Coffee is one of the most consumed products in the world and one of the few consumer categories where habit, brand power, and global scale create durable, compounding business models. It is a category that grows in recessions, expands in economic upcycles, and maintains pricing power across markets.

From global retail leaders like Starbucks, to vertically integrated roasters like JDE Peet’s, to consumer-packaged giants such as Nestlé, Smucker, and Keurig Dr Pepper, the coffee ecosystem is built on recurring demand and multi-decade brand loyalty. Even emerging players like Dutch Bros are proving that new formats can win share in one of the world’s most resilient beverage markets.

Below is a detailed, investor-driven breakdown of the coffee sector’s strongest publicly traded companies. We examine how each business generates revenue, where their margins come from, and what their latest financial results signal about future performance. Together, these insights highlight the top 7 coffee stocks to consider in 2026 for exposure to one of the world’s most durable consumer categories.

Why Coffee Stocks Matter in 2026

The global coffee industry continues to offer investors a blend of stability, pricing power, and long-term growth. In 2026, several structural trends make coffee stocks especially compelling.

Steady Global Demand Growth

Global consumption continues to rise as coffee becomes a daily ritual for more people across both mature and emerging markets. This steady, predictable demand creates a reliable foundation for long-term revenue growth.

Premiumization Strengthens Margins

Consumers are trading up to higher-quality beans, specialty roasts, and ethically sourced products. This shift toward premium coffee elevates margins for major brands and reinforces customer loyalty.

Expanding Product Formats

Growth is no longer confined to traditional roasted beans. Key segments such as ready-to-drink coffee, cold brew, capsule systems, and instant formats continue gaining momentum. These higher-margin categories offer companies new ways to diversify and grow.

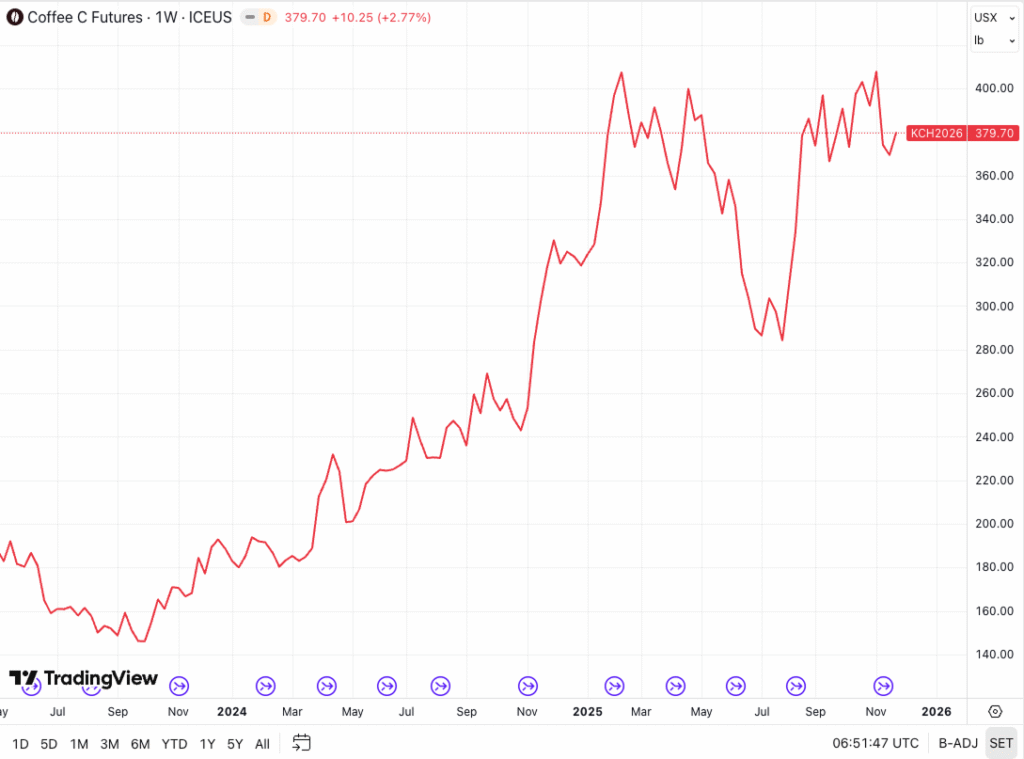

Higher and More Volatile Coffee Prices in 2026

Coffee prices surged through 2025 due to tight supply and weather disruptions, reaching levels above four dollars per pound on some benchmarks. While prices may ease slightly as new harvests come online, 2026 is still expected to be a high-price environment with ongoing volatility.

Large coffee companies tend to navigate this well. Their scale, hedging programs, and diversified sourcing allow them to absorb cost jumps and pass necessary price increases on to consumers.

Why This Benefits Investors

- Strong brands maintain pricing power even when input costs rise.

- Demand for coffee remains consistent across economic cycles.

- Diversified product portfolios help reduce the impact of commodity volatility.

- Premium and convenience-driven segments continue to expand total addressable market.

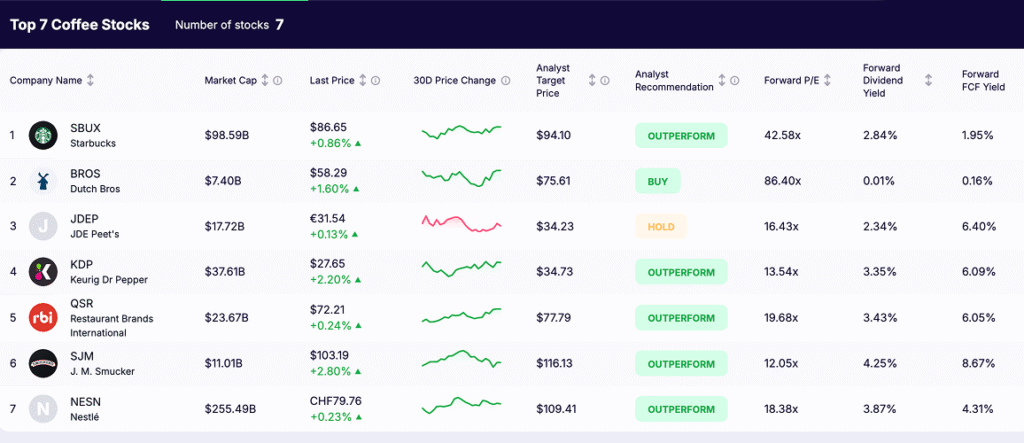

Top 7 Coffee Stocks (2026)

Company-by-Company Deep Dive

1. Starbucks (SBUX)

Market cap: 95.4B

Forward P/E: 20.9x

Forward dividend yield: 2.6%

Overview

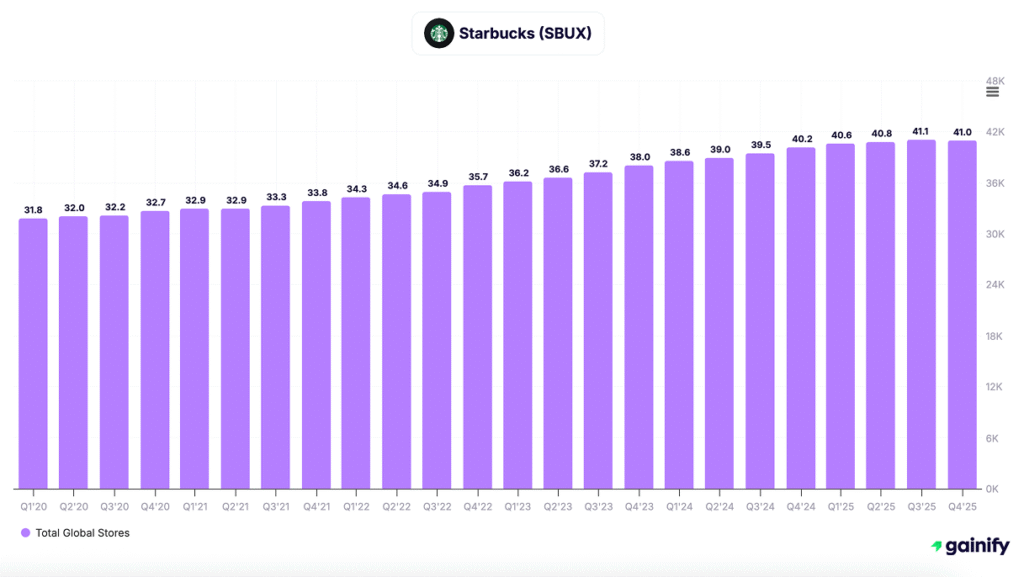

Starbucks remains the world’s dominant specialty coffee chain with 41,000+ stores and unmatched brand recognition, but the stock has materially underperformed. Over the last five years, SBUX is down roughly 12 percent, significantly lagging the S&P 500. Slowing traffic in its largest markets and rising cost pressure have challenged a business that once compounded at a far faster rate.

Business Model and Assets

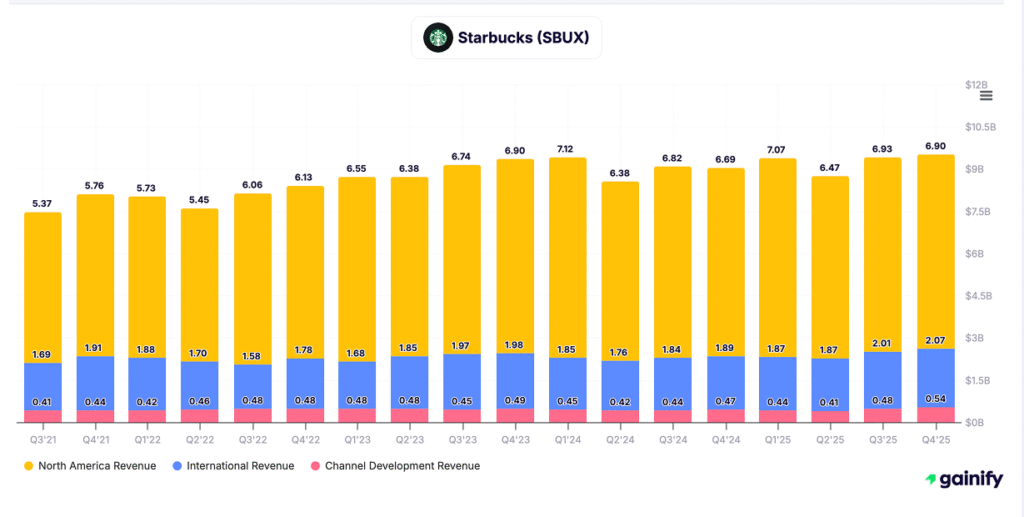

Starbucks is still a revenue machine built on three pillars: North America retail, International retail, and Channel Development (at-home coffee).

- North America – remains the core driver, consistently producing 6.3–7.1B dollars per quarter. Growth over the last two years has been mostly pricing-driven, not traffic-driven.

- International – generates 1.75–2.07B dollars per quarter. China’s volatility continues to weigh on consistency, even as unit growth accelerates.

- Channel Development – a small but high-margin contributor at 0.41–0.54B dollars per quarter, supported by the Nestlé at-home partnership.

Despite global scale and strong brand power, Starbucks increasingly relies on North America to anchor performance, with international recovery and at-home expansion acting as secondary growth levers.

Recent Performance Signals

The latest disclosures show a business that is still strong but no longer compounding at past rates:

• Revenue growth slowed to low single digits in FY2024–2025

• China comparable sales declined as consumer demand softened

• Operating margin contracted, pressured by labor and store renovation costs

• Capex elevated due to modernization and equipment upgrades

The company continues to lean on pricing to offset cost inflation, but traffic remains the key swing factor.

Investment Thesis

Starbucks still has one of the strongest consumer-brand moats in global foodservice. Its loyalty program has over 34 million active U.S. members, and its digital orders account for a growing share of transactions. Over the long term, Starbucks can stabilize margins and reignite growth through format upgrades, productivity initiatives, and more efficient international expansion.

But near-term, the path requires execution. The investment case today is more defensive and valuation-driven than purely growth-driven.

Key Risks

China recovery uncertainty, rising wage and commodity costs, and execution risk around store modernization and equipment investment.

2. Dutch Bros (BROS)

Market Cap: $7.40B

Forward P/E: 86.40x

Dividend Yield: 0.01%

Business Model

Dutch Bros is a drive-thru beverage chain built around speed, simplicity, and a cult-like customer base. Its model is one of the purest “traffic + unit expansion” stories in the entire restaurant sector.

Brand & Assets

The company controls more than 1,000 drive-thru shops, most of them company-operated, giving it stronger consistency and pricing control than typical franchise-heavy chains.

Stock Performance

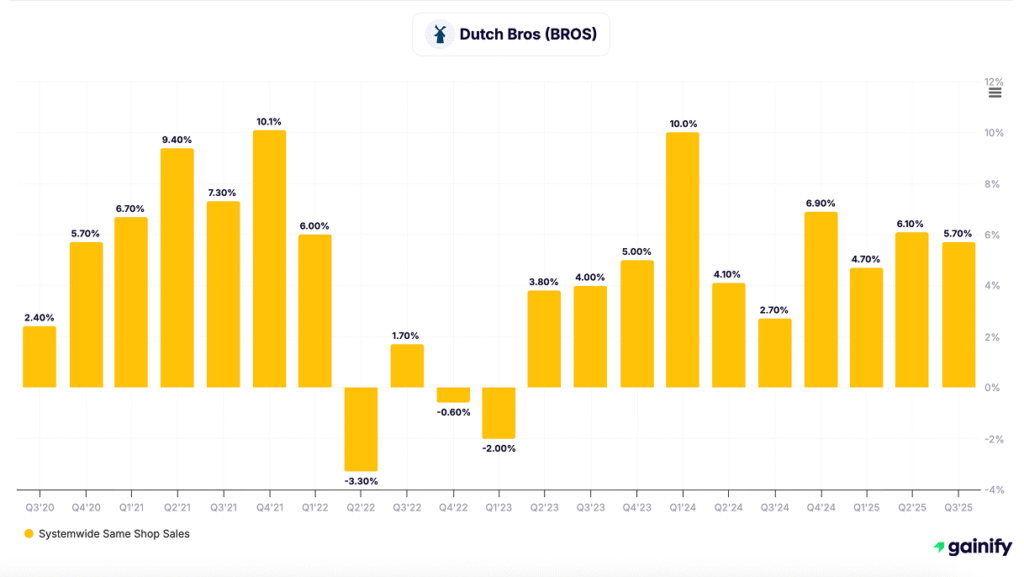

Dutch Bros has been one of the best-performing coffee stocks of 2025, benefiting from a rebound in traffic, strong store openings, and renewed optimism about long-term expansion. However, over the last 5 years the stock is up, but not that meaningfully, reminding investors how volatile high-growth restaurant concepts can be when margins tighten or expansion slows.

Key Dynamics Driving the Story

- Same-shop traffic is finally improving after two years of pressure.

- Newer markets are scaling faster than expected.

- Operational upgrades are helping store-level margins.

- The valuation remains very expensive, which makes the stock hypersensitive to even small execution missteps.

Why Investors Watch It

Dutch Bros sits in a rare space: a growth brand that actually resonates with younger demographics, expands rapidly, and has a long runway across the U.S. That combination makes BROS one of the most compelling long-term concepts in coffee, yet also one of the most volatile.

3. JDE Peet’s (JDEP)

Market Cap: $17.72B

Forward P/E: 16.43x

Dividend Yield: 2.34%

Business Model

JDE Peet’s is one of the largest packaged-coffee companies in the world, selling coffee through grocery channels, professional clients (offices, hotels, restaurants), and its own retail concepts. Unlike retail chains, this is a scale, distribution, and brand portfolio business, not a foot-traffic story.

Brand & Product Portfolio

JDE Peet’s owns a powerful mix of legacy European and global coffee brands, including: Jacobs, Douwe Egberts, L’OR, Peet’s Coffee, Senseo, Tassimo, Moccona, and others. This portfolio gives it broad price segmentation from premium espresso pods down to mass-market instant coffee.

Stock Performance

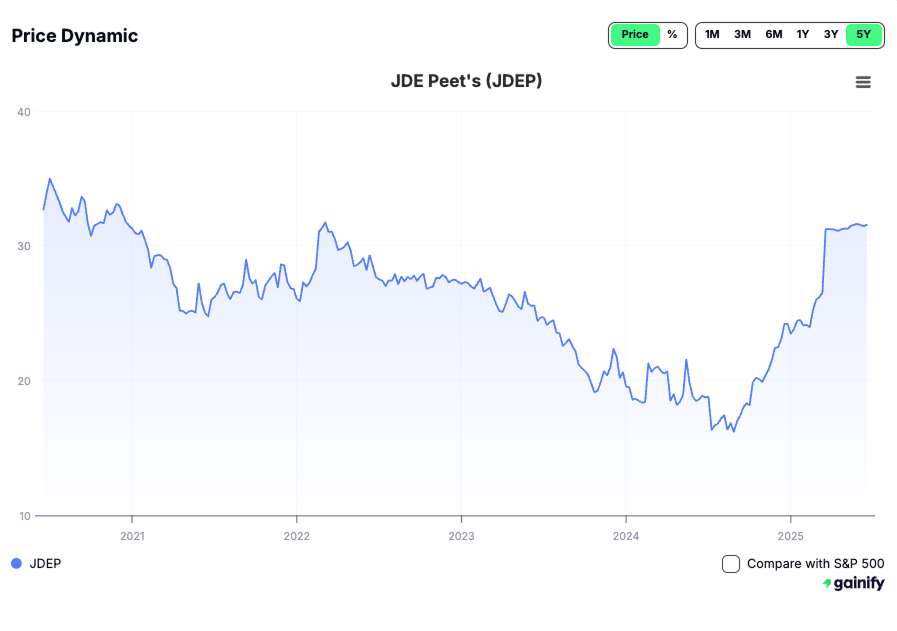

The stock has been relatively stable in 2025, helped by easing input costs and margin recovery.

However, over the past 5 years the stock is still significantly below its IPO levels, pressured by slower European consumer demand and earlier commodity inflation.

Key Dynamics Shaping the Story

- Margin recovery is the biggest driver, as coffee bean inflation cools.

- Consumer demand in Europe remains soft, limiting volume growth.

- Premium products (capsules, beans) continue to outperform mixes like instant.

- Management is pushing productivity and cost efficiency to protect profitability.

The business is steady and cash-generative, but it’s not currently a high-growth story.

Why Investors Pay Attention

JDE Peet’s offers global scale, diversified brands, and defensive cash flows, making it one of the most stable ways to invest in the coffee theme. At ~16x forward earnings with a solid dividend, it appeals to investors looking for defensive exposure rather than rapid expansion.

4. Keurig Dr Pepper (KDP)

Market Cap: $46.35B

Forward P/E: 17.25x

Dividend Yield: 2.52%

Business Model

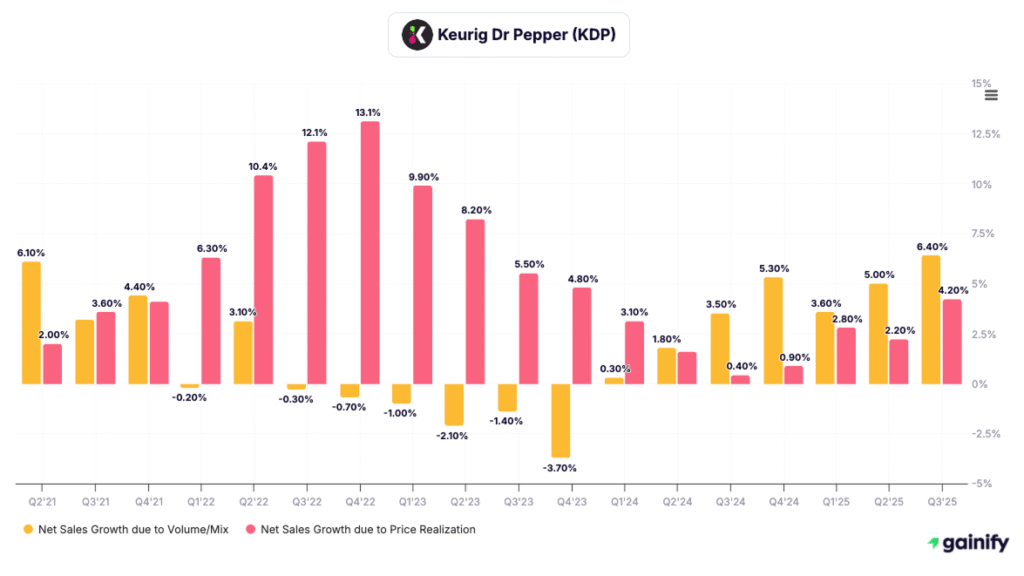

Keurig Dr Pepper operates a hybrid beverage model: one half is a high-margin single-serve coffee system built around Keurig brewers and K-Cup pods, and the other half is a broad cold-beverage portfolio (Dr Pepper, Canada Dry, Snapple, Bai).

For coffee investors, the key engine is the Keurig ecosystem, which monetizes:

- Brewer sales

- Proprietary K-Cup pods

- Licensed pods from major brands (Starbucks, Dunkin’, McCafé)

This is one of the most profitable coffee delivery systems in North America due to recurring pod revenue.

Recent Performance & Stock Behavior

KDP’s stock has been solid and stable through 2025, supported by margin improvement and strong pod consumption. But over a five-year span, performance is still muted compared to broader beverage peers due to slower brewer growth.

Q3 2025 highlights:

- Pod revenue up on better household attachment and premium mix

- Operating income improved as inflationary pressures eased

- Brewer sell-in softened, but pod consumption remained resilient

- Cash flow strengthened, giving management room for buybacks and dividends

The story remains consistent: strong recurring pod economics but slower brewer growth holds back overall momentum.

Key Dynamics Driving the Investment Case

- Single-serve coffee remains sticky with high repeat rates

- Pod pricing and premium SKUs lift margins

- Cold beverages provide diversification and scale benefits

- Cash generation supports shareholder returns

The risk is that brewer adoption has matured in the US, limiting long-term unit growth.

Why Investors Care

KDP offers defensive growth, predictable cash flows, and one of the most durable at-home coffee ecosystems on the market. It is not a hyper-growth story, but its combination of recurring revenue, brand partnerships, and margin stability makes it a reliable compounder at a reasonable valuation.

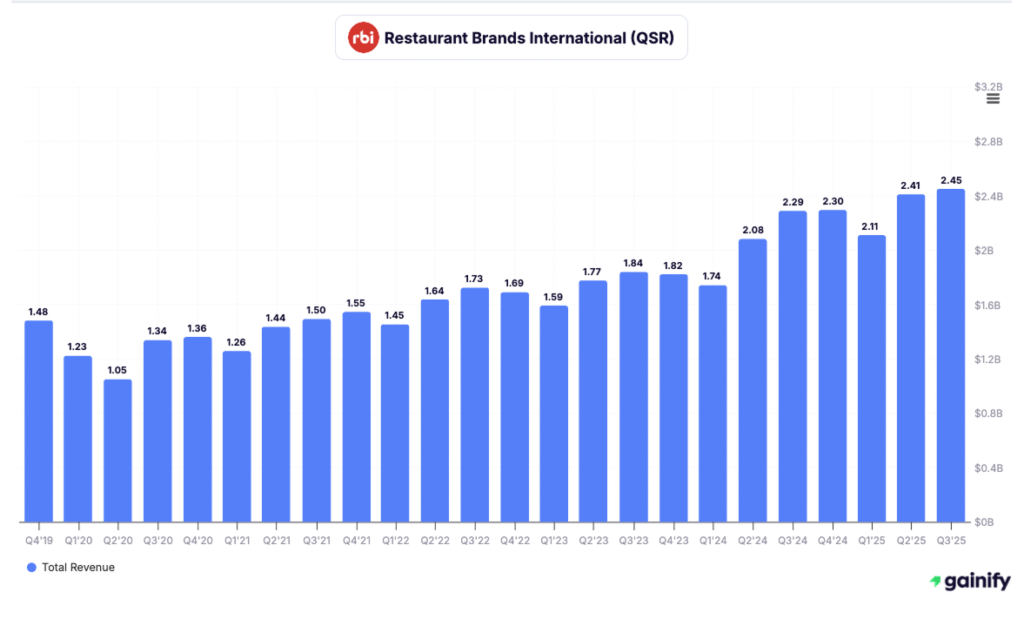

5. Restaurant Brands International (QSR)

Market Cap: $23.5B

Forward P/E: 17.87x

Dividend Yield: 3.29%

Business Model

Restaurant Brands International operates one of the largest global quick-service portfolios through four franchise-driven brands:

- Tim Hortons (coffee and baked goods)

- Burger King

- Popeyes

- Firehouse Subs

For coffee investors, the crown jewel is Tim Hortons, a dominant Canadian brand with powerful breakfast traffic, an entrenched loyalty program, and an expanding global footprint. QSR’s fully franchised model keeps capital intensity low and cash conversion high.

Recent Performance & Stock Behavior

QSR has been a steadier performer than many pure-play retail coffee chains in 2025, supported by strong franchise royalties and improving profitability across Burger King and Tim Hortons.

Over a five-year horizon, the stock is roughly flat, reflecting both operational resets at Burger King and uneven international growth.

Recent results show:

- Tim Hortons posted mid-single-digit systemwide sales growth, driven by beverages and breakfast

- Margin expansion across the portfolio as remodel programs, digital upgrades, and pricing take hold

- Cash flow remains strong due to the asset-light franchise model

- International markets continue to drive most of the incremental unit growth

The business is more stable than most restaurant peers, but not immune to consumer-spending cycles.

Key Dynamics Driving the Investment Case

- Tim Hortons is one of the most defensible coffee brands in North America

- Franchising keeps volatility low and returns high

- Digital engagement and loyalty are meaningful contributors to frequency

- Burger King’s turnaround progress remains a swing factor for sentiment

The risk is that growth depends heavily on execution across multiple brands, and some banners still lag industry leaders.

Why Investors Pay Attention

QSR offers income, stability, and global scale, with coffee exposure through Tim Hortons and strong free-cash-flow support from franchising. It will not deliver the growth of Dutch Bros or Starbucks, but its combination of royalty-driven earnings, dividend yield, and brand diversification makes it a high-quality defensive holding within the broader coffee ecosystem.

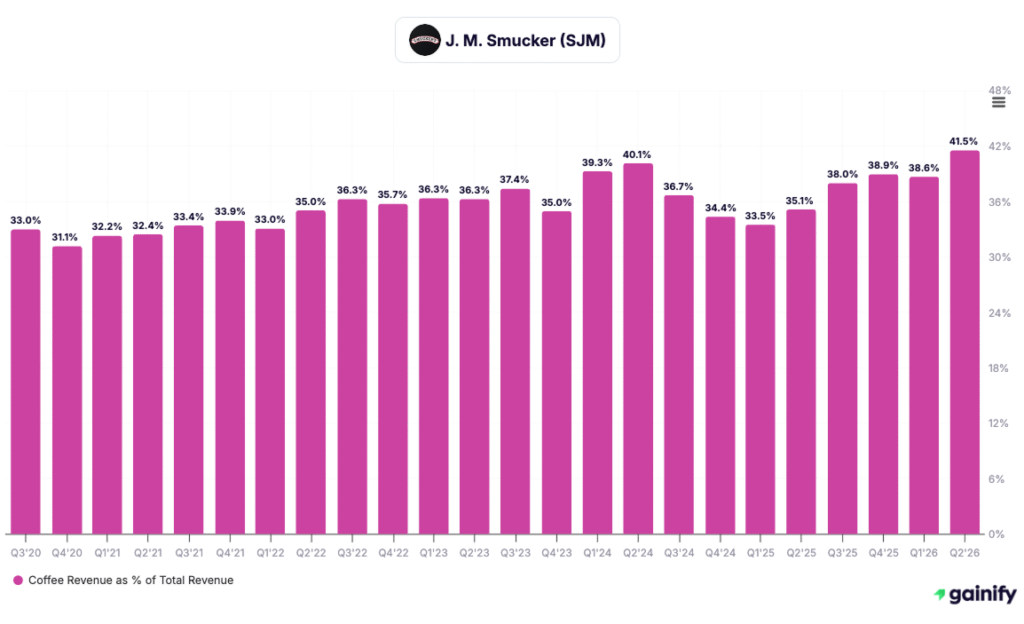

6. J.M. Smucker (SJM)

Market Cap: $12.1B

Forward P/E: 13.54x

Dividend Yield: 3.84%

Business Model

Smucker is primarily a consumer packaged goods (CPG) company, but its coffee portfolio is one of its most important businesses. Through its long-term partnership with Keurig, Smucker owns several of the highest-volume at-home coffee brands in the United States:

- Folgers (market leader)

- Dunkin’ at-home coffee

- Café Bustelo (fastest-growing Latin coffee brand in the U.S.)

- 1850 Coffee

This model monetizes brand equity, retail shelf space, distribution efficiency, and scale contracting, making it one of the most stable and cash-generative ways to invest in coffee.

Recent Performance & Stock Behavior

Smucker’s stock has been flat to slightly negative over the past five years, reflecting mixed performance across some of its legacy food categories. Coffee, however, remains one of the company’s most resilient and profitable segments.

Recent results show:

- Coffee volumes improving after two years of pricing-led declines

- Café Bustelo continuing double-digit growth, driven by Hispanic-market penetration

- Dunkin’ retail coffee stable with strong brand recognition

- Gross margin expansion due to easing input costs and optimized pricing

- Solid cash generation supporting dividends and debt reduction after the Hostess acquisition

The coffee segment remains an anchor of profitability and a buffer during softer periods in other categories.

Key Dynamics Driving the Investment Case

- Folgers remains a top household brand with unmatched penetration

- Café Bustelo is a structural growth driver with demographic tailwinds

- The Keurig ecosystem enhances distribution and recurring revenue

- Coffee offers higher-margin, more stable growth than many of Smucker’s food categories

Main risks include slow overall company revenue growth and competition in the value and premium coffee tiers.

Why Investors Pay Attention

SJM is a high-quality defensive coffee play. It lacks the headline excitement of Starbucks or Dutch Bros, but its brand durability, stable retail demand, and reliable free-cash-flow generation make it a compelling income name for long-term investors. Coffee is one of Smucker’s strongest business lines, and it remains the primary engine supporting both margins and dividends.

7. Nestlé (NESN)

Market Cap: $294.0B

Forward P/E: 19.70x

Dividend Yield: 3.24%

Business Model

Nestlé is the largest coffee company in the world, owning the most global and diversified portfolio in the category. Its scale is unmatched. Coffee sits at the center of its high-margin strategic segments through:

- Nescafé (world’s top instant-coffee brand)

- Nespresso (premium single-serve espresso)

- Starbucks at-home products through the Global Coffee Alliance

- Dolce Gusto machines and capsules

This model blends brand power, global distribution, premiumization, and recurring single-serve consumption, turning coffee into one of Nestlé’s most durable growth engines.

Recent Performance & Stock Behavior

Nestlé has been a steady compounder for decades, but its stock has been more muted in the last five years due to slower growth in packaged foods. Coffee, however, continues to outperform the corporate average and remains one of Nestlé’s brightest businesses.

Recent performance highlights:

- Nespresso posted mid-single-digit organic growth, with strong momentum in Europe and the U.S.

- Starbucks at-home portfolio expanded, gaining market share in North America

- Nescafé delivered solid emerging-market growth, especially in Asia and Latin America

- Margins improved as supply-chain pressures eased

Coffee remains one of the highest-margin categories within Nestlé’s entire portfolio.

Key Dynamics Driving the Investment Case

- Nespresso’s premium model has pricing power and strong customer retention

- Nescafé gives Nestlé deep EM penetration and defensive cash flow

- The Starbucks partnership is a strategic moat unmatched by any other packaged-goods competitor

- Coffee is a core category in Nestlé’s long-term strategy, consistently delivering above-company-average returns

The main risks include slower growth in legacy food categories and FX volatility in emerging markets.

Why Investors Pay Attention

Nestlé is the anchor stock for global coffee exposure. Its unmatched brand scale, premium espresso franchise, and diversified geographic footprint make it the largest and most stable coffee platform in the world. For investors seeking global diversification, defensive earnings, and category leadership, Nestlé remains the most complete coffee-stock holding.

The Business Models Behind Coffee Stocks

Publicly traded coffee companies generally operate under three distinct business models, each with its own economics, risk profile, and growth drivers. Understanding which one you are buying is critical before evaluating any coffee stock.

1. Global Retail Coffee Chains

These companies earn revenue through storefront traffic, beverage innovation, loyalty ecosystems, and premium brand positioning.

- High operating leverage as store volumes grow

- Recurring revenue driven by daily consumer habits

- Strong pricing power and customer loyalty

Examples: Starbucks (SBUX), Dutch Bros (BROS)

Retail chains thrive when same-store sales rise and new-store development remains disciplined.

2. Consumer Packaged Goods Coffee (CPG)

These companies sell coffee brands through supermarkets, online channels, and foodservice partners. Their value comes from scale, distribution reach, and brand portfolios.

- Higher margins than retail

- Lower capital intensity

- Globally diversified revenue streams

Examples: JDE Peet’s (JDEP), Keurig Dr Pepper (KDP), Smucker (SJM), Nestlé (NESN)

CPG leaders win through manufacturing efficiency, category share gains, and pricing power at retail.

3. Franchise-Driven Restaurant Groups

Coffee is part of a broader quick-service portfolio, generating royalty-based income rather than store-level profits.

- Stable royalty revenue

- Asset-light business model

- Lower operational risk

Example: Restaurant Brands International (QSR)

These companies benefit from coffee as a traffic driver within larger menu ecosystems.

Final Takeaway

Coffee stocks such as Starbucks, Dutch Bros, JDE Peet’s, Keurig Dr Pepper, Smucker, Nestlé, and Restaurant Brands International have begun to recover after a difficult five-year stretch marked by inflation, higher input costs, and slowing traffic growth. The recent rebound reflects stabilizing margins, better cost discipline, and renewed demand across key markets.

Even so, the sector remains a mix of growth stories and value opportunities. Retail chains are still rebuilding momentum, while CPG-focused companies benefit from stronger margins and global distribution scale. Taken together, coffee remains one of the most durable consumer categories, supported by habit, brand loyalty, and recurring demand.

For long-term investors, combining retail and CPG exposure offers a resilient and diversified way to participate in the global coffee market.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult a licensed financial professional before making investment decisions.