Pat Dorsey has earned a reputation as one of the most disciplined and intellectually rigorous investors of his generation. Best known for bringing the concept of economic moats into mainstream financial analysis, Dorsey’s work has reshaped how investors evaluate competitive advantages and long-term wealth creation. His years as Director of Equity Research at Morningstar made him a household name in professional investing circles, where he led a team dedicated to identifying companies with sustainable advantages. But his greatest contribution was taking an abstract idea that certain businesses can defend their profits against competition and turning it into a practical, research-driven framework that individual investors and institutions alike could apply.

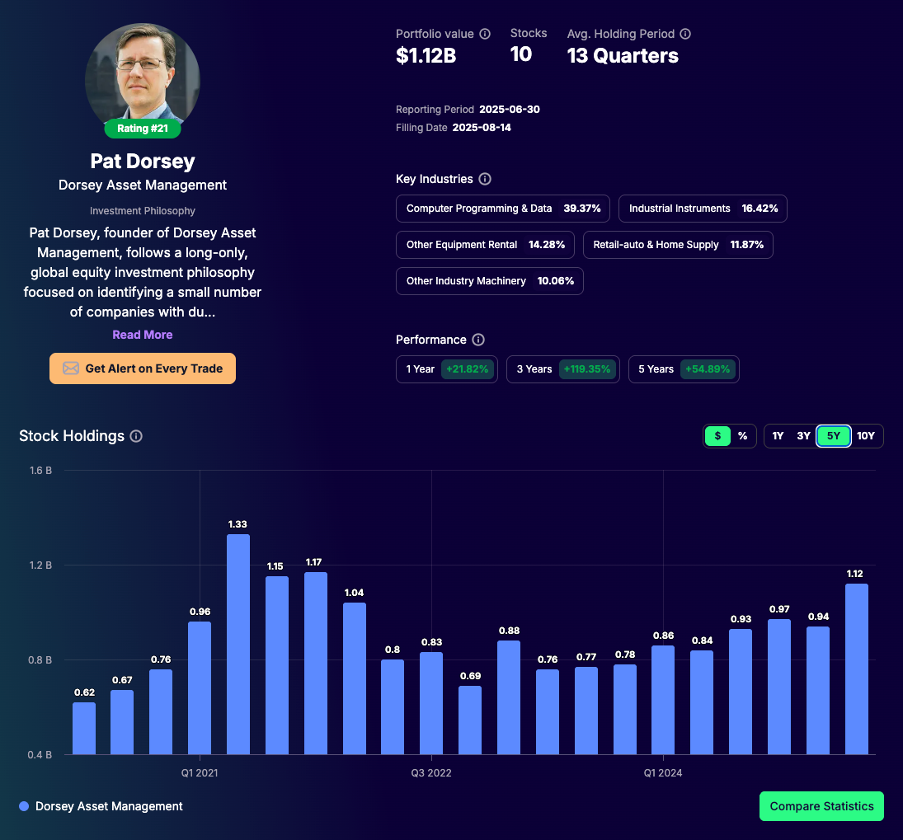

In 2014, Dorsey founded Dorsey Asset Management, a concentrated, long-only equity fund based in Chicago. Unlike many asset managers chasing dozens or even hundreds of names, Dorsey built his practice around focus and conviction. His fund typically owns only 10 to 15 companies at a time, believing that true outperformance comes not from diversification but from deep understanding of a select group of exceptional businesses. Today, the firm manages roughly $1.1 billion in assets, serving family offices, institutions, and high-net-worth clients.

Dorsey’s intellectual foundation rests on two books he authored: “The Five Rules for Successful Stock Investing” (2004), which remains a practical guide to evaluating businesses and avoiding pitfalls, and “The Little Book That Builds Wealth” (2008), which popularized the idea that identifying and holding moat-driven businesses is the surest path to compounding wealth. Together, these books form the blueprint of his philosophy: study businesses deeply, buy with discipline, and allow the power of compounding to work over years or decades.

As of Q2 2025, Dorsey Asset Management oversees a $1.12 billion portfolio concentrated in just 10 holdings. The fund is global in scope but tightly selective, with a bias toward companies that can reinvest capital at high rates of return while defending profits through cost advantages, switching costs, network effects, or scale efficiencies.

This report provides a complete breakdown of Dorsey’s Q2 2025 portfolio, outlines his most recent investment moves, and illustrates how the principles from his books continue to shape his strategy in practice. More than just a snapshot of a fund’s holdings, it offers a window into how one of today’s most thoughtful investors applies the theory of moats in the real world.

Pat Dorsey’s Investment Philosophy in Depth

The core of Pat Dorsey’s philosophy can be traced to the frameworks he laid out in his two influential books. In “The Five Rules for Successful Stock Investing”, he set out a simple but profound roadmap:

- Do your homework — Study businesses, not stock prices. Real analysis comes from cash flow, margins, and competitive dynamics, not ticker symbols.

- Find a moat — Identify what protects profits from competition. A business without a moat is a commodity.

- Have a margin of safety — Even a great company is a poor investment if bought too expensively. Valuation discipline is non-negotiable.

- Think long term — Wealth compounds over years, not quarters. Patience is an edge.

- Stay rational — Avoiding emotion, fads, and herd mentality is just as important as deep analysis.

His second book, “The Little Book That Builds Wealth”, drilled deeper into the concept of economic moats. Dorsey categorized them into four primary types:

- Intangible assets — patents, regulatory licenses, strong brands.

- Switching costs — barriers for customers to leave (e.g., software embedded into workflows).

- Network effects — the product improves as more people use it (e.g., search engines, social platforms).

- Cost advantages — scale efficiencies or unique processes that lower costs permanently.

Dorsey has argued repeatedly that if you can find a business with a wide moat and management that reinvests intelligently, you don’t need dozens of holdings. Just a handful will do.

How Moats Translate into Portfolio Construction

Dorsey Asset Management’s 10-stock portfolio is not accidental, as it is an embodiment of his philosophy. By keeping the number of positions small, Dorsey ensures that each company must pass a very high bar.

This is in sharp contrast to index funds or closet indexers who might hold hundreds of companies, diluting conviction. For Dorsey, concentration is a feature, not a bug. It allows him to channel research resources into truly understanding businesses, their competitive edges, and their capital allocation choices.

The average holding period of over three years reflects his view that wealth comes from letting moats compound. Turnover is low, not because of inertia, but because once he finds a company with durable advantages, the burden of proof is on selling — not holding.

Recent Portfolio Moves (Q2 2025)

In Q2 2025, Pat Dorsey actively rebalanced his $1.12 billion portfolio, deploying and reallocating capital in ways that reflect his moat-driven philosophy. The following changes highlight where he is concentrating conviction and reducing exposure.

Major Adds and Expansions

- ASML Holding (ASML) – Increased by $49.82M, nearly doubling his stake. ASML’s dominance in semiconductor lithography, especially its EUV machines, makes it irreplaceable and the very definition of a durable intangible asset moat.

- Danaher (DHR) – Expanded by $45.70M. With recurring revenue streams and a strong presence in life sciences, Danaher embodies the type of compounding machine Dorsey favors.

- AerCap Holdings (AER) – Added $24.06M. As the world’s largest aircraft lessor, AerCap benefits from efficient scale and long-term demand in aviation.

- Booking Holdings (BKNG) – Increased by $11.88M. A global leader in online travel, Booking benefits from brand strength and scale advantages.

- Alphabet (GOOG) – Added $3.84M despite already being a core holding. This looks more like a small top-up than a major shift.

- Semrush (SEMR) – A modest increase of $269K, keeping exposure steady in digital marketing tools.

New Buys

- Enovis (ENOV) – A fresh position worth $84.46M, instantly becoming one of Dorsey’s larger holdings. At an average cost of $33.08 per share, this move signals strong conviction in Enovis’s growth in medical technology and orthopedics.

Complete Exits

- PayPal (PYPL) – Sold entire position worth $58.77M at an average of $68.48 per share. While once considered a moat-worthy digital payments leader, competitive pressures may have reduced conviction.

- Sprout Social (SPT) – Fully exited, selling $48.83M at $21.19 per share. As a smaller, lower-conviction holding, Dorsey likely saw better opportunities elsewhere.

Cuts and Reductions

- Wix.com (WIX) – Reduced stake by $27.80M, cutting more than half the position. This sharp reduction suggests concerns over valuation or capital redeployment toward higher-conviction holdings.

- AutoZone (AZO) – Trimmed by $6.92M, a modest 5 percent cut. More tactical than fundamental, likely a rebalancing move.

- Meta Platforms (META) – Reduced by $1.20M, only 0.79 percent of the position. This appears to be minor rebalancing rather than a strategic shift away from Meta.

Summary: Dorsey aggressively deployed over $120M into ASML, Danaher, and AerCap, while initiating a significant new $84M stake in Enovis. These moves were funded by full exits from PayPal and Sprout Social, and by trimming Wix, AutoZone, and Meta. The portfolio remains concentrated in wide-moat businesses, with a clear preference for scale-driven and innovation-heavy companies.

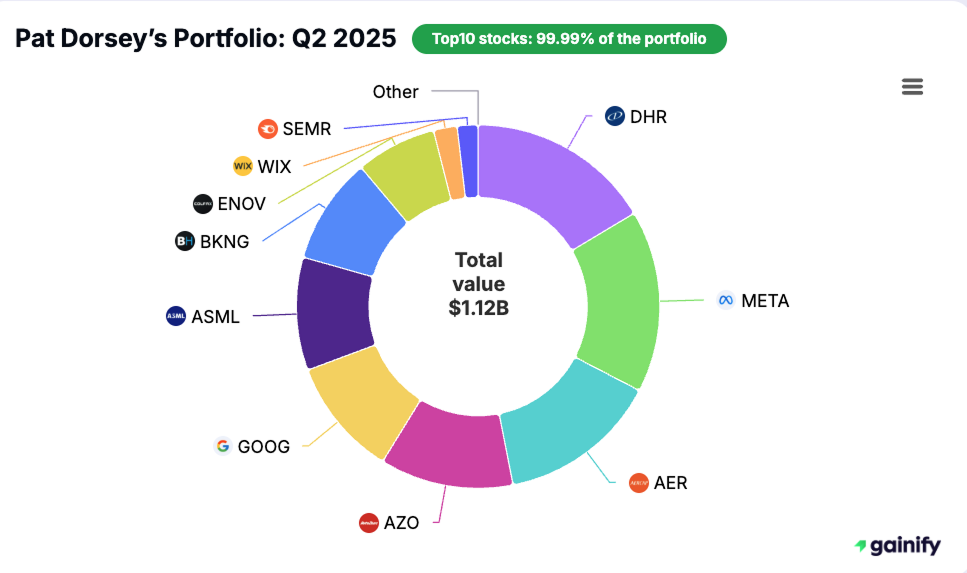

Top 10 Holdings Breakdown (Q2 2025)

Company | Portfolio % | Industry | Moat Description | Key Notes |

Danaher (DHR) | 16.42% | Industrial & Life Sciences | Intangible assets, switching costs, recurring revenues | Classic “compounding machine.” |

Meta Platforms (META) | 16.22% | Social Media & Digital Advertising | Network effects with billions of users and advertisers | Global digital ad leader. |

AerCap Holdings (AER) | 14.28% | Aircraft Leasing | Efficient scale in capital-intensive industry | Largest aircraft lessor worldwide. |

AutoZone (AZO) | 11.87% | Automotive Parts Retail | Cost advantages from distribution and scale | Defensive retail exposure. |

Alphabet (GOOG) | 10.53% | Internet Services & Cloud | Network effects in search, cloud scale, advertising dominance | Parent of Google & YouTube. |

ASML (ASML) | 10.06% | Semiconductor Equipment | Technological leadership, patents, and irreplaceability in EUV lithography | Core semiconductor moat. |

Booking Holdings (BKNG) | 9.49% | Online Travel Services | Network effects between hotels, airlines, and travelers | Strong brand in global travel. |

Enovis (ENOV) | 7.18% | Orthopedic & Healthcare Equipment | Intangible assets, specialized product integration | New position, high conviction. |

Wix.com (WIX) | 2.09% | Website-Building SaaS | Switching costs, recurring SaaS subscription model | Trimmed, still niche leader. |

Semrush (SEMR) | 1.85% | Digital Marketing SaaS | Niche SaaS, recurring revenue, growing adoption | Modest but stable position. |

Lessons for Investors

Pat Dorsey’s investment philosophy has remained consistent across his writings, research, and now his billion-dollar portfolio. His approach provides timeless lessons for individual and institutional investors alike:

- Focus Relentlessly on Moats

Companies with durable competitive advantages, whether built on intangible assets, switching costs, network effects, or efficient scale, have the best odds of compounding wealth over decades. Identifying and holding these rare businesses is the foundation of Dorsey’s strategy. - Concentration Beats Over-Diversification

Dorsey’s portfolio of only ten stocks, representing more than $1.1 billion, demonstrates that spreading capital too widely can dilute returns. A focused portfolio of high-conviction holdings often delivers superior results compared to a basket of mediocre names. - Think in Decades, Not Quarters

Compounding requires patience. Dorsey’s willingness to hold core positions such as Meta, Alphabet, and Danaher for more than 30 quarters illustrates his belief that time is the most powerful ally of an investor who owns great businesses. - Maintain Valuation Discipline

Even the strongest moat cannot justify paying any price. Dorsey trims or exits positions when valuations stretch too far or when capital can be better deployed elsewhere. Valuation discipline protects against overpaying for quality. - Cut and Redeploy When Needed

Exits from PayPal and Sprout Social in Q2 2025 show that Dorsey is willing to move on when a position no longer fits his framework. Redeploying capital into higher-conviction names such as ASML and Enovis reflects an active commitment to portfolio quality.

Together, these lessons remind investors that true advantage comes not from prediction but from process, a repeatable framework for finding, valuing, and holding exceptional businesses.

Conclusion

Pat Dorsey has long argued that investing is not about chasing the latest market trend but about owning enduring businesses with structural advantages. His Q2 2025 portfolio, valued at $1.12 billion and concentrated in just ten holdings, is a real-world demonstration of that principle.

The portfolio highlights several enduring themes:

- Wide-moat companies dominate, from ASML’s technological leadership to Danaher’s recurring revenue model.

- Discipline is visible in both the trims (Wix, AutoZone, Meta) and the exits (PayPal, Sprout Social).

- Patience is rewarded through long-term holdings such as Meta and Alphabet, which have been in the portfolio for more than 30 quarters.

For investors navigating noisy markets, Dorsey’s blueprint is refreshingly clear:

- Identify companies with sustainable moats.

- Buy them at prices that allow room for compounding.

- Hold patiently through market cycles.

- Reallocate decisively when better opportunities appear.

Ultimately, Dorsey’s portfolio shows that wealth creation is less about timing and more about owning a small number of exceptional businesses, managed with discipline and patience. In a world of constant distraction, his philosophy underscores the timeless power of focus and simplicity.