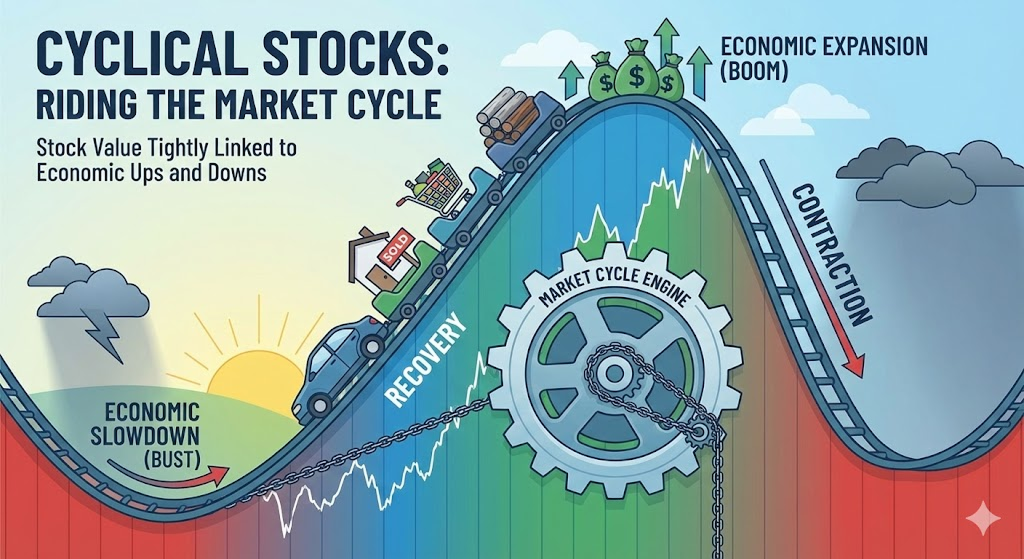

Some stocks rise sharply when the economy gains momentum and fall just as quickly when conditions soften. Others barely move at all.

This difference is not random. It reflects how certain companies are directly linked to the forces that shape consumer spending, corporate investment, industrial production, and credit demand.

These highly sensitive companies are known as cyclical stocks, and understanding them is one of the most useful tools for building portfolios that benefit from economic recoveries and avoid unnecessary downside risk.

Before defining them formally, it helps to understand the traits that make them move the way they do.

Highlights

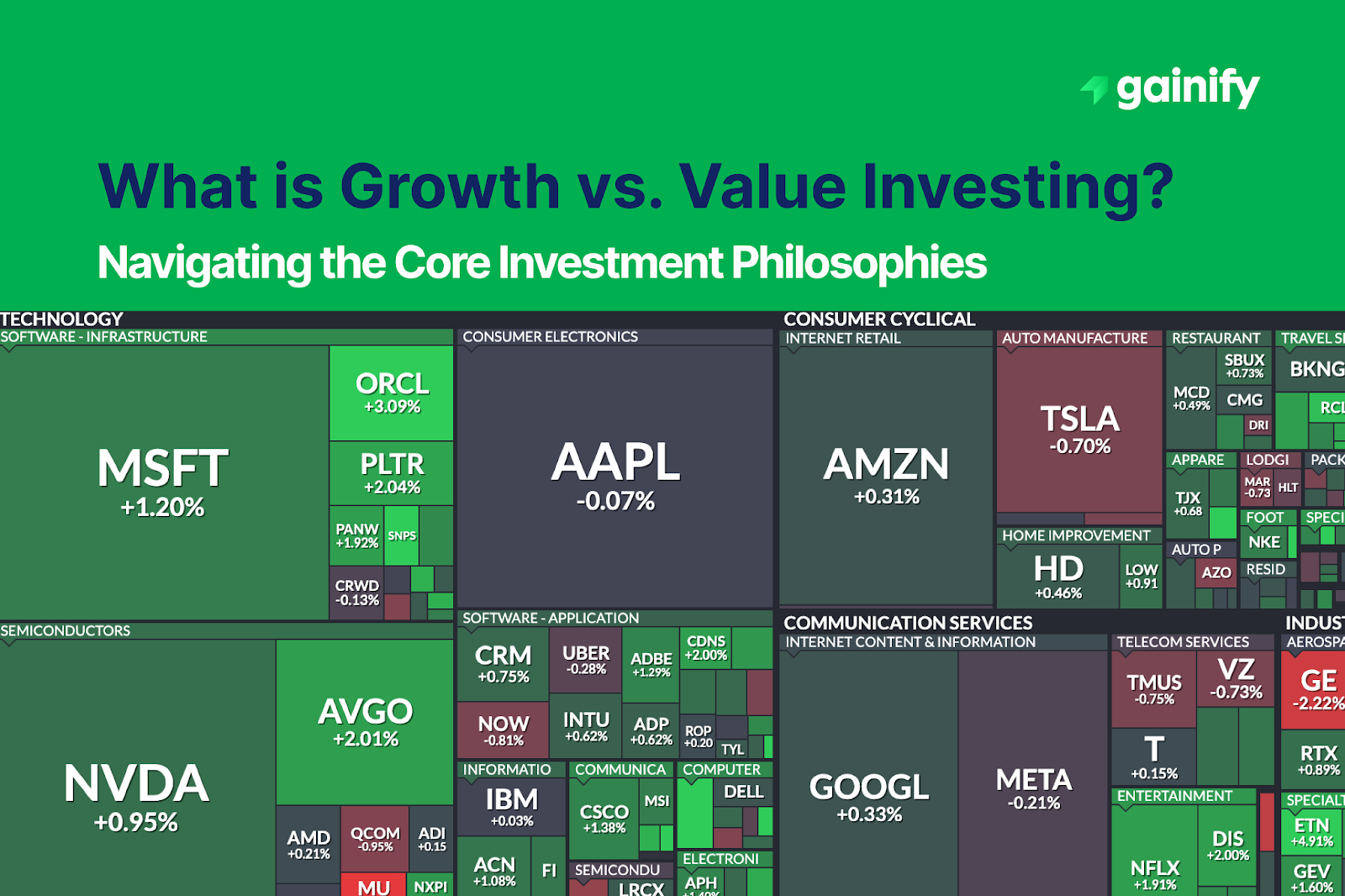

- Cyclical stocks rise and fall with changes in economic activity

- Key sectors include consumer discretionary, industrials, financials, materials, and parts of technology

- They outperform during recoveries and early expansions, and lag during recessions

What Exactly Are Cyclical Stocks?

Cyclical stocks are companies whose revenue, margins, and cash flows move in direct alignment with the economic cycle:

- When growth is strong, these companies typically see rising demand and expanding profitability.

- When the economy weakens, their earnings contract more quickly than those of defensive companies.

A SIMPLE DEFINITION: Cyclical stocks are businesses whose financial performance depends heavily on the strength of the overall economy.

Their sensitivity comes from the fact that their customers spend more in good times and pull back in slowdowns, which affects top-line growth, operating leverage, and ultimately valuation.

Key Characteristics of Cyclical Stocks

Cyclical stocks tend to share several core traits, regardless of industry:

- Revenue tied to macro conditions: when employment, income, or business sentiment improves, demand rises rapidly. When confidence fades, demand falls just as quickly.

- Profit margins that expand in upcycles: cyclicals often carry operating leverage. As volumes rise, costs grow more slowly than revenue, which boosts earnings.

- Meaningful valuation swings: because investors anticipate future conditions, valuation multiples expand early in a recovery and contract before a slowdown is fully visible in the data.

- Performance leadership at economic turning points: cyclical stocks often move ahead of the economic cycle itself because markets price changes in growth before they appear in official data.

Together, these characteristics explain both the upside potential and the inherent risks associated with cyclicals.

Major Types of Cyclical Stocks

Category | What Drives It | Description | Examples |

Consumer Cyclicals | Household income and confidence | Companies tied to discretionary spending such as retail, travel, dining, and autos. Demand rises when consumers feel financially secure. | |

Industrial Cyclicals | Manufacturing activity and capital investment | Businesses that depend on construction, logistics, aviation, and equipment spending. Earnings rise with industrial production. | |

Financial Cyclicals | Credit creation and economic activity | Banks and lenders that benefit from higher loan demand, strong credit quality, and increased consumer/business activity. | |

Commodities and Materials | Global supply and demand cycles | Producers of metals, energy, chemicals, and agricultural inputs. Highly sensitive to industrial growth and commodity prices. | |

Technology Cyclicals | Capital expenditure cycles and device demand | Hardware, semiconductor, and infrastructure tech companies tied to enterprise spending and upgrade cycles. |

Cyclical Stocks vs Defensive Stocks

Understanding cyclical stocks becomes easier when you compare them directly with defensive stocks. The two behave very differently across the economic cycle.

Cyclical stocks rise and fall with the economy. Their earnings accelerate when growth improves and contract when conditions weaken. These companies depend heavily on consumer confidence, business investment, credit availability, and industrial activity.

Defensive stocks move far less. Their products and services remain essential regardless of the environment. Demand is steady, margins hold up, and cash flows remain predictable through good and bad periods.

The tradeoff is simple:

- Cyclicals offer higher upside but come with higher volatility.

- Defensives offer stability but typically deliver smaller swings in returns.

Examples of defensive sectors include healthcare, utilities, and consumer staples, where spending tends to hold firm even in recessions.

In practice, investors use cyclical stocks to capture economic expansion and defensive stocks to protect portfolios during slower periods. A balanced long-term strategy blends both, adjusting exposure based on where the economy is in the cycle.

Why Cyclical Stocks Matter for Investors

Cyclical stocks are essential in active portfolio construction because they offer amplified exposure to the economic cycle. When the economy turns upward, these companies typically recover earlier, grow revenues faster, and expand margins more aggressively than defensive names. This creates outsized return potential at the start of each new cycle.

Professional investors rotate into cyclicals when forward conditions begin to improve. The signal set often includes:

- Monetary easing that lowers borrowing costs and stimulates spending

- Strengthening employment trends that boost household confidence

- Rising manufacturing output that signals improving industrial demand

- Reaccelerating consumer spending in discretionary categories

- Healthier credit conditions that support lending and business investment

Because earnings react more quickly to improving fundamentals, cyclical stocks are often the first group to lead markets higher when a recovery begins. For investors who monitor macro trends and allocate proactively, cyclicals can be a powerful driver of excess returns.

How Professionals Evaluate Cyclical Stocks

Evaluating cyclical stocks requires a structured approach that blends macro analysis with company-level fundamentals. Institutional investors focus on a small set of high-signal metrics that reveal how a business performs across the full economic cycle. Below is the distilled framework used across hedge funds, long-only managers and macro-aware equity teams.

Step 1: Map the Economic Cycle

The first question is always macro: Is the economy accelerating, decelerating or at an inflection point?

Cyclicals react sharply to changes in growth, credit, employment and rates. A correct read on the cycle often matters more than company-level detail. This sets the baseline for expectations around revenue, margins and valuation.

Step 2: Assess Revenue Sensitivity

The core variable is how tightly the company’s top line is tied to macro demand.

High-sensitivity sectors react immediately to the cycle (autos, airlines, semis). Lower-sensitivity cyclicals move with a lag (select industrials, financials).

Professionals look for businesses that either consistently outgrow their end markets or maintain share as conditions tighten.

Step 3: Measure Margin Leverage

Earnings power in cyclicals comes from operating leverage. Investors analyze:

- How margins move when revenue rises

- Whether cost structures are flexible or rigid

- Which segments drive margin expansion

Companies that convert incremental revenue into outsized earnings tend to outperform every cycle.

Step 4: Evaluate Cash Flow Durability

Cash flow quality determines who survives downturns and who thrives in recoveries.

Key questions:

- Does the business stay cash-flow positive in weak environments?

- Does working capital balloon when demand softens?

- Can management continue investing through the cycle?

Resilient FCF separates true compounders from fragile cyclicals that only work at the top.

Step 5: Test Balance Sheet Strength

Cyclicals with weak balance sheets often become forced sellers at the worst possible time.

Professionals analyze:

- Leverage

- Liquidity runway

- Debt maturities

- Interest-coverage ratios

A strong balance sheet is a strategic asset in this category.

Step 6: Anchor Valuation to the Cycle

Cyclical valuation cannot be evaluated on a single-year multiple. Earnings at peaks are inflated; earnings at troughs are depressed.

Institutional investors apply:

- Mid-cycle earnings

- Through-cycle free cash flow

- Normalized margins

This prevents buying “cheap at the top” and selling “expensive at the bottom.”

Should You Invest in Cyclical Stocks?

Cyclical stocks are powerful tools, but they require timing, discipline, and an understanding of macro dynamics. They tend to outperform when growth is accelerating, confidence is rising, and credit conditions are improving. They lag when the economy slows or visibility weakens.

The right approach is not “all in” or “avoid entirely.” Investors should size cyclical exposure according to risk tolerance, economic outlook, and portfolio objectives. Over full cycles, combining high-quality cyclicals with defensive stocks often produces superior risk-adjusted returns, smoothing volatility without sacrificing long-term upside.

Final Take: Why Cyclical Stocks Deserve Attention

Cyclical stocks give investors something defensives rarely provide: the ability to capture outsized gains when economic conditions turn upward. Their earnings expand faster, their valuations re-rate earlier, and their recoveries tend to lead the broader market.

Success is not about predicting every cycle perfectly. It is about owning resilient, well-positioned businesses that can absorb downturns and fully participate in expansions. Investors who understand these dynamics gain a structural advantage in constructing portfolios that perform across market environments.