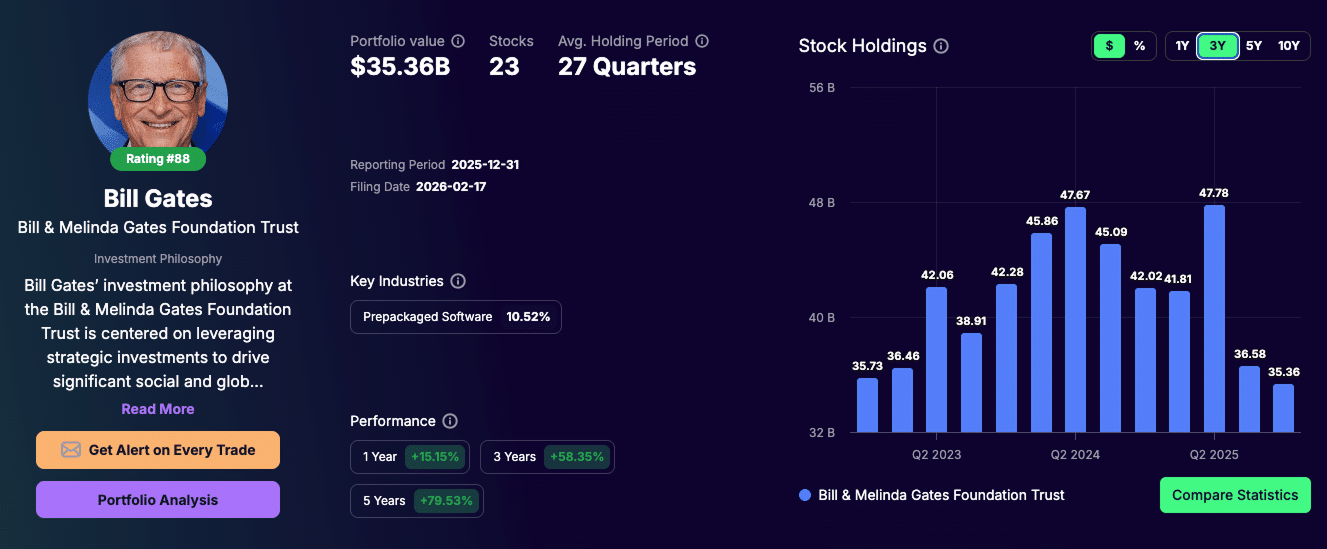

Bill Gates’ stock portfolio consists of publicly disclosed U.S. equity holdings managed through the Bill & Melinda Gates Foundation Trust, as reported in SEC 13F filings. The latest filing, submitted on February 17, 2026, reflects holdings as of Q4 2025 and values the portfolio at $35.36 billion, allocated across a highly concentrated set of long-term positions.

Bill Gates’ portfolio’s primary objective is to preserve and compound capital over long horizons while providing predictable liquidity to support ongoing philanthropic commitments. This objective drives a focus on businesses with durable, recurring cash flows and pricing power across economic cycles, while limiting exposure to short-duration or speculative growth that increases volatility and funding risk.

The portfolio’s structure is directly shaped by the Gates Foundation’s long-term funding commitments. In January 2026, the Foundation announced a $9 billion annual payout target, part of a multi-year plan to accelerate spending ahead of its planned 2045 closure, while capping operating expenses at approximately 14% of the total budget to maximize programmatic impact.

This article provides a clear, position-level breakdown of Bill Gates’ Q4 2025 portfolio, covering individual holdings, concentration, sector exposure, and major recent changes, using the latest filing data to highlight practical insights for long-term, risk-aware investors.

Bill Gates’ Stock Portfolio Key Metrics at the End of 2025

Bill Gates’ stock portfolio structure is defined by concentration, position sizing, and capital allocation discipline. The figures below show how $35.36 billion is distributed across holdings, how much weight is placed on core positions, and how the portfolio balances long-term compounding with liquidity needs.

Metric | Value |

|---|---|

✅ Total Portfolio Value | $35.36 Billion |

✅ Number of Holdings | 23 Stocks |

✅ Top 10 Holdings | 95.7% of portfolio value |

✅ Largest Holding | Berkshire Hathaway (BRK.B) 27.6% |

✅ Average Holding Period | 27 Quarters (7 Years) |

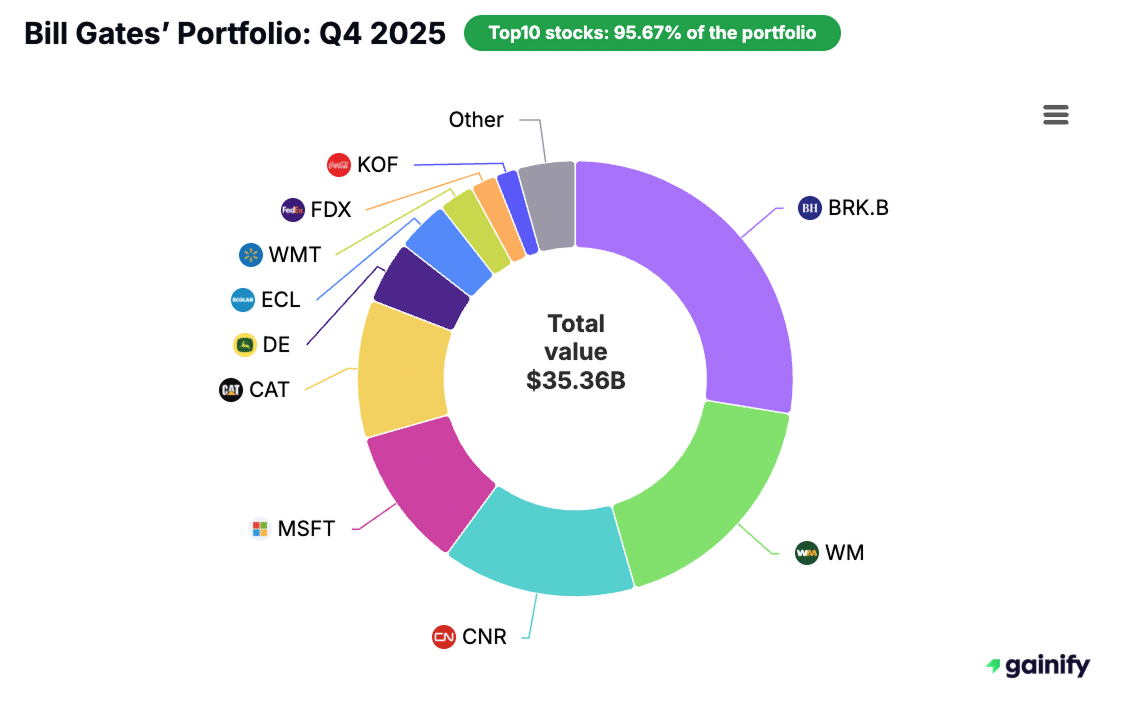

The structure of Bill Gates’ stock portfolio reflects how capital is intended to behave over time, rather than how frequently it is traded. The combination of concentration, limited position count, and sector exposure reveals a deliberate framework for managing risk, liquidity, and long-term compounding.

- Capital allocation is driven by concentration rather than broad diversification. With roughly 95% of portfolio value invested in the top 10 holdings, overall results are determined by a small number of core positions, reflecting a high-conviction ownership approach.

- A limited number of holdings enforces long-term discipline. Maintaining 23 positions constrains turnover and reduces the need for continuous reallocation, allowing business fundamentals rather than short-term market movements to drive returns.

- Cash-flow durability is the primary selection criterion. Portfolio exposure is concentrated in businesses capable of generating consistent cash flows across economic cycles, supporting predictable liquidity while limiting reliance on speculative or short-duration growth.

Viewed together, the portfolio is structured to support ongoing obligations while compounding capital steadily over time, rather than to maximize short-term performance or tactical flexibility.

About the Bill & Melinda Gates Foundation

The Bill & Melinda Gates Foundation Trust is the primary investment vehicle supporting the Gates Foundation’s work in global health, education, agriculture, and poverty reduction. Its role is to provide a stable and repeatable source of funding for the Foundation’s programs while preserving capital over a defined time horizon that extends through the Foundation’s planned closure in 2045.

In January 2026, the Foundation’s board approved a transition to a steady-state annual payout of approximately $9 billion as part of a broader plan to deploy up to $200 billion before 2045. Operating expenditures are capped at roughly 14 percent of the total budget to ensure the majority of resources are directed toward programmatic impact. This spending framework places increased importance on the Trust’s ability to generate durable investment returns and consistent liquidity.

The Trust’s investment assets totaled approximately $43 to $44 billion at the end of 2025, based on the latest public disclosures. The portfolio is managed independently from the Foundation’s grant-making operations by Cascade Investment LLC, with a mandate to support elevated annual distributions while maintaining long-term capital stability.

Investment strategy is centered on long-term ownership of a concentrated group of businesses with resilient operating models, durable cash flows, and pricing power across economic cycles. Sector exposure consistently emphasizes holding companies, software, insurance, healthcare innovation, environmental services, and infrastructure-oriented businesses. These characteristics align with the Trust’s financial requirements and the Foundation’s broader mission priorities.

Through the Foundation Trust and Cascade Investment, Bill Gates has developed an investment framework focused on capital discipline, long-duration ownership, and reliable funding capacity. The portfolio is structured to support one of the largest sustained philanthropic efforts globally while maintaining financial resilience over the remaining life of the Foundation.

Who Is Bill Gates and What Is His Role in the Gates Foundation’s Investment Strategy

Bill Gates is a long-term investor whose capital allocation decisions are closely tied to the funding needs of one of the world’s largest philanthropic organizations. While he is best known as the co-founder of Microsoft, his influence today is equally defined by how his investment portfolio is structured to support sustained, multi-decade capital deployment.

Gates’ investable assets are managed primarily through the Bill & Melinda Gates Foundation Trust and Cascade Investment, with a mandate that prioritizes capital preservation, predictable liquidity, and disciplined long-term compounding. Unlike most billionaire top investors, his portfolio must reliably support annual payouts measured in billions of dollars rather than optimize for short-term performance.

Several facts highlight the distinct nature of his investing approach. Gates has publicly stated that the majority of his wealth will be deployed for philanthropic purposes before 2045, creating a finite investment horizon. He served on Berkshire Hathaway’s board for 16 years, working closely with Warren Buffett, which strongly influenced his preference for concentrated ownership and cash-flow durability. Despite his technology background, the portfolio consistently favors infrastructure-scale and cash-generative businesses over early-stage or speculative technology investments.

As an investor, Gates emphasizes patience, low turnover, and business fundamentals. This philosophy directly shapes the portfolio analyzed in this article, from position sizing to sector exposure and risk management.

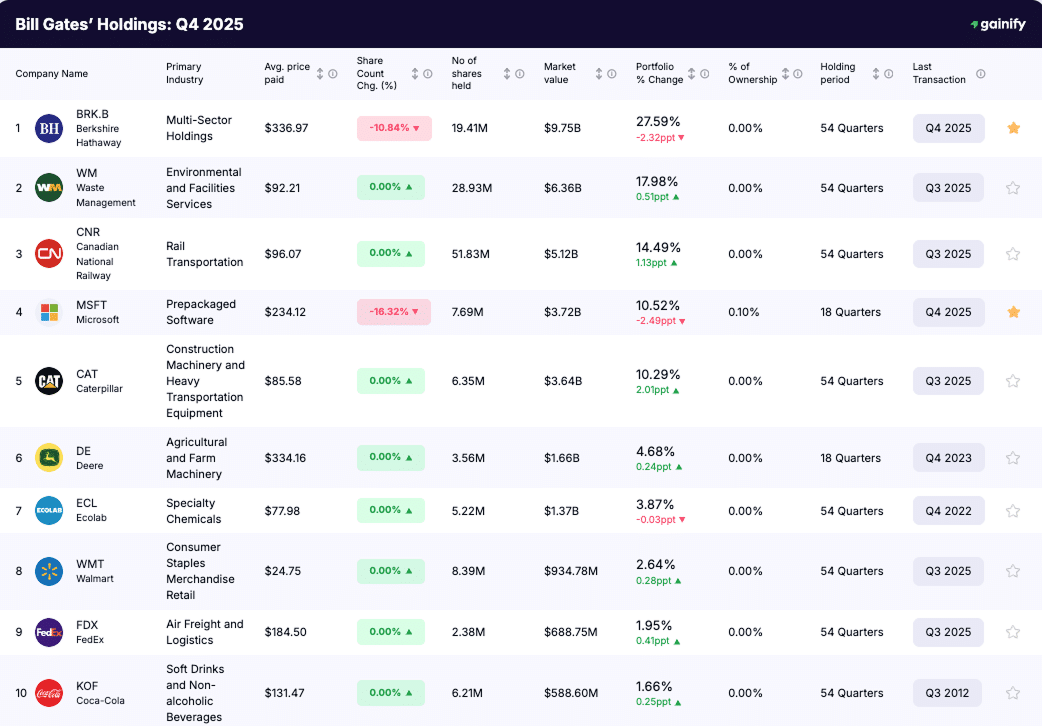

Top 10 Holdings in Bill Gates’ Stock Portfolio (Q4 2025)

The top 10 holdings represent the companies that account for the vast majority of Bill Gates’ disclosed U.S. equity exposure. At the end of 2025, these positions collectively make up approximately 95% of total portfolio value, meaning portfolio performance, risk, and liquidity are driven almost entirely by this group.

- Berkshire Hathaway (BRK.B)

Berkshire Hathaway is the largest position and central anchor of the portfolio. It provides internally diversified exposure through insurance, industrials, utilities, railroads, and equities, while benefiting from disciplined capital allocation and large, low-cost insurance float.- Market Value: $9.75B

- Shares Held: 19.41M

- Portfolio Weight: 27.59%

- Last Transaction: Q4 2025 (Sold 10.84% of shares)

- Waste Management (WM)

Waste Management generates predictable operating income and recurring free cash flow that supports consistent dividend distributions. Its revenue is largely contracted through long-term municipal and commercial agreements, allowing pricing to adjust with inflation while maintaining high cash conversion. These characteristics make the business a reliable source of distributable income and a stabilizing liquidity component across economic cycles.- Market Value: $6.36B

- Shares Held: 28.93M

- Portfolio Weight: 17.98%

- Last Transaction: Q3 2025 (Sold 10.24% of shares)

- Canadian National Railway (CNI)

Canadian National Railway operates an irreplaceable rail network with structural barriers to entry and high operating leverage. The business benefits from a largely fixed-cost asset base, where incremental freight volumes translate into disproportionate growth in operating income and free cash flow. This cost structure supports stable margins, strong cash generation, and long-duration earnings visibility across economic cycles.- Market Value: $5.12B

- Shares Held: 51.83M

- Portfolio Weight: 14.49%

- Last Transaction: Q3 2025 (Sold 13.60% of shares)

- Microsoft (MSFT)

Microsoft is the co-founded company of Bill Gates and remains a strategically important holding despite recent position reductions. The business generates substantial free cash flow through recurring enterprise software and cloud services, supported by high switching costs and long-term customer contracts. The reduction in position size reflects portfolio concentration management rather than a change in conviction around Microsoft’s underlying cash-generation capacity.- Market Value: $3.72B

- Shares Held: 7.69M

- Portfolio Weight: 10.52%

- Last Transaction: Q4 2025 (Cut 16.32% of shares)

- Caterpillar (CAT)

Caterpillar remains a top-five holding due to its exposure to long-cycle global infrastructure spending and its ability to convert equipment demand into recurring aftermarket and services income. The business benefits from long asset lifespans, replacement-driven demand, and strong operating leverage across construction, mining, and energy markets.- Market Value: $3.64B

- Shares Held: 6.35M

- Portfolio Weight: 10.29%

- Deere & Co. (DE)

Deere & Company provides exposure to global agricultural productivity and precision farming technology. The company combines equipment sales with embedded software, data analytics, and financing services, creating recurring revenue streams and reinforcing customer retention. Its position in the portfolio reflects long-term demand for food production efficiency and capital-intensive agricultural infrastructure.- Market Value: $1.66B

- Shares Held: 3.56M

- Portfolio Weight: 4.68%

- Ecolab (ECL)

Ecolab provides exposure to mission-critical water, hygiene, and sanitation services with recurring, contract-driven revenue. Its solutions are embedded in customer operations, creating high switching costs and stable cash generation. The holding aligns with Gates’ long-term focus on public health, water efficiency, and predictable operating income across economic cycles.- Market Value: $1.37B

- Shares Held: 5.22M

- Portfolio Weight: 3.87%

- Walmart (WMT)

Walmart provides defensive consumer exposure anchored in essential goods, scale economics, and consistent cash generation. Its pricing power, supply-chain efficiency, and steady free cash flow support reliable dividend payments, making the position a source of portfolio stability and predictable income during economic slowdowns.- Market Value: $934.78M

- Shares Held: 8.39M

- Portfolio Weight: 2.64%

- FedEx (FDX)

FedEx provides exposure to global trade and time-sensitive logistics infrastructure. The company operates an asset-intensive network spanning air, ground, and freight services, generating operating leverage as shipment volumes recover. Within the portfolio, FedEx adds cyclical logistics exposure while contributing cash flow from established network density and pricing discipline.- Market Value: $688.75M

- Shares Held: 2.38M

- Portfolio Weight: 1.95%

- Coca-Cola (KOF)

Coca-Cola provides exposure to emerging-market consumer staples with stable demand and predictable cash generation. As the largest Coca-Cola bottler in Latin America, the company benefits from exclusive bottling rights, strong local distribution, and resilient consumption patterns. The position contributes recurring dividend income and geographic diversification while limiting exposure to discretionary consumer cycles.- Market Value: $588.60M

- Shares Held: 6.21M

- Portfolio Weight: 1.66%

Why Berkshire Hathaway & Microsoft Dominate Bill Gates’ Stock Portfolio

Berkshire Hathaway and Microsoft continue to dominate Bill Gates’ portfolio, but for different reasons and with different capital trajectories. As of December 31, 2025, Berkshire Hathaway is the largest holding despite a Q4 reduction, while Microsoft has undergone a multi-quarter, deliberate drawdown that materially reshaped the portfolio.

Berkshire Hathaway’s Role and the Q4 2025 Reduction

Berkshire Hathaway remains the portfolio’s primary capital anchor, representing 27.6% of total portfolio value at year-end 2025. During Q4, Gates reduced the position by 10.84%, selling approximately $1.17 billion worth of shares.

This reduction did not change Berkshire’s role in the portfolio. Instead, it reflects:

- Ongoing liquidity generation to support elevated Foundation payouts

- Portfolio weight management as Berkshire appreciated relative to other holdings

- Tactical trimming rather than a shift in long-term conviction

Berkshire Hathaway continues to support the portfolio’s objectives in part due to Bill Gates’ long-standing investment relationship with Warren Buffett. Gates has maintained exposure to Berkshire for decades, reflecting confidence in Buffett’s disciplined capital allocation and governance framework. Berkshire’s diversified structure across insurance, regulated utilities, railroads, and operating businesses generates internally funded cash flows with low refinancing risk. As documented in research published by Harvard Business School on owner-oriented conglomerates, firms with strong internal capital generation and conservative balance-sheet management tend to sustain distributions more reliably during periods of macroeconomic stress. Berkshire closely fits this profile, reinforcing its role as a core, trust-based holding in the portfolio.

Even after the Q4 trim, Berkshire remains the single most important stabilizing asset in the portfolio.

Microsoft’s Multi-Quarter Reduction and Changing Portfolio Role

Microsoft’s position has been reduced gradually over multiple quarters rather than in a single decision. The Q4 2025 filing shows another 16.32% reduction in shares, extending a steady trimming process that began more than two years ago.

Microsoft shares held by the Gates Foundation declined as follows:

- Q4 2023: 38.2 million

- Q1 2024: 36.5 million

- Q2 2024: 34.9 million

- Q3 2024: 29.0 million

- Q4 2024: 28.5 million

- Q1 2025: 28.5 million

- Q2 2025: 26.2 million

- Q3 2025: 9.2 million

- Q4 2025: 7.7 million

Gates sold 64.91 percent of his Microsoft position in Q3, representing a massive $8.67 billion in nominal value. This sale pushed Microsoft from the number one holding down to the fourth position.

This pattern confirms a structured unwind rather than a reaction to short-term market conditions. Microsoft remains a high-quality business with strong free cash flow generation from enterprise software, cloud infrastructure, and artificial intelligence platforms. However, its historical appreciation created a level of concentration that conflicted with the Trust’s liquidity and funding requirements.

According to research from the University of Chicago Booth School of Business on endowment portfolio risk management, concentrated legacy positions are commonly reduced once they exceed threshold contribution limits to total funding capacity. Microsoft fits that exact framework.

How Berkshire and Microsoft Function Together

The interaction between Berkshire Hathaway and Microsoft explains the portfolio’s current structure.

- Berkshire Hathaway provides durable capital, diversification, and balance-sheet resilience

- Microsoft provides monetizable growth capital, now being harvested over time

This pairing allows the Gates Foundation Trust to:

- Maintain long-term compounding

- Fund increasing annual charitable outflows

- Avoid forced sales during adverse market conditions

As the Foundation accelerates spending toward its planned 2045 conclusion, the portfolio is being shaped to reduce single-issuer dependency while preserving capital durability.

What This Reveals About Gates’ Capital Strategy

The Q4 2025 reductions show that Gates’ investment decisions are driven by capital stewardship, not by changes in business quality or market narratives.

- Berkshire Hathaway is trimmed but remains foundational

- Microsoft is reduced methodically to manage concentration and liquidity

- Portfolio decisions are aligned with long-term obligations, not quarterly performance

For investors, this section illustrates how disciplined capital management operates when return generation must coexist with predictable, large-scale funding commitments.

Bill Gates’ Stock Portfolio Changes in Q4 2025

Bill Gates made no new investments in Q4 2025 and did not exit any positions. All portfolio activity during the quarter consisted of measured reductions in existing holdings, reflecting liquidity sourcing and concentration management rather than changes in long-term conviction.

The largest adjustment was a 10.84% reduction in Berkshire Hathaway, raising approximately $1.17 billion. Despite the trim, Berkshire remained the portfolio’s largest holding at year-end, indicating that the reduction was driven by portfolio weight control and funding needs rather than a reassessment of the business. Berkshire’s scale, liquidity, and diversified cash flows continue to make it the preferred source for incremental capital.

Microsoft was also reduced by 16.32% in Q4 ($751.7 million), extending a gradual, multi-quarter drawdown that has been underway for more than two years. This reduction follows earlier, larger trims and reflects an intentional effort to lower single-stock concentration after prolonged outperformance. Microsoft remains a core holding, and the ongoing reduction does not signal weakening confidence in its underlying fundamentals or cash-generation capacity.

No other holdings were adjusted during the quarter. The absence of new positions or exits confirms that Q4 2025 activity was portfolio maintenance rather than strategic repositioning. The pattern suggests that future changes are likely to remain incremental, sourcing liquidity from the most resilient holdings while preserving the portfolio’s long-term structure and cash-flow durability.

Bill Gates’ Portfolio Changes in Q3 2025

The third quarter of 2025 brought far more activity than the previous one, with several major adjustments across Gates’ portfolio. The most significant move was a large reduction in Microsoft (MSFT). Gates cut the position by 64.91 percent, selling roughly $8.67 billion in shares. Microsoft remains a core holding, but the scale of the reduction signals a deliberate rebalancing after years of outsized gains and a long period where MSFT dominated the portfolio.

Gates also trimmed several other long-standing positions. He reduced Berkshire Hathaway (BRK.B) by 9.78 percent, selling about $1.14 billion. Waste Management (WM) was cut by 10.24 percent, amounting to $743 million sold. Additional reductions included Caterpillar, Canadian National Railway, and Walmart, each reflecting smaller but deliberate adjustments.

Despite the heavy trimming at the top, the portfolio’s core structure remains intact. Berkshire Hathaway now holds the number one position by weight, while Microsoft (though significantly reduced) still sits among Gates’ largest holdings. The consistency of the top positions underscores his long-term strategy: maintain conviction in proven compounders while making measured shifts to balance concentration, fund philanthropic commitments, and optimize long-term portfolio resilience.

Bill Gates’ Portfolio Changes in Q2 2025

In the second quarter of 2025, Gates made only a few moves in his portfolio. The most notable was a 40.48 percent increase in Berkshire Hathaway (BRK.B), worth about $3.53 billion. This shows stronger conviction in Berkshire as a stable long-term compounder.

At the same time, Gates trimmed Microsoft (MSFT) by 7.96 percent, selling around $984 million. Microsoft is still his largest single holding, and the change looks more like rebalancing after years of strong gains rather than a shift in strategy.

Importantly, the top 10 positions in the portfolio have not changed. While Berkshire’s weight increased and Microsoft’s decreased, the overall structure stayed the same. This consistency highlights Gates’ long-term focus: holding core positions steady while making careful adjustments at the margin.

🛡️ Is Gates’ Stock Portfolio Defensive in 2025?

Gates continues to demonstrate the mindset of an investor at heart. His portfolio is carefully structured with a balanced mix of dividend stocks, defensive blue chips, and a select handful of high-growth technology names. Unlike many billionaire portfolios that lean heavily into speculative bets, Gates shows little appetite for risk in unproven sectors.

A key driver of this defensive tilt is the need for reliable portfolio income to fund the Bill & Melinda Gates Foundation’s philanthropic work. Dividend-rich holdings such as Berkshire Hathaway, Canadian National Railway, Waste Management, and major healthcare companies generate steady cash flows that can be redirected toward charitable grants. This creates a portfolio that is not just about long-term capital appreciation but also about consistent liquidity to support global health, education, and climate initiatives.

Outside of these income-heavy positions, Gates’ limited moves into higher-growth stocks like Microsoft show that he is willing to participate in innovation but without sacrificing the stability needed to underpin his charitable commitments. The fact that no major speculative additions have been made, reinforces that his 2025 strategy is about capital preservation, steady growth, and dependable distributions.

Key Investor Takeaways from Bill Gates’ Q4 2025 Portfolio Moves

- Q4 2025 activity focused entirely on controlled reductions. No new positions were added and no holdings were exited. All changes were trims of existing positions to manage liquidity and concentration.

- Microsoft continued a multi-quarter reduction. In Q4 alone, the position was reduced by 16.32%, extending a gradual unwind that began more than two years ago and significantly lowered single-stock exposure.

- Berkshire Hathaway was also trimmed but remained dominant. A 10.84% reduction in Q4 raised approximately $1.17 billion, yet Berkshire still ended the year as the largest holding, reinforcing its role as the portfolio’s structural anchor.

- Portfolio concentration remains intentionally high. Despite reductions, the top 10 holdings still represent the vast majority of total assets, confirming a conviction-driven approach rather than diversification by count.

- Sector exposure reinforces durability and cash-flow reliability. The portfolio remains concentrated in software, insurance, transportation infrastructure, and environmental services, sectors selected for recurring demand, pricing power, and long-term cash generation.

Overall, the Q4 2025 moves illustrate how a large, obligation-driven portfolio manages capital through measured trims of high-quality assets, rather than reactive trading or strategic pivots.

Want to track Gates’ latest moves? Visit Gainify.io to explore real-time updates on his 13F filings and stay ahead of his next big investment decisions.