The world of digital entertainment has grown into a massive industry, attracting a lot of money and attention. For smart investors, video game stocks offer exciting possibilities. Gaming is no longer just about playing games; it’s a huge part of our culture, connects people, and drives new ideas and economic growth. The whole world of digital fun keeps getting bigger.

We are entering a new phase in gaming. From advanced virtual reality to the huge boom in online gaming and mobile apps, the industry is always coming up with new things. This lively environment provides a unique chance to invest, promising good returns if you understand how it works. However, like any growing market, it also has its own challenges that need careful thought.

Many people know how big the video game market is. Experts predict that the global video game market, valued at $298.98 billion in 2024, will hit an amazing $600.74 billion by 2030. This means it will grow by about 12.2% each year from 2025 to 2030. This strong growth is fueled by people constantly wanting more immersive digital entertainment, interactive experiences, and the ever-growing reach of gaming-related products across different ages and platforms.

This article, “The Pixel Fortune Navigator,” is your complete guide to understanding video game stocks. We will explore what’s driving this growth, identify the major companies, and show you how to find potential success. Our goal is to give you the information you need to make smart choices and perhaps profit from the big opportunities in this lively and expanding industry.

Why Video Game Stocks are Gaining Momentum

The rise of the video game industry is powered by several strong trends. It’s not just about new games coming out; it’s a fundamental change in how we enjoy entertainment and interact online. This wider appeal brings in more investors and makes the industry’s future look stronger within the overall multimedia industry.

A major reason for this growth is the huge increase in mobile gaming. With most people having smartphones and affordable internet, mobile games are available to billions worldwide. Developers are focusing on making games for mobile first, designing them for shorter playtimes, and adapting content for different cultures to attract more users. Ways to make money, like in-app purchases, ads, and subscriptions, work very well across various groups, making this a significant source of income. The arrival of 5G technology promises even faster internet, making mobile gaming even better.

Besides mobile, console gaming continues to do well, thanks to new powerful consoles and strong demand for exclusive games. High-performance consoles, like the Sony PlayStation, with great graphics and super fast loading times attract both new and returning players, especially those looking for immersive 3D gaming experiences. Companies making these consoles are investing heavily in their own content and making older games work on new systems to build brand loyalty. This cycle of console innovation reinforces the high-quality entertainment experience that defines this part of the market.

Furthermore, the rise of live service games and esports has changed gaming into something people constantly engage with. Games are no longer one-time purchases; they are evolving platforms with ongoing content updates, seasonal events, and competitive leagues. This creates strong communities and steady income. Esports, in particular, has become a global phenomenon, attracting huge audiences and sponsorship deals, further boosting the industry’s mainstream appeal. Cloud gaming services are also a game changer, making it easier for people to play games without expensive hardware, which expands the potential audience. The COVID-19 pandemic certainly sped up how many people got into online gaming as social distancing encouraged more digital entertainment.

Top 10 Video Game Stocks and a Critical View

To understand the potential of video game stocks, it’s important to know the major companies that lead this fast-paced market. These companies are involved in different parts of the industry, from making and publishing games to creating game engines and specializing in mobile gaming. When looking at a publicly listed company, its Market capitalization, which is the total value of its outstanding shares, is a key number. We also consider things like their Industry Subrating and Management Subrating for a more complete financial picture, along with Safety Subrating, Financial Strength Subrating, Growth Subrating, and Value Subrating.

Here are some of the top companies in the video game sector by revenue, which often means they have a big impact on the market, along with examples of their key games and their market cap:

Sony Group Corporation (NYSE:SONY)

- Key Games: The company behind the Sony PlayStation console. Their PlayStation Studios create popular series like God of War, Marvel’s Spider-Man, The Last of Us, Horizon Zero Dawn, and Gran Turismo. They also publish games from other developers. Famous titles like Resident Evil and Monster Hunter are also big on their platforms through partnerships.

- Market Cap: $147.70 billion USD (as of July 2025)

Tencent Holdings (OTC:TCEHY)

- Key Games: A giant Chinese internet company with huge investments in gaming. They own Riot Games (League of Legends, Valorant) and have big stakes in Epic Games (Fortnite). They also develop and publish mobile hits like Honor of Kings and PUBG Mobile (through their Lightspeed & Quantum Studios) and Knives Out. Tencent is the world’s largest gaming company by revenue.

- Market Cap: $573.49 billion USD (as of July 2025)

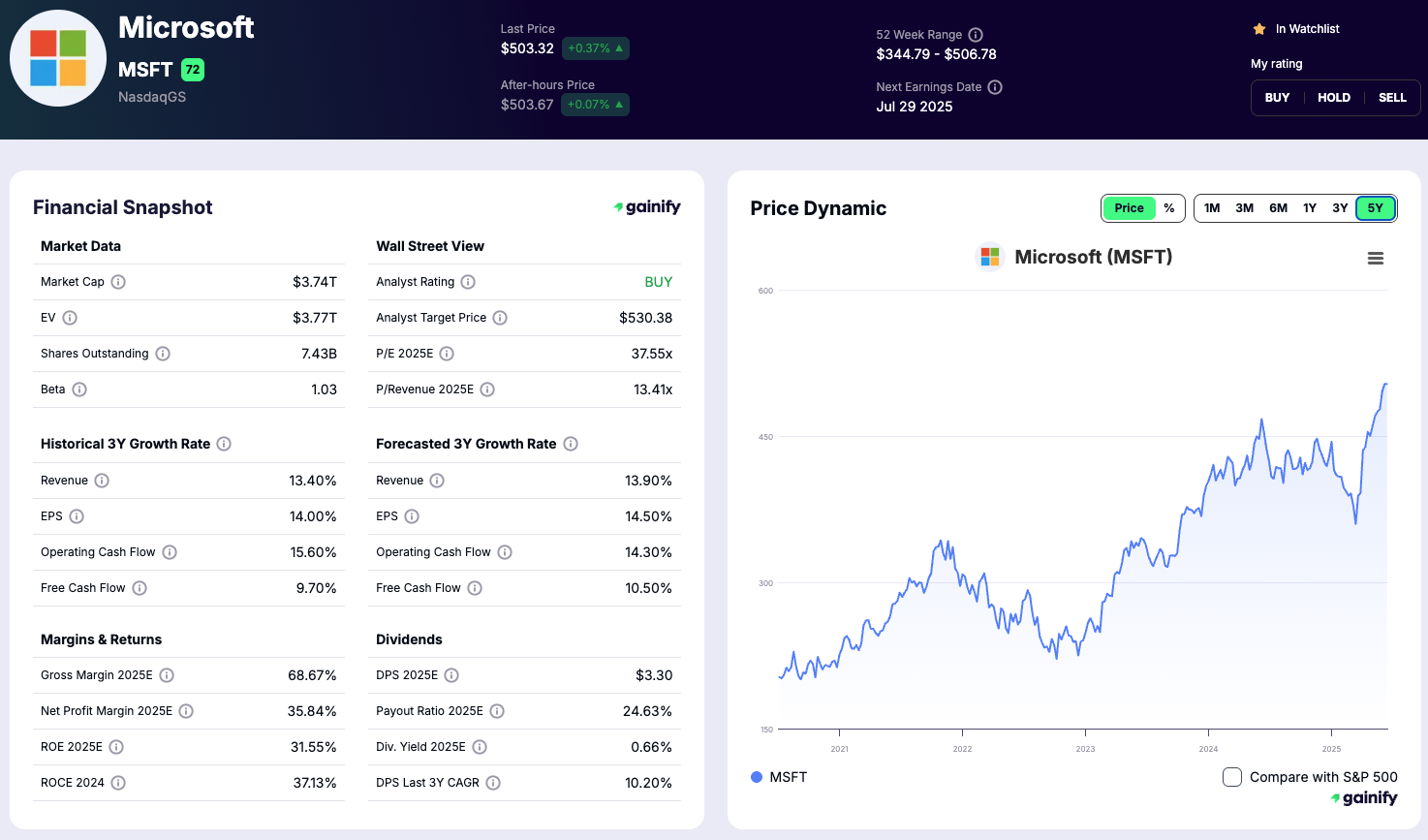

Microsoft Corporation (NASDAQ:MSFT)

- Key Games: Owns Xbox, Bethesda, and Activision Blizzard, expanding its reach through Game Pass subscriptions and cloud gaming. This includes major game series like Call of Duty, Warcraft, Candy Crush, Overwatch, Diablo, The Elder Scrolls, and Fallout.

- Market Cap: $3.740 trillion USD (as of July 2025 – this number is for the entire Microsoft company, which also has a big presence in the communication services sector, not just its gaming part).

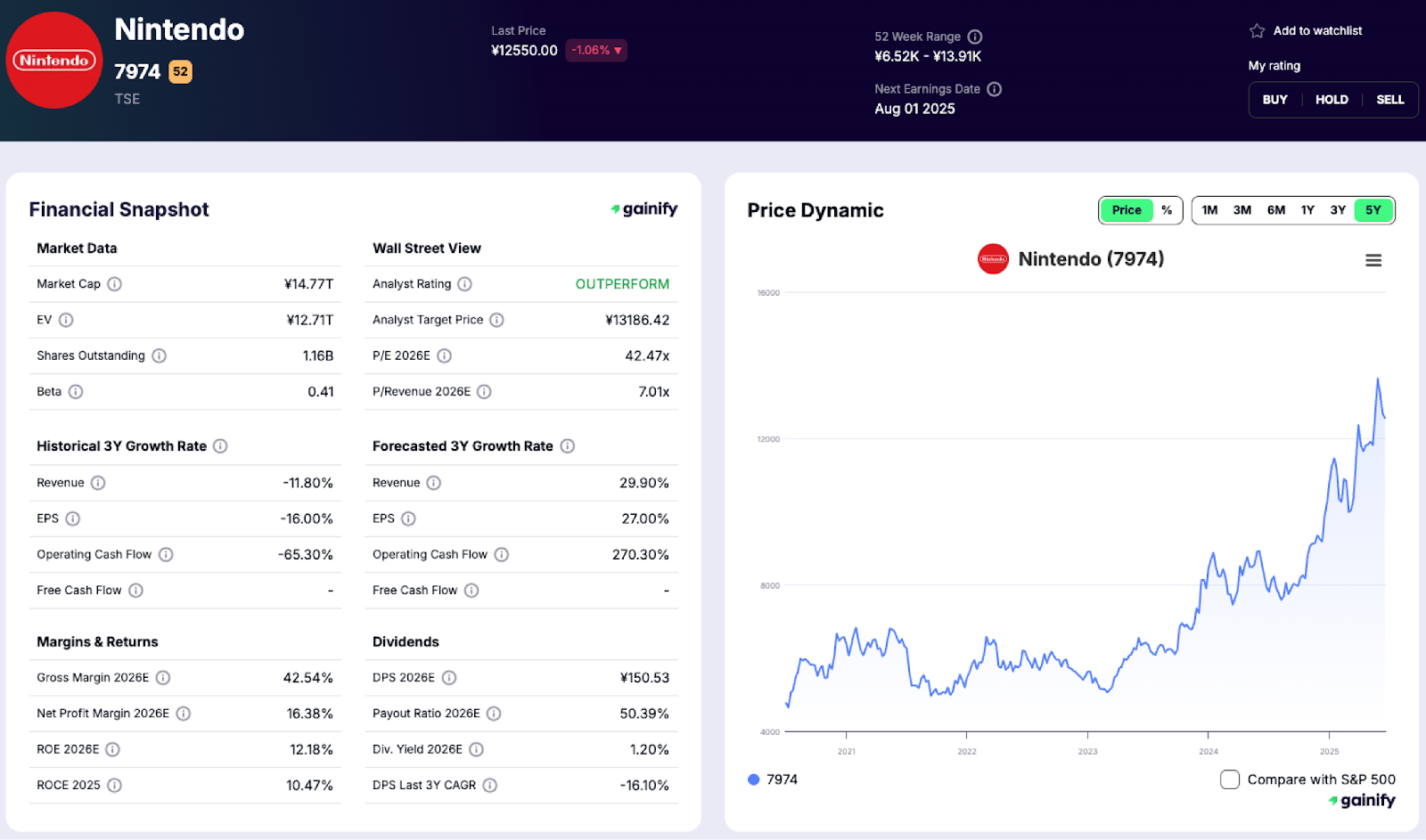

Nintendo (OTC:NTDOY)

- Key Games: Known for their innovative Switch console and beloved games like Super Mario, The Legend of Zelda, Pokémon, Animal Crossing, and Metroid. They are famous Game Makers/Designers. Classic series such as Mega Man and Street Fighter are also popular on their systems.

- Market Cap: $110.04 billion USD (as of July 2025)

NetEase, Inc. (NASDAQ:NTES)

- Key Games: A major Chinese game developer and publisher, strong in mobile and online PC games. Known for titles like Fantasy Westward Journey, Identity V, LifeAfter, and Naraka: Bladepoint. They also helped develop Diablo Immortal with Blizzard. Their influence also extends to the mobile game Knives Out.

- Market Cap: $81.41 billion USD (as of July 2025)

Electronic Arts Inc. (NASDAQ:EA)

- Key Games: A leading global publisher with a strong list of sports games including EA Sports FC (formerly FIFA) and Madden NFL. Other big game series include Apex Legends, Battlefield, The Sims, and Star Wars games. These are often considered Triple-A games, meaning they are big budget, high-profile releases.

- Market Cap: $37.36 billion USD (as of July 2025)

Take-Two Interactive Software, Inc. (NASDAQ:TTWO)

- Key Games: The company behind Rockstar Games (Grand Theft Auto, including GTA Online, Red Dead Redemption) and 2K (NBA 2K, WWE 2K, BioShock, Mafia, Sid Meier’s Civilization, Borderlands). The highly praised Baldur’s Gate 3 is also a significant role-playing game, though not directly made by Take-Two, it shows the quality of games investors look for.

- Market Cap: $42.78 billion USD (as of July 2025)

Roblox Corporation (NYSE:RBLX)

- Key Games: Roblox runs a platform where millions of user generated games and experiences are created and played daily, rather than making traditional games. Popular experiences on the platform include Adopt Me!, Brookhaven, and Piggy. Roblox’s platform is a form of online gaming and even includes augmented reality experiences, pushing the limits of 3D gaming.

- Market Cap: $71.68 billion USD (as of July 2025)

Unity Software Inc. (NYSE:U)

- Key Games: Unity doesn’t make or publish games in the usual way. Instead, it provides the widely used Unity game engine and development tools that countless game creators use. Games made with Unity include Genshin Impact, Hollow Knight, Cuphead, and Ori and the Will of the Wisps. Their technology is vital for making many video games, from small indie games to huge productions.

- Market Cap: $12.02 billion USD (as of July 2025)

Playtika Holding Corp. (NASDAQ:PLTK)

- Key Games: A global leader in free-to-play mobile games, known for social casino games and casual games like Slotomania, Bingo Blitz, House of Fun, and Board Kings.

- Market Cap: $1.77 billion USD (as of July 2025)

A Critical Look at Performance:

While the long-term future for the gaming industry looks bright, it’s important to know that many video game stocks haven’t always performed amazingly well recently.

Even with the overall growth, individual companies have faced problems. Some have dealt with intense competition, leading to higher marketing costs and pressure on their profits. Delays in releasing highly anticipated games, or games that don’t do as well as expected, have also affected their share price.

The gaming industry can have ups and downs, often tied to new console releases or big game launches. We’ve seen times when some companies’ revenue growth slowed, and investors became more careful, worried about rising development costs and how sustainable some ways of making money are.

For instance, while the broader market, like the S&P 500, saw big gains, some gaming companies struggled with how many people played their games after the pandemic boom, or faced more scrutiny over their in-app purchases. This reminds us that even in a growing sector like Electronic Gaming & Multimedia, how well individual companies perform can be very different and needs careful looking into.

The average industry performance for gaming stocks, while strong over the long term, often sees its share of ups and downs.

Diversifying with ETFs: A Closer Look at the VanEck Video Gaming and eSports ETF (ESPO) and Global X Video Games & Esports ETF (HERO)

For investors who want to spread out their risk in the video game sector without having to pick individual stocks, Exchange Traded Funds (ETFs) are a great option. These financial instruments typically hold a collection of companies involved in different parts of the gaming industry, from game makers and publishers to hardware companies and esports organizations, thereby spreading out the risk.

Among the most well-known and influential ETFs in this area is the VanEck Video Gaming and eSports ETF (NASDAQ: ESPO). ESPO aims to match the price and returns of the MVIS Global Video Gaming and eSports Index, which tracks companies involved in video game development, esports, and related hardware and software. Its holdings include a mix of major gaming companies from around the world, offering broad exposure to the sector. Another notable fund is the Global X Video Games & Esports ETF (NASDAQ: HERO), which tracks a similar group of companies in the gaming and esports world.

Top 5 Holdings of ESPO (as of July 2025):

- Nintendo Co., Ltd. (7.41%)

- Roblox Corporation (6.98%)

- Tencent Holdings Limited (6.03%)

- AppLovin Corporation (5.69%)

- NetEase, Inc. (5.66%)

Top 5 Holdings of HERO (as of July 2025):

- Roblox Corporation (7.39%)

- Konami Group Corporation (7.14%)

- Nintendo Co., Ltd. (6.77%)

- NetEase, Inc. (5.89%)

- Square Enix Holdings Co., Ltd. (5.82%)

While the video game industry has a strong story of long-term growth, the performance of ESPO and HERO, like the individual stocks they hold, has had its ups and downs. As of early July 2025:

- ESPO has returned approximately +48.51% over the past year and +24.44% year to date (YTD Return).

- HERO has shown a 1-Year Return of approximately +39.26% and its YTD Return is approximately +32.64%.

- The S&P 500, a benchmark for the broader U.S. stock market, has seen a YTD return of +6.64% and a 1-Year Return of +11.16%.

This positive performance for both ESPO and HERO over the past year and year-to-date can be linked to several things, including the staying power of live service games, the ongoing growth of esports, and a general improvement in how investors feel about growth industries. It’s notable that both ESPO and HERO have significantly outperformed the S&P 500 in the short term (YTD and 1-Year periods), indicating a strong recent rally in the gaming sector.

However, it’s important to look at performance over a longer time.

- For ESPO, the 5-Year Return is about +96.39%.

- For HERO, the 5-Year Return is about +32.81%.

- The S&P 500’s 5-Year Return is +94.12%.

While these numbers look good for ESPO, and both ETFs have delivered positive returns over five years, the gaming industry faced a tough time after the big boost it got during the pandemic. Some experts would say that after an initial surge, there was a period of slower growth for parts of the industry, which affected ETF performance. ESPO’s 5-Year return is very competitive with the S&P 500, showing strong long-term growth, while HERO’s 5-Year return is positive but trails the broader market benchmark. The ups and downs seen in some of the stocks these ETFs hold, especially those tied to the success of single games or hardware cycles, mean that even a diversified ETF isn’t immune to specific industry challenges. Investors should look beyond short-term gains and check the fund’s performance through different market conditions to truly understand its risks and potential returns. This is key for comparing how the industry performs against bigger indexes like the S&P 500, where gaming stocks have collectively done about 1.4 times better over the past five years.

The Other Side of the Coin

While most people are very positive about video game stocks, a balanced view requires us to consider potential challenges. It would be a mistake to ignore the natural ups and downs and unique problems within this sector. Some might argue that the industry’s reliance on “hit titles” carries a big risk. If a single major game, like a new Resident Evil installment, doesn’t sell well, it can significantly hurt a company’s financial performance and its stock’s share price. This is different from industries with more stable, ongoing income.

Furthermore, the highly competitive nature of the gaming market means new companies and exciting games are constantly fighting for players’ attention. This tough competition can lead to higher marketing costs and a shorter lifespan for even successful games, requiring constant investment in research and development to stay relevant. There are also worries about market saturation in some areas, making it harder for companies to grow steadily without constant innovation or expanding into new regions. For example, while Triple-A games get most of the headlines, the growing scene of indie games also presents a strong competitive challenge. Some might also point to possible regulatory challenges in different countries, which could affect how companies make money or access markets. The emergence of technologies like generative AI also presents both opportunities and potential disruptions to traditional game development, creating uncertainty for some players.

However, a thoughtful response to these concerns shows a deeper resilience in the industry. While individual games might indeed be unpredictable, the world of live service games and subscription models reduces this reliance on single hits by keeping players engaged and creating steady income. Smart companies spread their investments across different types of games and platforms, lessening the impact of any one game. What’s more, the fierce competition itself pushes innovation, ultimately benefiting players and moving the industry forward. Clever companies are adapting to regulatory environments, seeing them as chances to build sustainable and ethical business practices rather than impossible obstacles. The overall growth of the global gaming market suggests that expanding into new markets and new technologies will continue to create plenty of room for growth, even in a competitive environment. The large number of outstanding shares for many of these big companies means that market makers see plenty of trading activity.

Frequently Asked Questions (FAQ)

Q1: Is the video game market still growing?

A1: Absolutely, the video games market is experiencing robust growth. Experts predict its global size will reach an impressive $600.74 billion by 2030, showing an annual growth rate of about 12.2% from 2025. This expansion is powered by the rise of mobile gaming, new console technologies, and a continuously expanding global player base, trends that were notably accelerated by the COVID-19 pandemic and the rollout of 5G technology.

Q2: What are the biggest video game companies by revenue?

A2: Based on recent financial reports, some of the top-earning video game companies include Sony Interactive Entertainment, Tencent, Microsoft Gaming, Nintendo, and NetEase Games. These industry giants control a significant share of the market across various gaming categories, forming a substantial part of the Electronic Gaming & Multimedia sector.

Q3: What are the key risks when investing in video game stocks?

A3: Investing in video game stocks carries several risks. These include market volatility, heavily influenced by shifting player preferences and rapid technological changes. There’s also intense competition from both established and emerging companies, along with a reliance on the unpredictable success of major game releases. Potential regulatory changes and market saturation in certain areas are also important considerations, alongside the inherent risk of losing capital in any investment.

Q4: Are video game stocks a good long-term investment?

A4: Video game stocks can certainly be a strong long-term investment opportunity. This potential is driven by the industry’s consistent growth, ongoing technological advancements like cloud gaming and augmented reality, and the increasing integration of gaming into global culture. However, like all investments, it requires thorough research and a solid understanding of each company’s financial health and market position, including metrics like its market weight.

Q5: How does mobile gaming influence the overall video game market?

A5: Mobile gaming is a crucial engine for the video game market’s overall expansion. Its easy accessibility, massive global adoption, and highly effective monetization methods through in-app purchases and subscriptions contribute significantly to the industry’s total revenue and bring gaming to billions more players worldwide. Popular titles like Bingo Blitz perfectly illustrate the broad appeal and financial success of mobile online gaming.

Q6: What are some common ETFs for investing in video game stocks?

A6: The VanEck Video Gaming and eSports ETF (ESPO) and the Global X Video Games & Esports ETF (HERO) are widely recognized ETFs. They offer investors a diversified way to gain exposure to companies involved in video game development, esports, and related technologies.

Q7: Has the performance of video game stocks been consistently strong?

A7: While the video game industry shows a robust long-term growth trajectory, the performance of video game stocks has not been consistently strong; they often exhibit more volatility compared to broader market indices like the S&P 500. Their performance can swing based on factors like the success of individual hit games, fierce market competition, and general economic cycles. Despite this volatility, the overall long-term trends for the sector remain positive.

Conclusion: Your Controller to Future Growth

For the average investor looking at the exciting world of video game stocks, here are the most important points to consider from our journey through this market:

- Massive and growing opportunity: The video game market is not just big; it’s projected to nearly double to over $600 billion by 2030. This growth is driven by mobile games, new consoles, and more people playing globally, suggesting a powerful, expanding sector for your investment portfolio.

- Diverse ways companies make money: Don’t think of gaming companies as all the same. They range from console makers like Sony and Nintendo, to huge game publishers like EA and Take-Two, to mobile powerhouses like Tencent and Playtika, and even essential technology providers like Unity. Understanding these different types helps you pick companies with strong and varied income streams.

- High rewards come with high risks: While gaming stocks can offer impressive returns, as seen with ESPO’s 5-year performance, they are also more volatile than the broader market like the S&P 500. This is due to intense competition and the unpredictable success of new games. Be prepared for ups and downs, and remember there’s always the risk of losing money.

- The industry is adapting smartly: Companies are reducing their reliance on single “hit” games by focusing on ongoing live service games, subscription models, and diversifying across platforms. This shift creates more stable, recurring revenue, making the industry more resilient to market swings.

- It’s a fundamental shift, not a fad: Gaming has become a core part of global entertainment and social interaction. This isn’t a temporary trend; it’s a fundamental change in how people spend their leisure time and money. Investing here means tapping into a lasting cultural and technological transformation.

By keeping these practical insights in mind, you can approach the video game stock market with greater confidence and potentially find valuable opportunities within this vibrant digital frontier.