Quantum technology is beginning to move from the research lab into limited real-world use, although the industry is still in its early stages. Most companies remain in research mode, testing concepts, refining prototypes, and running small-scale pilot projects. The key question is not whether quantum will matter, but when it will be ready for consistent, large-scale use and in what form.

There are four main types of players in the quantum computing industry. The first group consists of quantum hardware specialists developing the physical machines. These include systems based on trapped-ion technology, which can produce highly stable qubits, and processors built with superconducting qubits, valued for their fast gate times and compatibility with modern chip fabrication methods. Others are exploring integrated photonics, which aims to create compact systems with low signal noise and the potential for room-temperature operation. While promising, all of these designs are still in development and have limited deployment outside of research or controlled commercial trials.

The second group is made up of quantum software developers. These companies focus on building programming frameworks, quantum algorithms, and early applications that run on a variety of hardware types. Most of their work is delivered through cloud-based quantum computing platforms, such as Azure Quantum, IBM Quantum, or AWS Braket. This setup allows researchers and select businesses to experiment with quantum resources without owning hardware, but most use cases today are experimental or for proof-of-concept work rather than production-level operations.

A third category includes companies creating hybrid systems that combine high-performance classical computing with quantum hybrid solvers. This approach allows certain parts of a problem to be run on quantum hardware while the remainder is handled by classical systems. Hybrid setups are a practical stepping stone, giving users a way to explore potential quantum benefits before machines can tackle entire workloads on their own.

The fourth group consists of large-cap tech stocks such as International Business Machines (IBM), Microsoft, and Alphabet. These companies integrate quantum research into broader innovation programs that also include AI, automation tools, and large-scale cloud services. Even for these giants, quantum remains a long-term strategic bet, with most activity still focused on research and pilot programs rather than revenue-generating products.

Stock prices in this space can be sensitive to certain types of announcements. Reports of progress in error correction, the introduction of a new modular scaling approach, or demonstrations of a prototype that appears to move the industry closer to quantum advantage often influence market sentiment. These milestones indicate valuable scientific progress, but they remain early steps on a long path and should not be mistaken for evidence that the technology is ready for full-scale, profitable deployment.

Industry leaders such as Nvidia CEO Jensen Huang and Microsoft CEO Satya Nadella believe that the first practical benefits from quantum computing will emerge in targeted, high-value areas. These could include drug discovery, where quantum systems might help model complex molecules; cyber security, where they could assist in testing or improving encryption methods; and factory scheduling, where they could optimize production timelines. These narrow applications will serve as important proving grounds, providing real-world feedback before quantum systems move toward broader adoption.

This article will examine the main categories of publicly traded companies involved in quantum computing, from pure-play hardware developers to large technology firms with dedicated quantum research programs. It will describe the technologies they are working on, highlight perspectives from leading executives, and explain how these factors shape both the potential rewards and the risks of investing in this emerging market.

What Is the “Mythical” Quantum Computer?

When people talk about the “mythical” quantum computer, they often picture a super machine that can instantly solve any problem faster than every classical computer on Earth. It sounds like something out of science fiction, a universal and all-powerful device that changes everything overnight. In reality, this vision is far from where the technology is today.

Quantum technology is not a single machine. It is a collection of different approaches to computing, each with its own strengths and weaknesses. Today’s systems include trapped-ion setups for stability, superconducting processors for fast operations, photonic engines for handling information with light, and annealing machines for solving optimization problems. These are separate paths, not steps toward one single perfect device.

Each of these approaches works best in specific situations. Some excel at optimization, others at secure communications, and some are better suited for running advanced algorithms. No current system is good at everything.

The biggest challenge is overcoming errors caused by noise and interference. Until researchers develop ways to correct these errors in real time, a truly universal fault-tolerant quantum computer will remain out of reach. Error correction is the single most important roadblock to universal quantum computing.

Right now, the focus is on making gradual, targeted progress. This includes linking smaller processors together, combining quantum with classical computing, and finding workloads where quantum can clearly outperform traditional methods. The aim is to prove value in small areas before aiming for broader adoption.

In simple terms, the mythical machine does not exist yet. What we do have are specialized tools that can work alongside classical computers, from emulators for AI testing to annealing systems for logistics and scheduling. Today’s quantum machines are precision tools, not all-purpose replacements.

Myth | Reality |

Quantum computers will replace classical computers completely | Quantum systems are designed to work alongside classical systems, handling only certain types of problems more efficiently |

The ultimate quantum computer already exists in secret labs | All current machines are prototypes or early commercial systems with significant limitations |

Quantum computing will solve every problem instantly | Only specific tasks benefit from quantum speed-ups, and even then, hardware and software must align |

We are a few years away from universal fault-tolerant machines | Achieving this will likely take decades and depends on breakthroughs in error correction and scalability |

Categories and Strategic Profiles

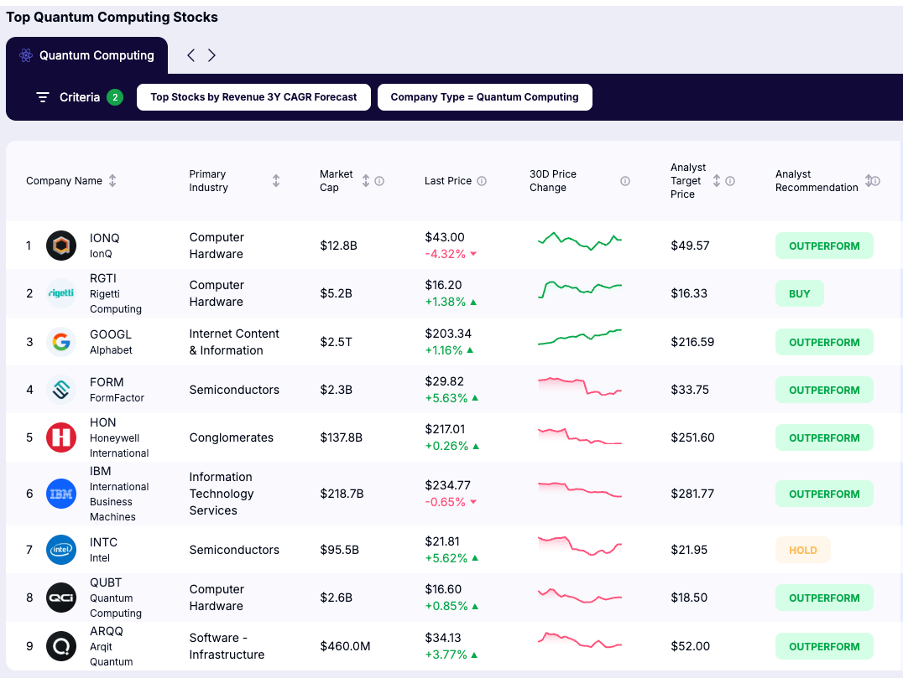

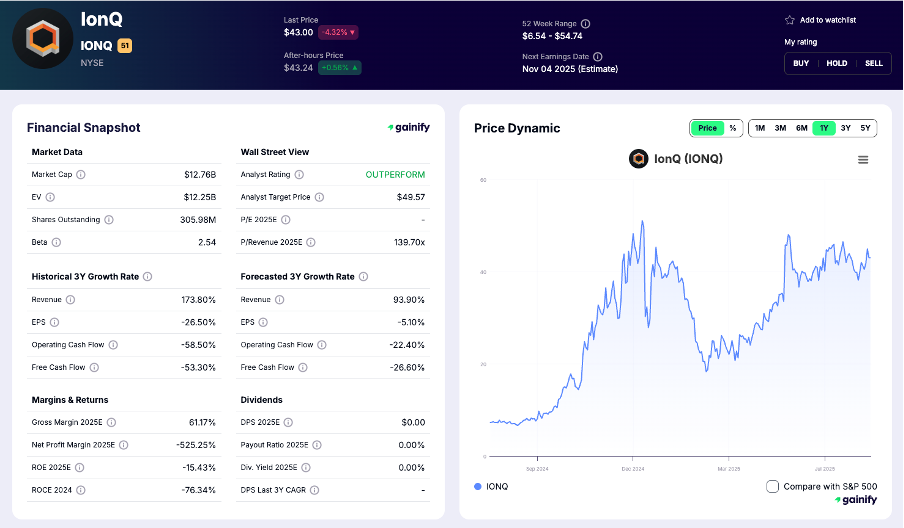

1. IonQ (NYSE: IONQ) – Trapped-Ion Innovator

IonQ builds quantum computers using trapped-ion technology, where individual atoms are held in place by lasers and used as qubits. These qubits have high two-qubit gate fidelity, which means they can perform accurate operations more often. This is an important step toward creating a fault-tolerant quantum computer that can run for long periods without errors.

The company’s systems are available through Azure Quantum and other cloud-based quantum computing platforms. This allows researchers and businesses to use IonQ’s machines for tasks such as AI applications, remote sensing, and testing new quantum algorithms without having to own the hardware themselves.

IonQ strengthened its capabilities by acquiring Oxford Ionics, gaining expertise in photonic computing engines and integrated photonics. These technologies could help reduce errors and make it easier to scale quantum systems by connecting multiple modules together.

Financial snapshot:

- Market cap: $17.64 billion

- Estimated revenue 2025: $108.6 million

- Projected revenue 2026: $197.6 million

- Price-to-sales (2025): ~162x

IonQ is seen as a quantum pioneer with a long-term vision. However, heavy investment in research and development means profitability is still years away.

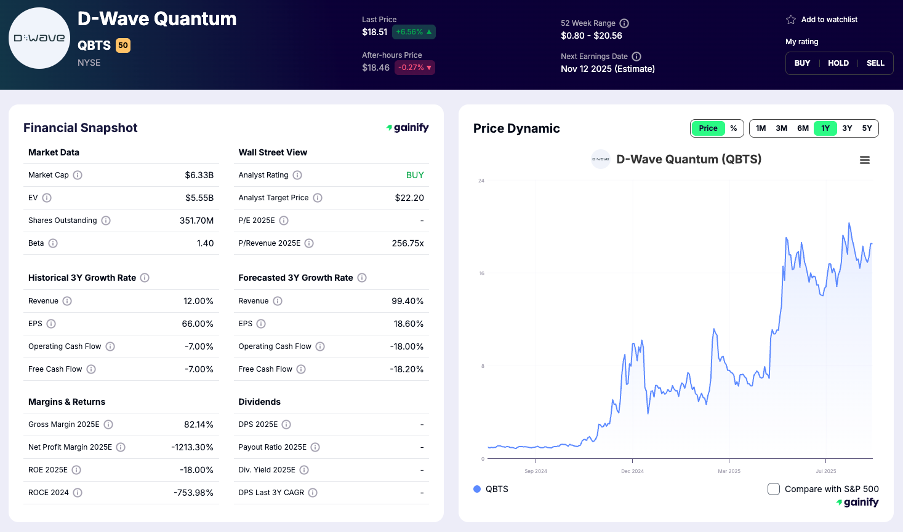

2. D-Wave Quantum Inc. (NASDAQ: QBTS) – Annealing Trailblazer

D-Wave builds annealing quantum systems, which are designed for quantum optimization tasks. These include vehicle routing, enterprise-scale factory scheduling, and portfolio management. Annealing systems are not universal quantum computers, but they can be very effective for specific types of problems where many possible solutions must be tested quickly.

Its current platform includes the Advantage 2 system and the Leap quantum cloud service. These work with quantum hybrid solvers, allowing businesses to combine classical and quantum processing for better results in certain optimization problems.

Unlike many quantum companies that remain focused on research, D-Wave already has paying customers. It has seen adoption in areas such as cyber security, logistics, and high performance computing. While the technology is still early stage, it is one of the few quantum systems being used in real-world commercial environments today.

Financial snapshot:

- Market cap: $10.6 billion

- Estimated revenue 2025: $25.6 million

- Projected revenue 2026: $39.8 million

- Price-to-sales (2025): ~294.6x

D-Wave’s strong cash reserves give it room to keep improving its systems and expanding its customer base. Its focus on practical use cases today sets it apart from peers that are still entirely in development mode.

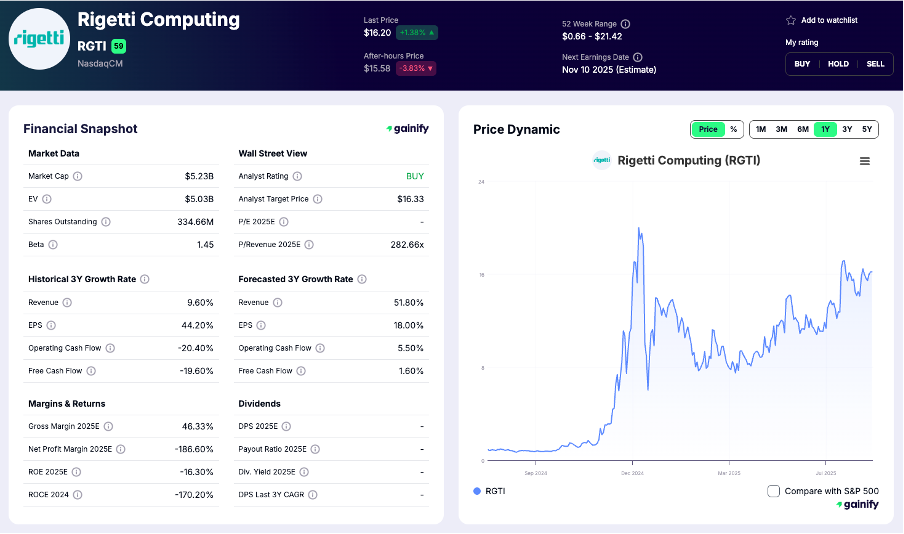

3. Rigetti Computing (NASDAQ: RGTI) – Full-Stack Contender

Rigetti develops superconducting quantum hardware using a modular scaling approach, which aims to link smaller quantum processors together to build more powerful systems over time. The company also operates its own foundry services for chip fabrication. This vertical integration allows Rigetti to work on qubit design, quantum integrated circuits, and supporting software tools all under one roof.

Rigetti works with partners in both the public and private sectors. One example is its collaboration with the Air Force Office of Scientific Research to explore AI applications and quantum research for defense-related problems. The company’s strategy is to align hardware advances with easy-to-use quantum emulators and cloud-based delivery, so developers can test and build applications even before large-scale hardware is ready.

Financial snapshot:

- Market cap: $8.3 billion

- Estimated revenue 2025: $7.6 million

- Projected revenue 2026: $20.5 million

- Price-to-sales (2025): ~282.7x

Rigetti’s potential lies in combining hardware innovation with developer-friendly software access. Its challenge will be scaling technology fast enough to keep pace with other competitors.

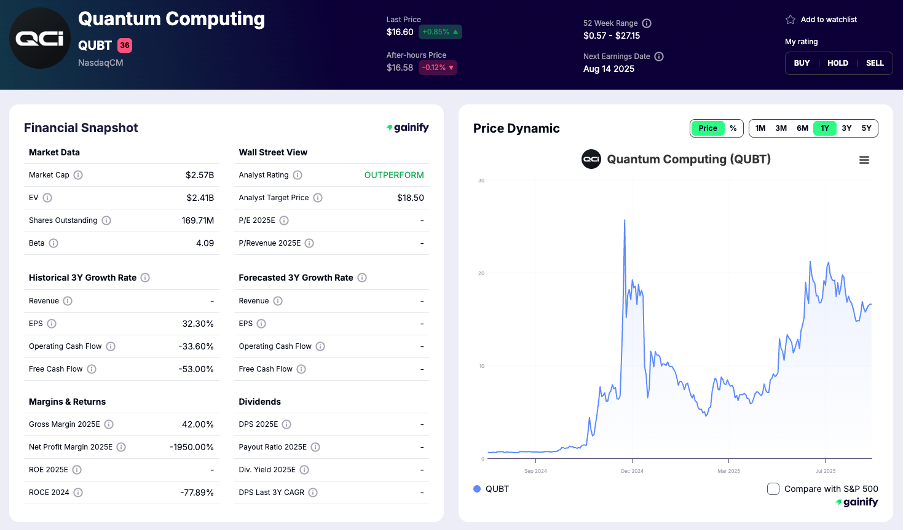

4. Quantum Computing Inc. (NASDAQ: QUBT) – Photonics & Applications Specialist

Quantum Computing Inc. focuses on integrated photonics, thin film lithium niobate components, and photonic computing engines that can be used for quantum communication and secure networking. These technologies aim to send and process quantum information using light, which can be more resistant to certain types of interference.

The company targets specialized markets such as cyber security and satellite-based remote sensing, where secure and efficient data transfer is critical. Its research includes work on entangled photon sources and photonic error correction, both of which could play a role in building future quantum communication networks.

Financial snapshot:

- Market cap: $2.6 billion

- Estimated revenue 2025: $0.8 million

- Projected revenue 2026: $2.79 million

- Price-to-sales (2025): ~2600x

While QUBT’s revenue is currently very small, its focus on photonics gives it a niche position in the broader quantum market. If quantum communication infrastructure grows in importance, the company’s early research could become a strategic advantage.

5. Tech Giants with Quantum Footprint: Microsoft, IBM, Alphabet

Microsoft

Through Azure Quantum, Microsoft is developing a path toward scalable, fault-tolerant quantum computers using topological qubits built from topological superconductors, sometimes referred to internally as “topoconductors.” The Majorana 1 chip project is part of its broader Quantum System Two initiative, which focuses on improving two-qubit gate fidelity and creating designs that can integrate smoothly into enterprise-scale cloud services. Microsoft CEO Satya Nadella has described this as a “next-generation computer” effort intended for cloud-first adoption. Microsoft’s approach remains research-focused, with real-world deployment still in the early stages.

IBM

International Business Machines (IBM) continues to advance its superconducting qubit roadmap, aiming for larger systems with better error correction and modular scaling. Its Quantum System Two architecture is designed to link multiple quantum processors into a more powerful, unified system. IBM’s research supports industries such as drug discovery, AI model training, and high performance computing. These systems are primarily used for experimentation and early-stage pilots rather than production-scale operations.

Alphabet (Google)

Google, through its quantum division, is developing Sycamore processors to explore quantum advantage in areas such as chemistry simulations and optimization problems. The company has also demonstrated quantum processors integrated into advanced computing setups that combine AI and quantum workloads. Some of this work is compatible with CUDA Quantum programming environments and tested on DGX Quantum platforms using the Grace Hopper Superchip for co-processing. This research remains in the prototyping phase and is not yet commercially available.

Industry Sentiment and Leadership Signals

Jensen Huang, Nvidia CEO

Huang has described quantum as better understood through the lens of quantum instruments rather than replacements for general-purpose computers. He points to Nvidia’s DGX Quantum and CUDA Quantum platforms as ways to bridge quantum physics research with enterprise AI.

Satya Nadella, Microsoft CEO

Nadella sees quantum technology as a cloud-native, embedded feature. He emphasizes that most users will first experience it in automation tools, AI services, and integrated platforms like Azure Quantum without even realizing they are tapping into quantum computing.

Investor Implications at a Glance

Company | Strengths | Considerations |

IonQ | Advanced trapped-ion systems, integrated photonics expertise, strong cloud access through Azure Quantum and other platforms | Heavy R&D spending with profitability still years away |

D-Wave | Proven commercial use of annealing quantum systems, effective quantum hybrid solvers for optimization | Focused on a narrow niche rather than universal quantum hardware |

Rigetti | Modular scaling design, in-house foundry for custom chip fabrication, government and defense partnerships | Complex execution challenges and slower-than-expected revenue growth |

QUBT | Photonic computing engines and quantum communication research with long-term potential | Very small revenue base and highly speculative path to adoption |

Microsoft & other tech giants | Large-cap resources, AI and cloud integration, Azure Quantum ecosystem | Quantum revenue will remain a small part of the business in the near future |

Key Takeaways for Investors

- Know the company’s role in the stack — hardware makers, software developers, and hybrid platform providers each have different risk and reward profiles.

- Watch research breakthroughs carefully — progress in error correction, two-qubit gate fidelity, and demonstrated quantum advantage can be meaningful catalysts.

- Expect quantum to complement rather than replace — for many years, quantum systems will work alongside classical and AI infrastructure instead of taking over entirely.