut | |

10 | MSFT | $248.7M | 3.86% | 500K | ▼ -2.0% | Cut |

Q2 2025 Changes in Detail: David Tepper’s Equity Portfolio

1. Sharp Cuts to China Holdings

For years, Tepper has been considered a China bull, holding large stakes in Alibaba, JD.com, and PDD. But in Q2 2025, he drastically reduced exposure, pulling out nearly $1 billion from Chinese equities:

- Alibaba (BABA): Cut by -23%, trimming about $240M. Position now $801M (still top holding).

- PDD Holdings (PDD): Slashed -54%, reducing by about $249M. Position now $209M.

- iShares China Large-Cap ETF (FXI): Reduced by -82%, selling about $161M. Position nearly exited.

- JD.com (JD): Cut -13%, selling about $34M. Position now $229M.

In total, Tepper pulled ~$685M out of these four Chinese positions in Q2.

2. Big Additions in Healthcare & Semiconductors

On the U.S. side, Tepper made aggressive new commitments, pouring more than $1.4B into healthcare and semiconductors:

- UnitedHealth Group (UNH): Added +1300%, worth $869M in fresh capital. Stake now $764M (11.85% of portfolio).

- NVIDIA (NVDA): Boosted +483%, adding $182M. Position now $276M.

- Intel (INTC): Doubled stake (+100%), adding $166M. Position now $179M.

- Taiwan Semiconductor (TSM): Added +280%, investing $140M. Position now $232M.

- Micron (MU): Increased +106%, adding about $40M. Position now $40M.

This highlights semiconductors as a core growth theme, tied to AI and cloud computing, while UNH provides a defensive anchor.

3. New Buys in Industrials & Airlines

Tepper also opened fresh cyclical and industrial positions, totaling about $220M in new buys:

- Raytheon (RTX): $77.95M

- IQVIA (IQV): $45.17M

- United Airlines (UAL): $40.52M

- Delta Airlines (DAL): $25.26M

- Whirlpool (WHR): $22.14M

- Goodyear (GT): $9.13M

4. Major Exits & Reductions

Tepper exited several long-held names, freeing up nearly $400M in capital:

- Full exits:

- Broadcom (AVGO): Sold $28M

- Wynn Resorts (WYNN): Sold $27M

- Las Vegas Sands (LVS): Sold $23M

- Cuts:

- Meta (META): Sold $93M (-27%)

- Oracle (ORCL): Sold $89M (-79%)

- Alphabet (GOOG): Sold $84M (-25%)

- Uber (UBER): Sold about $42M (-14%)

In total, Tepper trimmed or exited ~$400M in U.S. equities to reallocate toward healthcare and semiconductors.

Takeaways — David Tepper’s Q2 2025 Equity Strategy

- Portfolio contraction: Total value fell by nearly $2B quarter-over-quarter.

- China retreat: Sharp cuts show Tepper pulling back from a market he once favored.

- Healthcare and AI focus: UnitedHealth, NVIDIA, Intel, and TSM stand out as high-conviction bets.

- Opportunistic rotation: Select new positions in airlines and industrials highlight Tepper’s flexibility.

- Concentration remains high: Top 10 holdings = ~65% of portfolio, underscoring his conviction-driven style.

Tepper’s Q2 2025 portfolio reveals a manager playing both defense and offense: defensive healthcare on one side, high-growth semiconductors on the other — while pulling back from international risk. It’s a classic Tepper move: opportunistic, contrarian, and ready for whatever the market throws next.