Regional banks have spent two years under a cloud from unrealized losses on securities accumulated in the low-rate era. Those mark-to-market hits pressured confidence and multiples.

The backdrop is changing. With rates already drifting lower and the path biased to further cuts, those losses shrink on their own, deposit costs ease, and investors can refocus on core earnings power and book value.

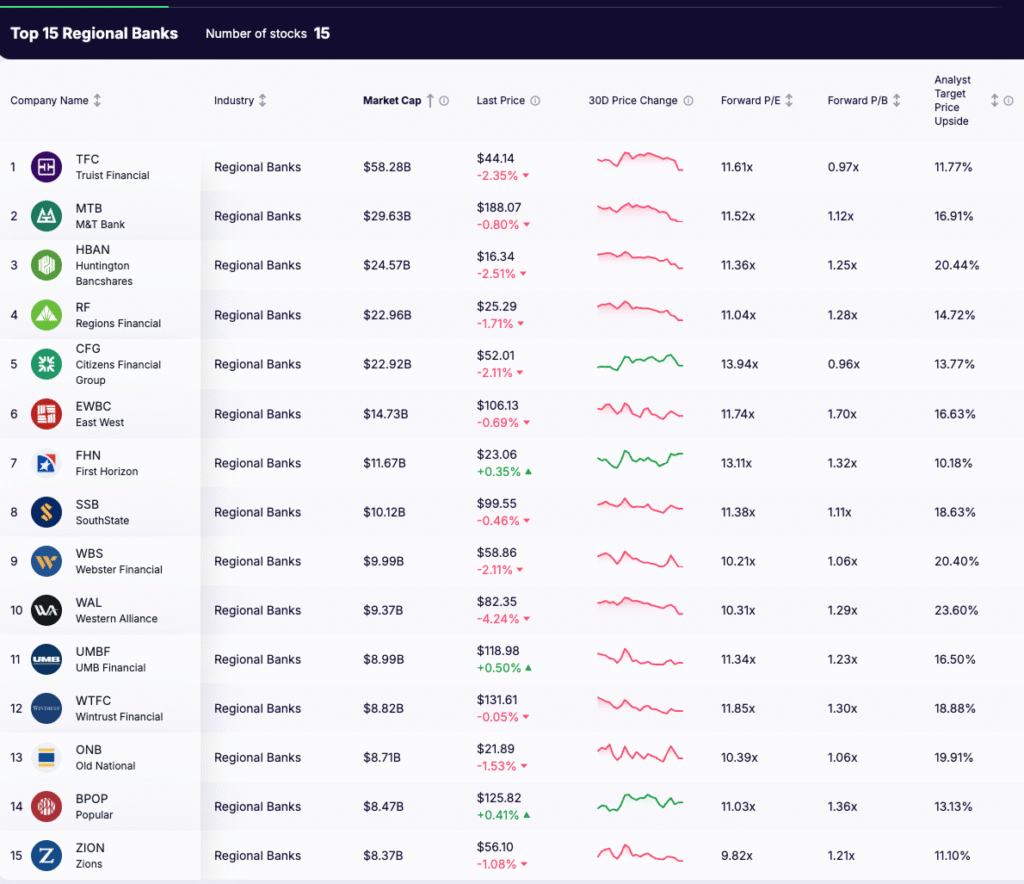

Below is a clean valuation snapshot of the top 15 U.S. regional banks by market cap from your screen. Use it to spot relative value and where the market is still pricing in caution.

Valuation Snapshot: Top 15 Regional Banks (Oct 2025)

# | Company | Ticker | Market Cap | Last Price | Fwd P/E | Fwd P/B | Analyst Upside |

1 | $58.28B | $44.14 | 11.61x | 0.97x | 11.77% | ||

2 | $29.63B | $188.07 | 11.52x | 1.12x | 16.91% | ||

3 | $24.57B | $16.34 | 11.36x | 1.25x | 20.44% | ||

4 | $22.96B | $25.29 | 11.04x | 1.28x | 14.72% | ||

5 | $22.92B | $52.01 | 13.94x | 0.96x | 13.77% | ||

6 | $14.73B | $106.13 | 11.74x | 1.70x | 16.63% | ||

7 | $11.67B | $23.06 | 13.11x | 1.32x | 10.18% | ||

8 | $10.12B | $99.55 | 11.38x | 1.11x | 18.63% | ||

9 | $9.99B | $58.86 | 10.21x | 1.06x | 20.40% | ||

10 | $9.37B | $82.35 | 10.31x | 1.29x | 23.60% | ||

11 | $8.99B | $118.98 | 11.34x | 1.23x | 16.50% | ||

12 | $8.82B | $131.61 | 11.85x | 1.30x | 18.88% | ||

13 | $8.71B | $21.89 | 10.39x | 1.06x | 19.91% | ||

14 | $8.47B | $125.82 | 11.03x | 1.36x | 13.13% | ||

15 | $8.37B | $56.10 | 9.82x | 1.21x | 11.10% |

How the Top 15 Regional Banks Stack Up on Valuation

Looking across the group, several clear patterns emerge:

1. Valuations are tightly clustered.

- Forward P/E ratios mostly sit between 10x and 12x.

- Price-to-book values fall in a narrow band from just under 1.0x to about 1.3x.

- This shows that, despite differences in size and footprint, the market is pricing these banks as a relatively uniform group.

2. Below-book names hint at re-rating potential.

- Truist Financial (TFC) and Citizens Financial Group (CFG) both trade below book value (0.96–0.97x P/B).

- If credit conditions remain stable and unrealized losses shrink as interest rates fall, these could see a catch-up in valuation multiples.

3. Premium valuations signal perceived quality.

- East West Bancorp (EWBC) stands out at 1.70x P/B, far above peers. Investors reward its strong profitability and balance sheet.

- Smaller premiums at Popular (BPOP) and First Horizon (FHN) reflect niche strengths and resilience.

4. The lowest earnings multiples come with caution.

- Zions Bancorporation (ZION, 9.8x P/E) and Western Alliance (WAL, 10.3x P/E) trade at discounts, tied to funding and credit risk concerns.

- By contrast, Citizens Financial (13.9x P/E) and First Horizon (13.1x P/E) command higher earnings multiples, suggesting expectations for improvement.

5. Analyst targets suggest selective upside.

- Most banks show mid-teens upside potential based on Street targets.

- The most optimistic forecasts are for Western Alliance (23.6%), Huntington Bancshares (20.4%), Webster Financial (20.4%), and Old National (19.9%).

- Even in a sector where multiples are compressed, analysts see room for recovery in select names.

Why Unrealized Losses Matter Less Now

Falling yields ease the pressure.

As interest rates decline, the value of banks’ fixed-income holdings rises. The mark-to-market losses that dominated 2023 and 2024 begin to reverse naturally.

Funding costs stabilize.

Deposit costs, which surged during the rate shock, are cresting. As wholesale funding rolls over at lower rates, net interest margins start to firm.

From securities marks back to fundamentals.

For two years, unrealized losses on bond portfolios overshadowed everything else. Several regional failures – Silicon Valley Bank, Signature Bank, and First Republic – were triggered by mismatched balance sheets and confidence shocks. With rates easing, those risks fade, allowing the investment conversation to return to credit quality, loan growth, and capital return.

Credit remains the key variable.

Lower yields relieve one burden, but they do not erase the credit cycle. Office CRE stress, rising consumer delinquencies, and regional loan concentrations must still be watched closely. These factors will decide which banks can close the valuation gap and which may struggle despite friendlier rate conditions.

Key Risks to Watch

- Credit deterioration: Office CRE remains vulnerable, and consumer delinquencies in credit cards and autos are rising. A deeper downturn could quickly erode capital buffers.

- Deposit competition: While funding costs are easing, any renewed deposit flight would pressure net interest margins and confidence.

- Regulatory pressure: Post-2023 failures brought tighter scrutiny on liquidity and capital. New rules could weigh on profitability.

- Regional concentration: Banks with heavy exposure to specific geographies or industries face outsized risks if local economies slow.

- Market sentiment: The memory of recent bankruptcies means sentiment can turn sharply if headlines reignite fears, even if fundamentals are intact.

Conclusion: From Repair to Recovery

Regional banks are leaving behind the drag of unrealized losses. With yields falling and funding costs stabilizing, valuations are beginning to matter again.

Across the top 15 names, valuations are tightly clustered. Forward P/E ratios sit mostly between 10x and 12x, while price-to-book values range from just under 1.0x to about 1.3x. The market is treating the group as a uniform bloc, despite differences in size and strategy.

Opportunities exist at both ends of the spectrum. Below-book names such as Truist and Citizens Financial could see re-rating potential if credit quality holds steady. At the other end, premium valuations at East West Bancorp, Popular, and First Horizon reflect investor confidence in profitability and resilience. Low-multiple banks like Zions and Western Alliance appear cheap, but the discounts signal credit and funding risks.

Analyst targets suggest selective upside, with most banks showing mid-teens potential. Western Alliance, Huntington, Webster, and Old National stand out with the strongest projected gains.

The sector’s path forward will be shaped by credit outcomes, particularly in commercial real estate and consumer lending. If credit stress remains contained, 2025 could mark the shift from repair to recovery. For investors, the key is careful stock selection, not broad exposure.